- Home

- »

- Medical Devices

- »

-

Hospital Gowns Market Size, Share & Growth Report, 2030GVR Report cover

![Hospital Gowns Market Size, Share & Trends Report]()

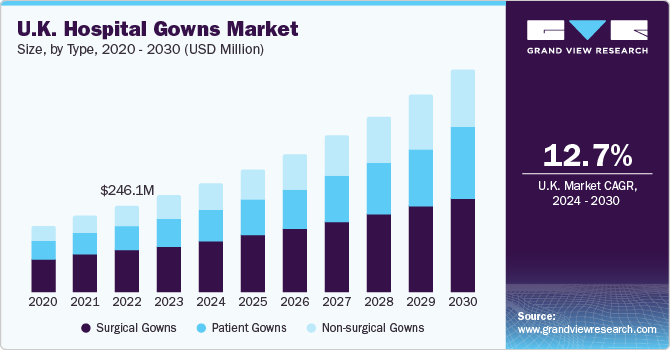

Hospital Gowns Market Size, Share & Trends Analysis Report By Type (Surgical Gowns, Non-surgical Gowns), By Usability (Disposable Gowns, Reusable Gowns), By Risk Type, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-640-0

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hospital Gowns Market Size & Trends

The global hospital gowns market size was estimated at USD 5.48 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 12.92% from 2024 to 2030. Factors such as the prevalence of Healthcare-Acquired Infections (HAIs), rising demand for patient safety and comfort coupled with increasing healthcare expenditure drive the market growth. For instance, according to the 2022 reports from the WHO, in hospitals that provide acute care, it has been found that approximately 7 out of 100 patients in high-income countries and 15 out of 100 patients in low- and middle-income countries are vulnerable to contracting at least one healthcare-associated infection (HAI) during their hospital stay.

Tragically, on average, one in ten patients affected by HAIs will not survive these infections. Hospital gowns provide overall protection against contamination, effectively lowering the risk of HAIs. They act as a barrier, preventing bacterial and other microbial diseases from entering a patient's body. Consequently, surgeons recommend that patients wear these gowns before undergoing medical procedures. These factors are anticipated to contribute to the growth of the market over the forecast period.

The increasing cases of accidents, including trauma events, burns, and road accidents, had a positive impact on the demand for hospital gowns in the hospitals. Accidents often result in severe injuries that require immediate medical attention. This leads to an increase in hospital admissions, and each admitted patient typically requires a hospital gown as part of their medical attire. For instance, as per the data reported by the U.S. Department of Transportation’s Traffic Safety Facts Sheet of New Jersey, in the year 2022 , there were 701 reported deaths due to car accidents, accounting for 1.64% of the total 42,795 traffic-related fatalities reported nationwide during the same period. New Jersey experienced a slight uptick in car accident deaths from the previous year (2021) to 2022.

Road accidents and other traumatic events frequently require immediate medical attention. In these critical situations, hospitals must quickly supply gowns for patients, and the standard attire for medical examinations and treatments is the hospital gown. As the number of accidents increases, there is a growing need to enhance and expand healthcare facilities to cope with the rising demand for medical services. Consequently, this surge in healthcare development is likely to lead to a higher demand for hospital gowns.

The novel product launch for the product portfolio expansion boosts the market. For instance, in October 2023 , Starlight Children's Foundation, in partnership with the MoneyGram Haas F1 Team located in Kannapolis, introduced a special Starlight Hospital Gown with the VF-23 theme at St. David's Children's Hospital, coinciding with the 2023 U.S. Grand Prix in Austin, Texas. Following the launch, these distinctive gowns were provided to a children's hospital in Las Vegas in preparation for the Formula 1 Las Vegas Grand Prix in November. Traditional hospital gowns can be quite uncomfortable, causing pediatric patients to feel vulnerable or embarrassed during an already overwhelming experience. In contrast, Starlight Gowns are crafted from high-quality fabric that provides a comfortable feel against the skin. These gowns feature side ties and plastic snaps on each shoulder, allowing for easy access during medical procedures. Such initiatives drive the industry’s growth shortly.

Moreover, the rising demand for patient safety and comfort plays a significant role in driving the market. Disposable and antimicrobial hospital gowns help minimize the risk of infections by providing a barrier between patients and potentially harmful microorganisms. This is particularly crucial for patients with weakened immune systems or those undergoing surgical procedures. As patient-centered care becomes a priority in healthcare, there is an increased focus on designing gowns that provide better comfort and allow for easier mobility. This has led to the development of gowns offering improved fit, flexibility, and features like ties or closures for better control and coverage. These considerations fuel the market for hospital gowns that prioritize patient comfort and dignity.

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The market is characterized by a high degree of growth owing to increasing investment in R&D programs, and increasing emphasis on patient comfort and dignity, leading to a growing demand for more comfortable and user-friendly hospital gowns. Moreover, technological advancements in textile materials are playing a pivotal role, enabling the development of innovative, antimicrobial fabrics for hospital gowns.

Key strategies implemented by players in the market are new product launches, regulatory approval, acquisitions, partnerships, and other strategies. For instance, in January 2022 , LASAK s.r.o. received UNE EN 13795 certification and approval for its surgical and protective gown Europa for use in clean rooms and operating theatres. The gown is made of textured polyester microfibers, features a knitted collar and cuffs for sleeves, water-resistant coupled with permanent antistatic properties.

