- Home

- »

- Medical Devices

- »

-

Hemostasis And Tissue Sealing Agents Market Report, 2030GVR Report cover

![Hemostasis And Tissue Sealing Agents Market Size, Share & Trends Report]()

Hemostasis And Tissue Sealing Agents Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Topical Hemostat, Adhesive & Tissue Sealant), By Material (Gelatin-based, Collagen-based, ORC-based), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-597-7

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemostasis And Tissue Sealing Agents Market Summary

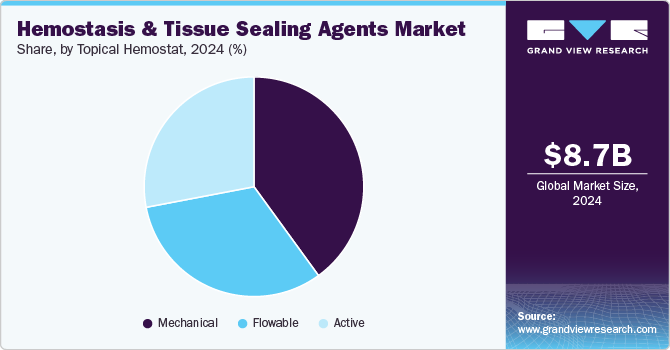

The global hemostasis & tissue sealing agents market size was estimated at USD 8,671.7 million in 2024 and is projected to reach USD 14,478.3 million by 2030, growing at a CAGR of 9.0% from 2025 to 2030. Hemostats and sealants are used to cease bleeding and hemorrhage caused by injuries and surgical procedures.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Norway is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, topical hemostat accounted for a revenue of USD 6,392.0 million in 2024.

- Topical hemostat is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 8,671.7 Million

- 2030 Projected Market Size: USD 14,478.3 Million

- CAGR (2025-2030): 9.0%

- North America: Largest market in 2024

The market is expected to witness lucrative growth over the next seven years owing to an increase in demand supported by rising surgery volumes. Growth in the geriatric population and the high prevalence of chronic conditions areamong the key drivers of the market. As per the centers for disease control and prevention (CDC) statistics, over 45% of the American population suffers from at least one chronic condition requiring critical care.

The demand for critical care among older patients has increased due to their vulnerability to slow-healing injuries and wounds. Similarly, elders active lifestyles is leading to the rise in routine injuries and wounds, contributing to the growth of the hemostasis and tissue sealing agents market. Additionally, the prevalence of chronic diseases among adults has significantly risen, with nearly 60% of adult Americans having at least one chronic disease, according to the National Association of Chronic Disease Directors' 2022 report. Chronic conditions such as diabetes, cancer, and cardiovascular diseases not only require surgical interventions but also drive the demand for these products. Various chronic conditions, including hernia fixation, diabetes-related complications, spinal injuries, ophthalmic injuries and replacements, urological disorders, and burns, further highlight the essential need for these specialized medical solutions.

Minimally invasive surgeries in the field of urology are particularly making use of hemostatic solutions, thereby promoting market growth. The highest demand is witnessed in cardiovascular conditions, followed by general surgeries. Higher application in cardiovascular disorders is attributed to better clinical results obtained by the use of sealants and hemostats compared to other wound closure techniques. However, a lack of reimbursements for these products may restrain the growth to a certain extent. The increasing cost of surgical procedures and the high price of surgical products are also expected to challenge the growth to an extent.

With a global rise in the incidence of chronic conditions, the volume of surgical procedures is expected to increase. According to the CDC, approximately 150 million Americans are suffering from at least one chronic condition, which leads to the need for surgery. Diabetes, as well as neurological, urological, and cardiac diseases, are also leading causes of an increase in the volume of surgical procedures. Middle East, Africa, and Asia are witnessing increased incidence of cardiovascular diseases and diabetes. With the growing incidence of chronic diseases, the number of injuries & surgeries is expected to increase, expanding the use of hemostats, adhesives, and tissue-sealing agents.

