- Home

- »

- Healthcare IT

- »

-

Healthcare Software As A Service Market Report, 2028GVR Report cover

![Healthcare Software As A Service Market Size, Share & Trends Report]()

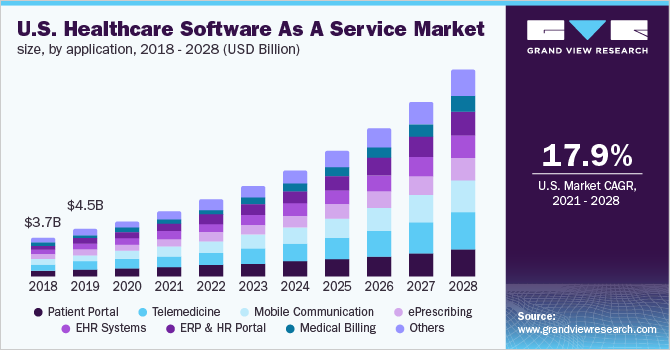

Healthcare Software As A Service Market Size, Share & Trends Analysis Report By Application (Patient Portal, Telemedicine, Mobile Communication), By Deployment Model, By End User, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-911-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

Report Overview

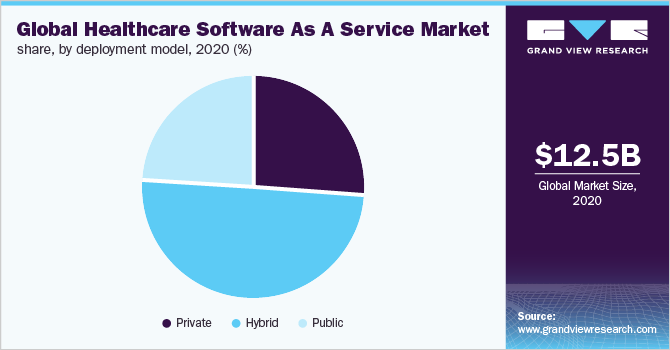

The global healthcare software as a service market size was valued at USD 12.5 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 19.5% from 2021 to 2028. The growing adoption of cloud technologies and growing digitalization in healthcare are major parameters driving the growth of the healthcare Software as a Service (SaaS) market during the forecast period. According to the Right Scale report published in 2019, a software service company, 94% of the enterprises use the cloud. It also suggests that around 21% of enterprises are planning to install cloud in near future.

Healthcare companies are adopting SaaS for cost benefits, security, ease of use, ease of integration, customer support, enhanced administration and management capabilities, uptime guarantee, scalability, customizability, data center infrastructure, disaster recovery plan, and reporting. SaaS finds various applications, such as in website, email, communications, mobile services, customer relationship management, mobile services, productivity apps, ERP, data analytics, document management, and database server.

Digitalization is witnessing rapid growth in the healthcare sector. The COVID-19 pandemic has accelerated digitalization. Healthcare organizations faced multiple challenges such as the shortage of workforce and resources. Healthcare organizations started adopting digital platforms during the pandemic to overcome these challenges and to increase return on investment. According to a survey published by Innovaccer Inc., a health cloud company, in 2021, 49% of healthcare organizations were actively working toward digital transformation.

The goal of health organizations was to provide telehealth services for 39% of respondents, automation of care management for 30% of respondents, automation of care pathways and coordination step for 20% of respondents, and enhancement of triage and risk assessment capabilities for 11% of respondents. Moreover, improving clinical operation, modernizing data platforms, the integration of disparate systems, and rationalizing IT expenditures were the top priorities of organizations. Thus, increasing plans to install and upgrade advanced digital facilities are estimated to drive market growth.

Increasing adoption of telehealth, wearable devices, mobile applications, remote patient monitoring, ERP, CRM, and surging patient data are contributing to the growth. As per a report by the International Telecommunication Union, 12.1 billion people are estimated to have smartphones by 2030. As per an article published by the Journal of Medical Internet Research in 2020, 30% of adults from the U.S. regularly use wearable devices. As per a study published by the European Commission in 2017, 96% of the doctors from Europe use EHR. All these parameters are contributing to the adoption of SaaS.

