- Home

- »

- Clinical Diagnostics

- »

-

Hemostasis Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Hemostasis Diagnostics Market Size, Share & Trends Report]()

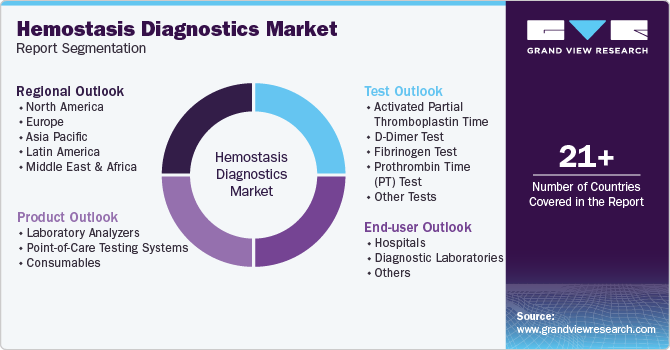

Hemostasis Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (POC Testing Systems, Consumables), By Test (Prothrombin Time Test, D Dimer Test), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-502-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemostasis Diagnostics Market Summary

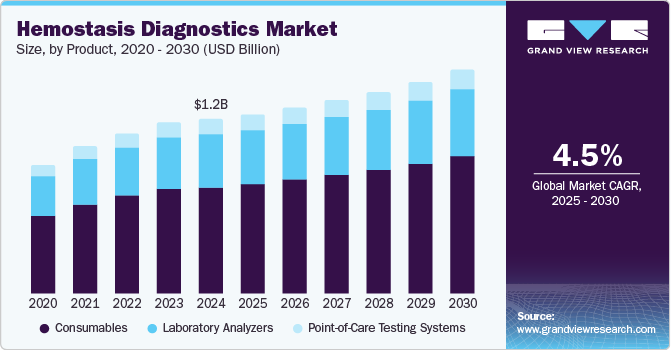

The global hemostasis diagnostics market size was estimated at USD 1.16 billion in 2024 and is projected to reach USD 1.49 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. Technological advancements in diagnostic techniques, including the development of point-of-care testing devices and automated analyzers, have made hemostasis diagnostics more accessible, accurate, and efficient.

Key Market Trends & Insights

- North America hemostasis diagnostics market dominated and accounted for a 38.84% share in 2024.

- The hemostasis diagnostics industry in the U.S. is projected to grow significantly during the forecast period.

- By product, the consumables segment accounted for the largest revenue share of 61.1% in 2024.

- By test, the Prothrombin Time (PT) test segment accounted for the largest revenue share of the market at 31.5% in 2024.

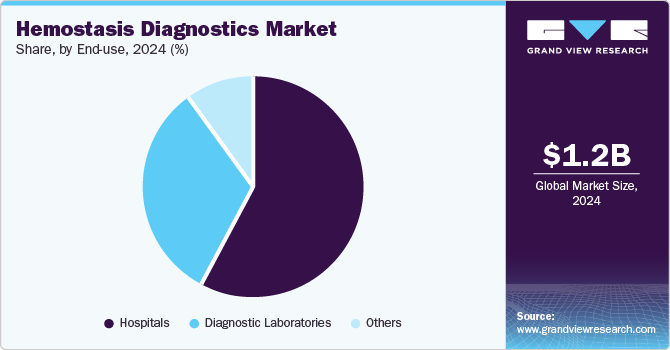

- By end use, the hospitals segment accounted for the largest revenue share of 57.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.16 Billion

