- Home

- »

- Consumer F&B

- »

-

Healthy Biscuits Market Size, Share & Demand, Global Report, 2025GVR Report cover

![Healthy Biscuits Market Size, Share & Trends Report]()

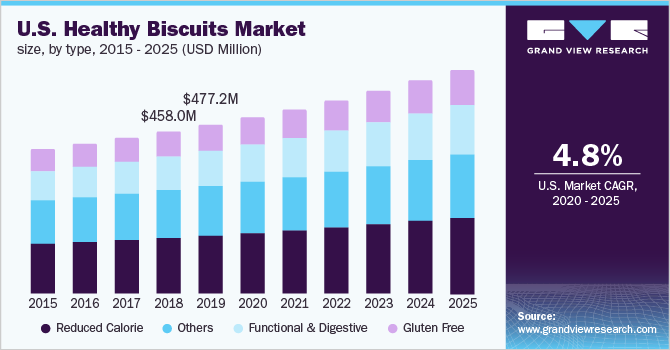

Healthy Biscuits Market (2020 - 2025) Size, Share & Trends Analysis Report By Type (Functional & Digestive, Gluten-free, Reduced Calorie), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-278-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2015 - 2018

- Forecast Period: 2020 - 2025

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthy Biscuits Market Summary

The global healthy biscuits market size was valued at USD 2.24 million in 2019 and is projected to reach USD 3.01 million by 2030, growing at a CAGR of 5.0% from 2020 to 2030. The market growth is attributed to rising awareness about health and fitness and growing preference for healthy snack products, especially among the working professionals and millennials.

Key Market Trends & Insights

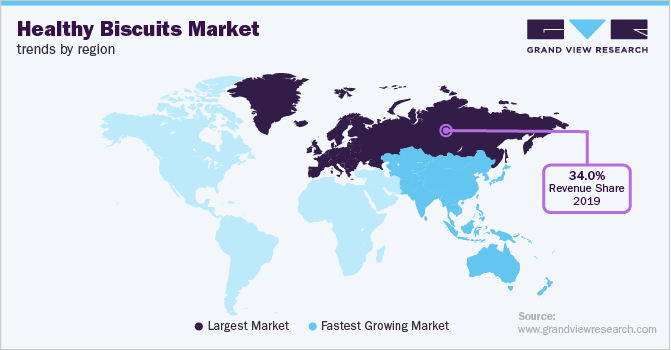

- Europe held the largest share in 2019.

- The Asia Pacific is expected to witness the fastest growth over the forecast period.

- Based on type, the reduced calorie segment accounted for the largest market in 2019.

Market Size & Forecast

- 2019 Market Size: USD 2.24 Million

- 2030 Projected Market Size: USD 3.01 Million

- CAGR (2020-2030): 5.0%

- Europe: Largest market in 2019

- Asia Pacific: Fastest growing market

The high nutritional value of healthy biscuits is also expected to augment their demand over the years to come. Increasing product popularity as go-to snacks, which can replace high-calorie content products like chocolates, cakes, and cookies, is further projected to drive the global market.Demand for healthy biscuits is increasing due to the active lifestyle of the consumers who look for convenient eating options. Rising demand for healthy snacks, coupled with high per capita food consumption, especially in developing countries such as India and China, is contributing to the growth of the global market. Moreover, packaging innovations and an increase in the number of fitness enthusiasts are expected to boost healthy biscuits market growth.

Low price, easy availability, quick consumption, and high nutritional value are some of the factors expected to result in an increasing acceptance of healthy biscuits. Manufacturers are actively indulging in the production of healthy biscuits in different flavors to enhance the taste. For instance, Parle offers digestive biscuits infused with the flavor of honey and oats, along with an aroma of cinnamon. This scenario has led to strong competition in the global market due to the presence of a large number of international and local manufacturers.

Increased demand for natural and non-GMO products has been observed in the global market. Consumers are shifting to natural food products owing to rising health awareness and growing food safety concerns. Moreover, improved lifestyles and the introduction of advanced purchase methods such as online grocery shopping have been fueling the market growth. Furthermore, companies are adopting innovative promotional strategies such as TV campaigns to spread awareness about their healthy products.