The rapid shift to remote working and increasing adoption of telemedicine increased focus on cloud computing and SaaS during the COVID-19 pandemic are expected to contribute to the growth of the market in the forthcoming years. According to a study published by Flexera, cost savings and moving the workload to the cloud were some of the major cloud initiatives. In 2019, 64% of the respondents were interested in cost savings. This number increased to 73% in 2020. Moreover, 58% of respondents were interested to move the workload to the cloud in 2019, which increased to 61% in 2020.

The healthcare software as service companies are adopting strategies, such as new product development, mergers and acquisitions, partnerships, collaborations, and joint ventures, which is expected to drive the market growth potential in the forthcoming years. For instance, in August 2021, Telstra Health announced its plans to acquire MedicalDirector for USD 256 million. MedicalDirector offers SaaS for practice management software, electronic healthcare records, billing, care coordination, scheduling, clinical content, medicines information, and cybersecurity solution.

COVID-19 Global Healthcare Software As A Service Market Impact: 19.7% Revenue Growth

Pandemic Impact

Post-COVID-19 Outlook

The global healthcare software as a service market increased by 18.7% from 2019 to 2020.

In 2021, the market will increase by 18.9% from 2020, owing to the increasing initiatives by the government and health organizations for the digitalization of healthcare

COVID-19 pandemic resulted in increased adoption of digital health technologies such as telehealth and mobile health application. This, in turn, increased the demand for SaaS from these applications

COVID-19 pandemic increased the adoption of cloud technologies. Post-pandemic, consumers will continue adopting cloud technologies such as SaaS owing to its benefits such as cost reduction, ease of deployment, maintenance, and integration.

Increasing focus on remote healthcare and increasing awareness and plans to adopt cloud computing during the COVID-19 pandemic positively impacted the market growth.

Increasing investments in the global healthcare software as a service industry along with various strategic initiatives undertaken by the key stakeholders is estimated to increase the adoption of healthcare software as a service.

Application Insights

The patient portal segment held the highest revenue share of 17.1% in 2020. The rising adoption of patient portal software and the availability of a large number of patient portals and software are contributing to the high revenue share of the segment. Moreover, increasing demand for digital tools such as a portal for patient engagement is expected to drive the adoption of patient portals. For instance, according to an article published by DocASAP, 54% of the patients prefer digital tools over the phone for appointments reminders and communication.

The telemedicine segment is expected to register the fastest growth over the forecast period. High adoption of telemedicine during the COVID-19 pandemic and increasing preference for these services are the key contributing factors driving the growth of the segment. Factors such as the increasing investments and funding in the telemedicine industry and the increasing acceptance of telemedicine by health insurance companies are estimated to drive the growth. For instance, in October 2021, Alloy, a telehealth company addressing women’s needs raised USD 3.3 million.

End-user Insights

The provider segment held the largest revenue share of over 70% in 2020 and is estimated to be the fastest-growing segment during the forecast period, owing to the high adoption rate of cloud computing and software as a service technology, by hospitals. For instance, according to a survey conducted by HIMSS, one of every two hospitals in Germany use cloud solutions for clinical records and administration.

Many hospitals are installing and updating digital technologies to cater to challenges such as shortage of skilled workforce and limited resources, thereby driving the growth. For instance, St. Thomas Elgin General Hospital from Canada implemented SaaS technology for medical imaging referral management, in November 2021.

The payer segment is estimated to witness lucrative growth during the forecast period. Health insurance companies have started adopting SaaS technology for various applications such as medical billing, ERP, and other portal systems. It is attributed to its benefits, such as reduction in deployment time, reduced costs, scalability, and ease of upgrades. Increasing digitalization in the insurance industry is supporting the growth of the segment.

