- Home

- »

- Pharmaceuticals

- »

-

Heparin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Heparin Market Size, Share & Trends Report]()

Heparin Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Route of Administration, By Application, By End-use (Outpatient, Inpatient), By Source, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-154-2

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Heparin Market Summary

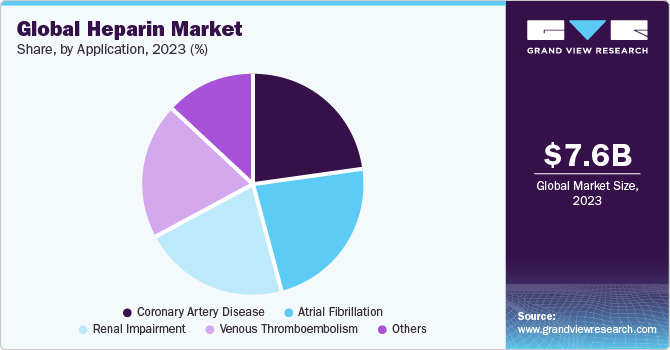

The global heparin market size was estimated at USD 7.56 billion in 2023 and is projected to grow at a CAGR of 2.7% from 2024 to 2030.The increasing prevalence of chronic diseases is a major factor in market growth.

Key Market Trends & Insights

- North America dominated the market and accounted for 38.6% share in 2023.

- By application, the Coronary Artery Disease (CAD) segment held the largest revenue share of 23.4% in 2023.

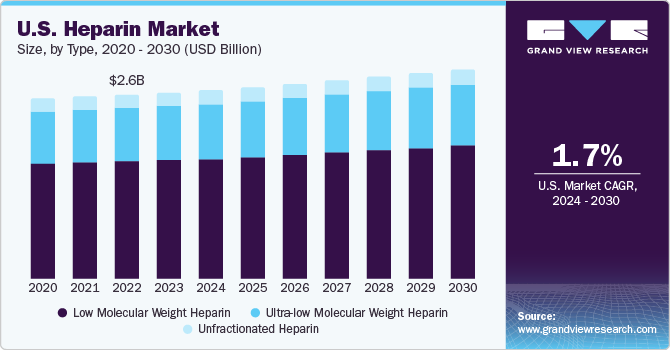

- By type, Low Molecular Weight Heparin (LMWH) segment accounted for the largest revenue share of 63.7% in 2023.

- By route of administration, subcutaneous administration of heparin accounted for the largest revenue share of 65.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.56 Billion

- 2030 Projected Market Size: USD 9.03 Billion

- CAGR (2024-2030): 2.7%

- North America: Largest market in 2023

According to a WHO article published in September 2023, Noncommunicable diseases (NCDs), also known as chronic diseases, cause about 41 million deaths annually, of which 17.9 million deaths are attributed to cardiovascular diseases (CVD). Cancer causes 9.3 million deaths, chronic respiratory diseases lead to 4.1 million deaths, and diabetes contributes to 2 million deaths, including those from diabetes-related kidney diseases. Growing demand for whole blood and blood components transfusion, increasing geriatric population and high usage of plasma in the pharmaceutical industry are factors expected to drive this market’s growth.

Growing demand for whole blood and blood components transfusion is boosting the demand for the heparin market. Many places worldwide are unable to meet their demand of blood. People are working hard to make more individuals aware of the importance of donating blood. According to an NCBI article published in October 2023, in the U.S. alone, someone needs blood every two seconds, and these transfusions save many lives. As 62 out of 171 countries have a 100% voluntary unpaid blood donation system, it is evident that maintaining an adequate and safe blood supply is challenging. The demand for heparin is set to rise alongside these initiatives, ensuring the success of transfusions and ultimately saving more lives.

The increasing prevalence of health issues in the elderly demographic is likely to propel the demand for heparin, as it plays a crucial role in preventing blood clots during medical procedures necessary for this age group. According to a WHO article published in October 2023, the global demographic over the age of 60 has been increasing, and is expected to double to 2.1 billion by 2050. As the global population ages, there is a higher likelihood of health issues that require medical interventions involving heparin, an anticoagulant crucial for preventing blood clots. This demographic shift poses challenges and opportunities, with the demand for heparin likely to surge as healthcare needs for the elderly become more prominent. The aging population serves as a significant growth driver, highlighting the expanding role of heparin in addressing the unique healthcare demands of an older demographic.

