- Home

- »

- Medical Devices

- »

-

Heart Closure Devices Market Size & Share Report, 2030GVR Report cover

![Heart Closure Devices Market Size, Share & Trends Report]()

Heart Closure Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Closure Type (CHD Closure, PFO Closure, LAA Closure), By Region (North America, APAC, Europe, LATAM, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-002-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Heart Closure Devices Market Summary

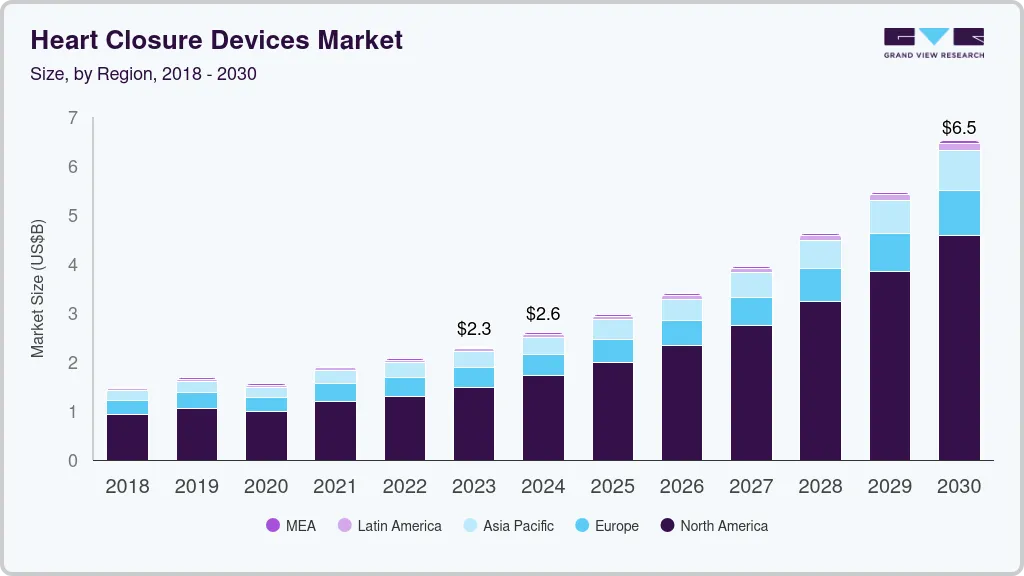

The global heart closure devices market size was estimated at USD 2.29 billion in 2023 and is projected to reach USD 6.51 billion by 2030, growing at a CAGR of 16.1% from 2024 to 2030. The adoption of high-priced technologies expanded options for reimbursement, strong clinical evidence surrounding the device, and expanded availability of qualified physicians are the main market drivers.

Key Market Trends & Insights

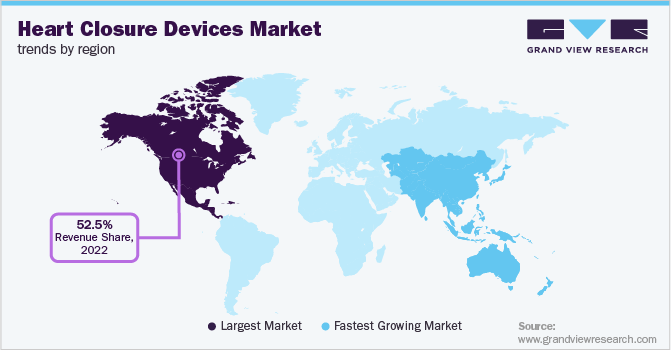

- North America dominated the global industry in 2022 and accounted for the largest share of more than 52.50%.

- Asia Pacific region is expected to register the fastest growth rate during the forecast period.

- By closure type, the LAAC segment dominated the industry in 2022 and accounted for the largest share of 49.00% of the overall revenue.

Market Size & Forecast

- 2023 Market Size: USD 2.29 Billion

- 2030 Projected Market Size: USD 6.51 Billion

- CAGR (2024-2030): 16.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

For instance, Abbott Laboratories' AMPLATZER Duct Occluder II Additional Sizes brand portfolio underwent the U.S.-based ADO II AS trial. Strong clinical evidence could encourage market expansion across the area as the demand for the device rises, since many physicians in countries of Latin America and Asia Pacific, particularly in Brazil, Mexico, Australia, and India, rely on studies from the U.S. and Europe. The industry was significantly impacted by the global COVID-19 pandemic. Procedures that were not necessary, like routine patient-doctor visits, screenings, and elective surgeries, were canceled or postponed after a number of regional and national governments at first issued orders to shelter in place to reduce potential exposure to and transmission of infection.

