- Home

- »

- Medical Devices

- »

-

Hospital Services Market Size, Share & Growth Report, 2030GVR Report cover

![Hospital Services Market Size, Share & Trends Report]()

Hospital Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Inpatient, Outpatient), By Ownership (Publicly/Government-Owned. For-Profit Privately Owned), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-677-6

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hospital Services Market Summary

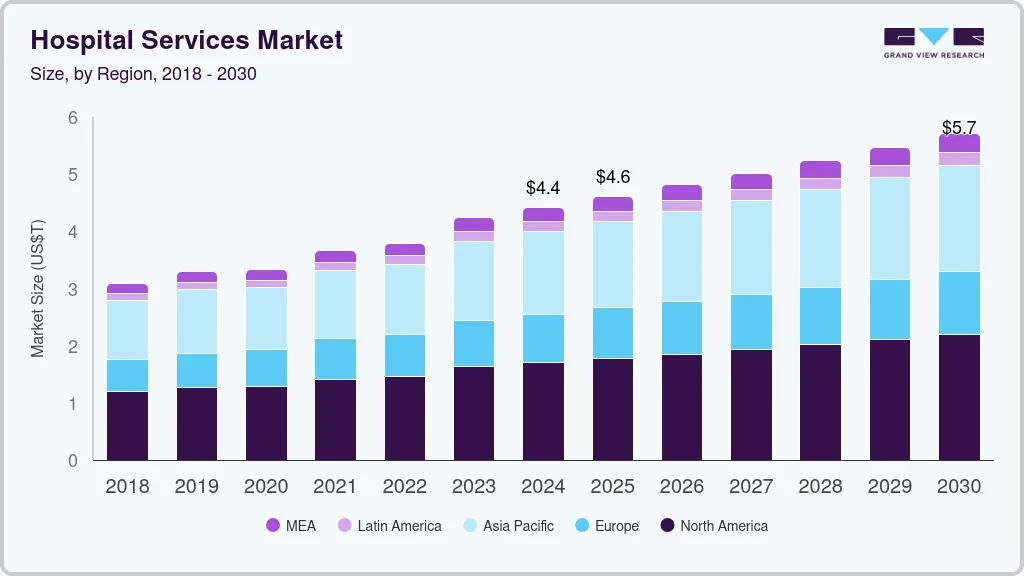

The global hospital services market size was estimated at USD 4.24 trillion in 2023 and is projected to reach USD 5.71 tillion by 2030, growing at a CAGR of 4.35% from 2024 to 2030. This can be attributed to the growing trend towards patient consumerism, rising insurance coverage, majorly in developing countries such as India and South Africa, and growing demand for quality care.

Key Market Trends & Insights

- North America hospital services market dominated the market with a share of 38.56% in 2023.

- The hospital services market in the U.S. is anticipated to grow at a significant CAGR during the forecast period.

- Based on type, the inpatient services segment accounting for the largest share of 48.71% in 2023.

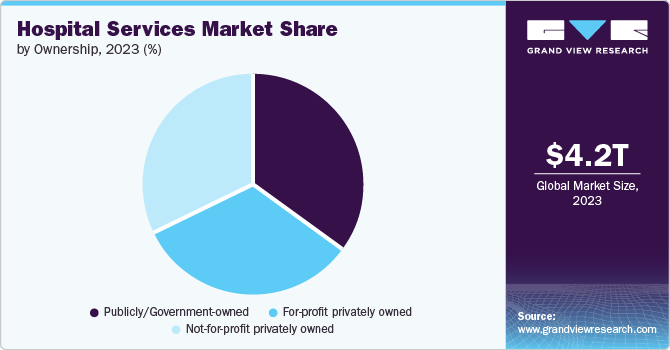

- By ownership, the publicly/government-owned segment held the largest share of 34.55% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.24 Tillion

