- Home

- »

- Electronic & Electrical

- »

-

Home Entertainment Devices Market, Industry Report, 2030GVR Report cover

![Home Entertainment Devices Market Size, Share & Trends Report]()

Home Entertainment Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device Type (Video, Audio, Gaming Console), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-254-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Entertainment Devices Market Summary

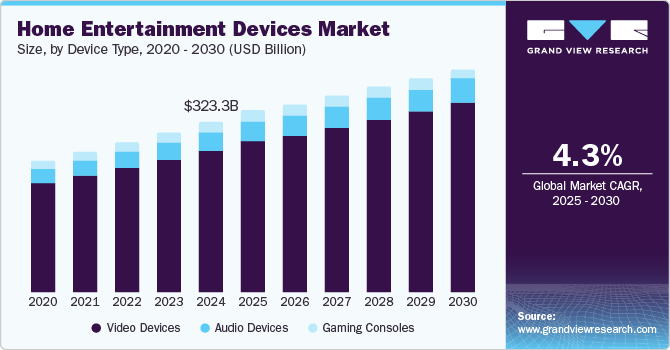

The global home entertainment devices market size was valued at USD 323.31 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2030. Increased adoption of smart and voice-activated devices, increasing internet penetration, and a growing middle class with higher disposable income are the key factors driving market growth.

Key Market Trends & Insights

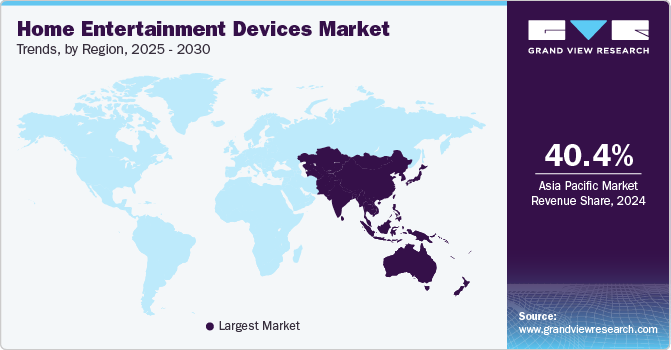

- Asia Pacific home entertainment device industry dominated the global market, with a revenue share of 40.4% in 2024.

- By device type, the video devices segment dominated with a revenue share of 82.9% in 2024.

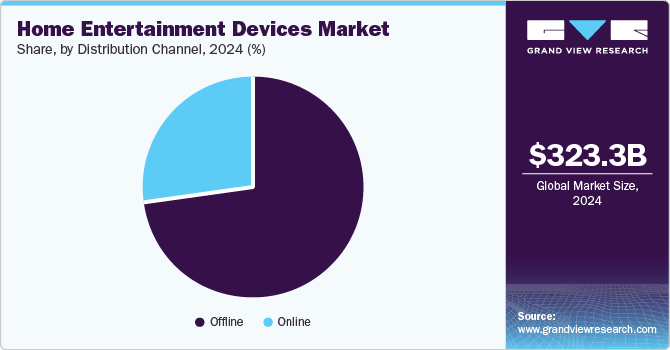

- By distribution channel, the offline segment held the largest revenue share of the home entertainment device market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 323.31 Billion

- 2030 Projected Market Size: USD 425.31 Billion

- CAGR (2025-2030): 4.3%

- Asia Pacific: Largest market in 2024

Modern-day home entertainment offers seamless interconnectivity, allowing consumers to buy entertainment devices from different providers and create their own setup. Additionally, the growing popularity of OTT platforms and game streaming also contributes to the growing sales of home entertainment devices.

During the pandemic, people worldwide were forced to stay at home for a considerable time. This spurred the demand for high-end entertainment devices. Consumers have started to explore the potential of smart entertainment devices, including smart TVs, smart speakers, sound bars, and VR headsets. These smart devices provided a better viewing and listening experience and offered features such as voice commands, multi-OTT platform support, and immersive gaming. This has boosted the demand for home entertainment devices across major markets worldwide. For instance, according to an article published by the Guardian, consumers in the U.K. spent almost USD 9 billion on smart home entertainment in 2020. Similarly, an article published by Gamer Network Limited states that consumers spent more than USD 60.4 billion on gaming in the U.S. in 2021, which also includes gaming hardware such as gaming consoles. The market grew by 8% compared to previous years.

