- Home

- »

- Clinical Diagnostics

- »

-

Hematology Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Hematology Diagnostics Market Size, Share & Trends Report]()

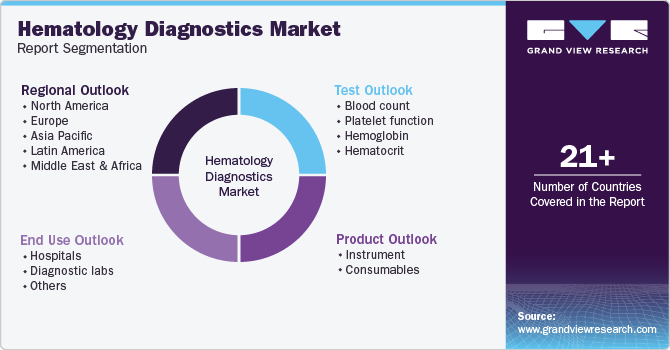

Hematology Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Test (Blood Count, Platelet Function, Hemoglobin, Hematocrit), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-660-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hematology Diagnostics Market Summary

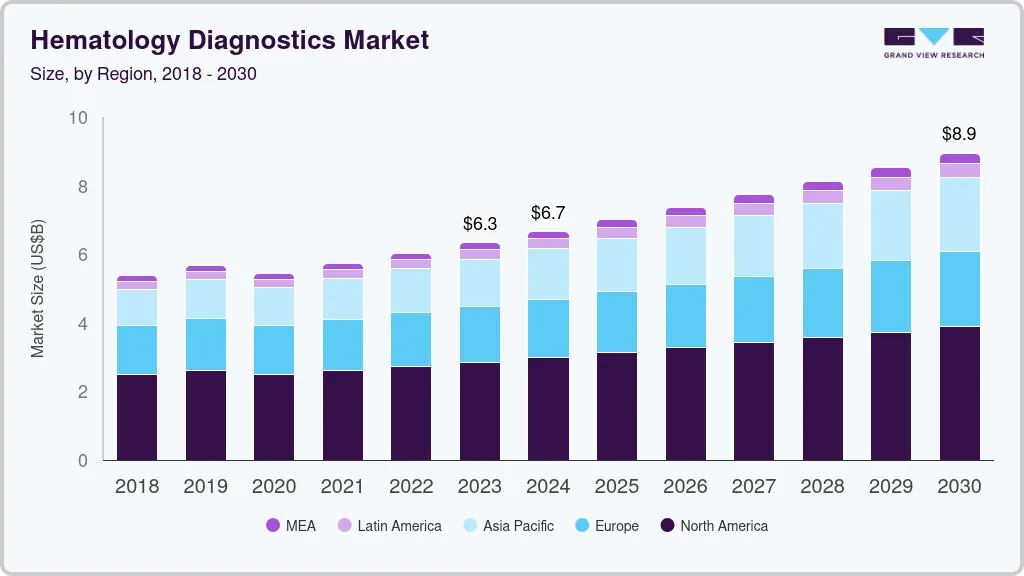

The global hematology diagnostics market size was estimated at USD 4,068.2 million in 2024 and is projected to reach USD 5,933.7 million by 2030, growing at a CAGR of 6.6% from 2025 to 2030. The increasing prevalence of blood cancer is a major factor contributing to the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of product, consumables accounted for the largest revenue share in 2024.

- Consumables are also the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,068.2 Million

- 2030 Projected Market Size: USD 5,933.7 Million

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2024

According to the report published by PhRMA, in 2022, highlights that nearly 89,010 Americans were diagnosed with a form of lymphoma, and the U.S. is expected to see 1,958,310 new cancer cases and 609,820 cancer-related fatalities. Rising awareness about thalassemia and technological advancements in hematology analyzers are factors expected to drive the hematology diagnostic market growth in the forecast period.

The ongoing technological advancements are aimed at delivering safer diagnoses with the shortest turnaround times and maximum efficiency. For instance, in December 2023, Agappe, an India based diagnostic technology brand has introduced its first of the kind in house manufactured HX series hematology equipment and the Mispa i200 series, an AE-powered Immunology CLIA analyzers, which aims at increasing the speed and accuracy of blood tests. Such advancements are anticipated to drive hematology diagnostics market growth.

