- Home

- »

- Advanced Interior Materials

- »

-

High Strength Aluminum Alloys Market Report, 2020-2027GVR Report cover

![High Strength Aluminum Alloys Market Size, Share & Trends Report]()

High Strength Aluminum Alloys Market Size, Share & Trends Analysis Report By Application (Aerospace, Automotive, Railway & Marine, Defense & Space), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-544-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The global high strength aluminum alloys market size was valued at USD 31.15 billion in 2019 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.5% from 2020 to 2027. The growth of the market can be attributed to increasing demand for high strength aluminum alloys from the aerospace industry on account of their properties preferred by aircraft system designers. Usage of aluminum alloys in the aerospace industry has been prominent for the past many years, considering factors such as reliability, reasonably isotropic, low cost compared to more exotic materials, high strength, corrosion resistance, and lightweight.

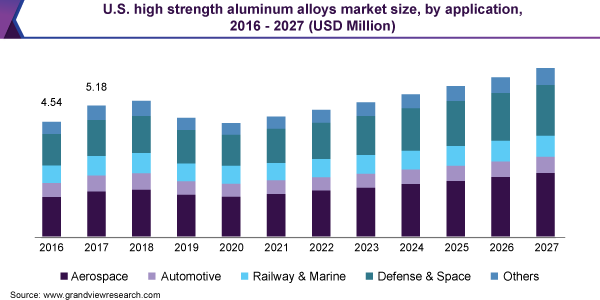

U.S. has been a key market on account of growing emphasis on the development of the manufacturing sector, which is augmenting the demand for high strength aluminum alloys in the end-use industries. According to the Bureau of Statistics, the output of the U.S. aerospace parts and products manufacturing industry is expected to grow at 2.7% from 2018 - 2028.

The growth of the global market has been affected as of 2020 on account of the outbreak of the COVID-19 virus, which has impacted and is expected to impact the aluminum industry’s demand-supply chain in terms of manufacturing, logistics, and prices. For instance, as of March 2020, Italy was the most impacted country in the world owing to which traders faced logistic issues. Issues such as drivers refused to operate during the quarantine days that trapped supplies in a place, thus unable to reach the end customers. Such instances resulted in a price increase for some aluminum alloys.

Despite this crisis, the industry is expected to uphold on account of demand for high strength aluminum alloys from end-use industries, especially automotive. The chances of rapid mitigation of the pandemic worldwide are expected to resume the supply chain of aluminum and demand is expected to turn out to be positive at the end of the forecast period. Increasing content of aluminum in vehicle manufacturing is a positive sign for the global market.

Application Insights

Aerospace was the largest application segment in 2019 with a revenue share of 30.8%. Usage of high strength aluminum alloys in the industry from small gears to large aircraft structures, along with increasing investment by aircraft manufacturers, is expected to propel segment growth.

Automotive is amongst the fastest growing application segments of the market and is expected to register a volume-based CAGR of 2.4% during the forecast period. As of 2019, the average aluminum content per vehicle was 179 kilograms, which is expected to increase further. Considering the increasing usage of aluminum in cars, coupled with growth in the automotive industry, the aluminum content in the automotive industry is expected to grow by around 40% from 2019 to 2027.

Reliability on aluminum by auto manufacturers has led the companies to further innovate and develop new alloys. For instance, in February 2020, Tesla developed a set of new aluminum alloys and submitted a patent application for it. The new alloys are for die casting of car parts and are expected to have high yield strength, high thermal conductivity, and high extrusion speed.

The market for high strength aluminum alloys is expected to witness a decline during 2020-21 on account of the COVID-19 pandemic in the world. The virus, which has been reported to have originated from Wuhan, China, has caused disruption in the supply chain, as China holds a significant position in the world for various markets, especially in terms of manufacturing.

For instance, the automotive industry relies on China for the production of several parts and systems, which has led to the temporary shutting down of many auto plants. Due to lack of parts availability, carmakers such as Hyundai, Kia, Ssangyong, and Nissan have temporarily halted their production, as of February 2020.

Major players of the automotive industry and various other end-use industries have shut down their plants amidst this crisis. For example, on March 18, 2020, companies including GM, Ford, FCA, Honda Motor Co., and Toyota Motor Corp have announced a temporary shutdown of their manufacturing plants.

Regional Insights

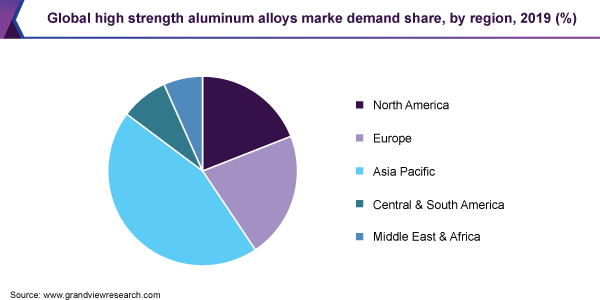

Asia Pacific held the largest revenue share of 43.6% as of 2019 and is expected to maintain its lead over the forecast period. Usage of high strength aluminum alloys in the automotive, railways, and defense is expected to propel the product demand over the forecast period. High strength aluminum alloys are extensively used in high-speed trains due to characteristics including lightweight, ease in assembly of parts, and high corrosion resistance.