- 2030 Projected Market Size: USD 5.71 Tillion

- CAGR (2024-2030): 4.35%

- North America: Largest market in 2023

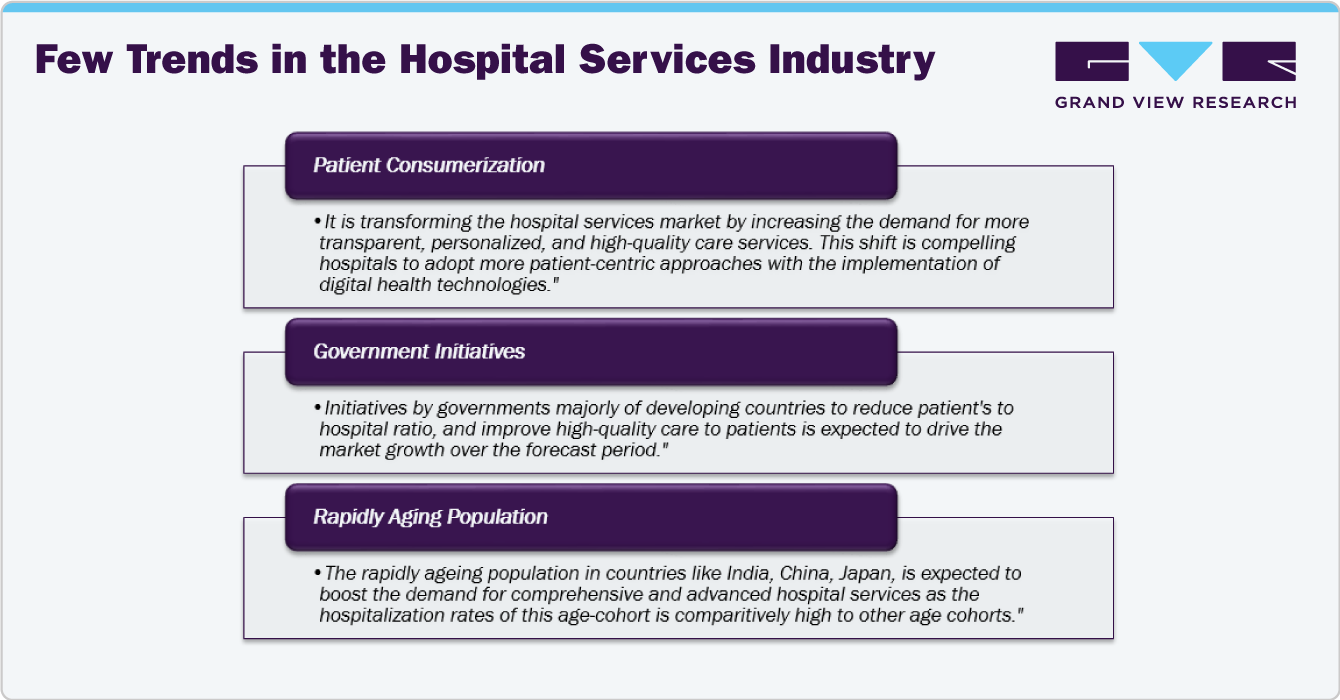

As the direct cost of healthcare services increases, patients are becoming more discerning while paying for these services. Patient consumerization is significantly impacting the market with the increase in demand for more personalized, transparent, and high-quality healthcare services. This shift is expected to increase the adoption of more customer-centric approaches in hospitals, including implementing advanced digital health technologies for appointments and consultations, enhancing patient engagement through personalized care plans, and prioritizing patient satisfaction in service delivery. Moreover, the growing emphasis on price transparency and value-based care is expected to shift the focus of hospitals to optimize their operations and improve cost-efficiency with high-quality care.

The growing awareness among the general public about the availability and benefits of advanced services has been a significant driver for the market growth. In addition, the expansion of healthcare insurance coverage, both public and private, has made these services more accessible to a wider population, particularly in developing economies. The increased affordability through insurance coverage is expected to boost the market growth over the forecast period. Moreover, owing to disparities in the number of patients to hospital ratios in developing countries, the government is launching several programs and initiatives to increase the number of hospitals in the countries. The Ayushman Bharat Scheme, launched by the Government of India in 2018, has significantly improved access to medical services in rural and urban areas. With the virtue of this initiative, the government launched around 1,500 thousand Ayushman Bharat-Health and Wellness Centres (AB-HWCs) till 2023.

