- Home

- »

- Medical Devices

- »

-

Menopause Market Size & Share, Industry Report, 2030GVR Report cover

![Menopause Market Size, Share & Trends Report]()

Menopause Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Dietary Supplements, OTC Pharma Products), By Region (NA, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-434-2

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Menopause Market Summary

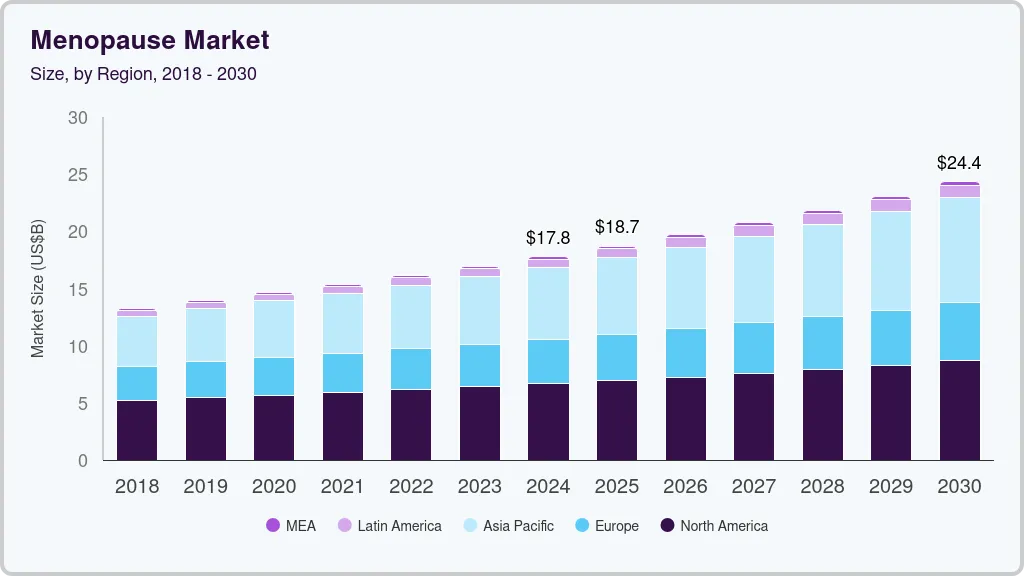

The global menopause market size was estimated at USD 17.79 billion in 2024 and is projected to reach USD 24.35 billion by 2030, growing at a CAGR of 5.42% from 2025 to 2030. The market is expected to witness significant growth, driven by demographic shifts and an increasing awareness of the health and wellness needs of aging women.

Key Market Trends & Insights

- North America menopause industry dominated globally in 2024 and accounted for the largest revenue share of 37.40%.

- The menopause industry in the U.S. held the largest share of 83.51% in 2024.

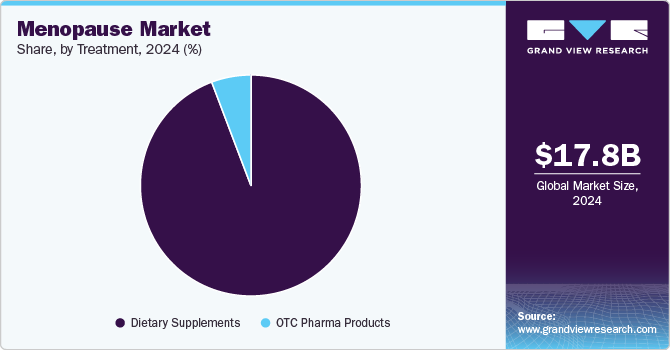

- By treatment, the dietary supplements segment dominated the market in 2024 and accounted for the largest revenue share of 94.23%.

Market Size & Forecast

- 2024 Market Size: USD 17.79 Billion

- 2030 Projected Market Size: USD 24.35 Billion

- CAGR (2025-2030): 5.42%

- North America: Largest market in 2024

- Latin America: Fastest growing market

By 2025, over 1 billion women globally are anticipated to reach menopause, which would make up approximately 12% of the global population. Vasomotor Symptoms (VMS) are experienced by almost 75% of women reaching menopause. According to a menopause study by StatPearls Publishing LLC in December 2023, 1.3 million females aged between 51 and 52 in the U.S. become menopausal every year. Around 5% of females aged 40 and 45 had early menopause symptoms & 1% of women reported premature menopause before the age of 40.

