- Home

- »

- Electronic & Electrical

- »

-

Household Appliances Market Size, Industry Report, 2033GVR Report cover

![Household Appliances Market Size, Share & Trends Report]()

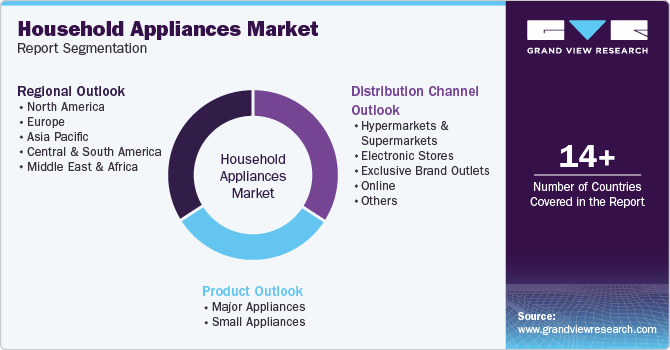

Household Appliances Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Major Appliances, Small Appliances), By Distribution Channel (Hypermarkets & Supermarkets, Electronic Stores, Brand Outlets), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-520-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Household Appliances Market Summary

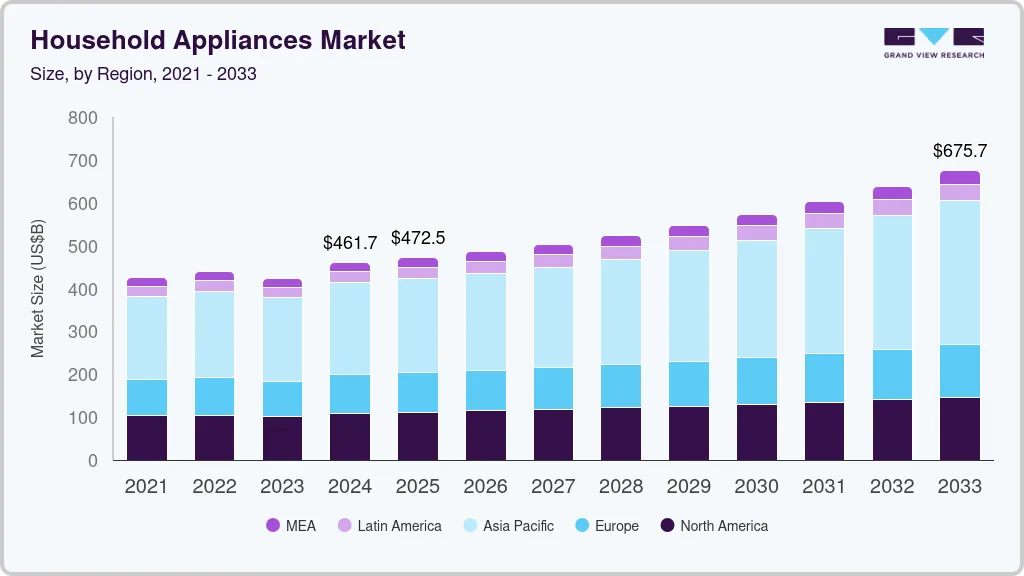

The global household appliances market size was estimated at USD 461.69 billion in 2024 and is projected to reach USD 675.73 billion by 2033, growing at a CAGR of 4.6% from 2025 to 2033. The global household appliances industry is driven by rising urbanization, increasing disposable incomes, and growing demand for energy-efficient solutions.

Key Market Trends & Insights

- The North America household appliances market is expected to grow at a CAGR of 3.8% from 2025 to 2030.

- The household appliances market in the U.S. is expected to grow at a CAGR of 3.8% from 2025 to 2030.

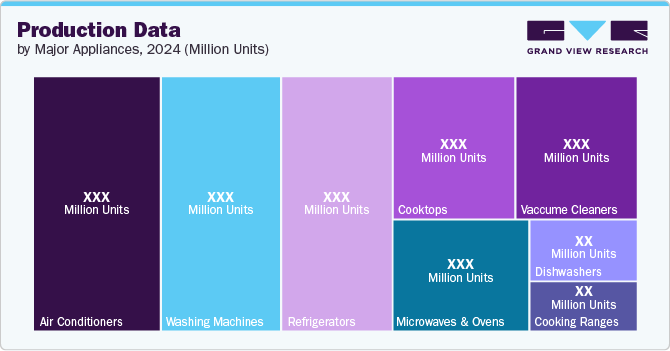

- By product, major appliances segment accounted for a revenue share of 89.55% in 2024.

