- Home

- »

- Biotechnology

- »

-

Hollow Fiber Filtration Market Size And Share Report, 2030GVR Report cover

![Hollow Fiber Filtration Market Size, Share & Trends Report]()

Hollow Fiber Filtration Market Size, Share & Trends Analysis Report By Membrane Material (Polysulfone, Polyethersulfone), By Technology (Microfiltration, Ultrafiltration), By Process, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-009-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hollow Fiber Filtration Market Size & Trends

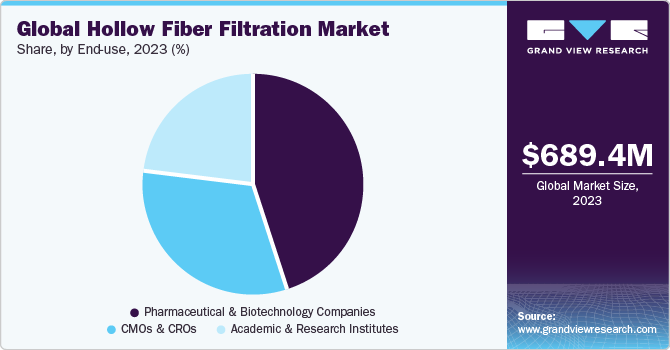

The global hollow fiber filtration market size was estimated to be USD 689.4 million in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 14.4% from 2024 to 2030. The global market for hollow fiber filtration (HFF) is being driven by several factors, including a rising inclination towards continuous manufacturing, expanded utilization of single-use techniques, and growing spending on cell-based technology. Furthermore, the growing adoption of hollow fiber filters to remove contaminants such as fungi, viruses, and bacteria also drives market growth. As per reports, the COVID-19 pandemic has had a positive effect on the market for hollow fiber filters.

A mix of well-known biopharmaceutical and pharmaceutical companies, as well as hollow fiber filtration industry participants, have stepped forward to contribute to global research efforts by supplying hollow fiber filtration for manufacturing treatment and vaccines that target COVID-19 infection. For instance, in July 2021, Asahi Kasei Medical had chosen to expand capacity at its spinning plant in Oita, Japan, for hydrophilic polyvinylidene fluoride hollow-fiber membranes for Planova BioEX filters. Furthermore, worldwide COVID-19 disease has increased the critical need for the manufacturing of Planova filters as well as the mass production of anti-coronavirus agents. In addition, applications of hollow fiber opened up new possibilities for the introduction of innovative solutions for the prevention and detection of viral diseases such as the COVID-19 virus thereby boosting the industry’s growth.

Growing desire for continuous manufacturing, thriving biopharmaceutical sector, and increasing use of single-use technologies are a few factors that are expected to contribute to the growth of the market in coming years. Furthermore, developing countries, coupled with growing investment in cell-based research, are likely to present significant growth opportunities for market participants.

Manufacturers are benefiting from significant growth prospects in the global market as a result of growing demand for hollow fiber filters. The need for hollow fiber is rising in the healthcare sector and it is being more widely used in medical and healthcare settings. Furthermore, it is projected that the active involvement of prominent pharmaceutical companies in the production of cutting-edge hollow fiber-based filters will have an impact on the development of this industry.

Market Dynamics

Growing demand for innovations in bioprocess engineering has led to considerable developments in single-use systems. Advancements in this domain are also fueled by the high usage rate of biopharmaceuticals in recent times. Moreover, a rise in the number of studies conducted to evaluate the efficiency of single-use bioprocesses also has aided in increasing awareness regarding hollow fiber technologies. Single-use technologies provide various benefits, such as a lower cross-contamination risk, lesser turnaround times, and higher flexibility to alter production volumes.

Also, single-use filtration systems are witnessing a huge demand in large-scale purification processes on account of lower overall filtration costs. As traditional filtration systems are labor-intensive and need some cleaning and flushing steps before and after the process, the adoption of single-use filtration technologies is poised to expand through 2030. In the case of hollow fiber filters, leading players offer single-use hollow fiber tangential flow filtration modules in a ready-to-use, humectant-free, gamma-irradiated format, which can save time and lead to minimal facility footprint. Hence, as more pharmaceutical and biotech companies adopt single-use technologies, the demand for hollow fiber filtration is expected to increase.

