- Home

- »

- Pharmaceuticals

- »

-

Hormone Replacement Therapy Market Size, Industry Report, 2033GVR Report cover

![Hormone Replacement Therapy Market Size, Share & Trends Report]()

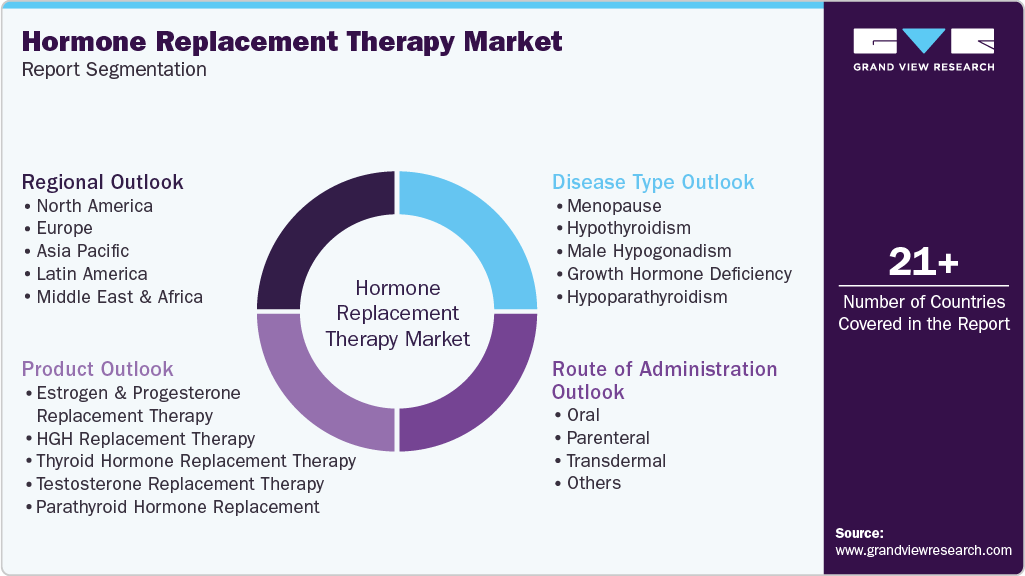

Hormone Replacement Therapy Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, (HGH Replacement Therapy), By Route of Administration, By Disease Type, By Region, And Segment Forecasts

- Report ID: 978-1-68038-784-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hormone Replacement Therapy Market Summary

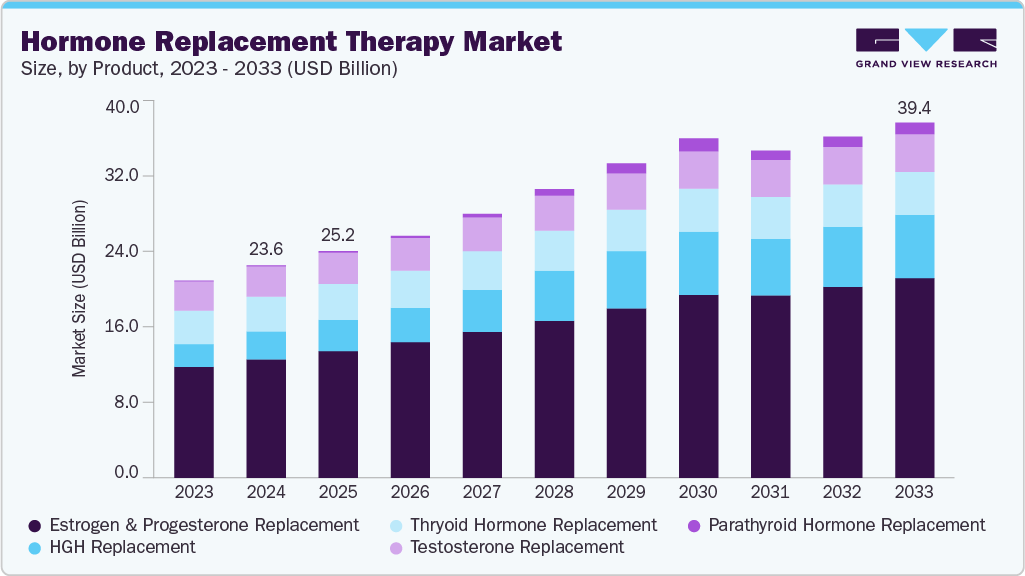

The global hormone replacement therapy market size was estimated at USD 23.58 billion in 2024 and is projected to reach USD 39.42 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The hormone replacement therapy industry is gaining momentum due to the rising prevalence of hormonal disorders, especially among aging populations.