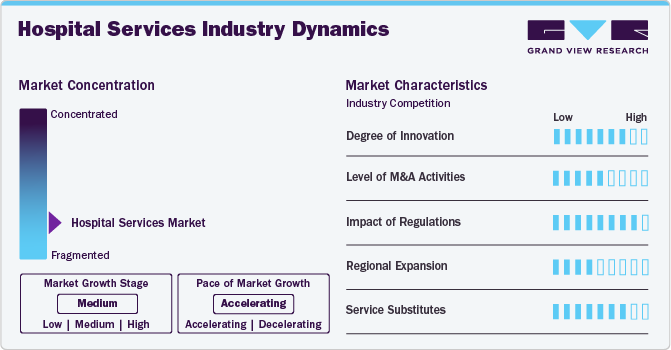

Industry Dynamics

The industry is highly fragmented, with major and emerging hospitals operating in different countries and regions. Furthermore, the degree of innovation is high, and the level of M&A activities is moderate. Regulations have a high impact on the industry, while regional expansion is moderate. However, service expansion is high.

The degree of innovation in the market is high due to improved healthcare delivery. Integration of advanced digital health technologies such as Electronic Health Records (EHRs), telehealth, and AI-driven diagnostic tools, to the adoption of novel healthcare models such as patient-centered care and value-based purchasing, hospitals are increasingly investing in innovative solutions. These advancements streamline hospital operations and facilitate a more personalized and effective treatment approach, improving patient outcomes and satisfaction. The continuous innovation within the industry reflects an overarching commitment to adapt to the evolving healthcare needs and challenges, ensuring sustainability and excellence in patient care.

The level of mergers and acquisitions (M&A) in the industry has witnessed a significant uptrend over the past few years, reflecting a transformative phase within the healthcare sector. This consolidation trend is driven by various factors, including the desire to expand geographic footprints, achieve economies of scale, enhance bargaining power with payers, and integrate advanced healthcare technologies. M&A activities are expected to continue as hospitals and healthcare systems strive for resilience and sustainability in a rapidly evolving healthcare landscape.

Few Recent M&A Transactions in the Industry

Company Name

Year

Month

Details

National Medical Care Company (Care)

2024

June

The company entered into a definitive agreement to acquire the Al Salam Health Medical Hospital, a 100-bed multispecialty hospital in Riyadh, UAE.

Atlantic Health & Saint Peter's Healthcare

2024

January

Atlantic Health and Saint Peter’s Healthcare entered into an agreement to merge the two health systems.

Fortis Healthcare

2023

August

The company entered into a definitive agreement to acquire Medeor Hospital Manesar, a multispecialty hospital in Haryana, India.

The impact of regulations on the market is high, affecting healthcare delivery, cost, and patient access. Regulations ensure that hospitals maintain a certain standard of care. With the establishment of minimum quality standards, regulatory bodies protect patients from substandard practices and ensure that healthcare providers meet specific benchmarks, leading to improved health outcomes. Compliance with regulations involves significant administrative work, which diverts resources from patient care and other hospital functions. Although these regulations protect patient interests, the burden impacts hospital efficiency and operational flexibility.

The impact of service expansion on the industry globally is high. As hospitals expand their service offerings, it intensifies competition within the market. To attract and retain patients, hospitals must differentiate themselves by providing a wider range of specialized services, advanced technologies, and enhanced patient experiences. These competitive dynamics drive innovation and improvements in the quality of care.

The expansion of the industry into new geographic regions has a moderate impact on the market. As hospitals extend their reach into emerging markets, particularly in developing economies, it drives increased competition and innovation within the industry. This regional expansion leads to improved access to quality healthcare and the introduction of advanced medical technologies and specialized services that were previously unavailable.

