- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyolefin Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Polyolefin Market Size, Share & Trends Report]()

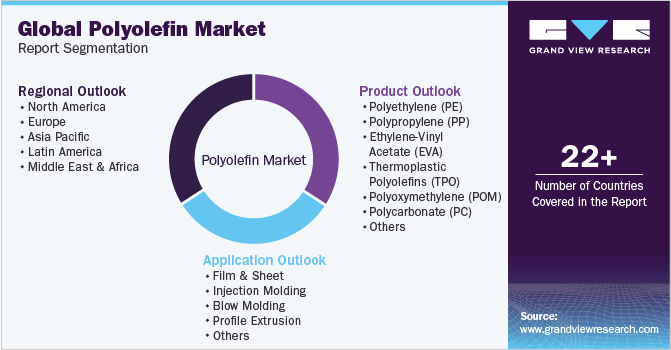

Polyolefin Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PE, PP, EVA, TPO, POM, PC, PMMA), By Application (Film & Sheet, Injection Molding, Blow Molding, Profile Extrusion), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-091-0

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyolefin Market Summary

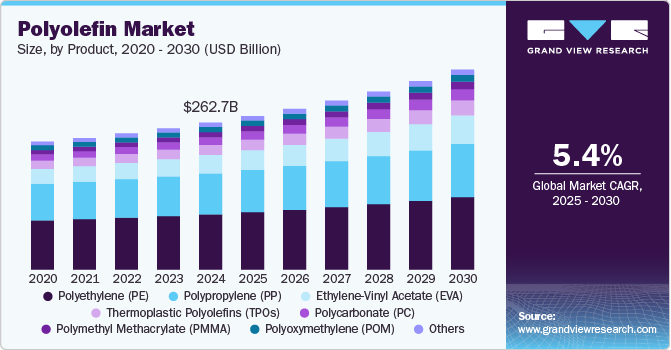

The global polyolefin market size was estimated at USD 262.71 billion in 2024 and is projected to reach USD 357.39 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The market is poised for growth due to increasing adaptation across the end-use industries.

Key Market Trends & Insights

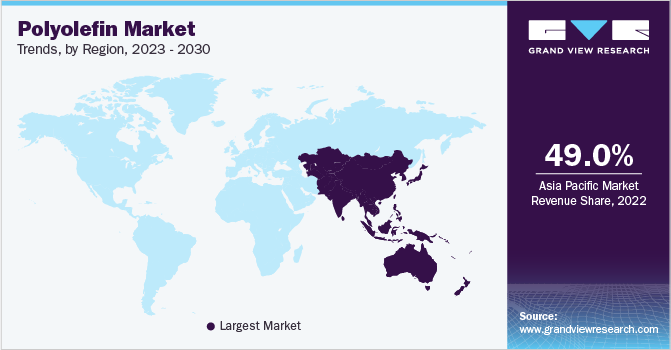

- In terms of region, Asia Pacific dominated the market and accounted for a revenue share of 49.95% in 2024.

- Country-wise, China's polyolefin market growth is expected to be driven by increasing domestic demand, expansion of production capacity, and the material's diverse applications.

- In terms of product, polyethylene (PE) accounted for a revenue share of 37.6% in 2024.

- Ethylene-Vinyl Acetate (EVA) is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 262.71 Billion

- 2030 Projected Market Size: USD 357.39 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

The use of polyolefins in automotive applications helps reduce fuel consumption on account of their ability to reduce the density and weight of vehicles compared to conventional materials such as rubber and metal. Increasing awareness regarding health hazards and consumer safety in various industries, such as electronics, healthcare, wire and cable, construction, and automotive, is expected to drive the global market over the forecast period. The rapidly developing automotive industry is expected to trigger the demand for plastics in under-the-hood components as well as exteriors and interiors of automobiles. Polyolefins are mainly used in under-the-hood components in the automotive industry.

The demand for polyolefins such as polyethylene, polypropylene, ethylene-vinyl acetate, and thermoplastics is expected to grow over the forecast period. This is due to the surging usage of medical masks, gloves, shoe & head covers, and gowns owing to rising health awareness among the masses and their increasing focus on hygiene and infection prevention.