Healthy Biscuits Market Trends

Rising awareness about health and wellness has prompted consumers to switch to healthy biscuits that are low in calories, sugar-free, gluten-free, and high in fiber. This trend of consuming healthy snacks is most widespread in European countries such as the U.K., Italy, Spain, and France. The demand for healthy biscuits is increasing due to the hectic lifestyles of consumers, who are always looking for convenient and healthy food items.

Rising incidences of lifestyle-related diseases such as obesity, heart disease, and diabetes among consumers is the major factor driving the demand for healthy biscuits, which, in turn, is anticipated to drive the market for sugar-free biscuits.

Obesity is a serious public health problem in most countries across the world, as it significantly increases the risk of chronic ailments such as cardiovascular diseases, type-2 diabetes, and hypertension. According to World Health Organization (WHO), in European countries, obesity affects 10%–30% of adults, and 30%–70% of adults are overweight. Thus, to control this condition, a greater number of people are switching to sugar-free drinks, biscuits, and confectionery.

Growing consumer inclination towards ready-to-eat and on-the-go products, owing to busier lifestyles and hectic work schedules, is driving the demand for packaged food products, which in turn, is expected to drive the demand for sugar-free biscuits. The increasing working population, especially working women, is anticipated to drive the market for sugar-free biscuits.

The growing trend of snacking and evolving eating habits such as a preference for low-calorie or low-sugar products are also driving the consumption of sugar-free biscuits. The major consumers of sugar-free biscuits are millennials and Gen Z. Moreover, various posts about healthy eating to maintain ideal body weight on social media are also influencing consumers to eat sugar-free biscuits.

The easy and wide availability of conventional biscuits through various distribution channels is the major factor restraining the growth of this market. Conventional biscuits are manufactured by various big players such as Kellogg Company, General Mills, Mondelēz International, and Parle Products that have strong distribution networks across the world and thus, serve a large number of consumers. Moreover, strong advertising and marketing by these players influence consumers to purchase these biscuits.

Type Insights

The reduced calorie segment accounted for the largest share in 2019. The market growth is attributed to rising consumer demand for healthier products, thereby encouraging the manufacturers to produce biscuits with less fat and sugar content. Various manufacturers are operating in this category. For instance, Galletas Gullón manufactures sugar-free Marie and fiber biscuits, Tiffany produces sugar-free biscuits in lemon, orange, and chocolate flavor, and IKO offers biscuits made of pumpkin, oats, and grain ingredients.

The functional and digestive segment is expected to expand at the fastest CAGR of 5.5% from 2019 to 2025. Growing demand for healthy snacks having a high source of dietary fiber is driving the segment. These biscuits are made of different nutrition-rich ingredients such as oats, wheat, and multi-grains. India is anticipated to witness significant growth in this category. The digestive biscuits market in India is majorly dominated by the Britannia Nutrichoice range. Some of the other prominent players operating in this category are Parle NutiCrunch, McVities, and Tiffany.

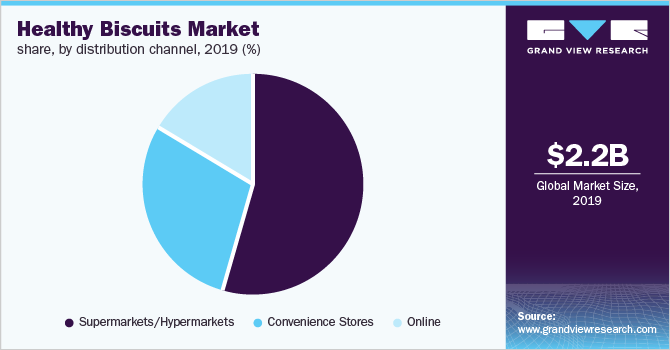

Distribution Channel Insights

Healthy biscuits have high accessibility through supermarkets and hypermarkets. This distribution channel generated a revenue of USD 1.2 billion in 2018. The physical display of products in the stores allows customers to scan product details. Moreover, the availability of a wide range of products offered by different brands enables consumers to compare and choose the best product. The growth of the organized retail sector and various offers and discounts provided by leading players have also helped in increasing the visibility of these products.