Membrane Material Insights

The polyethersulfone (PES) segment dominated the market with a revenue share of 35.7% in 2023 and is projected to exhibit the fastest CAGR during the assessment period. The growing market for high-performance engineering plastics in industries such as construction, aviation, and automotive is expected to drive global demand for PES during the projected timeline.

PES’ increasing use in the dental and medical sectors is expected to drive demand even further. Superior properties such as high thermal resistance & chemical resistance over polyamides as well as polycarbonates are estimated to drive growth in PES consumption.

Process Insights

The reusable hollow fiber membranes segment dominated the market with a share of 53.5% in 2023. This is attributed to factors such as high filtration accuracy, low investment and operating cost, easy to maintain, repairable, and others propelling segmental growth.

The surge in bioprocess engineering innovations has spurred the development of single-use systems, driven by the high consumption of biopharmaceuticals and studies assessing the efficiency of single-use bioprocesses. Single-use technologies, including filtration systems, are increasingly adopted due to benefits such as reduced cross-contamination risk, shorter turnaround times, and flexibility in adjusting production volumes. Single-use hollow fiber membranes exhibit the fastest CAGR over the projected period, owing to their extensive use in ultrafiltration & microfiltration applications and a genuine ready-to-use separation solution. They are humectant-free, fully integrity-tested, and gamma-irradiated when delivered. They save time and money because no cleaning is required.

Technology Insights

The microfiltration segment held the largest revenue share of 52.4% in 2023. Microfiltration is a low-pressure technique for separating high-molecular-weight compounds from dissolved solids. Most bacteria & suspended solids are separated by this process; however, viruses and multivalent ions are not separated. In addition, microfiltration fibers are typically classified by pore size, rejecting particles ranging from 0.1 to 0.7 microns, therefore the demand for microfiltration is more, which further boosts the segment growth.

On the other hand, the ultrafiltration segment is projected to grow at the fastest CAGR over the forecast period. Due to its cost-effectiveness, the market is also influenced by growing demands for ultrapure water technologies and systems in the healthcare sector. The membranes are also suitable for a variety of applications, including municipal and industrial treatment. Thus, it will increase the demand for ultrafilters and further fuel the market growth.

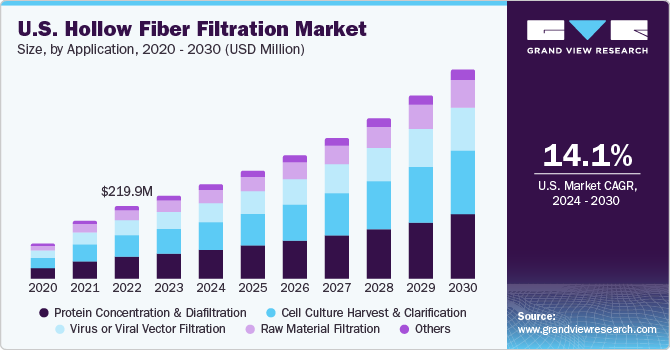

Application Insights

The protein concentration and diafiltration segment held the largest revenue share of 30.1% in 2023. A major driver for market growth is the use of this method in purifying and separating a variety of biomolecules, including nucleic acids, antibodies, and recombinant proteins. This approach is very popular as it can be used in various biological domains, including protein chemistry, biochemistry, molecular biology, and immunology. As a result, a majority of the key players are involved in this application segment. For instance, in November 2021, Toray Industries, Inc. announced the development of an extremely durable hollow fiber ultrafiltration membrane module enabling biotechnology purification & concentration operations and the availability of samples to clients.

On the other hand, the cell culture harvest segment is expected to grow at the fastest CAGR over the forecast period. Increased spending and research in regenerative medicine & therapies have increased market requirements for cell harvesting. The increase in the number of infectious diseases documented worldwide has supported the market's progress. For instance, as per the CDC, 7.2 million people visit physician’s offices due to infectious disease.

End-use Insights

The pharmaceutical and biotechnology companies segment held the largest share of 44.5% in 2023. The increasing adoption of hollow fiber filters in diafiltration, ultrafiltration, and microfiltration procedures in biopharmaceutical manufacturing, as well as the rising usage of continuous manufacturing processes owing to advantages like process efficiency & flexibility, have contributed to the larger share of this segment.

