- Home

- »

- IT Services & Applications

- »

-

Hotel And Hospitality Management Software Market Report, 2030GVR Report cover

![Hotel And Hospitality Management Software Market Size, Share & Trends Report]()

Hotel And Hospitality Management Software Market Size, Share & Trends Analysis Report By Type (Property Management, Central Reservation), By Deployment, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-431-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

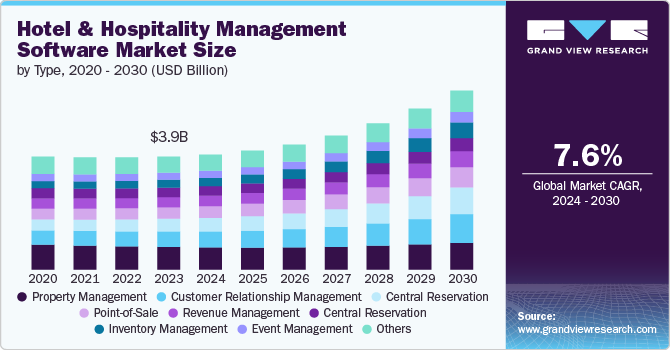

The global hotel and hospitality management software market size was estimated at USD 3.97 billion in 2023 and is anticipated to grow at a CAGR of 7.6% from 2024 to 2030. Several key factors drive the market growth. The increasing demand for enhanced guest experiences has prompted hotels to adopt advanced software solutions that streamline operations, personalize services, and improve customer engagement. The rising trend of automation in the hospitality sector and the need for real-time data analytics fuel market expansion. Furthermore, the proliferation of cloud-based platforms offers greater flexibility, scalability, and cost-effectiveness, making them attractive to businesses of all sizes. Additionally, the growing integration of artificial intelligence and machine learning in these solutions enhances decision-making processes and operational efficiency, further driving market growth.

The increasing demand for enhanced guest experiences is a significant driver of the hotel and hospitality management software market. As guests seek more personalized and seamless interactions during their stays, hotels increasingly rely on sophisticated software solutions to meet these expectations. These technologies enable hoteliers to tailor services to individual preferences, streamline check-in and check-out processes, and offer real-time responses to guest inquiries. By integrating customer relationship management (CRM) systems, mobile applications, and AI-driven tools, hotels can anticipate, and address guest needs more effectively, leading to higher satisfaction and loyalty. This focus on elevating the guest experience pushes hotels to invest in advanced management software, propelling the market's growth.

The rising trend of automation in the hospitality sector, coupled with the growing need for real-time data analytics, is a crucial driver of market expansion for hotel and hospitality management software. Automation streamlines various operational processes, such as reservations, billing, and housekeeping, reducing manual effort and minimizing errors. This enhances operational efficiency and allows staff to focus more on guest satisfaction. Concurrently, the demand for real-time data analytics enables hotels to make informed decisions quickly, optimize pricing strategies, and improve service delivery based on immediate insights into customer behavior and preferences. Together, these advancements empower hotels to operate more effectively and competitively, significantly contributing to expanding the hospitality management software market.

Type Insights

The property management segment accounted for the largest revenue share, over 20% in 2023. The need for streamlined and efficient management of daily operations within hospitality establishments drives the market. As hotels seek to enhance operational efficiency, reduce costs, and improve guest satisfaction, adopting PMS becomes increasingly essential. This software automates and integrates various functions such as room bookings, guest check-ins and check-outs, billing, and housekeeping management, ensuring that all hotel operations are managed seamlessly. Additionally, the growing trend toward cloud-based solutions offers enhanced accessibility, scalability, and data security, further propelling the hospitality industry's demand for property management software.

The central reservation segment is anticipated to grow at the fastest CAGR from 2024 to 2030. This is primarily driven by the increasing need for effective distribution management and maximizing room occupancy. CRS enables hotels to manage reservations across multiple channels, including direct bookings, online travel agencies (OTAs), and global distribution systems (GDS). By centralizing reservation data, hotels can ensure real-time availability and pricing accuracy across all platforms, reducing the risk of overbooking and optimizing revenue. As the hospitality industry becomes more competitive and guests increasingly book through various online channels, adopting CRS solutions is critical for hotels to maintain a strong market presence and enhance their revenue management strategies.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2023. The demand for flexibility, scalability, and cost-efficiency primarily drives the adoption of hotel and hospitality management software on cloud platforms. Cloud-based solutions allow hotels to access their management systems from anywhere, anytime, providing greater operational agility and enabling seamless updates without significant downtime. This model particularly appeals to small and medium-sized hotels that may need more resources for extensive IT infrastructure, as it reduces the need for large upfront investments and ongoing maintenance costs. Additionally, cloud-based software offers enhanced data security, automatic backups, and the ability to integrate easily with other systems, making it a preferred choice for many in the industry.

