- Home

- »

- Advanced Interior Materials

- »

-

Unitary Heaters Market Size, Share & Trends Report, 2030GVR Report cover

![Unitary Heaters Market Size, Share & Trends Report]()

Unitary Heaters Market (2023 - 2030) Size, Share & Trends Analysis Report By Operation (Gas-fired Unitary Heaters, Hydronic Unitary Heaters), By Application (Residential, Industrial), By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-104-4

- Number of Report Pages: 169

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global unitary heaters market size was estimated at USD 2,292.4 million in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 3.9% from 2023 to 2030. The growth of the market is expected to be driven by higher efficiency, lower noise levels, and lower operating costs. Moreover, unitary systems provide consistent temperatures across a household from one central unit. These factors are expected to positively impact product demand during the forecast year. Unitary heaters can be powered by various energy sources, including steam, hot water, propane, oil, and natural gas. Furthermore, with heating outputs ranging from 25,000 BTUs/hr to 400,000 BTUs/hr, a unit heater can heat a big room, such as a warehouse or mechanical shop. They are available in various efficiencies, with accepted efficiency units having a fixed capacity and high-efficiency units having variable capacities to maximize energy utilization.

Unit heaters are adaptable heating systems that deliver effective and targeted warmth in commercial, industrial, and residential applications. Individuals and organizations may make informed decisions about their heating needs by studying the types of unit heaters and their applications. Unit heaters provide a dependable and cost-effective solution for targeted heating requirements, whether they are used to maintain comfortable working conditions in industrial spaces, to complement central heating in commercial buildings, or to heat private garages and workshops.

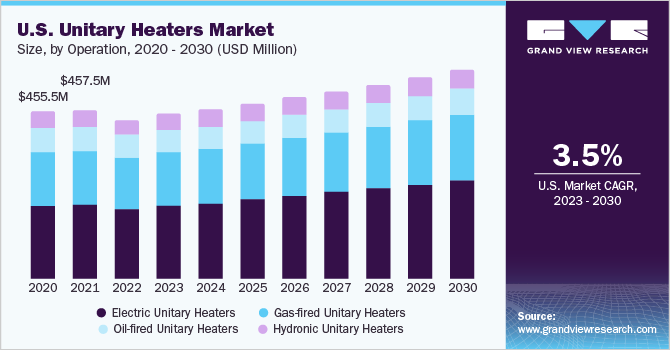

The growth of the market for unitary heaters in the U.S. is further aided by federal and state regulations that provide tax credits, rebates, and other supplemental incentives to boost energy-efficient system installations and encourage the use of renewable energy sources. Residential buyers in the U.S. may be eligible for an energy property credit, which allows them to claim 10% of the cost of labor, professional preparation, and installation. These previously mentioned reasons are expected to drive market demand in the approaching years.

Heating solution growth is expected to be boosted by rising building spending and increased maintenance and replacement activity. The building industry in the U.S. is focused on developing environmentally friendly and energy-efficient constructions. The U.S. Green Building Council (USGBC) founded the Leadership in Energy and Environmental Design (LEED) accreditation program.

LEED focuses on lowering energy usage through the design and development of energy-efficient projects. HVAC systems must meet the specifications stated in the New Buildings Institute, Inc. article "Advanced Buildings: Energy Benchmark for High-Performance Buildings." Such policies have also facilitated the development and implementation of ecologically sustainable alternatives such as unitary heaters.

Operation Insights

The electric unitary heaters segment led the market and accounted for more than 44.7% of the global revenue share in 2022. Electric unitary heaters are widely used in home, commercial, and light industrial applications. Electric resistance coils or heating elements are used to generate heat in these heaters. They are simple to install and use, and they give accurate temperature control. These factors are anticipated to drive the demand for electric unitary heaters in the projected timeframe.

The gas-fired unitary heaters segment is anticipated to witness a CAGR of 3.8% over the forecast period. In industrial & commercial settings, gas-fired unitary heaters are extensively employed. It efficiently heats huge spaces such as a commercial or industrial warehouse. They use natural gas or propane as a fuel source and generate heat through burning. These heaters frequently include a heat exchanger and a blower that distributes hot air over the surrounding area.

Hydronic unitary heaters are lightweight, low-cost to install, and weather resistant. They are designed for ceiling mounting and offer an easy and low-cost way of heating warehouses, supermarkets, factories, and other big open areas. The HB Series Horizontal Unit Heaters, for instance, are ideal for hot water installations. A wide spectrum of airflows allows for nearly limitless task design freedom. Beacon Morris horizontal unit heaters come in serpentine and header configurations.

