- Home

- »

- Clinical Diagnostics

- »

-

Home Care Testing Market Size, Share, Industry Report 2030GVR Report cover

![Home Care Testing Market Size, Share & Trends Report]()

Home Care Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Age (Pediatric, Adult, Geriatric), By Sample, By Test Type (Infectious Disease Tests, Pregnancy Tests), By Distribution Channel, By Product, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-083-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Care Testing Market Summary

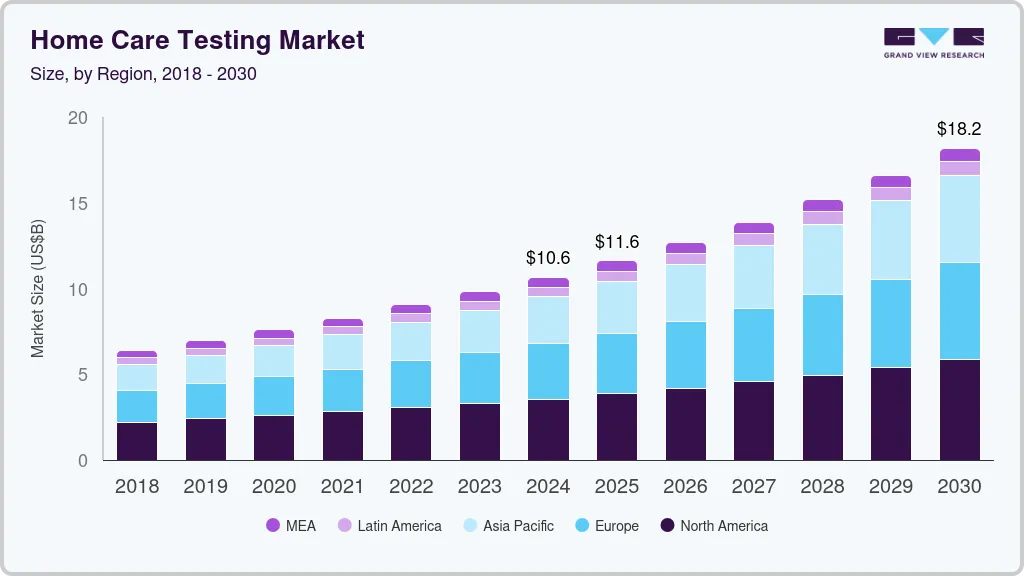

The global home care testing market size was estimated at USD 10.52 billion in 2024 and is projected to reach USD 17.95 billion by 2030, growing at a CAGR of 9.36% from 2025 to 2030. The market growth is driven by various factors such as the rising incidence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory diseases, growing demand for point-of-care testing, an aging population, and technological advancements.

Key Market Trends & Insights

- North America dominated the home care testing market with the largest revenue share of 33.71% in 2024.

- The home care testing market in the U.S. held a significant share of the North America market in 2024.

- Based on age, the geriatric segment led the market with the largest revenue share of 60.14% in 2024 and is expected to witness at the fastest CAGR over the forecast period.

- Based on sample, the urine sample segment led the market with the largest revenue share of 36.27% in 2024.

- Based on test type, the infectious disease test segment led the market with the largest revenue share of 40.69% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.52 Billion

- 2030 Projected Market Size: USD 17.95 Billion

- CAGR (2025-2030): 9.36%

- North America: Largest market in 2024

For instance, according to the United Nations data, the global geriatric population aged 65 years and above is expected to increase from around 10% of the total population in 2022 to around 16% in 2050. As the population ages, the demand for healthcare services is also expected to increase as older adults are more likely to have chronic conditions that require frequent monitoring, making home care testing devices a valuable tool for managing their health. The COVID-19 pandemic has also significantly contributed to the home care testing industry as patients seek to avoid exposure to virus by reducing their visits to healthcare facilities. The COVID-19 test from home also became increasingly popular. This trend has boosted the demand for home care testing such as rapid antigen tests, antibody tests, and PCR tests. The demand for home care testing devices has been further fueled by the need for regular testing among individuals who are at high risk of contracting the virus, such as healthcare workers and those who have been in close contact with the infected individuals.

Emerging innovations in home healthcare are seen as a potential solution to the gap between demand and supply. Testing, consultations with doctors, and high-quality patient care can now all be easily provided to patients at their home. These developments have made it possible for patients to manage their conditions more conveniently and efficiently. They no longer have to travel to healthcare facilities, which is particularly beneficial for those who live in rural or remote areas. The availability of home care testing and consultations with doctors has also increased access to healthcare services, which can potentially improve patient health outcomes.

