- Home

- »

- Electronic & Electrical

- »

-

Household Hand Tools Market Size, Industry Report, 2030GVR Report cover

![Household Hand Tools Market Size, Share & Trends Report]()

Household Hand Tools Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Cutting Tools, Measuring Tools, Taps & Dies, General Tools), By Distribution Channel (Retail Channels, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-981-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Household Hand Tools Market Size & Trends

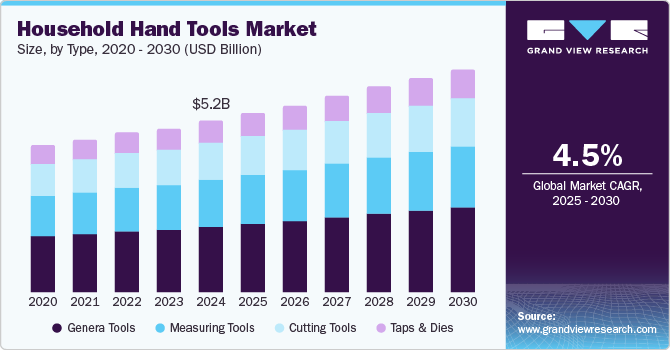

The global household hand tools market size was valued at USD 5.21 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. The major factors driving the market are the lack of professionals, the high cost of outsourcing home repairs, and the growing do-it-yourself (DIY) trend. Additionally, manufacturers are designing hand tools with better ergonomics and lasting and sustainable materials. This further facilitates the use of hand tools by consumers who do not have expertise or experience in handling such tools. Low cost, less space required to store, and ease of use are a few other factors contributing to market growth.

Rapid urbanization worldwide is compelling developers to construct infrastructure at a swift pace and affordable rates. However, developers often compromise on material quality and construction processes to expedite project completion and maintain profitability. This results in homeowners facing frequent repairs and replacements in plumbing, electrical, and furnishing systems. To mitigate the costs associated with extensive replacements and renovations, homeowners are increasingly opting to perform minor repairs and fixes independently. This trend is driving demand for household hand tools, as they enable homeowners to efficiently address quick fixes.

Countries in Europe and North America are experiencing a surge in DIY culture, driven by rising labor costs, a shortage of skilled professionals, and a growing interest in acquiring handyman skills. According to data published by the U.S. Chamber of Commerce, 45% of contractors declined projects in 2021 due to a lack of skilled labor. The availability of detailed repair tutorials from experts and the promotion of DIY projects on social media are encouraging consumers to utilize household hand tools for repairs, modifications, renovations, and recreational building projects. Furthermore, the increasing demand for prefabricated but unassembled furniture is bolstering the growth of the household hand tool market. Furniture manufacturers such as IKEA and e-commerce platforms such as Amazon offer a wide range of DIY furniture kits. These kits can be assembled into functional furniture using simple hand tools.

Improper handling of hand tools can result in serious injuries. According to the Consumer Product Safety Commission (CPSC), over one million people worldwide suffer injuries related to hand and power tool use. Household hand tool industry players are adopting innovative approaches to design and manufacture hand tools. This has led to the development of more ergonomic tools, which are easier to handle, safer, and more efficient. Such tools are particularly popular among younger populations, female consumers, and aging individuals who may find traditional hand tools difficult to use.

Type Insights

The general tools segment dominated the global household hand tools market based on product, with a revenue share of 82.9% in 2024. General hand tools encompass many tools used for fastening, cutting, and shaping materials. Common examples include screwdrivers, wrenches, pliers, hammers, staplers, riveting tools, wire strippers, punches, rasps, and files. These tools are widely used in households for general repair and maintenance tasks due to their affordability and versatility. Unlike industrial-grade power tools, which can be costly, general hand tools offer a cost-effective solution for a variety of common applications.

The general tools segment is also expected to experience the fastest CAGR from 2025 to 2030. Despite the increasing popularity of power tools, general household hand tools continue to hold significant importance. These tools are user-friendly and do not require specialized training, making them accessible to a wide range of users, including teenagers, young adults, and older individuals who may be more susceptible to accidents with power tools. These factors contribute to the enduring dominance of the general household hand tool industry.

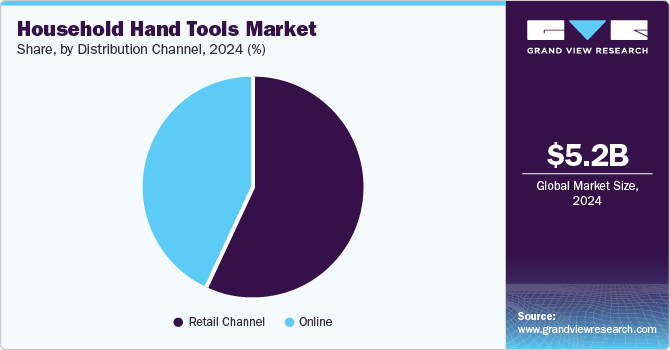

Distribution Channel Insights

The retail channel segment held the largest revenue share of the household hand tools market in 2024. Hand tools are widely available at hardware stores and home improvement centers. Offline retail stores enable consumers to physically examine a diverse range of tools from various manufacturers. This hands-on experience fosters confidence in the selection process. Additionally, retail and hardware stores often offer bundle discounts to customers purchasing multiple tools simultaneously.

