- Home

- »

- Consumer F&B

- »

-

Tea Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Tea Market Size, Share & Trends Report]()

Tea Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Black, Green, Oolong, Herbal) By Distribution Channel (Hypermarkets, Convenience Stores, Specialty Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-434-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tea Market Summary

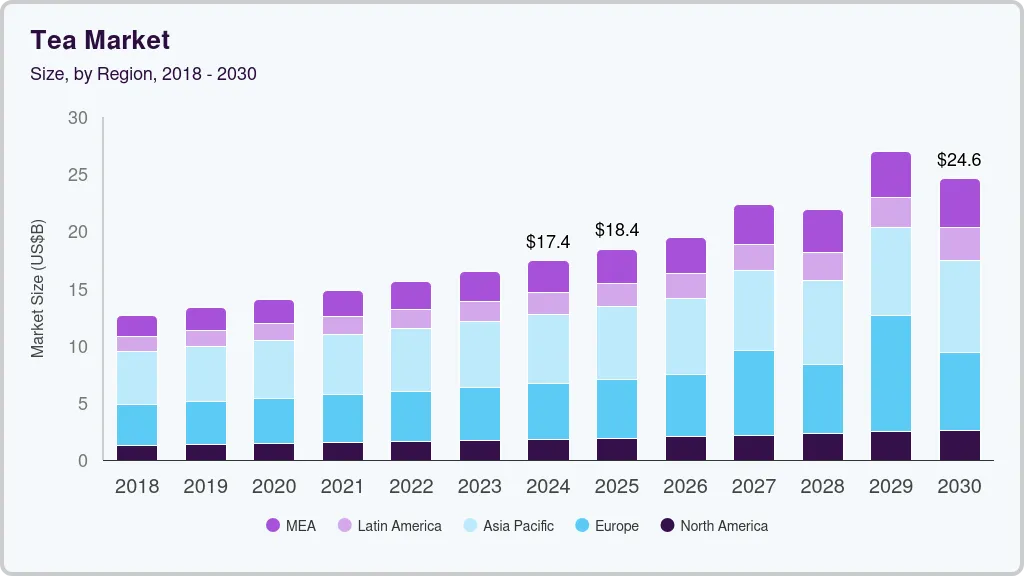

The global tea market size was valued at USD 17.42 billion in 2024 and is projected to reach USD 24.61 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The market growth is attributed to the rising health consciousness among consumers, who are increasingly aware of the health benefits of tea, including its ability to reduce inflammation and promote relaxation.

Key Market Trends & Insights

- Asia Pacific dominated the global tea market with a revenue share of 34.7% in 2024.

- The U.S. tea market is expected to grow significantly over the forecast period.

- By product, the black tea segment dominated the market with the revenue share of 38.8% in 2024.

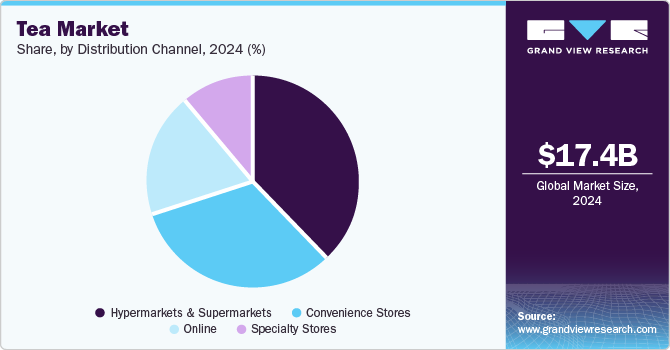

- By distribution channel, the hypermarkets & supermarkets segment dominated the market with a share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.42 Billion

- 2030 Projected Market Size: USD 24.61 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

Additionally, the demand for organic and premium teas is surging, with consumers seeking high-quality, specialty, and artisanal tea varieties. Furthermore, rapid growth in green tea consumption, valued for its antioxidant properties, continues to expand the market. In addition, the demand for organic tea increased, driven by consumer demand for alternatives to natural and environmentally friendly products.The popularity of flavored and herbal teas is also contributing to market growth, as these products cater to a wide range of consumer tastes and preferences. The rise of e-commerce and direct-to-consumer channels has made it easier for consumers to access a diverse range of tea products, further driving market expansion. In addition, the growing disposable incomes in emerging economies are leading to increased tea consumption, as more people can afford to indulge in this beverage.