The online category is anticipated to expand at a CAGR of 5.0% from 2020 to 2025. Online distribution is gaining increasing traction among consumers for such products. This distribution channel is penetrating the market with e-commerce platforms and the growing usage of smartphones in daily life. Companies like bigbasket.com and groffers.com are coming up with door-to-door delivery of products with an online display of a wide range of products. Moreover, coupon offers provided by online platforms are influencing the buying behavior of the customers.

Regional Insights

Europe held the largest share in 2019. The market growth is majorly attributed to the high demand for digestive biscuits and the presence of major players namely Mondelēz International, Inc., and United Biscuits. The U.K. accounted for a significant share in the Europe market in 2018. High product demand, as well as a number of product launches, are some of the factors boosting the growth in the country.

Traditionally perceived as unhealthy among consumers, biscuits, and cookies available today have been attracting an increasing number of consumers as many of these are gluten-free, with high fiber content, no added sugar, and high in protein. This is expected to drive the demand for healthy biscuits in the region. Moreover, since the outbreak of COVID-19, consumers confined to their homes have shown a higher tendency to binge on snacks, including biscuits and cookies of various kinds. This trend is also anticipated to boost product sales.

The market growth in Spain can be attributed to the increasing incidence of obesity in the country According to a study by the Mar de Barcelona hospital 80% of men and 55% of women will be overweight by 2030 and if obesity is not controlled 27 million people in Spain will be overweight by 2030. Spanish consumers are opting for smaller portions of snacks, which is expected to benefit the growth of the healthy biscuits market.

The Asia Pacific is expected to witness the fastest growth over the forecast period. Spurring demand for convenient and healthy snack products is likely to be a major factor in market growth. The market in India is marked by the presence of major players such as Britannia, Parle, and ITC, wherein Nutrichoice by Britannia occupies about 70.0% share in the premium health biscuit category, followed by Sunfeast’s Farmlite range.

Key Companies & Market Share Insights

Some of the major players operating in the global market are Mondelēz International, Inc., Pladis (United Biscuits), Britannia, Parle Products Pvt. Ltd., ITC Limited (Sunfeast), IFFCO (Tiffany), COSMIC NUTRACOS SOLUTIONS PRIVATE LIMITED (GAIA), UNIBIC Foods India Pvt. Ltd., and Anmol Industries Ltd.BelVita by Mondelēz has witnessed global sales double to more than USD 600 million since its launch in the U.S. in 2012. It has been considered as the fifth best-selling brand in the U.S. as an essential breakfast snack. Growing preference for healthy snacking items is expected to offer potential opportunities for the companies to expand their product offerings in this category in the near future.

Healthy Biscuits Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.34 million

Revenue forecast in 2025

USD 3.01 million

Growth rate

CAGR of 5.0% from 2020 to 2025

Base year for estimation

2019

Historical data

2015 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD million and CAGR from 2020 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Brazil; South Africa

Key companies profiled

Mondelēz International, Inc.; Pladis; Britannia; Parle Products Pvt. Ltd.; IFFCO; COSMIC NUTRACOS SOLUTIONS PRIVATE LIMITED; UNIBIC Foods India Pvt. Ltd.; Anmol Industries Ltd.; ITC Limited; IKO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthy Biscuits Market Segmentation

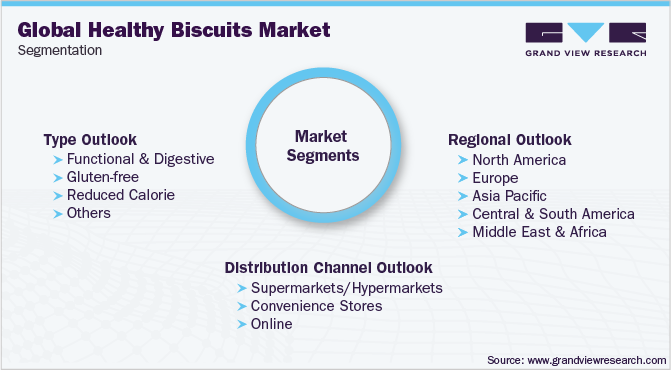

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global healthy biscuits market report on the basis of type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2015 - 2025)

-

Functional & Digestive

-

Gluten-free

-

Reduced Calorie

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.