- Home

- »

- Pharmaceuticals

- »

-

Hemophilia Market Size And Share, Industry Report, 2030GVR Report cover

![Hemophilia Market Size, Share & Trends Report]()

Hemophilia Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Hemophilia A, Hemophilia B), By Treatment Type (On-demand, Cure), By Therapy, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-989-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemophilia Market Size & Trends

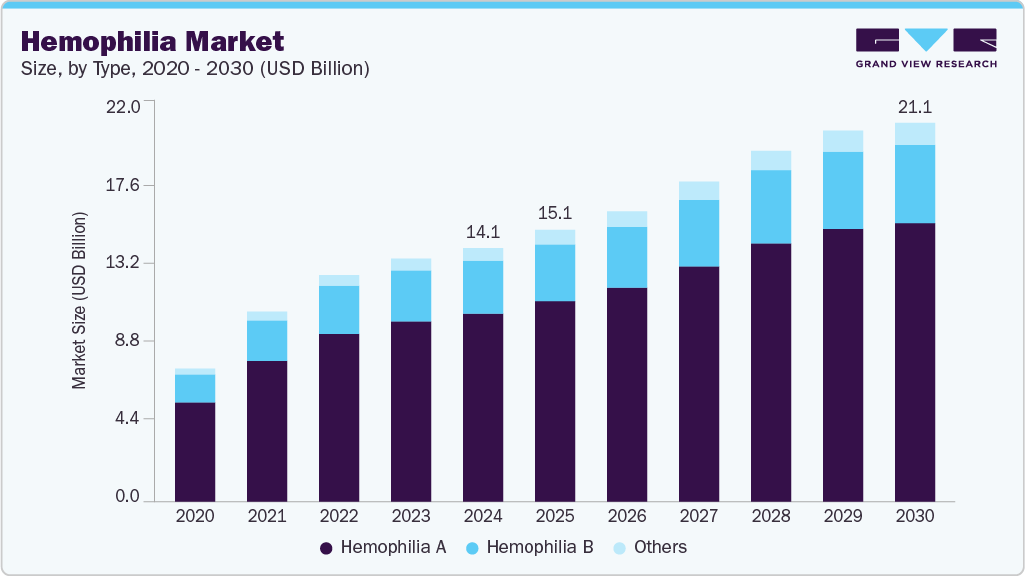

The global hemophilia market size was estimated at USD 14.11 billion in 2024 and is projected to reach USD 21.07 billion by 2030, growing at a CAGR of 6.91% from 2025 to 2030. The major factor driving the market is gene therapy approval, and multiple other candidates in various pipeline phases.

Key Market Trends & Insights

- North America leads the global hemophilia market with a regional share of 48.62% in 2024.

- The hemophilia market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- Based on type, Hemophilia A segment held the highest revenue share of 73.97% in 2024.

- By treatment type, the on-demand segment held the largest share of 54.95% in 2024.

- By therapy, the factor replacement therapy segment held the highest share of 61.07% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.11 Billion

- 2030 Projected Market Size: USD 21.07 Billion

- CAGR (2025-2030): 6.91%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, growing awareness of the disorders and increasing government support initiatives for early neonate detection fuel the market growth. According to the CDC, in 2024, an estimated 33,000 males were living with hemophilia in the United States.Hemophilia is a rare genetic bleeding disorder characterized by spontaneous (unexplained) bleeding and excessive bleeding following injury. It often results in repeated bleeding into joints, which can cause chronic joint disease and long-term disability. The severity and lifelong nature of the condition create a sustained demand for specialized treatments, including clotting factor replacement therapies, non-factor therapies, and emerging gene therapies. This persistent clinical need drives market growth and innovation, fueling investment in research, drug development, and patient care solutions.

