- Home

- »

- Homecare & Decor

- »

-

Home Furnishing Market Size, Share & Growth Report, 2030GVR Report cover

![Home Furnishing Market Size, Share & Trends Report]()

Home Furnishing Market Size, Share & Trends Analysis Report By Product (Home Furniture, Home Textiles, Wall Decor, Flooring), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-483-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Home Furnishing Market Size & Trends

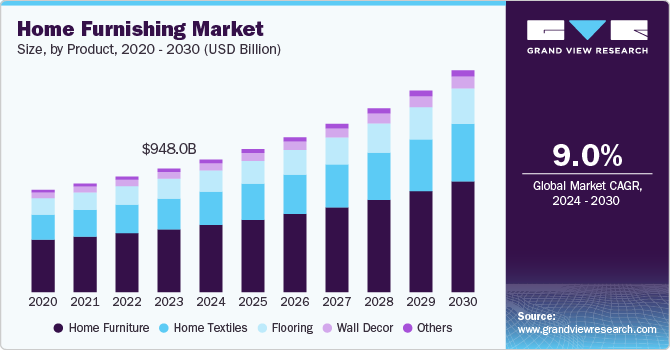

The global home furnishing market size was estimated at USD 948.0 billion in 2023 and is expected to grow at a CAGR of 9.0% from 2024 to 2030. The real estate market's health plays a crucial role in driving demand for home decor. A stable housing market encourages renovations and new home purchases, boosting sales of decor products. Rising disposable incomes, especially in emerging economies like China and India, further enhance consumer spending on home aesthetics. Shifting consumer tastes toward sustainability and eco-friendly products are influencing purchasing decisions. As awareness of environmental issues grows, consumers increasingly seek decor items made from sustainable materials34. Additionally, trends such as DIY home improvement projects and personalized decor options are gaining traction, encouraging consumers to invest in unique and customizable items that reflect their individual styles.

With urban living spaces becoming smaller, there is an increasing demand for furniture that serves multiple purposes. Consumers seek stylish yet functional solutions that maximize space while enhancing aesthetic appeal. As more people live in smaller homes, innovative storage solutions that combine functionality with design are becoming essential. The incorporation of innovative technologies into home furnishings is becoming more prevalent. Consumers seek convenient products, such as intelligent lighting and automated furniture solutions. Manufacturers respond to consumer demands with multifunctional furniture that maximizes space utilization while maintaining aesthetic appeal. The limited indoor space has resulted in growing interest in outdoor decor. Urban consumers invest in outdoor furniture and decor to enhance their balconies and patios, creating additional living areas that reflect their style.

The increase in rental living is also expected to be a key market driver in the near future. Urban areas often see a high proportion of rental properties due to high real estate costs. Renters typically move more frequently, leading to a demand for affordable, lightweight, and easily movable furniture. Rental markets encourage furniture that is easy to disassemble and reassemble. Flat-pack furniture from companies like IKEA has thrived in this environment. Renters also look for budget-friendly yet durable options, emphasizing affordability without sacrificing design.

The market is expected to face challenges in the form of higher costs and price-sensitive customers. The market for home furnishing is highly price-sensitive, particularly in emerging economies. Consumers often prioritize affordability over quality, which pressures manufacturers to lower prices while managing rising production costs due to raw material price fluctuations. This dynamic can lead to reduced profit margins and challenges in maintaining product quality. The availability of counterfeit or low-quality products at affordable prices poses a significant challenge for legitimate manufacturers. Consumers may choose these cheaper alternatives over higher-quality options, further restraining market growth.

Economic downturns, inflation, and recession fears can decrease consumer spending on non-essential items like home furnishings. Furniture is often considered a discretionary purchase, and consumers may prioritize essentials over home decor when faced with economic uncertainty.

While e-commerce has expanded the home furnishing market, it also presents significant challenges, especially for traditional brick-and-mortar stores. The shift to online shopping demands robust digital infrastructure, including user-friendly websites, secure payment systems, and efficient delivery options.

Product Insights

Home furniture was the largest category among all home furnishing products, and its market revenue exceeded USD 480 billion in 2023. Growing urbanization is expected to be a key driver for market growth over the forecast period. As urbanization accelerates, more people are moving to cities. The United Nations projects that by 2050, 68% of the global population will reside in urban areas, up from 55% today. This shift is driving demand for residential furniture as new housing developments emerge to accommodate growing populations. Infrastructure improvements, including residential construction and smart city initiatives, often accompany rapid urbanization. These developments necessitate various furniture types to fit modern living spaces, particularly in densely populated areas.