The proposed USD 2 trillion investment of the Federal Government of the U.S. in a 10-year infrastructure development plan is poised to capitalize on the low-risk environment, stable economy, and strong financial sector of the country. These favorable conditions have already attracted significant investor interest, fostering a conducive atmosphere for surged infrastructure expenditure and development in the U.S. This, in turn, is projected to positively impact the demand for polyolefins from the construction industry of the country.

Thermoplastic polyolefins segment of the market in the U.S. is projected to grow at a significant rate during the forecast period owing to an exceptional combination of durability, weather resistance, easy process ability, and versatility which refers to their ability to be molded and reshaped when heated, and solidify when cooled, without undergoing significant chemical change offered by them. This makes thermoplastic polyolefins highly sought-after materials in the U.S. for use in the automotive, construction, and consumer goods industries.

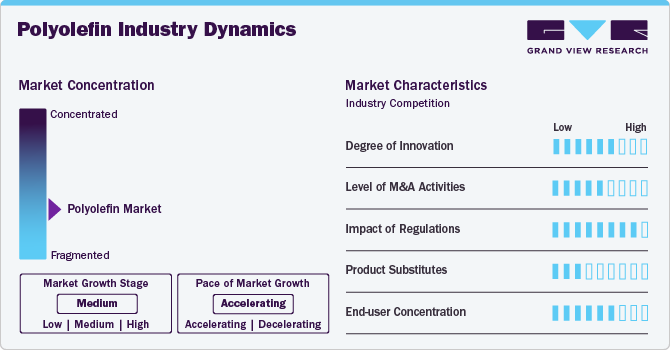

Market Concentration & Characteristics

The market is moderately fragmented, with key participants involved in R&D and technological innovations. Notable companies include China Petrochemical Corporation, LyondellBasell Industries Holdings B.V., PetroChina Company Limited, TotalEnergies, Chevron Corporation, Repsol, Dow, Inc., among others. Several players are engaged in framework development to improve their market share.

The polyolefin market is anticipated to grow due to robust demand from end-users and significant innovations aimed at improving both material performance and sustainability. Ongoing research and development efforts are resulting in the creation of advanced catalyst systems, metallocene-based polyolefins, and bio-based alternatives, which broaden application possibilities and enhance recyclability.

Additionally, the market is seeing a rise in merger and acquisition activities, as leading companies aim to broaden their product offerings, integrate operations, and extend their geographic presence—especially in rapidly growing regions like Asia-Pacific and the Middle East. This trend of consolidation, along with advancements in technology, is likely to boost economies of scale and speed up the adoption of specialty and high-performance polyolefins in packaging, automotive, and infrastructure industries.

The polyolefin market is anticipated to be influenced by changing regulatory frameworks, a low risk from alternative products, and concentrated demand from end-users. Increasing regulatory demands that focus on sustainability and circular economy initiatives are fostering innovation in recyclable and bio-based polyolefins, prompting manufacturers to invest in more sustainable production methods and advanced recycling technologies. Although environmental concerns are rising, the threat posed by alternatives like bioplastics or engineered resins remains moderate, thanks to the cost-effectiveness, versatility, and well-established processing systems of polyolefins.

Product Insights

Polyethylene (PE) led the polyolefin market across the product segmentation and accounted for a revenue share of 37.66% in 2024. Polyethylene has witnessed significant growth in recent years, with an increase in utilization across prototype development on 3D printers and CNC machines.

Furthermore, driven by the upsurge in industrialization, China, India, and Japan have emerged as prominent countries in the polyethylene market across the Asia Pacific (APAC) region. The expansion of the construction and furniture sectors, along with the presence of major automotive industries and increasing demand for sophisticated infrastructure, has emerged as a pivotal catalyst propelling the polyethylene industry in the Asia Pacific.

For instance, in April 2025, STEER World, a company specializing in materials transformation technology, introduced an innovative method to recycle crosslinked polyethylene (XLPE), which has been regarded as non-recyclable for a long time, by employing its unique Omega Twin-Screw Extrusion Technology. Frequently utilized in cable insulation, piping systems, and various high-performance applications, XLPE is known for its remarkable durability, which is attributed to its three-dimensional network of covalent bonds. While this structure provides exceptional thermal and mechanical resilience, it also renders the material challenging to recycle through traditional methods. As a result, most XLPE waste is disposed of in landfills, raising ongoing environmental issues.