Key Market Trends & Insights

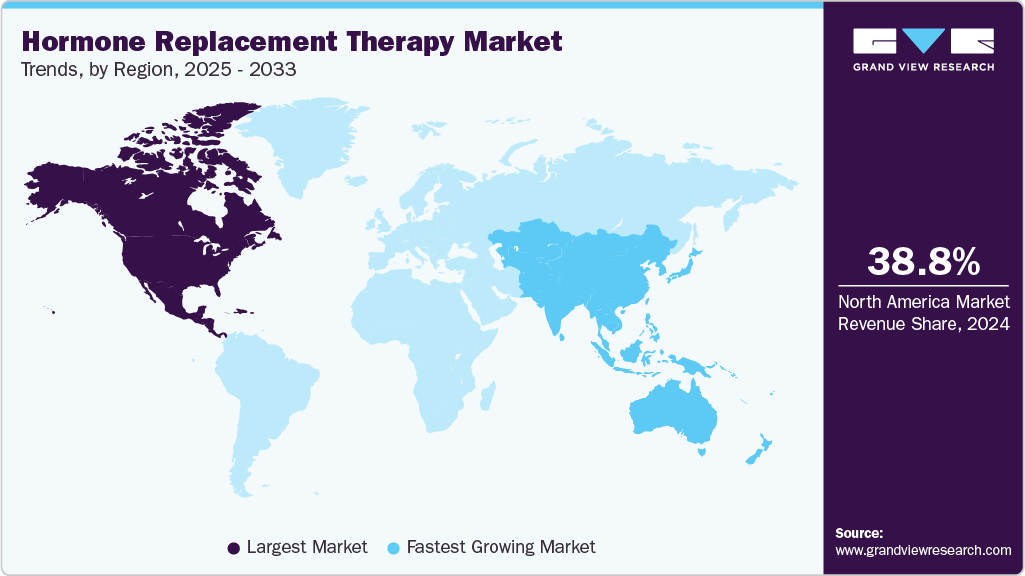

- North America dominated the hormone replacement therapy market with the largest revenue share of 38.78% in 2024.

- The hormone replacement therapy industry in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the estrogen and progesterone replacement therapy segment led the largest revenue share of 55.75% in 2024.

- By route of administration, the oral segment accounted for the largest market revenue share in 2024.

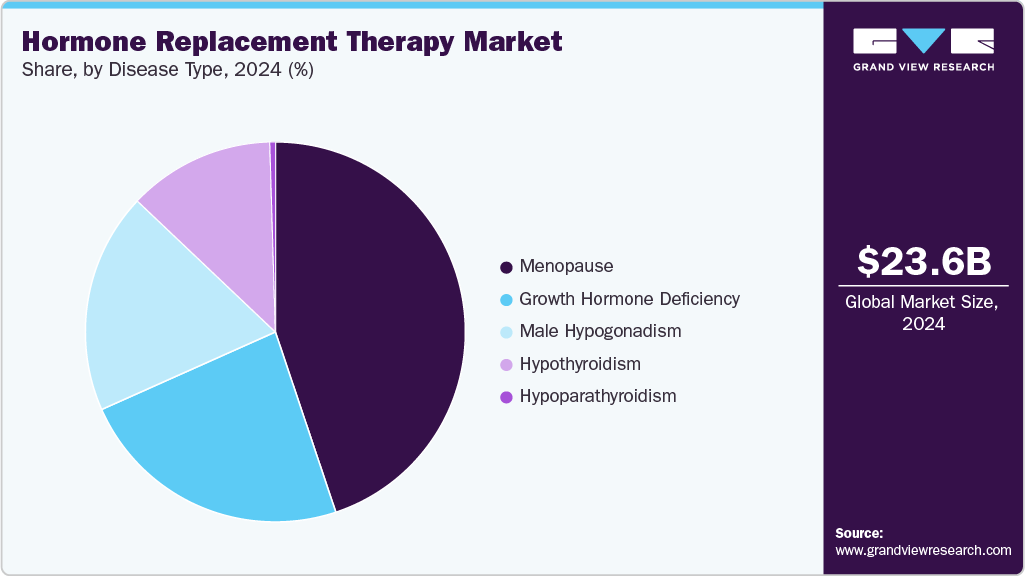

- By disease type, the menopause segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.58 Billion

