- Home

- »

- Clinical Diagnostics

- »

-

Hemato Oncology Testing Market Size, Industry Report, 2030GVR Report cover

![Hemato Oncology Testing Market Size, Share & Trends Report]()

Hemato Oncology Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Assay Kits & Reagents, Services), By Cancer (Leukemia, Lymphoma), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-174-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemato Oncology Testing Market Summary

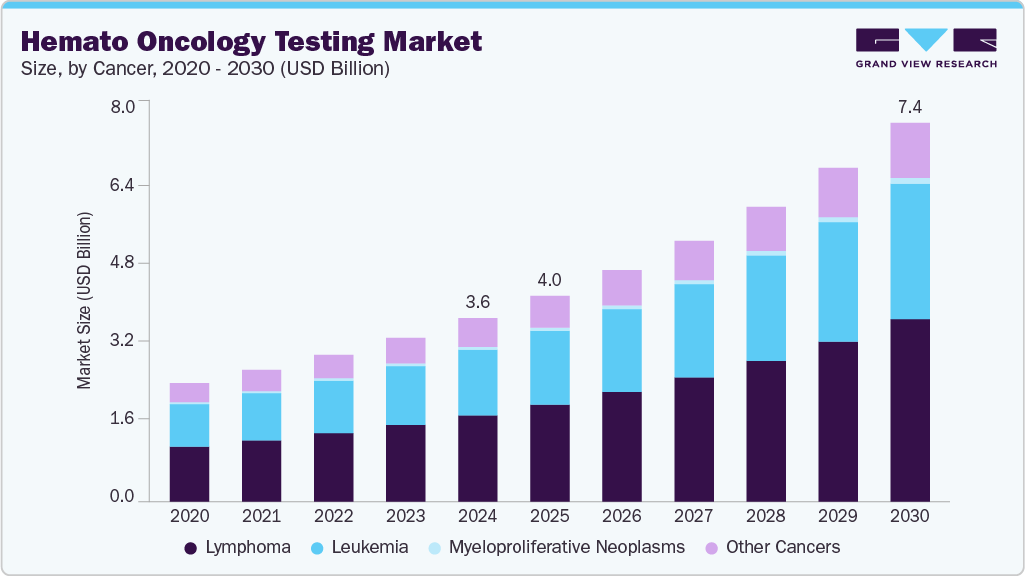

The global hemato oncology testing market size was estimated at USD 3.60 billion in 2024 and is projected to reach USD 7.44 billion by 2030, growing at a CAGR of 12.99% from 2025 to 2030. Hemato oncology is associated with the treatment, diagnosis, and prevention of blood-related cancers and diseases.

Key Market Trends & Insights

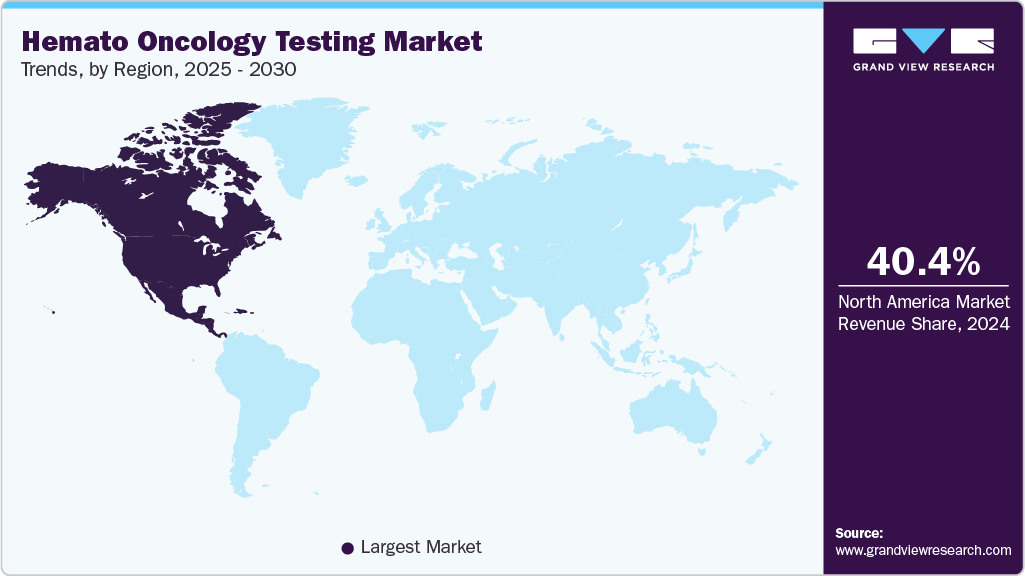

- North America hemato oncology testing market held the largest share of 40.40% of the global market in 2024.