Oil-fired heaters are constructed using time-tested and field-proven materials. These are also automatic and simple to service and install. Roll-formed, corrosion-resistant steel ensures the safety & durability of oil heaters. For instance, POR oil-fired unit heaters provide an effective form of heating, particularly in areas where fuels such as natural gas are scarce, or unreliable.

Application Insights

The commercial application segment led the market and accounted for more than 42.8% of the global revenue share in 2022. Unit heaters augment the central heating system in retail stores, restaurants, offices, and other commercial establishments, providing warmth to specific zones or locations. This is anticipated to contribute to the growth in demand in the commercial application segment over the forecast period.

Unit heaters, also known as space heaters, are stand-alone heating units that are used to heat specific zones or regions of a building. These heaters are often fixed on walls, ceilings, or floors and generate heat by using a heat source such as propane, natural gas, hot water, steam, or electricity. Unit heaters are also noted for their adaptability, energy economy, and ability to offer rapid and localized heating. Unit heaters are used in agricultural structures such as poultry houses, barns, and greenhouses to provide localized heating and to keep livestock, plants, and crops at appropriate temperatures.

The residential application segment is anticipated to witness a CAGR of 4.2% over the forecast period. Unit heaters are commonly used to heat domestic garages and workshops, allowing homeowners to keep warm while working on projects or keeping vehicles in colder areas. Portable and fixed industrial unitary heaters use a powerful fan to help circulate the warm air produced by the heating components. Unit heaters are widely used in warehouses, factories, workshops, and industrial facilities to offer focused heating in specified areas, assuring worker comfort and optimizing working conditions.

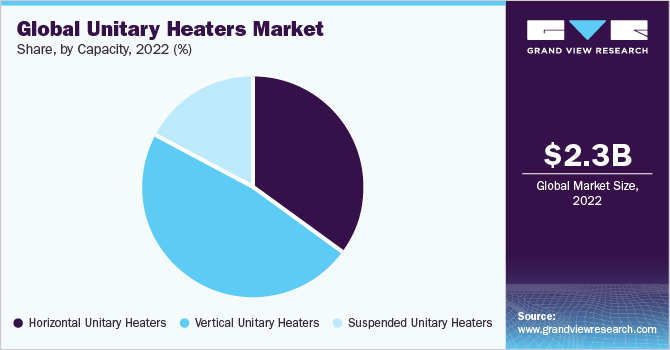

Type Insights

The vertical unitary heaters capacity segment led the market and accounted for 47.8% of the global revenue share in 2022. This vertical unit heater can recirculate the warm air accumulated near ceilings. Moreover, these are ideal for heating spaces with tall ceilings and where crane ways and other obstructions dictate higher mounting of heating equipment.

Horizontal louvers on the horizontal unit heaters can be changed to lengthen or shorten the heat throw and/or decrease or raise the mounting height. The horizontal electric unitary heaters models are mostly utilized in buildings with low ceilings and minimal barriers, and they are fitted with air deflector blades to modify airflow either up or down.

Suspended unitary heaters are technologically advanced kinds of unit heaters that are designed to provide exceptional energy efficiency, performance, and economy for lower operating and life cycle costs.

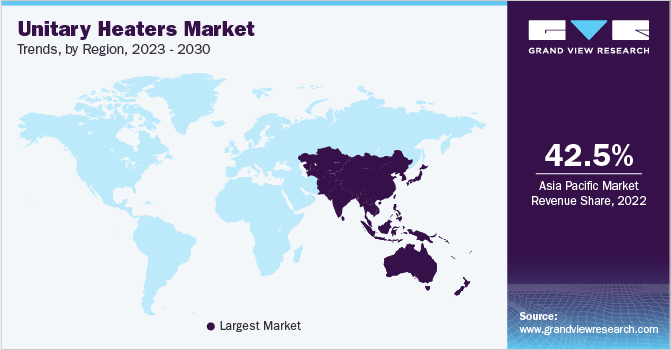

Regional Insights

Asia Pacific region dominated the market in 2022 by accounting for a revenue share of more than 42.5% owing to the massive investments by the governments of different countries in the region for the development of public infrastructure and the expansion of residential construction. There is rising awareness regarding energy saving across the region which is expected to augment the demand further.