In March 2025, the U.S. Food and Drug Administration approved Qfitlia (fitusiran) for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in adults and pediatric patients aged 12 years and older with hemophilia A or B, with or without factor VIII or IX inhibitors. Unlike traditional therapies that replace missing clotting factors, Qfitlia reduces antithrombin levels, thereby increasing thrombin production-an enzyme essential for effective blood clotting. This novel mechanism offers a promising alternative for patients with inhibitors, who often face limited treatment options. The approval of Qfitlia is expected to significantly impact the market by expanding therapeutic choices, improving disease management, and potentially reducing treatment burden through less frequent dosing and broader applicability across patient subtypes.

New Product Approval Analysis

Product

Type

Manufacturer

Approval Year

Alprolix

Extended half-life recombinant factor IX

Sanofi

2014

Eloctate

Extended half-life recombinant factor VIII

Sanofi

2014

Rixubis

Standard half-life recombinant factor IX

Takeda

2014

Nuwiq

Standard half-life recombinant factor VIII (human cell line)

Octapharma

2014

Zonovate

Standard half-life recombinant factor VIII

Novo Nordisk

2015

Kovaltry

Standard half-life recombinant factor VIII

Bayer AG

2016

Idelvion

Extended half-life recombinant factor IX

CSL Behring

2016

Adynovate

Pegylated extended half-life recombinant factor VIII

Takeda

2017

Rebinyn

Pegylated extended half-life recombinant factor IX

Novo Nordisk

2017

Afstyla

Standard half-life recombinant factor VIII

CSL Behring

2018

Jivi

Pegylated extended half-life recombinant factor VIII

Bayer AG

2018

Vonvendi

Recombinant von Willebrand factor

Takeda

2019

Esperoct

Pegylated extended half-life recombinant factor VIII

Novo Nordisk A/S

2019

Furthermore, increasing financial support for R&D through investments and growing grants for research are boosting the market growth. For instance, in March 2022, the Indiana University School of Medicine successfully raised USD 12 million of funding from the National Heart Blood and Lung Institute to develop improved therapies for hemophilia. R&D is approaching a better treatment approach using gene therapy and monoclonal antibodies. For instance, in April 2020, the FDA approved the genetically engineered product Sevenfact [coagulation factor VIIa (recombinant)-jncw] as a treatment option to control bleeding episodes in adolescents aged 12 years and above and in adults. Such product approvals are expected to propel the market growth.

Market Concentration & Characteristics

The market is experiencing a shift from traditional factor replacement therapies to next-generation treatments like gene therapies, monoclonal antibodies, and non-factor therapies. Innovations such as BioMarin's gene therapy (Roctavian for Hemophilia A) and Roche’s Hemlibra (emicizumab), a bispecific monoclonal antibody, redefine prophylaxis and on-demand treatment paradigms. These therapies offer extended dosing intervals, reduced infusion frequency, and the potential for functional cures, especially in Hemophilia A. Personalized treatment protocols, including subcutaneous and self-administered options, improve adherence and quality of life for patients, including pediatric populations.

High R&D costs, complex clinical trial design, and stringent regulatory requirements-especially for gene therapies and recombinant factor concentrates-pose significant entry barriers. Manufacturing challenges, including viral vector production and cold chain logistics, are particularly steep for new entrants. In addition, dominant players such as Takeda, CSL Behring, and Bayer benefit from extensive global networks, established physician relationships, and strong payer contracts, making it difficult for newer firms to gain market share.

Regulatory bodies such as the FDA and EMA require robust long-term efficacy and safety data for gene therapy candidates. Hemophilia treatments must demonstrate improvements in annual bleed rates (ABR), joint health, and patient-reported outcomes. While orphan drug incentives and fast-track designations accelerate development, post-marketing commitments remain a critical hurdle, particularly in pediatric populations. Health Technology Assessments (HTAs) in markets outside the U.S. heavily influence access and pricing, especially for high-cost treatments like gene therapies.

