- Home

- »

- Renewable Chemicals

- »

-

Chitosan Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Chitosan Market Size, Share & Trends Report]()

Chitosan Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Water Treatment, Medical & Pharmaceutical, Cosmetics, Food & Beverages, Agrochemicals, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-798-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Chitosan Market Summary

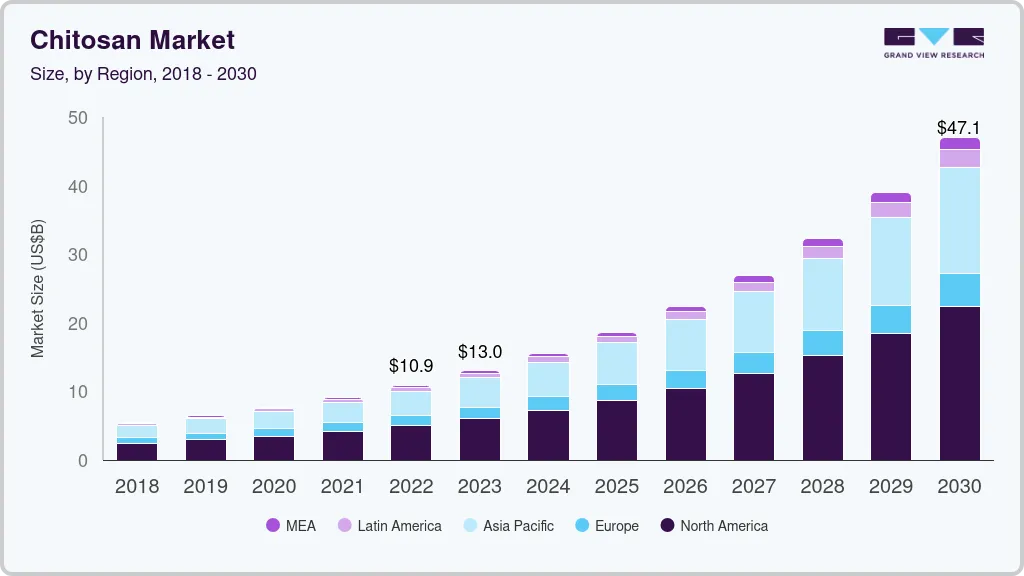

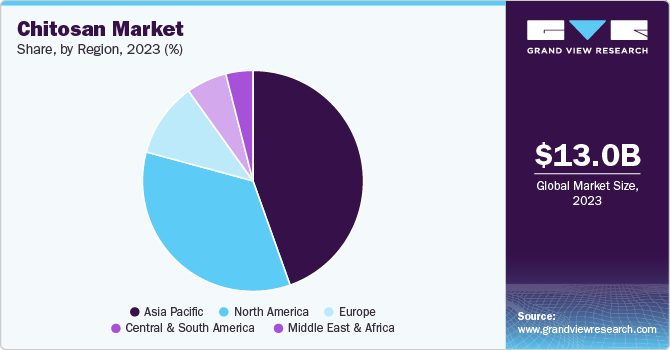

The global chitosan market size was estimated at USD 13.00 billion in 2023 and is projected to reach USD 47.06 billion by 2030, growing at a CAGR of 20.3% from 2024 to 2030. The growth is attributed to the increasing demand for naturally derived products and their high penetration in waste-water treatment, pharmaceutical, and cosmetics applications.

Key Market Trends & Insights

- Asia Pacific chitosan market dominated the market with the highest revenue share of nearly 44.5% in 2023.

- Asia Pacific is growing significantly during the forecast period.

- By application, biomedical dominated the market, with the highest revenue share of 31.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.00 Billion

- 2030 Projected Market Size: USD 47.06 Billion

- CAGR (2024-2030): 20.3%

- Asia Pacific: Largest market in 2023

Chitosan is expected to witness high demand from the food & beverage industry owing to favorable regulatory support by the developed economies and increasing awareness concerning the health benefits offered by the product. In addition, surging demand for the product as a food preservative and stabilizer has contributed to market growth. Furthermore, the rising utilization of the product as a clarifying agent in juices, as a thickening agent in beverages, and in packaging food products is anticipated to propel the demand.