Development of hospital gowns with fluid-resistant and antimicrobial material more prevalent to enhance infection control and boost market growth. Technological advancements have also played a role in the evolution of hospital gowns. Smart textiles, equipped with sensors to monitor patient vital signs or deliver therapeutic treatments, are emerging as a cutting-edge solution. These innovations not only improve patient experience but also contribute to more efficient and effective healthcare delivery. In addition, some companies are exploring the integration of antimicrobial properties into the fabric to further address infection control concerns.

Mergers and acquisition activities in the market are increasing and witness similar growth during the analysis timeframe. Market key players are acquiring developmental-stage companies to improve their product portfolios and better serve a larger patient base. Market key players aimed to consolidate production capabilities, streamline supply chains, and leverage the acquired company's expertise in developing advanced, comfortable, and infection-resistant hospital gown designs. The synergies created through such transactions are expected to result in a more robust and competitive presence in the hospital gowns industry, enabling the merged entity to offer a comprehensive range of products that meet the stringent standards of modern healthcare environments.

Regulatory bodies such as the FDA in the U.S., the European Medicines Agency (EMA) in Europe, and other regional health authorities play a crucial role in overseeing the compliance of hospital gowns with established standards. Strict regulations require elevated standards for gown materials, design, and performance. This results in the creation of gowns that are not only safer but also more effective in safeguarding both patients and healthcare workers from infections and other risks associated with healthcare.

North America holds the largest market share, owing to factors such as a high number of surgeries, rising healthcare spending, stringent regulations, and a high level of awareness regarding infection control measures that contribute to this dominance in this region. The dominance of the region is reinforced by the presence of leading hospital gown manufacturers in this region. Moreover, countries such as China and India are major contributors to the Asia Pacific market due to their large population base and expanding healthcare facilities. The increasing number of hospitals, clinics, and healthcare centers in these countries has led to a higher demand for hospital gowns to maintain hygiene standards and ensure patient safety.

The market comprises a large number of hospitalgownmanufacturers specializing in surgical gowns, non-surgical gowns, and patient gowns manufacturing leading to a fragmented market scenario.

The market has witnessed significant growth and is expected to expand further across various regions in response to increasing healthcare demands. Market players are strategically planning regional expansions to capitalize on emerging opportunities and cater to rising healthcare needs. In recent times, there has been a notable focus on penetrating new markets and strengthening existing footholds. In addition, the hospital gowns industry is witnessing a gradual shift towards disposable hospital gowns, driven by the increasing prevalence of contagious diseases.

Type Insights

Surgical gowns segment led the market and accounted for 52.17% of the total revenue share in 2023. Surgical gowns are designed to protect against various contaminations and infections during surgical procedures. They are made with barrier qualities, low particle release rates, purity, and tensile strength in mind. They also help to prevent illness, microbial, and fungal spread. They come in two varieties: reusable and disposable. Over the projected period, the market is expected to be driven by an increase in the number of surgical procedures and an incidence of hospital-acquired infections.

Moreover, the novel product launch by the industry's key players to enhance the product portfolio drives the segment growth. For instance, in November 2023 , Cardinal Health launched SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets in the U.S. This innovative gown is specifically crafted to offer surgical teams a secure and convenient means of accessing instruments within the operating room. Exclusively offered by Cardinal Health, the gown is structured to accommodate one recommended instrument in each pocket during surgical procedures. This design not only enhances the efficiency of handling instruments but also empowers clinical teams to concentrate on delivering safe and attentive patient care. Novel products often bring innovation to the market by introducing new features, materials, or designs that improve the functionality of hospital gowns. Such initiatives are expected to boost the market growth.

Patient gowns segment is projected to witness the highest growth rate over the forecast period. Long-term patient admissions in hospitals and clinics need the use of patient gowns. They are typically constructed with designs and fabrics that aid patient comfort and safety, and they are available in both reusable and disposable versions. Hospitals are emphasizing implementing infection control measures involving the adoption of gowns crafted from easily cleanable and disinfectable materials. In addition, some hospitals are integrating antimicrobial fabrics into their gowns to further minimize the risk of infections. Modern patient gowns are crafted with materials that prioritize not only skin comfort but also enhanced airflow. This dual focus aims to minimize the risk of overheating, ultimately contributing to an improved overall experience for patients. Over the projection period, such factors are expected to promote segment growth.

Risk Type Insights

High risk segment dominated the market with the largest revenue share in 2023. High risk type hospital gowns play a pivotal role in propelling the market due to their specialized design and advanced features tailored to meet the unique needs of patients facing elevated health risks. These gowns are engineered to provide superior protection against infectious agents and contaminants, making them indispensable in environments where the risk of transmission is heightened, such as isolation units and intensive care settings. The growing awareness of healthcare-associated infections and the need for stringent infection control measures have amplified the demand for high-risk hospital gowns.

In addition, during surgical and fluid-intensive procedures, high-risk hospital gowns can assist guard against germs and infectious diseases. High tensile strength, tear resistance, and breathability are all features of these gowns. Over the forecast period, rising hospital admissions and research activities are expected to enhance segment growth. For instance, as per the data reported by Coronavirus (COVID-19) Infection Survey on March 2023, in England, the overall rate of hospital admissions for people with confirmed COVID-19 increased, reaching 10.62 per 100,000 individuals. In addition, the admission rates for both the intensive care unit (ICU) and high dependency unit (HDU) remained relatively low, at 0.28 per 100,000 people. As the number of people being admitted to hospitals continues to rise, there is a growing need for medical care, resulting in an increased demand for hospital gowns. Each patient admitted to a hospital requires multiple gowns throughout their stay, adding to the demand for hospital gowns driving the segment growth.