Cultural significance furthermore contributes to the rising demand for tea. Traditional tea-drinking ceremonies and practices in countries such as China, Japan, India, and the UK have fostered a deep appreciation for tea as more than just a beverage but a cultural experience. As globalization spreads these cultural practices, interest in authentic teas and tea-related rituals has grown, driving demand for premium and specialty teas sourced from specific regions known for their tea production expertise.

Moreover, the tea market has evolved with a focus on variety and innovation. Consumers today have access to a wide range of tea flavors, blends, and functional varieties such as detox teas or energy-boosting blends. This diversity caters to different tastes and preferences, appealing to consumers seeking novelty and unique sensory experiences in their beverage choices. Additionally, ready-to-drink tea formats have gained popularity due to their convenience, particularly among urban populations and younger demographics seeking healthier alternatives to sugary drinks.

Another driver is the expanding cafe culture and the global proliferation of coffee and specialty tea shops. These establishments offer a wide selection of teas, often emphasizing quality, craftsmanship, and the art of tea preparation. This trend caters to tea enthusiasts and introduces new consumers to premium and exotic tea varieties, enhancing overall tea consumption. Furthermore, the convenience factor continues to influence tea consumption patterns. Ready-to-drink tea products, including bottled and canned teas, have gained popularity due to their accessibility and portability. These products cater to busy lifestyles and on-the-go consumption preferences, appealing particularly to urban populations and younger demographics who value convenience without compromising on health benefits.

Product Insights

Black tea dominated the market with the largest revenue share of 38.8% in 2024. Black tea is one of the most popular types of tea worldwide, appreciated for its strong flavor and versatility. It is a staple in many cultures, consumed both as a daily beverage and in various ceremonial contexts. The health benefits associated with black tea, such as its antioxidant properties and potential to support heart health, also contribute to its widespread popularity. Additionally, black tea is often used as a base for flavored teas and blends, further increasing its market appeal. The robust demand for ready-to-drink black tea products and the growing trend of tea consumption in emerging markets have also played a significant role in driving the revenue share of black tea.

Black tea, derived from the camellia sinensis plant, is preferred by a large population worldwide due to its strong flavor and high caffeine content. According to the World Tea Export Council, black tea is the most consumed tea in the world, accounting for approximately 75% of the total tea consumption. Black tea contains flavonoids similar to those found in fruits, red wine, and dark chocolate, improving heart function. In addition, black tea lowers low-density lipoproteins cholesterol levels, thus dropping the risk of heart disease. These advantages are expected to drive increased demand and growth in the black tea market in the coming years.

The herbal segment is expected to grow at the fastest CAGR of 8.2% over the forecast period. The increasing awareness of the health benefits of herbal teas, which include various blends such as chamomile, peppermint, and ginger, is a significant driver. Herbal teas are often sought for their potential therapeutic properties, such as aiding digestion, reducing stress, and improving sleep quality. The rising demand for natural and organic products has also contributed to the popularity of herbal teas, as consumers look for healthier and more sustainable options. Additionally, the variety of flavors and the absence of caffeine in most herbal teas make them appealing to a broad audience, including those who are health-conscious or have dietary restrictions. The expansion of specialty tea shops and the growing trend of wellness and holistic health practices further support the robust growth of the herbal tea segment in the global market.

Distribution Channel Insights

The hypermarkets & supermarkets channel dominated the market with the largest revenue share in 2024. Hypermarkets and supermarkets offer a wide variety of tea products, providing consumers with the convenience of one-stop shopping. The ability to physically examine products read labels, and compare prices enhances the shopping experience, making these retail channels highly attractive to consumers. Additionally, hypermarkets and supermarkets often run promotions and discounts, making premium tea products more accessible to a broader audience. The strategic placement of tea products within these stores, along with the availability of both international and local brands, further drives consumer interest and sales.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping allows consumers to browse and purchase a wide variety of tea products from the comfort of their homes, at any time. E-commerce platforms offer detailed product descriptions, customer reviews, and a broader selection of teas, including specialty and international brands that may not be available in local stores. Additionally, online retailers often provide competitive pricing, discounts, and subscription services, making it more affordable for consumers to explore and regularly purchase their favorite teas. The increasing use of smartphones and the internet has also facilitated the growth of online tea sales, as consumers can easily shop on the go. Furthermore, the rise of social media and digital marketing has enhanced product visibility and consumer engagement, attracting a larger audience to online channels.