- 2033 Projected Market Size: USD 39.42 Billion

- CAGR (2025-2033): 5.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Menopause-related conditions such as hot flashes, night sweats, vaginal dryness, and osteoporosis are fueling demand for effective therapies. For instance, October 2024, StatPearls Publishing reported that HRT was used to manage moderate-to-severe vasomotor symptoms, with the Postmenopausal Estrogen/Progestin Interventions trial of 875 women showing significant symptom reduction in estrogen-alone (OR, 0.42; 95% CI, 0.28-0.62) and estrogen-plus-progestin groups (OR, 0.38; 95% CI, 0.25-0.58) compared to placebo. The study clarified HRT’s limited role in chronic disease prevention while highlighting its importance in symptom relief. Growing awareness of male hypogonadism, coupled with rising life expectancy, further expands market adoption.

A study by the Oxford-Royal College of General Practitioners Research and Surveillance Centre, analyzing 1.8 million medical records from 465 general practices, reported that 5,451 women on estrogen-based HRT experienced a 78% reduction in COVID-19 infection and mortality rates. Rising awareness of conditions such as menopause, hypogonadism, and growth hormone deficiency is expanding the patient base. Pharmaceutical companies are introducing innovative therapies to meet demand. For example, in January 2022, Ascendis Pharma A/S received European Commission approval for SKYTROFA, the first once-weekly treatment for pediatric growth hormone deficiency, offering improved adherence and convenience compared to daily injections.

Market growth is further supported by increasing awareness of hormone deficiencies and rare disorders. Organizations like the UK-based Child Growth Foundation provide education, guidance, and support to patients, caregivers, and healthcare providers, enhancing adoption of HRT. Despite this momentum, high treatment costs remain a barrier in certain regions. Annual injectable HRT costs range from USD 288 to USD 1,440 for insured patients and USD 480 to USD 4,800 for uninsured individuals, limiting accessibility. Nevertheless, rising patient awareness, innovative drug delivery methods, and expanded therapeutic applications are expected to sustain long-term growth in the hormone replacement therapy industry.

Pipeline Analysis

NCT Number

Sponsor

Phases

NCT01070979

Warner Chilcott

PHASE3

NCT00630487

Pfizer

PHASE3

NCT00310791

Boston Children's Hospital

PHASE2|PHASE3

NCT02860130

Vantive Health LLC

PHASE3

NCT04615273

Ascendis Pharma Endocrinology Division A/S

PHASE3

NCT02781727

Ascendis Pharma Endocrinology Division A/S

PHASE3

NCT00185458

Bayer

PHASE3

NCT03306277

Novartis Gene Therapies

PHASE3

NCT03869385

Jena University Hospital

PHASE3

NCT03344458

Ascendis Pharma A/S

PHASE3

Source: ClinicalTrials.gov

Opportunity Analysis in the Hormone Replacement Therapy Market

Opportunity Area

Description

Instance

Innovation in Drug Delivery

Long-acting and convenient formulations improve adherence and reduce dosing frequency.

FDA expanded approval of once-weekly Sogroya (somapacitan-beco) to include pediatric patients aged 2.5+ years.

Bioidentical Hormones

Growing demand for safer, more natural hormone options tailored to patient needs.

FDA-approved bioidentical estrogen and progesterone are now available in oral forms such as tablets and capsules.

Expanding Indications

New therapeutic areas and rare conditions drive segment expansion beyond traditional uses.

FDA approved YORVIPATH (palopegteriparatide) for chronic hypoparathyroidism in adults, supported by PaTH Forward & PaTHway trials.

Regulatory Tailwinds

Designations like orphan drug exclusivity and priority review accelerate adoption and protect revenues.