In addition, the increasing demand for hemostatic and tissue sealing agents is driven by their growing use in minimally invasive urological surgeries, as well as high demand in cardiovascular and general surgeries. These agents are particularly effective in cardiovascular conditions, leading to superior clinical outcomes, reduced scarring, and faster recovery. Their manufacture is subject to strict Class II and Class III medical device regulations to ensure careful oversight. However, the market faces significant constraints due to potential adverse reactions and complications, which can impact patient well-being.

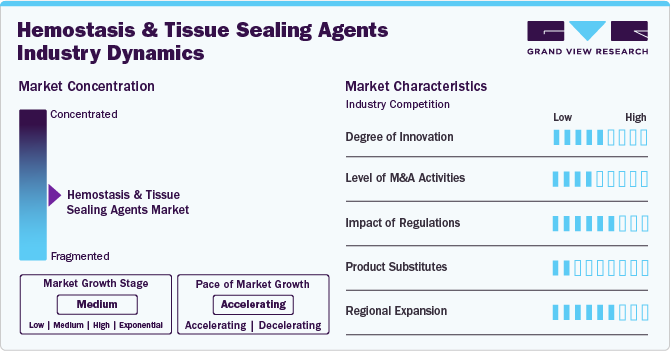

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating due to advancements in surgical techniques, increased adoption of minimally invasive procedures, and rising awareness among healthcare professionals regarding the benefits of using these agents in various medical specialties.

Key players market is employing a range of strategies, including new product launches, advanced product portfolio and established global presence may solidify their market positions. For instance, in November 2023, Ethicon, a part of Johnson & Johnson's MedTech division, had gained European approval for its Ethizia hemostatic sealing patch. Ethizia helps to treat internal organ bleeding and provides effective results on both sides of the wound.

The hemostasis & tissue sealing agents market has consistently seen a steady stream of innovation, companies continually launching novel products and technologies to address the shifting demands of the surgical community. For instance, Terumo's company introduced AQUABRID, an advanced surgical sealant, into the European, Middle Eastern, and African (EMEA) market.

Regulations are overseen by regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. and similar agencies globally. Strict regulatory frameworks assure the safety, effectiveness, and quality standards of products, influencing the industry's production, marketing, and distribution procedures.

The hemostasis & tissue sealing agents market is on an upswing due to the imperative need for synergies in research and development, empowering companies to innovate and provide advanced solutions that cater to the evolving requirements of healthcare professionals. Mergers and acquisitions play a crucial role in fostering strategic partnerships, offering companies the chance to leverage economies of scale to intensifying market scenarios. For instance, In August 2023, HemoSonics’s Quantra hemostasis system secured an innovative technology contract from Vizient Inc. This contract underscored the system's pioneering approach to hemostasis, indicating a burgeoning acceptance of advanced technology in the market.

Product substitutes in the hemostasis & tissue sealing agents market are sutures, staples, and energy-based devices serve as substitutes.

Key market players such as Johnson & Johnson, Pfizer Inc., Integra Life Sciences Corporation, Baxter, Smith & Nephew, and BD hold substantial shares in the market. Their dominant presence is largely due to their well-established brands, extensive distribution networks, and product portfolio. For instance, Johnson & Johnson's split consumer business reflects a more focused healthcare landscape, demonstrating their strategic approach to the market.

The market is experiencing robust global expansion due to the growing volume of surgical procedures performed in the region which has resulted in the increased demand for hemostats.

Product Insights

The topical hemostat segment accounted for the largest market share of 66.0% in 2024. These agents are compatible with conventional treatments, cost-efficient, rapidly absorbable, minimally reactive to tissue, and non-antigenic. Topical hemostats have been widely adopted due to their ability to integrate with existing treatment modalities, offering swift absorbability, minimal tissue response, and a lack of antigenic reactions. The market caters to a range of conditions, including cardiovascular and general surgeries, hernia fixation, diabetes-related complications, spinal injuries, ophthalmic injuries and replacements, urological disorders, and burns. The topical hemostats are further classified into mechanical, active, and flowable hemostats. Hemostasis involves the completion of coagulation, fibrinolysis, and platelet aggregation pathways by the activation of these factors.

