- Home

- »

- Consumer F&B

- »

-

Hopped Malt Extract Market Size, Industry Report, 2030GVR Report cover

![Hopped Malt Extract Market Size, Share & Trends Report]()

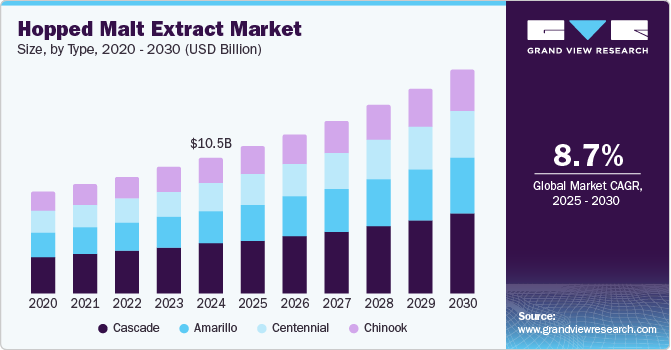

Hopped Malt Extract Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Cascade, Amarillo, Centennial, Chinook), By Application (Beverage, Food), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-274-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hopped Malt Extract Market Size Trends

The global hopped malt extract market was valued at USD 10.47 billion in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2030. The evolution of consumer preferences, particularly among younger demographics, has driven a surge in demand for craft beers infused with novel flavor profiles and unique ingredients. This shift in taste and the burgeoning popularity of craft beers crafted from premium ingredients such as hopped malt extract are propelling market growth. Furthermore, the accessibility of hopped malt extracts has empowered a significant segment of consumers to embark on homebrewing ventures, thereby further stimulating demand for these extracts. The expanding utilization of hopped malt extracts as flavoring agents in the realms of bakery, confectionery, and cereal products serves as an additional catalyst for the growth of the hopped malt extract industry.

The contemporary generation exhibits a pronounced inclination towards innovative and novel flavor experiences within their consumption of alcoholic beverages. This liking has fostered a significant surge in demand for craft beers in recent years, contrasting sharply with the traditional emphasis on uniformity over distinctive flavor profiles characteristic of mass-produced beers. According to a report disseminated by the Brewers Association, an estimated 9,812 craft breweries were operational within the U.S. in 2023. Hopped malt extract, a prominent ingredient, imparts a unique bittersweet flavor profile to both beers and whiskeys. Moreover, it contributes to the attainment of desirable attributes such as antioxidant properties, foam retention, and viscosity. Consequently, local breweries and artisanal craft producers exhibit a preference for utilizing hopped malt extract as the foundational element for low-alcohol yet flavor-rich variations of beers and whiskeys. The utilization of hopped malt extract offers several ancillary advantages, including a reduction in brewing time, enhanced consistency, and optimized resource allocation and space utilization for the production of subsequent batches. These multifaceted benefits have significantly augmented the demand for hopped malt extract among local breweries and artisanal liquor manufacturers.

The cultural phenomenon of homebrewing has witnessed a notable resurgence, particularly following the global pandemic. According to data from the Home Brewing Association, the U.S. currently boasts a community exceeding one million homebrewers. This demographic experienced a substantial expansion during the pandemic period, characterized by widespread restrictions.

Younger consumers, exhibiting a more adventurous palate, prefer craft beers over conventional options. They actively seek personalized experiences with diverse flavor profiles, and freshly brewed craft beers have consequently stimulated demand for ingredients such as hopped malt extract. Pre-made extracts have effectively instilled confidence within consumers, enabling them to embark on homebrewing endeavors without the necessity of extensive prior brewing experience or the significant expenditure of time and financial resources on preparation. The burgeoning popularity of homebrewing has also catalyzed local breweries to actively engage their clientele in their brewing processes. As an illustrative example, the Lone Girl Brewing Company extended invitations to members of the public to visit their brewing facility, participate in crafting their beer, and savor the enriching experience of the brewing process. Such initiatives, spearheaded by local breweries, in conjunction with the prevailing trend of homebrewing, have collectively contributed to heightened demand for brewing ingredients, including hopped malt extract.

