- Home

- »

- Medical Devices

- »

-

Hemostats Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Hemostats Market Size, Share & Trends Report]()

Hemostats Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Oxidized Regenerated Cellulose Based Hemostats), By Formulation (Matrix & Gel Hemostats), By Application (General Surgery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-238-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hemostats Market Summary

The global hemostats market size was estimated at USD 2.70 billion in 2023 and is projected to reach USD 4.24 billion by 2030, growing at a CAGR of 6.76% from 2024 to 2030. This can be attributed to the increasing prevalence of chronic diseases and growing volume of surgical procedures that have heightened the demand for hemostats to manage bleeding during intricate surgeries.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

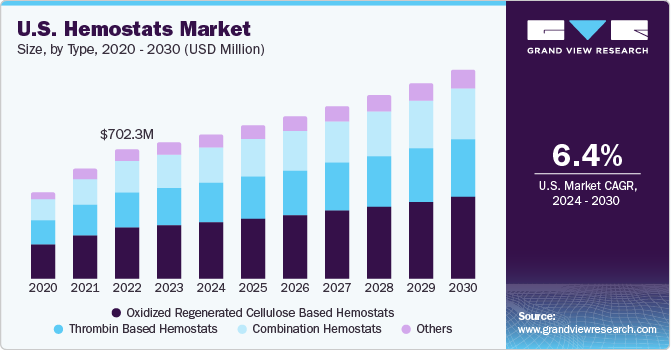

- Country-wise, U.S. is expected to register the significant CAGR from 2024 to 2030.

- By type, the oxidized regenerated cellulose-based hemostats segment accounted for the largest share of 44.03% in 2023.

- By formulation, the matrix & gel hemostats segment held the largest revenue share of 38.22% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.70 Billion

- 2030 Projected Market Size: USD 4.24 Billion

- CAGR (2024-2030): 6.76%

- North America: Largest market in 2023

Efforts by several market players to innovate and secure regulatory approvals for novel products further contribute to the market's expansion. For instance, in March 2023, Axio Biosolutions achieved clearance from the U.S. FDA under the 510(k) regulatory pathway for its Ax-Surgi Surgical Hemostat. This innovative hemostatic product utilizes chitosan and is specifically engineered to manage and control severe bleeding during surgical procedures effectively.

Recent estimates from the National Center for Biotechnology Information (NCBI) reveal that around 60-70% of all transfused red blood cells are used in a surgical context, underscoring the significance of hemostats in controlling post-surgery bleeding. In addition, the rising prevalence of chronic conditions like arthritis and osteoporosis is a major impetus propelling market growth. These chronic conditions frequently necessitate surgical interventions to alleviate pain and enhance joint functionality. Patients suffering from these disorders may have weakened bones and delicate blood vessels, amplifying the chance of intraoperative bleeding during surgeries, such as knee replacements.

Hemostatic agents are pivotal in managing bleeding effectively and mitigating complications like hematoma formation and prolonged surgery durations. For instance, According to the Centers for Disease Control and Prevention 2021 data, nearly 1 in 5 U.S. adults, or around 53.2 million people, are diagnosed with arthritis. This trend is anticipated to boost the demand for hemostasis agents in the coming years. Furthermore, rising geriatric population is a significant driving factor that boosts market growth. With age comes an increased susceptibility to certain health issues, many of which necessitate surgical interventions. As per data from the CDC, in the U.S. alone, the population aged 65 years and older is projected to reach nearly 98 million by 2060.

This demographic shift translates to a higher prevalence of age-related conditions requiring surgical interventions, boosting the demand for hemostatic products. Moreover, technological advancements contribute to the market growth. While the development and implementation of innovative technologies are raising production costs, they also extend the range of applications for hemostat products, thereby driving industry growth. For instance, in September 2022 Medtronic received FDA clearance for its Nexpowder endoscopic hemostasis device. This technology aims to improve patient outcomes and the overall quality of care.

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating due to the increasing incidence of chronic diseases, such as cardiovascular disease, cancer, and trauma occurrences has led to a significant increase in surgical procedures globally accelerating market growth. Moreover, technological advancement in the medical field, along with the approval of new products by regulatory bodies, is further driving the market's growth. For instance, Axio Biosolutions received FDA approval in March 2023 for its Ax-Surg Surgical Hemostat, a product designed to control severe surgical bleeding.

Key players focus on developing new products and technologies to meet the changing needs of the market. This could involve improving the efficiency of their products or introducing new applications for their products. For instance, in July 2023 Baxter International Inc. announced the launch of PERCLOT absorbable hemostatic powder in the U.S. PERCLOT is an absorbable, passive, and single-use hemostatic powder for the treatment of light bleeding in patients whose coagulation is intact.

