- Home

- »

- Automotive & Transportation

- »

-

Heavy Duty Road Filtration Aftermarket Industry Report, 2030GVR Report cover

![Heavy Duty Road Filtration Aftermarket Industry Size, Share & Trends Report]()

Heavy Duty Road Filtration Aftermarket Industry Size, Share & Trends Analysis Report By Product (Oil Filter, Air filter, Cabin Filter, Fuel Filter), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-248-8

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global heavy duty road filtration aftermarket industry size was estimated at USD 3,423.4 million in 2023 and is expected to grow at a CAGR of 3.9% from 2024 to 2030. The market growth is driven by the increasing demand for efficient and reliable filtration systems in heavy duty vehicles used on roads. Some of the most common filtration components used in heavy-duty vehicles include air filters, oil filters, fuel filters, and cabin air filters. As regulations on emissions and environmental impact continue to tighten, the demand for advanced filtration technologies is expected to grow, further driving the market growth. The U.S. has one of the largest heavy-duty road vehicle fleets, such as trucks, buses, tractor-trailers, dump trucks, cement mixers, and other specialty vehicles used in construction, mining, and other industries.

According to data from the Federal Highway Administration, the total number of registered commercial trucks in the U.S. was approximately 13.5 million as of 2022. As the demand for the goods and services industry continues to grow, the heavy-duty road vehicle fleet is expected to increase; further driving the demand for products and services in the heavy-duty road filtration aftermarket.

Aftermarket filters provide various advantages over conventional ones. However, their high cost may restrain market growth. OEM-manufactured filters are produced in bulk, providing economies of scale benefits to the manufacturers. Also, to suit varying applications, high-quality materials are used for manufacturing cellulose, polyhydroxyalkanoates biodegradable plastics.

Furthermore, the COVID-19 pandemic has highlighted the importance of maintaining good air quality in enclosed spaces, such as truck cabins. As a result, cabin air filters have become an increasingly important component of the heavy-duty road filtration aftermarket. The above factors will positively impact industry growth in the years to come.

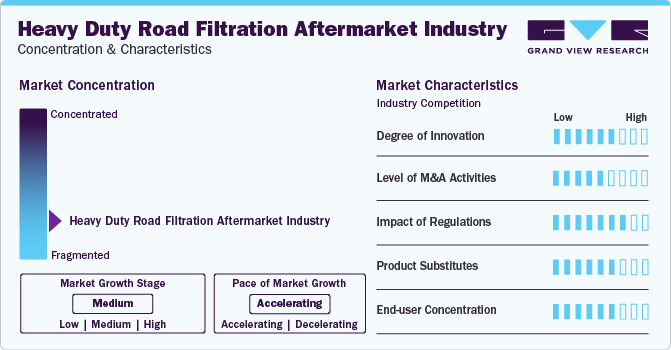

Market Concentration & Characteristics

Market growth stage is medium, and the pace of its growth is accelerating. The market is highly fragmented owing to the presence of a large number of regional and global players, which makes it difficult for small-scale manufacturers to compete with global players.

The heavy-duty road filtration aftermarket industry is also characterized by a high degree of product innovation; for instance, many manufacturers are developing new and improved filtration media that can capture smaller particles, while also maintaining high airflow rates. Some of the most innovative media include nanofiber products, which can capture particles as small as 0.3 microns, and blended media, which combines different types of fibers to optimize filtration efficiency.

Many consumers are looking for products that are environmentally friendly and have a low carbon footprint. As a result, to meet these demands, many manufacturers in the market are developing innovative products, which include filters made from sustainable and biodegradable materials, as well as hybrid and electric filtration systems that reduce emissions and fuel consumption, for instance, cellulose-based material filters and electromagnetic pulse (EMP) and high-altitude EMP (HEMP) filters. This provides huge growth opportunities to the market.

The heavy-duty road filtration aftermarket is impacted by various regulations and standards aimed at promoting sustainability and eco-friendliness. For instance, the National Emissions Standards for Heavy-Duty Engines: These standards are set by the U.S. Environmental Protection Agency (EPA), and are designed to reduce emissions of pollutants, such as nitrogen oxides and particulate matter from heavy-duty vehicles.