Traditional factor VIII and IX therapies (recombinant and plasma-derived) remain standard for many, especially in Hemophilia A and B. However, non-factor therapies like Hemlibra, desmopressin, and emerging gene therapies are gaining ground due to their improved efficacy, safety, and ease of use. On-demand treatments still rely on factor concentrates and fibrin sealants, but innovations in prophylaxis and potential cures rapidly reduce their use. Despite this, factor therapies maintain relevance in regions with limited access to advanced biologics.

Leading players such as Pfizer, Sanofi, Novo Nordisk, and Roche are expanding access to hemophilia therapies in Asia-Pacific, Latin America, and Eastern Europe through strategic partnerships and patient access programs. Emphasis is placed on increasing diagnosis rates and ensuring availability through hospital and specialty pharmacies. These efforts are supported by educational initiatives aimed at healthcare providers to improve early diagnosis and treatment adherence.

Type Insights

Hemophilia A held the market's highest share of 73.97% in 2024. A genetic disorder causes a lack of blood clotting factor VIII. The factors contributing to the dominance are the high prevalence of hemophilia A in developed regions and supportive government initiatives to launch products in major markets such as the U.S., Europe, and Japan. According to WFH’s 2020 survey, countries like the U.S., India, and Brazil are leading with 10,000 type A cases.

Hemophilia B is expected to grow significantly during the forecast period. A strong pipeline of products and the launch of gene therapy have catered to market growth. For instance, in February 2025, global biotechnology leader CSL announced four-year results from the pivotal HOPE-B study, confirming the long-term durability and safety of HEMGENIX (etranacogene dezaparvovec-drlb)-a one-time gene therapy for adults with hemophilia B. Presented at the 18th Annual Congress of the European Association for Haemophilia and Allied Disorders (EAHAD), the data demonstrated that HEMGENIX continues to deliver elevated and sustained factor IX activity levels, significantly reduces bleeding episodes, eliminates the need for routine prophylactic infusions, and maintains a favorable safety profile. These findings reinforce the transformative potential of gene therapy in hemophilia care. HEMGENIX is poised to reshape the hemophilia B treatment landscape by offering a durable, one-time therapeutic option, reducing lifelong treatment dependence, and driving a paradigm shift toward curative approaches in the broader market.

Treatment Type Insights

The on-demand segment dominated the market with a share of 54.95% in 2024. The on-demand treatment approach is a significant driver in hemophilia, particularly for patients managing acute bleeding episodes. Unlike prophylactic therapy, on-demand treatment offers flexibility, addressing bleeding events as they occur, which is often preferred by patients with mild to moderate hemophilia. This approach reduces medication usage and associated costs, making it attractive in resource-constrained settings. The demand for fast-acting, longer-lasting recombinant and non-factor therapies is growing, as they enhance patient outcomes and convenience. Advances in delivery methods, such as subcutaneous and extended half-life formulations, further support the expanding adoption of on-demand treatment in the evolving hemophilia care landscape.

The prophylaxis segment is positioned to grow at the fastest CAGR rate during the forecast period. Prophylaxis treatments are generally prescribed for severe patients. A novel approach to therapy for regular infusion of clotting factor concentrates is leading to segment growth. For instance, increasing the utilization of the bi-specific antibody product Helimbra (emicizumab) to treat the deficiency of clotting factor FVIII is driving market growth. Moreover, such treatments are expected to result in a better quality of life due to reduced productivity loss.

Therapy Insights

The factor replacement therapy segment held the highest share of 61.07% in 2024. Factor replacement therapy is regarded as a standard treatment option that replaces missing clotting factors in patients with both type A & B. Factor VIII replacement products are used for type A patients. In contrast, Factor IX replacement products are used for type B patients. Factor replacement products can either be plasma-derived or produced using recombinant DNA technology.

The gene therapy & monoclonal antibodies segment is expected to grow at the fastest CAGR rate during the forecast period. The rich gene therapy clinical pipeline, coupled with the success of Helimbra (emicizumab), a bispecific antibody that works by replacing the function of VIII in the blood clotting process. The monoclonal antibodies currently under late-stage clinical trials are Pfizer’s marstacimab (phase 3) and Novo Nordisk’s NNC0365-3769 (phase 3).