The market is characterized by a high degree of innovation, with companies consistently developing products that enhance efficiency and safety. For instance, Ethicon introduced the ETHIZIA hemostatic sealing patch in November 2023, which was clinically approved to halt disruptive bleeding. This product is a result of Ethicon's continuous effort to foster innovation in the hemostats market

Hemostats are classified as medical devices, and they comply with strict regulations set by health authorities. These regulations ensure that the products are safe, effective, and dependable. For instance, in North America, hemostats are classified by the U.S. Food and Drug Administration (FDA), while in Europe, they fall under the authority of the European Medicines Agency (EMA). Moreover, regulatory changes can create challenges for the hemostats market, such as changes in regulations can alter the approval process, requiring manufacturers to adapt their production processes

Mergers and acquisitions are on the rise due to the need for research and development synergies. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in August 2021, Baxter International Inc. acquired specific assets linked to the PerClot Polysaccharide Hemostatic System from CryoLife, Inc. This acquisition illustrates Baxter's strategy of purchasing products and technologies that both supplement and enhance the company's leading portfolio across hospitals, including in operating rooms

Product substitutes include alternative hemostatic agents and materials. For instance, sutures, and staplers are considered an alternative

Major players, such as Johnson & Johnson, CryoLife, Inc (Artivion), Pfizer, and Medtronic, dominate the market with significant brand recognition, extensive global reach, and substantial industry share

The market is experiencing robust global expansion due to a rise in the volume of orthopedic surgeries worldwide as a result of rising cases of lifestyle disorders, such as arthritis, osteoarthritis, and obesity. The growing volume of orthopedic, bariatric, hernia repair, cardiothoracic, and neurological surgical procedures performed has resulted in an increased product demand

Type Insights

The oxidized regenerated cellulose-based hemostats segment accounted for the largest market share of 44.03% in 2023. This can be attributed to exceptional hemostatic properties, which enable effective clotting and tissue regeneration, making them crucial in various surgical procedures. Their biocompatibility, biodegradability, and proven safety in managing bleeding complications during surgeries have reinforced their market position. For instance, products like Surgicel from Ethicon (Johnson & Johnson) have significantly contributed to their widespread adoption. These factors have solidified the segment's position in the market.

The combination hemostats segment will register the fastest CAGR over the forecast period due to the increasing complexity of surgeries that require multiple types of hemostats to manage bleeding. For example, cardiovascular surgeries often involve the use of multiple hemostats to control bleeding from different sites. In addition, the growing focus on minimizing post-operative complications and enhancing patient recovery has led to increased use of combination hemostats, which can simultaneously control bleeding from multiple sites. These hemostatic agents typically blend mechanical and biological agents, such as collagen sponges and gelatin matrices, with thrombin & fibrinogen, resulting in faster and more effective hemostasis, especially in difficult bleeding situations.

Formulation Insights

The matrix & gel hemostats segment held the largest revenue share of 38.22% in 2023. This growth can be attributed to the ease of application and versatility of hemostats, which make them suitable for various surgical procedures. For instance, in July 2023, Baxter International launched its PerClot absorbable hemostatic powder product in the U.S. This innovative product swiftly absorbs water from the blood, leveraging its molecular structure to create a gel-like adhesive matrix, forming a robust mechanical barrier. This innovative product shows the evolving nature of the matrix & gel hemostats segment and its potential to drive market growth in the future.

The sponge hemostats segment will witness the highest CAGR over the forecast period due to their unique properties, such as their ability to absorb high amounts of blood and exert mechanical pressure to halt bleeding. In December 2019, Advanced Medical Solutions Group acquired Biomatlante. Biomatlante is a renowned French company specializing in innovative surgical biomaterial technologies. This acquisition shows the growing acceptance and use of sponge hemostats, highlighting their increasing importance in the industry.

Application Insights

The orthopedic surgery segment accounted for the largest share of 29.89% in 2023. This is due to the high prevalence of orthopedic surgeries performed globally, including joint replacements, spinal surgeries, and sports injuries. For instance, in 2021, the total number of hip and knee replacements in the U.S. alone was over 2 million, indicating a high demand for effective hemostats in this segment. In addition, advancements in orthopedic surgery techniques and equipment have made it possible to perform complex surgeries with minimal bleeding, further driving the product demand.

