- Home

- »

- Advanced Interior Materials

- »

-

Heat Treated Steel Plates Market Size & Share Report, 2027GVR Report cover

![Heat Treated Steel Plates Market Size, Share & Trends Report]()

Heat Treated Steel Plates Market Size, Share & Trends Analysis Report By Process (Hardening & Tempering, Case Hardening, Annealing), By Application, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-431-4

- Number of Report Pages: 112

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The global heat treated steel plates market size was valued at more than USD 5.8 billion in 2019 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.9% from 2020 to 2027. Increasing shipbuilding activities primarily in Asia Pacific countries, such as Japan, South Korea, China, and Southeast Asian countries, is anticipated to fuel the demand for heat treated steel plates.

Southeast Asian countries including Malaysia, Singapore, Vietnam, and Philippines have evolved as new production hubs in recent years. For instance, Singapore is dominating the shipbuilding market in specialized and customized vessels, like offshore support vessels, yachts, and dredgers. Heat treated steel plates are widely used in shipbuilding for applications, including offshore equipment, repair pieces, and structural parts. Demand for steel plates is projected to rise over the coming years due to the growth of the shipbuilding sector in Asian countries.

The U.S. accounted for the largest share in the North America market for heat treated steel plates and the country is mainly driven by rising construction and infrastructure spending and automotive and aircraft manufacturing. Aging of infrastructure in the U.S. still remains one of the key issues.

The country has received a D+ grade for its infrastructure in a survey carried out by the American Society of Civil Engineers in 2017. For this, the government of the country needs to spend nearly USD 2 trillion over the next 10 years for the upgradation of infrastructure. This is likely to push the demand for various constructions and building related materials, such as steel plates, rebars, wires, and rods.

Geopolitical issues such as U.S.- China trade war and the outbreak of coronavirus are some of the key factors likely to restrain the market growth for the short term. China, being the largest manufacturing hub in the world, is projected to get most affected by these challenges. Due to disruptions in trade, demand for key commodities, such as steel, aluminum, and other metals, in the automotive, construction, and industrial machinery sectors is likely to observe sluggish growth for short period.

Process Insights

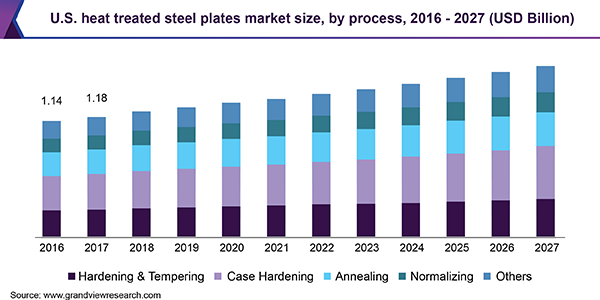

Based on the process, the heat treated steel plates market is segmented into hardening and tempering, case hardening, annealing, normalizing, and others. Hardening and tempering emerged as the second largest process segment in 2019 and is expected to maintain the same position over the forecast period. The combination of hardening and tempering develops exceptional hardness, strength, and toughness of the steel plate. It also decreases the material usage and improves machinability and formability of the steel plate.

Hardening involves heating of steel plate, followed by slow or rapid cooling. The plate is heated at a temperature above the upper critical (between 850-900ºC). The plate is again cooled slowly or rapidly (based on steel characteristics) in medium, such as oil, water, or air. The heating of the plate can be done with the help of induction, electric oven, cooker or gas.

Case hardening is projected to remain the fastest growing segment over the forecast period owing to its advantages, such as low cost, high strength and hardness, and the ability to form complex shapes. It is usually used for low carbon products owing to the poor hardenability of these products. Properties including wear resistance and ability to absorb stresses without failure are likely to increase the demand for heat treated steel plates in this segment.

Annealing involves heating the steel at high temperatures and then allowing it to cool at room temperature to improve the ductility and toughness of the product. Annealing is performed before the steel undergoes cold forming in order to reduce the load and energy required during the process and withstand large strains without failure.

