- Home

- »

- IT Services & Applications

- »

-

Property Management Software Market Size Report, 2033GVR Report cover

![Property Management Software Market Size, Share & Trends Report]()

Property Management Software Market (2026 - 2033) Size, Share & Trends Analysis Report By Deployment (Cloud, On-Premise), By Application (Residential, Commercial), By Solution, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-053-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Property Management Software Market Summary

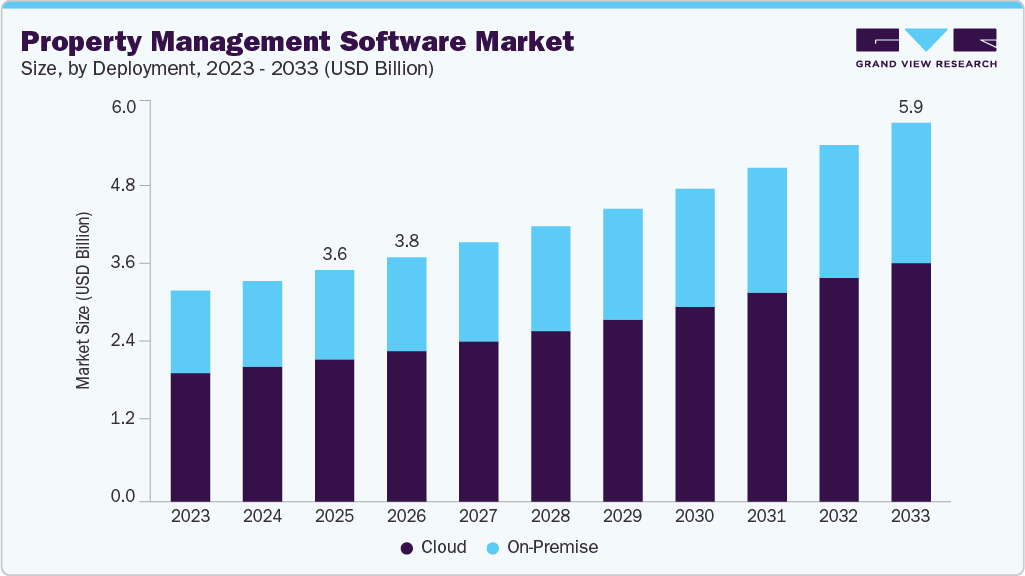

The global property management software market size was estimated at USD 3.61 billion in 2025 and is projected to reach USD 5.89 billion by 2033, growing at a CAGR of 6.4% from 2026 to 2033. The market is anticipated to grow due to increased demand for web-based services, such as Software as a Service (SaaS).

Key Market Trends & Insights

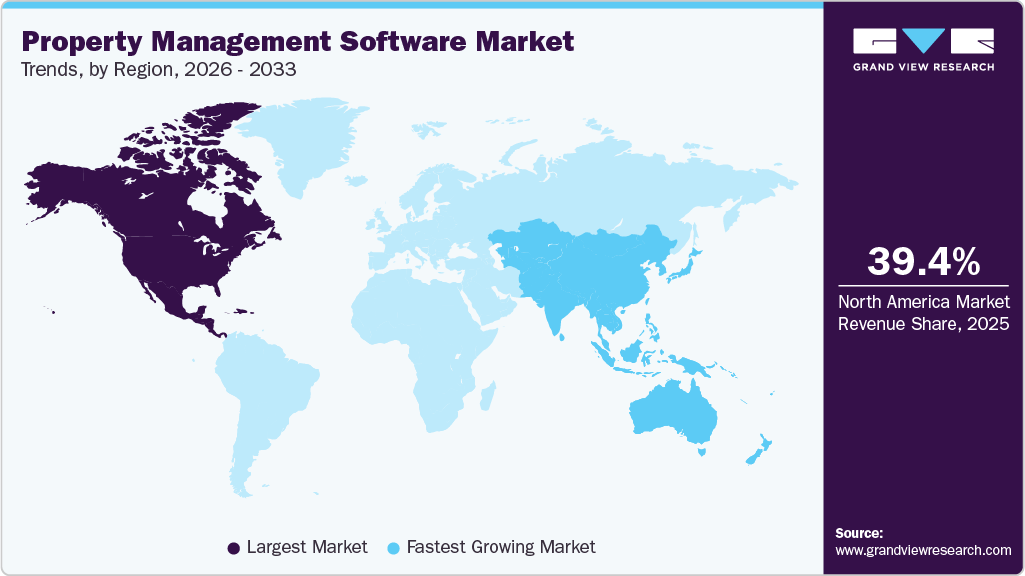

- North America held 39.4% revenue share of the property management software market in 2025.

- The U.S. property management software industry held the largest revenue share of 74.4% in 2025.