Major unit heater producers in North America are concentrating on providing energy-efficient devices that provide appropriate heating, have low maintenance and operational expenses, and emit lower amounts of pollution. Furthermore, rising demand for low-noise operations, integration of electric heaters with solar panels, and increased usage of sensors are projected to enhance unitary heater demand in the future years.

During the projected period, Central and South America are expected to expand at a CAGR of 2.9% over the forecast period. Demand for unitary heaters is anticipated to witness substantial growth owing to the increasing demand for manufacturing facilities in the emerging economies of the region. This is projected to have a positive impact on industrial construction, thereby boosting the industry demand over the forecast period.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including geographical expansions, product launches, and mergers & acquisitions to enhance market penetration and cater to the changing technological requirements of various applications such as residential, commercial, industrial, and residential. For instance, in January 2023, Mestek Canada Inc. acquired Transom Corp., which is a manufacturer of high-lift, low-ambient heat pumps, large-capacity heat recovery, air-cooled chillers, and water-cooled chillers, and makeup air units. Some prominent players in the global unitary heaters market include:

-

Mestek Inc.

-

Armstrong International Inc.

-

Beacon Morris

-

Dunham Bush

-

King Electric

-

Daikin Industries, Ltd.

-

Trane

-

Reznor HVAC

-

Lennox International

-

Thermon

-

Turbonics, Inc.

-

MODINE MANUFACTURING COMPANY

-

New York Blower Company

-

Zycon

-

SVL Inc.

-

Sterling HVAC

Unitary Heaters Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,369.9 million

Revenue forecast in 2030

USD 3,122.6 million

Growth Rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Operation, application, type, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Sweden; Norway; Spain; Finland; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Mestek Inc.; Armstrong International Inc.; Beacon Morris; Dunham Bush; King Electric; Daikin Industries, Ltd.; Trane; Reznor HVAC; Lennox International; Thermon; Turbonics, Inc.; MODINE MANUFACTURING COMPANY; New York Blower Company; Zycon; SVL Inc.; Sterling HVAC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unitary Heaters Market Report Segmentation

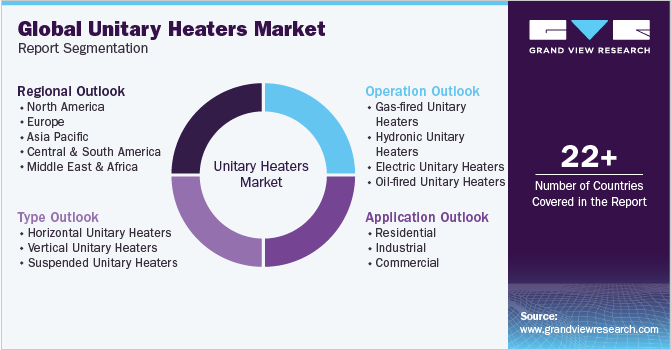

This report forecasts revenue growth at global, regional & country levels and analyzes the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global unitary heaters market report based on operation, application, type, and region:

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Gas-fired Unitary Heaters

-

Hydronic Unitary Heaters

-

Electric Unitary Heaters

-

Oil-fired Unitary Heaters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Horizontal Unitary Heaters

-

Vertical Unitary Heaters

-

Suspended Unitary Heaters

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Sweden

-

Norway

-

Spain

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global unitary heaters market size was estimated at USD 2,292.4 million in 2022 and is expected to be USD 2,369.9 million in 2023.

b. The unitary heaters market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 3,122.6 million by 2030.

b. Asia Pacific region dominated the market in 2022 by accounting for a share of 42.5% of the market owing to the massive investments by the governments of different countries in the region for the development of public infrastructure and the expansion of residential construction. Furthermore, there is rising awareness regarding energy saving across the region which is expected to augment the market demand further.

b. Some of the key players operating in the unitary heaters market include Mestek Inc., Armstrong International Inc., Beacon Morris, Dunham Bush, King Electric, Daikin Industries, Ltd., Trane, Reznor HVAC, Lennox International, Thermon, Turbonics, Inc., MODINE MANUFACTURING COMPANY, New York Blower Company, Zycon, SVL Inc., Sterling HVAC.

b. The market is expected to be driven by higher efficiency, lower noise levels, and lower operating costs. Moreover, unitary systems provide consistent temperatures across a household from one central unit. These factors are expected to positively impact product demand during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.