This can lead to an overall loss of productivity and quality of life, making treatment crucial. This creates a wide population pool to be served by menopause products, such as dietary supplements and Over-the-Counter (OTC) drugs, which can help relieve symptoms, including hot flashes, osteoporosis, night sweats, & vaginal atrophy.

Furthermore, early treatment is expected to reduce the stress of high healthcare expenditure, as females facing VMS lead to an overall burden of USD 660 million globally. In addition, productivity loss accounts for an additional USD 150 million. In addition, menopause triggers other healthcare conditions in females, such as reduced musculoskeletal health and increased risk of cardiovascular diseases. Three major conditions associated with accelerated incidence in menopausal women are hypertension (75%), depression (10%), and osteoporosis (30%).

Night sweats and hot flashes or VMS are key symptoms of Menopausal Transition (MT). In addition, issues such as mood swings, difficulty concentrating, and depression are being linked to menopause. Hot flashes are experienced by around 80% of females during menopause and are characterized by transient chills, anxiety, sweating, & sensations of heat that last for around 1 to 5 minutes. The increasing number of females experiencing the condition, along with the high prevalence of menopausal symptoms, is anticipated to drive the segment's growth. In addition, the increasing aging population across the globe is accelerating market growth.

Moreover, the high cost of prescription medication has led to an increased demand for OTC products, such as vaginal pain & dryness gels and moisturizers, for self-medication. In addition, telehealth consultations have made access to consultations easier and increased access to cheaper over-the-counter drugs that start as low as USD 13 on online websites. Your Menopause Microbiome is an AI startup working to create personalized OTC solutions for menopausal women.

Furthermore, recent innovations in menopause management have introduced several new products aimed at improving symptoms such as hot flashes and night sweats, particularly through non-hormonal approaches. Some notable developments include:

-

Bayer is advancing elinzanetant, a dual neurokinin-1 and 3 (NK-1 and NK-3) receptor antagonist, which is currently in late-stage clinical development. This medication targets the root causes of vasomotor symptoms (VMS) associated with menopause. In October 2024, Elinzanetant received New Drug Applications (NDAs) acceptance for review in multiple countries, including the U.S. and EU, indicating a strong potential for market availability.

-

In September 2024, Bonafide Health launched Thermella, a first hormone-free, prescription-free NK3 receptor antagonist designed specifically for menopause symptom management. It aims to rebalance the body's thermoregulatory center.

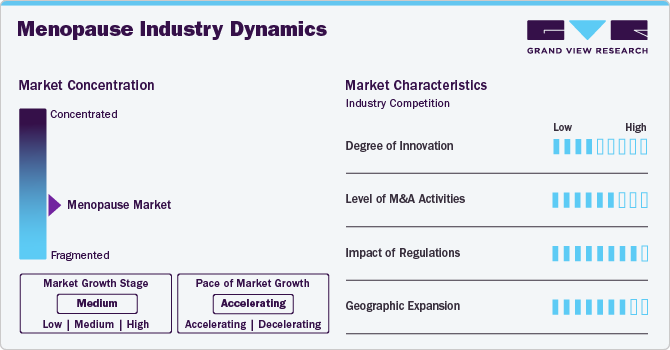

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of merger & acquisition activities, and geographic expansion. The market is highly fragmented, with the presence of various global and regional manufacturers.

The market is experiencing a moderate to high degree of innovation, driven by growing awareness, increasing demand for personalized care, and advancements in pharmaceutical and digital health solutions. In June 2024, ADM and Sirio Pharma introduced a gummy containing soy isoflavones aimed at easing estrogen depletion symptoms. Furthermore, traditional hormone replacement therapies (HRT) are being enhanced to improve safety and efficacy. Moreover, digital health platforms and wearable technologies are emerging to support symptom tracking, teleconsultations, and behavioral health interventions tailored to menopausal women. The integration of artificial intelligence and data analytics into these platforms further enhances personalized treatment approaches.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. For instance, in January 2024, Dr. Reddy’s Laboratories Ltd. acquired MenoLabs, a women’s health and dietary supplement brand from Amyris, Inc. in the U.S. This acquisition aims to accelerate the company’s growth in the women's nutrition and wellness market.