- By deployment, the cloud segment held the largest revenue share of 61.4% in 2025.

- By application, the residential segment held the largest revenue share in 2025.

- By end use, the property managers/ agents segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.61 Billion

- 2033 Projected Market Size: USD 5.89 Billion

- CAGR (2026-2033): 6.4%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

SaaS-enabled PMS helps streamline daily tasks, such as accounting, tenant tracking, and building maintenance. It provides a single, central platform where property managers can manage tenant requests, maintenance activities, and other operational tasks. Key features include online document storage, financial reports, accounting tools, maintenance tracking, digital lease agreements, and banking integrations. Regulatory compliance is a significant aspect of property management. PMS solutions help managers comply with local, state, and federal regulations by tracking leases, organizing legal documents, and staying up-to-date on regulatory changes. This is especially important in areas with strict laws, where failure to comply can result in severe penalties. As a result, property managers are increasingly adopting software that streamlines compliance with legal requirements.

Automated PMS tools reduce human errors and help property managers assign tasks more efficiently, preventing service delays. An automatic PMS helps reduce the time taken to respond to complaints and grievances of tenants or owners. Additionally, it streamlines property management procedures by facilitating rent collection processes, reducing communication gaps, tracking finances, and storing and leasing documents and contracts, among other benefits.

Whereas, in traditional ways of property management, the data is documented manually using Notepad, Microsoft Excel, or other spreadsheets. This made the process slow, inefficient, and more likely to have errors. Landlords either had to manage everything themselves or hire third-party managers, requiring more time and labor. Thus, PMS was formed to evade human errors and streamline work through automation. The easy availability of PMS has automated and simplified the work of owners and estate managers.

Moreover, PMS solutions and digital record-keeping have significantly enhanced productivity in the hospitality industry by consolidating and centralizing information across multiple devices and computers. These systems can also be customized based on a hotel’s needs to make operations easier, such as automating check-in/check-out, managing hotel inventory, handling bookings, integrating POS systems, calculating food and beverage costs, improving security and room access, and generating KPI reports.

Deployment Insights

The cloud segment dominated the property management software market, accounting for the largest revenue share of 61.2% in 2025. This growth is driven by the increasing adoption of cloud-based solutions by housing associations, corporate occupiers, property managers, and other organizations. Cloud PMS is widely adopted due to its cost-effectiveness, ease of use, scalability, and ability to help reduce tenant disputes. It also provides data backup and smooth data integration, preventing data loss. Additionally, cloud PMS helps property managers save money by reducing both the direct costs of manual processes and the indirect costs associated with recovering payments.

The on-premises deployment segment is expected to register considerable growth over the forecast period. A key reason for this growth is the increasing concern around data security and privacy. With on-premises systems, all data stays under the organization’s control because it is kept and operated on its internal servers. This is especially important for property managers who handle sensitive tenant information, financial details, and legal documents. By keeping data on-site, organizations can apply stronger security measures and lower the risk of data breaches that may occur with cloud-based solutions.

Solution Insights

The software segment dominated the property management software industry with the largest share in 2025. The market is growing as property managers increasingly turn to software, which simplifies daily operations and consolidates everything into one place. As property portfolios became increasingly complex, these platforms helped automate routine tasks, enhance decision-making with analytics, and enable teams to work from anywhere. The shift also reflected a growing understanding that robust software tools can enhance tenant satisfaction, increase occupancy, and optimize resource utilization, encouraging businesses to invest more in modern digital solutions.

The services segment is expected to grow at a significant CAGR over the forecast period. This growth reflects the increasing demand for expert support to handle the more complex aspects of property management. Many property owners and managers rely on service providers for assistance with compliance, tenant communication, marketing, and long-term planning, areas that often require more hands-on expertise than software alone can provide. These services also strengthen the value of software platforms through training, ongoing support, and customized setup, making it easier for teams to use digital tools effectively. Growth in this segment is further driven by factors such as increasing regulatory requirements, the push for better tenant experiences, skill gaps within in-house teams, and the need for faster onboarding as businesses adopt new technologies. Overall, services play a crucial role in helping property managers operate efficiently, mitigate risk, and achieve better results from their software investments.

Application Insights

The residential segment accounted for the largest market share of 70.5% in 2025 and is expected to continue its dominance over the forecast period. The dominance of the residential segment can be attributed to the increasing demand for rental properties and increasing investments in real estate. Urbanization trends and changing lifestyle preferences have led to a significant increase in the number of people opting to rent rather than buy homes. This trend is especially pronounced among younger generations, who prioritize flexibility and are less inclined to commit to long-term homeownership. As a result, there is a higher volume of rental properties, which drives the need for effective property management solutions. The residential segment is further distributed into sub-segments, namely multi-family housing/apartments, single-family housing, and others.