YORVIPATH received U.S. FDA orphan drug exclusivity, ensuring seven years of market protection.

Digital Health & Personalization

Telemedicine platforms expand patient access to HRT and support personalized care plans.

Evernow provides telehealth-based menopause care with HRT delivery and 24/7 expert support, raising USD 28.5M Series A funding.

Emerging Markets Awareness

Rising awareness and public health programs increase treatment uptake in developing regions.

Indian Menopause Society (IMS) initiatives raise menopause awareness and education in India.

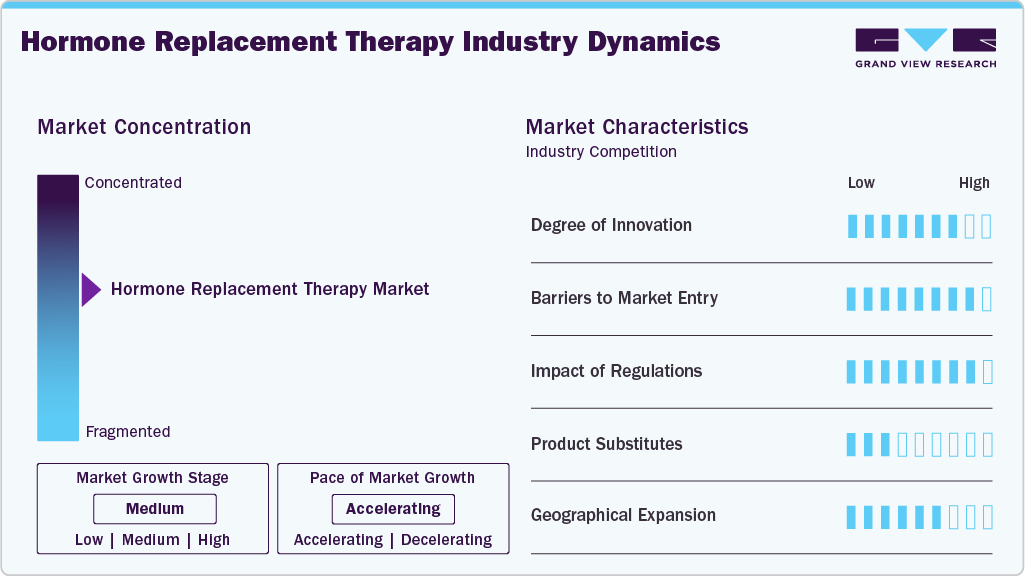

Market Concentration & Characteristics

The hormone replacement therapy industry is characterized by continuous innovation in formulations and delivery methods. Companies are developing transdermal patches, long-acting injectables, and bioidentical hormones to improve patient safety and adherence. Focus is also placed on minimizing side effects while offering more precise hormone balance. Innovations are largely treatment-driven, aiming to enhance outcomes for menopause, hypothyroidism, hypogonadism, and related disorders. This steady stream of therapeutic advancements maintains competitiveness among established players.

The hormone replacement therapy industry presents moderate to high barriers to entry due to the need for strong clinical validation and safety profiles. Hormone therapies must undergo rigorous clinical trials, which demand significant investment and time. Established players benefit from brand recognition, established supply chains, and strong physician trust. Smaller firms often face challenges in meeting regulatory standards and scaling production efficiently. These factors contribute to a concentrated market dominated by a few global leaders.

Regulations in the hormone replacement therapy industry are stringent, given the long-term use and potential risks of treatment. Products require strict approval processes from regulatory authorities to ensure efficacy, safety, and proper dosage guidelines. Any adverse effects can lead to product recalls or restrictions, impacting market penetration. Ongoing monitoring of post-marketing safety is essential, influencing how quickly new therapies gain adoption. Regulatory frameworks thus shape competition and product availability across geographies.

Product substitutes remain limited, as hormone replacement therapy is the primary treatment for hormone deficiencies and imbalances. Alternatives are often lifestyle interventions, dietary supplements, or over-the-counter remedies, which do not offer comparable clinical outcomes. Patients with severe hormonal deficiencies rely heavily on prescription-based therapies for effective management. Complementary approaches may exist but rarely serve as direct replacements for HRT. This lack of strong substitutes helps sustain steady demand for established therapies.