The rise in disposable income is another key factor encouraging consumers to frequently upgrade their entertainment devices. In 2020, the middle class worldwide collectively spent USD 44 trillion, or 68% of global spending. The spending by the middle class is expected to grow 50% by 2030. In addition to accommodation, food, and clothing, the middle class spends a considerable amount on home décor and home entertainment systems. This increased spending offers tremendous growth opportunities for the home entertainment device industry. Besides, the growing convenience of procuring home entertainment devices from online platforms is also encouraging the demand for home entertainment devices. Online platforms and e-commerce websites offer lucrative deals, discounts, and flexible payment options. This allows consumers to opt for better expensive versions without stretching their budgets.

Growing internet penetration and internet connectivity offered by modern home entertainment devices is further contributing to market growth. Home entertainment device industry players are rolling out a new breed of smart televisions, smart speakers, and next-generation gaming consoles that connect to the internet. These entertainment devices automatically update their software with the latest version and provide a better entertainment experience. Smart-connected television allows consumers to experience premium viewing experience with high-definition resolutions and the availability of different OTT platforms and applications. Similarly, the latest generation gaming consoles allow players to connect with players from different countries in real-time for a multiplayer gaming experience. Internet connectivity has enhanced the user experience; hence, more consumers are inclined to upgrade their existing set-up with an advanced version.

Device Type Insights

The video devices segment dominated the global home entertainment device market based on product, with a revenue share of 82.9% in 2024. Television has always been the prime choice of entertainment. The demand for smart TVs has witnessed a surge, especially during the COVID-19 period. With more people working from home, consumers preferred to indulge in movies and series on their television sets. The advent of smart TVs hosts multiple features such as high-definition displays, built-in Wi-Fi, High-Definition Multimedia Interface (HDMI) ports, and easy access to apps such as YouTube and Netflix. This has boosted the demand for video devices for entertainment.

The video device segment is also expected to experience the fastest CAGR from 2025 to 2030. In addition to smart TVs, consumers are also buying high-definition projectors to recreate the theater experience at home. TV projectors offer higher screen size and better resolution at a fraction of the cost compared to smart TVs. According to data provided by the leading projector manufacturer BenQ, the sales of home projectors in India witnessed a growth of 50% in 2021 compared to the previous year. Similarly, the sales of Optoma also witnessed a surge of 150% in the sales of their home projectors. This has helped the video entertainment devices segment to dominate the overall home entertainment device industry.

Distribution Channel Insights

The offline segment held the largest revenue share of the home entertainment device market in 2024. Consumers prefer offline buying as this channel allows riders to explore the features offered by the entertainment devices in person. Consumers can interact with the sales representative, which can help the consumer to scout better products as per their preference. Besides, benefits such as trade-in programs, flexible payment and EMI options, and free delivery and installation offered by retailers are also attracting consumers to buy home entrainment devices offline.

The online segment is expected to experience the fastest market growth during the forecast period. The availability of a wide range of products, the facility to compare products based on their features, and easy return policies are some major benefits of the online distribution channel. Online shopping is convenient and offers various price benefits and discounts, thus making it a more lucrative distribution channel. Furthermore, the rise in social media marketing is also supporting the growth of the online distribution channel.

Regional Insights

The North American home entertainment device market is anticipated to experience significant growth during the forecast period. The region is one of the early adopters of advanced consumer electronics such as smart TVs and smart speakers. The rising number of gamers in the region is encouraging the sales of gaming consoles. The presence of a tech-savvy consumer population, along with an established internet infrastructure, is helping the region grow at a considerable pace.

U.S. Home Entertainment Devices Market Trends

The U.S. dominated the North American home entertainment devices market in 2024. It is a lucrative market for smart televisions as it is one of the prime sources of entertainment for the country's people. According to the U.S. Media Consumption Report, an average consumer in the U.S. watches TV more than two hours per day. Activities such as binge-watching, movie marathons, watching live sports events, and online streaming through different OTT platforms are getting popular among younger generations. This has encouraged the demand for connected TVs offering better viewing experience. The country is also a key market for gaming consoles, as there are more than 190 million video gamers aged 5 to 90 years. Among these, 36% of the players play games on consoles.

Asia Pacific Home Entertainment Devices Market Trends

The Asia Pacific home entertainment device industry dominated the global market, with a revenue share of 40.4% in 2024. The rise in disposable income among developing countries is the most prominent driver of the market. The region is home to some of the largest consumer markets, including China, India, Indonesia, and ASEAN countries experiencing substantial urban expansion. Rising urbanization and consumers’ willingness to spend on upgraded entertainment systems allowed the region to become a prominent market. In addition to video and audio devices, Asia Pacific is also the biggest market for gaming consoles. The region has approximately 1.5 billion video game players, and thus, the demand for gaming consoles remained high in the past few years.