- The hemato oncology testing market in the U.S. is expected to grow moderately over the forecast period.

- By cancer, the lymphoma segment held the largest market share of 47.04% in 2024.

- By product, the services segment held the largest market share in 2024.

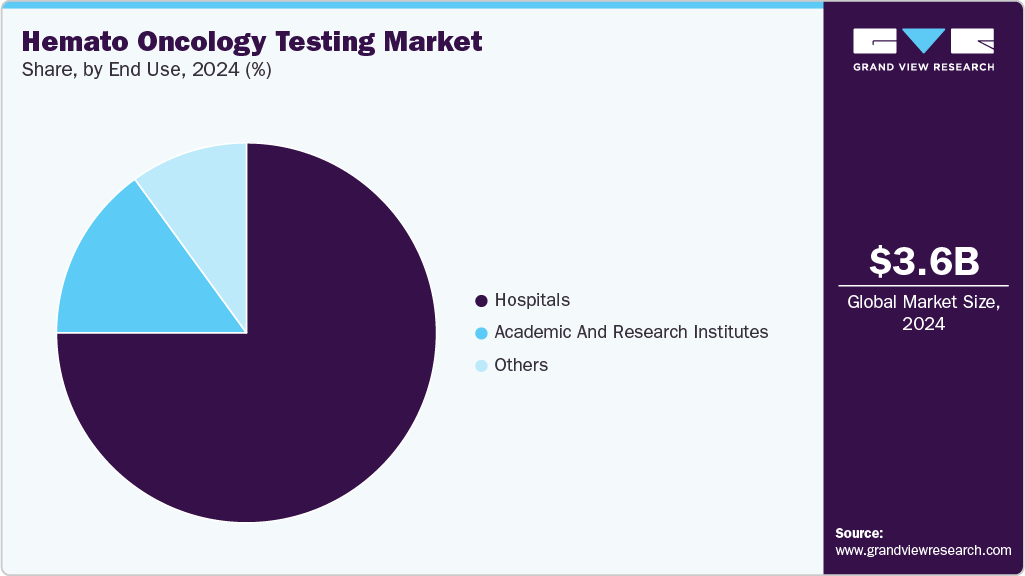

- By end use, the hospitals segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.60 Billion

- 2030 Projected Market Size: USD 7.44 Billion

- CAGR (2025-2030): 12.99%

- North America: Largest market in 2024

Increasing prevalence of lymphoma & myeloma, growing demand for personalized therapy, availability of advanced molecular techniques for hemato-oncology diagnostics, and increasing drug-diagnostics co-development are some of the major factors anticipated to boost the growth of the market during the forecast period. The rapid evolution of molecular diagnostics has transformed the landscape of hemato-oncology, offering precise and personalized approaches for the detection, diagnosis, prognosis, and treatment of various blood cancers. These cutting-edge techniques have significantly improved the understanding of disease biology and therapeutic response, leading to better patient outcomes and more efficient clinical workflows.

Molecular diagnostics in hematologic malignancies often rely on methods like real-time PCR, fluorescence in situ hybridization (FISH), and next-generation sequencing (NGS) to detect specific genetic alterations. For instance, chronic myeloid leukemia (CML) is routinely diagnosed using PCR-based tests targeting the BCR::ABL1 fusion gene or FISH assays. Standardization of BCR/ABL measurement internationally has facilitated easier and more accurate diagnosis of CML across laboratories. Similarly, acute myeloid leukemia (AML) and acute lymphoblastic leukemia (ALL) benefit from molecular diagnostics, with NGS panels enabling the identification of multiple gene mutations simultaneously, including FLT3-ITD, NPM1, and TP53, which are critical for risk stratification and treatment selection. In lymphomas, techniques like T-cell clonality assays, targeted FISH, and IgVH analysis are widely employed, while the JAK2 V617F mutation serves as a critical marker for diagnosing polycythemia vera in high-risk patients.

Recent advancements have introduced more sophisticated tools such as single-cell sequencing, optical genome mapping (OGM), and long-read sequencing. Single-cell sequencing provides unprecedented resolution at the cellular level, offering insights into clonal diversity and tumor evolution. OGM, as demonstrated in a recent study published in The Journal of Molecular Diagnostics, enables comprehensive cytogenomic profiling of tumors, including multiple myeloma, by efficiently identifying structural variants and copy number changes even in low-yield cell populations. This pan-genomic approach reduces the need for separate, marker-specific tests, streamlining workflows and improving diagnostic accuracy. The study at Lille University Hospital confirmed that OGM can reduce the number of cells required for complete genomic profiling, showing 93% concordance with traditional FISH on five tested markers and identifying over 22 additional genomic variants of interest.

