- Home

- »

- Homecare & Decor

- »

-

Home And Garden Pesticides Market Size Report, 2030GVR Report cover

![Home And Garden Pesticides Market Size, Share & Trends Report]()

Home And Garden Pesticides Market Size, Share & Trends Analysis Report By Type (Herbicides, Insecticides, Fungicides, Fumigants), By Formulation Type (Powder, Liquid), By Application (Garden, Household), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-657-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Home And Garden Pesticides Market Trends

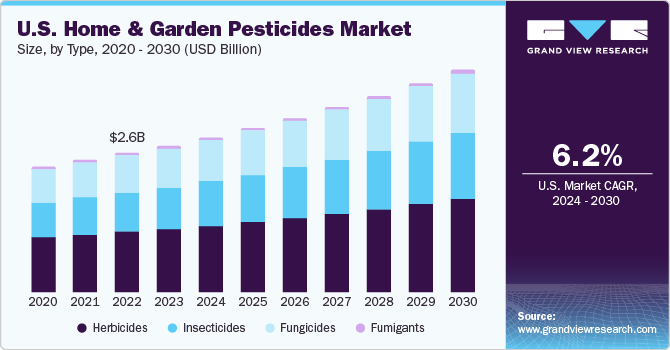

The global home and garden pesticides market size was estimated at USD 8.58 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030. Home gardens have been an important part of family farming and local food systems for millennia. Many pesticide treatments for residences are now ready-to-use, with liquid formulation types requiring no further mixing, which makes farming local food easier. Moreover, pesticide producers have simplified the safe application of pesticides. Pesticides used daily include ant and roach sprays in the kitchen, weed killers for the yard, mildew cleaners in the bathroom, and mosquito repellents outside. Pesticides are commonly used for keeping homes and gardens pest-free.

Many businesses are launching new products, such as BASF’s Renestra insecticide, which has a dual mode of action and controls a broad spectrum of insects. It enables farmers to control a variety of insect pests as well as soybean aphids. Innovative home and garden pesticide sprays with precise nozzles and targeted delivery systems minimize overspray and improve effectiveness. Mortein Smart, a premium innovation, was also launched. The product switches between high and normal settings automatically. In addition, according to Bonnie Plants, more than 20 million Americans planted a vegetable garden for the first time during the COVID-19 outbreak, indicating that the market for home and garden pest control solutions is quickly expanding in North America. It appears to be an opportune time for a seed start-up in the form of Sproutl, a UK-based gardening software firm trying to introduce gardening to a whole new generation of gardeners and encourage everyone to get involved.

Moreover, the Horticultural Trade Association reports that the number of gardeners increased by three million in 2021, with over half of those being aged under 45 years. Plant searches surpassed those for clothes during the lockdown and Google GOOG +0.1 percent searches linked to gardening have risen from May 2020 to May 2021. Furthermore, the growing popularity of Do-It-Yourself (DIY) gardening hobbies is an added factor supporting the market growth. Gardening as a hobby is particularly popular among Americans as well as Europeans, with a record number of youngsters taking up gardening as a hobby. This will also be one of the key factors driving the market growth during the forecast period.

In addition, according to the blog by Financial Times in September 2020, gardening was the second most popular activity during the COVID-19 lockdown in 2020, the first being watching TV. A rise in the trend for green spaces in urban homes and parks has intrigued a significant potential for the home and garden pesticides industry over the next few years. The global population is increasing at an exponential rate, which in turn has increased the needs of the people. Also, rising awareness about environmental degradation has led to people creating a greener environment around them to avoid pollution, poor air quality, and water contamination.

To mitigate these effects, governments of various countries have launched several schemes to build green spaces and parks based on environmental guidelines. For instance, in India, as per the guidelines of the Atal Mission for Rejuvenation and Urban Transformation (AMRUT), each urban local body (ULB) should have at least one green space or park based on the environmental guidelines set by the Urban and Regional Development Plans Formulation Type and Implementation (URDPFI). Thus, with an increase in green spaces around metro cities, there has been a rise in product demand to protect plants from pests. Non-crop pesticides are increasingly used in industrial sites, public spaces, and even aquatic environments for weed control, insect management, and disease prevention. Also, concerns about vector-borne diseases like mosquitoes and ticks are driving demand for targeted pest control solutions beyond the typical home and garden pest management.

