- Home

- »

- Medical Devices

- »

-

Home Blood Pressure Monitoring Devices Market Report 2030GVR Report cover

![Home Blood Pressure Monitoring Devices Market Size, Share & Trends Report]()

Home Blood Pressure Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Sphygmomanometers, Digital BP Monitor, Ambulatory BP Monitors), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-206-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global home blood pressure monitoring devices market size was estimated at USD 1.25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.62% from 2024 to 2030. This can be attributed to the easy usage and probability of devices and the need to reduce healthcare expenditure, increasing the demand for home-based monitoring devices. Moreover, research has demonstrated that home blood pressure monitoring can enhance medication adherence, patient involvement and lower healthcare expenses. According to the estimates published by the United Nations in 2020, the number of individuals aged above 65 globally will be twice the number of children under five and almost equivalent to the number of children under 12 years by 2050.

In the U.S., nearly half of the population-a staggering 48.1%-suffer from hypertension, as per the National Center for Health Statistics. While the incidence of hypertension has decreased in some high-income countries, the National Library of Medicine reported the prevalence of the condition in low- and middle-income countries to be just over 31% in 2020. The increasing demographic prevalence of hypertension is a key factor driving market growth.

Furthermore, blood pressure monitoring devices in homecare settings rose during the COVID-19 pandemic due to the incidence of comorbidities and the remote applicability of these products. According to the American Medical Association, the necessity of self-measuring blood pressure (SMBP) increased due to disruptions in conventional healthcare settings caused by lockdowns and social distancing guidelines. Despite an overall upsurge in SMBP devices, some surveys pointed to a decline in manual, automated, and pharmacy BP measurements. The shift towards remote monitoring methods like SMBPs represents an attempt to control COVID-19 spread while maintaining effective hypertension management.

The improvement in devices for measuring blood pressure, such as digital sphygmomanometer, contributes to market growth. In addition, the rising adoption of digital sphygmomanometer technology for the measurement of blood pressure is expected to fuel growth. Portable or remote blood pressure measuring devices are drawing focus due to their associated benefits, such as wireless transmission of patient information and large data storage space for patient management.

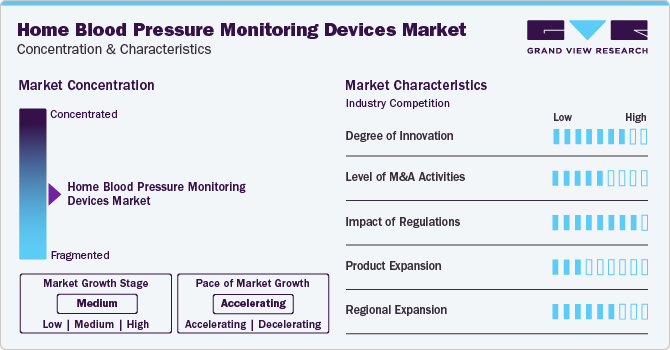

Market Concentration & Characteristics

The market growth is moderate and pace of market growth is accelerating. The market is moderately competitive, and key players contribute to this competitive landscape with strategic initiatives, product development, research and development, and regional expansion to propel market growth.

The home blood pressure monitoring devices market is characterized by a high degree of innovation owing to the rising technological developments in the field and increasing prevalence of oral conditions. Manufacturers are focused on developing cost-effective, innovative, and easy-to-use products. Moreover, advanced technologies such as mHealth, which support treatment and medication compliance in patients for chronic disease management, are expected to fuel market growth.

The market is characterized by a moderate-to-high degree of merger and acquisition activity. Notably, some firms may form alliances with established local distributors to leverage existing sales channels and customer bases, thus expediting market entry and reducing operational expenses. This approach allows them to capitalize on the growing demand for home blood pressure monitoring devices. For instance, in February 2021, Hillrom announced that it acquired the contact-free continuous monitoring technology from EarlySense for USD 30 million. This acquisition will help the company develop next-gen AI-based sensing technologies, specifically for the remote patient care market.

The regulatory framework for home blood pressure monitoring devices varies across different regions and jurisdictions. Global regulatory bodies are amending and adding regulations to aid the proper implementation of medical devices in homecare systems, aiding market growth. Furthermore, in 2021, the EU granted approval to a wrist-worn cuff less BP monitoring system developed by Aktiia SA. Such patent grants and approvals are indicative of a supportive regulatory environment, which is likely to boost production and market entry of novel as well as innovative products in the region.

Collaborations and the competitive environment across the market have led to product innovations by several prominent players. For instance, in May 2021, Biobeat announced the launch of its continuous Ambulatory Blood Pressure Monitoring (ABPM) chest-monitoring device.