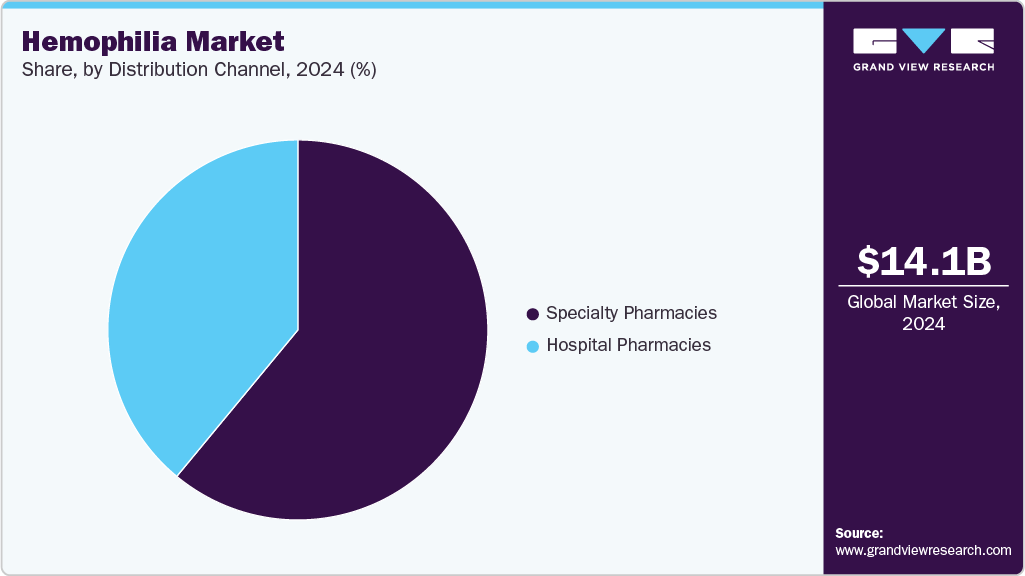

Distribution Channel Insights

The specialty pharmacies dominated the market with a share of 61.58% in 2024. Since hemophilia is a rare and complex disorder, very few trained professionals who can offer hemophilia treatment. Most hemophilia patients in the U.S. receive treatment at the “hemophilia treatment centers” or HTCs, as they are popularly known. Most HTCs have multidisciplinary teams that are experts in managing hemophilia and receive most of their drug requirements from specialty pharmacies.

The hospital pharmacies segment is expected to grow at the fastest CAGR during the forecast period. The approval of gene therapy, which would mostly be administered in hospitals as it requires continuous monitoring for side effects, is expected to drive segment growth. Furthermore, some of the HTCs are also associated with hospitals.

Regional Insights

North America leads the hemophilia market, accounting for the largest regional share of 48.62% in 2024, driven by a high disease prevalence, established diagnostic infrastructure, and early access to advanced therapies. The region benefits from strong government and private insurance support, ensuring better affordability and adherence to prophylactic treatments. Increased awareness about early diagnosis and comprehensive care models, such as hemophilia treatment centers (HTCs), further enhances disease management outcomes. The availability and uptake of recombinant clotting factors, extended half-life therapies, and emerging gene therapies contribute significantly to market growth. Moreover, key pharmaceutical companies and ongoing clinical trials strengthen North America's leadership position in the global hemophilia landscape.

U.S. Hemophilia Market Trends

The hemophilia market in the U.S. is highly advanced, with on-demand treatments still used in acute bleeding events but prophylaxis therapy dominating long-term care. Gene therapy trials are accelerating, especially for Hemophilia A. There is increasing demand for extended half-life recombinant factors and plasma-derived therapies for patients with inhibitors. Hospital pharmacies stock desmopressin and fibrin sealants for surgical management. Telehealth platforms and home-infusion services are boosting adherence.