The adhesive & tissue sealant segment shows the fastest CAGR over the forecast period, this is due to increased adoption of advanced surgical procedures that require efficient tissue sealing solutions. For instance, innovations in minimally invasive surgeries, such as robotic-assisted procedures in various medical fields like urology, gastroenterology, and gynecology, demand precise tissue sealing to minimize complications and ensure successful outcomes.

Hemostats consist of hemostatic agents and their delivering systems, which may be prefilled syringes or ready-to-use applicators. Adhesives and sealants play a prominent role in controlling blood loss during surgeries. They function by binding with and sealing the damaged tissues. Binding leads to the development of a barrier over injuries and surgical wounds and helps promote coagulation. The factors promoting their demand for sutures are faster procedure rate, minimal invasion, reduced post-surgical infections, and prevention of exudation of other body fluids. These are further sub-segmented on the basis of sealants used in synthetic, natural, and adhesion barrier products.

Material Insights

The gelatin-based topical hemostats segment accounted for the largest market share in 2024. This is due to the rise in surgical interventions and the increasing prevalence of chronic conditions, blood disorders played pivotal roles in propelling the market's growth. Gelatin-based hemostats provide effectiveness in controlling bleeding during various surgical procedures. Their biocompatibility and ability to absorb large volumes of blood make them an ideal choice for managing post-surgical bleeding. Moreover, several companies in the market are investing heavily to advance their offerings. For instance, Creilson, Inc., a biotechnology firm based in Brooklyn, successfully secured USD 25 million in a Series A-4 financing round led by Paulson Investment Company. This substantial investment aims to expedite the market entry of Creilson's hemostatic gel.

The collagen-based topical hemostats segment shows the fastest CAGR over the forecast period, this is due to increasing adoption of advanced surgical procedures that require efficient tissue sealing solutions. Collagen-based topical hemostats are biocompatible, have excellent wound healing properties, and are easy to apply and remove.Furthermore, they provide a controlled release of hemostatic agents, which is beneficial for controlling bleeding during surgical procedures. This makes them an attractive option for both patients and healthcare providers.

Application Insights

The general surgery segment accounted for the largest market share in 2024. This is primarily due to the high volume of surgeries conducted annually, including noncardiac thoracic, abdomen, peripheral vasculature, head and neck and others. All these surgeries necessitate effective hemostasis to control bleeding and reduce complications. Furthermore several market leaders are actively investing in the market by launching innovative products and seeking approvals, for instance, in November 2022 Medtrade Products Ltd received CE certification for its Uterine Hemostatic Tamponade, CELOX. This product is a major innovation that offers quick and efficient management of postpartum hemorrhage, a frequent and serious side effect of childbirth. Such product launches by key market players are expected to boost the segment's growth.

The collagen-based topical hemostats segment shows the fastest CAGR over the forecast period, this is due to the increasing popularity of advanced surgical procedures that necessitate effective tissue sealing agents. The advancements in minimally invasive surgeries, such as robotic-assisted procedures in fields like urology, gastroenterology, and gynecology. These procedures demand precise tissue sealing to reduce complications and ensure optimal outcomes. Collagen-based hemostats, being absorbable and biocompatible, closely resemble the natural structure of collagen in tissue, making them an ideal choice for these procedures

End-use Insights

The hospitals segment accounted for the largest market share in 2024. This is primarily due to the rising number of surgeries globally due to the aging population and the incidence of various diseases leading to their rising adoption by surgeons, further solidifying the dominance of the market. Hospitals are the primary users of these products, given their extensive use in a wide range of surgical procedures. The need for effective hemostasis and tissue sealing is critical in hospitals helps to manage patient recovery and reduces the risk of complications in surgery.

The ambulatory surgical centers show the fastest CAGR over the forecast period, this is due to increasing popularity of outpatient surgery centers, which often perform a wide range of surgeries that require effective hemostasis and tissue sealing. These centers typically operate under strict controls and have shorter hospital stays compared to traditional hospitals. This growing trend towards minimally invasive surgeries in ambulatory surgical centers has led to an increased demand for hemostasis and tissue sealing agents.