The commercial segment is expected to grow at the fastest CAGR over the forecast period. The growing commercial sector across the globe is one of the major factors driving market demand. The increasing focus on cyber risk management, growing disposable income, and evolving consumption technologies, among others, are other factors expected to fuel investments in the commercial sector, which drives the PMS market growth. Moreover, the commercial segment includes various sub-segments, namely retail spaces, office spaces, hotels, and others. PMS has become an essential tool in the hotel management industry. It helps in handling the interface of numerous departments within a hotel to manage the estate or land effectively. It also helps automate various hotel operations, including guest bookings, guest details, materials management, online reservations, food and beverage costing, point of sale, accounts receivable, HR and payroll, and maintenance management. Additionally, it supports functions such as sales and marketing, quality management, and other hotel amenities.

End Use Insights

The property managers/ agents segment dominated the property management software market in 2025. Property management has become increasingly complex due to the growth in the number and variety of properties, including residential, commercial, and industrial. Property managers handle a range of tasks, including tenant screening, lease administration, rent collection, maintenance coordination, and compliance with local regulations. The complexity of these operations necessitates the use of advanced PMS to streamline and automate processes, improve efficiency, and reduce administrative burdens.

The housing associations segment is expected to witness considerable growth over the forecast period. Apartments and townships in this space often struggle with issues such as collecting rent on time, managing lease contracts, and keeping track of tenants effectively. To address these issues, property management software (PMS) providers are introducing user-friendly tools for on-site inspections, automated payment monitoring, clear reporting dashboards, and streamlined maintenance scheduling. A key advantage comes in affordable housing programs, where PMS ensures precise rent calculations by matching tenant contributions against government subsidies, promoting transparency and fairness in rental allocations. This targeted functionality enables housing associations to operate more efficiently, reduce administrative burdens, and enhance tenant satisfaction while complying with subsidy regulations.

Regional Insights

North America dominated the property management software market, accounting for a 39.4% revenue share in 2025. This dominance can be attributed to the widespread availability of high-speed internet, strong cloud computing capabilities, and cutting-edge software development resources. This creates an ideal environment for the adoption and innovation of PMS. Companies in North America are at the forefront of developing and implementing advanced technological solutions, making the region a leader in the target market.

U.S. Property Management Software Market Trends

The U.S. property management software industry held the largest share of 74.4% in 2025. This dominance is expected to continue and is anticipated to grow at a significant CAGR from 2026 to 2033. The U.S. has a high rate of urbanization, with a large portion of the population living in cities and metropolitan areas. This urban concentration drives the development of large residential complexes, commercial buildings, and mixed-use properties. The U.S. also has a well-established real estate sector with institutional investors, REITs, and independent landlords managing diverse and extensive property portfolios. According to the U.S. Department of the Treasury, approximately 90% of families earning less than USD 20,000 annually spend more than 30% of their income on housing costs, a key threshold defined by HUD. This growing housing cost burden prompts property managers and housing providers to adopt software that enhances operational efficiency, ensures transparency, and facilitates compliance with federal housing requirements. The ongoing need for remote property management, accelerated by the pandemic, is further strengthening the adoption of PMS. As a result, the U.S. remains the primary driver of PMS innovation and revenue growth in the North American market.

Asia Pacific Property Management Software Market Trends

Asia Pacific is expected to record the fastest CAGR of 8.9% over the forecast period. Several factors contribute to this rapid growth, reflecting the dynamic and evolving real estate landscape in the region. Several countries in the Asia Pacific are implementing government initiatives and smart city projects to enhance urban infrastructure and improve the quality of life. These projects often involve large-scale property developments that require advanced management solutions. PMS plays a crucial role in smart city initiatives by providing tools for efficient property management, energy management, and tenant services.

The property management software market in China is experiencing significant growth, driven by significant investment in PropTech (Property Technology) startups and innovative solutions aimed at transforming the real estate industry. These investments support the development of advanced PMS tailored to the unique requirements of the market. PropTech startups in China are focusing on areas such as smart buildings, tenant engagement, and data analytics, driving innovation and market growth in the PMS sector.

Europe Property Management Software Market Trends

The adoption of property management software in Europe is on the rise, driven by several key factors. Europe has been at the forefront of sustainability initiatives, with a strong focus on reducing carbon emissions and improving energy efficiency in buildings. PMS plays a crucial role in promoting sustainability by optimizing energy usage, monitoring environmental performance, and facilitating green building certifications. The integration of sustainability features into property management software aligns with European priorities and drives adoption among property managers committed to sustainable property management practices.

