- Home

- »

- Petrochemicals

- »

-

Helium Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Helium Market Size, Share & Trend Report]()

Helium Market (2025 - 2030) Size, Share & Trend Analysis Report By Phase (Liquid, Gas), By Application (Cryogenics, Leak Detection, Welding), By End use (Medical & Healthcare, Nuclear Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-164-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Helium Market Summary

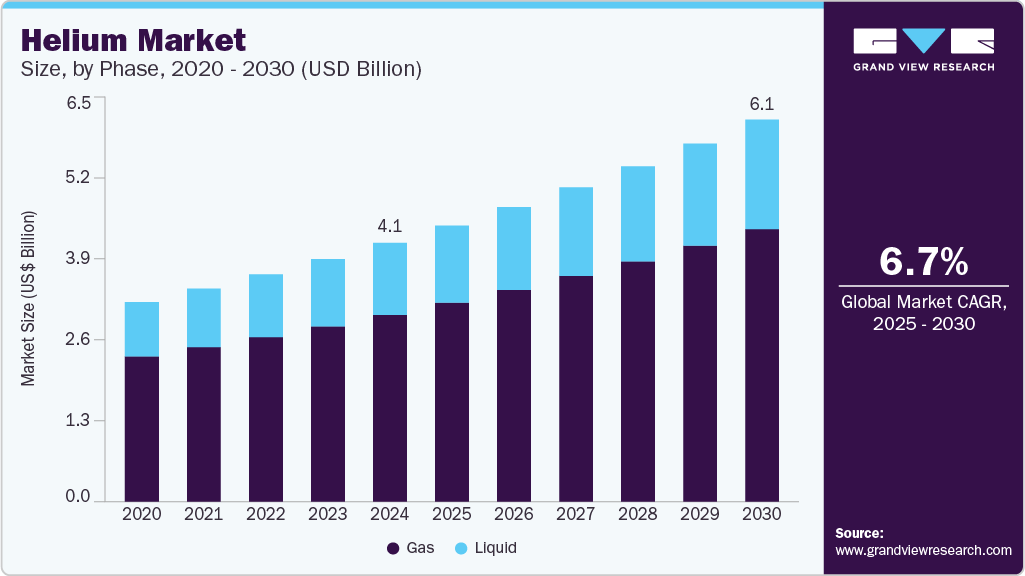

The global helium market size was estimated at USD 4.1 billion in 2024 and is projected to reach USD 6.06 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. This is attributed to increasing product usage in numerous end use industries like aerospace, defense, medical, electronics & electrical, and energy sectors, among others.

Key Market Trends & Insights

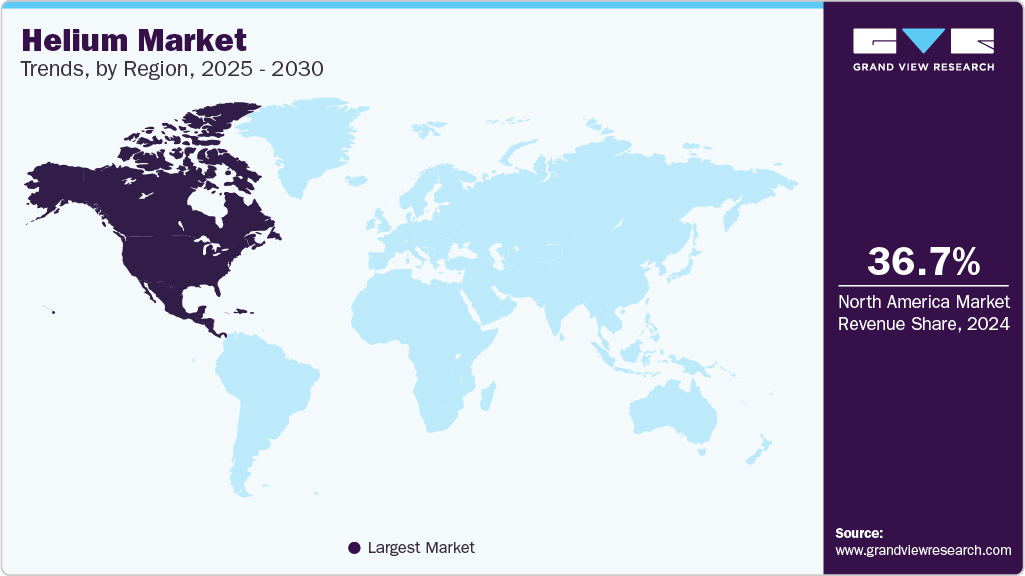

- North America helium market held a dominant revenue share of 36.7% in 2024.