Hopped malt extract finds diverse applications beyond liquor brewing, serving as a flavoring agent in bakery products, confectioneries, and breakfast cereals. Furthermore, it is utilized in the formulation of sauces, marinades, glazes, coatings, and non-alcoholic beverages. With a growing inclination towards natural flavoring agents and the recognition of nutritional benefits such as vitamin B content and antioxidant properties, consumers exhibit a pronounced preference for food products incorporating hopped malt extract as an ingredient.

Type Insights

The cascade segment dominated the global hopped malt extract market based on type, with a revenue share of 36.5% in 2024. Cascade hops are recognized for their versatility and are widely favored by brewers due to their capacity to impart distinct flavor and aromatic profiles to the finished beer. Characterized by a unique citrusy character and a notable level of acidity, Cascade hops contribute significantly to the final product's bitterness and complex flavor profiles. Consequently, they find extensive application in crafting a diverse range of beer styles, including American Pale Ale, India Pale Ale, American Wheat Beer, and Belgian Witbier, among others. The escalating global demand for craft beers has concurrently spurred a heightened demand for robust and uniquely flavored ingredients. This dynamic has served to underscore the pivotal role of Cascade hops within the broader context of the hopped malt extract industry.

The amarillo segment is expected to experience the fastest CAGR from 2025 to 2030. Analogous to Cascade hops, Amarillo hops exhibit a pronounced and distinctive citrusy aroma and flavor profile. Beyond their flavor-enhancing properties, these hops are also employed as a bittering agent in both conventional and craft brewing processes. Characterized by a high alpha acid content, Amarillo hops have garnered significant popularity among brewers due to their exceptional capacity to impart intense citrusy flavors and aromas to the finished product. These factors contribute to the burgeoning prominence of Amarillo hops within the overall hopped malt extract industry.

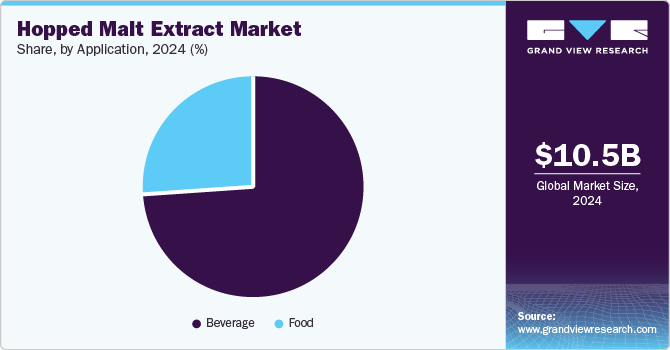

Application Insights

The beverage segment held the largest revenue share of the hopped malt extract market in 2024. The burgeoning demand for craft beers, characterized by distinctive flavor profiles and aromatic nuances, has significantly stimulated the utilization of hopped malt extract within this segment. Hopped malt extract offers a substantial advantage by streamlining the brewing process, thereby conserving both time and resources. This efficiency has incentivized local breweries to favor the use of malt extracts over the more labor-intensive process of producing them from scratch. Beyond their application in alcoholic beverages, hopped malt extracts are increasingly incorporated into non-alcoholic beverages due to their inherent nutritional value. Notably, hopped malt extracts are rich in vitamins and antioxidants. Consequently, the beverage sector currently dominates the overall hopped malt extract industry.

The beverage segment is also expected to experience the fastest CAGR during the forecast period. The growing number of homebrewers has fostered a concomitant increase in demand for pre-processed extracts, including hopped malt extract. The escalating enthusiasm for homebrewing, coupled with the convenience afforded by readily available pre-processed extracts, is anticipated to contribute significantly to the substantial growth of the beverage segment in the forthcoming years.

Regional Insights

The North America hopped malt extract industry dominated the global market, with a revenue share of 35.2% in 2024. The region exhibits a high concentration of individuals who consume beer. The utilization of hopped malt extract in the production of malt-based whiskies further stimulates demand for this extract within the region. The availability of key ingredients, the prevailing trend of homebrewing, and the presence of communities actively promoting craft beers with distinctive flavor profiles contribute to the region's dominance within the overall market.