Regional Insights

North America hemostasis and tissue sealing agents market dominated the overall global market in 2024. This is due to the region having a high prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer, which drive the demand for advanced medical solutions, including hemostasis and tissue sealing agents, to manage surgical interventions effectively. For instance, the Cancer Statistics 2022 report projects around 1,918,030 new cancer cases and 609,360 cancer deaths in the U.S., including approximately 350 deaths per day from lung cancer, the leading cause of cancer death. Within the North American market, adhesives and sealants constitute a substantial portion, reflecting their widespread usage and significance in various surgical procedures.

U.S. Hemostasis And Tissue Sealing Agents Market Trends

The U.S. accounted for North America's largest share of the global hemostasis and tissue sealing agents market in 2024, due to its extensive healthcare infrastructure, high adoption rate of advanced surgical techniques, and significant investments in research and development. The emphasis on innovation and access to innovative medical technologies positions the U.S. healthcare system as a key player, driving the region's large market share in this sector. This growth is further supported by the rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer within the region, leading to a higher demand for advanced medical solutions, including hemostasis and tissue sealing agents, to manage surgical interventions effectively

Europe Hemostasis And Tissue Sealing Agents Market Trends

Europe hemostasis & tissue sealing agents market was identified as a lucrative region in this industry due to the large aging population, which increases the demand for surgical procedures. The growing need for quicker and more effective healing after surgery drives the market for hemostasis and tissue sealing agents in Europe.

The hemostasis & tissue sealing agents market in the UK is expected to grow over the forecast period primarily due to the increasing adoption of advanced surgical procedures that necessitate efficient tissue sealing solutions. These innovations in minimally invasive surgeries demand precise tissue sealing to avoid complications and ensure optimal outcomes.

The hemostasis & tissue sealing agents market in the France is expected to grow over the forecast period due to the increasing demand for critical care among older patients due to their susceptibility to slow-healing injuries and wounds. With more older adults adopting active lifestyles, the occurrence of routine injuries and wounds has increased, thereby fueling the expansion of the hemostasis and tissue sealing agents market.

Germany hemostasis & tissue sealing agents marketis expected to grow over the forecast period due to the prevalence of chronic diseases among adults has seen a significant increase. Disease conditions, such as cancer, cardiovascular diseases, and diabetes, collectively accounted for 44% of the total disability-adjusted life years in Germany. In response to this trend, numerous population-based observational studies are focusing on understanding the risk factors associated with these chronic diseases. This factor is driving the higher demand for hemostasis and tissue sealing agents in the French market

Asia Pacific Hemostasis And Tissue Sealing Agents Market Trends

The Asia Pacific region is expected to witness the fastest growth during the forecast period. This progress is driven by increasing healthcare expenditures of geriatric population, and advancements in healthcare infrastructure. Moreover, the escalating number of surgical procedures and the growing awareness regarding the benefits of hemostasis and tissue sealing agents in minimizing post-operative complications are contributing to the region's anticipated fastest growth rate during the forecast period.

Japan hemostasis & tissue sealing agents market has Asia Pacific largest share in 2024. Japan's healthcare sector is highly advanced and has a robust regulatory environment for medical devices, which favors the development and adoption of advanced hemostasis and tissue sealing agents. Moreover, the country's aging population leads to a high demand for medical interventions requiring hemostasis and tissue sealing, further driving market growth. Japanese companies have been investing significantly in research and development in this field, leading to the creation of innovative products that meet the needs of the market.

The hemostasis & tissue sealing agents market in China is expected to grow over the forecast period due toincreased medical tourism for surgical procedures, which necessitates the use of hemostasis and tissue sealing agents. Alongside this, the rising healthcare expenditure in developing countries, including China, is another factor contributing to this market expansion. As more individuals seek advanced medical treatments abroad, the demand for these essential medical tools is expected to rise.

