- Home

- »

- Network Security

- »

-

Homeland Security Market Size And Share Report, 2030GVR Report cover

![Homeland Security Market Size, Share & Trends Report]()

Homeland Security Market (2023 - 2030) Size, Share & Trends Analysis Report By Types (Aviation, Maritime, Border, Critical Infrastructure Security, Cybersecurity, CBRN Security & Mass Transit Security), By Region, And Segment Forecasts

- Report ID: 978-1-68038-877-0

- Number of Report Pages: 76

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Homeland Security Market Summary

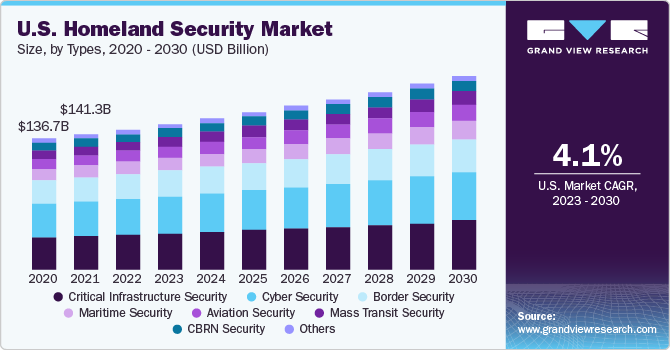

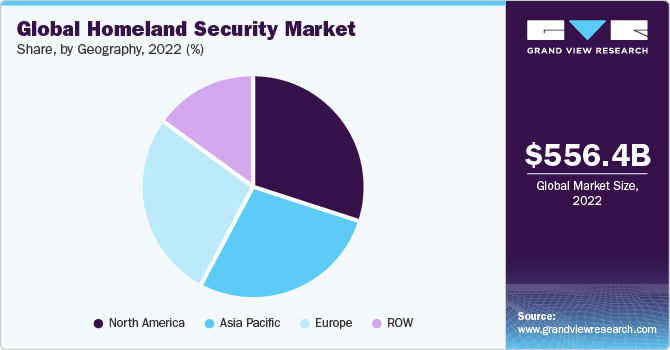

The global homeland security market size was valued at USD 556.40 billion in 2022 and is projected to reach USD 868.65 billion by 2030, growing at a CAGR of 5.8% from 2023 to 2030. The increase in demand for safety equipment and solutions across several industries such as aviation, maritime, cyber, and border security is anticipated to drive market growth over the forecast period.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 30.4% in 2022.

- By type, the critical infrastructure security segment accounted for the largest revenue share of 25.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 556.40 Billion

- 2030 Projected Market Size: USD 868.65 Billion

- CAGR (2023-2030): 5.8%

- North America: Largest market in 2022

The market is expected to grow at a significant pace across the world due to the rising cases of terrorist attacks, cross-border disputes, illegal immigration, smuggling, human trafficking, and the occurrence of numerous natural disasters. The industry is highly competitive, and manufacturers invest heavily in R&D operations to offer innovative products. Several government initiatives were undertaken to restrict increasing cross-border insurgency and terrorist threats are expected to drive demand.

Several government initiatives were undertaken to restrict increasing cross-border insurgency and terrorist threats are expected to drive demand. Also, growing human trafficking, drug smuggling, and illegal immigration are persuading the government of various countries to invest profoundly in the procurement of homeland security solutions. Cybersecurity is anticipated to be the fastest-growing market segment. This growth can be attributed to regions such as North America, and Europe that is investing immensely in cyber defenses, hence, driving the market. The majority of illegal immigrants in these countries come from developing countries and work in low-wage jobs in the agricultural, construction, and service sectors.

Advanced technologies such as cloud, social, and next-generation mobile computing in the business environment are fundamentally altering the way organizations exploit information technology for sharing information and conducting online. Unmanned aircraft systems (UAS) are being used extensively in national safety missions across the world.Unmanned systems are becoming more affordable, proficient, and easier to operate which is expected to drive the industry growth further. The market is expected to witness a substantial growth over the forecast period, owing to rising demand for security solutions and equipment across various industry verticals such as maritime, aviation, border and cyber security, among others.