In 2024, Oxford Gene Technology (OGT) introduced the SureSeq Myeloid Fusion Panel, a groundbreaking RNA-based NGS tool designed for the comprehensive identification of fusion genes in AML. This panel, developed in collaboration with leading myeloid cancer experts, covers over 30 key disease-associated fusions, including KMT2A and MECOM, and employs a partner-gene agnostic approach to detect rare and novel fusions in a single assay. The integration of this panel into end-to-end NGS workflows has significantly enhanced the ability to classify samples, reducing the need for extensive bioinformatics resources and improving turnaround times in clinical laboratories.

Moreover, long-read sequencing technologies, such as those developed by Pacific Biosciences and Oxford Nanopore, are revolutionizing the field by providing complete, error-free readouts of complex genomic regions. These platforms are overcoming the limitations of short-read NGS, enabling the detection of structural variants, complex rearrangements, and copy number changes with unparalleled precision.

Collectively, these advanced molecular technologies are reshaping the diagnostic landscape in hemato-oncology, providing clinicians with powerful tools for personalized medicine. The continuous innovation in this space promises to further enhance the accuracy, speed, and cost-effectiveness of cancer diagnostics, ultimately leading to better patient outcomes and more personalized treatment strategies.

In addition, lymphoma and myeloma are among the most common and clinically significant hematologic malignancies in the United States, contributing significantly to the overall cancer burden.

Non-Hodgkin Lymphoma (NHL)

NHL accounts for approximately 4% of all cancers in the U.S., making it one of the most prevalent cancers. According to the American Cancer Society, an estimated 80,350 people (45,140 males and 35,210 females) are projected to be diagnosed with NHL in 2025. This includes both adults and children, reflecting the broad age range affected by this aggressive cancer. In addition, around 19,390 people (11,060 males and 8,330 females) are expected to die from NHL in 2025. The overall lifetime risk for developing NHL is approximately 1 in 44 for men and 1 in 54 for women, though individual risk can vary significantly based on genetic, lifestyle, and environmental factors.

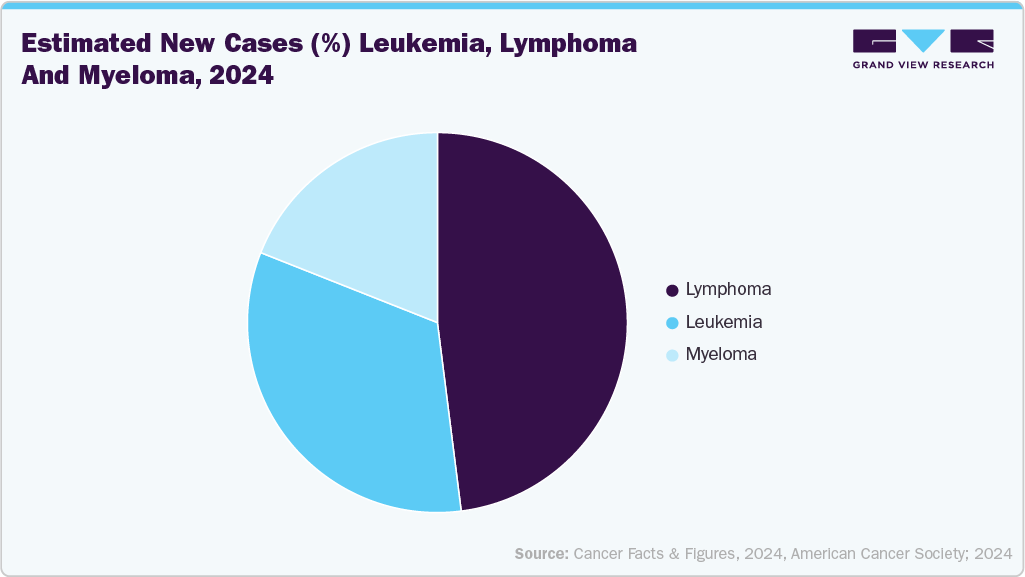

Leukemia, Lymphoma, and Myeloma Incidence

Every 3 minutes, someone in the United States is diagnosed with a blood cancer, including leukemia, lymphoma, or myeloma. In 2024 alone, an estimated 187,740 people in the U.S. will be newly diagnosed with these hematologic cancers, accounting for approximately 9.4% of the 2,001,140 total new cancer cases expected that year.