- 2030 Projected Market Size: USD 1.49 Billion

- CAGR (2025-2030): 4.5%

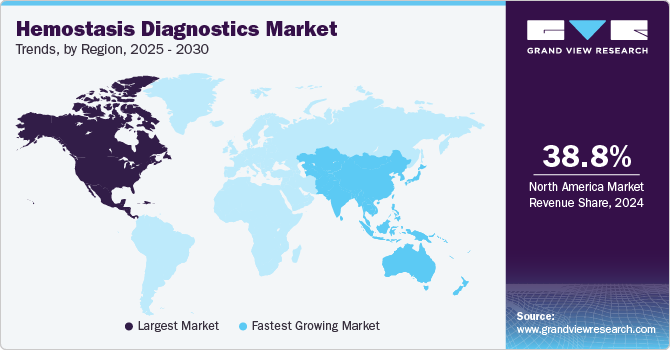

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Innovations such as microfluidics, artificial intelligence, and high-throughput systems are enhancing diagnostic precision, enabling faster clinical decision-making, and improving patient outcomes. Hemostasis diagnostics play a crucial role in identifying and managing blood clotting disorders, which are highly prevalent due to the rising global burden of chronic diseases such as cardiovascular disorders, diabetes, and cancer. These conditions often predispose individuals to coagulopathies, driving the demand for advanced diagnostic tools.

The aging population is another critical driver, as older adults are more susceptible to clotting disorders and associated complications. Furthermore, increasing awareness among healthcare professionals and patients about the importance of early diagnosis and monitoring of coagulation disorders has fueled market expansion.

Government initiatives and funding to combat bleeding and thrombotic disorders, coupled with the growing adoption of personalized medicine, are also contributing to industry growth. In addition, the rising incidence of surgical procedures and trauma cases, which necessitate coagulation testing, is boosting demand.

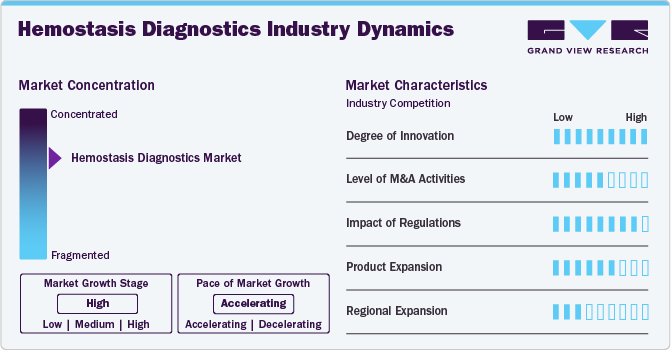

Market Concentration & Characteristics

The degree of innovation is high, driven by advancements in technology and a growing emphasis on precision medicine. The development of portable and user-friendly POC devices allows for rapid, near-patient testing of coagulation parameters such as PT/INR and aPTT. These devices are particularly valuable in emergency settings and for chronic disease management, reducing turnaround times and enabling immediate clinical decisions.

Diagnostic companies are increasingly collaborating with academic and research institutions to leverage cutting-edge scientific discoveries. These partnerships often focus on developing novel biomarkers, enhancing assay sensitivity, and exploring new diagnostic technologies such as microfluidics and AI.

Regulations have a profound impact on the hemostasis diagnostics industry. Hemostasis diagnostics, being medical devices or in-vitro diagnostic (IVD) tools, are subject to stringent regulatory approval processes. Agencies such as the FDA in the U.S., the European Medicines Agency (EMA), and similar bodies in other regions require comprehensive clinical data to validate performance. This ensures high-quality products but often extends time-to-market and increases development costs.

Product expansion in the industry is a key growth strategy driven by evolving clinical needs, technological advancements, and increasing demand for comprehensive diagnostic solutions. Companies are focusing on diversifying their portfolios to cater to a wide range of coagulation disorders and healthcare settings.

There is significant growth potential in emerging economies, particularly in regions like Asia-Pacific, Latin America, and the Middle East and Africa. These areas are experiencing improvements in healthcare infrastructure, rising healthcare spending, and a growing awareness of diagnostic testing. Companies are targeting these markets with cost-effective solutions and region-specific products to meet local needs.