The on-premises segment is anticipated to grow at a CAGR of over 6% during the forecast period. The adoption of on-premises hotel and hospitality management software is driven by the need for greater control, customization, and compliance. Larger hotel chains or those with specific operational requirements may prefer on-premises solutions as they allow for a higher degree of customization tailored to the property's unique needs. This approach also gives hotels complete control over their data, which is critical for institutions with strict regulatory compliance requirements or concerns about data sovereignty. Furthermore, on-premises solutions can offer more robust performance in environments with limited internet connectivity, ensuring uninterrupted service even in remote locations.

End-use Insights

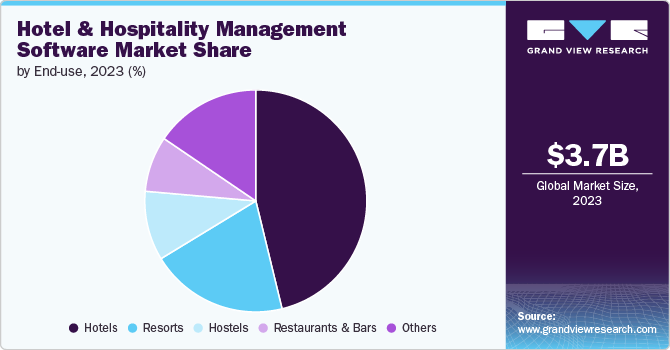

The hotel segment accounted for the largest market share of over 46% in 2023. The need to enhance operational efficiency, improve guest experiences, and manage complex logistical challenges leading to its adoption in the market. Hotels, which often manage large volumes of guests, room bookings, and staff, require sophisticated systems to streamline daily operations such as reservations, housekeeping, billing, and customer relationship management. Integrating various functions into a single platform allows hotels to optimize resource allocation, reduce operational costs, and provide a more personalized experience to guests. Additionally, the increasing competition in the hospitality industry compels hotels to adopt advanced software solutions that can help them stay competitive by offering superior service and efficiently managing their operations.

The restaurants and bars segment is anticipated to grow at the highest CAGR from 2024 to 2030. The adoption of hotel and hospitality management software in restaurants and bars is primarily driven by the need to manage inventory, streamline order processing, and enhance customer service. Restaurants and bars deal with high volumes of orders, inventory turnover, and staff coordination, making efficient management software crucial for maintaining service quality and profitability. These systems enable restaurant and bar owners to track inventory levels in real time, manage table reservations, process orders quickly, and analyze sales data to make informed decisions. Moreover, the growing demand for seamless and speedy customer experiences, especially in fast-paced environments like bars and restaurants, drives the adoption of software solutions that can automate routine tasks, reduce wait times, and improve overall operational efficiency.

Regional Insights

North America hotel and hospitality management software held the major share of over 35% of the global market in 2023. The North American market is witnessing a trend toward advanced integration and automation. There is a growing emphasis on adopting cloud-based solutions and artificial intelligence (AI) to enhance operational efficiency and guest personalization. Furthermore, the region is experiencing increased investment in data analytics and customer relationship management (CRM) systems, driven by the need for deeper insights into guest preferences and behavior to deliver tailored experiences.

U.S. Hotel And Hospitality Management Software Market Trends

The hotel and hospitality management software market in the U.S. is expected to grow significantly from 2024 to 2030. The U.S. market is characterized by a strong shift towards mobile and contactless technologies. The adoption of mobile check-in/check-out, digital keys, and mobile concierge services is accelerating, driven by evolving consumer expectations for convenience and safety. Additionally, there is significant interest in leveraging AI and machine learning to optimize revenue management and operational processes, reflecting the U.S.'s focus on technological innovation and competitive differentiation in the hospitality sector.