The availability of user-friendly point-of-care (POC) hematological tests offers a twofold benefit. Firstly, it reduces the necessity for extensive user training, making it easier for healthcare professionals to operate these diagnostic tools effectively. Secondly, POC tests enable remote testing, allowing medical assessments to be conducted beyond traditional clinical settings. For instance, in January 2023, Seamaty highlighted the success of their SD1 Auto Dry Chemistry Analyzer in the market, this POC instrument excels at providing precise medical diagnoses. Notably, the streamlined tests significantly decrease the turnaround time, enhancing efficiency in patient care. The growing acceptance of such tests, owing to their ability to provide essential insights across various clinical contexts, is attributable to the growing market throughout the forecast period.

Hematology diagnostic equipment are anticipated to experience increased market demand, driven by rising automation and increased spending on diagnostic procedures. Several laboratories are adopting automation for the post-analytical, analytical, and pre-analytical steps to improve efficiency and standardize the process. For instance, in recent years, Tecan and Qiagen collaborated for automating whole blood sampling, reducing the risk of lab staff for coming in direct contact with infectious materials. This is anticipated to contribute to a heightened demand for automation, which would help the market drive market growth.

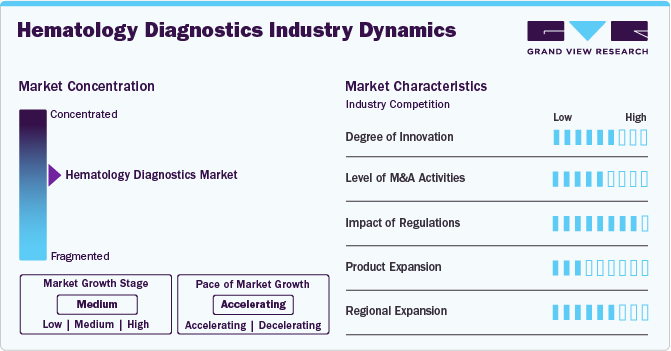

Market Concentration & Characteristics

The market is characterized by moderate-to-high levels of innovation, including the frequent development and introduction of novel techniques and diagnostic technologies like laser-based flow cytometry and blood transferrin receptor kits, which define the global hematology diagnostics market. Key players are investing in innovative methods and technologies to meet the global demand of the market.

The market is characterized by the leading players with moderate levels of product launches and merger and acquisition (M&A) activity. Market players like Siemens, Healthineers and Abbott are involved in new product launches and merger and acquisition activities. Such strategic activities as M&A, partnership, and collaboration are only serving to increase company’s competitiveness and expand their geographic reach and help to enter new territories.

The market is characterized by moderate-to-high levels of innovation, including the frequent development and introduction of novel techniques and diagnostic technologies like laser-based flow cytometry and blood transferrin receptor kits, which define the global hematology diagnostics market. Key players are investing in innovative methods and technologies to meet the global demand of the market.The market is characterized by the leading players with moderate levels of product launches and merger and acquisition (M&A) activity. Market players like Siemens, Healthineers and Abbott are involved in new product launches and merger and acquisition activities. Such strategic activities as M&A, partnership, and collaboration are only serving to increase company’s competitiveness and expand their geographic reach and help to enter new territories.

Regulations have a substantial impact on the hematology diagnostics market. Regulatory frameworks ensure product safety, efficacy, and accuracy, particularly for diagnostic devices and tests. Regulatory factors, including medical device regulations, patient safety standards, documentation requirements, and hygiene standards, have an impact on the hematology diagnostics market. These factors impact the development, manufacturing, and sales of hematology diagnostics equipment. Global regulatory standards are being standardized to accelerate the approval process for hematology diagnostic devices.

Product substitutes pose a moderate threat in the hematology diagnostics market. Hematology diagnostics products have experienced significant product expansion driven by standardization and design advancements. This means developing new and improved things to help doctors and nurses care for patients' better health during medical procedures. They are used for a wider range of treatments, making healthcare even better for everyone.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Expansion strategies include forming partnerships with local distributors, establishing manufacturing facilities, and launching region-specific products to address local healthcare needs. This approach not only strengthens market position but also diversifies revenue streams.

Product Insights

The consumables segment dominated the market with a share of 66.0% in 2023 and is also expected to witness the fastest growth with a CAGR of 6.9% in the forecast period. Consumables further include reagents, stains and controls, and calibrators. The heightened requirement for consumables is driven by the growing need to diagnose blood disorders and other infections. For instance, in December 2023, Sysmex expanded its sales in Europe, which consisted of the reagents used in blood testing for identification of the Amyloid Beta, and Sysmex Corporation developed concentrated reagents for hematology analyzers. Furthermore, the segment's growth is being fueled by an increasing test volume due to rising awareness and early detection efforts.

