- Home

- »

- Medical Devices

- »

-

Hospital Gowns Market Size, Share & Trends Report, 2030GVR Report cover

![Hospital Gowns Market Size, Share & Trends Report]()

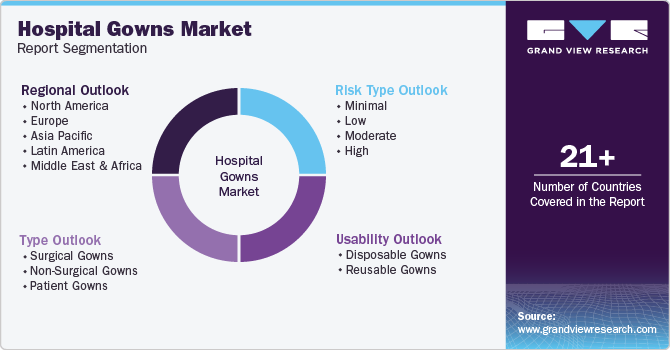

Hospital Gowns Market Size, Share & Trends Analysis Report By Type (Surgical Gowns, Non-Surgical Gowns), By Usability (Disposable Gowns, Reusable Gowns), By Risk Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-640-0

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hospital Gowns Market Size & Trends

The global hospital gowns market size was estimated at USD 2.88 billion in 2023 and is projected to grow at a CAGR of 7.80% from 2024 to 2030. Factors such as the prevalence of Healthcare-Acquired Infections (HAIs), rising demand for patient safety and comfort coupled with increasing healthcare expenditure drive the market growth. For instance, according to the 2022 reports from the WHO, in hospitals that provide acute care, it has been found that approximately 7 out of 100 patients in high-income countries and 15 out of 100 patients in low- and middle-income countries are vulnerable to contracting at least one healthcare-associated infection (HAI) during their hospital stay.

Tragically, on average, one in ten patients affected by HAIs will not survive these infections. Hospital gowns provide overall protection against contamination, effectively lowering the risk of HAIs. They act as a barrier, preventing bacterial and other microbial diseases from entering a patient's body. Consequently, surgeons recommend that patients wear these gowns before undergoing medical procedures. These factors are anticipated to contribute to the growth of the market over the forecast period.

The increasing cases of accidents, including trauma events, burns, and road accidents, had a positive impact on the demand for hospital gowns in the hospitals. Accidents often result in severe injuries that require immediate medical attention. This leads to an increase in hospital admissions, and each admitted patient typically requires a hospital gown as part of their medical attire. For instance, as per the data reported by the U.S. Department of Transportation’s Traffic Safety Facts Sheet of New Jersey, in the year 2022, there were 701 reported deaths due to car accidents, accounting for 1.64% of the total 42,795 traffic-related fatalities reported nationwide during the same period. New Jersey experienced a slight uptick in car accident deaths from the previous year (2021) to 2022.

Road accidents and other traumatic events frequently require immediate medical attention. In these critical situations, hospitals must quickly supply gowns for patients, and the standard attire for medical examinations and treatments is the hospital gown. As the number of accidents increases, there is a growing need to enhance and expand healthcare facilities to cope with the rising demand for medical services. Consequently, this surge in healthcare development is likely to lead to a higher demand for hospital gowns.

The novel product launch for the product portfolio expansion boosts the market. For instance, in October 2023, Starlight Children's Foundation, in partnership with the MoneyGram Haas F1 Team located in Kannapolis, introduced a special Starlight Hospital Gown with the VF-23 theme at St. David's Children's Hospital, coinciding with the 2023 U.S. Grand Prix in Austin, Texas. Following the launch, these distinctive gowns were provided to a children's hospital in Las Vegas in preparation for the Formula 1 Las Vegas Grand Prix in November.

Traditional hospital gowns can be quite uncomfortable, causing pediatric patients to feel vulnerable or embarrassed during an already overwhelming experience. In contrast, Starlight Gowns are crafted from high-quality fabric that provides a comfortable feel against the skin. These gowns feature side ties and plastic snaps on each shoulder, allowing for easy access during medical procedures. Such initiatives drive the industry’s growth shortly.

Moreover, the rising demand for patient safety and comfort plays a significant role in driving the market. Disposable and antimicrobial hospital gowns help minimize the risk of infections by providing a barrier between patients and potentially harmful microorganisms. This is particularly crucial for patients with weakened immune systems or those undergoing surgical procedures.

As patient-centered care becomes a priority in healthcare, there is an increased focus on designing gowns that provide better comfort and allow for easier mobility. This has led to the development of gowns offering improved fit, flexibility, and features like ties or closures for better control and coverage. These considerations fuel the market for hospital gowns that prioritize patient comfort and dignity.

