- Home

- »

- Healthcare IT

- »

-

Healthcare Quality Management Software Market ReportGVR Report cover

![Healthcare Quality Management Software Market Size, Share & Trends Report]()

Healthcare Quality Management Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment Mode (Cloud-based, Web-based, And On-premise), By Application, By Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-085-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

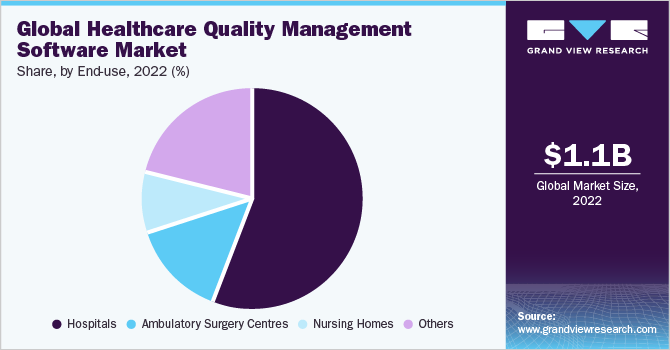

The global healthcare quality management software market size was valued at USD 1.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.24% from 2023 to 2030. The market is experiencing significant growth driven by various factors such as rising healthcare expenses, the growing unstructured medical data, and increasing medical errors. Moreover, governments worldwide are prioritizing value-based care, resulting in regulatory mandates and requirements for improved patient safety, high-quality care, and enhanced clinical outcomes. As a result, hospitals and healthcare facilities are increasingly adopting QMS software solutions to fulfil these requirements.

The healthcare industry is facing a growing problem due to unorganized data, resulting in an increase in medical errors and higher costs. A study published by Multidisciplinary Digital Publishing Institute (MDPI) in 2022 found that medication errors among nurses were prevalent, with a rate of 72.1%. However, only 41.2% of these errors were reported. Among the medication errors, wrong doses accounted for the most common type, with a rate of 46.9%. Another study published in Saudi Pharmaceutical Journal and conducted in a central hospital in Saudi Arabia, a total of 4,860 medication errors were identified during 2018-2020, where over 50.0% of the errors were associated with medication prescribing, ordering, and transcription. Thus, there is a growing need for quality management software to address these issues, which is expected to drive market growth.

In addition, the article "Medication Dispensing Errors and Prevention" highlights that approximately 7,000 to 9,000 Americans lose their lives each year due to medication errors. Many others experience adverse reactions or encounter pharmaceutical issues, but these incidents often go unreported. As medical errors continue to increase, the demand for healthcare QMS solutions is expected to grow, thereby expanding the market.

The increasing popularity of medical tourism has led hospitals to focus JCI accreditation and ISO certifications in order to attract more patients. Individuals who travel overseas for medical treatment prefer hospitals with JCI accreditation. Medical tourism plays a crucial role in the economies of several Asian countries, including India, Indonesia, Malaysia, and Thailand, contributing to their GDP. Moreover, these countries are actively working towards expanding the number of JCI-accredited hospitals, which is expected to positively impact the market.

However, restrictions on outpatient visits and social isolation due to the COVID-19 pandemic had a substantial effect on quality and compliance management. The number of patients visiting hospitals and healthcare facilities has decreased dramatically, negatively impacting the industry growth. Post-pandemic, healthcare QMS software will help businesses recover from the consequences of the pandemic, enabling them to focus more effectively on risk management and other operational difficulties, consequently driving the market over the projection period.

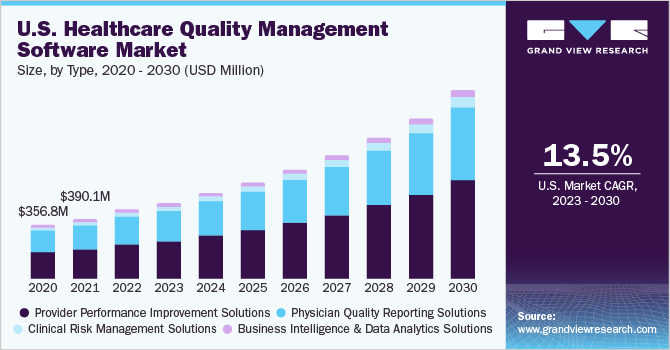

Type Insights

Business intelligence and data analytics solutions held the largest market share of over 51.0% in 2022 and is expected to witness the fastest growth in the forecast period. This is attributed to the increasing use of data analytics solutions, which enable healthcare providers to process large amounts of data, identify patterns and trends, and gain insights to improve patient outcomes, reduce costs, and increase operational efficiency. BI and analytics solutions are particularly valuable in analyzing clinical and operational data to identify areas for quality improvement.

The need of BI and analytics solutions in healthcare industry is increasing due to the growing significance of quality management. BI tools can improve facility performance and identify new KPIs for facility management, addressing the limitations of current performance measurement. The growing importance of these solutions in improving performance will drive their adoption in hospitals and other facilities, thereby fuelling the growth of the segment. On the other hand, increasing focus on compliance and adherence is propelling the growth of clinical risk management solutions segment.

Application Insights

The data management segment held the largest market share of 41.5% in 2022. This growth is primarily driven by the increasing volume of inconsistent healthcare data and the rising demand from regulatory organizations for reports that meet strict quality standards. Regulatory bodies, such as government agencies and accrediting organizations, require healthcare providers to submit comprehensive reports on various quality metrics, including patient outcomes, safety measures, and adherence to best practices.