Instruments are expected to witness the considerable growth with in forecast period. Increasing automation and technological advancements are anticipated to be the primary growth drivers for hematology analyzers. For instance, in July 2022, Horiba medical introduced a new series Yumizen H500 & H550 a benchtop compact analyzer, that provides safe and secure automated quality management and is equipped with Multi analysis modes. Instruments are efficient & reliable instruments, automated racks, and quality tools providing high-quality medical analysis with fast accurate results. Furthermore, another major benefit of utilizing hematology analyzers over traditional cell counting is large-scale capa city designed for all kinds of laboratories and analyses 100+ samples simultaneously in analyzers, which makes it an ideal choice for medical applications. Therefore, such technological advancements are propelling the demand for analyzers.

Test Insights

The blood count segment captured the largest revenue share at 45.0 % in 2024. Organizations such as the American Cancer Society are rising awareness about diseases and chronic conditions such as Neutropenia, which are caused low WBC counts, propelling the population towards having frequent WBCs test. The WBC tests aid in identifying infections, inflammation, and other health conditions that impact WBC count. Hematology diagnostics offer the unique benefit of determining the total WBC count through reliable diagnostic procedures. These tests are valuable for general health assessments during routine check-ups. Similarly, abnormal Complete Blood Count (CBC) test results often indicate underlying infections, creating a consistent demand for diagnosis among patients. This broad scope of application is anticipated to drive growth.

Platelet function segment is projected to grow at the fastest CAGR over the forecast period. Advanced diagnostic tools are in high demand due to the rising prevalence of hematological disorders such as thrombocytopenia and hemophilia. Advances in technology, such as point-of-care testing and wearable monitoring devices, have greatly enhanced the precision and effectiveness of platelet function tests. Increased awareness and extensive screening initiatives have increased the need, as old-age individuals worldwide, who are more prone to blood disorders, also contribute to the requirement for comprehensive diagnostic solutions.

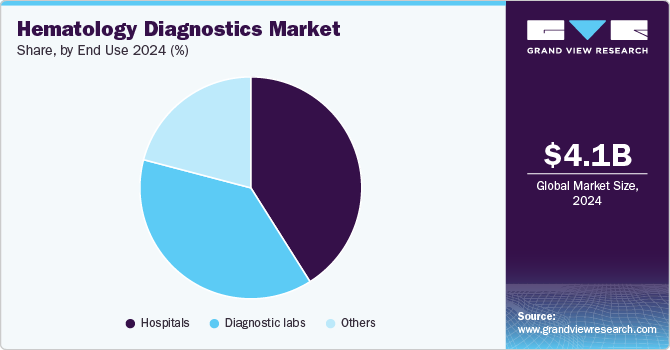

End Use Insights

The hospital segment held the largest revenue share of 41.0% in 2024. This is attributable to growing hematology diagnostics demand in forensic labs and hospital medical labs for disease diagnosis, blood cell counts, detecting illegal drug use, monitoring therapeutic drug levels, protein analysis, blood typing, thyroid function assessment, and detecting the presence of antibodies. According to the British Society for Hematology report, hematology workforce in the UK has increased in hospitals in recent years and about, 6% of clinical hematology staff is due to retire within coming 3-5 years as compared to 11% of nursing staff.

The diagnostics lab segment is expected to grow at the fastest CAGR of 7.0% over the forecast period. According to the American Clinical Laboratory Association, more than 7 million clinical laboratory tests are conducted annually in the U.S. As a result, the increasing number of diagnostic tests in these facilities and the demand for instruments are expected to drive demand. Additionally, the automation of diagnostic instruments is projected to lower the cost of the tests, consequently driving further demand.

Regional Insights

North America hematology diagnostics market dominated the market and accounted for a 45.0 % share in 2024. This high share is attributable to increasing prevalence of cancer; for instance, the global number of cancer sufferers is predicted to rise as lung cancer is the largest cause of cancer death worldwide, with an estimated cancer cases in the U.S. reaching 1.9 million in 2022. The rising incidence of diseases such as anemia, hemophilia, leukemia, sickle-cell anemia, lymphomas, and several infections has contributed to the emerging demand for hematology diagnosis. For instance, a PhRMA report, in 2022, about 184,000 Americans were estimated to be diagnosed with blood cancer. Same reports stated that the prevalence of sickle-cell anemia is about 100,00 individuals and nearly 3.2 million individuals are living with bleeding disorders. Such factors are poised to propel the diagnostics market.

