- Home

- »

- Advanced Interior Materials

- »

-

Hot Melt Adhesives Market Size, Share, Industry Report 2030GVR Report cover

![Hot Melt Adhesives Market Size, Share & Trends Report]()

Hot Melt Adhesives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Packaging, Assembly, Woodworking, Automotive, Nonwovens, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-896-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hot Melt Adhesives Market Summary

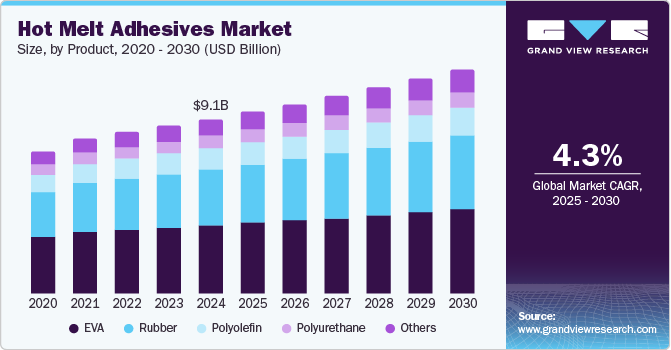

The global hot melt adhesives market size was valued at USD 9.08 billion in 2024 and is projected to reach USD 11.65 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. This growth can be attributed to the increasing demand for hot melt adhesives in the packaging sector. Rapid expansion of the e-commerce sector and rising logistics demands, especially in the food & beverage industry, are also expected to fuel this growth over the coming years.

Key Market Trends & Insights

- The Asia Pacific hot melt adhesives market dominated the global market with a revenue share of 51.7% in 2024.

- The U.S. hot melt adhesives market dominated the regional market in 2024.

- By product, the Ethylene-vinyl Acetate (EVA) segment dominated the market with a revenue share of 39.3% in 2024.

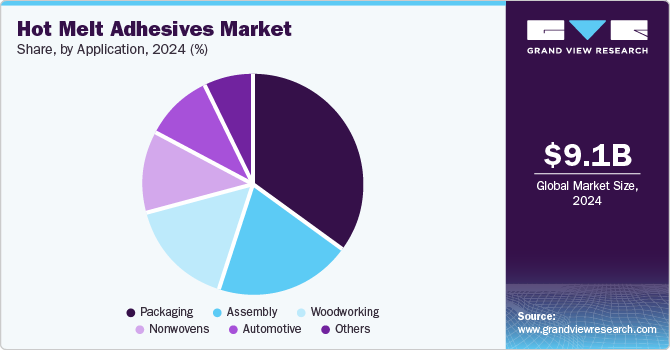

- By applicayion, packaging segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.08 Billion

- 2030 Projected Market Size: USD 11.65 Billion

- CAGR (2025-2030): 4.3%

- Asia Pacific: Largest market in 2024

In addition, sustainability concerns have led to a shift toward hot melt adhesives, which emit lower Volatile Organic Compounds (VOCs) than solvent-based alternatives. These adhesives comply with regulatory standards while catering to consumer preferences for eco-friendly solutions. Furthermore, technological advancements in polymer-based adhesives enhance their performance attributes, including bonding strength and durability, expanding their application scope across industries such as automotive, construction, and nonwoven hygiene products.

The growth of the hot melt adhesives industry is also supported by the rise of emerging markets, particularly in the Asia Pacific region. Rapid industrialization, urbanization, and increasing consumer purchasing power have boosted product demand across sectors such as construction and automotive. Manufacturers are increasingly adopting automated production systems that rely on hot melt adhesives to enhance operational efficiency and reduce costs.

Moreover, investments in research & development have enabled companies to design innovative adhesive solutions tailored to diverse industry requirements. With industries prioritizing efficiency and performance, the demand for advanced hot melt adhesives continues to increase. Thus, expanding application scope and growing technological innovations are expected to drive sustained growth in the hot melt adhesives industry in the coming years.

Product Insights

The Ethylene-vinyl Acetate (EVA) segment dominated the market with a revenue share of 39.3% in 2024 owing to its excellent adhesion properties and flexibility, which make it suitable for use in various applications. Packaging, automotive, and construction industries increasingly prefer EVA-based adhesives due to their effectiveness and reliability. The high demand for lightweight and durable materials has further supported the popularity of EVA in various sectors. In addition, advancements in formulations have enhanced the performance characteristics of EVA, contributing to its leading position in the hot melt adhesives industry.