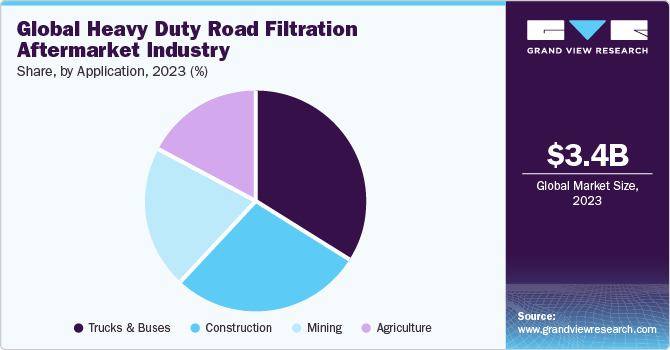

Application Insights

The trucks & buses segment accounted for a substantial share in 2023. The demand for filters including oil and fuel filters in the trucks and buses sector has been steadily increasing since trucks & buses require regular maintenance and filter changes to keep them running smoothly. For instance, as recommended by truck and bus manufacturers, the oil filter must be changed every 10 to 15 thousand kilometers; the fuel filter, every 40 to 50 thousand kilometers; and the air filter every 20 to 35 thousand kilometers. The above mentioned factors are expected to boost the demand for heavy-duty road filtration aftermarket.

The construction segment has been growing rapidly in recent years. Construction vehicles are often exposed to harsh operating conditions, such as dust, dirt, and debris, which can get into the fuel & engine system and cause damage to the vehicle. Heavy-duty road filter helps prevent this by removing contaminants, such as dirt, rust, and water, from various parts of the vehicle.Several types of fuel filters are commonly used in construction vehicles, including primary and secondary fuel filters. Primary fuel filters are typically located between the fuel tank and engine, while secondary fuel filters are located between the primary filter and engine.

Product Insights

The oil filters segment held a significant share of 36.0% in 2023. Oil filters are an essential component of heavy-duty road vehicles, as they help remove contaminants from the engine oil, preventing damage and increasing the engine’s lifespan. Furthermore, increasing awareness of the importance of engine maintenance and the need to reduce downtime has also contributed to the demand for oil filters. The above factor is likely to positively influence the demand for oil filters in the heavy-duty road vehicle filtration aftermarket.

With the growth of the transportation industry and a rise in e-commerce, many trucking companies are looking for ways to reduce costs and increase efficiency. Regular maintenance, including the replacement of fuel filters, is an important step in achieving these goals. The fuel filter collects debris, contaminants, and moisture that could otherwise get into the engine and may damage the cylinder, pistons, and other engine components. In addition, new regulations and standards are being implemented to reduce emissions from heavy-duty vehicles, which is further driving the demand for fuel filters in the market.

Regional Insights

North America heavy duty road filtration aftermarket is projected to witness significant growth over the forecast period. The highly unified supply chain network in North America connects manufacturers and consumers efficiently through multiple transportation modes, including freight rail, air, and express delivery services; maritime transport; & truck transport, thus driving market growth. The availability of convenient financing options, a strong emphasis by regional governments to ensure in-house automotive production, and investments in infrastructure development are some of the factors expected to contribute to market growth in North America.

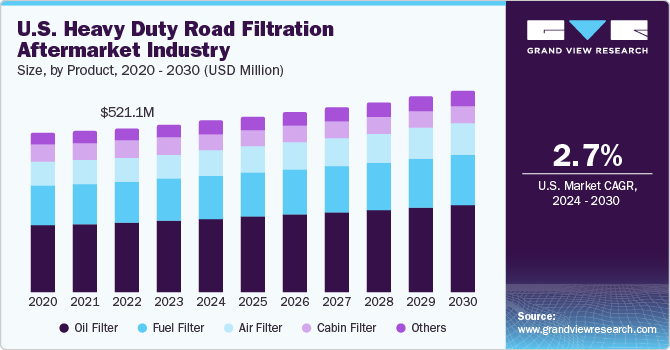

U.S. Heavy Duty Road Filtration Aftermarket Industry Trends

The U.S. heavy-duty road filtration aftermarket is estimated to grow at a CAGR of 2.7% from 2024 to 2030. The growing transportation and logistics industry is expected to positively impact the demand for heavy-duty road filtration aftermarket.