Geographical expansion in the hormone replacement therapy industry is focused on extending treatment access in emerging economies. Increasing awareness of menopause, hypothyroidism, and hypogonadism in Asia-Pacific and Latin America is driving market entry strategies. Leading pharmaceutical companies are strengthening distribution networks and partnerships to reach new patient populations. The availability of advanced formulations is gradually expanding beyond North America and Europe. This geographic diversification is expected to enhance revenue streams and reduce reliance on mature markets.

Product Insights

The estrogen and progesterone replacement therapy segment led the market with the largest revenue share of 55.75% in 2024, driven by high demand for treatments addressing menopausal symptoms. A growing population of women experiencing hot flashes, osteoporosis, and sleep disturbances has created consistent use of these therapies. Pharmaceutical companies have strengthened product portfolios with oral, transdermal, and injectable formulations to meet varying patient needs. For instance, April 2024, Mayne Pharma Commercial LLC reported that BIJUVA was the first and only FDA-approved combination of bio-identical estradiol and bio-identical progesterone in a single daily oral capsule, proven to reduce moderate to severe hot flashes while limiting risk to the uterine lining. Increasing clinical preference for combined hormone therapies is improving treatment effectiveness and adherence. Rising awareness of long-term benefits, such as bone health maintenance, is expanding patient adoption, establishing estrogen and progesterone therapies as the leading contributors to revenue.

The parathyroid hormone replacement segment is projected to grow at the fastest CAGR of 29.7% over the forecast period, fueled by the rising prevalence of hypoparathyroidism. Patients with calcium regulation disorders require long-term hormone therapy for effective management. Growing clinical recognition of the disease has led to increasing diagnosis rates worldwide. Availability of recombinant parathyroid hormone therapies is improving treatment outcomes and patient quality of life. For instance, April 2025, The Journal of Clinical Endocrinology & Metabolism reported results from a Phase 1, randomized, double-blind, placebo-controlled trial evaluating MBX 2109, a long-acting parathyroid hormone (PTH) replacement therapy. Findings showed that MBX 2109 demonstrated favorable safety, tolerability, pharmacokinetics, and pharmacodynamics, highlighting its potential as a long-acting solution. Pharmaceutical innovation focusing on safer and longer-acting formulations is expected to sustain rapid growth in this specialized treatment segment.

Route of Administration Insights

The oral segment led the market with the largest revenue share of 41.13% in 2024, due to its ease of use and patient convenience. Oral formulations for estrogen, progesterone, and thyroid hormones remain widely prescribed across healthcare systems. High compliance rates and accessibility through retail pharmacies further support demand. Pharmaceutical firms continue to invest in improving safety and absorption efficiency of oral drugs. Broader availability of generics has strengthened adoption in both developed and emerging regions. For instance, March 2025, the U.S. FDA confirmed that bioidentical hormones such as estradiol and progesterone were available in oral formulations, including tablets and capsules, offering improved tolerability and consistency compared to compounded alternatives, further reinforcing the dominance of oral administration in hormone therapies.

The parenteral segment is projected to grow at the fastest CAGR of 7.0% over the forecast period, owing to the demand for long-acting and targeted therapies. Injectable formulations for testosterone, growth hormones, and parathyroid hormones provide precise dosing and sustained effects. Physicians increasingly recommend parenteral options for patients requiring strict hormone level regulation. Advancements in depot injections and subcutaneous implants are enhancing treatment adherence, while growing acceptance of these delivery systems in endocrinology practices is widening their usage. For instance, in July 2023, the U.S. Food and Drug Administration (FDA) expanded the approval of Novo Nordisk’s Sogroya (somapacitan-beco) to include pediatric patients aged 2.5 years and older, positioning it as the first and only once-weekly growth hormone therapy for both children and adults. Initially approved in August 2020 for adult growth hormone deficiency, this long-acting subcutaneous injection highlighted the clinical utility of parenteral formulations in improving adherence by reducing the need for daily dosing. These factors collectively support the strong growth trajectory of parenteral administration.