Shrimp shells, crab shells, and squid pens are the most prominent raw materials used to produce chitin and chitosan. Chitosan is available in three varieties: alpha, beta, and gamma. Alpha and beta chitosan are the most widely available products manufactured using shrimp/crab shells and squid pens, respectively. The various types of chitosan differ in their chitin strand structure, which determines the characteristics and properties of the chitosan manufactured.

One of the market growth drivers, especially in the Asia-Pacific region, is the abundant availability of raw materials. It is one of the most abundant biopolymers and a significant waste product in the fishery industry. Chitosan is primarily obtained from various materials, including shrimp & crab shells and squid pens. Traditionally, these wastes were discarded or used directly as fertilizers. In addition, remarkable research on chitosan during the past few decades has revealed its significant importance in various applications, including wastewater treatment, pharmaceuticals, and food & beverage.

However, initiatives taken by manufacturers and researchers to improve purity to meet the required standards are expected to open new avenues for the existing and new market players during the forecasted period. In addition, rising demand for chitosan as an antibacterial, anti-cancerous, anti-inflammatory, and anti-fungal agent in pharmacological applications is expected to drive demand during the forecast period.

Application Insights

Biomedical dominated the market, with the highest revenue share of 31.0% in 2023. This is attributed to the increasing demand for bio-based ingredients in drug manufacturing. High investments in the pharmaceutical and medical sectors, coupled with demand for advanced healthcare products, are expected to impact market growth during the forecast period positively.

On the other hand, increasing demand for bio-derived personal care products is expected to be a key driver for market growth. Chitosan's bacteriostatic and fungistatic properties are expected to open new avenues for the product market in cosmetic applications. Increasing demand for chitosan used for skin and hair care cream manufacturing as a hydrating agent will likely drive market growth.

The rising application scope of chitosan for manufacturing dental care products, including mouthwash, toothpaste, and tooth gels, will likely increase demand for these products. The increasing application scope of chitosan for manufacturing color cosmetics such as lipsticks, eye shadows, and nail polishes is expected to propel demand during the forecast period. Furthermore, the rising demand for chitosan to treat various skin problems, including acne and scars, will likely drive the growth.

Regional Insights

Asia Pacific chitosan market dominated the market with the highest revenue share of nearly 44.5% in 2023. This is attributed to the Asia Pacific region having emerged as a dominant force in the market, driven by a combination of factors that enhance its position in the global landscape. As of 2023, the market in this region is experiencing significant growth, with projections indicating that it will continue to expand rapidly in the coming years.

Asia Pacific is growing significantly during the forecast period. The growing demand for skin care products, especially among women and teenagers, is anticipated to positively impact the product market during the forecast period. The growing fashion industry and increasing demand for naturally derived hair and skin care products in the region are expected to propel demand throughout the forecasted period. Growing investments in municipal wastewater treatment and the increasing use of bio-derived chemicals in the field are expected to drive the demand during the forecast period.

The pharmaceutical industry in Canada is considered one of the most profitable sectors and has been the fourth fastest-growing healthcare industry after China, U.S., and Spain. As a result, a positive pharmaceutical industry outlook in Canada is likely to fuel the demand. The robust manufacturing base of global cosmetic producers such as Johnson & Johnson, Unilever, and Procter & Gamble in the U.S. is expected to promote demand for chitosan in formulating personal care products.

Key Chitosan Company Insights

Some of the key players operating in Panvo Organics Pvt. Ltd, Qingdao Yunzhou Biochemistry Co.,Advanced Biopolymers AS3, Meron Biopolymers:

-

Qingdao Yunzhou Biochemistry Co., Ltd. is a biotechnology company based in Qingdao, Shandong, China. The company specializes in producing and supplying chitosan-based products, which are derived from chitin, a natural polymer found in crustaceans' shells.