The hemostasis & tissue sealing agents market in the Saudi Arabia is expected to grow over the forecast period due to the increased adoption of advanced surgical procedures that necessitate efficient tissue sealing solutions. For instance, the surge in minimally invasive surgeries, particularly in urology, where hemostatic solutions are extensively used. This trend is driven by the demand for precise tissue sealing to minimize complications and ensure successful outcomes, thereby promoting the growth of the hemostasis & tissue sealing agents market.

Kuwait hemostasis & tissue sealing agents market is expected to grow over the forecast period due to rising healthcare spending in Kuwait, which has led to an increased demand for advanced medical procedures and related equipment, including hemostasis and tissue sealing agents. Moreover, advancements in minimally invasive surgeries, such as robotic-assisted procedures in various medical fields like urology, gastroenterology, and gynecology, have led to an increased demand for precise tissue sealing solutions.

Key Hemostasis And Tissue Sealing Agents Company Insights

The competitive scenario in the hemostasis and tissue sealing agents market is driven by both established players and new entrants, with innovation, market expansion, and niche specialization being key strategies. Companies are focusing on developing advanced materials and formulations that provide superior performance and patient comfort. Additionally, the trend towards personalized medicine is influencing the development of hemostasis and tissue sealing agents tailored to specific patient needs

Key Hemostasis And Tissue Sealing Agents Companies:

The following are the leading companies in the hemostasis and tissue sealing agents market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- CryoLife Inc

- Advance Medical Solution (AMS) Group Plc.

- Cohera Medical Inc.

- Integra Life Sciences Corporation

- Pfizer Inc.

- BD

- Baxter

- HyperBranch Medical Technology

- Biomet Inc

- B Braun Medical Inc

- Smith & Nephew

Recent Developments

-

In November 2023, Johnson & Johnson's MedTech division, Ethicon, introduces Ethizia, a hemostatic sealing patch, obtaining European approval for its launch, marking a significant addition to their medical offerings in Europe.

-

In August 2023, HemoSonics’s Quantra hemostasis system received an Innovative Technology Contract from Vizient Inc.

-

In December 2022, Integra LifeSciences successfully concluded the acquisition of Surgical Innovation Associates, marking a strategic expansion in their surgical solutions portfolio. This acquisition enhances Integra's position in the medical device market and reinforces their commitment to advancing surgical innovation.

Hemostasis And Tissue Sealing Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.42 billion

Revenue forecast in 2030

USD 14.48 billion

Growth rate

CAGR of 9.0% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Johnson & Johnson; CryoLife Inc; Advance Medical Solution (AMS) Group Plc; Cohera Medical Inc; Integra Life Sciences Corporation; Pfizer Inc; BD; Cohesion Technologies Inc; HyperBranch Medical Technology; Biomet Inc; Braun Medical Inc; Smith & Nephew

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemostasis And Tissue Sealing Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hemostasis & tissue sealing agents marketreport on the basis of product, material, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Hemostat

-

Active

-

Mechanical

-

Flowable

-

-

Adhesive & Tissue Sealant

-

Synthetic Tissue Sealant

-

Natural Tissue Sealant

-

Adhesion Barrier Products

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin-based Topical Hemostats

-

Collagen-based Topical Hemostats

-

ORC-based Topical Hemostats

-

Polysaccharide-based Topical Hemostats

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Neurosurgery

-

Vascular Surgery

-

Cardiovascular Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemostasis and tissue sealing agents market size was estimated at USD 8.67 billion in 2024 and is expected to reach USD 9.42 billion in 2025.

b. The global hemostasis and tissue sealing agents market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2030 to reach USD 14.48 billion by 2030.

b. North America dominated the hemostasis and tissue sealing agents market with a share of 33.0% in 2024. This is attributable to the rising prevalence of cardiovascular disorders, diabetes, and cancer in the region.

b. Some key players operating in the hemostasis & tissue sealing agents market include CryoLife, BD, Medtronic, B. Braun, and Advance Medical Solutions Group

b. Key factors that are driving the hemostasis & tissue sealing agents market growth include growth in geriatric population and prevalence of chronic conditions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.