Europe Hotel And Hospitality Management Software Trends

The hotel and hospitality management software market in Europe is growing significantly at a CAGR of over 6% from 2024 to 2030. Europe's hotel and hospitality management software market is increasingly focused on sustainability and compliance with stringent regulations. There is a notable trend towards integrating software solutions that support green practices, such as energy management systems and waste reduction technologies. Additionally, the region is adopting multi-language and multi-currency capabilities to cater to a diverse and international clientele, enhancing the flexibility and accessibility of management systems.

Asia Pacific Hotel And Hospitality Management Software Trends

The hotel and hospitality management software market in Asia Pacific is growing significantly at a CAGR of over 9% from 2024 to 2030. In Asia Pacific, the market is driven by rapid urbanization and the expansion of the tourism industry, leading to increased demand for scalable and adaptable management software. There is a significant trend towards mobile-first solutions, reflecting the high smartphone penetration and digital engagement in the region. Additionally, adopting cloud-based platforms is growing as businesses seek cost-effective and flexible solutions to manage their operations amidst diverse and rapidly changing market conditions.

Key Hotel And Hospitality Management Software Company Insights

Key companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Hotel And Hospitality Management Software Companies:

The following are the leading companies in the hotel and hospitality management software market. These companies collectively hold the largest market share and dictate industry trends.

- Agilysys NV LLC.

- Cloudbeds

- Hotelogix India Pvt. Ltd

- Maestro PMS

- Mews Systems

- Microsoft

- Oracle

- RoomRaccoon

- SAP SE

- StayNTouch

Recent Developments

-

In August 2024, Agilysys, a global provider of hospitality software services and solutions, completed the acquisition of Book4Time in an all-cash transaction valued at USD150 million. Book4Time, headquartered in Canada, specializes in spa management software and ancillary revenue solutions for resorts, hotels, and various property types across over 100 countries. The company’s software integrates with over 60 technology providers, including property management and point-of-sale systems. Agilysys has stated that this acquisition will enhance its ability to expand its solutions-per-customer penetration on a global scale.

-

In March 2024, Mews Systems, a provider of hospitality cloud solutions, announced the successful completion of a new funding round, raising USD 110 million. The investment round is spearheaded by existing investor Kinnevik, with participation from Revaia, Notion Capital, Goldman Sachs Alternatives, and new investor LGVP. This latest funding round values Mews at USD 1.2 billion.

Hotel And Hospitality Management Software Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.04 billion

Revenue forecast in 2030

USD 6.29 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Agilysys NV LLC.; Cloudbeds; Hotelogix India Pvt. Ltd; Maestro PMS; Mews Systems, Microsoft; Oracle; RoomRaccoon; SAP SE; StayNTouch

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hotel And Hospitality Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hotel and hospitality management software market report based on type, deployment, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Property Management

-

Customer Relationship Management (CRM)

-

Central Reservation

-

Channel Management

-

Event Management

-

Inventory Management

-

Point-of-Sale

-

Revenue Management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

Hybrid

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hotels

-

Resorts

-

Hostels

-

Restaurants and Bars

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hotel and hospitality management software market size was estimated at USD 3.97 billion in 2023 and is expected to reach USD 4.04 billion in 2024.

b. The global hotel and hospitality management software market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 6.29 billion by 2030.

b. North America dominated the hotel and hospitality management software market with a market share of 35.94% in 2023. The hotel and hospitality management software market in North America is witnessing a trend toward advanced integration and automation. There is a growing emphasis on adopting cloud-based solutions and artificial intelligence (AI) to enhance operational efficiency and guest personalization. Furthermore, the region is experiencing increased investment in data analytics and customer relationship management (CRM) systems, driven by the need for deeper insights into guest preferences and behavior to deliver tailored experiences.

b. Some key players operating in the hotel and hospitality management software market include Agilysys NV LLC., Cloudbeds, Hotelogix India Pvt. Ltd, Maestro PMS, Mews Systems, Microsoft, Oracle, RoomRaccoon, SAP SE, and StayNTouch.

b. Several key factors drive the growth of the hotel and hospitality management software market. The increasing demand for enhanced guest experiences has prompted hotels to adopt advanced software solutions that streamline operations, personalize services, and improve customer engagement. The rising trend of automation in the hospitality sector and the need for real-time data analytics fuel market expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."