One of the significant factors restraining the market growth is the lack of standardized regulatory frameworks across regions. While some countries have established clear guidelines for the approval, marketing, and use of home testing kits, others lack uniform regulations, creating challenges for manufacturers seeking to expand globally. In addition, concerns over the accuracy and reliability of certain home testing devices can lead to skepticism among consumers and healthcare professionals, further hindering adoption. These challenges are compounded by limited access to advanced diagnostic technologies in developing regions and the high initial costs associated with bringing innovative home testing solutions to market.

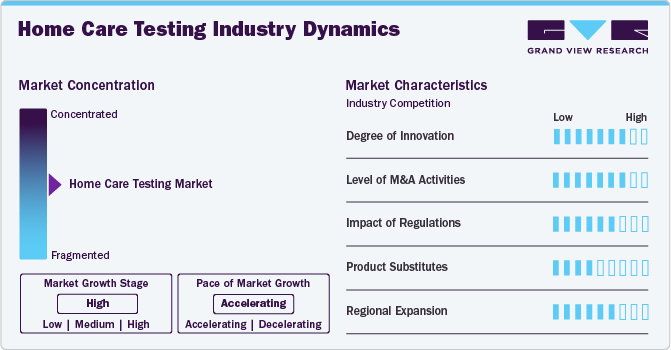

Market Concentration & Characteristics

The home care testing industry is characterized by a high degree of innovation, driven by technological advancements and a growing demand for convenient healthcare solutions. Innovations in the home care testing sector include the development of user-friendly diagnostic kits that allow patients to conduct tests independently from their homes. These advancements encompass various formats, such as rapid antigen tests, PCR tests, and self-monitoring devices that provide immediate results. For instance, in July 2021, Abbott announced the launch of the Panbio COVID-19 Antigen Self-Test in India, enabling rapid detection of the virus for adults and children. The self-test aims to enhance testing accessibility, allowing individuals to quickly identify infections and isolate accordingly. Results are available in 15 minutes, supporting public health efforts during the pandemic.

The home care testing industry has experienced a significant level of merger and acquisition (M&A) activity, driven by the rising efforts by companies to diversify their product portfolios and enhance their technological capabilities. For instance, in June 2021, Ro acquired at-home diagnostics company Kit to enhance its healthcare platform. This acquisition allows Ro to offer self-administered tests and a CLIA-certified lab, improving patient-centric care for various conditions. Kit will continue operating independently while integrating its services with Ro's existing in-home care capabilities, encouraging preventative healthcare solutions.

Regulations play a critical role in shaping the home care testing industry by establishing mandatory product safety, accuracy, and efficacy guidelines. Regulatory frameworks from organizations such as the U.S. FDA, European CE marking, and other regional authorities ensure that self-testing devices meet stringent quality standards. In addition, these regulations build consumer trust and also pose challenges for manufacturers, such as increased development costs and extended time-to-market.

The threat of product substitutes in the home care testing industry is significantly low due to several key solutions such as the home care testing solutions offer significant convenience and accessibility for patients managing chronic conditions. Unlike traditional diagnostic methods that require visits to healthcare facilities, home testing kits allow individuals to perform tests in the comfort of their homes, thereby reducing time and travel costs associated with healthcare visits. This convenience is particularly crucial for patients with chronic diseases, such as diabetes or cardiovascular conditions, who require regular monitoring to manage their health effectively.

Regional expansion in the home care testing industry is characterized by targeted initiatives by companies to increase their presence in emerging markets while strengthening footholds in developed regions. Companies are leveraging various strategies such as strategic partnerships, collaborations, and expansion to address region-specific healthcare challenges and regulatory requirements.

Age Insights

Based on age, the geriatric segment led the market with the largest revenue share of 60.14% in 2024 and is expected to witness at the fastest CAGR over the forecast period. According to an article by the United Nations Population Fund, the global geriatric population aged 65 years and above has almost doubled between 1974 and 2024 to reach 10.3% from 5.5%. Moreover, this number is further expected to increase to 20.7% between 2024 and 2074. Similarly, the number of people aged 80 years and above is expected to triple in the same period. This increasing geriatric population is expected to drive the demand for home care testing, contributing to the segment growth.