Deployment Model Insights

In 2020, the hybrid segment held the highest revenue share of 50.2% in the global healthcare software as a service market. It is attributed to the high adoption of hybrid SaaS by all industries, including healthcare as it offers a combination of public and private cloud. The hybrid deployment model offers benefits, including flexibility to support a remote workforce, better security and data control at reduced costs, improved scalability, enhanced innovation, improved security, and easy risk management.

The public deployment model is estimated to witness lucrative growth during the forecast period. According to a study conducted by HIMMS in Germany, the majority of the hospitals in Germany use the public cloud. Public SaaS offers significant cost savings as they are managed by third-party vendors. Moreover, it is easy to maintain and upgrade. However, the public cloud may have speed, accessibility, and security issues cloud is shared.

Regional Insights

In 2020, North America accounted for the highest revenue share of 47.7%. The high market presence of major players such as IBM, Google, SAP, and Microsoft in the U.S. and Canada is a major contributor to the high revenue share. Moreover, high awareness about cloud technologies and rapid adoption of different cloud technologies including SaaS is further driving the growth.

There is high demand for quality care and high regulatory pressure to reduce care costs. This is driving the demand for various digital healthcare technologies thereby driving the market growth. For instance, in August 2021, the Health Resources and Services Administration (HRSA) invested USD 19 million for telehealth expansion.

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period, attributed to various initiatives undertaken by key stakeholders. For instance, in November 2021, Augnito.ai, an artificial intelligence-based voice solution provider, introduced The Big Diwali SaaS Fest to offer and promote digitalization for clinical documentation among doctors in India.

Factors, such as the rise in adoption of mobile and telehealth and growing digitalization are supporting the growth. According to an article published by the Ministers Department of Health in April 2020, 4.3 million health services were delivered by telehealth by the Australian Government. The government also announced its plans to further expand telehealth facilities in the near future.

Key Companies & Market Share Insights

Key players operating in the healthcare SaaS market are Microsoft, Salesforce, Adobe, SAP, Oracle, CISCO, Google, IBM, ServiceNow, and Workday. Players operating in the market are adopting various strategies such as partnerships, collaborations, mergers and acquisitions, and product developments to expand product portfolio and global presence. For instance, in November 2021, EverCommerce, a SaaS company, announced its plans to acquire DrChrono, an EHR, practice management, and billing software company, to expand its product offerings. Some of the prominent players operating in the global healthcare software as a service market are:

-

Microsoft

-

Salesforce

-

Adobe

-

SAP

-

Oracle

-

CISCO

-

Google

-

IBM

-

ServiceNow

-

Workday

Healthcare Software As A Service Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 14.8 billion

Revenue forecast in 2028

USD 51.7 billion

Growth Rate

CAGR of 19.5% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment model, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Russia; Japan; China; Australia; India; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Microsoft; Salesforce; Adobe; SAP; Oracle; CISCO; Google; IBM; ServiceNow; Workday

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research, Inc. has segmented the global healthcare software as a service market report based on application, deployment model, end user, and region:

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Patient Portal

-

Telemedicine

-

Mobile Communication

-

ePrescribing

-

EHR Systems

-

ERP & HR Portal

-

Medical Billing

-

Others

-

-

Deployment Model Outlook (Revenue, USD Million, 2016 - 2028)

-

Private

-

Hybrid

-

Public

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Provider

-

Payers

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global healthcare software as a service market size was estimated at USD 12.5 billion in 2020 and is expected to reach USD 14.8 billion in 2021.

b. The global healthcare software as a service market is expected to grow at a compound annual growth rate of 19.5% from 2021 to 2028 to reach USD 51.7 billion by 2028.

b. North America dominated the healthcare software as a service market and accounted for the largest revenue share of 47.7% in 2020.

b. Some key players operating in the healthcare software as a service market include Microsoft, Salesforce, Adobe, SAP, Oracle, CISCO, Google, IBM, ServiceNow and Workday.

b. Key factors that are driving the healthcare software as a service market growth include growing adoption of cloud services and digital technologies by healthcare organizations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."