- By phase, the gas phase dominated the global market with a revenue share of 72.2% in 2024.

- By application, the cryogenics application held the largest revenue share of 23.0% in 2024.

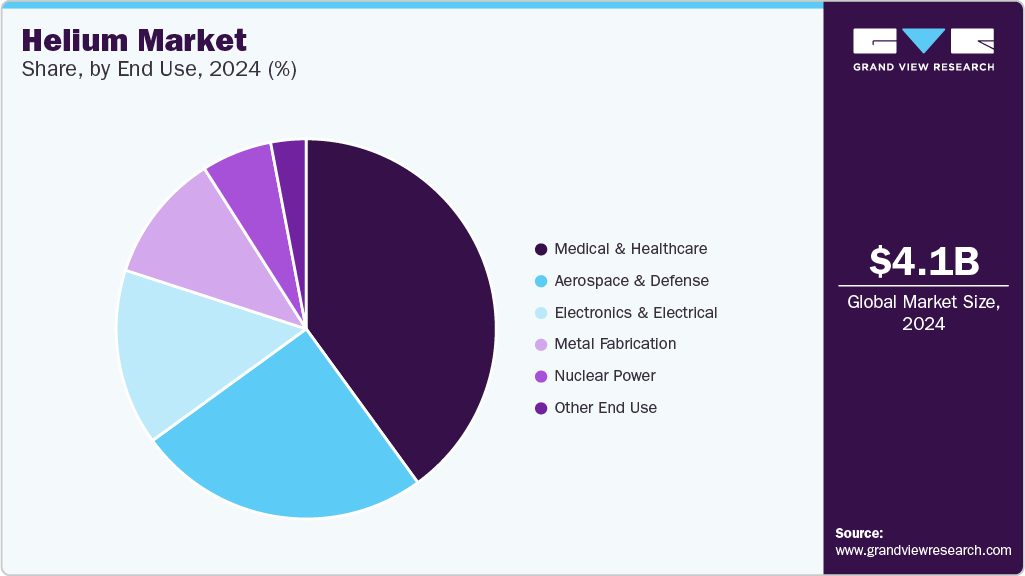

- By end use, the medical & healthcare segment accounted for a revenue share of 40.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.1 Billion

- 2030 Projected Market Size: USD 6.06 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

Helium is an essential component in various scientific experiments and research, particularly in fields such as physics, chemistry, and materials science. As scientific research continues to advance, the product demand remains high. The global industry is experiencing an uptick in competitive activity, with both domestic and international manufacturing firms vying for market share. While multinational corporations hold a substantial portion of the industry, several domestic companies based in nations like Canada, Qatar, Russia, and India are consolidating their presence.

According to the U.S. Department of the Interior, helium ranks as the second most widely available element, following hydrogen. It is an odorless and colorless inert gas, distinguished by its exceptional characteristics. It is considered a finite natural resource, primarily extracted from natural gas reservoirs. The geologic characteristics of regions like Texas, Oklahoma, and Kansas result in some of the highest product concentrations in the world within the natural gas found there, ranging from 0.3 to 2.7 percent. While helium is commonly recognized as a safe, non-flammable gas utilized for inflating balloons, its significance extends far beyond these applications. It serves as a pivotal element in various domains, encompassing scientific research, advanced medical technology, high-precision manufacturing, space exploration, and national defense.

For instance, the medical sector relies on helium for critical diagnostic equipment, notably in MRI machines. In the defense industry, it plays a crucial role in rocket engine testing, scientific balloons, surveillance aircraft, air-to-air missile guidance systems, and numerous other essential applications. The global market exhibits distinctive characteristics in terms of supply, demand, and storage, which have led to a nearly constant escalation in prices. In the past decade, helium demand has remained stagnant, primarily due to limited supply, despite a backdrop of 30% global GDP growth. Unlike the typical relationship between GDP growth and commodity demand, product prices rise each year.