U.S. Hematology Diagnostics Market Trends

The rise of patient centered test kits and personalized diagnostics, with the emergence of blood related disorders, have boosted the market growth prospects. According to a recent report by Leukemia and Lymphoma Society, in 2023, an estimated 184,720 people in the U.S. are expected to be diagnosed with leukemia, lymphoma, or myeloma. Most cases of leukemia occur in older adults, the median age at diagnosis is 67 years. The growing prevalence of blood illness amongst the population is a rising demand for hematology diagnostic test kits and equipment. For instance, the American Society of Hematology, Sickle cell trait, a blood disorder, affects 1 million to 3 million Americans, and more than 100 million people worldwide carry the sickle cell trait. The presence of several pharmaceutical and medical device companies is also expected to boost the demand for the hematology diagnostics market.

Europe Hematology Diagnostics Market Trends

Hematology diagnostics market in Europe was identified as a lucrative region in this industry. A supportive regulatory framework in the region helps manufacturers to boost productivity and open a wide scope for developments in the region. For instance, in line with the European Commission's Health Technology Assessment (HTA) proposal, the European Hematology Association (EHA) supports a permanent mechanism for joint clinical assessments. This mechanism should concentrate on innovative technologies, such as in-vitro diagnostic devices, that address unmet medical needs or have a significant impact on public health.

The hematology diagnostics market in the UK is anticipated to witness significant growth over the forecast period due to the presence of several small and medium-sized companies that significantly contribute to the economy. The country has a reputation for quality solutions and services including blood test kits and blood diagnosis services via locally based several private blood and urine test services such as Bloods4you and The Blood Clinic. Hence, diagnostics devices are anticipated to witness significant demand in the forecast period

Germany hematology diagnostics market is expected to grow over the forecast period. With the ongoing developments in the regions, such as the German Cancer Research Center (DKFZ) is working on developing new diagnostic methods for leukemia and lymphoma using mass spectrometry. Global players such as Thermo Fischer, Danaher, and Abbott are consistently involved in carrying out strategic mergers and collaborations in the regions, which is anticipated to create lucrative opportunities in Germany.

The hematology diagnostics market in France is anticipated to witness significant growth over the forecast period. The diagnostics industry has been undergoing significant changes, especially in the wake of the COVID-19 pandemic. Recently, few companies have elaborated its interest in increasing their bioproduction capabilities and collaborating with government health sovereignty, for instance, in January 2024, HORIBA Medical introduced a CE-IVDR approved, HELO 2.0 automated hematology platform, offering higher modular solutions with a range of track-based system and quality-controlled parameters.

Asia Pacific Hematology Diagnostics Market Trends

Hematology diagnostics is anticipated to witness significant growth in the hematology diagnostics market. This is attributed to the presence of major market players and local players such as Sysmex Corporation and Agilent Technologies. In addition, this growth owes to the significantly increasing investments in hematology diagnostics technologies across the region, rise in per capita income leading to increased adoption of diagnostic and therapy products coupled with government initiatives to improve healthcare infrastructure are expected to fuel the regional growth. The rising adoption of devices with new advanced features in emerging countries such as China, Japan, and India is anticipated to drive the market growth over the forecast period.

The hematology diagnostics market in China is expected to grow over the forecast period due to the rise in per capita income is leading to increased adoption of diagnostic and therapy products. Government initiatives to improve healthcare infrastructure are expected to fuel the regional market growth. China's rapidly evolving healthcare landscape and patient needs played a significant role in driving the market.

Japan hematology diagnostics market is expected to grow over the forecast period due to the presence of some major companies, such as Sysmex Corporation, Sekisui medical Co., Ltd, Morimoto pharma offering molecular and hematology diagnostics kits. For instance, in Japan, in June 2022, Sysmex launched its XR- series, which is considered as flagship model, having models that includes sample sorting, sample archives, automated quality transportation all in one place, assisting for better and smooth diagnostics procedures. Several government organizations and academic & research institutes have a demand for these devices. Hence, major players in the market are adopting several strategies such as mergers & acquisitions and partnerships & collaborations to stay competitive in the market.

Latin America Hematology Diagnostics Market Trends

The hematology diagnostics market in Latin Americais expected to experience significant growth throughout the forecast period. The market is driven by the increasing prevalence of blood-related disorders such as anemia, leukemia, and hemophilia, coupled with a growing awareness regarding early diagnostic measures. Latin America’s aging population also contributes significantly to market growth, as hematological conditions are more common among the elderly. Advancements in diagnostic technologies, such as automated hematology analyzers and molecular diagnostics, are facilitating faster and more accurate test results, thereby boosting adoption.