Technological advancements in the pharmaceutical and biotechnology sectors, as well as the rapid growth of the biopharmaceutical sector globally, are expected to contribute to the segment's revenue growth over the forecast period. The growing use of hollow membrane filtration and continuous production technologies has increased processing plant efficiency while decreasing overall procedure time. It is furthermore anticipated to support the segment's revenue growth over the forecast period.

Regional Insights

North America dominated the regional market with a revenue share of 39.4% in 2023. During the projected period, the region is expected to retain its leadership. This expansion can be attributed to the existence of growing alliances between pharmaceutical & biotechnology companies. Furthermore, the region's significant participation in the industrial sector is due to support from governmental bodies combined with increased R&D expenditures.

Moreover, rapid advancement of technology such as perfusion systems & growing demand for biologics due to the increasing chronic disease prevalence. Likewise, the rising adoption of hollow fiber techniques and the strong presence of major market players are projected to drive revenue growth in the region.

In the near future, the Asia Pacific regional market is expected to advance exponentially. Frequent developments in the pharmaceutical and biotechnology sectors, a rising prevalence of chronic diseases, ongoing improvements in the healthcare & R&D infrastructure, and growing economic assistance from regional governments are all aiding industry growth. Furthermore, an upsurge in CRO penetration and increased outsourcing from key global regions are anticipated to drive revenue growth and market expansion in the region.

Key Companies & Market Share Insights

Key players in this market are implementing various strategies including partnerships through mergers and acquisitions, geographical expansion, and strategic collaborations to expand their market presence. For instance, in July 2023, Sartorius opened a novel manufacturing plant for cell culture media in Puerto Rico. The expansion is anticipated to strengthen the company’s portfolio in the American region. Similarly, in October 2022, Asahi Kasei Bioprocess America, under Japan-based company Asahi Kasei, announced its expansion in Glenview, Illinois and it is anticipated to drive market growth, mainly including hollow fiber membrane, virus filtration, and various other innovative equipment. Thus, these strategic initiatives by various other organizations are projected to propel the growth of the segment over the forecast period.

Key Hollow Fiber Filtration Companies:

- Sartorius AG

- Repligen Corporation

- Danaher Corporation

- Merck KGaA

- Asahi Kasei Corporation

- PARKER HANNIFIN CORP.

- Cole Parmer

- Sterlitech Corporation

- Synder Filtration, Inc.

- Meissner Filtration Products, Inc.

Hollow Fiber Filtration Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 783.9 million

Revenue forecast in 2030

USD 1.76 billion

Growth rate

CAGR of 14.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Membrane material, process, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sartorius AG; Repligen Corporation; Danaher Corporation; Merck KGaA; Asahi Kasei Corporation; PARKER HANNIFIN CORP.; Cole Parmer; Sterlitech Corporation; Synder Filtration Inc.; Meissner Filtration Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hollow Fiber Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global hollow fiber filtration market report based on membrane material, process, technology, application, end-use, and region:

-

Membrane Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polysulfone (PS)

-

Mixed Cellulose Ester

-

Polyvinylidene Difluoride (PVDF)

-

Polyethersulfone (PES)

-

Others

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-use Hollow Fiber Membranes

-

Reusable Hollow Fiber Membranes

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Microfiltration

-

Ultrafiltration

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Virus or Viral Vector Filtration

-

Protein Concentration & Diafiltration

-

Cell Culture Harvest & Clarification

-

Raw Material Filtration

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hollow fiber filtration market size was estimated at USD 689.4 million in 2023 and is expected to reach USD 783.9 million in 2024.

b. The global hollow fiber filtration market is expected to grow at a compound annual growth rate of 14.4% from 2024 to 2030 to reach USD 1.76 billion by 2030.

b. North America dominated the hollow fiber filtration market with a share of 39.39% in 2023. This is mostly attributed to the occurrence of significant market participants, as well as rising R&D spending and federal assistance.

b. Some key players operating in the hollow fiber filtration market include Sartorius AG, Repligen Corporation, Danaher Corporation, Merck KGaA, Asahi Kasei Corporation, PARKER HANNIFIN CORP., Cole Parmer, Sterlitech Corporation, and others

b. The rising demand for bioprocessing products, the availability of skilled professionals, and expanding growth opportunities in the biopharma sector are among the key factors expected to propel market revenue growth during the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."