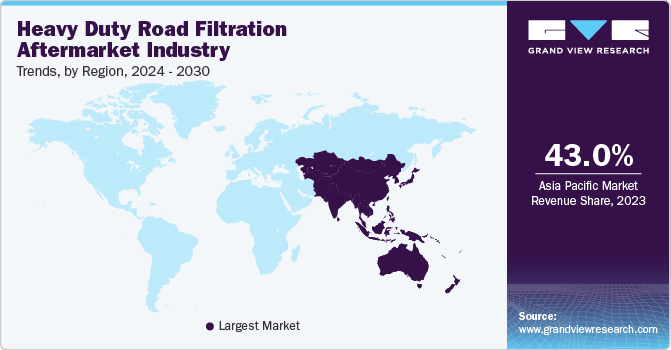

Asia Pacific Heavy Duty Road Filtration Aftermarket Industry Trends

The heavy-duty road filtration aftermarket in Asia Pacific dominated the global industry and accounted for a share of 43.0% in 2023. The increasing usage of heavy-duty road vehicles in various end-use applications, such as hauling cargo, construction, mining, and transporting goods, in countries like India, China, and Japan drives regional market growth. Furthermore, the mining industry in this region significantly impacts market growth, with many countries in the region being rich in natural resources, such as coal, iron ore, copper, and gold. The mining industry is responsible for the extraction, processing, and transportation of these resources, which includes the use of heavy machines for mining, such as dump trucks, excavators, haul trucks, draglines, dozers, and crushing equipment.

The China heavy-duty road filtration aftermarket held a revenue share of over 44% in 2023, and it is mainly driven by a rise in mining activity across the country. China is the world's leading producer of many minerals, including coal, iron ore, and rare earth metals.

The Heavy duty road filtration aftermarket in India is anticipated to grow at CAGR of 5.1% from 2024 to 2030 due to rising construction activity and investment in residential & commercial buildings. Which is likely to create opportunities for manufacturers and suppliers in the heavy-duty road filtration aftermarket in India.

Europe Heavy Duty Road Filtration Aftermarket Industry Trends

The Europe heavy-duty road filtration aftermarketheld the second-largest revenue share in 2023. Increasing demand for reliable and efficient filtration systems, coupled with a growing focus on environmental regulations, is driving regional market growth.

The heavy-duty road filtration aftermarket in Germany held a share of over 24% in 2023, mainly driven by the high volume of commercial transportation and heavy equipment usage across the country.

The France heavy-duty road filtration aftermarket is expected to grow at a CAGR of 2.1% from 2024 to 2030 due to rising heavy commercial and mining vehicle sales to support the growth of transportation, logistics services, and mining industry.

Central & South America Heavy Duty Road Filtration Aftermarket Industry Trends

The heavy-duty road filtration aftermarket in Central & South America is expected to register a significant CAGR over the forecast period. Central & South America has been experiencing steady economic growth in recent years, which has led to increased demand for heavy-duty vehicles and equipment.

The Brazil heavy-duty road filtration aftermarket held a share of over 52% in 2023 due to significant growth of the country’s transportation, agriculture, and construction industries.

Middle East & Africa Heavy Duty Road Filtration Aftermarket Industry Trends

The heavy-duty road filtration aftermarket in Middle East & Africa is expected to grow due to the expansion of infrastructure development projects, expansion of e-commerce and logistics, and increasing need for reliable transportation services.

The Saudi Arabia heavy-duty road filtration aftermarket is expected to grow at a lucrative rate of 4.3% from 20245 to 2030 owing to the rapidly expanding construction and infrastructure sectors, which require such vehicles for the transportation of goods and materials.