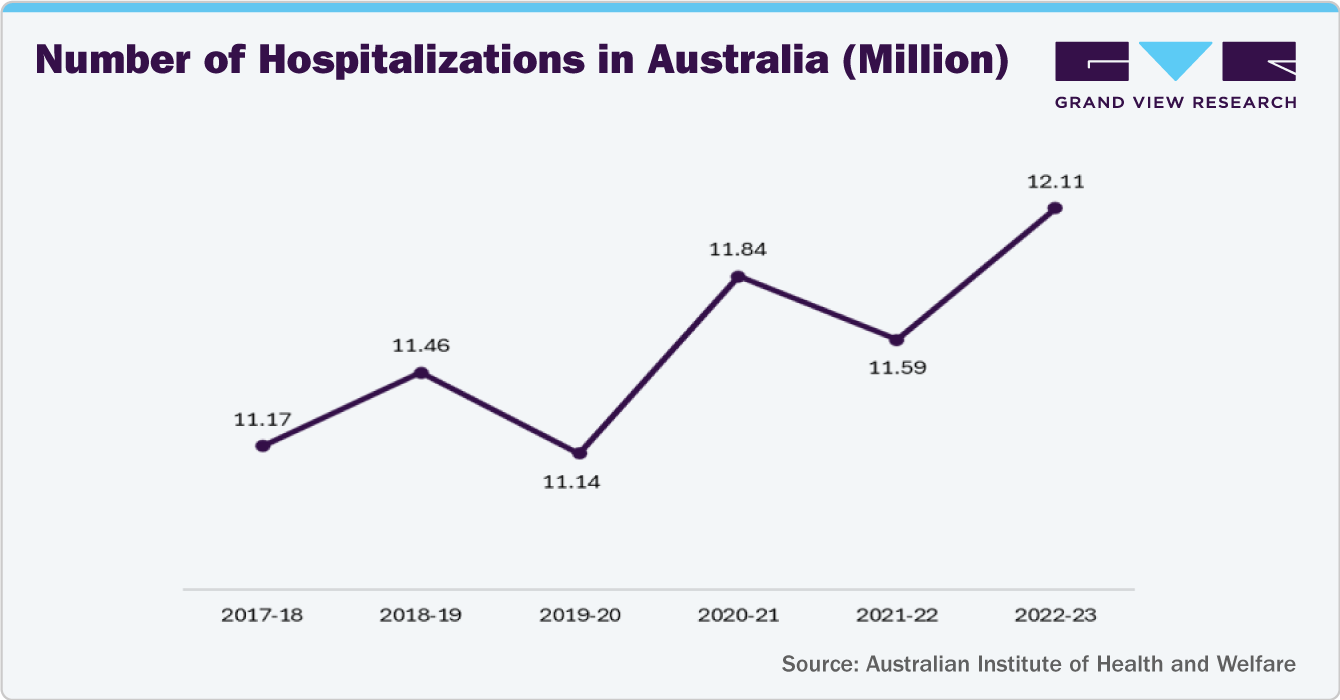

Type Insights

Based on type, the inpatient services segment dominated the market, accounting for the largest market share of 48.71% in 2023. The need for extensive, 24/7 healthcare services provided by hospitalization, specifically for severe health problems and surgical procedures, is expected to drive the demand for the segment. Moreover, the increase in insurance coverage in developing countries is expected to boost hospital inpatient volumes, contributing to the demand for the segment globally. According to the Australian Institute of Health and Welfare, in 2022-2023, around 12.1 million patients were hospitalized in Australia, a substantial increase from 11.6 million patients in 2021-2022.

However, the outpatient services segment is expected to grow at the fastest CAGR over the forecast. Advancements in medical technology, such as minimally invasive surgical techniques and improved wound healing equipment, have enabled quicker patient recovery, decreasing the average length of hospital stays. In addition, the rising adoption of telemedicine and remote consultation procedures boosted the outpatient services market, as patients can receive care without physically visiting the hospital. According to NHS England, in 2022-23, around 124.5 million outpatient appointments were reported in England, a 1.7% increase from 2021-22 and around 0.4% decrease from 2019-20.

Ownership Insights

The publicly/government-owned segment held the largest revenue share of 34.55% in 2023 owing to the high patient volume in these settings due to low cost or affordable care compared to private settings. In addition, countries are focusing on increasing the number of public hospitals in rural areas to provide high-quality care to underserved areas. Hence, governments invest in public health to provide better workforce capacity and high-quality care. For instance, in June 2024, the Government of Australia acquired Calvary Public Hospital and transitioned it to Canberra Health Services (CHS). The acquisition was a part of increased investment by the government in health infrastructure, staffing, and services in Australia.