Prevalence and Survivorship

As of the latest estimates, approximately 1,698,339 people in the U.S. are living with or in remission from leukemia, lymphoma, myeloma, myelodysplastic syndromes (MDS), or myeloproliferative neoplasms (MPNs). This high prevalence reflects both improved survival rates due to advances in treatment and early diagnosis, as well as the long-term nature of disease management in these patients.

Market Impact and Growth Drivers

The rising prevalence of these hematologic malignancies is expected to drive significant market growth over the coming years. Key factors contributing to this trend include:

-

Early Detection Initiatives: Increasing awareness and early screening programs are leading to earlier diagnosis and better survival outcomes.

-

Innovation in Diagnostic Technologies: Advancements in molecular diagnostics, liquid biopsies, and next-generation sequencing (NGS) are enabling more precise disease characterization and personalized treatment strategies.

-

Supportive Regulatory Environment: Favorable policies and expedited regulatory pathways are accelerating the commercialization of novel diagnostic tests.

-

Patient Advocacy and Awareness: Ongoing efforts by major market players and patient advocacy groups are raising awareness about the importance of early diagnosis and comprehensive disease monitoring.

Overall, the growing incidence of lymphoma, myeloma, and related hematologic cancers underscores the critical need for advanced, cost-effective diagnostic solutions, driving strong demand for innovative testing products and services in the hemato-oncology market.

Market Concentration & Characteristics

The degree of innovation in the hemato oncology testing industry is experiencing rapid growth, driving significant improvements in disease detection, risk stratification, and personalized treatment strategies for hematologic malignancies. Advancements in biomarker discovery, such as NPM1, FLT3-ITD, and IDH1/2 mutations, enable more precise molecular profiling of leukemia and lymphoma. Liquid biopsy techniques using circulating tumor DNA (ctDNA) and cell-free RNA are gaining traction as less invasive tools for monitoring disease progression and detecting minimal residual disease (MRD). In addition, the application of artificial intelligence (AI) to genomic data is refining diagnostic accuracy and supporting more tailored therapeutic decisions. These developments transform clinical workflows and contribute to more effective, patient-specific approaches in hemato oncology.

The level of mergers and acquisitions (M&A) in the market is moderate and gradually increasing as diagnostic companies aim to expand their molecular testing portfolios and access advanced genomic technologies. Firms are engaging in targeted acquisitions to integrate capabilities in next-generation sequencing (NGS), single-cell analysis, and real-time PCR-based assays for blood cancers such as leukemia, lymphoma, and multiple myeloma. Strategic collaborations between molecular diagnostic developers and biopharmaceutical companies are becoming more common, particularly to co-develop companion diagnostics for targeted therapies. While the market has not seen frequent large-scale mergers, selective M&A activity focused on hematologic malignancy diagnostics contribute to competitive consolidation and innovation.

The impact of regulations on the market is high, as global regulatory bodies impose strict standards for the clinical validation, safety, and effectiveness of molecular diagnostic tests. Agencies such as the FDA (U.S.), EMA (Europe), and PMDA (Japan) require extensive clinical evidence to support the use of diagnostics in hematologic malignancies such as leukemia, lymphoma, and myeloma. The FDA’s oversight of companion diagnostics for targeted therapies-especially for conditions like AML-demands rigorous analytical performance and clinical utility data. In Europe, the IVDR has added complexity to the approval process, requiring detailed technical documentation and third-party conformity assessments. In addition, patient privacy regulations such as HIPAA and GDPR affect how genomic data is collected and managed in research and clinical settings. These frameworks can lengthen product development timelines and significantly shape investment and innovation strategies within the market.

Product expansion in the market is moderate to high, driven by the rising need for precise, multi-parameter diagnostic solutions targeting hematologic malignancies such as leukemia, lymphoma, and myeloma. Developers are increasingly focusing on broadening their assay menus and integrating next-generation sequencing (NGS), digital PCR, and flow cytometry into comprehensive test panels. This trend supports the detection of multiple genetic markers and rare mutations in a single workflow. However, expanding product portfolios requires balancing innovation with technical validation, clinical utility, and compatibility with evolving therapeutic regimens. In addition, collaborations with pharmaceutical companies for companion diagnostics and investments in biomarker discovery contribute to broader testing capabilities, supporting more personalized and targeted treatment approaches across diverse patient populations.