Minimal risk gowns segment is projected to witness the highest growth rate over the forecast period. Minimal risk hospital gowns are designed with a greater emphasis on patient comfort, featuring better fit, softer materials, and improved coverage. This focus on patient comfort can drive healthcare facilities to choose these gowns over traditional options, boosting market growth. In basic care units, standard medical units, standard isolation, and as cover robes for visitors, as well as for research and academic purposes, minimal risk hospital gowns are utilized. They aid in the prevention of bacterial and fungal diseases. Hepatitis B and C, Ebola hemorrhagic fever, and HIV are all transmitted by contact with tainted bodily fluids. Due to the nature of their employment, healthcare workers are exposed to such infections frequently.

For instance, as per the data reported by the World Health Organization (WHO) in 2023 , approximately 354 million individuals globally are living with hepatitis B or C, with the majority facing barriers to accessing testing and treatment. According to a study by the WHO, implementing vaccination, diagnostic tests, medications, and education campaigns could potentially prevent around 4.5 million premature deaths in low- and middle-income countries by 2030. Thus, the increasing incidence of hepatitis infections drives the demand for minimal-risk gowns.

Usability Insights

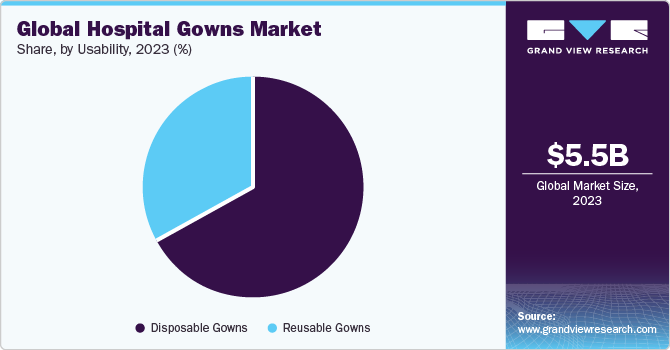

Disposable gowns segment dominated the market with the largest revenue share in 2023. Disposable hospital gowns are a cost-effective solution because they are only used once. These gowns are recommended over reusable gowns in terms of safety and quality. Using disposable gowns also saves money on the costs of washing, bleaching, and conditioning. Disposable gowns are made from hypoallergenic and dermatologically certified materials. In addition, the data supported by Winner Medical Co., Ltd. in October 2022 , states that a disposable surgical gown is essential for preserving the cleanliness of the operating room by preventing contamination. It plays a vital role in maintaining a sterile environment and helps ensure that the operating room stays free from dirt and germs. Usually, these gowns are disposed of after use, a practice that greatly reduces the risk of cross-contamination between patients and healthcare personnel. Disposable gowns also serve to limit the danger of infection and contamination from one patient to the next. Over the projection term, all these benefits are expected to help enhance segment growth.

Reusable gowns segment is projected to witness the highest growth rate over the forecast period. Liquid-resistant polyester or carbon fabric is used to make reusable gowns. They're biocompatible, tear-resistant, and highly sterilizable, and they can help prevent nosocomial infections and contaminated liquids from entering the hospital. Moreover, opting for reusable hospital gowns is in line with the worldwide effort to adopt more eco-friendly practices. These gowns play a crucial role in minimizing medical waste when compared to disposable gowns. Although the initial investments in reusable gowns may be higher, their extended lifespan and ability to endure multiple rounds of washing and sterilization make them a cost-effective choice in the long term. This not only benefits the environment by reducing waste but also results in substantial savings for healthcare facilities, making reusable gowns an appealing and practical option driving the demand for reusable hospital gowns.

Regional Insights

North America accounted for 29.66% of the global market in 2023 and is expected to continue its dominance over the forecast period. The demand for hospital gowns in North America is predicted to rise as the number of surgeries and healthcare personnel rises. For instance, as per the data published by the Journal of Obstetrics and Gynecology Research in March 2023 , there is a rising global worry about the health impacts of unnecessary or unsafe medical procedures. Predictions for the year 2030 indicated that the frequency of cesarean sections will keep rising in the coming decade, with both underutilization and excessive use expected to persist. It was projected that by 2030, at the current rate, approximately 28.5% of women globally will undergo cesarean sections, amounting to 38 million procedures annually. This prevalence will vary from 7.1% in Sub-Saharan Africa to 63.4% in Eastern Asia region. Moreover, by delivering improvements and adjustments, major market players in the region are attempting to boost the use of hospital gowns. Furthermore, rising rates of hospital-acquired infections are predicted to increase demand for hospital gowns. Over the forecast period, all these factors are expected to propel the market forward.

Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. Increased healthcare infrastructure development in this area, as well as raising awareness about patient safety and sanitation needs, is projected to enhance the market. The majority of Indian hospitals use third-party contracts to manage their linen and laundry needs. As people become more aware of the necessity of maintaining hygiene in hospitals and its role in decreasing disease transmission, the demand for better linen clothes in hospitals has increased in this region.