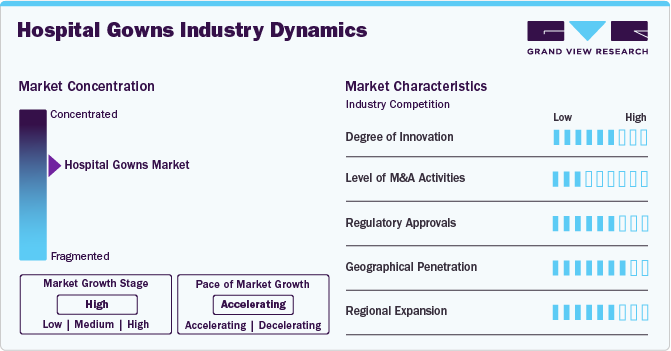

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market is characterized by a high degree of growth owing to increasing investment in R&D programs, and increasing emphasis on patient comfort and dignity, leading to a growing demand for more comfortable and user-friendly hospital gowns. Moreover, technological advancements in textile materials are playing a pivotal role, enabling the development of innovative, antimicrobial fabrics for hospital gowns.

Key strategies implemented by players in the market are new product launches, regulatory approval, acquisitions, partnerships, and other strategies. For instance, in January 2022, LASAK s.r.o. received UNE EN 13795 certification and approval for its surgical and protective gown Europa for use in clean rooms and operating theatres. The gown is made of textured polyester microfibers, features a knitted collar and cuffs for sleeves, water-resistant coupled with permanent antistatic properties.

Development of hospital gowns with fluid-resistant and antimicrobial material more prevalent to enhance infection control and boost market growth. Technological advancements have also played a role in the evolution of hospital gowns. Smart textiles, equipped with sensors to monitor patient vital signs or deliver therapeutic treatments, are emerging as a cutting-edge solution. These innovations not only improve patient experience but also contribute to more efficient and effective healthcare delivery. In addition, some companies are exploring the integration of antimicrobial properties into the fabric to further address infection control concerns.

Mergers and acquisition activities in the market are increasing and witness similar growth during the analysis timeframe. Market key players are acquiring developmental-stage companies to improve their product portfolios and better serve a larger patient base. Market key players aimed to consolidate production capabilities, streamline supply chains, and leverage the acquired company's expertise in developing advanced, comfortable, and infection-resistant hospital gown designs. The synergies created through such transactions are expected to result in a more robust and competitive presence in the hospital gowns industry, enabling the merged entity to offer a comprehensive range of products that meet the stringent standards of modern healthcare environments.

Regulatory bodies such as the FDA in the U.S., the European Medicines Agency (EMA) in Europe, and other regional health authorities play a crucial role in overseeing the compliance of hospital gowns with established standards. Strict regulations require elevated standards for gown materials, design, and performance. This results in the creation of gowns that are not only safer but also more effective in safeguarding both patients and healthcare workers from infections and other risks associated with healthcare.

North America holds the largest market share, owing to factors such as a high number of surgeries, rising healthcare spending, stringent regulations, and a high level of awareness regarding infection control measures that contribute to this dominance in this region. The dominance of the region is reinforced by the presence of leading hospital gown manufacturers in this region. Moreover, countries such as China and India are major contributors to the Asia Pacific market due to their large population base and expanding healthcare facilities. The increasing number of hospitals, clinics, and healthcare centers in these countries has led to a higher demand for hospital gowns to maintain hygiene standards and ensure patient safety.

The market comprises a large number of hospital gown manufacturers specializing in surgical gowns, non-surgical gowns, and patient gowns manufacturing leading to a fragmented market scenario.

The market has witnessed significant growth and is expected to expand further across various regions in response to increasing healthcare demands. Market players are strategically planning regional expansions to capitalize on emerging opportunities and cater to rising healthcare needs. In recent times, there has been a notable focus on penetrating new markets and strengthening existing footholds. In addition, the hospital gowns industry is witnessing a gradual shift towards disposable hospital gowns, driven by the increasing prevalence of contagious diseases.

Type Insights

Surgical gowns segment led the market and accounted for 52.01% of the total revenue share in 2023. Surgical gowns are designed to protect against various contaminations and infections during surgical procedures. They are made with barrier qualities, low particle release rates, purity, and tensile strength in mind. They also help to prevent illness, microbial, and fungal spread. They come in two varieties: reusable and disposable. Over the projected period, the market is expected to be driven by an increase in the number of surgical procedures and an incidence of hospital-acquired infections.