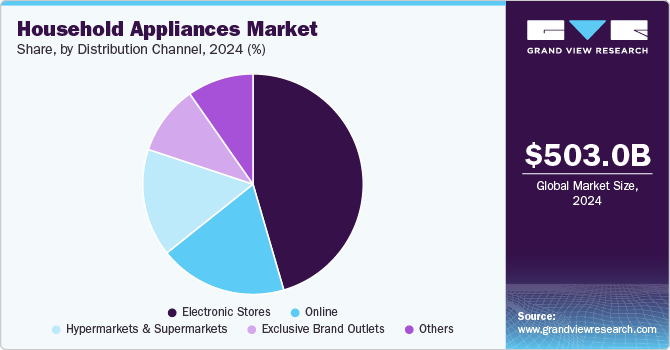

- By distribution channel, sales through electronic stores segment accounted for a revenue share of 45.49% in 2024 in the market.

Market Size & Forecast

- 2024 Market Size: USD 461.69 Billion

- 2033 Projected Market Size: USD 675.73 Billion

- CAGR (2025-2033): 4.6%

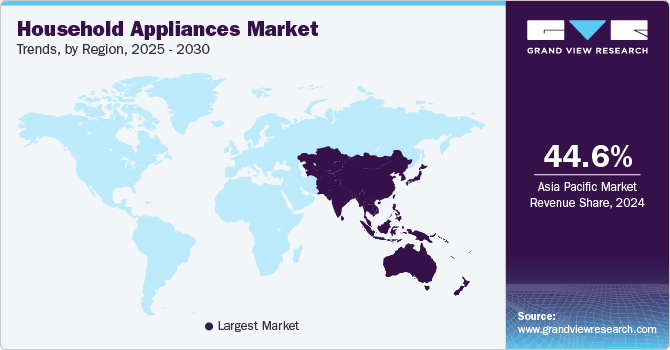

- Asia Pacific: Largest market in 2024

Stricter government regulations and eco-conscious consumers are pushing manufacturers toward sustainable, long-lasting appliances. The integration of smart technology and IoT enhances convenience, while home renovation trends boost demand for stylish, high-performance products. Additionally, e-commerce expansion makes appliances more accessible, and government incentives further promote eco-friendly innovations, fueling market growth worldwide.

The consumer penetration of household appliances is increasing globally, driven by rising urbanization and higher disposable incomes. Consumers are prioritizing durability, aesthetics, and connectivity, leading to greater adoption of modern refrigerators, ovens, washing machines, and dishwashers. Additionally, stringent energy regulations and sustainability initiatives, such as EU Ecodesign rules, are encouraging the shift toward eco-friendly, long-lasting appliances. The ongoing home renovation boom and technological advancements are further fueling market expansion, making household appliances more accessible and essential worldwide.

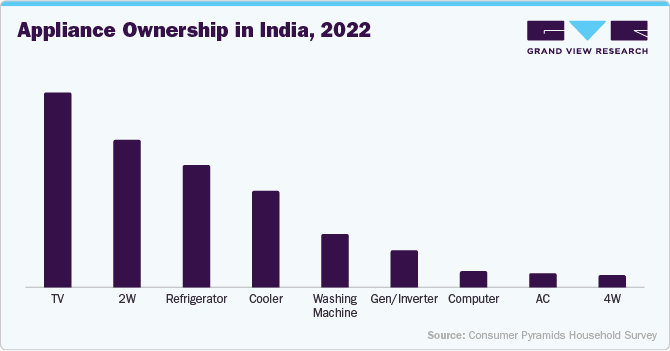

The rise in household appliance ownership globally is driven by several factors beyond income growth and urbanization. Declining appliance costs due to improved manufacturing efficiencies and economies of scale have made products more affordable. Electrification in rural areas is expanding access to modern appliances in previously underserved regions. Additionally, changing consumer lifestyles, including busier schedules and a focus on convenience, are increasing demand for automated home solutions. The rise of dual-income households has also fueled the need for time-saving appliances like dishwashers and robotic vacuums. Lastly, aggressive marketing strategies and financing options from retailers and manufacturers have made it easier for consumers to purchase high-end and smart appliances.