Millennials are significantly shaping the furniture market through their unique purchasing habits and preferences. Millennials often start their shopping journey online, conducting extensive research before making significant purchases. They value the ability to compare prices, read reviews, and explore product details online before visiting stores to experience the furniture in person. While they appreciate the tactile experience of in-store shopping, many millennials prefer a seamless transition between online and offline channels. Retailers are trying to integrate their online presence with physical stores to meet this expectation effectively.

The home textiles market is expected to grow at a CAGR of 9.6% from 2024 to 2030, primarily driven by consumers' ever-evolving aesthetics. Consumers increasingly prefer textiles made from organic and recycled materials. This trend is pushing manufacturers to adopt eco-friendly practices and innovate sustainable product lines, aligning with environmental consciousness among consumers. There is a high emphasis on comfort and quality, which has resulted in product evolution. The trend has increased demand for products promoting better sleep and comfort, such as hypoallergenic bedding. Consumers are willing to invest in high-quality textiles that enhance their living environments.

The pandemic has led many consumers to invest in home improvement projects, further driving demand for decorative textiles. DIY activities have also gained popularity, encouraging consumers to personalize their living spaces with unique textile choices. Advances in technology, including digital printing and intelligent textiles, enable manufacturers to offer personalized products that cater to individual consumer preferences. Features like temperature regulation are gaining popularity in textiles.

The wall décor market is expected to grow at a CAGR of over 8% from 2024 to 2030. Consumers increasingly seek personalized wall decor items that reflect their styles and preferences. This trend encourages manufacturers to offer customizable products, such as bespoke artwork and tailored designs, enhancing consumer engagement and satisfaction. The rise of e-commerce platforms has transformed the way consumers purchase wall decor. Online shopping provides convenience, a wider selection of products, and competitive pricing, making it easier for consumers to explore various styles and options from home. This trend is expected to continue, with online retailing projected to grow significantly in the coming years.

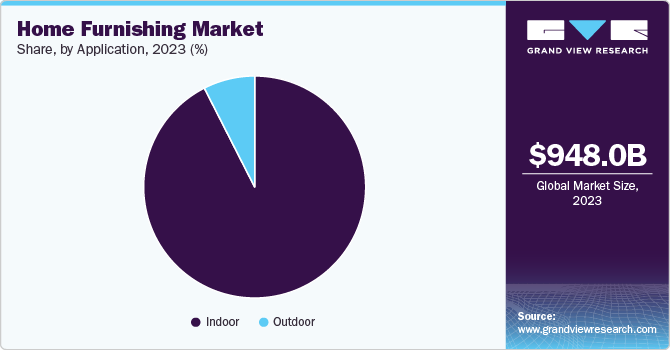

Application Insights

Indoor home furnishing was the largest segment and accounted for a revenue of USD 877 billion in 2023. There is a strong emphasis on bringing the outdoors inside, using natural materials like wood and stone, as well as indoor plants and living green walls. Homes are designed for multiple functions, combining living, working, and socializing spaces. This trend includes multifunctional furniture and rooms that can easily transition between different uses. Sustainability is a significant concern for consumers, leading to increased demand for eco-friendly products made from recycled materials or sustainably sourced goods.

The outdoor furnishing market is evolving, influenced by several key trends that reflect changing consumer preferences and lifestyles. There is a noticeable shift towards bright, bold colors and playful patterns in outdoor furnishings. Designers encourage homeowners to experiment with mixing florals, stripes, and vibrant hues to create lively outdoor spaces. This trend allows easy updates through textiles like pillows and throws without a complete furniture overhaul. The demand for comfortable, durable outdoor seating continues to rise. Homeowners are moving away from traditional plastic furniture to plush couches, sectionals, and chairs made from performance fabrics that withstand the elements while providing comfort.

Regional Insights

North America was the largest home furnishing market, with a market revenue of USD 350 billion in 2023, and is expected to grow at a CAGR of 8.4% from 2024 to 2030. The pandemic has shifted consumer focus towards home environments, with many investing in home improvements and furnishings to create comfortable and functional living spaces. This trend is linked to the perception of homes as a key to physical and mental well-being, driving demand for various home furnishings. A robust housing market, characterized by rising construction and sales of new homes, is a significant driver. Increased household formations and the demand for single-family and multifamily units are fueling the need for furniture and décor.