Upcoming rail projects in the region are expected to positively influence the demand for high strength aluminum alloys over the forecast period. For example, in March 2020, Hyundai Rotem won the contract of supplying 15 trainsets by 2024 from SG Rail and a joint venture of John Holland and McConnell Dowell South East Asia won a contract of designing and building three stations on the Pandan Reservoir branch, Singapore by the Land Transport Authority.

Railways, automotive, and aerospace constitute a large share in the market, which indicates that logistics and transport have a major impact on the industry. The coronavirus outbreak, which led to lockdown in the majority of the countries, is responsible for the decreased demand for transport facilities. For example, the suspension of railway operations for passengers until April 14, 2020, by the Indian Ministry of Railways.

The pandemic caused disruption to all modes of transport, but railways is expected to be a reliable transport alternative in the crisis. For example, on March 20, 2020, Nippon Express Co. launched a rail service, in collaboration with Sinotrans from Shanghai to Wuhan for supplying the basic necessities, such as masks, food products, and other relief related items. Such initiatives are expected for railways to be the least affected transport system during the pandemic, which indicates growth in the sector, thus positively influencing the global market growth.

As of 2019, Europe was the second largest regional market for high strength aluminum alloys, which is however, expected to have a major blow on its aluminum industry in 2020-21 on account of the tariff barriers by U.S., in addition to the COVID-19 pandemic. The U.S. anti-dumping investigation by the International Trade Commission that began on March 9, 2020, followed by a petition by 5 aluminum producers, is expected to be a major concern for the European markets. As of March 25, 2020, the investigation into common aluminum alloy sheets from Croatia, Serbia, Slovenia, Spain, Germany, Greece, Italy, Romania, and Turkey has led the European aluminum industry to cause worry over the chance of additional trade barriers between the region and U.S.

North America is expected to register the highest CAGR, in terms of revenue, over the forecast period. The growth is attributed to the U.S., which is amongst the major countries in the world with high demand for high strength aluminum alloys. The country accounted for a volume share of around 74% in 2019. Increasing investment by the end-use industries in terms of expanding their manufacturing footprint in the country has been a key driver for high strength aluminum alloys to expand in North America.

For instance, in January 2020, Airbus, a major aircraft manufacturer, announced its plan to increase the production of its A320 family aircraft at the Mobile, Alabama facility to seven aircraft per month by 2021. The company made an additional investment of USD 40 million for constructing a support hanger at the site, which led the overall investment to reach USD 1 billion.

Key Companies & Market Share Insights

The companies included in the value chain of the market have and are expected to adopt strategies, such as capacity expansion, new product development, and acquisitions, in order to sustain and gain a larger share in the market for high strength aluminum alloys. For instance, in 2018, the National Aluminium Company had plans to set up a high-end aluminum product plant in India with an aim to cater to the growing end-use applications, including bullet trains, aerospace, and electric vehicles. In August 2019, the company informed about forming a joint venture with Mishra Dhatu Nigam for production of aluminum alloy plates and sheets.

Moreover, in August 2019, Novelis launched Advanz 6HS-s650, a high strength aluminum automotive product, for next generation body design. It is expected to be the strongest in the 6xxx series, along with 15-20% in-service strength. Some of the prominent players in the high strength aluminum alloys market include:

-

Advanced Materials Technology

-

Alemix

-

Aleris Corporation

-

Alcoa Corporation

-

Hindalco Industries Ltd.

-

Kobe Steel, Ltd.

-

NALCO

-

Norsk Hydro ASA

-

Precision Armament

-

Rio Tinto

High Strength Aluminum Alloys Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 29.9 billion

Revenue forecast in 2027

USD 41.06 billion

Growth Rate

CAGR of 3.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

Advanced Materials Technology; Alemix; Aleris Corporation; Alcoa Corporation; Hindalco Industries Ltd.; Kobe Steel, Ltd.; NALCO; Norsk Hydro ASA; Precision Armament; Rio Tinto

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels, and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global high strength aluminum alloys market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Aerospace

-

Automotive

-

Railway & Marine

-

Defense & Space

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global high strength aluminum alloys market size was estimated at USD 31.1 billion in 2019 and is expected to reach USD 29.9 billion in 2020.

b. The global high strength aluminum alloys market is expected to grow at a compound annual growth rate of 3.5% from 2019 to 2027 to reach USD 41.0 billion by 2027.

b. Aerospace dominated the high strength aluminum alloys market with a share of 30.8% in 2019. This is attributable to the usage of high strength aluminum alloys in the industry from small gears to large aircraft structures along with increasing investment by aircraft manufacturers.

b. Some key players operating in the high strength aluminum alloys market include Advanced Materials Technology, alemix Aleris Corporation, Alcoa Corporation, Hindalco Industries Ltd., Kobe Steel, Ltd., NALCO, Norsk Hydro ASA, Precision Armament, Rio Tinto.

b. Key factors that are driving the market growth include increasing product demand from the aerospace industry on account of properties preferred by aircraft system designers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."