U.S. Hopped Malt Extract Market Trends

The U.S. dominated the North American hopped malt extract market in 2024. The nation distinguishes itself by possessing the highest density of breweries globally. Currently, the country serves as the home to an impressive 5,025 breweries and 4,750 craft breweries, boasting the highest per capita brewery count worldwide. Favorable government legislation pertaining to the brewing industry, coupled with the promotion of homebrewing and robust demand for craft beers, has collectively shaped the overarching beer industry within the nation. Consequently, the demand for hopped malt extract has been witnessing a significant upward trajectory in recent years.

Asia Pacific Hopped Malt Extract Market Trends

The Asia Pacific hopped malt extract market is expected to experience the fastest CAGR during the forecast period. Evolving lifestyles, characterized by urbanization and increasing disposable income, have fostered a growing preference among younger demographics in the region for artisanal and craft beers. Concurrently, the burgeoning trend of social drinking, coupled with a consumer inclination towards beverages with lower alcohol content, is also contributing to the expansion of the hopped malt extract industry within the Asia-Pacific region.

China held the largest revenue share of the regional industry in 2024. Alcohol consumption constitutes an integral aspect of Chinese culture, particularly within the context of social events such as weddings, festivals, and formal or business gatherings. A substantial segment of the population within the country exhibits a preference for beer consumption. Given the prominent role of beer within Chinese consumer culture, the demand for hopped malt extract has experienced consistent growth. Furthermore, the substantial consumer base of alcohol within the country significantly contributes to its dominant position within the regional hopped malt extract industry.

Europe Hopped Malt Extract Market Trends

The European hopped malt extract market is anticipated to experience a significant CAGR during the forecast period. The region boasts a well-established beer culture, particularly in nations like the UK, Germany, France, and Spain. Europe is distinguished by both the highest proportion of alcohol consumers and the highest per capita alcohol consumption globally. The region possesses a rich tapestry of craft breweries renowned for their time-honored brewing traditions. Furthermore, social drinking festivals, such as the Oktoberfest in Germany and the Alltech Craft Brews and Food Fair in Ireland, serve as platforms for brewers across the region and the world to converge. This rich beer culture, coupled with a high rate of beer consumption among the populace, has fostered a significant surge in demand for hopped malt extract within the region.

Key Hopped Malt Extract Company Insights

Some of the key companies operating in the global hopped malt extract market are Muntons, Coopers, Hambleton Bard Ltd., BrewDemon, Cerex, Brewferm, and Mangrove Jacks. Companies actively engage in product launches and acquisitions to expand their market presence and visibility. Companies are trying to engage with local breweries and promote their offerings. Besides, the companies are also trying to upgrade their products to offer the best possible solutions for home brewers.

-

Muntons is a recognized name in the malt industry. The company was founded in 1921 and is based in the U.K. It offers a wide variety of brewing, distillation, home brewing, and plant malts. The company has an elaborate hopped malt extract from pale ale extract, wheat malt extract, roasted malt extract, ultra-dark malt extract, and melanoidin malt extract. The company also offers pre-made home-brewing beer kits to consumers.

-

BrewDemon, or Demon Brewing Co., is a U.S.-based beer kit company established in 2012. The company offers a wide range of products, including pre-made brewing kits, recipe kits, brewing and distillation equipment, and home brewing essential ingredients, including hops, yeast, and malts.

Key Hopped Malt Extract Companies:

The following are the leading companies in the hopped malt extract market. These companies collectively hold the largest market share and dictate industry trends.

- Muntons

- Coopers

- Hambleton Bard

- BrewDemon

- Cerex

- Brewferm

- Mangrove Jack’s

Recent Developments

-

In November 2022, Abstrax, a California-based company, launched the Hop Profile Master Kit for home brewing. The kit includes 12 hop varietals from around the world, including Cascade, Centennial, Chinook, and Willamette.

-

In July 2021, The Pinter, a U.K.-based home brewing beer kit provider, launched its new beer brewing kit. The kit is ready to make a kit with Pinter Packs, making 10 pints (5.5L) each. The pack includes pre-hopped malt extract for beer making.

Hopped Malt Extract Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.32 billion

Revenue forecast in 2030

USD 17.19 billion

Growth Rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Muntons, Coopers, Hambleton Bard Ltd., BrewDemon, Cerex, Brewferm, Mangrove Jacks

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hopped Malt Extract Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the hopped malt extract market report based on type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cascade

-

Amarillo

-

Centennial

-

Chinook

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beverage

-

Food

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.