Following polyethylene, polypropylene witnessed a market revenue share above 27.0% in 2024. Polypropylene can be easily manufactured into living hinges, extremely thin plastics that can be bent without breaking. Although polypropylene is not particularly used in structural applications, it finds its major usage in applications such as bottling certain edible products or even liquid soaps, shampoos, and more.

Ethylene vinyl acetate (EVA) is a redispersible polymer that is available in the form of a free-flowing powder. It shares resemblances with low-density polyethylene, showcasing heightened gloss, softness, and flexibility. These polyolefins exhibit excellent performance under low temperatures and are commonly employed as hot-melt adhesives, finding widespread application in products like soccer cleats and plastic wraps. Furthermore, EVA extends its utility to biomedical engineering, serving as a part and component of a drug delivery device in various healthcare applications.

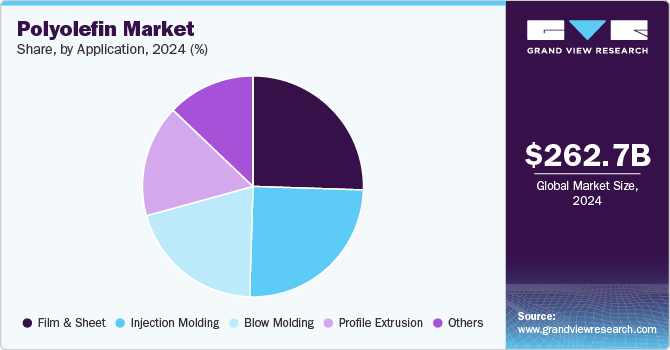

Application Insights

The film & sheet led the market for polyolefin market across the application segmentation and accounted for a revenue share of 25.51% in 2024. Polyolefins provide high-quality shrink films with improved clarity and appearance for the consumer goods industry. Polyolefins have stronger puncture resistance, are FDA approved, have no chlorine content, and are more durable; however, they are relatively more expensive.

Due to increased use in the packaging business, Asia Pacific (APAC) is one of the significant markets for polyolefin, which includes both edible and non-edible goods. Rising disposable income and living standards in China, India, Japan, Malaysia, Indonesia, and Thailand will support industry expansion throughout the forecast period. However, the European market has significant potential due to high demand for polyolefins in the furniture and interior industries.

Growing emphasis on sustainability and progressive efforts to reduce carbon footprint by various consumer electronics manufacturers have augmented the demand for post-consumer recycled plastic resins in recent years. Laptop manufacturers such as Lenovo manufactures notebooks, desktops, workstation, monitors, and other accessories using post-consumer recycled plastic resins. This increasing adoption of post-consumer recycled plastic resins is expected to continue over the forecast period.

Injection molding is used for producing custom polyolefin materials. As polyolefin parts are made in molds and must be cooled before removal, the process is discontinuous. Injection molding necessitates the use of a machine, plastic materials, and molds. To make the final product, molten plastic is pumped into the mold cavity and cooled. It is commonly used in the production of automobile parts, medical devices, containers, and others.

Growing demand for polyolefin injection molding from a variety of end-use sectors, combined with increased manufacturer awareness about the benefits of polyolefin injection molding, is expected to fuel the demand for polyolefin injection molding. Heat and pressure-resistant materials are becoming increasingly popular as infrastructure development accelerates in countries such as Brazil and India. This is likely to increase the use of polyolefin injection molding by manufacturers of building products.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of 49.95% in 2024. The region stands out for its abundance of skilled labor available at a low cost and easily accessible land. This shift in production focus toward emerging economies, particularly China and India, is poised to have a positive impact on market growth throughout the forecast period. The region is a major hub for rapidly expanding industries like construction, automotive, and electronics, offering significant potential for polyolefin manufacturers.

Continuing infrastructural investments are expected to sustain economic growth in China, and the automotive, aerospace, and construction sectors are expected to benefit from reforms, including regulatory changes, policy adjustments, or structural enhancements. However, these prospects are not long-term, and growth is likely to remain sluggish in the industrial sector, which is likely to impact the consumption of polyolefin over the forecast period.

China's Polyolefin market growth is expected to be driven by increasing domestic demand, expansion of production capacity, and the material's diverse applications. China's robust industrial foundation, along with innovation and sustainability initiatives supported by policy, is anticipated to contribute to the polyolefin market's long-term development.