Disease Type Insights

The menopause segment led the market with the largest revenue share of 44.84% in 2024, due to the high incidence of menopausal symptoms among women globally. Common conditions such as hot flashes, night sweats, osteoporosis, and urogenital atrophy drive consistent demand for therapies. Estrogen and progesterone-based treatments remain the standard approach for symptom relief and long-term health benefits. Growing awareness of the impact of menopause on quality of life is improving treatment uptake. For instance, in September 2024, a retrospective analysis presented by The Menopause Society revealed that 70% to 80% of women experience menopause symptoms such as hot flashes that adversely affect quality of life and productivity, with an average duration of 7 to 11 years. The study noted that many women remained on HRT well into their 60s and beyond, often to maintain symptom relief and overall quality of life, reinforcing the enduring demand for effective estrogen- and progesterone-based therapies. Pharmaceutical innovation in patches, gels, and oral formulations is enhancing adherence. These elements ensure the continued leadership of menopause treatment in the market.

The hypoparathyroidism segment is projected to grow at the fastest CAGR of 29.7% over the forecast period, driven by rising clinical recognition and the need for long-term hormone replacement to manage calcium imbalance. Recombinant parathyroid hormone therapies are demonstrating superior outcomes compared to conventional supplementation, boosting adoption. For instance, in August 2024, the U.S. Food and Drug Administration approved YORVIPATH (palopegteriparatide) injection for adults with hypoparathyroidism, granting orphan drug and priority review status. Approval was supported by global Phase 2 (PaTH Forward) and Phase 3 (PaTHway) trials, making YORVIPATH the first and only therapy for this rare disorder. With proven efficacy and growing patient demand for effective management, the segment is positioned among the fastest-growing in hormone therapy.

Regional Insights

North America dominated the hormone replacement therapy market with the largest revenue share of 38.78% in 2024, due to a large patient base dealing with menopause and hypogonadism. The presence of major pharmaceutical players such as Pfizer, AbbVie, and Eli Lilly enhances treatment accessibility across the region. Rising awareness of hormonal disorders is fueling demand for advanced treatment formulations. High healthcare expenditure and access to specialized endocrinology services further strengthen market leadership. Increasing focus on long-term wellness is expanding the adoption of preventive therapies. This combination secures North America’s position as the leading regional contributor to revenue.

U.S. Hormone Replacement Therapy Market Trends

The hormone replacement therapy market in the U.S. accounted for the largest market revenue share in North America in 2024, due to a well-established healthcare system and high diagnosis rates of hormonal disorders. Strong clinical research infrastructure supports the rapid introduction of innovative therapies. The high prevalence of menopause-related complications among women contributes significantly to market share. Demand for testosterone replacement among men is also rising, creating a balanced growth environment. Advanced drug delivery solutions such as patches and implants are widely adopted by patients. These factors make the U.S. the core growth driver within North America.

Europe Hormone Replacement Therapy Market Trends

The hormone replacement therapy market in Europe reflects steady demand driven by an aging population and increasing life expectancy. Countries across the region are witnessing rising cases of hypothyroidism and menopause-related complications. Strong presence of companies such as Bayer and Novo Nordisk is ensuring a consistent supply of innovative treatments. Patient awareness of treatment benefits is steadily improving across key markets. Adoption of bioidentical hormones is becoming a preferred option in clinical practice. These dynamics are ensuring sustainable market expansion in Europe.

The UK hormone replacement therapy market is marked by rising demand for treatments that address menopause and hypothyroidism. Growing clinical preference for safer and more personalized therapies is boosting adoption. Patient education and improved consultation practices are leading to earlier interventions. Pharmaceutical companies are focusing on expanding the availability of transdermal and oral formulations. Increasing awareness of male hypogonadism is adding another dimension to market growth. Together, these factors establish the UK as a key European market for hormone therapies.

The hormone replacement therapy market in Germany is expanding with strong contributions from a well-developed healthcare infrastructure. Menopausal women form a significant patient group, driving consistent demand for estrogen and progesterone therapies. High clinical standards support early diagnosis and long-term treatment planning. Availability of multiple drug delivery formats is enhancing treatment adherence among patients. Research collaborations with global pharmaceutical companies are strengthening innovation pipelines. These elements make Germany one of the most significant contributors to Europe’s growth.