The rubber segment is anticipated to witness a significant CAGR during the forecast period. This growth can be attributed to the increasing demand for hot melt adhesives in applications requiring strong and durable bonds, particularly in pressure-sensitive products such as labels and tapes. The ability of rubber-based adhesives to provide rapid bonding helps speed up the manufacturing processes, thereby reducing labor costs. In addition, advancements in rubber adhesive formulations are enhancing their performance in various environmental conditions, further boosting their appeal across industries. Therefore, the growing reliance on hot melt adhesives in critical applications positions the rubber segment for robust growth in the coming years.

Application Insights

The packaging segment held the largest market revenue share in 2024. This dominance is due to the extensive use of hot melt adhesives in various packaging applications, including case and carton sealing, tray forming, and labeling. The increasing demand for efficient packaging solutions, driven by the growth of e-commerce in the past few years, has significantly contributed to this trend. In addition, advancements in adhesive technology have improved the performance and reliability of hot melt adhesives in packaging, making them a preferred choice among manufacturers. Industries prioritizing effective and sustainable packaging options have also significantly contributed to the growth of the packaging segment.

The nonwovens segment is anticipated to witness a significant CAGR during the forecast period. This growth can be attributed to the growing concerns regarding personal hygiene and increasing disposable income, leading to higher demand for nonwoven products such as diapers and feminine hygiene items. Manufacturers increasingly use hot melt adhesives to produce these goods, which are in high demand as consumers prioritize hygiene and convenience. In addition, the automotive industry is also contributing to the growth, as hot melt adhesives are extensively used for various applications within vehicles. As a result, these factors are expected to contribute to the expansion of this segment in the hot melt adhesives industry over the coming years.

Regional Insights

The Asia Pacific hot melt adhesives market dominated the global market with a revenue share of 51.7% in 2024 due to rapid industrial growth and a strong presence of manufacturers in packaging, automotive, and construction sectors in the region. The expanding middle-class population in APAC has also driven demand for consumer goods, increasing the need for effective adhesive solutions. Significant investments in infrastructure projects, including transportation and residential construction, have further contributed to the demand for hot melt adhesives. The surge in e-commerce in countries such as China and India has amplified the need for efficient packaging solutions. These trends have contributed to the leading position of Asia Pacific in the hot melt adhesives market.

China Hot Melt Adhesives Market Trends

The China hot melt adhesives market dominated the regional market in 2024, driven by its manufacturing strength in electronics and textiles. Technological innovation has enabled the development of advanced adhesive solutions for various sectors. The country’s robust export market and trade agreements enhance its global supply role. Furthermore, the focus on sustainable manufacturing practices has increased demand for eco-friendly adhesives. Hence, China is expected to maintain its dominance in the region during the forecast period.

Europe Hot Melt Adhesives Market Trends

The Europe hot melt adhesives market held a significant revenue share in the global market in 2024 due to robust demand for hot melt adhesives from industries such as packaging, automotive, and construction. The increasing focus on sustainable and efficient adhesive solutions has driven the adoption of hot melt adhesives across these sectors. In addition, advancements in adhesive technology have enhanced the performance and versatility of hot melt adhesives, making them a preferred choice for manufacturers. The presence of a strong industrial base in countries such as Germany and France further boosts the use of hot melt adhesives. As a result, Europe is expected to play a key role in driving market growth in the coming years.

North America Hot Melt Adhesives Market Trends

The North America hot melt adhesives market is anticipated to witness significant growth during the forecast period. This growth can be attributed to the increasing demand from major end-use industries, including automotive, packaging, and electronics. The strong manufacturing base in North America supports the need for effective adhesive solutions across various application segments. The recovery of the construction sector post-economic slowdown is also expected to result in a surge in demand for hot melt adhesives. With companies continuing to innovate and improve their adhesive products, North America is well-positioned for sustained market expansion.