Malaysia Hospital Gown Market: These gowns serve as essential attire for patients undergoing medical examinations, treatments, and during hospital stays, adhering to the standards set by medical facilities. The growth of the healthcare sector, coupled with the increasing emphasis on patient care, has propelled the market for hospital gowns in Malaysia.

Key Hospital Gowns Company Insights

The market has witnessed notable trends in recent years, significantly impacting the activities of top players in the healthcare industry. One prominent trend is the increasing demand for more comfortable and patient-friendly hospital gowns. Patients and healthcare providers alike are emphasizing the need for gowns that prioritize comfort, dignity, and ease of use. This shift in consumer preferences has led top industry players to invest in innovative designs and materials, moving away from traditional, generic hospital gowns.

Moreover, there is a growing focus on infection prevention and control within healthcare practice, driving the adoption of antimicrobial and disposable hospital gowns. This trend has prompted leading companies to develop and introduce advanced gown technologies that help reduce the risk of hospital-acquired infections. In response to sustainability concerns, eco-friendly and reusable hospital gowns have gained traction, with top players incorporating environmentally conscious practices into their product development and manufacturing processes. This aligns with the broader industry movement towards sustainable healthcare practices.

The impact on the activities of top players is evident in their strategic initiatives, including mergers, acquisitions, and partnerships to strengthen their position in the evolving hospital gowns market. Companies are investing in research and development to create gowns that meet the dual objectives of patient comfort and infection control. In addition, marketing efforts are being adjusted to highlight the features and benefits of these new-age hospital gowns, reflecting the changing expectations of both healthcare professionals and patients.

Key Hospital Gowns Companies:

The following are the leading companies in the hospital gowns market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these hospital gowns companies are analyzed to map the supply network.

- Angelica Corporation

- Cardinal Health

- Standard Textile Co., Inc.

- Medline Industries, Inc.

- AmeriPride Services Inc.

- 3M

Recent Developments

-

In November 2023 , Cardinal Health recently introduced its SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets in the U.S. This innovative gown is specifically designed to offer surgical teams a secure and convenient means of accessing instruments during procedures in the operating room. Available exclusively from Cardinal Health, the gown is crafted to accommodate one recommended instrument per pocket, streamlining handling processes during surgeries. This design aims to enhance efficiency for clinical teams, allowing them to concentrate more on delivering safe and attentive patient care.

-

In January 2023 , the Association for the Advancement of Medical Instrumentation (AAMI) recently published an updated American National Standard that provides vital information for both manufacturers and users of PPE in the healthcare sector. Known as ANSI/AAMI PB70, this standard outlines the performance requirements for various items like surgical gowns, isolation gowns, protective apparel, surgical drapes, and drape accessories. The primary goal is to ensure the effectiveness of these items in safeguarding healthcare workers during surgeries and other medical procedures.

-

In July 2022 , Virginia Hospital System pioneered the creation of an eco-friendly, reusable gown that not only enhances comfort but also prioritizes safety. These gowns boast improved fitting, making them more comfortable to wear, and their design ensures a cooler experience. In addition, the gown is easier to put on and take off, simplifying the process for healthcare professionals. A notable feature is its ability to be reused up to 100 times, contributing to sustainability efforts.

-

In March 2022 , Invenio launched the V90 surgical gown series, a cutting-edge line of surgical gowns. Packed with advanced features, these gowns boast sonic welding throughout, ensuring durability. The inclusion of soft knit cuffs and a convenient hook-and-loop closure not only enhances comfort but also allows for effortless adjustment and comprehensive coverage. The series offers a variety of performance options, including non-reinforced, fabric, and film-reinforced gowns, providing users with the flexibility to select the gown that best suits their specific procedure.

Hospital Gowns Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.18 billion

Revenue forecast in 2030

USD 12.80 billion

Growth rate

CAGR of 12.92% from 2024 to 2030

Base year

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, usability, risk type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medline Industries, Inc.; Standard Textile Co., Inc.; Angelica Corporation; AmeriPride Services Inc.; 3M; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Gowns Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital gowns market report based on type, usability, risk type, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Surgical Gowns

-

Non-surgical Gowns

-

Patient Gowns

-

-

Usability Outlook (Revenue, USD Million, 2017 - 2030)

-

Disposable Gowns

-

Low

-

Average

-

Premium

-

-

Reusable Gowns

-

Low

-

Average

-

Premium

-

-

-

Risk Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Minimal

-

Low

-

Moderate

-

High

-

-

Region Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital gowns market size was estimated at USD 5.48 billion in 2023 and is expected to reach USD 6.18 billion in 2024.

b. The global hospital gowns market is expected to grow at a compound annual growth rate of 12.92% from 2024 to 2030 to reach USD 12.80 billion by 2030.

b. North America dominated the hospital gowns market with a share of 29.66% in 2023. This is attributable to the rising number of surgeries and the increasing prevalence of cardiovascular diseases.

b. Some key players operating in the hospital gowns market include Medline Industries, Inc., Standard Textile Co., Inc., Angelica, AmeriPride Services Inc., 3M, and Cardinal Health.

b. Key factors that are driving the hospital gowns market growth include an increasing number of surgical procedures, rising incidence of Hospital Acquired Infections (HAIs), and the outbreak of various epidemics and pandemics.