U.S. Home Furnishing Market Trends

The U.S. home furnishing market was estimated at USD 235 billion in 2023 and is expected to grow at a CAGR of 8.5% over the forecast period. Consumers are spending more on stylish and high-quality furniture, with the average annual expenditure on furniture per consumer unit increasing significantly from USD 355 in 2010 to USD 750 in 2023. This trend indicates more substantial growth potential for the market as disposable incomes rise. The rise of remote work has increased demand for home office furniture as consumers adapt their living spaces for work and leisure. This shift has spurred sales across various furniture segments.

The expansion of e-commerce platforms has transformed how consumers shop for home furnishings. Online sales have surged, with many consumers appreciating the convenience of home delivery and a broader selection of online products. As homes become smaller due to urbanization and changing family structures, there is a growing demand for multifunctional and space-saving furniture solutions. Consumers are increasingly looking for compact and easily movable items that maximize utility. These products are more easily available through online stores as compared to other conventional channels.

Asia Pacific Home Furnishing Market Trends

Asia Pacific is expected to remain the fastest-growing market for home furnishing over the forecast period, with a CAGR of 9.8%. Growing urbanization is expected to remain a key driver for market growth in the region. Asia is experiencing significant urban migration, with the population projected to rise from 56.9% in 2022 to 68% by 2050. This influx into cities creates a heightened demand for housing and, consequently, for home furnishings to fill these new living spaces.

Many Asian countries are witnessing rapid economic growth and increasing disposable incomes. This financial uplift allows consumers to invest more in home furnishings, enhancing their living environments with stylish and comfortable options. The expanding middle class in countries like China and India is driving demand for quality home furnishings as these consumers seek to improve their living standards and home aesthetics.

Key Home Furnishing Company Insights

The home furnishing market comprises a mix of large players catering to all product categories and regional smaller players who focus on only one or two of the product categories. Many retailers are adopting omnichannel strategies, integrating online and offline sales channels to provide a seamless shopping experience. This approach helps capture a broader audience and meet diverse consumer needs. Companies are investing in product innovation to differentiate themselves in a crowded marketplace. This includes introducing innovative furniture solutions that incorporate technology for added functionality.

Key Home Furnishing Companies:

The following are the leading companies in the home furnishing market. These companies collectively hold the largest market share and dictate industry trends.

- Wayfair Inc

- IKEA

- Ashley Furniture Industries Inc.

- RH (Restoration Hardware)

- Williams-Sonoma, Inc.

- La-Z-Boy Inc.

- Raymour & Flanigan

- American Signature

- Oppein Home Group Inc.

- Jason Furniture (Hangzhou) Co., Ltd

- Steelcase Inc.

Home Furnishing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1018.2 billion

Revenue forecast in 2030

USD 1703.9 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Wayfair Inc.; IKEA; Ashley Furniture Industries Inc.; RH (Restoration Hardware); Williams-Sonoma, Inc.; La-Z-Boy Inc.; Raymour & Flanigan; American Signature; Oppein Home Group Inc.; Jason Furniture (Hangzhou) Co., Ltd; Steelcase Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Furnishing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global home furnishing market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Furniture

-

Home Textiles

-

Flooring

-

Wall Decor

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

Paper Bags

-

Reusable Containers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global home furnishing market size was estimated at USD 948.0 billion in 2023 and is expected to reach USD 1,018.2 billion in 2024.

b. The global home furnishing market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to USD 1703.9 billion by 2030

b. The home furniture segment dominated the home furnishing market, with a revenue share of 50.9% in 2023.

b. Some key players operating in the home furnishing market include Iovate Health Sciences, Abbott, Quest Nutrition, PepsiCo., Cliff Bar, The Coca-Cola Company, MusclePharm, The Bountiful Company, Post Holdings, BA Sports Nutrition, Cardiff Sports Nutrition, Jacked Factory, Orgain

b. Key factors that are driving the home furnishing market growth include a stable real estate market, shifting consumer tastes toward sustainability and eco-friendly products, and growing trends of DIY home improvement projects and personalized decor options. Besides, consumers are also seeking stylish and functional home furnishing alternatives thus, maximizing space without compromising on aesthetic appeal.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."