Application Insights

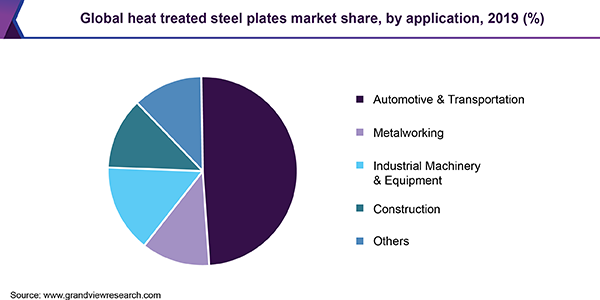

Based on application, the market for heat treated steel plates is segmented into automotive and transportation, metal working, industrial machinery and equipment, construction, and others. Automotive and transportation emerged as the largest segment in 2019 and accounted for a share of 49%. Steel is considered to be a sustainable material due to recyclability. Therefore, rising concerns over environmental pollution, service life, and driving comfort are projected to drive the demand for heat treated steel plates in the automotive and transportation segment.

In the automotive and transportation industry, case hardening is largely used to enhance hardness and static and dynamic strength of components over quench and hardened steel as they are not sufficient to withstand bending and rotating stress. Various grades of steel plates are used in long member of trucks, automotive sections, and structural parts of railways.

The industrial machinery and equipment segment was valued at USD 879.5 million in 2019. High strength steel plates are used in molds, dies, cranes, and earthmoving and construction machinery. Moreover, rising demand for tools that are used in various operations, like cutting, drilling, various movements, drilling, sanding, deformation, and knurling, is anticipated to remain a key factor contributing to the segment growth over the coming years. In this segment, lathe machines consume a large amount of heat treated steel as they provide hardness, strength, and machinability.

Regional Insights

Asia Pacific accounted for a share of more than 38% in the market for heat treated steel plates in 2019. Demand for heat treated steel plates is high in this region owing to growing consumption in the end-use industries. The industrial machinery sector in the region is poised to witness lucrative growth in the years to come on account of major infrastructure projects. These projects will be primarily built in energy, transportation, information, and water transportation.

North America is expected to witness significant growth in the forthcoming years owing to increasing construction spending, incessant automotive production, and growing aerospace manufacturing. Furthermore, government funding for aerospace and defense and changes in trade policies are likely to attract significant demand for heat treated steel plates in the region.

Middle East and Africa is projected to exhibit a CAGR of 3.4% from 2020 to 2027. The growth is attributed to the diversification programs by various governments, primarily in GCC countries. These countries are focusing on reducing their dependence on the oil and gas sector and are projected to increase investments in road infrastructure, such as highways and railways, healthcare, water transportation, and other manufacturing sectors.

Heat Treated Steel Plates Market Share Insights

Players operating in the market for heat treated steel plates are involved in mergers and acquisitions activities at the local and regional levels in order to increase their market share. For instance, in June 2018, Nippon Steel Corporation acquired Ovako AB, a Sweden based manufacturer of heat treated steel plates and special steel. Nippon Steel Corporation added Ovako AB as its wholly owned subsidiary. The acquisition was intended at expanding its product portfolio and global presence.

Key market participants include Nippon Steel Corporation, Baosteel, Tata Steel, ArcelorMittal, POSCO, Outokumpu, JFE Holdings, Thyssenkrupp AG, Essar Steel, and Novolipetsk Steel.

Recent Development

-

In June 2023, Outokumpu collaborated with Thyssenkrupp Materials Processing Europe and Boysen Group to expand in the automotive industry. This collaboration is aimed to lower the carbon footprints of steel in the automotive sectors.

-

In April 2023, the VELUX Group collaborated with ArcelorMittal, the world's leading steel and mining company to develop new steel-making technologies that aimed to reduce carbon emissions and improve the energy efficiency of the steel.

Report Scope

Attribute

Details

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Market representation

Revenue in USD Million and CAGR from 2020 to 2027

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Germany, France, Russia, China, Japan, India, South Korea, Brazil, and Iran

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global heat treated steel plates market report based on process, application, and region:

-

Process Outlook (Revenue, USD Million, 2016 - 2027)

-

Hardening & Tempering

-

Case Hardening

-

Annealing

-

Normalizing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Automotive & Transportation

-

Metalworking

-

Industrial Machinery & Equipment

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central and South America

-

Brazil

-

-

MEA

-

Iran

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."