Regional expansion in the market is moderate, supported by gradual improvements in cancer awareness, diagnostic accessibility, and healthcare infrastructure in emerging regions. While North America and parts of Europe maintain a strong presence due to established clinical systems and reimbursement mechanisms, growth in regions such as Asia-Pacific, Latin America, and the Middle East is progressing steadily. Countries in Asia-Pacific are enhancing genomic capabilities through policy support and increased research funding, though access remains uneven across rural and urban areas. Similarly, Latin America and the Middle East are seeing incremental adoption of molecular diagnostics, aided by national cancer programs and infrastructure development. These factors contribute to a measured, region-by-region expansion of hemato oncology testing services.

Cancer Insights

Based on cancer, the market is segmented into leukemia, lymphoma, MPNs, and other cancers. The lymphoma segment is dominating the market in 2024 with a share of 47.04% and is expected to showcase the fastest CAGR of over 13.4% over the forecast period. The growing prevalence and improved survival outcomes for lymphoma especially in younger patients-drive ongoing demand for early, accurate, and personalized diagnostics. According to the Leukemia & Lymphoma Society, in 2024, approximately 89,190 new lymphoma cases were found in the U.S., with 8,570 cases of Hodgkin lymphoma (HL) and 80,620 cases of non-Hodgkin lymphoma (NHL). Growing FDA clearance for advanced lymphoma diagnostic technology is also driving segment growth.

Leukemia is expected to grow significantly over the forecast period. The increasing prevalence of blood cancer is a driving factor of this segment. Multiple genetic and environmental risk factors the a factsheetre identified in the development of leukemia. According to the leukemia and lymphoma society factsheet 2023-2024, around 456,481 individuals in the U.S. are either living with leukemia or in remission. Males are affected more than females, with about 35.5% more men living with leukemia, and higher rates of diagnosis and mortality among them. Leukemia ranks as the tenth most common cancer in the U.S., with its age-adjusted incidence rate rising by 9.4% from 12.71 per 100,000 in 1975 to 13.91 per 100,000 in 2020. Some of the most common tests for diagnosis of leukemia include repeated Complete Blood Count (CBC) tests and bone marrow examinations post diagnosis of symptoms.

Product Insights

Based on product, the services segment held a majority share of 58.69% in 2024, and it is likely to maintain its dominance over the forecast period. Service providers include specialist diagnostic consulting services and patient education services, which offer patients with specific pre- and postdiagnosis care. The majority of these services offer customized plans for individual patients, which are anticipated to grow at a significant rate in the near future. Furthermore, a rise in prevalence of leukemia and myeloma cancers, as well as increased awareness about advanced therapies, such as personalized medicine, have fueled the growth of the services segment.

The assay kits and reagents segment is expected to grow at a notable CAGR over the forecast period. They are designed to detect specific biomarkers, genetic mutations, and other indicators of blood cancer, enabling healthcare professionals to diagnose & treat the disease more effectively. The increasing demand for accurate and rapid diagnostic tests is expected to drive the adoption of assay kits and reagents. In addition, advancements in molecular diagnostics and the development of new technologies, such as Next-Generation Sequencing (NGS), are expected to contribute to market growth.

Technology Insights

Based on technology, the PCR segment held a majority share of 30.23% in 2024, and it is likely to maintain its dominance over the forecast period. Use of PCR has been key in the diagnosis of blood cancers, as these tests are highly sensitive and detect the presence of various biomarkers in bone marrow & blood cells. PCR is highly efficient in detecting blood cancer cells that are not typically detected by cytogenic techniques, such as FISH. Furthermore, the use of PCR has also been vital in determining a patient’s molecular response to therapies.

The NGS segment is expected to witness the fastest CAGR of 14.3% during the forecast period due to various advantages this technology offers, such as more sensitivity and specificity. Several cancer researchers have deemed the substantial importance of this technology in hemato-oncology and have put efforts into developing bioinformatics algorithms that could be utilized for cancer screening and test development. For instance, in December 2023, Huntsman Cancer Institute at the University of Utah stated that NGS-based detection has shown a significant potential to predict the risk of relapse of MRD in young adults and children.

End Use Insights

Based on end use, the market is segmented into hospitals, academic & research institutes, and others. The hospitals segment held a majority share of 75.32% in 2024 and it is anticipated to dominate the market over the forecast period at a CAGR of 13.2%. Hospital laboratories are vital components of the healthcare system, serving either within hospitals or as attached facilities. They can be categorized as public or private, catering to specific patient populations. Increase in collaborations between key players and hospitals to introduce novel testing methods for blood cancers is expected to drive market growth. For instance, in March 2025, Mayo Clinic Laboratories and KYAN Technologies entered into partnership to bring KYAN’s Optim.AI, an AI-driven ex-vivo drug sensitivity test to the U.S. market. This innovative platform helps identify optimal cancer therapies using minimal biological material, aiding both treatment decisions and drug development through functional precision medicine.