Moreover, the novel product launch by the industry's key players to enhance the product portfolio drives the segment growth. For instance, in November 2023, Cardinal Health launched SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets in the U.S. This innovative gown is specifically crafted to offer surgical teams a secure and convenient means of accessing instruments within the operating room.

Exclusively offered by Cardinal Health, the gown is structured to accommodate one recommended instrument in each pocket during surgical procedures. This design not only enhances the efficiency of handling instruments but also empowers clinical teams to concentrate on delivering safe and attentive patient care. Novel products often bring innovation to the market by introducing new features, materials, or designs that improve the functionality of hospital gowns. Such initiatives are expected to boost the market growth.

Patient gowns segment is projected to witness the highest growth rate over the forecast period. Long-term patient admissions in hospitals and clinics need the use of patient gowns. They are typically constructed with designs and fabrics that aid patient comfort and safety, and they are available in both reusable and disposable versions. Hospitals are emphasizing implementing infection control measures involving the adoption of gowns crafted from easily cleanable and disinfectable materials.

In addition, some hospitals are integrating antimicrobial fabrics into their gowns to further minimize the risk of infections. Modern patient gowns are crafted with materials that prioritize not only skin comfort but also enhanced airflow. This dual focus aims to minimize the risk of overheating, ultimately contributing to an improved overall experience for patients. Over the projection period, such factors are expected to promote segment growth.

Risk Type Insights

High risk segment dominated the market with the largest revenue share in 2023. High risk type hospital gowns play a pivotal role in propelling the market due to their specialized design and advanced features tailored to meet the unique needs of patients facing elevated health risks. These gowns are engineered to provide superior protection against infectious agents and contaminants, making them indispensable in environments where the risk of transmission is heightened, such as isolation units and intensive care settings. The growing awareness of healthcare-associated infections and the need for stringent infection control measures have amplified the demand for high-risk hospital gowns.

In addition, during surgical and fluid-intensive procedures, high-risk hospital gowns can assist guard against germs and infectious diseases. High tensile strength, tear resistance, and breathability are all features of these gowns. Over the forecast period, rising hospital admissions and research activities are expected to enhance segment growth. For instance, as per the data reported by Coronavirus (COVID-19) Infection Survey on March 2023, in England, the overall rate of hospital admissions for people with confirmed COVID-19 increased, reaching 10.62 per 100,000 individuals.

In addition, the admission rates for both the intensive care unit (ICU) and high dependency unit (HDU) remained relatively low, at 0.28 per 100,000 people. As the number of people being admitted to hospitals continues to rise, there is a growing need for medical care, resulting in an increased demand for hospital gowns. Each patient admitted to a hospital requires multiple gowns throughout their stay, adding to the demand for hospital gowns driving the segment growth.

Minimal risk gowns segment is projected to witness the highest growth rate over the forecast period. Minimal risk hospital gowns are designed with a greater emphasis on patient comfort, featuring better fit, softer materials, and improved coverage. This focus on patient comfort can drive healthcare facilities to choose these gowns over traditional options, boosting market growth. In basic care units, standard medical units, standard isolation, and as cover robes for visitors, as well as for research and academic purposes, minimal risk hospital gowns are utilized. They aid in the prevention of bacterial and fungal diseases. Hepatitis B and C, Ebola hemorrhagic fever, and HIV are all transmitted by contact with tainted bodily fluids. Due to the nature of their employment, healthcare workers are exposed to such infections frequently.

For instance, as per the data reported by the World Health Organization (WHO) in 2023, approximately 354 million individuals globally are living with hepatitis B or C, with the majority facing barriers to accessing testing and treatment. According to a study by the WHO, implementing vaccination, diagnostic tests, medications, and education campaigns could potentially prevent around 4.5 million premature deaths in low- and middle-income countries by 2030. Thus, the increasing incidence of hepatitis infections drives the demand for minimal-risk gowns.

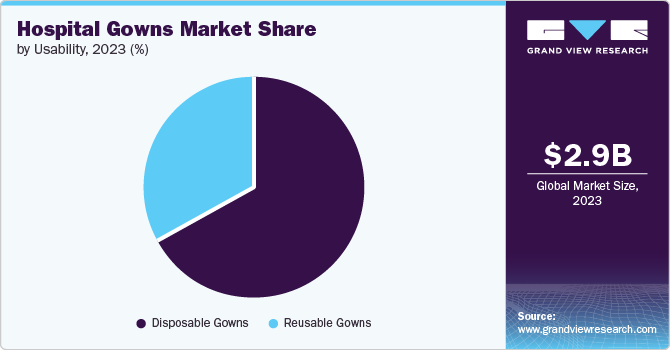

Usability Insights

Disposable gowns segment dominated the market with the largest revenue share in 2023. Disposable hospital gowns are a cost-effective solution because they are only used once. These gowns are recommended over reusable gowns in terms of safety and quality. Using disposable gowns also saves money on the costs of washing, bleaching, and conditioning. Disposable gowns are made from hypoallergenic and dermatologically certified materials. In addition, the data supported by Winner Medical Co., Ltd. in October 2022, states that a disposable surgical gown is essential for preserving the cleanliness of the operating room by preventing contamination.