The pediatric segment is expected to witness at a significant CAGR during the forecast period. Home care testing can improve outcomes for pediatric patients by allowing for more frequent monitoring and earlier detection of changes in health status. Moreover, advancements in neonatal care have led to lower infant mortality rates, and premature infants, as well as babies with life-limiting birth defects or chronic illnesses, have a greater chance of survival. These factors have increased the demand for pediatric care services.

Sample Insights

Based on sample, the urine sample segment led the market with the largest revenue share of 36.27% in 2024, and is anticipated to witness at the fastest CAGR over the forecast period. Urine sample collection is a non-invasive and easy process that can be performed at home. Technology advancements have led to more accurate and reliable urine sample testing, allowing for earlier detection and treatment of health conditions. In January 2023, Withings, a company pioneering in connected health, announced the launch of an in-home biomarker analysis platform, U-Scan. It is a miniaturized health lab that can be placed inside any toilet bowl to analyze urine samples and provide users with real-time health information. It detects a wide range of health conditions, such as urinary tract infections, kidney disease, and even some types of cancer.

The blood sample segment is expected to grow at a significant CAGR over the forecast period. Blood sample testing can be used to detect several health conditions, including diabetes, heart disease, and several other infections. This makes it a widely used diagnostic tool in the healthcare industry. It is a convenient and cost-effective way to monitor the patient’s health and diagnose medical conditions.

Test Type Insights

Based on test type, the infectious disease test segment led the market with the largest revenue share of 40.69% in 2024. The convenience and accessibility of homecare testing for infectious diseases has become an essential tool after the COVID-19 pandemic, as many people were hesitant to visit hospitals or clinics for fear of exposure to the virus. Homecare testing for COVID-19 was crucial to control the spread of the virus, especially in areas with high infection rates. In February 2023, the FDA authorized the first over-the-counter at-home test to detect COVID-19 and influenza viruses.

The diabetes and glucose tests segment is expected to witness at the fastest CAGR over the forecast period. Diabetes is a chronic condition that affects millions of people worldwide, and glucose testing is a key part of managing diabetes. Home care testing kits for glucose monitoring are widely available, and they allow patients to test their blood sugar levels at home using a simple finger prick. In April 2023, the world-first pilot program, conducted by a hospital trust in the UK, allows pregnant women to take the glucose tolerance test at home using a home care testing kit. Continuous advancements in this field would further drive the segment’s growth.

Distribution channel Insights

Based on distribution channel, the retail pharmacies segment led the market with the largest revenue share of 49.59% in 2024. These are easily accessible to consumers, with many in convenient locations such as shopping centers and grocery stores. This makes it easy for consumers to purchase home care testing kits or pick up test results. Moreover, retail pharmacies have a wide range of home care testing products, such as blood glucose, cholesterol, pregnancy, and infectious diseases such as HIV and hepatitis. This allows consumers to choose the tests that best suit their needs, thus increasing the demand for home care testing.

The online pharmacies segment is expected to grow at the fastest CAGR during the forecast period. The market growth is attributed to factors such as ease of convenience, availability of a wide range of products, competitive pricing, privacy, and accessibility. Online pharmacies offer competitive pricing for home care testing products, which can be more affordable than purchasing them from a physical retail pharmacy. This could be one of the factors driving the segment’s growth.

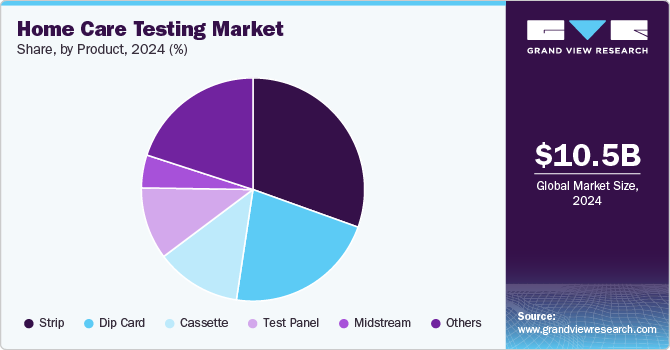

Product Insights

The strip segment led the market with the largest revenue share of 30.85% in 2024. The strip tests are relatively inexpensive and easy to use and can be performed without the need for specialized equipment or laboratory analysis, making them ideal for self-monitoring and early detection of health conditions. These are also portable, making them ideal for use in resource-limited settings and for mobile healthcare applications.