The academic & research institutes segment is expected to grow significantly over the forecast period. They are likely to remain key drivers of the market growth. These institutions are at the forefront of identifying novel biomarkers, developing innovative diagnostic techniques, and exploring new avenues for early detection, accurate diagnosis, & personalized treatment strategies. As research and study in this sector increase over the forecast period, the market is expected to grow. A growing number of research institutes and laboratories across the globe are likely to increase the demand for advanced and effective diagnostic techniques. The rising demand for standardization in techniques, such as dPCR, is likely to boost the adoption over the coming years. Moreover, increased funding for public and private research organizations is expected to further augment the demand for hemato-oncology products.

Regional Insights

North America hemato oncology testing industry dominated the global market, with a 40.40% share in 2024, and it is anticipated to witness the fastest CAGR of 14% over the forecast period. The region’s dominance is driven by several factors, such as increasing prevalence of blood cancer, increasing R&D studies and trials, and technological advancements in diagnostic methods. Various diagnostic tools & techniques are available in the market, including liquid biopsy, Positron Emission Tomography (PET), Next-Generation Sequencing (NGS) testing solutions, and molecular testing.

U.S. Hemato Oncology Testing Market Trends

The U.S. hemato oncology testing industry accounted for the largest share in the North American market in 2024, driven by the high prevalence of blood cancer. This can be attributed to several factors, including an aging population, environmental exposures, and genetic predispositions. In addition, advancements in diagnostic techniques have led to early detection and improved reporting of these cancers. Regardless of the underlying causes, the pervasiveness of blood cancer presents a formidable challenge for healthcare providers, researchers, and policymakers, necessitating a concerted effort to develop innovative strategies for prevention, early detection, & personalized treatment approaches.

Moreover, growing strategic initiatives between key players and diagnostic clinics and laboratories is contributing to regional growth. For instance, in January 2025, Mayo Clinic Laboratories and Lucence entered into strategic collaboration to expand global access to Lucence’s LiquidHALLMARK, a highly sensitive liquid biopsy test using next-generation sequencing (NGS) to analyze ctDNA and ctRNA for actionable cancer biomarkers. This partnership aims to enhance personalized cancer care by providing clinicians with deeper genomic insights for treatment planning. The integration of LiquidHALLMARK into Mayo’s offerings may significantly boost adoption of liquid biopsy and NGS-based tests in hematologic cancers by enabling non-invasive, real-time tumor profiling. It strengthens personalized treatment strategies, improves monitoring capabilities, and expands access to precision diagnostics in the U.S. oncology landscape.

Europe Hemato Oncology Testing Market Trends

The Europe hemato oncology testing industry is growing steadily. Blood cancers, including leukemia, lymphoma, and myeloma, are among the most common types of cancer in Europe. According to the European Cancer Information System (ECIS), there were an estimated 467,733 new cases of blood cancers in Europe in the last few years, accounting for approximately 8.5% of all new cancer cases. The European LeukemiaNet (ELN) guidelines for diagnosing & treating AML in adults are widely accepted by physicians and researchers. The rapid progress in genomic testing and the development of new therapies, such as FLT3, IDH1, IDH2, & BCL2 inhibitors, has led to an update of the guidelines. This revised version incorporates a new genetic risk classification system, updated response criteria, and treatment recommendations. Moreover, the market in the country is highly competitive, with multiple players offering a range of tests and technologies. Global companies, such as Bio Rad Laboratories, Asuragen, Alercell, and Abbott, have a presence in the EU hemato oncology testing industry, offering a variety of tests and diagnostic tools. As awareness of blood cancer and the importance of early detection continue to grow, the demand for innovative diagnostic solutions is expected to drive market growth in the coming years.

The hemato oncology testing industry in France is growing with support from national research programs and strong public-private partnerships. In September 2023, Cancer Research UK and the French National Cancer Institute (INCa) signed a new scientific partnership to collaborate on cancer research and improve patient outcomes. The partnership aimed to share knowledge and expertise in cancer research & treatment, develop new treatments & therapies, and enhance international cooperation & collaboration, address common cancer challenges, such as increasing cancer incidence, and improve patient access to innovative treatments. The agreement facilitated the exchange of researchers, scientists, and clinicians between the UK and France, fostering a stronger connection between the two countries' cancer research communities.