It plays a vital role in maintaining a sterile environment and helps ensure that the operating room stays free from dirt and germs. Usually, these gowns are disposed of after use, a practice that greatly reduces the risk of cross-contamination between patients and healthcare personnel. Disposable gowns also serve to limit the danger of infection and contamination from one patient to the next. Over the projection term, all these benefits are expected to help enhance segment growth.

Reusable gowns segment is projected to witness the highest growth rate over the forecast period. Liquid-resistant polyester or carbon fabric is used to make reusable gowns. They're biocompatible, tear-resistant, and highly sterilizable, and they can help prevent nosocomial infections and contaminated liquids from entering the hospital. Moreover, opting for reusable hospital gowns is in line with the worldwide effort to adopt more eco-friendly practices. These gowns play a crucial role in minimizing medical waste when compared to disposable gowns.

Although the initial investments in reusable gowns may be higher, their extended lifespan and ability to endure multiple rounds of washing and sterilization make them a cost-effective choice in the long term. This not only benefits the environment by reducing waste but also results in substantial savings for healthcare facilities, making reusable gowns an appealing and practical option driving the demand for reusable hospital gowns.

Regional Insights

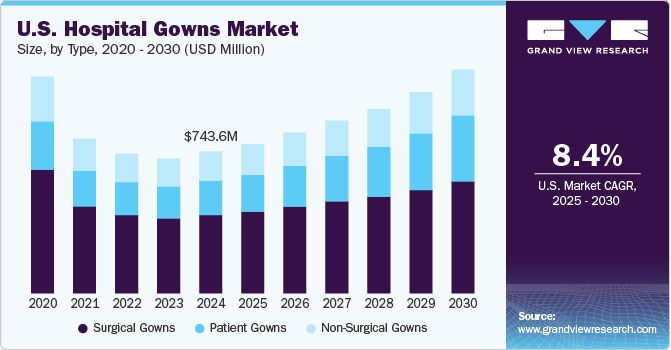

North America hospital gowns market accounted for 29.66% of the global market in 2023 and is expected to continue its dominance over the forecast period. The demand for hospital gowns in North America is predicted to rise as the number of surgeries and healthcare personnel rises. For instance, as per the data published by the Journal of Obstetrics and Gynecology Research in March 2023, there is a rising global worry about the health impacts of unnecessary or unsafe medical procedures. Predictions for the year 2030 indicated that the frequency of cesarean sections will keep rising in the coming decade, with both underutilization and excessive use expected to persist.

It was projected that by 2030, at the current rate, approximately 28.5% of women globally will undergo cesarean sections, amounting to 38 million procedures annually. This prevalence is expected to vary from 7.1% in Sub-Saharan Africa to 63.4% in Eastern Asia region. Moreover, by delivering improvements and adjustments, major market players in the region are attempting to boost the use of hospital gowns. Furthermore, rising rates of hospital-acquired infections are predicted to increase demand for hospital gowns. Over the forecast period, all these factors are expected to propel the market forward.

Asia Pacific Hospital Gowns Market Trends

The hospital gowns market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. Increased healthcare infrastructure development in this area, as well as raising awareness about patient safety and sanitation needs, is projected to enhance the market. The majority of Indian hospitals use third-party contracts to manage their linen and laundry needs. As people become more aware of the necessity of maintaining hygiene in hospitals and its role in decreasing disease transmission, the demand for better linen clothes in hospitals has increased in this region.

Malaysia hospital gown market is witnessing significant growth owing to the growth of the healthcare sector, coupled with the increasing emphasis on patient care. These gowns serve as essential attire for patients undergoing medical examinations, treatments, and during hospital stays, adhering to the standards set by medical facilities.

Key Hospital Gowns Company Insights

The market has witnessed notable trends in recent years, significantly impacting the activities of top players in the healthcare industry. One prominent trend is the increasing demand for more comfortable and patient-friendly hospital gowns. Patients and healthcare providers alike are emphasizing the need for gowns that prioritize comfort, dignity, and ease of use. This shift in consumer preferences has led top industry players to invest in innovative designs and materials, moving away from traditional, generic hospital gowns.