-

Panvo Organics Pvt. Ltd. is a prominent manufacturer based in Chennai, India, specializing in Active Pharmaceutical Ingredients (APIs), Nutraceutical Ingredients, and Specialty Chemicals. Established in 2006, the company has rapidly become a key player in producing Glucosamine and Chitosan, among other products.

Key companies are adopting several organic and inorganic growth strategies to maintain and expand their market share, such as capacity expansion, mergers & acquisitions, and joint ventures.

Key Chitosan Companies:

The following are the leading companies in the chitosan market. These companies collectively hold the largest market share and dictate industry trends.

- Qingdao Yunzhou Biochemistry Co.

- Panvo Organics Pvt. Ltd.

- Advanced Biopolymers AS

- Meron Biopolymers

- Biophrame Technologies

- United Chitotechnologies Inc.

- Heppe Medical Chitosan GmbH

- KitoZyme S.A.

- Foodchem International Corporation

- Chitosanlab

- FMC Corporation

- Golden-Shell Pharmaceutical Co. Ltd.

- Primex EHF

- Nano3Bio

- Koyo World (Hong Kong) Co. Ltd.

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- KYTOSAN LLC

Recent Development

-

In September 2023, Heppe Medical Chitosan (HMC) introduced the first-ever chitosan molecular weight standards at EUCHIS. This innovation enables researchers and customers to utilize dependable chitosan for molecular weight analysis without comparing them to other materials.

-

In November 2022, Chitogen Inc., a U.S.-based medical manufacturing company, signed a letter of intent with Tru Shrimp to purchase commercial quantities of chitosan produced from the ground-up exoskeleton of its farm-raised shrimp. This move was made to build a large-scale shrimp farm in South Dakota, U.S.

-

In September 2021, KitoZyme launched a new version of its vegan chitosan at Vitafoods. KitoZyme has developed a patented process for producing chitin and chitosan from fungi on an industrial scale. This breakthrough innovation has significantly impacted these biopolymers' perception and potential applications.

Chitosan Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.55 billion

Revenue forecast in 2030

USD 47.06 billion

Growth rate

CAGR of 20.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Vietnam; Brazil; Saudi Arbia; South Africa

Key companies profiled

Qingdao Yunzhou Biochemistry Co.; Panvo Organics Pvt Ltd; Advanced Biopolymers AS; Meron Biopolymers; Biophrame Technologies; United Chitotechnologies Inc.; Heppe Medical Chitosan GmbH; KitoZyme S.A; Foodchem International Corporation; Chitosanlab; FMC Corporation; Golden-Shell Pharmaceutical Co. Ltd.; Primex EHF; Nano3Bio; Koyo World (Hong Kong) Co. Ltd.; Dainichiseika Color & Chemicals Mfg. Co. Ltd.; KYTOSAN LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chitosan Market Report Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chitosan market report based on application, and region:

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Water Treatment

-

Pharmaceutical

-

Biomedical

-

Cosmetics

-

Food & Beverage

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global chitosan market is expected to grow at a compound annual growth rate of 20.3% from 2024 to 2030 to reach USD 47.06 billion by 2030.

b. Asia Pacific dominated the chitosan market with a share of 44.5% in 2023. This is attributable to the rapid development of end-use industries in Japan, China, India, and South Korea.

b. Some key players operating in the chitosan market include Biophrame Technologies, Heppe Medical Chitosan GmbH, Meron Biopolymers, Qingdao Yunzhou Biochemistry Co., Golden-Shell Pharmaceutical Co. Ltd, and FMC Corp.

b. Key factors that are driving the chitosan market growth include increasing demand from the cosmetics industry and rising scope of usage in waste-water treatment industry.

b. The global chitosan market size was estimated at USD 13.00 billion in 2023 and is expected to reach USD 15.55 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.