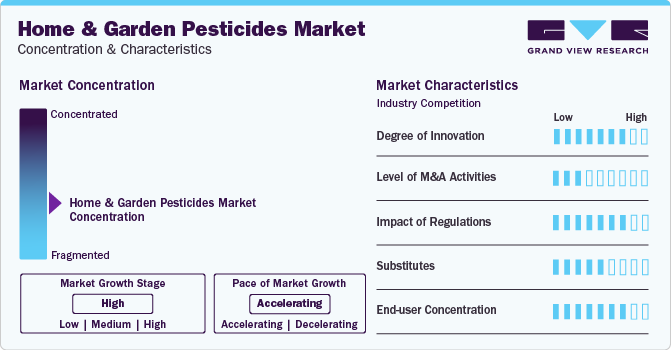

Market Concentration & Characteristics

The growth of this market can be attributed to increasing consumer spending on pesticides owing to the growing preference for user-friendly sprays, granules, and traps make pest control more convenient and effective. Understanding market dynamics is crucial for companies to compete effectively, adapt to changing regulations and consumer preferences, and identify promising avenues for innovation and growth. By embracing innovative solutions, addressing sustainability concerns, and diversifying their reach, players in this market can navigate the landscape of concentration and carve a path for success in the evolving world of pest control.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion. Smaller companies and startups can sometimes introduce impactful innovations due to their agility and focus on specific segments.

Increased spending power in some regions allows consumers to invest in pest control solutions for their homes and gardens. Stringent regulations, especially around safety and environmental impact, pose challenges for the industry but also drive innovation towards safer and more targeted solutions.Companies complying with stricter regulations can gain a competitive edge in markets with less stringent standards.

Type Insights

The herbicides segment dominated the market with the largest revenue share of 43.50% in 2023. The growing popularity of DIY gardening activities is also boosting product demand, due to the increased adoption of landscaping among homeowners. Herbicides are products used for killing undesired plants, similar to how pesticides are used to kill pests. Herbicides are commonly used to eliminate weeds or clear brush from an area. Herbicides are available in both synthetic and organic forms.

Regardless of the type, they should be handled with extreme caution. In addition, the rising demand for hardscaping is also projected to bode well for the overall growth of the home and garden pesticides industry. Hardscaping is witnessing increased acceptance due to the growing demand for paving blocks and stamped concrete plank pavers made up of natural stones and porcelain. These products help prevent water runoff and flooding issues. The insecticides segment is anticipated to grow at a CAGR of 6.7% from 2024 to 2030.

Formulation Type Insights

Innovations in pesticide powder formulations are constantly being made to improve their effectiveness against pests. These advancements include water-soluble powders and dust formulations that are easy to apply and effective against specific pests. Powder formulations are often preferred for their stability and longer shelf life compared to some liquid formulations. Manufacturers are working on enhancing the longevity of powdered pesticides, ensuring they remain effective over time. Companies are also offering concentrated powder formulations that allow users to customize the strength of the pesticide solution, making it more appealing to household end users dealing with different levels of pest incursions.

Liquid formulations are often favored for their ease of application. Ready-to-use liquid pesticides, which require minimal mixing or dilution, have gained popularity among homeowners looking for convenient solutions for pest control. Liquid formulations may incorporate continuous release technologies, allowing for a gradual and sustained release of active ingredients. This contributes to longer-lasting pest control effects. Additionally, advancements in formulation technologies, such as microencapsulation or nanotechnology, are making liquid and powder formulations even more effective. These technologies enhance the stability, efficacy, and targeted delivery of the pesticides.