The market is experiencing considerable regional expansion, with significant growth in various parts of the world. Growth in certain regions may be higher due to the higher preference for self-measurement and higher prevalence of diseases.

Product Insights

Aneroid blood pressure monitors led the market with a revenue share of 36.48%, owing to their higher durability and widespread usage. Furthermore, their lower cost in comparison aids home-based monitoring settings by a larger margin. For geriatric patients or patients with chronic illnesses, having a home blood pressure monitoring system is essential due to their regular usage. Aneroid sphygmomanometers require lesser maintenance, and are thus favored.

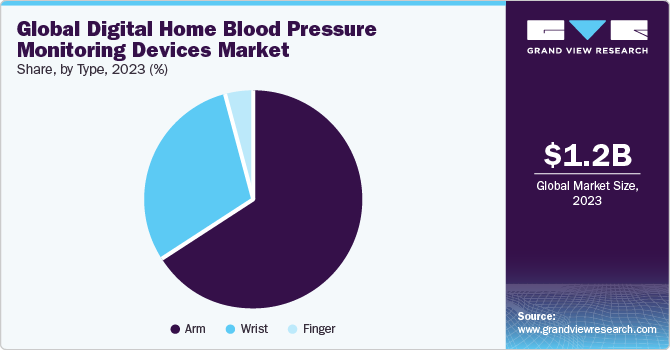

Digital home blood pressure monitoring devices are expected to register the fastest CAGR over the forecast period. The rising demand for digital monitors can be attributed to the growing awareness among patients about cardiovascular disease, hypertension, and blood pressure monitoring devices, as well as the increasing prevalence of hypertension worldwide. Furthermore, the market is driven by continuous technological advancements, such as improvements in wearable technology, apps, and mobile devices in the consumer healthcare segment, as well as a decrease in the average selling price for retailers and manufacturers, and an increase in penetration in the professional market. Some examples of technologically advanced digital blood pressure monitors available in the market include Microlife WatchBP home A, QardioArm, and iHealth blood pressure monitors from Omron.

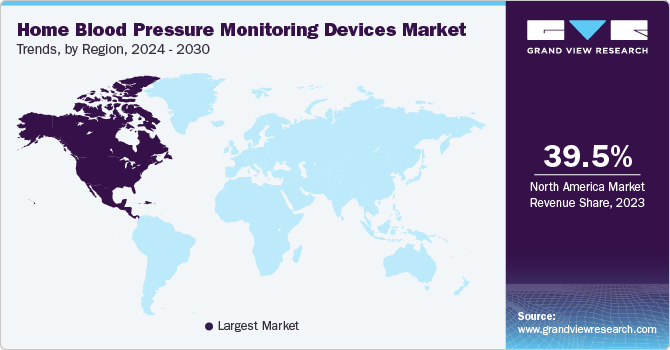

Regional Insights

North America dominated the market and accounted for a share of 39.56% in 2023. Growth in the region is driven by a high disease prevalence, rising consumer awareness, proactive government measures, technological advancements, and improvements in healthcare infrastructure.

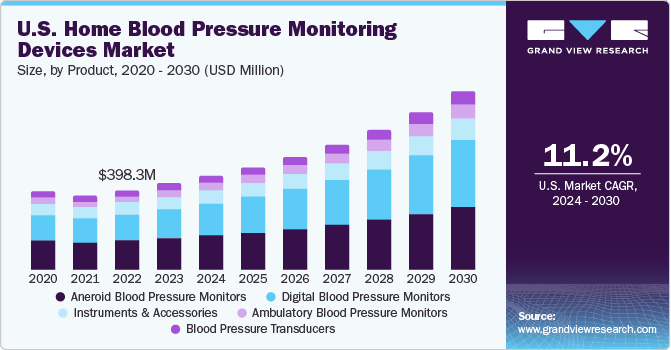

U.S. Home Blood Pressure Monitoring Devices Market Trends

In 2023, the U.S. home blood pressure monitoring devices market dominated the North American region with approximately 87% revenue share. The country is at the forefront of technological developments, specifically in healthcare. Hence, the continuous advancements noted in medical devices, particularly in blood pressure monitoring systems, nurtures innovation and adoption of new technologies.

Europe Home Blood Pressure Monitoring Devices Market Trends

The home blood pressure monitoring devices market in Europe was the second-largest regional market in 2023. The imminent implementation of In-vitro Diagnostics Regulation (IVDR) and new Medical Device Regulation (MDR) in the European Union is anticipated to change the medical devices regulatory scenario drastically and encourage the incorporation of advanced technologies in medical devices.