Europe Hemophilia Market Trends

The hemophilia market in Europe represents a mature market with high adoption of recombinant factor concentrates and growing interest in gene therapies. Countries like Germany and France lead in Hemophilia A and B treatment innovation. National health systems support the wide use of Factor VIII prophylaxis, and plasma-derived products remain relevant for rare subtypes. Octapharma, Sanofi, and Bayer AG maintain a strong regional clinical presence.

The UK hemophilia market is expected to grow significantly over the forecast period. The NHS ensures broad access to prophylactic Factor VIII and IX, but budget constraints encourage switching to biosimilars and extended half-life therapies. Gene therapy programs are advancing through clinical partnerships. Specialty centers manage rare variants and severe cases with monoclonal antibody therapies like emicizumab.

The hemophilia market in Germany emphasizes innovation and safety, favoring recombinant therapies and participating in numerous gene therapy trials. Hospital pharmacies dominate distribution, and patients with inhibitors are increasingly managed using non-factor therapies. Collaborations with biotech firms are accelerating personalized care pathways.

France hemophilia market is supported by public healthcare and high awareness. Desmopressin is routinely used for mild cases, while recombinant Factor VIII dominates severe Hemophilia A treatment. Gene therapy access is growing through academic hospital partnerships. Specialty pharmacies ensure the timely delivery of home-infusion products.

Asia Pacific Hemophilia Market Trends

The hemophilia market in Asia Pacific is experiencing the fastest growth, driven by expanding healthcare access, rising awareness, and affordability. Japan and South Korea lead in adopting recombinant and plasma-derived factor concentrates. Governments are increasingly funding prophylaxis programs and gene therapy pilot studies.

Japan hemophilia market is expected to grow significantly as Japan’s advanced healthcare system supports the wide use of Factor VIII and IX recombinant therapies. The country sees early adoption of monoclonal antibodies and participation in global gene therapy trials. Hospital pharmacies and specialty distribution channels ensure consistent patient access.

The hemophilia market in China is projected to witness significant growth due to the growing middle class. Government-backed rare disease programs accelerate hemophilia diagnosis and treatment. Plasma-derived Factor VIII and IX are widely used, though recombinant options are gaining traction. Investment in local gene therapy production and increased partnerships with global players like Takeda and Sanofi boost innovation.

Latin America Hemophilia Market Trends

The hemophilia market in Latin America is an emerging market for hemophilia treatment, with increasing access to prophylaxis therapy and broader diagnosis of Hemophilia A and B. OTC treatment is rare; most care is administered via hospital pharmacies. Awareness campaigns and global NGO partnerships are improving treatment access.

Brazil hemophilia market leads the region with a strong public health focus on Hemophilia A. Government programs support plasma-derived Factor VIII and IX, while private centers offer access to recombinant therapies and monoclonal antibodies. Specialty pharmacies and hospitals are equipped for both acute and chronic care.

Middle East & Africa Hemophilia Market Trends

The hemophilia market in the MEA is emerging with rising demand for affordable and accessible hemophilia therapies. Increased diagnosis rates of Hemophilia A and rising investment in specialty care infrastructure are key drivers. Saudi Arabia and the UAE are introducing recombinant therapies and supporting gene therapy trials.

Saudi Arabia hemophilia market is growing due to healthcare modernization. This supports the growing demand for Factor VIII/IX replacement and increasing interest in gene therapy. Partnerships with international players are helping introduce non-factor therapies, while hospital pharmacies ensure regulated access to essential treatments.