Energy efficiency has become a key priority for homeowners and property managers, given the significant impact that major household appliances have on overall energy consumption. As a result, the growing focus on energy optimization is expected to drive market growth, with consumers increasingly replacing older, less efficient models with newer, energy-saving options.

To support this transition, the European Commission introduced three new initiatives in 2024 aimed at enhancing energy efficiency and eco-design standards for household products across the EU. As part of these efforts, a new web portal has been launched to provide accessible information on energy efficiency and regulatory compliance for consumers, manufacturers, and retailers. Additionally, new rules under EU Regulation (EU/2024/994) have been implemented to ensure the accuracy and reliability of online energy-labelled product information. These regulations require suppliers to verify their identity via eIDAS when registering products in the European Product Registry for Energy Labelling (EPREL), thereby enhancing transparency and compliance.

Furthermore, appliances like refrigerators, which can account for up to 14% of a home's energy use, have seen substantial efficiency improvements, with new models consuming less than a third of the energy of older ones. As a result, global standards such as Energy Star have become key indicators for consumers. These standards are continually updated to reflect technological advancements, leading to increased adoption. While energy-efficient appliances may have a higher upfront cost, they offer long-term savings on electricity bills, making them highly attractive in markets worldwide.

Although online shopping is on the rise, the majority of customers still prefer to buy household appliances from physical stores, with home centers being the most popular option, according to The Home Improvement Research Institute. Nevertheless, the future of appliance purchasing presents various opportunities, as online platforms like Amazon, Best Buy, and Costco attract consumers with their convenience and delivery services. For smaller local and regional distributors, having a strong online presence is essential. By incorporating features such as product comparison tools and outstanding customer service, they can distinguish themselves in a competitive landscape. Furthermore, brands like Samsung are enhancing their in-store experience by launching experiential retail locations where customers can engage with products before making a purchase.

Product Insights

Major appliances accounted for a revenue share of 89.55% in 2024. These appliances, such as refrigerators, washing machines, and ovens, are necessary for daily living and often replaced less frequently than smaller appliances, contributing to steady demand. Additionally, technological innovations in major appliances, such as energy efficiency, smart features, and improved performance, have made them more attractive to consumers, further driving their sales. The larger revenue per unit and the trend toward home renovation and upgrading have also increased the market share of major appliances.

Despite rising living costs prompted half of global consumers to postpone major purchases, nearly 19% still intended to buy major luxury household appliances, within the next year. This positions major household appliances as one of the most sought-after luxury categories, following clothing (31%) and fresh produce like meat, fruit, or vegetables (30%), according to YouGov Surveys conducted in June 2023.

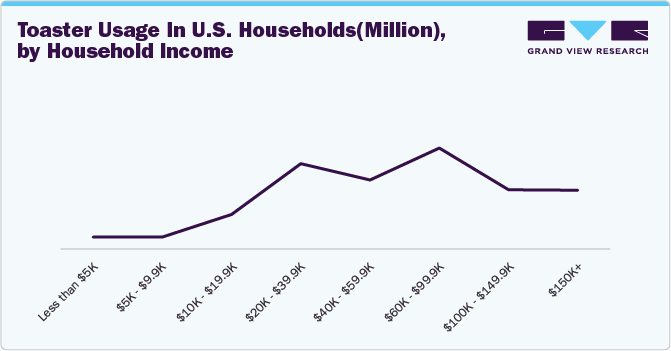

The small appliances market is expected to grow at a CAGR of 6.4% from 2025 to 2030. increasing consumer demand for convenience and time-saving products, such as coffee makers, blenders, and robotic vacuums, has led to a surge in their popularity. As lifestyles become busier, consumers are looking for ways to simplify daily tasks, which has boosted the adoption of small appliances. Additionally, small appliances tend to have lower price points, making them more accessible to a wider range of consumers. Technological advancements in small appliances, such as smart features and improved performance, have also contributed to their growth.