The German hemato oncology testing industry is a highly competitive and rapidly evolving landscape, driven by technological advancements, increasing demand for personalized medicine, and government initiatives to improve healthcare outcomes. The market is characterized by a mix of local & international players, including Siemens Healthcare, Roche Diagnostics, Abbott Diagnostics, and Bio-Rad Laboratories. German companies such as bioMérieux, Ortho-Clinical Diagnostics (OCD), and Greiner Bio-One are also major players. Companies form partnerships with research institutions, pharmaceutical companies, and other market players to access new technologies and expertise. Manufacturers further focus on improving the cost-effectiveness of their products and services to remain competitive in a price-sensitive market.

Asia Pacific Hemato Oncology Testing Market Trends

The Asia Pacific hemato oncology testing industry is expected to grow significantly due to the rising demand for treatment options and the increasing incidence of various lymphoma types during the forecast period. Key market players in the region are actively involved in R&D, resulting in a robust pipeline of potential treatments. For instance, Kura Oncology's ongoing clinical trial for tipifarnib, a pipeline candidate being investigated for treating peripheral T-cell lymphoma, demonstrates the company's commitment to advancing innovative therapies for patients.

In addition, there has been a growing interest and investment in developing liquid biopsy tests for blood cancers in Asia. These noninvasive tests can detect and monitor cancer cells or biomarkers in a patient's blood or other bodily fluids, providing an alternative to traditional tissue biopsies. Furthermore, players in the region are focusing on advancements in genomic profiling and precision medicine, leading to the development of targeted diagnostic tests that can identify specific genetic mutations or biomarkers associated with blood cancers. This information can guide personalized treatment decisions.

Japan hemato oncology testing industry is expected to witness rapid expansion, propelled by the government's substantial investments aimed at combating the country's escalating cancer burden. This surge in cancer prevalence is due to Japan's rapidly aging demographics, with one of the highest median ages worldwide at 44 years. Distinguishing itself from neighboring countries, Japan has implemented nationwide cancer screening initiatives, a proactive measure to address its rising cancer prevalence.

For instance, in January 2021, Illumina partnered with Otsuka Pharmaceuticals to develop and commercialize an IVD genomic profiling testing kit for patients in Japan with blood cancers. Such partnerships are anticipated to drive market growth in the region.

Latin America Hemato Oncology Testing Market Trends

Latin America hemato oncology testing industry is growing due to the expansion of healthcare infrastructure and increased investment in the healthcare sector. Many countries in the region are witnessing improvements in their healthcare systems, including the establishment of specialized cancer treatment centers and the modernization of diagnostic laboratories. Government initiatives to enhance healthcare access and affordability are enabling patients to undergo diagnostic testing.

In October 2023, The Pan American Health Organization (PAHO) and the International Agency for Research on Cancer (IARC) launched the Latin America and the Caribbean Code Against Cancer. This new Code, as part of the World Code Against Cancer, aimed to alleviate the cancer burden in the region by offering recommendations grounded in the latest scientific evidence. The development of this Code results from collaborative effort between PAHO and IARC, involving a large group of scientific experts from the region who reviewed the evidence and formulated recommendations for optimal cancer prevention.

The Brazil hemato oncology testing industry is progressing with support from national research institutions, growing awareness, and government initiatives. The government has implemented various initiatives to improve cancer care, including national cancer control programs and funding for cancer research & diagnostics. Policies subsidizing diagnostic tests & treatments make these services more affordable and accessible to the general population. Furthermore, government support for research and innovation in medical diagnostics fosters the development of new & improved diagnostic technologies. These policy measures expand the hemato oncology testing industry by enhancing the availability and quality of diagnostic services.

Middle East & Africa Hemato Oncology Testing Market Trends

The hemato oncology testing industry in the Middle East & Africa (MEA) is growing at a significant pace. The countries in the region are increasingly adopting molecular and genetic testing into their diagnostic protocols. These technologies allow more precise classification of hematologic malignancies, aiding in treatment decision-making and prognostication. The adoption of these advanced techniques, however, varies across the region, influenced by factors such as the availability of infrastructure, skilled healthcare professionals, and financial resources.

Moreover, the increasing number of clinical trials and research initiatives is driving innovation in hemato oncology testing within the MEA region. Academic institutions, research centers, and pharmaceutical companies are conducting clinical trials to evaluate novel diagnostic technologies, biomarkers, and therapeutic interventions for hematologic malignancies. Participation in international collaborative research networks and initiatives such as the Global Initiative for Cancer Registry Development (GICR) & the African Cancer Registry Network (AFCRN) are also expanding research opportunities and advancing knowledge in hemato oncology testing specific to MEA population.