The cassette segment is expected to grow at a substantial CAGR during the forecast period. These tests are designed to be simple and easy to use, producing results in less than a minute. In addition, cassette tests are more sensitive and specific than strip tests, making them ideal for detecting low levels of analytes. In October 2021, Intrivo announced launching an FDA-authorized at-home rapid COVID-19 self-test, Intrivo's On/Go. The test delivers 95% accuracy within 10 minutes, making it a reliable and convenient way for individuals to test themselves for COVID-19 in the comfort of their own homes.

Regional Insights

North America dominated the home care testing market with the largest revenue share of 33.71% in 2024. The region has a highly developed healthcare system, which has led to higher investment in research and development of home care testing. Moreover, the availability of a wide range of testing products, such as rapid diagnostic tests, self-monitoring devices, and mobile health apps, is also contributing to the region’s market growth. In addition, a supportive regulatory framework is also driving market growth. For instance, the FDA in the U.S. and Health Canada in Canada have established clear regulatory pathways for home care testing products, which has enabled faster approval and commercialization of new products.

U.S. Home Care Testing Market Trends

The home care testing market in the U.S. held a significant share of the North America market in 2024. One of the major factors driving market growth is the increasing demand for convenient healthcare solutions as patients seek to manage their health from home. Moreover, the increasing regulatory support and efforts by regulatory bodies to increase access to advanced care testing are expected to fuel the market growth in the country. For instance, in October 2024, the FDA authorized the marketing of Healgen’s Rapid Check COVID-19/Flu A&B Antigen Test, the first at-home COVID-19 and flu test approved outside emergency use authorization. This over-the-counter test for ages 14 and above provides results in 15 minutes. It detects influenza A/B and SARS-CoV-2 proteins with high accuracy.

Europe Home Care Testing Market Trends

The home care testing market in Europe is experiencing significant growth. The rising prevalence of chronic diseases, particularly diabetes and cardiovascular conditions, has led to an increased demand for home-based diagnostic solutions. Patients increasingly prefer home care testing as it allows for convenient monitoring of their health without the need for frequent visits to healthcare facilities. Moreover, supportive regulatory frameworks across Europe have facilitated the introduction of new products into the market.

The UK home care testing market is experiencing significant growthprimarily due to the increasing prevalence of chronic diseases and the advancements in technology. According to Diabetes UK, around 5.6 million people in the UK suffer from diabetes, with the number increasing by around 167,822 from 2021-22 to 2022-23. As chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders become more common, there is an increased demand for convenient and efficient monitoring solutions in the UK.

The home care testing market in Germany is experiencing significant growth, driven by the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, which necessitate continuous monitoring. As patients seek more convenient options for managing their health, home care testing solutions are becoming increasingly popular. These tests allow individuals to perform essential diagnostics at home, reducing the need for frequent hospital visits and enabling timely health management.

Asia Pacific Home Care Testing Market Trends

The home care testing market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by demographic and technological advancements. Asia Pacific has one of the fastest aging populations in the world. This aging population often suffers from chronic diseases such as diabetes and cardiovascular conditions, creating a high demand for home care testing solutions that allow for regular monitoring and management of health conditions from the comfort of the home. The convenience and accessibility offered by these products are crucial in addressing the healthcare needs of this demographic, thereby fueling market growth.

The Japan home care testing market is driven by an aging population, technological advancements, and evolving patient preferences. According to the World Economic Forum, approximately 29.8% population of Japan will be aged 65 years and above in 2021. As Japan's population ages, with a growing number of individuals suffering from chronic diseases such as diabetes and cardiovascular conditions, the demand for convenient and accessible healthcare solutions is expected to increase.

The home care market in India is experiencing growth driven the technological advancements, increasing healthcare awareness, and growing patient awareness. Home care solutions in the country are witnessing a significant shift as patients seek convenience and efficiency in managing their health. Moreover, the increasing efforts to enhance healthcare accessibility have also played a crucial role in promoting home care testing, as they aim to provide quality healthcare services to a broader population, especially in rural areas where access to medical facilities is limited.

Latin America Home Care Testing Market Trends

The home care testing market in Latin America is experiencing significant growth,owing to the region's developing healthcare infrastructure and growing middle-class population with rising disposable income, which has also increased demand for home care testing solutions. In addition, rising patient awareness about the benefit of home care testing over in-facility testing is further contributing to this growth.