Moreover, there is a growing focus on infection prevention and control within healthcare practice, driving the adoption of antimicrobial and disposable hospital gowns. This trend has prompted leading companies to develop and introduce advanced gown technologies that help reduce the risk of hospital-acquired infections. In response to sustainability concerns, eco-friendly and reusable hospital gowns have gained traction, with top players incorporating environmentally conscious practices into their product development and manufacturing processes. This aligns with the broader industry movement towards sustainable healthcare practices.

The impact on the activities of top players is evident in their strategic initiatives, including mergers, acquisitions, and partnerships to strengthen their position in the evolving market. Companies are investing in research and development to create gowns that meet the dual objectives of patient comfort and infection control. In addition, marketing efforts are being adjusted to highlight the features and benefits of these new-age hospital gowns, reflecting the changing expectations of both healthcare professionals and patients.

Key Hospital Gowns Companies:

The following are the leading companies in the hospital gowns market. These companies collectively hold the largest market share and dictate industry trends.

- Angelica Corporation

- Cardinal Health

- Standard Textile Co., Inc.

- Medline Industries, Inc.

- AmeriPride Services Inc.

- 3M

Recent Developments

-

In March 2024, Children's Minnesota partnered with Henna & Hijabs to launch modest hospital gowns designed specifically for children. The gowns are designed with intentional features to provide appropriate modest coverage while allowing medical care teams to perform necessary procedures. These gowns are expected to improve the hospital experience for many children, mainly those from culturally diverse backgrounds.

-

In November 2023, Cardinal Health recently introduced its SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets in the U.S. This innovative gown is specifically designed to offer surgical teams a secure and convenient means of accessing instruments during procedures in the operating room. Available exclusively from Cardinal Health, the gown is crafted to accommodate one recommended instrument per pocket, streamlining handling processes during surgeries. This design aims to enhance efficiency for clinical teams, allowing them to concentrate more on delivering safe and attentive patient care.

-

In January 2023, the Association for the Advancement of Medical Instrumentation (AAMI) recently published an updated American National Standard that provides vital information for both manufacturers and users of PPE in the healthcare sector. Known as ANSI/AAMI PB70, this standard outlines the performance requirements for various items like surgical gowns, isolation gowns, protective apparel, surgical drapes, and drape accessories. The primary goal is to ensure the effectiveness of these items in safeguarding healthcare workers during surgeries and other medical procedures.

-

In July 2022, Virginia Hospital System pioneered the creation of an eco-friendly, reusable gown that not only enhances comfort but also prioritizes safety. These gowns boast improved fitting, making them more comfortable to wear, and their design ensures a cooler experience. In addition, the gown is easier to put on and take off, simplifying the process for healthcare professionals. A notable feature is its ability to be reused up to 100 times, contributing to sustainability efforts.

-

In March 2022, Invenio launched the V90 surgical gown series, a cutting-edge line of surgical gowns. Packed with advanced features, these gowns boast sonic welding throughout, ensuring durability. The inclusion of soft knit cuffs and a convenient hook-and-loop closure not only enhances comfort but also allows for effortless adjustment and comprehensive coverage. The series offers a variety of performance options, including non-reinforced, fabric, and film-reinforced gowns, providing users with the flexibility to select the gown that best suits their specific procedure.

Hospital Gowns Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.03 billion

Revenue forecast in 2030

USD 4.75 billion

Growth rate

CAGR of 7.80% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, usability, risk type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medline Industries, Inc.; Standard Textile Co., Inc.; Angelica Corporation; AmeriPride Services Inc.; 3M; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Gowns Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital gowns market report based on type, usability, risk type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Gowns

-

Non-Surgical Gowns

-

Patient Gowns

-

-

Usability Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable Gowns

-

Low

-

Average

-

Premium

-

-

Reusable Gowns

-

Low

-

Average

-

Premium

-

-

-

Risk Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Minimal

-

Low

-

Moderate

-

High

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital gowns market size was estimated at USD 2.88 billion in 2023 and is expected to reach USD 3.03 billion in 2024.

b. The global hospital gowns market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 4.75 billion by 2030.

b. North America dominated the hospital gowns market with a share of 29.66% in 2023. This is attributable to the rising number of surgeries and the increasing prevalence of cardiovascular diseases.

b. Some key players operating in the hospital gowns market include Medline Industries, Inc., Standard Textile Co., Inc., Angelica, AmeriPride Services Inc., 3M, and Cardinal Health.

b. Key factors that are driving the hospital gowns market growth include an increasing number of surgical procedures, rising incidence of Hospital Acquired Infections (HAIs), and the outbreak of various epidemics and pandemics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."