The hemato oncology testing industry in Saudi Arabia is influenced by various factors, including technological advancements, increasing awareness about blood cancer, and the rapidly aging population. The Saudi government has prioritized healthcare as a key sector for development, leading to the establishment of specialized oncology centers equipped with state-of-the-art diagnostic technologies. These centers, particularly in major cities like Riyadh, Jeddah, and Dammam, are equipped with advanced imaging modalities, molecular diagnostic tools, and pathology laboratories capable of conducting comprehensive diagnostic workups for hematologic malignancies. This infrastructure investment is crucial for enhancing diagnostic accuracy, enabling timely treatment decisions, and improving patient outcomes across the Kingdom.

Key Hemato Oncology Testing Company Insights

Major market players engage in various strategies, such as distribution agreements, mergers and acquisitions, and expansions. Most crucially, they exhibit a high degree of innovation in product research and development to improve their market penetration.

Key Hemato Oncology Testing Companies:

The following are the leading companies in the hemato oncology testing market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Abbott

- EntroGen, Inc.

- Qiagen N.V.

- Cepheid (Danaher Corporation)

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Amoy Diagnostics Co., Ltd.

- ASURAGEN, INC

- ArcherDX, Inc. (IDT)

Recent Developments

-

In April 2025, researchers at the Advanced Centre for Treatment, Research and Education in Cancer (ACTREC), Tata Memorial Centre in Mumbai, developed RAPID-CRISPR. This novel test detects acute promyelocytic leukemia (APL) in less than three hours.

-

In January 2025, Adaptive Biotechnologies and NeoGenomics forged a multi-year partnership to enhance personalized disease monitoring for blood cancer patients. This collaboration integrates Adaptive's FDA-cleared clonoSEQ test for minimal residual disease (MRD) detection with NeoGenomics' COMPASS and CHART assessment services to provide clinicians with comprehensive insights for improved patient care.

-

In July 2024, Thermo Fisher Scientific partnered with the National Cancer Institute (NCI) for the myeloMATCH precision medicine trial. This trial utilizes next-generation sequencing (NGS) technology to rapidly identify genetic biomarkers in patients with acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS).

Hemato Oncology Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.03 billion

Revenue forecast in 2030

USD 7.44 billion

Growth rate

CAGR of 12.99% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cancer, product, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; India; China; Japan; Australia; Thailand; Singapore; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Abbott; EntroGen, Inc.; Qiagen N.V.; Cepheid (Danaher Corporation); Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Amoy Diagnostics Co., Ltd.; ASURAGEN, INC; ArcherDX, Inc. (IDT)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Hemato Oncology Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the market trends in each of the sub-markets from 2018 to 2030. For this study, Grand View Research has segmented the global hemato oncology testing market report based on cancer, product, technology, end use, and region:

-

Cancer Outlook (Revenue, USD Million, 2018 - 2030)

-

Leukemia

-

Acute Myeloid Leukemia (AML)

-

Acute Lymphocytic Leukemia (ALL)

-

Chronic Lymphocytic Leukemia

-

Chronic Myeloid Leukemia

-

-

Lymphoma

-

Non-Hodgkin Lymphoma

-

Hodgkin Lymphoma

-

-

Myeloproliferative Neoplasms

-

Polycythemia vera (PV)

-

Essential thrombocythemia (ET)

-

Myelofibrosis (MF)

-

-

Other Cancers

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Assay Kits and Reagents

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR

-

Real-time qPCR

-

Digital PCR

-

-

IHC

-

NGS

-

Cytogenetics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

Singapore

-

South Korea

-

Thailand

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the hemato oncology testing market include Cepheid, Amoy Diagnostics Co., Ltd., EntroGen, Inc., Asuragen, Inc., and ArcherDX, Inc.

b. Key factors that are driving the hemato oncology testing market growth include the rising prevalence of blood cancer, increasing drug diagnostics co-development, and the availability of advanced molecular diagnostics techniques for hemato oncology testing.

b. The global hemato oncology testing market size was estimated at USD 3.07 billion in 2022 and is expected to reach USD 3.50 billion in 2023.

b. The global hemato oncology testing market is expected to grow at a compound annual growth rate of 12.54% from 2023 to 2030 to reach USD 8.00 billion by 2030.

b. North America dominated the hemato oncology testing market with a share of 37.15% in 2022. This is attributable to the rising prevalence of lymphoma and myeloma and the growing demand for personalized therapy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.