The market is regulated by various authorities, depending on the product category: hormonal, non-hormonal, or dietary supplements. Hormonal therapies, such as hormone replacement therapy (HRT), are classified as prescription medications and are strictly regulated by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), along with similar national regulatory bodies. These products must go through extensive clinical trials to demonstrate their safety and efficacy before receiving approval. Non-hormonal treatments, which include selective estrogen receptor modulators (SERMs) and neurokinin receptor antagonists, are also regulated as pharmaceuticals and follow similar approval processes. In contrast, dietary supplements, such as plant-based or herbal remedies, are subject to less stringent oversight. In the U.S., for instance, the FDA regulates dietary supplements under the Dietary Supplement Health and Education Act (DSHEA). This legislation does not require pre-market approval but mandates proper labeling and ongoing safety monitoring.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In September 2024, Theramex announced the initial commercial sale of Yselty (linzagolix) in Germany. This treatment for uterine fibroids provides a vital option for females facing significant unmet medical needs. This achievement enhances the available resources in the battle against uterine fibroids, offering females a crucial solution for managing moderate-to-severe symptoms associated with this condition.

Treatment Insights

The dietary supplements segment dominated the market in 2024 and accounted for the largest revenue share of 94.23% and is also anticipated to register the fastest CAGR over the forecast period. Dietary supplements are used by females to help ease the symptoms of menopause, such as hot flashes, night sweats, mood swings, and insomnia. In addition, research has shown a positive role of dietary supplements in the prevention of early menopause. An article published by the National Institutes of Health in November 2023 evaluated the effect of dietary supplements such as calcium & vitamin D and physical exercise on women. The study revealed that a combination of dietary supplements along with physical exercise counteracts various symptoms and lowers the effects of menopause in women.

The over-the-counter (OTC) pharma products segment is anticipated to register a considerable CAGR over the forecast period. The over the counter (OTC) pharma products segment is divided into hormonal and nonhormonal products. OTC hormone preparations are becoming more common among females undergoing menopause. Some of the major products in the segment are Dehydroepiandrosterone (DHEA), ibuprofen, topical progesterone, and melatonin. Growing awareness about the use of hormonal therapies is anticipated to accelerate the market over the forecast period. The non-hormonal products include antidepressants, ibuprofen, naproxen, lubricants & moisturizers, and clonidine (anti-hypertensive). According to NCBI, vaginal dryness or vaginal atrophy prevalent among women undergoing menopause ranges between 62% to 67%. This makes the use of OTC vaginal lubricants and moisturizers common to reduce symptoms. Vaginal moisturizers (Vagisil) and vaginal lubricants (Astroglide and K-Y) are available to help relieve vaginal dryness.

Regional Insights

North America menopause industry dominated globally in 2024 and accounted for the largest revenue share of 37.40%, owing to the local presence of major market players, developed healthcare infrastructure, and increasing prevalence of menopause symptoms in females. A growing emphasis on personalized medicine, early diagnosis & treatment, and rapid adoption of healthcare apps for online consultations of OTC drugs are additional factors anticipated to propel the region’s market further.

U.S. Menopause Market Trends

The menopause industry in the U.S. held the largest share of 83.51% in 2024. As the millennial population is aging, the country has a large number of women entering menopause; around 6,000 women are expected to enter menopause each day in the U.S. According to a menopause survey of women aged 35 and above conducted in January 2024 by AARP, a U.S.-based nonprofit organization, around 90% of women experience menopausal symptoms that affected their lives as well as work, along with other day-to-day activities.

Canada menopause market is anticipated to register the fastest growth during the forecast period. There is an increase in awareness about dietary requirements, leading to a greater demand for them among older women. Hence, companies are launching several products to cater to this growing demand for dietary supplements in the country.