The France hormone replacement therapy market is characterized by rising adoption of modern therapies for menopause and thyroid disorders. Increasing patient awareness about hormone-related complications is improving diagnosis and treatment uptake. Pharmaceutical firms are expanding their presence through diverse product portfolios. Clinical preference for transdermal and parenteral routes supports patient adherence. Growing recognition of testosterone deficiency among men is broadening treatment adoption. These trends collectively reinforce France’s importance within the European market.

Asia-Pacific Hormone Replacement Therapy Market Trends

The hormone replacement therapy market in the Asia Pacific is expected to register at the fastest CAGR of 6.3% over the forecast period, due to the rising prevalence of hormonal disorders among women and men is creating substantial demand. Growing awareness about menopausal symptoms and thyroid deficiencies is increasing treatment adoption. Expanding healthcare infrastructure is improving patient access to advanced therapies. International pharmaceutical companies are strengthening their distribution networks in this region. These drivers position Asia Pacific as the fastest-growing market globally.

The Japan hormone replacement therapy market is shaped by a rapidly aging population and increasing incidence of hormonal deficiencies. Menopause-related conditions are a major driver of treatment demand among women. High focus on healthy aging is encouraging greater acceptance of long-term therapies. Pharmaceutical companies are introducing advanced formulations tailored to local patient needs. Rising recognition of testosterone deficiency in men is contributing to additional growth. These dynamics make Japan a crucial market in the Asia Pacific region.

The hormone replacement therapy market in China is witnessing strong growth, supported by rising awareness of menopause and hypothyroidism. Rapid urbanization and lifestyle changes are leading to greater diagnosis of hormonal disorders. Expansion of hospitals and retail pharmacies is improving treatment accessibility. Pharmaceutical companies are focusing on introducing oral and transdermal formulations to meet local demand. Increased recognition of male hypogonadism is adding to overall therapy adoption. These factors are fueling China’s position as a high-growth HRT market in the Asia Pacific.

Latin America Hormone Replacement Therapy Market Trends

The hormone replacement therapy market in Latin America is gradually expanding with growing diagnosis rates of thyroid and menopausal disorders. Rising disposable income is improving access to advanced hormone therapies. Countries across the region are experiencing increasing demand for testosterone and growth hormone treatments. Pharmaceutical companies are strengthening their presence through partnerships with local distributors. Patient awareness of preventive therapies is rising, particularly in urban areas. These factors support the steady development of the hormone therapy market in Latin America.

The Brazil hormone replacement therapy market is the leading contributor in Latin America due to its large patient pool. High prevalence of hypothyroidism and menopausal conditions is fueling demand for hormone therapies. Rising awareness of male hypogonadism is further strengthening adoption. The expanding private healthcare sector is improving patient access to advanced treatments. Pharmaceutical companies are actively introducing new delivery formats to support adherence. These elements make Brazil a central growth hub for HRT in Latin America.

Middle East & Africa Hormone Replacement Therapy Market Trends

The hormone replacement therapy market in the Middle East and Africa is developing with increasing recognition of hormonal disorders. Rising cases of hypothyroidism and menopause-related complications are shaping treatment demand. Growing investment in private healthcare is improving the availability of advanced therapies. International pharmaceutical companies are gradually expanding their distribution channels across the region. Adoption of testosterone therapies among men is becoming more common. These factors indicate steady but emerging growth in the MEA market.

The Saudi Arabia hormone replacement therapy market is expanding with a higher focus on addressing menopause and thyroid disorders. Rising healthcare expenditure is improving patient access to advanced treatment options. Increasing awareness of hormonal health among women is driving demand for estrogen and progesterone therapies. Testosterone replacement adoption is gaining attention among men seeking long-term solutions. Pharmaceutical companies are introducing new delivery methods to improve compliance. These drivers establish Saudi Arabia as a significant emerging market within MEA.

Key Hormone Replacement Therapy Company Insights

Eli Lilly and Company and Pfizer Inc. are expanding their hormone replacement therapy portfolios with innovative solutions targeting menopause and testosterone deficiencies. Bayer AG and AbbVie, Inc. emphasize estrogen and progesterone therapies that address menopausal symptoms and osteoporosis, strengthening their global market reach. Novo Nordisk A/S and Merck & Co., Inc. focus on growth hormone and thyroid hormone replacement, supported by their expertise in endocrinology and strong product pipelines.