High usage of plasma in the pharmaceutical industry by major players is anticipated to facilitate the market demand. For instance, in March 2023, Takeda's substantial investment of about 100 billion yen (USD 754 million) in building a new manufacturing facility for plasma-derived therapies (PDTs) in Osaka, Japan, signifies a significant market growth driver. This substantial commitment reflects the pharmaceutical industry's increasing reliance on plasma-derived products, including anticoagulants like heparin, highlighting the industry's dedication to meeting the rising demand for essential treatments. Takeda's strategic move aligns with the high usage of plasma in the pharmaceutical sector, emphasizing the crucial role of anticoagulants in addressing patient needs and contributing to the market’s growth.

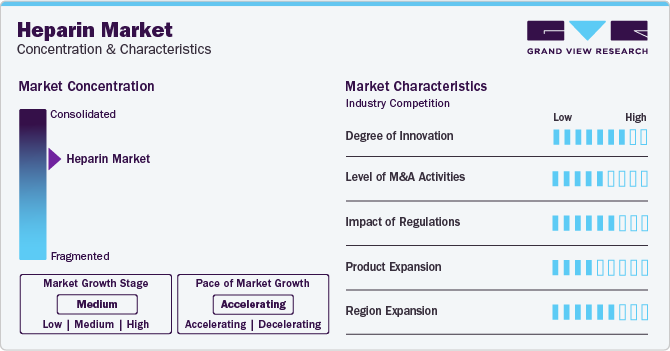

Market Concentration & Characteristics

The global heparin market has experienced a significant degree of innovation, with advancements in production methods, quality assurance, and novel applications. Ongoing research and development contribute to improved formulations and enhanced therapeutic outcomes, reflecting a dynamic and progressive landscape. Innovations in heparin production, such as bioengineered alternatives and advanced purification techniques, exemplify the market's commitment to enhancing efficacy and safety. Several players, such as Pfizer Inc.; LEO Pharma A/S; Dr. Reddy’s Laboratories Ltd.; and GlaxoSmithKline plc, are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories.

Companies are actively investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline Types. This results in increasing the cost of developing novel heparin technologies. This market's product expansion includes introducing new formulations, like low molecular weight heparins, and diverse dosage forms, such as prefilled syringes. These innovations cater to specific medical needs, ensuring a broader range of options for healthcare practitioners and improved patient convenience.

Application Insights

The Coronary Artery Disease (CAD) segment held the largest revenue share of 23.4% in 2023. CAD involves the narrowing of coronary arteries, leading to reduced blood flow to the heart. According to an NCBI article published in August 2023, CAD, considered the most common heart disease, involves atheromatous changes in heart-supplying vessels, leading to various clinical disorders. As a leading cause of mortality in the U.S., CAD necessitates interventions like heparin, which plays a crucial role in preventing blood clot formation and managing acute coronary events. The focus on initial risk factor evaluation aligns with the comprehensive approach to CAD management, where heparin serves as a key component.

Atrial fibrillation segment is estimated to register a significant CAGR from 2024 to 2030. Atrial fibrillation, a common heart rhythm disorder, necessitates anticoagulant therapy to prevent blood clot formation. According to the CDC, atrial fibrillation is estimated to be reported in 12.1 million people in the U.S. by 2030, and is an underlying cause of death in 26,535 people. Additionally, it was revealed that 15% - 20% of stroke patients also suffer from arrhythmia, which calls for the use of blood thinners as a form of treatment. The main signs and symptoms of this illness are fatigue, weakness, dizziness, shortness of breath, chest discomfort, palpitations, and lightheadedness. These aspects are expected to boost the demand for heparin.

Regional Insights

North America dominated the market and accounted for 38.6% share in 2023, driven by a rising patient awareness, high disease burden, proactive government measures, technological advancements, and improvements in healthcare infrastructure. The presence of key players in this region is a significant propeller of market growth. According to the CDC article published in May 2023, the prevalence of a heart disease is the leading cause of death in the U.S., resulting in one death every 33 seconds and serving as a significant growth driver for the market. The high incidence of CVD underscores the crucial role of heparin, a key anticoagulant, in managing and treating cardiovascular conditions, contributing to the market's sustained demand.

Asia Pacific is anticipated to witness the fastest CAGR from 2024 to 2030. Cardiovascular diseases stand as the predominant cause of death and disability in Asia Pacific region, posing a substantial economic burden on health systems. According to the NCBI article published in June 2023, “The report on cardiovascular health and diseases in China 2021: an updated summary,” underlines this challenge, revealing that around 330 million individuals in China are affected by various cardiovascular conditions.