The Brazil home care testing market is anticipated to witness at a significant CAGR during the forecast period, driven by a combination of technological advancements, demographic trends, and healthcare policy initiatives. Brazil’s aging population has increased the demand for accessible and convenient health monitoring solutions. Chronic diseases such as diabetes, hypertension, and cardiovascular conditions are prevalent in this aging population, creating a high demand for home-based diagnostic tools. Moreover, the availability of cost-effective devices and growing awareness about preventive healthcare have encouraged Brazilian consumers to adopt home testing as an efficient alternative to frequent clinical visits.

Middle East And Africa Home Care Testing Market Trends

The home care testing marketin the Middle East & Africa is expanding as awareness of chronic and infectious diseases is rising across the region. Initiatives to improve healthcare access, especially in underserved areas, have enhanced the adoption of testing kits. Moreover, the growing affordability of these solutions and the rising efforts to increase patient comfort further contribute to this growth.

The Saudi Arabia home care testing market is characterized by rapid innovation, growing competition, and increasing demand for convenient and accessible healthcare solutions. Moreover, the government’s commitment to reducing the burden on hospitals and enhancing the efficiency of healthcare services has led to a greater emphasis on home-based diagnostic and monitoring solutions.

Key Home Care Testing Company Insights

The home care testing industry is fragmented, with major players focusing on growth strategies, such as new product launches, collaborations, partnerships, expansion, and mergers & acquisitions.

Key Home Care Testing Companies:

The following are the leading companies in the home care testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- BD

- Quidel Corporation

- BioSure

- F. Hoffmann-La Roche Ltd.

- Nova Biomedical

- Siemens Healthcare GmbH

- ACON Laboratories, Inc.

- OraSure Technologies, Inc.

- Chembio Diagnostics, Inc.

Recent Developments

-

In November 2024, NOWDiagnostics announced the launch of at-home syphilis tests in U.S. This is the only FDA-authorized syphilis test in the U.S. for over-the-counter use, now available for purchase online via Amazon and at major retail, pharmacy, and drugstore locations nationwide.

-

In September 2024, Mankind Pharma launched its "Rapid News Self-Test Kits" to address critical health challenges in India. These kits aim to enhance accessibility and early detection for conditions such as dengue, malaria, and other infectious diseases. With a focus on affordability and accuracy, this initiative aligns with Mankind Pharma's goal of improving healthcare access across India.

-

In February 2023, R.R. Donnelley & Sons Company (RRD) expanded its diagnostic test kit solution to meet the growing demand for at-home testing. The COVID-19 pandemic has boosted the demand for at-home testing, and RRD's expansion of its diagnostic test kit solution aims to help meet this demand.

Home Care Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.48 billion

Revenue forecast in 2030

USD 17.95 billion

Growth rate

CAGR of 9.36% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age, sample, test type, distribution channel, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; BD; Quidel Corporation; BioSure; F. Hoffmann-La Roche Ltd.; Nova Biomedical; Siemens Healthcare GmbH; ACON Laboratories; Inc.; OraSure Technologies, Inc.; Chembio Diagnostics, Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Care Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of industry trends in each of the subsegments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global home care testing market report based on the age, sample, test type, distribution channel, product, and region:

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Urine

-

Saliva

-

Blood

-

Others

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

HIV Test Kit

-

Diabetes and Glucose Tests

-

Cholesterol and Triglycerides Tests

-

Pregnancy Tests

-

Infectious Diseases Tests

-

Urinary Tract Infection Tests

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Supermarket/Hypermarket

-

Online Pharmacies

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Strip

-

Cassette

-

Test Panel

-

Midstream

-

Dip Card

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global home care testing market size was estimated at USD 10.52 billion in 2024 and is expected to reach USD 11.48 billion in 2025.

b. The global home care testing market is expected to grow at a compound annual growth rate of 9.36% from 2025 to 2030 to reach USD 17.95 billion by 2030.

b. North America dominated the home care testing market with a share of 33.71% in 2024. This is attributable to increasing number of product launches and ease of use for home care testing devices.

b. Some key players operating in the home care testing market include Abbott; BD; Quidel Corporation; BioSure; F. Hoffmann-La Roche Ltd.; Nova Biomedical; Siemens Healthcare GmbH; ACON Laboratories, Inc.; OraSure Technologies, Inc.; Chembio Diagnostics, Inc.

b. Key factors that are driving the market growth include increase in chronic disorders prevalence and the increase in the adoption of testing kits for disorder diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.