According to AKAP Energy, over the past two decades, helium pricing has displayed a CAGR of 8%, reaching approximately $375 per thousand cubic feet (mcf) by late 2022. This figure is approximately 100 times the current pricing of natural gas in the United States. In recent years, the escalating global helium shortage has emerged as a pressing issue, driven by the diminishing availability of this precious gas. Helium, a rare and invaluable resource, finds utility across diverse sectors including healthcare, electronics, and aerospace. The product supply remains finite and constrained, with its principal source being extraction from natural gas reserves. Concurrently, product demand has been on the rise, propelled by its exceptional attributes, including its remarkably low boiling point, rendering it an ideal choice for a multitude of applications.

Drivers, Opportunities & Restraints

The helium market is driven by its critical role in MRI machines, semiconductor manufacturing, and fiber optics. Its inert, non-reactive nature and extremely low boiling point make it ideal for cooling and precision applications. As global healthcare and high-tech industries expand, especially in Asia-Pacific and North America, demand for helium continues to rise.

Helium is primarily extracted as a byproduct of natural gas, and its global supply is limited to a few countries, notably the U.S., Qatar, and Algeria. Supply disruptions due to plant shutdowns, geopolitical issues, or export restrictions often lead to shortages and price volatility. These factors create uncertainty for downstream users and hinder long-term planning.

Opportunities lie in the exploration of new helium reserves and the adoption of advanced extraction technologies, including helium recovery from low-concentration gas fields. Emerging helium production projects in Africa, Canada, and Australia aim to diversify supply. Additionally, innovations in helium recycling systems offer cost-effective and sustainable solutions for end users in research and industrial settings.

Phase Insights

The gas phase dominated the global market with a revenue share of approximately 72.2% in 2024. This is attributed to increasing product adoption in various areas of applications, including leak detection, gas chromatography, welding & cutting, cooling & refrigeration, and in nuclear power, among others. Furthermore, helium gas is indispensable in the realm of scientific research and experimentation, spanning disciplines such as physics, chemistry, and materials science. It plays a critical role in cryogenic studies, low-& low-temperature investigations, and serves as a carrier gas in a multitude of analytical instruments.

Cutting-edge technologies and innovations, like quantum computing and quantum communication, frequently depend on superconducting components that necessitate liquid helium for precise cooling. These emerging technologies play a significant role in the growing demand for the product. Moreover, it is a finite resource with restricted availability. The majority of global production is derived as a byproduct of natural gas extraction, and not all natural gas reservoirs contain helium. With depleting existing helium reserves and the challenge of finding new sources, product scarcity further fuels its demand.

Application Insights

The cryogenics application segment held the largest revenue share of 23.0% in 2024. Helium is one of the few substances that can achieve and maintain extremely low temperatures. It is often used to cool materials and equipment to temperatures close to absolute zero (-273.15°C or -459.67°F), which is essential for various scientific experiments and applications. Furthermore, cryogenic technology is used in space exploration for various purposes, including cooling infrared detectors on telescopes and scientific instruments on spacecraft. It plays a role in maintaining the low temperatures required for these instruments to function effectively.

Helium is an inert, non-flammable, and lighter-than-air gas. Its low density allows objects filled with helium to become buoyant and rise in the Earth's atmosphere. This property makes it an ideal choice for lifting applications. Moreover, it is a safe lifting gas because it does not support combustion. This makes it a preferred choice for applications where safety is paramount, such as in passenger-carrying balloons or airships. Helium is used in various processes within semiconductor manufacturing, such as ion implantation, ion beam milling, and chemical vapor deposition. It helps maintain stable and consistent temperatures during these processes, contributing to the quality and precision of semiconductor devices.

According to the Semiconductor Industry Association (SIA), when examining regional performance, it's notable that the Americas market experienced the most substantial growth, with a 16.2% increase in sales in 2022. China, while remaining the single largest market for semiconductors, reported sales of $180.4 billion in 2022, reflecting a 6.2% decline compared to 2021. In addition, annual sales in Europe and Japan exhibited considerable growth in 2022, with increases of 12.8% and 10.2%, respectively. Thus, a rise in the production and sales of semiconductors increases product demand.

End Use Insights

The medical & healthcare segment accounted for a revenue share of 40.0% in 2024. This is attributed to the increasing product usage in various areas of applications in the medical & healthcare sectors, such as MRI machines, endoscopy, laser technology, breathing mixtures, spectroscopy, and in positron emission tomography (PET), among others. Helium-filled aerostats, tethered balloons, or blimps are used for surveillance and monitoring purposes. They provide a stable platform for various payloads, including radar, cameras, and communication equipment, which are used in border security, military surveillance, and disaster management.