Table of Contents

Chapter 1 Hospital Gowns Market: Methodology and Scope

1.1 Market Segmentation and Scope

1.1.1 Type

1.1.2 Usability

1.1.3 Risk Type

1.1.4 Regional Scope

1.1.5 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database:

1.3.2 Gvr’s Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.7.1 Commodity Flow Analysis (Model 1)

1.7.1.1 Approach 1: Commodity Flow Approach

1.7.2 Volume Price Analysis (Model 2)

1.7.2.1 Approach 2: Volume Price Analysis

1.7 List Of Secondary Sources

1.8 List Of Primary Sources

1.9 List Of Abbreviations

1.10 Objectives

1.10.1 Objective 1

1.10.2 Objective 2

1.10.3 Objective 3

1.10.4 Objective 4

Chapter 2 Hospital Gowns Market: Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Insights

Chapter 3 Hospital Gowns Market: Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Ancillary Market Outlook

3.2 Penetration & Growth Prospect Mapping

3.3 User Perspective Analysis

3.3.1 Consumer Behavior Analysis

3.3.2 Market Influencer Analysis

3.4 List Of Key End Users

3.5 Market Dynamics

3.5.1 Market Driver Analysis

3.5.1.1 Increase In Number Of Surgical Procedures

3.5.1.2 Rising Incidence Of Hospital-Acquired Infections (Hais)

3.5.1.3 Impact Of Covid-19 Pandemic

3.5.2 Market Restraints Analysis

3.5.2.1 Increasing Demand For Homecare Services

3.6 Hospital Gowns: Market Analysis Tools

3.6.1 Industry Analysis - Porter’s

3.6.2 Swot Analysis, By Pest

3.7 Impact of COVID-19 on Market & Post Pandemic Insights

Chapter 4. Hospital Gowns Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Hospital Gowns Market: Type Movement Analysis & Market Share, 2023 & 2030

4.3. Surgical Gowns

4.3.1. Surgical Gowns Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. Non-Surgical Gowns

4.4.1. Non-Surgical Gowns Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5. Patient Gowns

4.5.1. Patient Gowns Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. Hospital Gowns Market: Usability Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Hospital Gowns Market: Usability Movement Analysis & Market Share, 2023 & 2030

5.3. Disposable Gowns

5.3.1. Disposable Gowns Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.1.1. Low

5.3.1.1.1. Low Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.1.2. Average

5.3.1.2.1. Average Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.1.3. Premium

5.3.1.3.1. Premium Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Usable Gowns

5.4.1. Usable Gowns Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4.1.1. Low

5.4.1.1.1. Low Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4.1.2. Average

5.4.1.2.1. Average Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4.1.3. Premium

5.4.1.3.1. Premium Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. Hospital Gowns Market: Risk Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Hospital Gowns Market: Risk Type Movement Analysis & Market Share, 2023 & 2030

6.3. Minimal

6.3.1. Minimal Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. Low

6.4.1. Low Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. Moderate

6.5.1. Moderate Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. High

6.6.1. High Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. Hospital Gowns Market: Regional Estimates & Trend Analysis