The U.S. hot melt adhesives market dominated the regional market in 2024. This dominance can be attributed to the country's advanced manufacturing capabilities and high consumer spending. In addition, the automotive industry is experiencing a resurgence, leading to increased consumption of hot melt adhesives in various applications. Furthermore, the packaging sector remains a significant contributor to market growth, driven by the rise in e-commerce and demand for efficient packaging solutions. Therefore, the U.S. market is expected to maintain its dominance in the North American industry.

Key Hot Melt Adhesives Company Insights

Key companies in the global hot melt adhesives industry include Henkel AG & Co. KGaA, H.B. Fuller Company, Dow, Sika AG, and Jowat SE. These companies adopt various strategies to enhance their competitive edge. These include investing in research and development to innovate and improve product offerings, expanding their geographic presence through strategic partnerships and acquisitions, and focusing on sustainable practices to meet environmental regulations. Furthermore, companies emphasize customer engagement and tailored solutions to address specific market needs while enhancing their distribution networks to ensure efficient product availability and support for construction projects worldwide.

-

Henkel AG & Co. KGaA is a key player in adhesive technologies and consumer products. The company offers a wide range of adhesives, sealants, and functional coatings for industrial applications and well-known consumer brands in categories such as laundry and personal care. With a strong commitment to innovation and sustainability, Henkel serves diverse industries worldwide, including automotive, electronics, and packaging.

-

DOW offers a diverse portfolio of products, including plastics, performance materials, coatings, and silicones, catering to various sectors such as packaging, infrastructure, mobility, and consumer care. With a commitment to innovation and sustainability, Dow focuses on creating solutions that address global challenges while positively impacting the environment.

Key Hot Melt Adhesives Companies:

The following are the leading companies in the hot melt adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Dow

- Sika AG

- Jowat SE

- Evonik Industries AG

- AVERY DENNISON CORPORATION

- TEX YEAR INDUSTRIES INC

- Buhnen GmbH & Co. Kg

- 3M

Recent Developments

-

In April 2024, Henkel, Kraton, and Dow announced a partnership to enhance sustainability in the North American consumer goods industry. Their collaboration aims to reduce emissions by integrating renewable raw materials into adhesive products. This initiative is expected to contribute to the development of more environment-friendly and sustainable solutions in the sector.

-

In October 2023, Dow and Avery Dennison launched a new hot melt label adhesive to enhance the recyclability of packaging. The initiative was aimed at enabling polyolefin filmic labels to be mechanically recycled alongside polypropylene or polyethylene packaging. This innovation addresses sustainability challenges in the packaging industry while maintaining adhesive performance.

Hot Melt Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.46 billion

Revenue forecast in 2030

USD 11.65 billion

Growth Rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Asia Pacific; Europe; Central and South America; Middle East and Africa.

Country scope

U.S.; Canada; Mexico; China; India; Japan; South Korea; Germany; UK; France; Italy; Brazil; Argentina; Colombia; GCC

Key companies profiled

Henkel AG & Co. KGaA; H.B. Fuller Company; Dow; Sika AG; Jowat SE; Evonik Industries AG; AVERY DENNISON CORPORATION; TEX YEAR INDUSTRIES INC; Buhnen GmbH & Co. Kg; 3M

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hot Melt Adhesives Market Report Segmentation

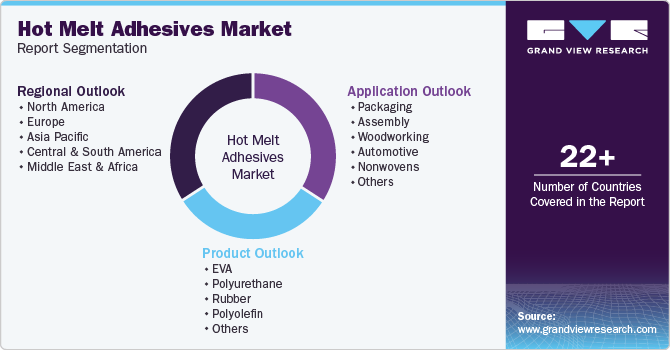

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global hot melt adhesives market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

EVA

-

Polyurethane

-

Rubber

-

Polyolefin

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Assembly

-

Woodworking

-

Automotive

-

Nonwovens

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

Colombia

-

-

MEA

-

GCC

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.