Furthermore, it is used in spacecraft as a pressurant gas for propulsion systems, as well as for cooling sensitive equipment and instruments. Its low boiling point and inert nature are advantageous in the vacuum and extreme conditions of space. Product usage in the nuclear power sector is growing, particularly in the development of next-generation nuclear reactors & advanced gas-cooled reactors. Its effectiveness as a coolant and its compatibility with nuclear processes contribute to its extensive usage in this industry. However, product demand, even within this sector, must be managed carefully due to its limited supply. Efforts to secure helium resources & enhance its usage in nuclear power continue to be a priority.

Regional Insights

The Asia Pacific helium market is poised for rapid expansion, driven by strong demand from the electronics, semiconductors, and healthcare sectors, particularly in countries like China, Japan, South Korea, and India. The region is witnessing a surge in semiconductor manufacturing investments, where helium is critical for wafer cooling and maintaining inert environments. Additionally, the rising adoption of MRI machines and other advanced diagnostic tools in the growing healthcare infrastructure further boosts helium consumption. However, the region remains largely import-dependent, prompting increased interest in securing long-term supply contracts and exploring regional partnerships for stable sourcing.

North America Helium Market Trends

North America helium market held a dominant revenue share of 36.7% in 2024 due to the presence of abundant reserves of helium-rich natural gas. In addition, the U.S. is home to the Federal Helium Reserve, which was established in 1925 and is one of the world's largest helium storage facilities. The reserve has played a significant role in the global market by supplying the product to various industries. Europe also holds a significant share, in terms of production as well as consumption of the product from various end use industries. Europe has a well-established healthcare sector that relies on helium for medical imaging equipment, primarily magnetic resonance imaging (MRI) machines.

Europe Helium Market Trends

Europe helium market holds a substantial share in the global market, supported by well-established demand across healthcare, aerospace, research, and industrial sectors. The region's advanced medical imaging capabilities, especially in MRI applications, are a major driver of helium usage. Germany, the UK, and France lead consumption, backed by strong R&D and space exploration initiatives. Although Europe lacks significant domestic helium reserves, strategic imports and investments in recycling and conservation technologies have helped offset supply challenges. Regulatory focus on supply chain sustainability and energy efficiency is also shaping helium usage practices across the continent.

Latin America Helium Market Trends

The helium market in Latin America is in a developmental phase but shows growing potential due to rising investments in healthcare and industrial manufacturing. Countries like Brazil, Mexico, and Argentina are increasing their reliance on medical imaging equipment, such as MRI machines, which require liquid helium as a coolant. Industrial applications, including welding and leak detection, are also contributing to modest demand growth. However, the region is heavily import-dependent and faces infrastructure limitations, prompting a need for strategic alliances and improved distribution networks to meet the rising helium demand efficiently.

Middle East & Africa Helium Market Trends

The Middle East & Africa helium market is emerging, with demand primarily driven by growing investments in healthcare infrastructure, oil & gas services, and aerospace projects. The UAE and Saudi Arabia are witnessing increased deployment of MRI equipment and industrial technologies reliant on helium. In Africa, the market remains relatively untapped but is expected to grow with improving access to advanced medical diagnostics. The region also holds geological potential for helium exploration, particularly in East African rift systems, which may offer long-term opportunities for local production and export-oriented development. Strategic investments and partnerships are expected to enhance the region’s helium value chain.

Key Helium Company Insights

Some key players operating in the market include Air Products and Chemicals, Inc., and Linde Plc. The global industry is highly competitive. The majority of manufacturing companies, suppliers, and traders are based in North America and Europe. Rapid industrialization, economic progress, availability of helium-rich reserves, and cheap labor contribute to market growth in these regions. Manufacturers are undertaking various strategic initiatives, such as mergers & acquisitions, partnerships, collaborations, production capacity expansions, and new product launches, to strengthen their market share.

Key Helium Companies:

The following are the leading companies in the helium market. These companies collectively hold the largest market share and dictate industry trends.

- Air Products and Chemicals, Inc.

- Linde Plc

- Air Liquide

- Messer Group

- Taiyo Nippon Sanso India

- MESA Specialty Gases & Equipment

- Matheson Tri-Gas Inc.