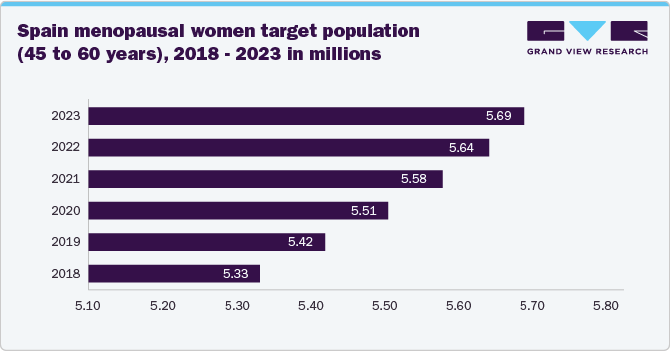

Europe Menopause Market Trends

Europe menopause industry is anticipated to register considerable growth during the forecast period. The region has a large number of women entering menopause every year, along with a high prevalence of menopausal symptoms such as vaginal dryness. Key players are introducing new products in the market, and medical practitioners are recommending dietary supplements as a healthy alternative to HRT for easing the transition through menopause.

The menopause industry in Germany is anticipated to register a significant CAGR during the forecast period. Germany has one of the strongest healthcare infrastructures in Europe. According to the Statistisches Bundesamt (Destatis), in 2021, around 13.2% of its GDP, i.e., USD 513.034 billion (EUR 474 billion), was spent on healthcare. According to the United Nations Population Fund population data in 2023, 23% of Germans were aged above 65 years, which is expected to increase in the coming years. The increasing geriatric population is responsible for the growing incidence of menopause-related conditions, such as hot flashes, as the symptoms can persist for decades. This opens opportunities for market players to target products to women in older age groups.

The UK menopause market is anticipated to register a considerable CAGR during the forecast period. The NHS has identified the average age of menopause in women as 51 years in the UK, with exceptions that enter menopause before 40 years of age or even in their 30s. It is estimated that around 13 million women, or around one-third of the female population in the UK, are premenopausal or menopausal. Considering the large target population, researchers are innovating products to ease the transition of women through menopause.

Asia Pacific Menopause Market Trends

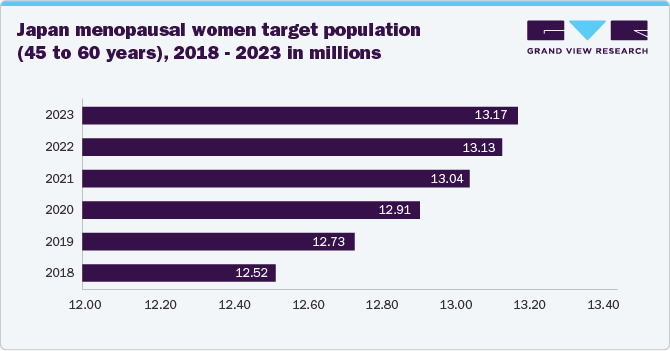

The Asia Pacific menopause industry is anticipated to grow at a significant CAGR over the forecast period. Large population, increasing awareness about menopause, and adoption of dietary supplements are contributing to market growth. In addition, the market's dynamics are influenced by various factors, including cultural attitudes toward menopause, the availability of diverse product formulations, and the growth of e-commerce platforms facilitating consumer access.

The menopause market in China held the largest share in 2024. The country is witnessing key product innovations by key players, focused on using natural sources for obtaining dietary supplements. In March 2023, Aptorum Group Limited, a clinical-stage biopharmaceutical company, launched a dietary supplement, NativusWell, for use by menopausal women. In addition, Aptorum Group Limited partnered with JD.com, an e-commerce platform in China, for the distribution of its products.

India menopause industry is anticipated to register significant growth during the forecast period. According to a study published by Elsevier B.V. in 2021, the average menopausal age in Indian women is 46.6 years, leading to the early onset of hot flashes. There has been an increase in awareness about women’s health in the country, along with a growing trend of adopting Ayurvedic supplements such as Shatavari for easing symptoms such as hot flashes, as well as Ashwagandha-based supplements.