7.1. Regional Outlook

7.2. Hospital Gowns Market: Regional Movement Analysis & Market Share, 2023 & 2030

7.3. North America

7.3.1. North America Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.2. U.S.

7.3.2.1. Key Country Dynamics

7.3.2.2. Competitive Scenario

7.3.2.3. Regulatory Scenario

7.3.2.4. Reimbursement Scenario

7.3.2.5. U.S. Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.3. Canada

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Regulatory Scenario

7.3.3.4. Reimbursement Scenario

7.3.3.5. Canada Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. Europe

7.4.1. Europe Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.2. UK

7.4.2.1. Key Country Dynamics

7.4.2.2. Competitive Scenario

7.4.2.3. Regulatory Scenario

7.4.2.4. Reimbursement Scenario

7.4.2.5. UK Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.3. Germany

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. Regulatory Scenario

7.4.3.4. Reimbursement Scenario

7.4.3.5. Germany Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.4. France

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. Regulatory Scenario

7.4.4.4. Reimbursement Scenario

7.4.4.5. France Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.5. Italy

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Regulatory Scenario

7.4.5.4. Reimbursement Scenario

7.4.5.5. Italy Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.6. Spain

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Regulatory Scenario

7.4.6.4. Reimbursement Scenario

7.4.6.5. Spain Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.7. Denmark

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. Regulatory Scenario

7.4.7.4. Reimbursement Scenario

7.4.7.5. Denmark Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.8. Sweden

7.4.8.1. Key Country Dynamics

7.4.8.2. Competitive Scenario

7.4.8.3. Regulatory Scenario

7.4.8.4. Reimbursement Scenario

7.4.8.5. Sweden Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.9. Norway

7.4.9.1. Key Country Dynamics

7.4.9.2. Competitive Scenario

7.4.9.3. Regulatory Scenario

7.4.9.4. Reimbursement Scenario

7.4.9.5. Norway Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5. Asia Pacific

7.5.1. Asia Pacific Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.2. Japan

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Regulatory Scenario

7.5.2.4. Reimbursement Scenario

7.5.2.5. Japan Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.3. China

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Scenario

7.5.3.4. Reimbursement Scenario

7.5.3.5. China Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.4. India

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Scenario

7.5.4.4. Reimbursement Scenario

7.5.4.5. India Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.5. South Korea

7.5.5.1. Key Country Dynamics

7.5.5.2. Competitive Scenario

7.5.5.3. Regulatory Scenario

7.5.5.4. Reimbursement Scenario

7.5.5.5. South Korea Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.6. Australia

7.5.6.1. Key Country Dynamics

7.5.6.2. Competitive Scenario

7.5.6.3. Regulatory Scenario

7.5.6.4. Reimbursement Scenario

7.5.6.5. Australia Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5.7. Thailand

7.5.7.1. Key Country Dynamics

7.5.7.2. Competitive Scenario

7.5.7.3. Regulatory Scenario

7.5.7.4. Reimbursement Scenario

7.5.7.5. Thailand Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6. Latin America

7.6.1. Latin America Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6.2. Brazil

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Regulatory Scenario

7.6.2.4. Reimbursement Scenario

7.6.2.5. Brazil Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6.3. Mexico

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Scenario

7.6.3.4. Reimbursement Scenario

7.6.3.5. Mexico Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6.4. Argentina

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Regulatory Scenario

7.6.4.4. Reimbursement Scenario

7.6.4.5. Argentina Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7. Middle East & Africa

7.7.1. Middle East & Africa Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7.2. South Africa

7.7.2.1. Key Country Dynamics

7.7.2.2. Competitive Scenario

7.7.2.3. Regulatory Scenario

7.7.2.4. Reimbursement Scenario

7.7.2.5. South Africa Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7.3. Saudi Arabia

7.7.3.1. Key Country Dynamics

7.7.3.2. Competitive Scenario

7.7.3.3. Regulatory Scenario

7.7.3.4. Reimbursement Scenario

7.7.3.5. Saudi Arabia Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7.4. UAE

7.7.4.1. Key Country Dynamics

7.7.4.2. Competitive Scenario

7.7.4.3. Regulatory Scenario

7.7.4.4. Reimbursement Scenario

7.7.4.5. UAE Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7.5. Kuwait

7.7.5.1. Key Country Dynamics

7.7.5.2. Competitive Scenario

7.7.5.3. Regulatory Scenario

7.7.5.4. Reimbursement Scenario

7.7.5.5. Kuwait Hospital Gowns Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Market Participant Categorization

8.2. Key Company Profiles

8.2.1. Angelica Corporation

8.2.1.1. Company Overview

8.2.1.2. Financial Performance

8.2.1.3. Service Benchmarking

8.2.1.4. Strategic Initiatives

8.2.2. Cardinal Health

8.2.2.1. Company Overview

8.2.2.2. Financial Performance

8.2.2.3. Service Benchmarking

8.2.2.4. Strategic Initiatives

8.2.3. Standard Textile Co., Inc.

8.2.3.1. Company Overview

8.2.3.2. Financial Performance

8.2.3.3. Service Benchmarking

8.2.3.4. Strategic Initiatives

8.2.4. Medline Industries, Inc.

8.2.4.1. Company Overview

8.2.4.2. Financial Performance

8.2.4.3. Service Benchmarking

8.2.4.4. Strategic Initiatives

8.2.5. AmeriPride Services Inc.

8.2.5.1. Company Overview

8.2.5.2. Financial Performance

8.2.5.3. Service Benchmarking

8.2.5.4. Strategic Initiatives

8.2.6. 3M

8.2.6.1. Company Overview

8.2.6.2. Financial Performance

8.2.6.3. Service Benchmarking

8.2.6.4. Strategic Initiatives

8.3. Heat Map Analysis/ Company Market Position Analysis

8.4. Estimated Company Market Share Analysis, 2022

8.5. List of Other Key Market Players

List of Tables

Table 1. List of Secondary Sources

Table 2. List of Abbreviations

Table 3. Global Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 4. Global Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 5. Global Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 6. Global Hospital Gowns Market, by Region, 2017 - 2030 (USD Million)

Table 7. North America Hospital Gowns Market, by Country, 2017 - 2030 (USD Million)

Table 8. North America Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 9. North America Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 10. North America Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 11. U.S. Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 12. U.S. Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 13. U.S. Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 14. Canada Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 15. Canada Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 16. Canada Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 17. Europe Hospital Gowns Market, by Country, 2017 - 2030 (USD Million)

Table 18. Europe Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 19. Europe Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 20. Europe Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 21. Germany Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 22. Germany Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 23. Germany Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 24. UK Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 25. UK Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 26. UK Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 27. France Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 28. France Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 29. France Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 30. Italy Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 31. Italy Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 32. Italy Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 33. Spain Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 34. Spain Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 35. Spain Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 36. Denmark Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 37. Denmark Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 38. Denmark Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 39. Sweden Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 40. Sweden Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 41. Sweden Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 42. Norway Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 43. Norway Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 44. Norway Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 45. Asia Pacific Hospital Gowns Market, by Country, 2017 - 2030 (USD Million)

Table 46. Asia Pacific Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 47. Asia Pacific Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 48. Asia Pacific Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 49. China Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 50. China Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 51. China Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 52. Japan Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 53. Japan Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 54. Japan Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 55. India Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 56. India Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 57. India Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 58. South Korea Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 59. South Korea Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 60. South Korea Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 61. Australia Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 62. Australia Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 63. Australia Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 64. Thailand Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 65. Thailand Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 66. Thailand Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 67. Latin America Hospital Gowns Market, by Country, 2017 - 2030 (USD Million)

Table 68. Latin America Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 69. Latin America Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 70. Latin America Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 71. Brazil Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 72. Brazil Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 73. Brazil Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 74. Mexico Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 75. Mexico Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 76. Mexico Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 77. Argentina Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 78. Argentina Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 79. Argentina Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 80. Middle East & Africa Hospital Gowns Market, by Country, 2017 - 2030 (USD Million)