Regional Insights

Asia Pacific tea market dominated the global industry with a revenue share of 34.7% in 2024. Tea has a significant cultural and social value across many regions in Asia Pacific. Moreover, tea is often perceived as more beneficial than other drinks, attracting health-conscious individuals to choose tea over carbonated beverages. The increasing popularity of tea among millennials has led to a rising demand for flavored varieties such as clove, pepper, cinnamon, masala, mixed fruit, and more, driving market growth in the Asia Pacific region.

India Tea Market Trends

India held around 35.0% of the regional market share in 2024 and is expected to grow in the coming years. India has a deep-rooted cultural inclination towards tea, making it a staple beverage across various demographics. This cultural preference fuels consistent domestic consumption. Rising disposable incomes and urbanization have also expanded the consumer base for tea products, including premium and specialty teas. Health consciousness among consumers also drives the market demand, with herbal and green teas gaining popularity for their perceived health benefits.

China Tea Market Trends

China tea market held a substantial market share in 2023. With the rising health consciousness among consumers, tea is increasingly valued for its perceived health benefits, including antioxidants and potential medicinal properties. Additionally, China's growing middle class and urbanization have led to higher disposable incomes and changing lifestyles, contributing to greater consumption of premium tea varieties and innovative tea products. Moreover, tea tourism and the promotion of tea culture as part of China's heritage have boosted domestic consumption and driven demand for high-quality teas across different regions of the country.

North America Tea Market Trends

The North American tea market held a substantial industry share in 2024. Health consciousness among consumers has driven a shift towards beverages perceived as healthier alternatives to traditional options like coffee. Tea, known for its antioxidant properties and various health benefits, has gained popularity as part of this trend. Furthermore, cultural diversification has introduced a wider range of tea varieties and flavors to the market, appealing to a broader audience beyond traditional tea drinkers. Innovations in tea preparation methods and packaging, such as convenient tea bags and ready-to-drink options, have also increased popularity among busy consumers seeking convenience without sacrificing health benefits.

U.S. Tea Market Trends

The U.S. tea market is expected to grow significantly over the forecast period. Increasing health awareness among consumers has led to a surge in tea consumption, particularly for green tea, herbal tea, and fruit tea. The introduction of diverse flavors has attracted tea enthusiasts, driving the market expansion. For instance, in June 2024, Y'all Sweet Tea announced the launch of seven new flavors and expanded its presence in grocery retail outlets. This expansion marks a significant step for the brand, which aims to capture a larger market share by diversifying its product offerings. The demand for natural and organic ingredients has driven interest in specialty teas. In addition, continuous tea consumption throughout the year, regardless of seasonality, contributes to market growth.

Europe Tea Market Trends

The European market is anticipated to witness substantial growth in the coming years. The growing trend towards healthier beverage choices among European consumers is driven by increasing awareness of the health benefits associated with tea, such as antioxidants and potential weight management properties. Additionally, tea is perceived as a versatile drink that caters to a variety of tastes and preferences, including herbal and specialty teas that appeal to health-conscious and adventurous consumers alike. Moreover, European cultural diversity has led to a broader acceptance and integration of tea traditions from different regions, contributing to its popularity across various demographics.

UK Tea Market Trends

The UK tea market is projected to witness rapid growth over the forecast period. Changing lifestyles increasingly emphasize the importance of herbal tea, as many people prefer herbal options over-caffeinated ones. Green tea's substantial nutritional benefits and fat-burning properties are contributing significantly to the expansion of the tea market. This rising demand for tea enables producers to offer a range of natural and infused flavors tailored to health-conscious consumers.