Distribution Channel Insights

Sales through electronic stores accounted for a revenue share of 45.49% in 2024 in the market. Electronic stores have become a key distribution channel in the household appliances industry, seamlessly combining traditional retail advantages with modern technology. These stores offer a well-rounded shopping experience, merging the hands-on benefits of in-store browsing with the ease of online access. With a diverse selection of high-quality appliances, knowledgeable staff, and personalized service, they provide a more engaging and informative experience than many online platforms. Their physical presence allows customers to interact with products, receive immediate support, and enjoy instant purchases and services.

Sales of household appliances through online channels are expected to grow with a CAGR of 6.1% from 2025 to 2030. The household appliances industry is witnessing significant growth in the online channel, driven by a shift in consumer behavior toward digital shopping. According to Adtaxi's 2024 Ecommerce Survey, 78% of Americans are now comfortable purchasing major appliances online, an increase from 73% reported the previous year. This growing acceptance reflects broader trends in online shopping, where convenience and the ability to compare products and prices easily have become paramount. With 93% of American adults engaging in online shopping and a notable increase in daily online shoppers, the online channel has become a critical platform for major appliances, offering an efficient way to reach a vast audience.

Regional Insights

The Asia Pacific household appliances market accounted for a revenue share of 44.61% in 2024. The region is home to some of the fastest-growing cities globally, with countries like China, India, Indonesia, and Vietnam experiencing substantial urban expansion. This urban growth is often accompanied by a surge in housing and infrastructure development, which in turn drives demand for household appliances. As more people move to urban areas, the need for modern homes equipped with essential appliances increases. Newly built apartments and houses are often designed to accommodate contemporary lifestyles, requiring appliances that offer convenience, efficiency, and space-saving solutions. This trend is particularly evident in densely populated cities where living spaces are often smaller, necessitating the use of compact and multifunctional appliances.

North America Household Appliances Market Trends

The North America household appliances market is expected to grow at a CAGR of 3.8% from 2025 to 2030. The market is characterized by its maturity and homogeneity, primarily driven by demand from a growing housing industry and increasing disposable incomes. In the U.S., the high costs associated with manufacturing have prompted many companies to offshore their production to other countries. This shift has been further influenced by the strengthening of the U.S. dollar, resulting in a market that relies more on imports than exports. Despite these challenges, the rise in disposable income and the robust housing industry have helped offset some of the adverse effects of the stronger dollar.

The household appliances market in the U.S. is expected to grow at a CAGR of 3.8% from 2025 to 2030. The growing number of households in the U.S. significantly contributes to the rising demand for major appliances like washing machines, dishwashers, refrigerators, air conditioners, and microwaves & ovens. According to data released by the U.S. Census Bureau and the Department of Housing and Urban Development, the sales of new single‐family houses were at a seasonally adjusted annual rate of 662,000 in February 2024, 14.3% above the revised rate of 625,000 in February 2023.

Europe Household Appliances Market Trends

The Europe household appliances market is expected to grow at a CAGR of 4.0% from 2025 to 2030. The growing home renovation market in Europe, with R&M projects rising from 48% in 2008 to 54% in 2022, is boosting demand for modern kitchen appliances. Consumers prioritize durability, aesthetics, and smart technology, investing in modern ovens, refrigerators, and dishwashers. EU Ecodesign rules further promote long-lasting, repairable products, aligning with the renovation boom and fueling market growth.

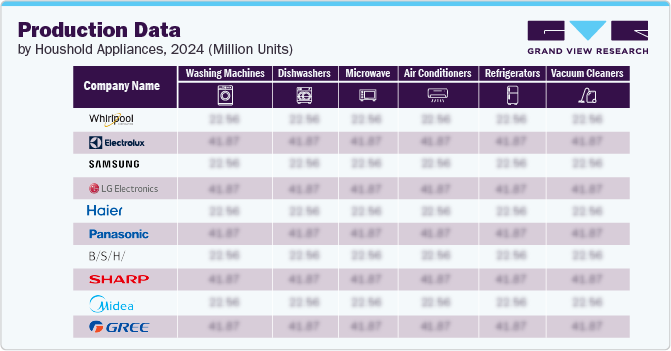

Key Household Appliances Company Insights

Many manufacturers are integrating IoT technology to develop smart appliances that connect with mobile apps or virtual assistants like Amazon Alexa and Google Assistant. This enables users to control appliances remotely, monitor energy consumption, and receive maintenance alerts. Additionally, to appeal to design-conscious consumers, companies are introducing customizable options such as interchangeable panels and color choices. Modular designs allow consumers to upgrade specific components without replacing the entire unit. Brand share analysis reveals that companies adopting these innovations are gaining a competitive edge, as consumers increasingly prioritize smart functionality and personalized design in their purchasing decisions.