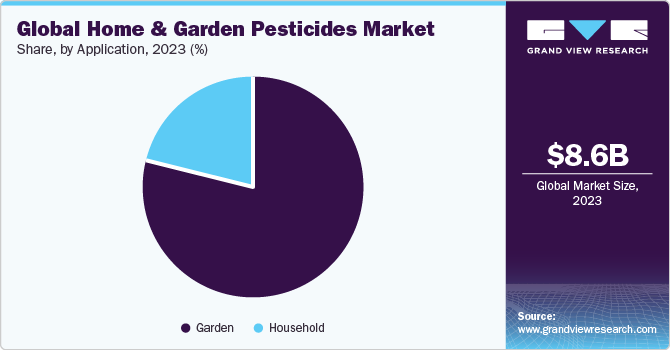

Application Insights

The garden application segment held the largest revenue share of over 79% in 2023. The epidemic boosted the appeal of backyard gardens. The lockdown, according to many of these new growers, provided them time and energy to focus on their new hobby of cultivating. During the lockdown, the National Allotment Society reported an increase in the number of people signing up for plots on their local council's waiting lists, demonstrating that this is an urban as well as a rural trend.

Restaurants and small eateries, such as outside cafes, are popular places for social meetings and possible plant displays. This also opens the door for market expansion. Furthermore, numerous projects are underway to promote planting activities in public spaces, such as transportation stations, roadways, and lanes. On an overcast day with moderate temperatures, the best time to use a pesticide is when the soil is reasonably dry and there is no forecast for rain. To avoid pesticide drifting to non-target regions, the pesticide is never applied in windy conditions.

Distribution Channel Insights

Offline segment emerged to be most preferred distribution channel for purchasing home and garden pesticide products. Home improvement and garden specialty retailers are the main players in the distribution of these products, as consumers often visit these stores for expert advice and a wide range of product options. Mass merchandisers, which include large chain stores, supermarkets, and hypermarkets, are also popular for purchasing pesticides as they often offer a variety of brands and products at competitive prices.

The introduction of e-commerce has significantly impacted the home and garden pesticides market, with online platforms such as Amazon, Home Depot, and specialized gardening websites providing a wide range of products with the convenience of online shopping. These platforms often feature customer reviews and ratings; which consumers rely on when making purchasing decisions. Some pesticide manufacturers and brands sell directly to consumers through their own websites, allowing for direct communication, brand building, and potentially lower prices due to the elimination of intermediaries.

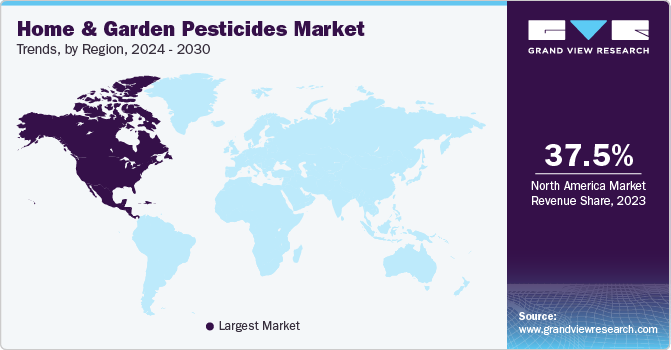

Regional Insights

The North America home and garden pesticides market held the largest share of 37.54% of the global revenues in 2023. In the U.S. and Canada, tending a kitchen garden is currently a key trend, where homeowners produce fresh vegetables for their own needs. The U.S. home and garden pesticides market growth is driven by rise of urban gardening and DIY gardening trends among the consumers in the country. In 2019, the average spending on home and garden products from January through mid-May was USD 7 million to USD 14 million. With COVID-19 and its socially distancing orders, the amount spent in 2020 was approximately twice the amount spent in 2019. Pesticides are widely utilized in the developing world, and demand for pesticides is rising because of the existing food production system, which prioritizes high agricultural yields.

Pesticides, manufactured from chemicals that can control pests or influence plant growth, have provided an approach for developing countries to enhance harvests. Many farmers in underdeveloped nations believe that using pesticides is the best way to protect their crops from pests, such as desert locusts, which are considered a major threat to crops in Africa this year. Therefore, using insecticides may be the only source of crop insurance. The market in the UK is expected to grow at a substantial rate over the forecast period owing to the rise in spending on home gardens.

