Household Aluminum Foil Market Trends

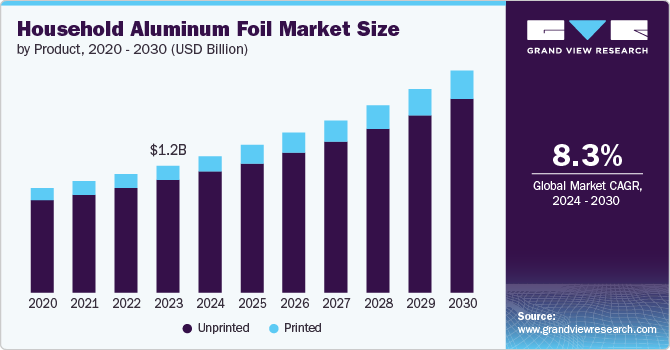

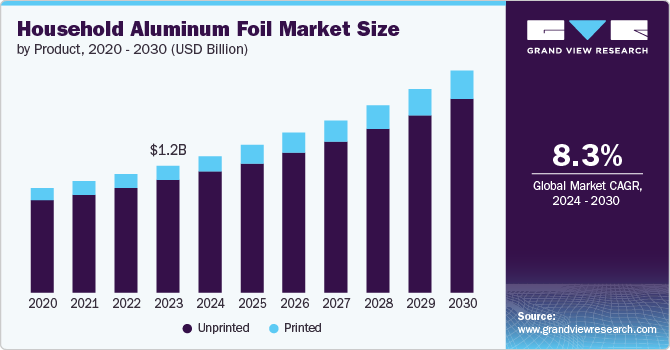

The global household aluminum foil market size was valued at USD 1.24 billion in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. This is attributed to changing consumer lifestyle and increased need for convenient & hygienic packaging solutions for on the go consumption habits. Aluminum foil is commonly used to wrap food due to its features such as long shelf life, temperature resistance, light weight, durability and recyclability. The rise in the global working class population has increased demand for packaged food, fueling the market growth.

Shifts in consumer lifestyles and preferences have resulted in an increased demand for convenient and hygienic packaging solutions. Aluminum foil is widely used for wrapping foods due to its advantageous features such extended shelf life protection, temperature resistance, light weight, durability, and recyclability. These qualities make it an ideal choice for preserving the freshness and quality of a variety of food products.

The growing working-class population globally has significantly contributed to the increase in demand for packaged food products. With more people having busy lifestyles and looking for quick meal solutions, the demand for pre-packaged foods that can be easily stored and transported has increased. This trend has fueled the market growth of household aluminum foil as it plays a crucial role in maintaining the quality of packaged foods while ensuring convenience and hygiene.

Furthermore, the versatility and convenience offered by household aluminum foil have contributed to its increasing popularity among consumers. Aluminum foil can be used for various purposes beyond food packaging, such as cooking, grilling, baking, and many more. Aluminum foil can be recycled, which makes it an eco-friendlier option than other packaging materials. As consumers become more conscious about environmental issues and seek eco-friendly alternatives,leading to a growing demand for aluminum foil as a sustainable packaging choice.

Product Insights

The unprinted segment dominated the market and accounted for the largest revenue share of 88.2% in 2023. Large number of working population prefer to use this product due to its economic cost and ease of use. Unprinted aluminum foils, cater to consumers who prioritize simplicity and functionality over elaborate packaging.

The printed segment is expected to grow at the fastest CAGR of 9.2% from 2024 to 2030. Printed designs add a touch of personality and vibrancy to kitchens. This can be particularly appealing to design-conscious consumers who appreciate decorative touches in everyday items. Prints can go beyond aesthetics and offer practical benefits. Information printed on the foil, such as cooking temperatures or recommended uses, can be a convenient reference for home cooks.