The UK property management software market is witnessing demand due to a combination of factors such as efficiency, transparency, and scalability in streamlined PMS. Property managers in the UK are seeking software solutions that can automate routine tasks, centralize data management, and provide actionable insights to optimize operations.

Key Property Management Software Company Insights

Some of the key companies operating in the market include MRI Software LLC and AppFolio, Inc.

-

MRI Software LLC is a global real estate technology company offering solutions for property management, financials, leasing, facilities, and investment management. With more than 45,000 clients across 170+ countries, it has a strong global presence. Its property management software supports residential, commercial, and mixed-use portfolios, providing tools for accounting, leasing, maintenance, and tenant services through an open, flexible, and integrated platform.

-

AppFolio, Inc. is a cloud-based real estate software company. It serves over 20,000 customers and manages more than 8 million units across diverse property types worldwide. Its core product, AppFolio Property Manager, delivers end-to-end property management: marketing & leasing, maintenance, accounting & reporting, resident communications, and workflow automation. Recently, AppFolio expanded into “real-estate performance management,” embedding AI via its Realm-X platform to streamline leasing, maintenance, and other operational workflows, aiming to increase efficiency and support growth.

Key Property Management Software Companies:

The following are the leading companies in the property management software market. These companies collectively hold the largest market share and dictate industry trends.

- AppFolio, Inc

- Reapit

- Entrata, Inc.

- MRI Software LLC

- RealPage, Inc.

- REI Master

- Yardi Systems, Inc.

- Zillow Group, Inc.

- SAP SE

- ResMan

- Buildium, A RealPage Company

- Innago

- SimplifyEm Inc.

- Rentec Direct

- Hemlane, Inc.

Recent Developments

-

In October 2025, MRI Software expanded its AI companion, Ask Agora, to strengthen its AI-first strategy for real estate businesses. The enhanced tool delivers smarter insights by turning data into intelligent, easy-to-use workflows. MRI states that the upgrade enhances the user experience and supports its open-platform approach, enabling clients to make faster and more informed decisions.

-

In October 2025, Entrata introduced two new AI-powered platforms, Homebody RXP for residents and the Operations Experience Platform (OXP) for property teams, at its Summit 2025, advancing its goal of “Autonomous Property Management.” Homebody RXP is now live across Entrata communities, providing residents with a single, easy-to-use app for leasing, payments, maintenance, renewals, and other services. OXP serves as a smart control center for property teams, offering clear visibility of tasks, AI-supported workflows, unified communication tools, and detailed resident profiles. Together, these platforms simplify daily operations, enhance the resident experience, and increase overall efficiency for property managers.

-

In May 2025, Yardi launched Yardi Acquisition Manager, a fully integrated platform that automates real estate acquisition and disposition workflows. The solution centralizes deal data, documents, underwriting models, and due diligence activities, providing real-time insights to accelerate deal execution and improve ROI. It connects seamlessly with Yardi Voyager, Valuation Manager, Yardi Matrix, and CommercialEdge for comprehensive property intelligence.

Property Management Software Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.81 billion

Revenue forecast in 2033

USD 5.89 billion

Growth rate

CAGR of 6.4% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Deployment, solution, application, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AppFolio, Inc.; Reapit, Entrata, Inc.; MRI Software LLC, RealPage, Inc.; REI Master; Yardi Systems, Inc.; Zillow Group, Inc.; SAP SE; ResMan; Buildium, A RealPage Company; Innago; SimplifyEm Inc.; Rentec Direct; Hemlane, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Property Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the property management software market report based on deployment, solution, application, end use, and region:

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-Premise

-

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Multi-Family Housing/ Apartments

-

Single-Family Housing

-

Others

-

-

Commercial

-

Retail Spaces

-

Office Spaces

-

Hotels

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Housing Associations

-

Property Managers/ Agents

-

Property Investors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global property management software market size was estimated at USD 3.61 billion in 2025 and is expected to reach USD 3.81 billion in 2026.

b. The global property management software market is expected to grow at a compound annual growth rate of 6.4% from 2026 to 2033 to reach USD 5.89 billion by 2033.

b. North America dominated the property management software market with a share of 39.4% in 2025. This is attributable to the increasing number of hotel spaces in the U.S. and the presence of prominent players in the region, including AppFolio, Inc., Buildium, Entrata, Inc., MRI Software LLC, and Yardi Systems Inc.

b. Some key players operating in the property management software market include AppFolio, Inc., MRI Software LLC, Console Australia Pty Ltd, RealPage, Inc., REI Master, Yardi Systems Inc., CoreLogic, Entrata, Inc., Zillow Group, Inc., SAP, ManageCasa, ResMan.

b. Key factors that are driving the property management software market growth include escalating demand for web-based services including Software as a Service (SaaS) by property management software providers, increasing investments in real estate, and a rise in the demand for transparency in property management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.