This affected prominent companies. For instance, a major player, LifeTech Scientific, in its 2020 annual report mentioned a revenue decline of 24.8%, which was approximately RMB206.4 million. Furthermore, revenues from its sales of LAmbreTM LAA occluders declined by roughly 18.8%, Cera occluders reduced by roughly 17.3%, CeraFlex occluders dropped by roughly 30.7%, and HeartR occluders significantly reduced by approximately 37.2%. This demonstrated an impending decline due to delayed/canceled procedures. Moreover, various government initiatives in nations like China and India would aid local businesses in increasing market share, which would support market growth over the forecast period.

However, for MNCs like Boston Scientific and Abbott, this can be challenging to increase their respective market shares. For instance, the Indian government increased its import tax on medical products from 5% to 7.5% plus an additional 4% fee, in January 2016, to better implement the country’s ‘Make in India’ initiative. In addition, the Central Board of Indirect Taxes and Customs (CBIC) recently announced that to boost manufacturing, the basic import tax on raw materials and related components was reduced to 2.5% with a full exemption from special extra duties. MNCs will find it challenging to compete in this market due to policies in both China and India that follow a similar route.

Heart Closure Devices Market Trends

The market is likely to be driven by the positive influence of a number of clinical trials running around the devices in the market. This has happened as companies continue to promote their products, raising understanding of the device and encouraging the gradual development of favorable clinical data in favor of the uptake of their product lines. For instance, strong results from studies like the RESPECT and REDUCE trials, which demonstrate the value of early PFO closure and were financed by W. L. Gore and St. Jude Medical (previous to Abbott Laboratories' ownership of St. Jude Medical), respectively, will promote PFO closure volumes, ultimately leading to market expansion.

In addition, the industry is anticipated to benefit from increased competition brought on by the introduction of innovative devices by companies in the coming years. For instance, HeartStitch, which uses stitches rather than the conventional double-disc design and has already received the CE mark for its NobleStitch EL, is anticipated to enter the PFO closure device market globally, especially in regions like Asia Pacific, where the company could eventually be profitable through its distribution channels.

Few of the Notable Emerging Products of the Global Market

Company

Brand Name

Current Status

LifeTech Scientific

KONAR-MF

Received CE Mark in 2018

HeartR

Received approval in China in 2015

Cera and CeraFlex occluders

Received approval in China in 2017

Absnow

Received approval in China in 2020

Abbott Laboratories

AMPLATZER Piccolo Occluder

Received USFDA and CE Mark approval in 2019

Lepu Medical

Technology

(Beijing)

Fully Degradable VSD Occluder

Under Pre-clinical inspection in China and underfilling for CE mark

W. L. Gore

CARDIOFORM ASD Occluder

Received USFDA and CE Mark approval in 2019

Furthermore, in cost-conscious countries, such as India and Brazil, and, to some extent, in nations where government actions are probably in favor of domestic producers, like China, competitive prices will be crucial to boosting device sales. It would be essential for companies to strategically price their products to boost sales. For example, the pricing for heart defect closure devices is the lowest in India among the Asia Pacific countries studied in the report. To keep device prices low, Abbott Laboratories provides hospitals with bundle devices and offer products at a discount. This might eventually enable the company to sustain its market position over the coming years.

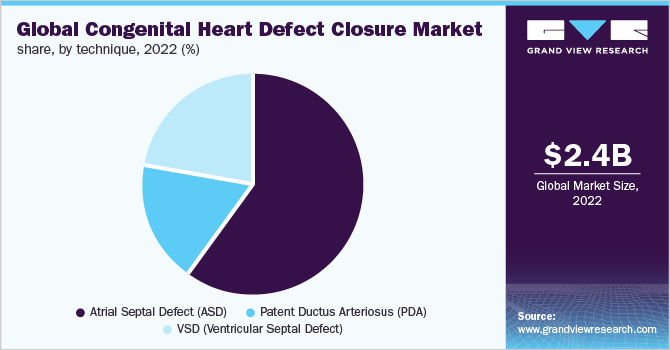

Closure Type Insights

Based on the closure type, the industry has been categorized into Congenital Heart Defect (CHD) closure, Patent Foramen Ovale (PFO) closure, and Left Atrial Appendage Closure (LAAC). The LAAC segment dominated the industry in 2022 and accounted for the largest share of 49.00% of the overall revenue. The growing number of nonvalvular AF patients who have been shown to be at high risk for stroke and also in whom oral anticoagulants are ineffective. For instance, data from the Journal of Arrhythmia from 2017 shows that the number of cases is largest in densely populated nations like China and India, which would eventually increase the demand for LAAC.