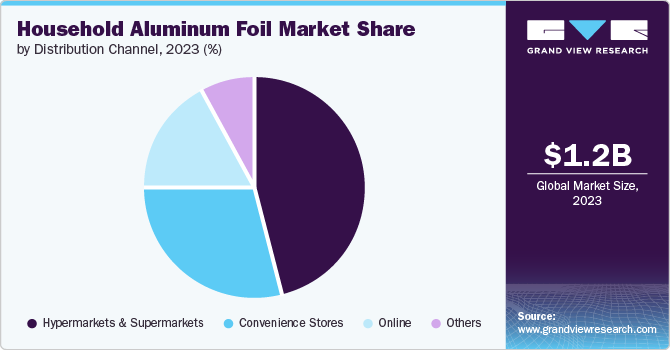

Distribution Channel Insights

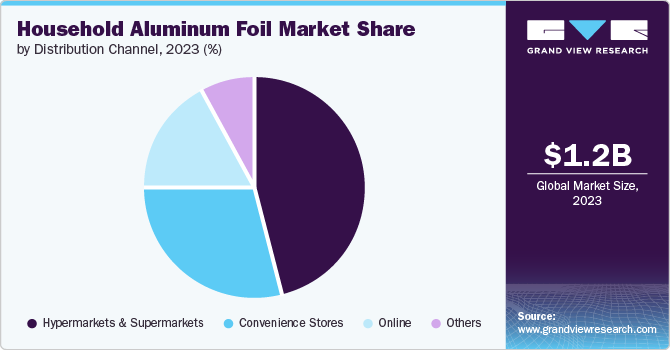

Hypermarkets & supermarkets held the largest revenue share of 45.6% in 2023 as these stores offer a wide range of options and offer a one-stop shop for all household needs. It has been observed that extensive promotional campaigns by leading brands can help to increase the sales of the product, which attracts manufacturers to utilize these channels. Consumers can physically verify the products before any purchase and renovated structure of hypermarkets have been attracting the customers.

The online segment is projected to grow at the fastest CAGR of 8.9% during the forecast period. Online shopping allows customers to browse and purchase products at their convenience, without having to visit a physical store. Online retailers often have lower overhead costs, enabling them to offer competitive prices on their products.

Regional Insights

North America household aluminum foil market held a considerable share of 40.4% in 2023. It is attributable to lifestyle changes, increasing disposable income and growing consumer awareness about the usage of aluminum foils in household.

U.S. Household Aluminum Foil Market Trends

The U.S. household aluminum foil market dominated the North America market in 2023 due to the busy lifestyle that has led to a greater reliance on ready-to-eat meals and packaged foods, which often require aluminum foil for storage and heating purposes.

Europe Household Aluminum Foil Market Trends

Europe household aluminum foil market was identified as a lucrative region in 2023 due tobusy lifestyles that fuel the demand for convenient food storage solutions. According to European Aluminium Foil Association, most households in the region are used to having aluminum foil in the home. Aluminum foil's barrier to steam, light, liquid, & aromas is a key reason for its application in the kitchen.

The UK household aluminum foil market is expected to grow significantly in the coming years due to busy lifestyle of people in the country. Aluminum foil's ease of use and versatility, from wrapping leftovers to covering cookware, cater to this need for quick and efficient food handling. The Germany household aluminum foil market held a substantial market share in 2023 owing to the growing popularity of ready-to-eat meals.

Asia Pacific Household Aluminum Foil Market Trends

The Asia Pacific household aluminum foil market is anticipated to witness the fastest CAGR during the forecast period. This growth is owing to the increasing urbanization and increasing disposable income that have led to a rise in demand for convenient and cost-effective packaging solutions.

The household aluminum foil market in India is expected to grow rapidly from 2024 to 2030 due to rapid industrialization and urbanization that have resulted in a surge in the consumption of packaged food products that require efficient packaging solutions. The China household aluminum foil market is expected to grow rapidly in the coming years due to the changing lifestyle preferences.