Table 81. Middle East & Africa Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 82. Middle East & Africa Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 83. Middle East & Africa Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 84. South Africa Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 85. South Africa Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 86. South Africa Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 87. Saudi Arabia Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 88. Saudi Arabia Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 89. Saudi Arabia Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 90. UAE Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 91. UAE Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 92. UAE Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 93. Kuwait Hospital Gowns Market, by Type, 2017 - 2030 (USD Million)

Table 94. Kuwait Hospital Gowns Market, by Usability, 2017 - 2030 (USD Million)

Table 95. Kuwait Hospital Gowns Market, by Risk Type, 2017 - 2030 (USD Million)

Table 96. Participant’s Overview

Table 97. Financial Performance

Table 98. Service Benchmarking

Table 99. Strategic Initiatives

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Hospital Gowns Market, Market Segmentation

Fig. 7 Market Driver Analysis (Current & Future Impact)

Fig. 8 Market Restraint Analysis (Current & Future Impact)

Fig. 9 Market Opportunity Analysis (Current & Future Impact)

Fig. 10 Market Challenge Analysis (Current & Future Impact)

Fig. 11 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 12 Porter’s Five Forces Analysis

Fig. 13 Regional Marketplace: Key Takeaways

Fig. 14 Global Hospital Gowns Market, for Surgical Gowns, 2017 - 2030 (USD Million)

Fig. 15 Global Hospital Gowns Market, for Non-Surgical Gowns, 2017 - 2030 (USD Million)

Fig. 16 Global Hospital Gowns Market, for Patient Gowns, 2017 - 2030 (USD Million)

Fig. 17 Global Hospital Gowns Market, for Disposable Gowns, 2017 - 2030 (USD Million)

Fig. 18 Global Hospital Gowns Market, for Low, 2017 - 2030 (USD Million)

Fig. 19 Global Hospital Gowns Market, for Average, 2017 - 2030 (USD Million)

Fig. 20 Global Hospital Gowns Market, for Premium, 2017 - 2030 (USD Million)

Fig. 21 Global Hospital Gowns Market, for Reusable Gowns, 2017 - 2030 (USD Million)

Fig. 22 Global Hospital Gowns Market, for Low, 2017 - 2030 (USD Million)

Fig. 23 Global Hospital Gowns Market, for Average, 2017 - 2030 (USD Million)

Fig. 24 Global Hospital Gowns Market, for Premium, 2017 - 2030 (USD Million)

Fig. 25 Global Hospital Gowns Market, for Minimal, 2017 - 2030 (USD Million)

Fig. 26 Global Hospital Gowns Market, for Low, 2017 - 2030 (USD Million)

Fig. 27 Global Hospital Gowns Market, for Moderate, 2017 - 2030 (USD Million)

Fig. 28 Global Hospital Gowns Market, for High, 2017 - 2030 (USD Million)

Fig. 29 Regional Outlook, 2021 & 2030

Fig. 30 North America Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 31 U.S. Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 32 Canada Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 33 Europe Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 34 Germany Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 35 UK Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 36 France Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 37 Italy Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 38 Spain Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 39 Denmark Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 40 Sweden Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 41 Norway Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 42 Asia Pacific Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 43 Japan Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 44 China Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 45 India Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 46 Australia Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 47 South Korea Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 48 Thailand Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 49 Latin America Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 50 Brazil Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 51 Mexico Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 52 Argentina Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 53 Middle East and Africa Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 54 South Africa Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 55 Saudi Arabia Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 56 UAE Hospital Gowns Market, 2017 - 2030 (USD Million)

Fig. 57 Kuwait Hospital Gowns Market, 2017 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Hospital Gowns Type Outlook (Revenue, USD Million, 2017 - 2030)

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Hospital Gowns Usability Outlook (Revenue, USD Million, 2017 - 2030)

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Hospital Gowns Risk Type Outlook (Revenue, USD Million, 2017 - 2030)

- Minimal

- Low

- Moderate

- High

- Hospital Gowns Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- North America Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- North America Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- U.S.

- U.S. Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- U.S. Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- U.S. Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- U.S. Hospital Gowns Market, By Type

- Canada

- Canada Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Canada Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Canada Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Canada Hospital Gowns Market, By Type

- North America Hospital Gowns Market, By Type

- Europe

- Europe Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Europe Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Europe Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- UK

- UK Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- UK Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- UK Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- UK Hospital Gowns Market, By Type

- Germany

- Germany Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Germany Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Germany Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Germany Hospital Gowns Market, By Type

- France

- France Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- France Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- France Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- France Hospital Gowns Market, By Type

- Italy

- Italy Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Italy Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Italy Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Italy Hospital Gowns Market, By Type

- Spain

- Spain Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Spain Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Spain Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Spain Hospital Gowns Market, By Type

- Denmark

- Denmark Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Denmark Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Denmark Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Denmark Hospital Gowns Market, By Type

- Sweden

- Sweden Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Sweden Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Sweden Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Sweden Hospital Gowns Market, By Type

- Norway

- Norway Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Norway Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Norway Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Norway Hospital Gowns Market, By Type

- Europe Hospital Gowns Market, By Type

- Asia Pacific

- Asia Pacific Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Asia Pacific Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Asia Pacific Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Japan

- Japan Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Japan Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Japan Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Japan Hospital Gowns Market, By Type

- China

- China Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- China Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- China Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- China Hospital Gowns Market, By Type

- India

- India Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- India Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- India Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- India Hospital Gowns Market, By Type

- South Korea

- South Korea Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- South Korea Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- South Korea Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- South Korea Hospital Gowns Market, By Type

- Australia

- Australia Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Australia Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Australia Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Australia Hospital Gowns Market, By Type