However, the for-profit, privately owned segment is expected to witness the fastest CAGR over the forecast period. This is attributed to the growing demand from patients for personalized care, which private hospitals are often better equipped to provide due to lower patient-to-staff ratios and more modern facilities. Moreover, shorter waiting times for elective surgeries and consultations offer an advantage over the public healthcare systems, contributing to the segment's growth over the forecast period. In addition, expanding health insurance coverage, including private and employer-provided plans that offer better provisions for private hospital care, is expected to drive the market's growth.

Regional Insights

North America hospital services marketdominated the market with a share of 38.56% in 2023.This is attributed to the increasing demand for advanced services, the increasing adoption of technologically advanced solutions in the facilities, and substantial investments in healthcare infrastructure and services by both government and private sectors.

U.S. Hospital Services Market Trends

The U.S. hospital services market is driven by its extensive hospital network and comprehensive care, owing to an increase in the adoption of advanced technologies and high healthcare expenditures. In addition, policy reforms and increased healthcare insurance under the Affordable Care Act have increased access for a broader population segment. Moreover, the trend towards consolidation, with hospitals merging to form larger systems, is expected to enhance healthcare delivery and improve patient outcomes, further contributing to the market's growth.

Asia Pacific Hospital Services Market Trends

The Asia Pacific hospital services market is experiencing rapid growth due to the rapidly aging population, increasing prevalence of chronic diseases, and significant improvements in healthcare infrastructure. In addition, rising healthcare expenditures, growing health consciousness among the population, and government initiatives aimed at improving healthcare access and quality are expected to drive the growth of the market. Investments in digital health technologies and a push towards medical tourism in countries such as India, Thailand, and Singapore significantly contribute to the market dynamics in the Asia Pacific region.

China hospital services market holds a significant share in the Asia Pacific region. This is attributed to the government's increased focus on healthcare reform and healthcare insurance coverage. In addition, the rapidly aging population, rising incidences of chronic diseases, and urbanization are contributing to the growth of the industry in the country. Moreover, investments in healthcare infrastructure and a push towards digital health solutions enhance service delivery and efficiency.

India hospital services market has witnessed significant growth in the past few years, primarily due to increasing demand for quality care amid a growing population. Moreover, government initiatives aimed at improving healthcare infrastructure and growth in public-private partnerships are significantly impacting market growth.

Europe Hospital Services Market Trends

Europe hospital services marketis expected to grow significantly over the forecast period. Universal healthcare systems across various European countries ensure improved access to hospital services, contributing to the market's growth. Investment in healthcare infrastructure, coupled with EU-wide initiatives aimed at improving healthcare quality and interoperability, is expected to drive the growth of the market.

The UK hospital services market is dominated by public hospitals, with the National Health Service (NHS) playing a central role in providing comprehensive services to the population. However, the market is witnessing growth in private hospitals due to shorter waiting times and the demand for elective procedures.

The Hospital Services Market in France is expected to grow due to the presence of its robust public healthcare system. Additionally, France is focusing on healthcare system reforms to improve efficiency, reduce healthcare costs, and integrate digital health solutions, such as telemedicine, to enhance service delivery and patient care.

Latin America Hospital Services Market Trends

Latin America hospital services market is experiencing significant growth, driven by an increasing demand for advanced medical treatments and services across the region. Moreover, government and private sector initiatives focusing on healthcare reforms to improve efficiency and patient outcomes, including expanding healthcare insurance coverage and adopting digital health technologies, are expected to drive the market's growth.

Argentina hospital services market is expected to witness significant growth over the forecast period. The country has a mix of public and private healthcare providers, with a significant portion of services delivered through public hospitals, which provide free or low-cost care to citizens.

Middle East & Africa (MEA) Hospital Services Market Trends

Middle East & Africa (MEA) hospital services market is witnessing dynamic change, driven by an increasing population, rising prevalence of chronic diseases, and significant investments in healthcare infrastructure, particularly in Gulf Cooperation Council (GCC) countries and South Africa. The region is also seeing a marked shift towards privatizing healthcare, aiming to complement public health and meet the growing demands for higher quality and specialized services.