Increasing proliferation of social networking and advancement of information technology offer infinite benefits in the living and working environments. However, such advantages can also create troubles in several types of cyber exploitation threats. Advances in Cyber Security gather the knowledge of cyber security experts from academia, government and industry across national and international boundaries to offer ways and means, which protect and sustain the cyberspace ecosystem.

There is an increasing demand for few federally funded technologies such as Path Scan, which is a intrusion detection system that prevent cyber-attacks by detecting anomalous network-hopping activities; MLSTONES, which is biology based malware and event analysis forensic tools that tags and sequences events looking for similarities.

Another unique approach to cyber security is virtual dispersive networking, which is highly advanced than the non-traditional military radio spread-spectrum security approaches. Such dispersive technologies encrypt each component message individually and route them over diverse protocols following independent paths.

Key market participants in the homeland security market are unceasingly focusing on reduction in the cost of innovative next-generation technologies and solutions such as sensor technology for evolving customer needs. Suppliers in the industry invest immensely on R&D to offer efficient, scalable technologies, which offer real-time instrumentation and analytics across networks. It includes delivering deep intelligence and high-fidelity visibility about networked systems, their vulnerabilities, and providing required information on security.

Cyber security is expected to be a significant segment owing to the increased investment in cyber security products and solutions due to growing cyber threats, cyber espionage, and cyber frauds. With increasing uncertainties in international relations is leading to greater threat from cyber espionage. An alarming increase in digitalization, mobile data usage, and cloud usage as well as cyber security laws and legislations are expected to fuel growth of cyber security systems and solutions.

Types Insights

The critical infrastructure security segment accounted for the largest revenue share of 25.7% in 2022. In the U.S., the Department of Homeland Security (DHS) has identified 16 sectors involving critical infrastructure, including energy, communications, transportation, financial services, food and agriculture. The significant cyber protection risks occur from the widespread and increasing dependence on information and communication technology infrastructure and e-services, which has led the key focus on ensuring safety by combating cybercrime more efficiently and advancing national defense capabilities.

The maritime security segment is expected to grow at the fastest CAGR of 7.0% during the forecast period. The growth of the maritime security segment is attributed to the increasing use of maritime transport which has led to an increase in illegal immigration, smuggling of prohibited substances, and terrorist attacks on ports and coastal regions

Regional Insights

North America dominated the market and accounted for the largest revenue share of 30.4% in 2022. The growth is attributed to rise in adoption of homeland security products and services which led to modernization of military through improvement programs.

With advancements in technology, cyber threats, terrorism, and border security concerns, governments and organizations in North America have recognized the need to invest in advanced security solutions. This has led to increased spending on surveillance systems, communication networks, biometric identification, and cybersecurity measures. The goal is to enhance the protection of critical infrastructure, public safety, and national security.

Rest of the world segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. The region has witnessed significant improvement in economy leading to increased investment in infrastructure, which fuels security risks. In addition, increase in illegal and terrorist activities and growing threat of cybercrime boosted the market growth.

Key Companies & Market Share Insights

Key players in the market have adopted the strategy of mergers & acquisitions to expand their product and service portfolios.

Key Homeland Security Companies:

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- L-3 Communications Holding, Inc.

- Magal Security Systems Ltd.

- Raytheon Technologies Corporation

- Safran

- ThalesUnisys

Recent Developments

-

According to the Emergency Event Database, there were 387 natural disasters and hazards worldwide in 2022, claiming 30,704 deaths and affecting 185 billion people. The economic losses were estimated to be over USD 223.8 billion.

-

African initiatives, such as the Accra Initiative and the Peace Fund against terrorism, whereasin 2019, the Government of the Philippines crafted and adopted a National Action Plan on Preventing and Countering Violent Extremism (NAP/P/CVE).

-

World Population Review estimates that 52 billion people living illegally in the U.S. by 2023, followed by 16 billion in Germany, 14 billion in Saudi Arabia, and 11 billion each in Russia and the UK.