The cardiovascular surgery segment is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the rising prevalence of cardiovascular diseases that necessitate surgical interventions. As per the World Health Organization, over 17.9 million people died from heart disease and stroke in 2019, indicating a high demand for hemostatic agents in cardiovascular surgeries. Furthermore, an increasing number of minimally invasive surgeries in the cardiovascular field has also contributed to segment growth. For instance, in August 2023, Teleflex Inc. received U.S. FDA clearance for the expanded indication for QuikClot Control+ in cardiac surgical procedures. This indicates the continued advancement in cardiovascular surgical techniques and growing demand for effective hemostatic agents.

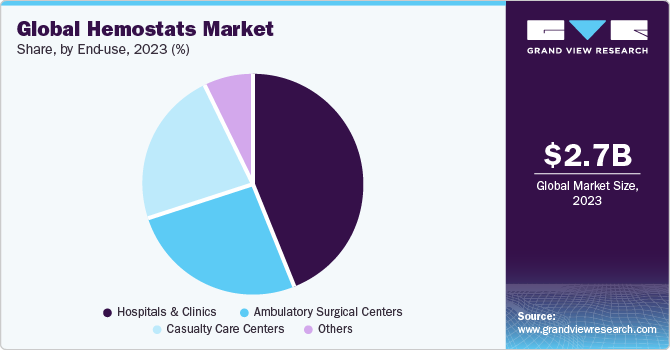

End-use Insights

The hospital & clinics segment accounted for the largest revenue share of 44.13% in 2023 due to the high volume of surgical procedures conducted in hospitals. The usage of hemostats is widespread in these settings due to their crucial role in controlling bleeding during surgical procedures, thereby ensuring patient safety and successful outcomes. Furthermore, the increasing number of medical institutions catering to patients' surgical needs has led to a sustained demand for a wide range of efficient product offerings for managing bleeding complications in various surgical procedures.

For instance, according to a report by the American Hospital Association, in 2022, the number of hospitals in the U.S. increased to 6,129, signaling a trend of rapid expansion, which is projected to persist during the forecast period. The casualty care centers segment is expected to show the fastest growth rate over the forecast period. These centers provide immediate medical care to individuals with acute injuries or severe conditions and heavily rely on hemostatic agents to control bleeding effectively. The increasing number of accidents, injuries, and sudden illnesses is anticipated to support the segment's growth.

Regional Insights

The hemostats market in North America accounted for the largest share of 32.94% in 2023 due to strong infrastructure supporting R&D, presence of major companies, and considerable burden imposed on the region's healthcare systems due to chronic conditions. Some prominent players boast substantial expertise, resources, and well-established distribution networks, significantly contributing to the region's prominence. Moreover, the rising volume of orthopedic, bariatric, hernia repair, cardiothoracic, and neurological surgical procedures conducted in this region has fueled product demand, further consolidating the region's position as a dominant force in the hemostats industry.

U.S. Hemostats Market Trends

The U.S. hemostats market held a significant share in 2023. The high volume of surgical procedures performed in the U.S., especially in areas like orthopedics and cardiovascular surgeries, has increased product demand. For instance, in 2022 according to the American Joint Replacement annual report 2022, more than 2.8 million knee and hip procedures were conducted across 50 states. This extensive data underscores the sheer volume of surgical interventions in the U.S. and emphasizes the consequential demand for hemostatic agents in these medical specialties.

Europe Hemostats Market Trends

The hemostats market in Europe witnessed considerable growth due to the high geriatric population and rise in approvals from the European regulatory authority for hemostatic products. For instance, in November 2022, CELOX PPH Uterine Haemostatic Tamponade from Medtrade Products Ltd. received CE certification. This product is useful for rapid and effective control of postpartum bleeding.

The UK hemostats market is expected to grow at a significant CAGR over the forecast period due to the increasing volume of surgical procedures. According to the article published by the British Orthopedic Association in May 2022, more than 42,000 orthopedic operations were conducted in March 2022 in England. Thus, the large patient pool is anticipated to propel the regional market growth.

The hemostats market in France is expected to grow over the forecast period due to the increasing geriatric population. According to the article published by the LE MONDE in March 2023, around 26% of people living in France are aged over 60 years.

The Germany hemostats market will witness lucrative growth in the future due to high prevalence of chronic conditions, a rise in surgical volumes, and a growing geriatric population in the country.

Asia Pacific Hemostats Market Trends

The hemostats market in Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030 due to the region's substantial population, increasing healthcare expenditure, and high demand for advanced medical treatments & technologies. In addition, rising prevalence of chronic conditions and a growing need for specialized medical interventions positions Asia Pacific as a pivotal player in the anticipated economic and healthcare advancements.