Product insights

The consumables segment accounted for the largest revenue share of 61.1% in 2024. The frequent use of consumables ensures a steady, recurring revenue generation for manufacturers, as they need to be replaced frequently. In addition, advancements in diagnostic technologies have led to the development of specialized consumables that enhance test accuracy and efficiency, further solidifying their market dominance. Consumables also play a critical role in maintaining the standardization and quality control of diagnostic results, which is particularly important in coagulation testing. Furthermore, as healthcare access grows globally, especially in emerging markets, the need for consumables continues to rise, driving their market growth.

The Point-Of-Care (POC) testing systems segment is likely to grow at a CAGR of 5.1% over the forecast period. POC systems offer quick, real-time results, which are crucial in emergency and critical care settings where timely decision-making can significantly impact patient outcomes. These systems also provide convenience by enabling diagnostic tests to be conducted outside traditional laboratories, making them accessible in a variety of settings such as emergency rooms, outpatient clinics, and even at home. Technological advancements in miniaturization, automation, and connectivity have improved the accuracy, ease of use, and affordability of POC devices, further driving their adoption.

In addition, POC testing reduces healthcare costs by eliminating the need for centralized laboratory testing and shortening hospital stays. As the healthcare industry shifts toward more personalized care, POC systems allow patients to monitor their conditions more frequently, particularly for chronic diseases like cardiovascular conditions that require regular coagulation monitoring. The growing prevalence of chronic diseases and regulatory support for the development of POC devices have further fueled market growth.

Test Insights

The Prothrombin Time (PT) test segment accounted for the largest revenue share of the market at 31.5% in 2024. It is a routine test used extensively in hospitals and clinics, particularly for managing patients on anticoagulant therapy, such as those taking warfarin. The PT test is cost-effective, easy to perform, and requires minimal training, making it accessible in various healthcare settings, including point-of-care environments. Its global acceptance and recommendation by medical guidelines for conditions like liver disease, vitamin K deficiency, and bleeding disorders further contribute to its dominance.

The D-Dimer test segment is likely to grow at a CAGR of 4.6% over the forecast period. The segment is likely to show lucrative growth on account of its critical role in diagnosing thrombotic conditions such as deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC). It is highly sensitive and often used to rule out these conditions, reducing the need for more invasive and expensive imaging tests. This makes it a first-line diagnostic tool in emergency and critical care settings. In addition, the D-Dimer test is cost-effective, easy to perform, and widely used in hospitals, clinics, and emergency departments. It is often used alongside other coagulation tests, enhancing its diagnostic value. With the growing prevalence of cardiovascular diseases and other risk factors for thrombotic events, the demand for D-Dimer testing continues to rise.

End Use Insights

The hospitals segment accounted for the largest revenue share of 57.7% in 2024. With a large patient volume, especially in emergency and critical care settings, hospitals are key for diagnosing and managing coagulation disorders like deep vein thrombosis, disseminated intravascular coagulation, and more. They have the infrastructure and expertise to perform advanced tests such as PT, aPTT, and D-Dimer, often using state-of-the-art technologies. Hospitals also adhere to stringent regulatory and clinical guidelines, ensuring high-quality testing. The growing prevalence of chronic conditions further drives the need for hemostasis diagnostics in hospitals, solidifying their market dominance.

The diagnostic laboratories segment is likely to grow at a CAGR of 4.3% over the forecast period. Laboratories are a key diagnostic setting for accurate and early detection of these conditions, leveraging sophisticated technologies like coagulation analyzers and D-dimer tests. In addition, the rising adoption of routine screening for thrombosis and related complications, especially among aging populations, further boosts the need for specialized testing services. Advancements in point-of-care hemostasis testing are complementing, rather than replacing laboratory-based diagnostics, as complex cases still require comprehensive laboratory analysis. Furthermore, the growing focus on personalized medicine and treatment monitoring has increased reliance on precise laboratory diagnostics to tailor therapies effectively.