-

In April 2023, L3Harris Technologies, Inc., a U.S.-based technology business, announced the completion of testing of L3Harris' breakthrough positioning, navigation, and timing (PNT) with the U.S. Air Force Research Lab (AFRL). It aims to determine the potential of U.S. space-based military PNT and demonstrate critical technologies geared to address the threat to national security.

-

In April 2023, the Biennial National Strategy for Transportation Security (NSTS) of the United States Department of Homeland Security (DHS) includes new transportation security initiatives such as an open architecture approach to Transportation Security Equipment (TSE) systems architecture and One-Stop Security to streamline international travel. The policy aims to secure the nation's transportation systems from assault or damage by terrorists or other violent parties from 2023 through 2027.

-

In March 2023, the U.S. administration released a National Cybersecurity Strategy with the goal of securing the digital ecosystem for all Americans by shifting the responsibility for cybersecurity to the organizations that are most capable of reducing risks and realign incentives so that organizations are more likely to make long-term investments in cybersecurity.

-

According to the Congressional Research Service Report of July 2022, More than 95 countries reportedly operated some unmanned military aircraft in 2021. The most advanced UAS are built in the United States. Iran, Israel, China, and Turkey, however, have shown rising degrees of competence in their approaches to unmanned technologies in recent years, with Iranian, Chinese, and Turkish UAS playing a notable role in recent military actions.

-

In June 2022, according to the World Bank press release, two-third of the population worldwide send or receive digital payments, with a share of developing countries increased to 57% in 2021 from 35% in 2014.

-

In March 2022, Teledyne FLIR Defense, a subsidiary of Teledyne Technologies Incorporated announced launch of Lightweight Vehicle Surveillance System (LVSS) with innovative air domain awareness (ADA) and expanded counter-unmanned aerial system (C-UAS) features. LVSS ADA C-UAS is a better version of Teledyne FLIR's field-proven LVSS structure, including dependable, easy deployment, and cutting-edge technology to detect and defeat the growing threat of micro drones.

-

According to the United Nations Conference on Trade and Development (UNCTD), more than 80% of international trade in carried by sea in 2021, and Asia continues to be the world's leading maritime freight area, with Asian ports in both developed and developing regions.

Homeland Security Market Report scope

Report Attribute

Details

Market size value in 2023

USD 586.40 billion

Revenue forecast in 2030

USD 868.65 billion

Growth Rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Types, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea

Key companies profiled

Elbit Systems Ltd.; Teledyne FLIR LLC; General Dynamics Corporation; L3Harris Technologies, Inc.; L-3 Communications Holding, Inc.; Magal Security Systems Ltd.; Raytheon Technologies Corporation; Safran; Thales; Unisys

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Homeland Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global homeland security market on the basis of types and region:

-

Types Outlook (Revenue in USD Billion, 2017 - 2030)

-

Aviation Security

-

Maritime Security

-

Border Security

-

Critical Infrastructure Security

-

Cyber Security

-

CBRN Security

-

Mass Transit Security

-

Others

-

-

Regional Outlook (Revenue in USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

ROW

-

Latin America

-

Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global homeland security market size was estimated at USD 556.40 billion in 2022 and is expected to reach USD 586.40 billion in 2023.

b. The global homeland security market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 868.65 billion by 2030.

b. North America dominated the homeland security market with a share of 28.5% in 2019. This is attributable to an increase in budgetary allocation for homeland security expenditure owing to safety rising concerns about domestic law and terrorist attacks, prompting the federal governments across U.S. and Canada to enhance of their country’s security and defense infrastructure.

b. Some key players operating in the homeland security market include lbit Systems Ltd., FLIR Systems Inc., General Dynamics Corporation, Harris Corporation, L-3 Communications Holding Inc., Raytheon Company, Safran SA, Thales SA, and Unisys Corporation.

b. Key factors that are driving the market growth include an increase in demand for safety equipment and solutions across several industries such as aviation, maritime, cyber, and border security along with technological advancements in the homeland security equipment offerings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.