Type Insights

Low Molecular Weight Heparin (LMWH) segment accounted for the largest revenue share of 63.7% in 2023. LMWH is an anticoagulant that is administered intravenously or subcutaneously and is majorly used in the treatment of prophylaxis of venous thromboembolic disease, deep vein thrombosis, and pulmonary embolism. Some examples of LMWH are enoxaparin and dalteparin. According to the NCBI article published in October 2023, a substantial proportion of patients (77%) received prophylaxis with LMWH, and the findings of the study indicate that LMWH was associated with a significantly lower rate of venous thromboembolism compared to unfractionated heparin. This highlights the distinctive role of LMWH in reducing the risk of venous thromboembolism in individuals undergoing such medical procedures.

Ultra-low Molecular Weight Heparin (ULMWH) segment is anticipated to witness the fastest CAGR from 2024 to 2030. ULMWH has a molecular weight of 2,000 to 3,000 daltons and is synthesized by unfractionated porcine mucosal heparin’s partial depolymerization. ULMWH binds to and activates antithrombin III, inactivating factors Xa and IIa (thrombin). Semuloparin (AVE5026) is a ULMWH having oligomeric heparin molecules, which can have potential applications in the prevention of venous thromboembolism in patients undergoing chemotherapy for cancer. ULMWHs, such as fondaparinux by Aspen, are also becoming common. However, some of the adverse effects are bleeding, allergic reactions, and heparin-induced thrombocytopenia. These aspects are boosting market expansion.

Route of Administration Insights

Subcutaneous administration of heparin accounted for the largest revenue share of 65.4% in 2023. The major advantage of subcutaneous injections is that they can be easily administered at home with little knowledge and expertise, making it a cost-effective alternative. According to NCBI article published in August 2023, the elevated bioavailability of Enoxaparin, with 90% of the drug being accessible through subcutaneous administration, stands as a significant growth driver for the subcutaneous segment. This advantage positions Enoxaparin as a favorable choice over traditional heparin, emphasizing the efficient and potent delivery achieved through the subcutaneous route.

Intravenous (IV) administration segment is estimated to register a significant CAGR from 2024 to 2030. It involves direct injection into the bloodstream, making it a pivotal delivery route, especially in critical medical situations. According to an NCBI article published in July 2023, rapid onset of action makes it the preferred choice during emergencies, surgeries, or acute conditions, where an immediate and potent anticoagulant effect is essential. Healthcare professionals often opt for IV administration to ensure quick and precise control over the coagulation process.

End-use Insights

The outpatient segment accounted for the largest revenue share of 61.1% in 2023. Outpatients hold a distinct advantage over other healthcare options, primarily driven by the significant reduction in hospital-related expenses, including admission costs and other hospitality-related charges. The prominent share of this segment is attributed to cost-effectiveness, enhanced service availability, and the convenience heparin offers to patients. The emphasis on low costs and increased accessibility contributes to the dominance of this segment, reflecting a healthcare trend prioritizing economic efficiency and patient convenience.

Inpatient segment is estimated to register a significant CAGR from 2024 to 2030, due to advancements in wound healing equipment, leading to quicker patient recovery times. Effective insurance and reimbursement policies play a pivotal role in increasing hospital visits, contributing to the potential expansion of the Inpatient segment. This aligns with the healthcare landscape's focus on improved treatment outcomes and financial support, reinforcing the positive trajectory for inpatient services. These aspects are expected to boost the demand for heparin.

Source Insights

The porcine segment accounted for the largest revenue share of 90.0% in 2023. This can be attributed to porcine’s wide usage in heparin production, especially LMWH, such as enoxaparin. Porcine heparin (180-220 units/mg) also has a higher anticoagulant activity when compared to bovine (130-150 units/mg), owing to its strong pharmacological and biochemical effects. Porcine heparins are 30%-50% more potent than bovine heparins. Furthermore, porcine heparin is easier to neutralize in adverse situations.

Bovine heparins, derived from the intestinal mucosa of cows, are the segment estimated to register the fastest CAGR over the forecast period. Bovine heparin has lower efficacy compared to porcine and attains only 76% of the maximum plasma concentration. When expressed in weight, bovine heparin attains 1.5-fold higher plasma concentration than porcine heparin and it does not increase its anticoagulant capacity.