Germany Tea Market Trends

Germany's market is anticipated to witness substantial growth in the coming years. Tea is perceived as a healthier alternative to other beverages like coffee, aligning with German consumers' growing trend towards health and wellness. Additionally, the variety of tea flavors and types available, including herbal teas and specialty blends, appeals to a diverse consumer base seeking unique taste experiences. Cultural influences also play a significant role, as Germany has a longstanding tradition of tea consumption, particularly in regions influenced by British and Eastern European tea-drinking customs.

Middle East and Africa Tea Market Trends

The Middle East and Africa is projected to witness the fastest CAGR of 7.5% over the forecast period. Tea consumption in these regions is deeply rooted in cultural and social traditions, where tea symbolizes hospitality and is often an integral part of daily life and social gatherings. Additionally, the growing population and urbanization in many parts of the Middle East and Africa have led to a larger consumer base with increasing disposable incomes, thereby boosting tea consumption.

Key Tea Company Insights

Some key companies in the tea market include R. Twining and Company Limited, Dilmah Ceylon Tea Company PLC., Bigelow Tea, PepsiCo, YORKSHIRE TEA, and others.

-

Dilmah offers unblended, garden fresh Ceylon tea picked and packed directly at the source. Dilmah organic tea is produced from raw material that is free from pesticides and fertilizer, available in individually foil wrapped bags and bulk food service pack.

-

Bigelow Tea Company is a specialty tea manufacturer. It provides Bigelow plus Vitamin C teas considering the importance of health and wellness trend. This tea provides the 100% of the daily required value of Vitamin C in one serving. Below also provides green and black tea with healthy antioxidants Vitamin C.

Key Tea Companies:

The following are the leading companies in the tea market. These companies collectively hold the largest market share and dictate industry trends.

- R. Twining and Company Limited

- Dilmah Ceylon Tea Company PLC.

- Bigelow Tea

- PepsiCo

- YORKSHIRE TEA

- Starbucks Coffee Company

- Unilever

- Caraway Tea

- Harris Freeman

- The Republic of Tea

Recent Developments

-

In September 2024, Tata Tea Gold unveiled a limited edition of Kumartuli-themed packs to celebrate the Durga Puja festival. The packs incorporate five symbolic elements: Dhunuchi dance, Shankho Dhwani, Dhaki, Ashtami Pujarin, and Sindoor Khela. Each bag features a QR code that activates augmented reality experiences, allowing consumers to project ceremonial elements into their surroundings.

-

In March 2024, Pansari Group launched its new green tea range, TVOY GREEN TEA, sourced from the esteemed Nilgiris in Tamil Nadu, India. Grown at an elevation of 1900 meters, this eco-friendly product is certified ISO 9001:2008, HACCP, and Fair Trade. TVOY GREEN TEA features biodegradable Pyramid Tea Bag Filter Packaging, emphasizing the company’s commitment to sustainability. The competitively priced product will be available at retail outlets and through e-commerce platforms, catering to the growing demand for quality green tea.

-

In March 2024, PepsiCo announced a partnership with Unilever to launch Pure Leaf Zero Sugar Sweet Tea, a new product aimed at meeting the growing demand for zero-sugar beverages. This latest addition to the Pure Leaf brand offers a sweet tea flavor without added sugars, providing a healthier option for consumers conscious of their sugar intake.

-

In June 2023, Bigelow Tea announced the launch of three new tea varieties: Lavender Chamomile Plus, Orange & Spice Herbal Tea, and Matcha Green Tea with Turmeric. Each new tea is crafted to offer unique flavor profiles and health benefits, catering to diverse consumer preferences. Bigelow Tea aims to continue its tradition of providing high-quality teas.

Tea Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.42 billion

Revenue forecast in 2030

USD 24.61 billion

Growth Rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Ireland, China, Japan, India, Australia, South Korea, Argentina, South Africa, and Turkey

Key companies profiled

R. Twining and Company Limited; Dilmah Ceylon Tea Company PLC.; Bigelow Tea; PepsiCo; YORKSHIRE TEA ; Starbucks Coffee Company; Unilever; Caraway Tea; Harris Freeman; The Republic of Tea

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tea Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tea market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Black

-

Green

-

Oolong

-

Herbal

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Ireland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

- Turkey

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.