Key Heavy Duty Road Filtration Aftermarket Industry Company Insights

The global market is highly competitive on account of the presence of global and local manufacturers. Companies are engaged in expansion through mergers & acquisitions and joint ventures. These companies offer a wide range of systems that are sold through multiple channels, including distributors, company-owned websites, retailers & their websites, and e-commerce websites. For instance, in October 2023, MANN+HUMMEL announced the acquisition of a majority stake in Suzhou U-Air Environmental Product. This strategy will strengthen MANN+HUMMEL's footprint in the growing Chinese and Southeast Asian markets.

Key Heavy Duty Road Filtration Aftermarket Industry Companies:

The following are the leading companies in the heavy duty road filtration aftermarket industry. These companies collectively hold the largest market share and dictate industry trends.

- Denso Corporation

- Parker Hannifin Corporation

- MAHLE GmbH

- Mann+Hummel Holding GmbH

- Donaldson Company Inc.

- Pall Corporation

- Filtration Group Corporation

- Sogefi SpA

- UFI Filters Group

- Cummins Filtration Inc.

- Hengst SE & Co. KG

- Clarcor Inc.

- Purolator Filters LLC

- Baldwin Filters Inc.

- G.U.D. Holdings Inc.

- Fram Group Operations LLC

Recent Developments

-

In April 2023, MANN+HUMMEL announced its comprehensive product portfolio in original equipment quality for the new F-Max truck from Ford. The range includes oil, fuel, and urea filters, as well as drying agent boxes

-

In October 2022, MANN+HUMMEL launched a new WK 11 051 filter, designed for use in commercial vehicles. The WK 11 051 filter offers very high particle separation efficiency, ensuring that even the smallest particles are filtered out of the fuel system

Heavy Duty Road Filtration Aftermarket Industry Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,547.3 million

Revenue forecast in 2030

USD 4.46 billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

March 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Denso Corp.; Parker Hannifin Corp.; MAHLE GmbH; Mann+Hummel Holding GmbH; Donaldson Company Inc.; Pall Corp.; Filtration Group Corp.; Sogefi SpA; UFI Filters Group; Cummins Filtration Inc.; Hengst SE & Co. KG; Clarcor Inc.; Purolator Filters LLC; Baldwin Filters Inc.; G.U.D. Holdings Inc.; Fram Group Operations LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heavy Duty Road Filtration Aftermarket Industry Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the heavy duty road filtration aftermarket industry report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Filter

-

Air Filter

-

Cabin Filter

-

Fuel Filter

-

Others Filter

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Trucks & Buses

-

Construction

-

Mining

-

Agriculture

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heavy duty road filtration aftermarket industry size was estimated at USD 3,423.4 million in 2023 and is expected to be USD 3,547.3 million in 2024.

b. The global heavy duty road filtration aftermarket industry in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 4.46 billion by 2030.

b. Asia Pacific dominated the heavy duty road filtration aftermarket with a revenue share of 43.0% in 2023, on account of several factors including increasing heavy duty road vehicle fleet along with rising demand for heavy duty road vehicle for various end-use application including hauling cargo, construction, mining and transporting goods.

b. Some of the key players operating in the heavy duty road filtration aftermarket industryinclude Denso Corporation; Parker Hannifin Corporation; MAHLE GmbH; Mann+Hummel Holding GmbH; Donaldson Company Inc.; Pall Corporation; Filtration Group Corporation; Sogefi SpA; UFI Filters Group; Cummins Filtration Inc.; Hengst SE & Co. KG; Clarcor Inc.; Purolator Filters LLC; Baldwin Filters Inc.; G.U.D. Holdings Inc.; Fram Group Operations LLC.

b. Key factors that are driving the heavy duty road filtration aftermarket industry growth include increasing demand for road filtration equipment owing to better performance of the engine. Moreover, new advancements in aftermarket filters are offering higher quality at a lower cost. This thus provides huge growth opportunities to the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.