The UK home blood pressure monitoring devices market is estimated to grow at a significant CAGR from 2024 to 2030. This can be attributed to growing population and increasing number of people suffering from several chronic disorders. Moreover, rising number of hypertension patients in this region is expected to boost the market growth. Furthermore, high BP is estimated to cost the government annually. The high cost and increasing prevalence of high BP are anticipated to fuel market growth. Moreover, hypertension is one of the main causes of stroke, with nearly 55% of stroke patients having high BP. In January 2021, Omron Healthcare supported the national campaign led by The Stroke Association, UK, to increase awareness related to stroke and its causes.

The home blood pressure monitoring devices market in Germany is anticipated to register the faster growth in the Europe market over the forecast period, registering a staggering 13.04% CAGR. Ongoing advancements in technology, coupled with improving healthcare infrastructure, drive the market growth significantly. Germany is the largest market for medical devices in Europe. Furthermore, the nation’s strong foundation in holistic healthcare, encompassing conventional medicine and complementary therapies, fosters a culture where individuals are encouraged to monitor their blood pressure as a vital component of a comprehensive approach to promote overall health and well-being.

The Russia home blood pressure monitoring devices market occupied a significant 11.22% of the total market revenue in 2023. The high prevalence of hypertension, coupled with high mortality from strokes, is anticipated to aid segment growth. Russia has mandatory state health insurance program for all its residents. However, over the past few years, the public healthcare system has been facing several challenges that are anticipated to increase patient preference for home care over public health hospitals, boosting market demand for home-based BP monitors.

Asia Pacific Home Blood Pressure Monitoring Devices Market Trends

The home blood pressure monitoring devices in Asia Pacific is anticipated to witness lucrative growth from 2024 to 2030. Major factors boosting growth are favorable government initiatives supporting adoption of advanced medical devices, growing geriatric population, and increasing healthcare expenditure. The region is home to two countries leading world population metrics, with higher geriatric population and disease incidence. Thus, the region sees higher demand for blood pressure monitoring devices in homecare settings.

China home blood pressure monitoring devices market recorded the largest revenue share in Asia pacific in 2023, and is expected to grow at a lucrative CAGR over the forecast period. According to WHO, as of 2021, nearly 270 million Chinese individuals had hypertension, with around 13.8% of the patients having their condition under control, indicating need for constant monitoring and high growth potential for BP monitors in the country.

The home blood pressure monitoring devices market in Japan is expected to grow over the forecast period due to an increase in the ongoing research initiatives in the country for the development of novel technologies and products. In Japan, nearly 43 million individuals were estimated to suffer from hypertension, while around 14 million were unaware that they had hypertension, in 2020. These factors are anticipated to increase emphasis on hypertension awareness and favor market growth. Presence of market leaders, such as Omron healthcare and Nihon Kohden, in country is anticipated to drive market growth.

Latin America Home Blood Pressure Monitoring Devices Market Trends

The home blood pressure monitoring devices in Latin America is estimated to witness steady growth during the forecast period, owing to rising number of people living with chronic diseases and cardiac disorders. Furthermore, the proportion of aging population is growing in Latin America, due to increase in the average life expectancy and demographic changes. The aging population in Latin America is expected to reach 18.5% by 2050. This is expected to increase prevalence of age-associated diseases, driving demand for home BP monitoring devices.

Brazil home blood pressure monitoring devices market dominated the Latin America region and is expected to grow at a significant growth rate due to positive economic growth following financial and political stability in the country. Due to the growing presence of manufacturers within the country, cost for components has reduced, leading to in-house manufacturing of affordable and technologically updated devices. Wrist-worn products are predicted to hold majority share due to introduction of smart watches capable of monitoring multiple parameters. These factors are anticipated to fuel market growth.

Middle East & Africa Home Blood Pressure Monitoring Devices Market Trends

The home blood pressure monitoring devices market in Middle East & Africa is anticipated to witness a steady growth over the forecast period. The key driving forces include presence of supportive government initiatives, increasing health care expenditure, and growing awareness. Moreover, according to World Health Observatory report by the WHO, nine Middle Eastern countries have the highest obesity statistics ranking among adults aged 18 and above. Obesity is one of the risk factors for developing hypertension, and the high prevalence of obesity is, thus, anticipated to fuel market growth.

Saudi Arabia home blood pressure monitoring devices market is expected to grow at a lucrative rate due to high unmet clinical needs, rising disposable income, and an increasing number of collaborative agreements with international organizations, such as WHO & UN. In Saudi Arabia, the government initiatives and lifestyle-based disorders mainly drive demand for healthcare-related products. In 2019, approximately 35% of adults in the country were obese, while more than 6.5% of them had high blood pressure. These lifestyle disorders have, thereby, increased demand for diagnostic equipment, hospital beds, & rehabilitation equipment in the country

Key Home Blood Pressure Monitoring Devices Company Insights

The market is fragmented, with prominent players accounting for a significant percentage of the market. Some key players companies in the global home blood pressure monitoring devices market include GE Healthcare; A&D Medical Inc.; Omron Healthcare Inc.; and Philips Healthcare.