Key Hemophilia Company Insights

Major market players include Takeda Pharmaceutical Company Limited, CSL Behring, Pfizer Inc., Bayer AG, Sanofi, Novo Nordisk A/S, F. Hoffmann-La Roche Ltd., Octapharma AG, BioMarin, and Spark Therapeutics, Inc. These companies are actively advancing the field through innovative therapies such as gene therapy, monoclonal antibodies, and extended half-life recombinant factor concentrates. The focus remains on improving treatment efficacy, reducing dosing frequency, and addressing inhibitor-related challenges. Strategic collaborations, specialty pharmacy networks, and patient support programs are critical components of their competitive strategies, alongside increased investment in digital platforms and real-world evidence generation.

Key Hemophilia Companies:

The following are the leading companies in the hemophilia market. These companies collectively hold the largest market share and dictate industry trends.

- Takeda Pharmaceutical Company Limited

- CSL Behring

- Pfizer, Inc.

- Bayer AG

- BioMarin

- Spark Therapeutics, Inc.

- Sanofi

- F. Hoffmann La-Roche Ltd.

- Novo Nordisk A/S.

- Octapharma AG.

Recent Developments

-

In May 2024, the U.S. Food and Drug Administration (FDA) updated the label for ALTUVIIIO [Antihemophilic Factor (Recombinant), Fc-VWF-XTEN Fusion Protein-ehtl] to include comprehensive results from the Phase 3 XTEND-Kids study. The data demonstrated that once-weekly dosing with ALTUVIIIO provides highly effective bleed protection in children with Hemophilia A.

-

In December 2024, scientists in India reported a successful use of gene therapy to treat severe Hemophilia A, a rare hereditary disorder caused by a defective gene that leads to severe, spontaneous, and potentially life-threatening bleeding episodes. The clinical trial was led by Alok Srivastava from the Centre for Stem Cell Research (CSCR) at Christian Medical College, Vellore, with financial support from the Union Department of Biotechnology.

-

In February 2023, the U.S. Food and Drug Administration (FDA) approved ALTUVIIIO™ [Antihemophilic Factor (Recombinant), Fc-VWF-XTEN Fusion Protein-ehtl], formerly known as efanesoctocog alfa. This first-in-class therapy offers a high-sustained Factor VIII replacement, significantly advancingthe treatment of Hemophilia A.

Hemophilia Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.08 billion

Revenue forecast in 2030

USD 21.07 billion

Growth rate

CAGR of 6.91% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment type, therapy, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Takeda Pharmaceutical Company Limited; CSL Behring; Pfizer, Inc.; Bayer AG; BioMarin; Spark Therapeutics, Inc.; Sanofi; F. Hoffmann La-Roche Ltd.; Novo Nordisk A/S.; Octapharma AG.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemophilia Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2025 to 2030. For this study, Grand View Research has segmented the global hemophilia market report based on type, treatment type, therapy, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemophilia A

-

Hemophilia B

-

Others

-

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

On-demand

-

Cure

-

Prophylaxis

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Factor Replacement Therapy

-

Plasma derived Factor Concentrates

-

Factor VIII

-

Factor IX

-

-

Recombinant Factor Concentrates

-

Factor VIII

-

Factor VII

-

Factor IX

-

-

-

Desmopressin & Fibrin sealants

-

Gene Therapy & Monoclonal Antibodies

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Specialty Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemophilia market size was estimated at USD 14.11 billion in 2024 and is expected to reach USD 15.08 billion in 2025.

b. The global hemophilia market is expected to grow at a compound annual growth rate of 6.91% from 2025 to 2030 to reach USD 21.07 billion by 2030.

b. Based on type, hemophilia A dominated the hemophilia market with a share of 73.97% in 2024. This is attributable to the target disease prevalence and the higher number of approved products.

b. Some key players operating in the hemophilia market include Takeda Pharmaceutical Company Limited; CSL Behring; Pfizer, Inc.; Bayer AG; BioMarin, Spark Therapeutics, Inc.; Sanofi; F. Hoffmann La-Roche Ltd.; Novo Nordisk A/S.; and Octapharma AG.

b. Key factors that are driving the market growth include gene therapy approval for hemophilia treatment, presence of strong pipeline and the rising life expectancy due to the availability of treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.