- Iwatani Corporation

- Gazprom PJSC

- Gulf Cryo S.A.L.

- IACX Energy

Recent Developments

-

In March 2024, Messer Group confirmed its successful bid to acquire the U.S. Federal Helium System, including the Cliffside field, helium caverns, a 423-mile pipeline, and associated assets, following an auction by the General Services Administration. Having operated the Cliffside Gas Plant since 2022, Messer aims to solidify its position in the global helium market and ensure long-term supply security across key industries such as healthcare, semiconductors, aerospace, and scientific research.

-

In October 2023, North America Helium (NAH) announced its seventh facility into production. This facility is located in Cadillac, near Ponteix, Saskatchewan. The upcoming facility will commence with an initial helium production capacity of 22 million cubic feet per year (MMcf/year). Owing to ongoing drilling achievements in the region, NAH is already in the process of devising expansion plans for this facility in 2024.

Helium Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.39 billion

Revenue forecast in 2030

USD 6.06 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Phase, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; and South Africa.

Key companies profiled

Air Products and Chemicals, Inc.; Linde Plc; Air Liquide; Messer Group; Taiyo Nippon Sanso India; MESA Specialty Gases & Equipment; Matheson Tri-Gas Inc.; Iwatani Corporation; Gazprom PJSC; Gulf Cryo S.A.L.; IACX Energy

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

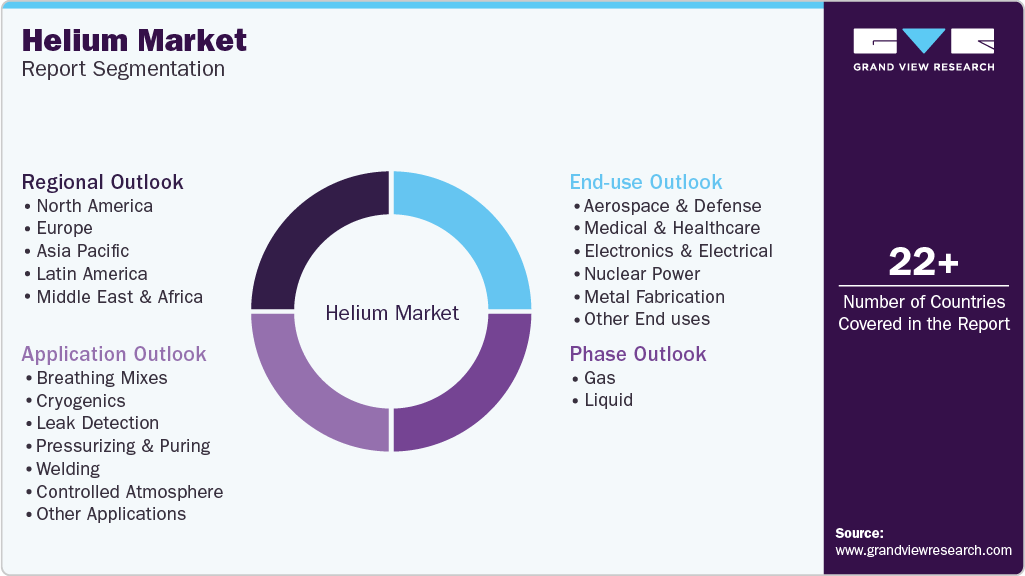

Global Helium Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global helium market report based on phase, application, end use, and region:

-

Phase Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gas

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Breathing Mixes

-

Cryogenics

-

Leak Detection

-

Pressurizing & Puring

-

Welding

-

Controlled Atmosphere

-

Other Applications

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Medical & Healthcare

-

Electronics & Electrical

-

Nuclear Power

-

Metal Fabrication

-

Other End uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global helium market size was estimated at USD 4,110.4 million in 2024 and is expected to reach USD 4,385.8 million in 2025.

b. The global helium market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 6,065.6 million by 2030.

b. North America dominated the global helium market with a share of 36.0% in 2024. This is attributable to the presence of abundant reserves of helium-rich natural gas.

b. Some key players operating in the global helium market include Air Products and Chemicals, Inc., Linde Plc, Air Liquide, Messer Group, Taiyo Nippon Sanso India, and MESA Specialty Gases & Equipment, among others.

b. Helium is an essential component in various scientific experiments and research, particularly in fields such as physics, chemistry, and materials science. As scientific research continues to advance, the demand for the product remains high.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.