Global companies in the home blood pressure monitoring devices market are leveraging diverse strategic approaches to bolster their market position, including mergers, collaborations, product development, and expansion through local and international networks.

Key Home Blood Pressure Monitoring Devices Companies:

The following are the leading companies in the home blood pressure monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Omron Healthcare Welch Allyn, Inc.

- A&D Medical Inc.

- SunTech Medical, Inc.

- American Diagnostics Corporation

- Withings

- Briggs Healthcare

- GE Healthcare

- Kaz Inc.

- Microlife AG

- Rossmax International Ltd.

- GF Health Products Inc.

- Spacelabs Healthcare Inc.

- Philips Healthcare; B. Braun

Recent Developments

-

In January 2023, Biobeat received FDA clearance for their remote stroke volume and cardiac output monitoring devices. The company’s remote patient monitoring devices are the first-ever to receive FDA clearance for cuffless blood pressure monitoring from photoplethysmography (PPG) only.

-

In January 2022, Aktiaa announced a hypertension trial of the world’s first automated and 24/7 blood pressure monitor along with a U.S. hypertension center. Such initiatives are expected to help the market grow post-pandemic.

-

In June 2021, CardieX Limited, an Australian medical technology company, announced that its subsidiary, ATCOR, completed a world-first algorithm for a wearable optical sensor which is able to provide a unique range of cardiovascular health parameters based around ATCOR’s patented SphygmoCor technology.

Home Blood Pressure Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.36 billion

Revenue forecast in 2030

USD 2.63 billion

Growth rate

CAGR of 11.62% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Russia; Belgium; The Netherlands; Nordics; China; India; Japan; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Omron Healthcare Welch Allyn, Inc.; A&D Medical Inc.; SunTech Medical, Inc.; American Diagnostics Corporation; Withings; Briggs Healthcare; GE Healthcare; Kaz Inc.; Microlife AG; Rossmax International Ltd.; GF Health Products Inc.; Spacelabs Healthcare Inc.; Philips Healthcare; B. Braun

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Blood Pressure Monitoring Devices Market Report Segmentation

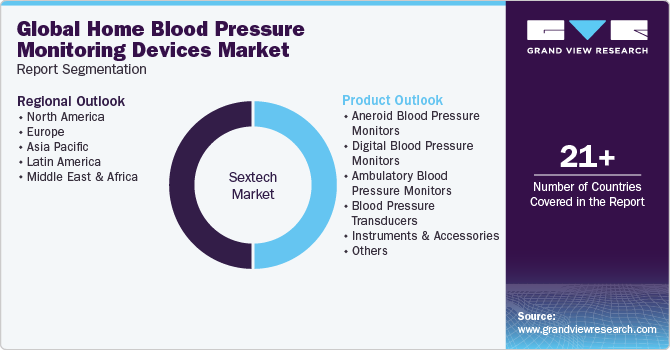

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global home blood pressure monitoring devices market report based on product and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Aneroid Blood Pressure Monitors

-

Digital Blood Pressure Monitors

-

Arm

-

Wrist

-

Finger

-

-

Ambulatory Blood Pressure Monitors

-

Blood Pressure Transducers

-

Disposable

-

Reusable

-

-

Instruments and Accessories

-

Blood Pressure Cuffs

-

Reusable

-

Disposable

-

-

-

Others (Bladders, Bulbs and Valves, Manometers)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Belgium

-

The Netherlands

-

Nordics

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

The Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global home blood pressure monitoring devices market size was estimated at USD 1.25 billion in 2023 and is expected to reach USD 1.36 billion in 2024.

b. The global home blood pressure monitoring devices market is expected to grow at a compound annual growth rate of 11.62% from 2024 to 2030 to reach USD 2.63 billion by 2030.

b. North America dominated the market and accounted for a share of 39.56% in 2023. Growth in the region is driven by a high disease prevalence, rising consumer awareness, proactive government measures, technological advancements, and improvements in healthcare infrastructure.

b. Some key players companies in the global home blood pressure monitoring devices market include GE Healthcare; A&D Medical Inc.; Omron Healthcare Inc.; and Philips Healthcare.

b. The improvement in devices for measuring blood pressure, such as digital sphygmomanometer, contributes to market growth. In addition, the rising adoption of digital sphygmomanometer technology for the measurement of blood pressure is expected to fuel growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."