Saudi Arabia hospital services market is witnessing significant transformation due to the government's Vision 2030 initiative, which focuses on healthcare as a key sector for development. This initiative is expected to increase investments in healthcare infrastructure and services to improve the overall health and well-being of the population.

Key Hospital Services Company Insights

The market is highly competitive, with both private and public hospitals competing for significant market share. Advancements in medical technology, such as minimally invasive surgical technologies and imaging modalities, are key competitive factors as hospitals invest heavily to provide better patient outcomes. In addition, hospitals are focusing on specialized services, improving patient-centric care, geographic expansion through acquisitions, and forming strategic partnerships with insurers and employers to secure patient volumes and gain a competitive edge.

Key Hospital Services Companies:

The following are the leading companies in the hospital services market. These companies collectively hold the largest market share and dictate industry trends.

- Apollo Hospitals Enterprise Ltd.

- Max Healthcare

- West Suffolk NHS Foundation Trust

- Royal Papworth Hospital NHS Foundation Trust

- Cedars-Sinai

- UCLA Medical Centers

- The Johns Hopkins Hospital

- Mayo Clinic

- Keio University (Medical Services)

- THE ROYAL MELBOURNE HOSPITAL

- Burjeel Holdings

Recent Developments

-

In June 2024, the University of Alabama at Birmingham (UAB) launched the first Tele-ICU expanded hospital in Alabama, U.S., by partnering with Whitefield Regional Hospital. This partnership is expected to improve the Tele-ICU capabilities of UAB, and to provide evidence-based care services to patients.

-

In July 2023, Nutex Health Inc. opened Covington Trace ER & Hospital, a new microhospital in Louisiana. The hospital includes eight private exam rooms, an emergency room, ten private inpatient beds, and an in-house pharmacy, laboratory, and imaging services.

-

In January 2023, the Government of India launched thefirst 100% carbon-neutral hospital in Bengaluru, India, with a capacity of 500 beds.

Hospital Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.42 trillion

Revenue forecast in 2030

USD 5.71 trillion

Growth Rate

CAGR of 4.35% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD billion/trillion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, ownership, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Apollo Hospitals Enterprise Ltd., Max Healthcare, West Suffolk NHS Foundation Trust, Royal Papworth Hospital NHS Foundation Trust, Cedars-Sinai, UCLA Medical Centers, The Johns Hopkins Hospital, Mayo Clinic, Keio University (Medical Services), THE ROYAL MELBOURNE HOSPITAL, Burjeel Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital services market report based on type. ownership, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Inpatient Services

-

Cardiovascular Disorders

-

Cancer

-

Musculoskeletal Diseases

-

Emergency & Trauma

-

Respiratory Disorder

-

Gastroenterology

-

CNS Disorders

-

Pregnancy and Postpartum Care

-

Urology & Nephrology Disorders

-

Others

-

-

Outpatient Services

-

Ancillary Services

-

-

Ownership Outlook (Revenue, USD Billion, 2018 - 2030)

-

Publicly/Government-owned

-

Not-for-profit privately owned

-

For-profit privately owned

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital services market size was estimated at USD 4.24 trillion in 2023 and is expected to reach USD 4.42 trillion in 2024.

b. The global hospital services market is expected to grow at a compound annual growth rate of 4.35% from 2024 to 2030 to reach USD 5.71 trillion by 2030.

b. North America hospital services market dominated the market with share of 38.56% in 2023. This is attributed to the increasing demand for advanced services, the increasing adoption of technologically advanced solutions in the facilities, and substantial investments in healthcare infrastructure and services by both government and private sectors.

b. Some key players operating in the hospital services market include Apollo Hospitals Enterprise Ltd., Max Healthcare, West Suffolk NHS Foundation Trust, Royal Papworth Hospital NHS Foundation Trust, Cedars-Sinai, UCLA Medical Centers, The Johns Hopkins Hospital, Mayo Clinic, Keio University (Medical Services), THE ROYAL MELBOURNE HOSPITAL, Burjeel Holdings

b. Key factors that are driving the hospital services market growth include growing trend towards patient consumerism, rising insurance coverage, majorly in developing countries such as India and South Africa, and growing demand for quality care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.