The risk management plays a crucial role in enhancing patient safety and minimizing liabilities for healthcare organizations. By utilizing effective risk management software, healthcare providers can record and track events, allowing them to proactively identify risks, maintain regulatory compliance and mitigate potential harm.

Deployment Mode Insights

The cloud-based segment dominated the market and accounted for revenue share of 45.9% in 2022. This is due to the flexibility provided by cloud-based solutions, which allow organizations to easily adjust their software usage to meet changing regulatory requirements and operational needs. Additionally, cloud-based systems reduce upfront costs, enable smooth data sharing and collaboration, and provide convenient remote accessibility. These features are transforming the quality management system and contributing to the rapid growth of the cloud-based segment.

The web-based segment is expected to gain positive acceptance among users, similar to cloud-based systems. However, market growth may vary as cloud-based systems are still preferred due to their ability to operate without constant internet connectivity. While the web-based system relies on an internet connection, it offers the advantage of allowing users to access the system from any location. This factor is expected to further propel the growth of the web-based segment in the market.

On-premises software accounted a significant revenue share in 2022 due to its ability to provide data security and control, making it an appealing choice for healthcare organizations with strict compliance requirements associated with quality management system in healthcare organization aiming to prevent data breaches.

End-use Insights

The hospital segment held the largest market share of 56.5% in 2022 and is projected to experience the fastest growth during the forecast period. This growth can be attributed to several factors, including the increasing focus on patient safety, and the rise in medical error rates. Increasing number of hospitals focusing on JCI accreditation, the adoption of healthcare information technology, and government mandates to maintain quality standards are also contributing to the segment growth.

The ambulatory surgery center is expected to experience significant growth during the forecast period. This can be attributed to various factors, such as the increasing in medical errors, the adoption of an effective QMS ensuring patient safety, and the cost reduction associated with quality management are the key factors driving the growth of the segment.

Regional Insights

North America dominated the market with a share of 43.3% in 2022. Growing product launches by the leading player and increasing efforts by CMS to shift toward value-based care have resulted in greater acceptance of these solutions in North America. In November 2021, for instance, Crothall Healthcare introduced a web-based Quality Management System platform in conjunction with Intelex.

On the other hand, Asia Pacific is anticipated to witness lucrative growth during the forecast period. This is due to the growing number of hospitals in the region and rising healthcare spending. Increasing adoption of IT solutions among hospitals in the region and improving focus on providing quality care services are favoring the market growth.

Key Companies & Market Share Insights

The market is moderately competitive since players continue to focus on providing customized solutions, mergers and acquisitions, and expansion into new markets. As part of their commercialization strategies, companies are also investing in the development of new platforms and products with improved capabilities. Furthermore, collaborations between key players in the healthcare industry are anticipated to be a major driving force for market growth.

For instance, in February 2022, Hexagon AB acquired ETQ, a SaaS-based QMS software provider. This acquisition will strengthen Hexagon AB's market position by adding a QMS software platform to its portfolio. In November 2021, Crothall Healthcare partnered with Intelex to launch "team quest," a dedicated web based QMS platform. This collaboration resulted in the development of a comprehensive software solution designed to streamline quality management processes in hospitals. Some of the key players in the healthcare quality management software market include:

-

MorCare

-

Karminn Consultancy Network

-

Intelex Technologies

-

EFFIVITY

-

Okkala Solutions Private Limited

-

MEG

-

Premier, Inc.

-

Qualityze Inc.

-

Title21 Software, Inc.

-

OdiTek Solutions

-

Ideagen

Healthcare Quality Management Software Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 1.3 billion

The revenue forecast in 2030

USD 3.1 billion

Growth Rate

CAGR of 13.24 % from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, deployment mode, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

MorCare; Karminn Consultancy Network; EFFIVITY.; Intelex Technologies; Okkala Solutions Private Limited; MEG; Premier, Inc.; Qualityze Inc.; Title21 Software, Inc.; OdiTek Solutions; Ideagen

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Quality Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare quality management software market report based on type, application, deployment mode, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Business intelligence and Data analytics solutions

-

Clinical risk management solutions

-

Physician quality reporting solutions

-

Provider performance improvement solutions

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Management

-

Risk Management

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

Web Based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory surgery centres

-

Nursing homes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare quality management software market size was estimated at USD 1.1 billion in 2022 and is expected to reach USD 1.3 billion in 2023.

b. The global healthcare quality management software market is expected to grow at a compound annual growth rate of 13.24% from 2023 to 2030 to reach USD 3.1 billion by 2030.

b. North America dominated the healthcare quality management software market with a share of 43.3% in 2022. Growing product launches by the leading player and increasing efforts by CMS to shift toward value-based care have resulted in greater acceptance of these solutions in North America.

b. Some key players operating in the healthcare quality management software market include MorCare; Karminn Consultancy Network; EFFIVITY.; Intelex Technologies; Okkala Solutions Private Limited; MEG; Premier, Inc.; Qualityze Inc.; Title21 Software, Inc.; OdiTek Solutions; Ideagen

b. Key factors that are driving the market growth include rising healthcare expenses, the growing unstructured medical data, and increasing medical errors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.