Regional Insights

North America hemostasis diagnostics market dominated and accounted for a 38.84% share in 2024. The region's aging population is a primary driver, as older adults are more susceptible to coagulation disorders like deep vein thrombosis and atrial fibrillation. This demographic shift increases the demand for diagnostic tools to manage and monitor these conditions.

U.S. Hemostasis Diagnostics Market Trends

The hemostasis diagnostics industry in the U.S. is projected to grow significantly during the forecast period. The U.S. market is experiencing significant growth due to various factors, including a rising prevalence of coagulation disorders and robust healthcare infrastructure. The increasing incidence of chronic diseases such as diabetes, cardiovascular disorders, and cancer further increases the demand for coagulation diagnostics, as these conditions often involve clotting complications.

Europe Hemostasis Diagnostics Market Trends

The Europe hemostasis diagnostics market is likely to emerge as a lucrative region. Europe's well-developed healthcare systems and strong emphasis on early diagnosis and preventive care are key factors for market growth. Countries like Germany, France, and the UK are investing in cutting-edge diagnostic technologies, including automated coagulation analyzers and point-of-care devices. In addition, rising awareness campaigns and government initiatives aimed at improving disease management are boosting test volumes.

The hemostasis diagnostics market in the UK is projected to grow during the forecast period. Chronic diseases such as diabetes and cardiovascular disorders, which often involve clotting complications, are driving the demand for hemostasis diagnostics. The National Health Service (NHS) plays a significant role in facilitating access to these diagnostic services through its comprehensive healthcare coverage. In addition, the UK is a hub for medical research and innovation, with ongoing advancements in personalized medicine and anticoagulant therapies bolstering the need for precise diagnostic solutions.

France hemostasis diagnostics market is expected to show steady growth over the forecast period. France's well-established healthcare system, supported by universal health coverage, ensures widespread access to diagnostic services, boosting test adoption rates. The country is also investing in modernizing its diagnostic infrastructure, with a focus on automated coagulation analyzers and point-of-care testing devices to improve efficiency and accuracy.

The hemostasis diagnostics market in Germany is projected to expand during the forecast period. Germany's strong presence in medical research and innovation, coupled with the presence of leading diagnostic companies, drives advancements in personalized medicine and anticoagulant therapies. Government initiatives focused on preventive care and early diagnosis further fuel the market growth.

Asia Pacific Hemostasis Diagnostics Market Trends

The Asia Pacific hemostasis diagnostics industry is expected to experience the highest growth rate of 5.1% CAGR during the forecast period. The region's large and aging population is a significant driver, as older adults are more prone to conditions like deep vein thrombosis, pulmonary embolism, and atrial fibrillation. Additionally, the growing incidence of chronic diseases such as diabetes, cardiovascular disorders, and cancer further boosts the demand for advanced diagnostic solutions.

The hemostasis diagnostics market in China is projected to expand throughout the forecast period. Ongoing healthcare reforms and increased government investment in medical infrastructure have significantly improved access to diagnostic services. The adoption of advanced technologies, including automated coagulation analyzers and point-of-care testing devices, is expanding. Additionally, the growing focus on early diagnosis and preventive healthcare is driving market growth.

Japan hemostasis diagnostics market is anticipated to grow during the forecast period. Key factors driving the market growth include the growing geriatric population and the rising prevalence of coagulation disorders. The country’s aging demographic is a major contributor, as older individuals are more susceptible to clotting-related conditions that require regular monitoring and testing.

Latin America Hemostasis Diagnostics Market Trends

The hemostasis diagnostics industry in Latin America is expected to experience significant growth throughout the forecast period. Healthcare infrastructure in the region is evolving, with the government investing in medical facilities and diagnostic laboratory networks. This has led to increased adoption of advanced diagnostic solutions. Moreover, rising awareness of preventive healthcare and early diagnosis is contributing to higher test volumes across the region.

Brazil hemostasis diagnostics market is likely to grow over the forecast period. The healthcare system is undergoing improvements, with increased government investment in medical infrastructure and diagnostic technologies. Additionally, major players are expanding their business into Brazil owing to a high potential target population.