China held the largest revenue share of the regional industry in 2024. The country is witnessing a drastic change in consumer lifestyle and behavior. With rising urbanization and a large population of the younger generation, the desire to upgrade entertainment devices is becoming more prevalent in the country. Chinese consumers are increasingly becoming tech-savvy, and the demand for innovative products is backed by the progressive use of 5G connectivity. Additionally, the availability of home entertainment devices from global manufacturers has further encouraged market growth.

Europe Home Entertainment Devices Market Trends

The European home entertainment device market is expected to experience a significant CAGR during the forecast period. Compared to pre-pandemic consumption, home entertainment is witnessing a positive surge among European countries, especially in the UK, Germany, and France. The consumer in the region have strong spending capacity and look to upgrade their entertainment devices periodically. With the growing popularity of OTT platforms such as Netflix and Disney+, consumers prefer to buy smart TVs for streaming video on demand (SVOD). According to data published by the European Commission, an average European watches TV for 210 minutes per day, with over 95% of the homes having television in the region. Besides, the region is also a prominent market for gaming consoles. In 2023, video game consoles were the second most popular gaming platforms, with 56% of players preferring consoles in Western Europe. All such factors are contributing to the consistent growth of home entrainment devices industry in the region.

Key Home Entertainment Devices Company Insights

Some of the key companies operating in the global home entertainment device market are Samsung Electronics Co. Ltd., Panasonic Corporation, Sony Corporation, LG Electronics Inc., and Microsoft Corporation. Every major player in the home entertainment device industry follows a key market strategy of new product development. Companies compete in terms of features, design & innovation, and prices to stay dominant in the market. Home entertainment device manufacturers are also focusing on the aesthetic design of appliances that complement the ambiance in modern-day homes.

-

Samsung Electronics Co. Ltd., a South Korea-based consumer electronics company, is a global leader in providing innovative home entertainment devices. Samsung offers a wide range of ultra-high-resolution smart televisions, TV projectors, premium home audio systems, and sound bars. The company is known for its advanced designs, features, and technological innovations such as TVs with curved screens and music frames.

-

Sony Corporation is a Japanese company renowned for its technologically advanced audio-visual product offerings and gaming consoles. The company offers an array of high-resolution televisions that are loaded with features. The company also has expertise in developing advanced sound systems and sound bars, wireless speakers, and high-resolution headphones.

Key Home Entertainment Devices Companies:

The following are the leading companies in the home entertainment devices market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics Co. Ltd.

- Panasonic Corporation

- Sony Corporation

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Sennheiser electronic GmbH & Co. KG

- Bose Corporation

- Koninklijke Philips N.V.

- Haier Inc.

- Microsoft Corporation

Recent Developments

-

In May 2024, Samsung introduced a new AI TV series with integrated advanced AI technology to enhance the viewing experience. The new 2024 Neo QLED 8K QN900D is equipped with a powerful 8K NQ8 AI Gen3 Processor, delivering superior pictures and sound quality.

-

In September 2024, Sony announced the launch of its new gaming console version PS5 Pro. The company claimed the gaming console to be its most powerful and expensive console to date.

Home Entertainment Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 345.16 billion

Revenue forecast in 2030

USD 425.31 billion

Growth Rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device Type, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Samsung Electronics Co. Ltd., Panasonic Corporation, Sony Corporation, LG Electronics Inc., Mitsubishi Electric Corporation, Sennheiser Electronic GmbH & Co. KG, Bose Corporation, Koninklijke Philips N.V., Haier, Inc., and Microsoft Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

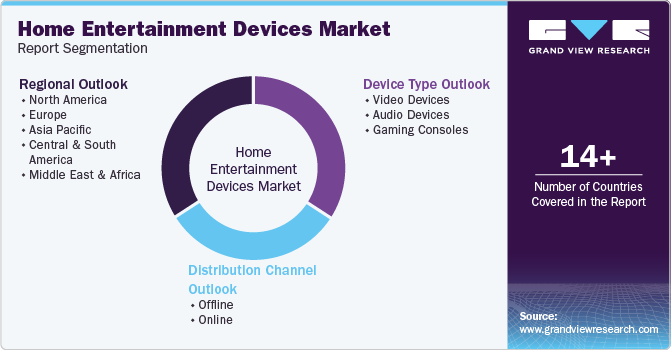

Global Home Entertainment Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global home entertainment devices market report based on device type, distribution channel, and region.

-

Device Type (Revenue, USD Billion, 2018 - 2030)

-

Video Devices

-

Audio Devices

-

Gaming Consoles

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.