- Thailand

- Thailand Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Thailand Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Thailand Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Thailand Hospital Gowns Market, By Type

- Asia Pacific Hospital Gowns Market, By Type

- Latin America

- Latin America Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Latin America Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Latin America Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Brazil

- Brazil Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Brazil Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Brazil Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Brazil Hospital Gowns Market, By Type

- Mexico

- Mexico Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Mexico Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Mexico Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Mexico Hospital Gowns Market, By Type

- Argentina

- Argentina Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Argentina Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Argentina Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Argentina Hospital Gowns Market, By Type

- Latin America Hospital Gowns Market, By Type

- Middle East & Africa

- Middle East & Africa Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Middle East & Africa Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Middle East & Africa Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- South Africa

- South Africa Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- South Africa Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- South Africa Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- South Africa Hospital Gowns Market, By Type

- Saudi Arabia

- Saudi Arabia Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Saudi Arabia Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Saudi Arabia Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Saudi Arabia Hospital Gowns Market, By Type

- UAE

- UAE Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- UAE Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- UAE Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- UAE Hospital Gowns Market, By Type

- Kuwait

- Kuwait Hospital Gowns Market, By Type

- Surgical Gowns

- Non-Surgical Gowns

- Patient Gowns

- Kuwait Hospital Gowns Market, By Usability

- Disposable

- Low

- Average

- Premium

- Reusable

- Low

- Average

- Premium

- Disposable

- Kuwait Hospital Gowns Market, By Risk Type

- Minimal

- Low

- Moderate

- High

- Kuwait Hospital Gowns Market, By Type

- Middle East & Africa Hospital Gowns Market, By Type

- North America

Hospital Gowns Market Dynamics

Driver: Rising number of surgical procedures globally

Growing number of surgeries globally is a key factor expected to drive industry expansion over the forecast period. For instance, as per Mölnlycke Health Care AB, 70 million surgical procedures are performed every year in Europe. Since hospital gowns eradicate the chances of pathogen transmission to both staff and patients, they are considered an essential requirement for surgical procedures. These factors are expected to drive demand for hospital gowns over the forecast period. According to the Healthcare Cost and Utilization Project, in 2016, around 9,942,000 surgeries were performed in the U.S. within ambulatory care settings.

Hospital gowns prevent the transmission of nosocomial infections to a certain degree, owing to which surgeons prefer using disposable products over reusable ones. Such factors are expected to boost market growth over the forecast period. Furthermore, according to a report published by Lancet Commission on Global Surgery 2030, approximately 313 million surgical procedures are performed worldwide each year. Meanwhile, as per the American Society of Plastic Surgeons (ASPS), in 2018, in the U.S., around 17.7 million surgeries and minimally invasive cosmetic surgeries were undertaken. Similarly, Eurostat data states that in 2018, at least 1.16 million cesarean sections were conducted in the EU-27 region. As a result, usage of hospital gowns is anticipated to soar over the forecast period.

Restraint: Growing popularity of homecare services

Increase in adoption of home care services is anticipated to hinder market growth over the forecast period. Long-term care, notable assistance services, and cost-effectiveness are major advantages of home care services. However, patients undergoing home care generally do not wear hospital gowns and prefer comfortable daily clothes. The presence of several organizations offering home care services in North America and Europe is promoting home care services segment. As per Statistics Norway, around 32% of people aged 80 and above availed home care services in 2016. This is expected to boost this market’s growth, but restrain the demand for hospital gowns, over the forecast period. Moreover, the demand for home healthcare among aging population is also increasing as they are at a higher risk of acquiring the COVID-19 infection and avoid visiting healthcare facilities. Hence, this is likely to hamper market growth.

Opportunity: Innovations and technological advancements in hospital gowns

Increasing demand for technologically advanced products such as lightweight and breathable fabric material gowns and lucrative marketing is expected to boost revenue growth of the hospital gowns market over the forecast period. Surgical gowns are considered as hygienic clothing worn by surgeons and other professionals who are present in operation theaters during surgeries. This clothing helps in preventing bacteria and various pathogens from getting into direct contact with the person who is operating. Rapid innovations in the market are helping in making these gowns more efficient by preventing harmful infections, which is anticipated to help market growth over the forecast period.

A variety of gowns are available in the market for different purposes. For instance, owing to higher protection levels provided by disposable surgical gowns, these type of surgical gowns are expected to have significant adoption in place of reusable surgical gowns. Even though reusable materials used in hospital gowns have evolved, disposable gowns have a more solid, reliable, and reproducible bacterial impermeability. With reusable gowns, these properties seem to fade with wetting or repeated washes. Moreover, single-use materials are easy-to-use, safe to dispose, and also an economical solution. Thus, companies are more focused towards manufacturing disposable hospital gowns.

What Does This Report Include?

This section will provide insights into the contents included in this hospital gowns market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Hospital gowns market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Hospital gowns market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the hospital gowns market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for hospital gowns market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of hospital gowns market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Hospital Gowns Market Categorization:

The hospital gowns market was categorized into four segments, namely type (Surgical Gowns, Non-surgical Gowns, Patient Gowns), usability (Disposable Gowns, Reusable Gowns), risk type (Minimal, Low, Moderate, High), and regions (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The hospital gowns market was segmented into type, usability, risk type, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The hospital gowns market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into nineteen countries, namely, the U.S.; Canada; the UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; and UAE.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Hospital gowns market companies & financials:

The hospital gowns market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-