Key Companies & Market Share Insights

-

Pfizer Inc.; LEO Pharma A/S; and Sanofi are some of the dominant market players.

-

Pfizer, Inc. is a pharmaceutical company based in the U.S. and founded in 1849. It manufactures products for curing a wide range of medical disciplines, including diabetes, immunology, cardiology, oncology, dermatological diseases, rare diseases, inflammatory diseases, oncology, and vaccines.

-

Sanofi was incorporated in 1994 and is headquartered in France. It engages in R&D, manufacturing g, and marketing of therapeutic solutions, comprising diabetes, human vaccines, innovative drugs, consumer healthcare, CVD, internal medicine, immunology, neurology, thrombosis, oncology, arthritis, central nervous system, osteoporosis, primary healthcare, vaccines, animal health, and Genzyme.

-

B. Braun Medical, Inc.; Sandoz (Novartis AG); and Aspen Holdings are some of the emerging market players

-

Novartis AG is a Swiss-based multinational company involved in R&D, manufacturing, and marketing of healthcare products. The company was formed following the merger of Sandoz Laboratories, Inc. and Ciba-Geigy AG. It is a publicly held organization and operates through two segments: Innovative Medicines and Sandoz.

- B. Braun Medical, Inc. is involved in developing, manufacturing, and marketing innovative medical products & services. The company was established in 1839 and is headquartered in Germany.

Key Heparin Companies:

- Pfizer Inc.

- LEO Pharma A/S

- Dr. Reddy’s Laboratories, Ltd.

- GlaxoSmithKline plc

- Sanofi

- Aspen Holdings

- Fresenius SE & Co., KGaA

- B. Braun Medical, Inc.

- Sandoz (Novartis AG)

Recent Developments

-

In June 2023, Techdow USA Inc., part of the Hepalink Group, launched Enoxaparin Sodium (Enoxaparin). This crucial product, available in seven popular pre-filled syringe formats, addresses the critical need for outpatient treatment and prevention of harmful blood clots.

-

In July 2023, Endo International's Par Sterile Products business commenced the shipment of bivalirudin injection in a convenient ready-to-use 250 mg/50 mL single-use vial. This product stands out as the sole liquid format of bivalirudin available in the U.S.

-

In August 2023, The FDA has approved Delcath Systems, Inc.'s HEPZATO KIT for treating adult patients with metastatic uveal melanoma and unresectable hepatic metastases.

-

In November 2023, the FDA has approved CorMedix's antimicrobial drug to reduce catheter-related bloodstream infections in kidney disease patients, marking the company's first commercial product launch.

Heparin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.72 billion

Revenue forecast in 2030

USD 9.03 billion

Growth rate

CAGR of 2.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, route of administration, application, end-use, source, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Pfizer Inc.; LEO Pharma A/S; Dr. Reddy’s Laboratories Ltd.; GlaxoSmithKline plc; Sanofi; Aspen Holdings; Fresenius SE & Co. KGaA; B. Braun Medical, Inc.; Sandoz (Novartis AG)

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heparin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global heparin market reportbased on type, route of administration, application, end-use, source, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Molecular Weight Heparin

-

Ultra-low Molecular Weight Heparin

-

Unfractionated Heparin

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Subcutaneous

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030

-

Venous Thromboembolism

-

Atrial Fibrillation

-

Renal Impairment

-

Coronary Artery Disease

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Outpatient

-

Inpatient

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Porcine

-

Bovine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global heparin market size was estimated at USD 7.56 billion in 2023 and is expected to reach USD 7.72 billion in 2024.

b. The global heparin market is expected to grow at a compound annual growth rate of 2.7% from 2024 to 2030 to reach USD 9.03 billion by 2030.

b. North America dominated the heparin market with a share of 38.69% in 2023. This is attributable to rising patient awareness, high disease burden, proactive government measures, technological advancements, and improvements in healthcare infrastructure. The presence of key players in this region is a key propeller of market growth.

b. Some key players operating in the heparin market include Pfizer Inc., LEO Pharma A/S, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc, Sanofi, Aspen Holdings, Fresenius SE & Co. KGaA, B. Braun Medical, Inc., Sandoz (Novartis AG).

b. Key factors that are driving the heparin market growth include the increasing prevalence of chronic diseases, growing demand for whole blood and blood components transfusion, increasing geriatric population, and increasing usage of plasma in the pharmaceutical industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.