The hematology diagnostics market in Brazil is anticipated to grow during the forecast period. The growth is fueled by the country's rising prevalence of hematological disorders, and expanding healthcare infrastructure. Brazil's healthcare sector is undergoing modernization, with an increased emphasis on the adoption of advanced diagnostic tools and technologies. Programs aimed at reducing the burden of non-communicable diseases are indirectly driving demand for diagnostic tests, including hematology diagnostics.

Saudi Arabia Hematology Diagnostics Market Trends

The hematology diagnostics market in Saudi Arabiais anticipated to experience substantial growth during the forecast period. These include a growing prevalence of hematological disorders such as sickle cell anemia and thalassemia, which are particularly common in the region due to genetic predispositions. Saudi Arabia's government initiatives under Vision 2030, which aim to diversify the economy and expand healthcare infrastructure, are expected to significantly benefit the diagnostics sector.

Key Hematology Diagnostics Company Insights

Some of the key players operating in the market include Abbott, Beckman Coulter, Inc., Siemens Healthineers, Mindray Medical International Limited, F. Hoffmann-La Roche Ltd, Sysmex Corporation, Bio-Rad Laboratories, EKF Diagnostics. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New product developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Hematology Diagnostics Companies:

The following are the leading companies in the hematology diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Beckman Coulter, Inc.

- Sysmex Corporation

- Horiba

- Bio-Rad Laboratories

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- NIHON KOHDEN CORPORATION.

- EKF Diagnostics

Recent Developments

-

In September 2024, Scopio Labs, a medtech startup that creates AI-powered workflow solutions, partnered with Beckman Coulter, a world leader in clinical diagnostics, to hasten the adoption of Scopio's next-generation peripheral blood smear platforms. This partnering with Scopio Labs is majorly to promote hematology digital cell morphology platform adoption.

-

In January 2024, HORIBA Medical introduced a CE-IVDR approved, HELO 2.0 automated hematology platform, offering higher modular solutions with a range of track-based system and quality-controlled parameters.

-

In May 2023, Siemens Healthineers launched next-gen hematology analyzers products. The products include Atellica HEMA 580 and 570 analyzers. The analyzer provides intuitive interfaces & multi-analyzer automation connectivity to remove workflow roadblocks supporting faster results.

-

In July 2023 Sysmex launched its XR- series, which is considered as flagship model, having models that includes sample sorting, sample archives, automated quality transportation all in one place, assisting for better and smooth diagnostics procedures.

Hematology Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.31 billion

Revenue forecast in 2030

USD 5.93 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; and South Africa.

Key companies profiled

Abbott; Beckman Coulter, Inc.; Sysmex Corporation; Horiba; Bio-Rad Laboratories; Siemens Healthineers AG; F. Hoffmann-La Roche Ltd; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; NIHON KOHDEN CORPORATION; and EKF Diagnostics.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hematology Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hematology diagnostics market report based on product, test, end use, and region:

-

Outlook (Revenue, USD Million, 2018 - 2030)

-

Instrument

-

Analyzers

-

Flow cytometers

-

Others

-

-

Consumables

-

Reagents

-

Stains

-

Others Accessories

-

-

-

Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood count

-

Platelet function

-

Hemoglobin

-

Hematocrit

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hematology diagnostics market size was estimated at USD 4.07 billion in 2024 and is expected to reach USD 4.31 billion in 2025.

b. The global hematology diagnostics market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 5.93 billion by 2030.

b. North America dominated the hematology diagnostics market with a share of 45.0 % in 2024. The rising incidence of diseases such as anemia, hemophilia, leukemia, sickle-cell anemia, lymphomas, and several infections has contributed to the emerging demand for hematology diagnosis.

b. Some key players operating in the hematology diagnostics market include Abbott, Beckman Coulter, Inc., Sysmex Corporation, Horiba, Bio-Rad Laboratories, Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., NIHON KOHDEN CORPORATION, and EKF Diagnostics

b. Key factors that are driving the hematology diagnostics market growth include the increasing prevalence of blood cancer is a major factor contributing to the market growth. According to the report published by PhRMA , in 2022, highlights that nearly about 89,010 Americans were diagnosed with a form of lymphoma, and the U.S. is expected to see 1,958,310 new cancer cases and 609,820 cancer-related fatalities

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.