The online segment is expected to experience the fastest market growth during the forecast period. Online shopping portals and e-commerce platforms offer various hand tools from diverse manufacturers. Consumers can conveniently locate their desired tools and compare products from different companies on these platforms. Customers can also peruse numerous customer reviews to inform them of their purchasing decisions. Additional features such as fast and free delivery, hassle-free return and exchange policies, and brand and platform guarantees are significant factors contributing to the rapid growth of this segment.

Regional Insights

The North America household hand tools industry dominated the global market, with a revenue share of 33.7% in 2024. A shortage of skilled labor and high labor costs are key factors driving demand for household hand tools in the region. North American consumers frequently opt to undertake minor home repairs independently. The need for tools to perform maintenance and repair work, coupled with rising homeownership rates among younger generations, presents significant growth opportunities for the household hand tool industry in the region.

U.S. Household Hand Tools Market Trends

The U.S. dominates the North American household hand tools market. U.S. consumers frequently opt to undertake DIY repair, maintenance, and renovation projects rather than outsourcing these tasks to professionals. According to the USA Home Improvement Statistics, in 2023, 37% of homeowners preferred to complete home renovations independently. Furthermore, the average U.S. homeowner undertakes home renovations every 3-5 years. Such projects necessitate specialized tools, thereby driving consistent growth in demand for household hand tools within the country.

Asia Pacific Household Hand Tools Market Trends

The Asia Pacific household hand tools market is anticipated to experience the fastest growth during the forecast period. The region is undergoing rapid urbanization, particularly in China, India, Indonesia, and other ASEAN countries. This rapid urbanization has resulted in the construction of poorly built homes, which necessitate frequent repairs by homeowners. Consequently, demand for household hand tools has surged in the region. Additionally, the low cost and easy accessibility of these tools to low-income consumers are further driving the growth of the household hand tool market in the Asia Pacific.

China held the largest revenue share of the regional industry in 2024. As one of the world's largest construction markets, China continuously witnesses significant construction and infrastructure development. This rapid infrastructure development encompasses both public infrastructure and housing. The expanding housing infrastructure is a primary driver of household hand tool sales. Most Chinese homeowners prefer to undertake home repairs and maintenance tasks independently due to the high cost of professional labor.

Europe Household Hand Tools Market Trends

The European household hand tools market is anticipated to experience significant growth during the forecast period. European homeowners often prefer to undertake home repair and maintenance tasks independently. The EU is currently experiencing significant labor shortages, which can lead to substantial costs for professional services, regardless of the task's scale. Consequently, homeowners frequently utilize hand tools and other necessary equipment to address these issues.

Key Household Hand Tools Company Insights

Some of the key companies operating in the global household hand tools market are Stanley Black & Decker, Apex Tool Group, Great Wall Precision, Klein Tools; Wurth Group, PHOENIX, Channellock; Akar Tools, JPW Industries; JK Files, JETECH; Excelta; Sinotools; TTi; and Kennametal Inc. Major player in the household hand tools industry are consistently incorporating innovating design approach to make hand tools more ergonomic and efficient. Companies are also experimenting with using new materials to make the hand tool more sustainable and long-lasting.

-

Stanley Black & Decker is a U.S.-based global leader in tools and storage. The company offers a wide range of hand tools, power tools, and storage solutions under renowned brands such as Stanley, Black & Decker, DEWALT, and Craftsman. The company’s products include general, measuring, and cutting tools. These products are well-known for their ergonomic design, durable material, innovative features, and sustainability.

-

Wurth Group is a leading fastening technology player headquartered in Germany. The company is recognized for its comprehensive range of products, including hand tools, screws, anchors, and adhesives, among others. The company is embracing digital technologies to enhance tool performance and user experience. The company also provides specialized tools for automotive repairs and electrical work.

Key Household Hand Tools Companies:

The following are the leading companies in the household hand tools market. These companies collectively hold the largest market share and dictate industry trends.

- Stanley Black & Decker

- Apex Tool Group

- Great Wall Precision

- Klein Tools; Wurth Group

- PHOENIX; Channellock

- Akar Tools

- JPW Industries

- JK Files

- JETECH

- Excelta

- Sinotools

- TTi

- Kennametal Inc.

Recent Developments

-

In October 2024, Bosch Power Tools, a global leader in hand and power tool manufacturing, introduced a range of 30 new tools in a new product showcase event. The company expanded its elaborate tool range by introducing hand and power tools for plumbing applications. Some of the tools launched at the event include nailers & staplers, utility knives, and impact drivers & wrenches.

-

In July 2021, DEWALT, a leading player in the household hand tool industry, introduced a new line of premium hand tools named TOUGHSERIES. The company claimed the series to be the most durable and corrosion resistant. The series includes newly designed hammers, screwdrivers, and measuring tools such as tapes.

Household Hand Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.44 billion

Revenue forecast in 2030

USD 6.79 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, India, China, Japan, Australia, South Korea, Brazil, South Africa

Key companies profiled

Stanley Black & Decker, Apex Tool Group, Great Wall Precision, Klein Tools, Wurth Group, PHOENIX, Channellock, Akar Tools, JPW Industries, JK Files, JETECH, Excelta, Sinotools, TTi, Kennametal, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Hand Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global household hand tools market report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cutting Tools

-

Measuring Tools

-

Taps & Dies

-

Genera Tools

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail Channel

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.