Middle East and Africa Hemostasis Diagnostics Market Trends

The hemostasis diagnostics market in the Middle East and Africa is expected to grow due to several driving factors. The growing healthcare investments in the region, particularly in countries like Saudi Arabia, the UAE, and South Africa, are enhancing access to advanced diagnostic technologies.

Saudi Arabia hemostasis diagnostics industry is anticipated to experience lucrative growth over the forecast period. Government initiatives focused on preventive healthcare, early diagnosis, and the management of chronic diseases are driving the demand for hemostasis diagnostics. The presence of international diagnostic companies and local market players further supports the market growth in the country.

Key Hemostasis Diagnostics Company Insights

The competitive landscape in the hemostasis diagnostics industry is characterized by the presence of several global and regional players, offering a range of diagnostic solutions, including automated coagulation analyzers, point-of-care testing devices, and reagent kits. Key players are focusing on new product development to gain market share. For instance, in April 2024, Haemonetics Corporation got U.S. FDA clearance for its Global Hemostasis-HN assay cartridge. The cartridge enables the TEG 6s analyzer to expand its viscoelastic testing at the point of care and laboratory settings.

Key Hemostasis Diagnostics Companies:

The following are the leading companies in the hemostasis diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche AG

- Danaher Corporation

- Sysmex Corporation

- Siemens Healthineers

- Horiba Medical

- Haemonetics Corporation

- HemoSonics, LLC

- Sterile Safequip and Chemicals LLP

- TECO Medical Instruments

- Stago

Recent Developments

-

In September 2024, Sysmex Corporation announced the launch of HISCL HIT IgG Assay Kit, which enables the detection of IgG antibodies for patients undergoing heparin therapy. The assay kit works in line with the CN-6500/CN-3500 analyzers offered by the company.

-

In April 2024, Siemens Healthineers and Sysmex Corporation have started independently distributing their shared hemostasis testing portfolio to laboratories in the U.S. and Europe, each under their own brands. This initiative provides healthcare providers with easier access to top hemostasis testing solutions that address various conditions and diseases affecting patients.

-

In March 2024, Zybio launched its EXT 9800 Fully-Automated Coagulation Analyzer along with other products. With this launch, the company will be focusing on providing innovative breakthroughs in the medical diagnostics field

Hemostasis Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.20 billion

Revenue forecast in 2030

USD 1.49 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

F. Hoffmann-La Roche AG; Danaher Corporation; Sysmex Corporation; Siemens Healthineers; Horiba Medical; Haemonetics Corporation; HemoSonics, LLC; Sterile Safequip and Chemicals LLP; TECO Medical Instruments; Stago

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Hemostasis Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hemostasis diagnostics market report based on the product, test, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Analyzers

-

Automated Systems

-

Semi-automated Systems

-

Manual Systems

-

-

Point-of-Care Testing Systems

-

Consumables

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Activated Partial Thromboplastin Time

-

D-Dimer Test

-

Fibrinogen Test

-

Prothrombin Time (PT) Test

-

Other Tests

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemostasis diagnostics market size was estimated at USD 1.16 billion in 2024 and is expected to reach USD 1.20 billion in 2025.

b. The global hemostasis diagnostics market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 1.49 billion by 2030.

b. North America dominated the hemostasis diagnostics market with a share of 38.9% in 2024. This is attributable to high awareness regarding bleeding and clotting disorders along with high frequency of routine health checkups

b. Some key players operating in the hemostasis diagnostics market include F. Hoffmann-La Roche AG; Danaher Corporation; Sysmex Corporation; Siemens Healthineers; Horiba Medical; Haemonetics Corporation; HemoSonics, LLC; Sterile Safequip and Chemicals LLP; TECO Medical Instruments; Stago

b. Key factors that are driving the market growth include rising prevalence of bleeding disorders, technological advancements in point of care systems, and growing awareness regarding preventive healthcare

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.