The Japan hemostats market is expected to witness significant growth in the coming years. The rising number of surgical procedures in Japan is projected to boost market growth. In addition, the presence of major players, such as Johnson & Johnson, Pfizer, B. Braun Melsungen AG, and BD, is projected to boost the country’s market growth.

The hemostats market in China accounted for a significant share in 2023 due to high population. Moreover, rise in the volume of surgical procedures and heavy investment in medical technologies have contributed to its growth.

The India hemostats market is expected to grow over the forecast period due to constant developments by established and emerging players in the Indian market. Startups and companies, such as Axio Biosolutions, that develop low-cost hemostat are anticipated to boost the country’s market growth.

Middle East & Africa Hemostats Market Trends

The hemostats market in MEA will witness significant growth due to rising volume of surgeries being performed on account of the high population, prevalence of chronic diseases, and improved healthcare infrastructure. The high incidence of road accidents and injuries in the region also creates product demand, thereby boosting the region’s growth.

The Saudi Arabia hemostats market is expected to grow over the forecast period due to the rising prevalence of musculoskeletal disorders. According to the study published by the National Library of Medicine in August 2022, musculoskeletal diseases are the 3rd reason for hospital visits across Saudi Arabia.

The hemostats market in Kuwait is expected to grow over the forecast period on account of the increasing older population and rising volume of surgeries for various conditions, such as orthopedic, neurological, and cardiovascular among others.

Key Hemostats Company Insights

The competitive scenario in the hemostats market is highly competitive, with key players, such as Stryker Corporation, B. Braun Melsungen AG, and Baxter International Inc., holding significant positions. The competition is primarily driven by the increasing volume of surgical procedures globally, especially orthopedic surgeries, which necessitate the use of hemostats.

Key Hemostats Companies:

The following are the leading companies in the hemostats market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- CryoLife, Inc (Artivion)

- Integra LifeSciences Corporation

- Pfizer

- B. Braun Melsungen AG

- Becton, Dickinson, and Company

- Medtronic

- Baxter

- Stryker Corporation

Recent Developments

-

In November 2023, Johnson & Johnson's MedTech division, Ethicon, launched Ethizia, a novel hemostatic sealing patch, after receiving European approval. This move marks a significant milestone for Ethicon, adding a new dimension to its medical offerings

-

In July 2023, Baxter International Inc., a global surgical innovation pioneer, introduced PERCLOT Absorbable Hemostatic Powder in the United States, a ready-to-use solution designed to successfully manage light bleeding in patients with intact coagulation

-

In January 2023, Medcura, Inc., announced that the FDA had granted its LifeGel Absorbable Surgical Hemostat. This product provides more effective treatment of life-threatening or irreversibly debilitating diseases or conditions

-

In December 2022, Integra LifeSciences acquired Surgical Innovation Associates, marking a strategic expansion in its surgical solutions portfolio. This acquisition enhanced Integra's position in the medical device market and reinforced its commitment to advancing surgical innovation

Hemostats Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.86 billion

Revenue forecast in 2030

USD 4.24 million

Growth rate

CAGR of 6.76% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

March 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, formulation, application, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Johnson & Johnson; Pfizer; B. Braun Melsungen AG; Integra LifeSciences Corp.; CryoLife Inc, (Artivion); Becton Dickinson and Company; Medtronic; Baxter; Stryker Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemostats Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hemostats market report on the basis of type, formulation, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Thrombin Based Hemostats

-

Oxidized Regenerated Cellulose Based Hemostats

-

Combination Hemostats

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Matrix & Gel Hemostats

-

Sponge Hemostats

-

Powder Hemostats

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgery

-

General Surgery

-

Neurological Surgery

-

Cardiovascular Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Casualty Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemostats market size was estimated at USD 2.70 billion in 2023 and is expected to reach USD 2.86 billion in 2024

b. The global hemostats market is expected to grow at a compound annual growth rate of 6.76% from 2024 to 2030 to reach USD 4.24 billion by 2030.

b. North America hemostats market with a share of 32.9% in 2023. This is attributable to increased demand for surgeries, growing popularity of minimally invasive surgeries (MIS), and aging population

b. Some key players operating in the hemostats hemostats market include Johnson & Johnson, CryoLife, Inc (Artivion), Integra LifeSciences Corporation, Pfizer, B. Braun Melsungen AG, Becton, Dickinson, and Company, Medtronic, Baxter, and Stryker Corporation

b. Key factors that are driving the hemostats market growth include focus on personalized medicine, development of new and innovative hemostats:, presence of an untapped population pool characterized with a snoring condition, and the integration with advanced technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.