Noven Pharmaceuticals, Inc. and ASCEND Therapeutics US, LLC. enhance competitiveness by advancing transdermal delivery systems and patient-friendly formats. F. Hoffmann-La Roche Ltd. and Viatris, Inc. support market accessibility through biologics, generics, and cost-effective options. Competition in the market is shaped by delivery innovations, growing demand for personalized treatments, and expanding adoption across developed and emerging regions.

Key Hormone Replacement Therapy Companies:

The following are the leading companies in the hormone replacement therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Eli Lilly and Company

- Bayer AG

- Noven Pharmaceuticals, Inc.

- Pfizer Inc.

- Merck & Co., Inc.

- Viatris, Inc.

- Novo Nordisk A/S

- F. Hoffmann-La Roche Ltd.

- ASCEND Therapeutics US, LLC.

- AbbVie, Inc.

Recent Developments

-

In July 2025, Bayer announced that the U.S. FDA extended the review period for its New Drug Application (NDA) for elinzanetant, a non-hormonal treatment for moderate to severe vasomotor symptoms in menopause. The FDA required additional time to assess the submission and supporting data fully. The extension added up to 90 days to the Prescription Drug User Fee Act (PDUFA) review timeline.

-

In May 2025, Daewon Pharmaceutical partnered with Bayer Korea to exclusively distribute and market Angeliq and Climen in Korea. Daewon managed sales, marketing, and promotions, while Bayer supplied the medications. These therapies target estrogen deficiency symptoms in postmenopausal women and help prevent osteoporosis. In 2024, Angeliq and Climen accounted for roughly 30% of Korea’s HRT market.

-

In October 2023, Theramex announced an agreement to acquire the European rights to Duphaston and Femoston from Viatris Inc.. Viatris retained the rights for Australia and Japan. The transaction was subject to customary regulatory and antitrust approvals. These therapies, Duphaston (dydrogesterone) and Femoston (estradiol/dydrogesterone), are prescribed for hormone replacement therapy (HRT) indications, addressing symptoms related to estrogen deficiency in postmenopausal women.

Hormone Replacement Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.17 billion

Revenue forecast in 2033

USD 39.42 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, route of administration, disease type and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Eli Lilly and Company; Bayer AG; Noven Pharmaceuticals, Inc.; Pfizer Inc.; Merck & Co., Inc.; Viatris, Inc.; Novo Nordisk A/S; F. Hoffmann-La Roche Ltd.; ASCEND Therapeutics US, LLC.; AbbVie, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hormone Replacement Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hormone replacement therapy market report based on product, route of administration, disease type, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Estrogen & Progesterone Replacement Therapy

-

HGH Replacement Therapy

-

Thyroid Hormone Replacement Therapy

-

Testosterone Replacement Therapy

-

Parathyroid Hormone Replacement

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Parenteral

-

Transdermal

-

Others

-

-

Disease Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Menopause

-

Hypothyroidism

-

Male Hypogonadism

-

Growth Hormone Deficiency

-

Hypoparathyroidism

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hormone replacement therapy market size was estimated at USD 23.58 billion in 2024 and is expected to reach USD 25.17 billion in 2025.

b. The hormone replacement therapy market is projected to grow at a CAGR of 5.8% from 2025 to 2033 to reach USD 39.42 billion by 2033.

b. Based on product, estrogen and progesterone replacement therapy segment led the market with the largest revenue share of 55.75% in 2024, driven by high demand for treatments addressing menopausal symptoms.

b. Some of the key players operating in the hormone replacement therapy market include Eli Lilly and Company, Bayer AG, Noven Pharmaceuticals, Inc., Pfizer Inc., Merck & Co., Inc, Viatris, Inc., Novo Nordisk A/S, F. Hoffmann-La Roche Ltd., ASCEND Therapeutics US, LLC., AbbVie, Inc.

b. Key factors that are driving market growth include rising awareness of hormonal disorders, and advancements in drug formulations and delivery methods. Increased access via telemedicine, government support, and new product launches are also driving demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.