According to a study conducted by Power Sheds in 2021, a manufacturer of garden sheds, the UK experienced a significant increase in consumer spending at garden centers as the country emerged from lockdown and transitioned toward a state of normalcy earlier this year. The study also revealed that the extended periods spent at home during the past 18 months led to a substantial rise in expenditures on home and garden solutions and equipment. Specifically, there was an additional USD 887 million spent at garden centers in the period of April-June 2021 when compared to the corresponding timeframe in 2020.

India home and garden pesticides market

The home and garden pesticides market in India is expected to grow at a CAGR of 8.4% from 2024 to 2030, as a result of factors such as rapid urbanization, increasing disposable income, and popularity of organic gardening practices creates demand for natural pest control products.

UK home and garden pesticides market

The home and garden pesticides market in the UKis projected to grow at a CAGR of 6.8% from 2024 to 2030. The UK home and garden pesticides market is poised for continued growth, driven by sustainability concerns, technological advancements, personalized solutions, and increased focus on public health.

Key Companies & Market Share Insights

The global home and garden pesticides market is characterized by the presence of a few well-established players such as Central Garden & Pet Company, S.C. Johnson & Sons Inc., Bayer AG, The Scotts Company LLC, Syngenta, Organic Laboratories Inc., Reckitt Benckiser Group PLC, DuPont de Nemours Inc., BASF SE, and Willert Home Products. Key players focus on strategies, such as mergers, acquisitions, innovations, and new product launches, to enhance their portfolio offerings.s

Key Home And Garden Pesticides Companies:

The following are the leading companies in the home and garden pesticides market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these home and garden pesticides companies are analyzed to map the supply network.

- Central Garden & Pet Company

- S.C. Johnson & Sons Inc.

- Bayer AG

- The Scotts Company LLC

- Syngenta

- Organic Laboratories, Inc.

- Reckitt Benckiser Group PLC

- DuPont de Nemours, Inc.

- BASF SE

- Willert Home Product

Recent Developments

-

In April 2021, Central Garden & Pet partnered with Profitero, Inc. to expand its reach through online platforms. Through this partnership, Central Garden & Pet will be able to access its e-commerce business across its retail partners

-

In Feb 2021, S.C. Johnson & Sons Inc. decided to sell the majority stakes of its local business. The company is planning to sell major stakes in India Unit to Banks, a privately held investment firm

-

In July 2020, Bayer AG collaborated with Prospera Technologies Inc., to generate an integrated digital solution for vegetable greenhouse growers. This will enable Bayer AG’s consumers to make more effective decisions and optimize profitability and sustainability

Home And Garden Pesticides Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.07 billion

Revenue forecast in 2030

USD 12.97 billion

Growth Rate (Revenue)

CAGR of 6.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, formulation type, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa, UAE, Saudi Arabia

Key companies profiled

Central Garden & Pet Company; S.C. Johnson & Sons Inc.; Bayer AG; The Scotts Company LLC; Syngenta; Organic Laboratories, Inc.; Reckitt Benckiser Group PLC; DuPont de Nemours, Inc.; BASF SE; Willert Home Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home And Garden Pesticides Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030.For the purpose of this study, Grand View Research has segmented the global home and garden pesticides market report on the basis of type, formulation type, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Herbicides

-

Insecticides

-

Fungicides

-

Fumigants

-

-

Formulation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Garden

-

Household

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global home and garden pesticides market size was estimated at USD 8.14 billion in 2022 and is expected to reach USD 8.58 billion in 2023.

b. The global home and garden pesticides market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 12.97 billion by 2030.

b. Herbicides dominated the global home and garden pesticides market with a share of 44% in 2022. This is attributable to its increasing demand in order to get rid of weeds and other harmful and unwanted plants.

b. Some key players operating in the global home and garden pesticides market include Central Garden & Pet; SC Johnson & Son; Willert Home Products, Inc.; The Scotts Miracle-Gro Company; Spectrum Brands Holdings, Inc.; Bayer AG; Syngenta AG; Organic Laboratories Inc.; Reckitt Benckiser Group plc; BASF SE, and DuPont de Nemours, Inc.

b. Key factors that are driving the home and garden pesticides market growth include the growing trend of home gardening and increased expenditure on lawn and garden maintenance and prominent demand for organic pesticides.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."