Key Household Appliances Companies:

The following are the leading companies in the household appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH

- LG Electronics Inc.

- Electrolux AB

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Sharp Corporation

- Miele

- Midea Group

- Koninklijke Philips N.V.

- Breville Group Limited

- De'Longhi S.p.A.

Recent Developments

-

In August 2024, Samsung announced its "Smart Forward" updates aimed at enhancing the functionality, futureproofing, and safety of its home appliances. This strategy focuses on incorporating AI advancements and software updates to extend the lifespan and adaptability of appliances, ensuring they remain up to date with evolving user needs. Key features include improved connectivity, advanced diagnostics, and safety protocols, allowing appliances to operate more efficiently while being remotely monitored and controlled via the SmartThings platform.

-

In July 2024, Whirlpool India launched its Ice Magic Pro Glass Door refrigerator range, catering to the evolving needs of Indian households. This new range combines stylish design with advanced technology, featuring an intuitive user interface and an energy-efficient IntelliSense Inverter Technology that adapts to cooling needs. The sleek glass door design enhances the aesthetics of modern kitchens, while the refrigerator's features focus on preserving freshness and optimizing energy consumption002E

-

In July 2024, Electrolux, a leading home appliance brand, introduced a new range of smart laundry appliances focused on prolonging the life of clothes and reducing resource consumption. This innovative range includes 600-900 series washers, 700-800 series washer dryers, and 600-900 series tumble dryers, all designed with smart features to optimize water, energy use, and fabric care. By integrating advanced technology, Electrolux aims to support more sustainable laundry practices while ensuring better care for garments over time.

Household Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 472.47 billion

Revenue forecast in 2033

USD 675.73 billion

Growth Rate (Revenue)

CAGR of 4.6% from 2025 to 2033

Actuals

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million, Volume in Thousand Units, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Benelux; Nordics; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Whirlpool Corporation; Samsung Electronics Co. Ltd.;Robert Bosch GmbH; LG Electronics Inc.; Electrolux AB; Haier Smart Home Co., Ltd.; Panasonic Corporation; Sharp Corporation; Miele; Midea Group; Koninklijke Philips N.V.; Breville Group Limited; De'Longhi S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Appliances Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global household appliances market report on the basis of product, type, distribution channel, and region.

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Major Appliances

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Washing Machine and Dryers

-

Air Conditioner

-

-

Small Appliances

-

Coffee Makers

-

Toasters

-

Juicers, Blenders and Food Processors

-

Hair Dryers

-

Irons

-

Deep Fryers

-

Space Heaters

-

Electric Trimmers and Shavers

-

Air Purifiers

-

Humidifiers & Dehumidifiers

-

Rice Cookers & Steamers

-

Air Fryers

-

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Benelux

-

Nordics

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global household appliances market size was estimated at USD 503.03 billion in 2024 and is expected to reach USD 523.60 billion in 2025.

b. The global household appliances market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 675.73 billion by 2030.

b. The Asia Pacific household appliances market accounted for a revenue share of 44.61% in 2024. The region is home to some of the fastest-growing cities globally, with countries like China, India, Indonesia, and Vietnam experiencing substantial urban expansion. As more people move to urban areas, the need for modern homes equipped with essential appliances increases

b. The household appliances market in the U.S. is expected to grow at a CAGR of 3.8% from 2025 to 2030. The growing number of households in the U.S. significantly contributes to the rising demand for major appliances like washing machines, dishwashers, refrigerators, air conditioners, and microwaves & ovens

b. The global household appliances market is driven by rising urbanization, increasing disposable incomes, and growing demand for energy-efficient solutions. Stricter government regulations and eco-conscious consumers are pushing manufacturers toward sustainable, long-lasting appliances. The integration of smart technology and IoT enhances convenience, while home renovation trends boost demand for stylish, high-performance products. Additionally, e-commerce expansion makes appliances more accessible, and government incentives further promote eco-friendly innovations, fueling market growth worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.