North America Polyolefin Market Trends

The polyolefin industry in North America is poised for significant growth, fueled by readily available feedstock, expanding end-use industries, and a rising emphasis on sustainable materials.

The U.S. Polyolefin market is projected to experience considerable growth in the next few years, fueled by an uptick in demand from critical sectors like packaging, automotive, and construction. The flexible packaging sector remains on the rise, bolstered by a growing consumer inclination towards lightweight, durable, and recyclable materials, which makes polyethylene (PE) and polypropylene (PP) the ideal material.

Europe Polyolefin Market Trends

The polyolefin market in Europe is likely to witness sluggish growth owing to various factors, such as stalled industrial output caused by economic uncertainties, supply chain disruptions, and regulatory changes, which have collectively impacted market dynamics and expansion. Nevertheless, a promising outlook in Eastern Europe, driven by robust consumerism and manufacturing, is poised to stimulate the growth of the polyolefin market.

The growing industrial advancements, regulatory changes, and increased demand from end-users fuel the Polyolefin market in Germany. A significant emphasis on sustainability and circular economy principles is promoting the usage of recyclable and mechanically recycled polyolefins, especially in the packaging and consumer goods sectors.

Key Polyolefin Company Insights

In the Polyolefin Market, major players have adopted various strategic initiatives, such as new product launches, production expansion, mergers and acquisitions, and others. These initiatives enable the market players to maintain the competitive environment and meet global demand.

-

For instance, in February 2025, CCL Label announced the introduction of a new generation of shrink sleeves crafted from recycling-friendly polyolefin (PO) material in Southeast Asia. The low-density PO material is appropriate for flotation separation during the sink/float process at PET recycling facilities. The advancement of this high-shrink variant of EcoFloat shrink sleeve allows brand customers to transition from PVC or PET-G shrink sleeves, which hinder recycling, to an eco-friendlier alternative made from polyolefin. This material has received approval from recyclers and has been recognized by RecyClass in Europe and APR in the United States.

-

For instance, in October 2024, ExxonMobil unveiled Signature Polymers, a fresh strategy for engaging with customers and the wider value chain. The primary goal of Signature Polymers is to establish itself as the most valued global partner in the industry by enhancing service and collaboration. ExxonMobil will roll out new initiatives designed to inspire and inform how it markets its products and offers support, aiding customers in their innovation, strategy, and growth efforts. This new approach will help customers feel more assured in addressing the intricate challenges of the value chain by simplifying processes and promoting greater collaboration.

Key Polyolefin Companies:

The following are the leading companies in the polyolefin market. These companies collectively hold the largest market share and dictate industry trends.

- China Petrochemical Corporation

- LyondellBasell Industries Holdings B.V.

- PetroChina Company Limited

- TotalEnergies

- Chevron Corporation

- Repsol

- Dow, Inc.

- Exxon Mobil Corporation

- Braskem

- Borealis AG

Polyolefin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 274.38 billion

Revenue forecast in 2030

USD 357.39 billion

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR (%) from 2025 to 2030

Report coverage

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

China Petrochemical Corporation; LyondellBasell Industries Holdings B.V.; PetroChina Company Limited; TotalEnergies; Chevron Corporation; Repsol; Dow, Inc.; Exxon Mobil Corporation; Braskem; and Borealis AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyolefin Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2033. For this study, Grand View Research has segmented the global polyolefin market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Ethylene-Vinyl Acetate (EVA)

-

Thermoplastic Polyolefins (TPO)

-

Polyoxymethylene (POM)

-

Polycarbonate (PC)

-

Polymethyl Methacrylate (PMMA)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Film & Sheet

-

Injection Molding

-

Blow Molding

-

Profile Extrusion

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polyolefin market size was estimated at USD 262.71 billion in 2024 and is expected to reach USD 274.38 billion in 2025.

b. The global polyolefin market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 357.39 billion by 2030.

b. Film & sheet segment dominated the polyolefin market with a share of 25.51% in 2024. Polyolefin is diversely applied in food packaging, blown film bags, industrial thermoforming, and more.

b. Some key players operating in the polyolefin market include Sinopec Corporations, LyondellBasell Industries Holdings N.V., ExxonMobil Chemicals, and Petrochina Company Limited.

b. Key factors that are driving the polyolefin market growth include rising innovation in plastic technologies, the advent of cheap interior furnishings in automobiles, and strict industrial standards concerning carbon emissions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.