The CHD closure segment also accounted for a significant share of the overall revenue in 2022 mainly due to the advancements in the region's facility infrastructure, accessibility of congenital heart defect closure devices, and an increase in the number of qualified physicians, all of which will encourage the use of minimally invasive devices. For instance, due to improved developments in the hospital infrastructure, ASD and PDA closure therapies continue to have major market penetration in the market, consequently resulting in industry expansion.

Regional Insights

North America dominated the global industry in 2022 and accounted for the largest share of more than 52.50% of the overall revenue owing to high R&D investments and trials in this region. For instance, the Lifetech Scientific-sponsored IDE study on LAmbre. To establish safety and effectiveness data, the LAmbre device would be evaluated in this clinical trial among the U.S. population. Positive clinical results might boost the adoption of the LAA closure device in the U.S. as many physicians in the country are influenced by clinical studies. The Asia Pacific region, on the other hand, is expected to register the fastest growth rate during the forecast period.

Heart closure devices have been commercially available for more than a decade, which has allowed for the development of stronger healthcare infrastructure for performing minimally invasive heart defect closure treatments, resulting in further boosting the industry expansion. Many heart defect closure technologies are available in nations like Australia, where minimally invasive heart defect closure technologies were introduced years before it was in other international markets. For instance, W. L. Gore’s GORE CARDIOFORM Septal Occluder was approved in the U.S. in 2018 and in Australia in 2015.

Key Companies & Market Share Insights

Providing training and building physician relationships is essential to help rivals increase brand loyalty for their devices, ultimately assisting the company in establishing a market presence, which drives revenue growth. For instance, Lifetech Scientific participates in a variety of activities and clinical practice-related events throughout the regional scope. These activities include organizing interventional procedure live workshops and relaying cases followed by symposiums. For instance, Lifetech and a Canadian pediatric cardiologist organized a VSD Workshop in March 2017. For Lifetech, through this workshop, breaking into the North American market for the first time was a major step toward the company's goal of expanding internationally. Several companies are creating distinct products to set them apart from competitor product lines to obtain higher market shares.

For instance, by developing the AtriClip PRO2, which could clog the LAA during minimally invasive cardiac therapies, AtriCure has enhanced the AtriClip, a surgical LAA closure device currently in use. Similar to this, Abbott Laboratories' AMPLATZER Amulet and Boston Scientific's WATCHMAN are both incorporated into the LAmbre endocardial LAA closure device from Lifetech Scientific. The increase in industry competition can be credited to the growing number of players, product approvals, and efficient distribution agreements. As a result, competitive rivalry in the industry is anticipated to be high over the forecast period. Some of the prominent players in the global heart closure devices market include:

-

Abbott

-

W. L. Gore & Associates, Inc.

-

Boston Scientific Corp.

-

Occlutech

-

Heartstitch

-

SMT

-

Cardia, Inc.

-

Lifetech Scientific Corp.

-

Lepu Medical Technology (Beijing)Co., Ltd.

-

AtriCure Inc.

Heart Closure Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.29 billion

Revenue forecast in 2030

USD 6.51 billion

Growth rate

CAGR of 16.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Closure type, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K.; France; Spain; Italy; Japan; China; India; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Abbott Laboratories; W. L. Gore & Associates, Inc; Boston Scientific Corp.; Occlutech; Heartstitch; SMT; Cardia, Inc.; Lifetech Scientific Corp.; Lepu Medical Technology (Beijing)Co., Ltd.; AtriCure Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heart Closure Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global heart closure devices market report on the basis of closure type and region:

-

Closure Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Congenital Heart Defect Closure

-

By Technique

-

ASD

-

PDA (inclusive of PDA closure and embolization coils)

-

VSD

-

-

-

PFO Closure

-

LAA Closure

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global heart closure devices market size was estimated at USD 2.36 billion in 2021 and is expected to reach USD 2.81 billion in 2023.

b. The global heart closure devices market is expected to grow at a compound annual growth rate of 14.9% from 2023 to 2030 to reach USD 7.43 billion by 2030.

b. The LAA Closure segment dominated the global heart closure devices market and accounted for the largest revenue share in 2021.

b. Some of the prominent players in the heart closure devices Market include Abbott Laboratories; W. L. Gore & Associates, Inc; Boston Scientific Corporation; Occlutech; Heartstitch; SMT; Cardia, Inc.; Lifetech Scientific Corporation; Lepu Medical Technology (Beijing)Co.,Ltd.; AtriCure Inc.

b. Adoption of high-priced technologies, expanded options for reimbursement, strong clinical evidence surrounding the device, and expanding the availability of qualified physicians are some of the driving factors of the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.