Latin America Menopausal Market Trends

The Latin America menopause market is anticipated to register the fastest CAGR during the forecast period. Technological advancements in the region, coupled with an increase in healthcare awareness, are anticipated to fuel the market. Increasing government spending on healthcare is likely to promote market growth further, as the majority of the population is dependent on government initiatives for pharmaceutical products.

The menopause industry in Brazil accounted for a major share in the Latin America region in 2024. Brazil is witnessing a surge in obesity among women. As per the Global Obesity Observatory, in 2019, obese women accounted for 21% of the female population in Brazil. The rate of obesity is even higher among women aged between 55 and 64. This is directly proportional to the severity of menopausal symptoms such as hot flashes.

MEA Menopause Market Trends

The menopause industry in MEA is anticipated to register considerable growth during the forecast period. Economic development, coupled with high unmet healthcare needs, is fueling the Middle East and Africa market. As per a study by BMC Women's Health in September 2023, the knowledge about symptoms of menopause in this region is average; only 66.8% of women in the UAE admitted to having knowledge about menopause.

The menopause market in South Africa is experiencing the fastest growth during the forecast period. The majority of the aging population in South Africa comprises women who experience menopause during late adulthood. As per an article published by The Conversation in January 2024, around 5.9% of the South African population is over 65 years old. There is a major need to include education regarding menopause and associated symptoms in health programs for women.

Key Menopause Company Insights

Key participants in the menopause industry are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Menopause Companies:

The following are the leading companies in the menopause market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Theramex

- AbbVie, Inc.

- Pure Encapsulations, LLC

- Dr. Reddy’s Laboratories Ltd.

- ReNew Life Holdings Corporation

- Padagis

Recent Developments

-

In January 2024, Bayer AG announced the successful last trial of a menopausal relief drug. The purpose of this drug is to improve sleep and ease hot flashes in postmenopausal women.

-

In December 2024, Theramex acquired products such as Duphaston and Femoston from Viatris in Europe (ex-UK). This product acquisition strengthened the company’s menopause portfolio, helping it offer a wide range of treatments for women across Europe.

-

In March 2023, Theramex entered a licensing partnership with Radius Health, Inc. This agreement aims to help distribute and commercialize ELADYNOS (abaloparatide) for the treatment of osteoporosis in postmenopausal women in the European Economic Area, Brazil, the UK, and Australia.

-

In October 2022, Padagis announced the relaunch of its adjustable dosing spray, Evamist. The purpose of this relaunch is to provide complex, specialized products to patients and customers in the U.S.

Menopause Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.71 billion

Revenue forecast in 2030

USD 24.35 billion

Growth rate

CAGR of 5.42% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Austria, Japan, China, India, Australia, Thailand, South Korea, Taiwan, Malaysia, Singapore, Vietnam, Hong Kong, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Bayer AG; Theramex; AbbVie, Inc.; Pure Encapsulations, LLC; Dr. Reddy’s Laboratories Ltd.; ReNew Life Holdings Corporation; Padagis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Menopause Market Report Segmentation

This report forecasts revenue growth at a global, regional, and country level and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global menopause market report based on treatment and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

OTC pharma products

-

Hormonal

-

Non-hormonal

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

Austria

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Taiwan

-

Malaysia

-

Singapore

-

Vietnam

-

Hong Kong

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global menopause market size was estimated at USD 17.79 billion in 2024 and is expected to reach USD 18.71 billion in 2025.

b. The global menopause market is expected to grow at a compound annual growth rate of 5.42% from 2025 to 2030 to reach USD 24.35 billion by 2030.

b. North America dominated the menopause market with a share of 37.40% in 2024. This is attributable to the high prevalence of menopausal symptoms such as hot flashes, and high healthcare expenditure.

b. Some key players operating in the menopause market include Bayer AG, Theramex, AbbVie, Inc., Pure Encapsulations, LLC, Dr. Reddy’s Laboratories Ltd., ReNew Life Holdings Corporation, Padagis

b. Key factors that are driving the menopause market growth include the high prevalence of vasomotor & other menopausal symptoms and increasing research supporting the advantages of dietary supplements.

b. The dietary supplements segment dominated the menopause market and accounted for a revenue share of more than 94.23% in 2024..

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.