Key Household Aluminum Foil Company Insights

Some of the key companies in the household aluminum foil market include Alufoil Products Pvt. Ltd, Flexifoil Packaging Pvt. Ltd., Eurofoil, Amcor plc, All Foils, Inc. and Hindalco Industries Ltd. Organizations in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Carcano Antonio S.p.A. is a manufacturing firm that specializes in designing and producing packaging materials, particularly aluminum laminates. It operates in the industrial engineering and manufacturing sectors, with a focus on providing innovative and sustainable solutions.

-

Hindalco Industries Ltd, a manufacturer of aluminum and copper products. The company’s product range includes aluminum in various forms such as billets, ingots, and wire rods, alumina, as well as value-added products like rolled products, extrusions, and foils.

Key Household Aluminum Foil Companies:

The following are the leading companies in the household aluminum foil market. These companies collectively hold the largest market share and dictate industry trends.

- Alufoil Products Pvt. Ltd

- Carcano Antonio S.p.A.

- Alcoa Corporation

- Aluflexpack group

- Cuki Cofresco S.r.l.

- Flexifoil Packaging Pvt. Ltd.

- Eurofoil

- Amcor plc

- All Foils, Inc.

- Hindalco Industries Ltd.

Recent Developments

-

In August 2023,Amcor announced that it entered into an agreement to acquire Phoenix Flexibles. This acquisition is expected to enhance Amcor’s capacity in India.

-

In March 2023, LSKB Aluminium Foils Pvt Ltd. launched HOMEFOIL, India’s first Golden Embossed Foil. The product is developed using innovative technology in environmentally friendly, safe & well-ventilated premises to meet the hygiene level.

Household Aluminum Foil Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.33 billion

|

|

Revenue forecast in 2030

|

USD 2.15 billion

|

|

Growth Rate

|

CAGR of 8.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

August 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, Distribution Channel and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, Australia, South Korea, Brazil, and UAE

|

|

Key companies profiled

|

Alufoil Products Pvt. Ltd, Carcano Antonio S.p.A., Alcoa Corporation, Aluflexpack group, Cuki Cofresco S.r.l., Flexifoil Packaging Pvt. Ltd., Eurofoil , Amcor plc, All Foils, Inc., Hindalco Industries Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

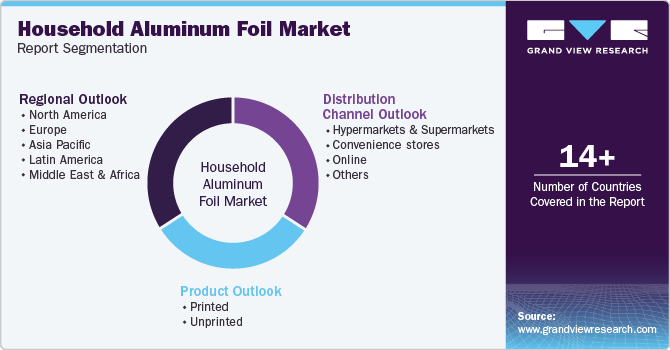

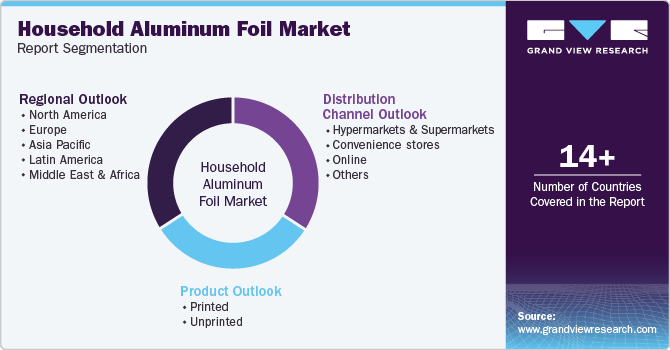

Global Household Aluminum Foil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global household aluminum foil market report based on product,distribution channel and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)