- Home

- »

- Healthcare IT

- »

-

Humanoid Robot Market Size & Share, Industry Report, 2030GVR Report cover

![Humanoid Robot Market Size, Share & Trends Report]()

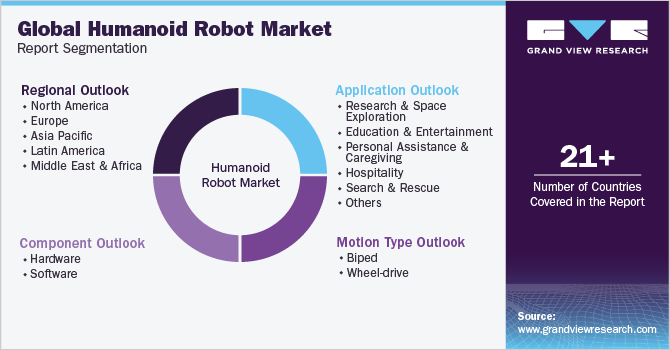

Humanoid Robot Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Personal Assistance & Caregiving, Hospitality, Search And Rescue), By Motion (Biped, Wheel Drive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-126-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Humanoid Robot Market Summary

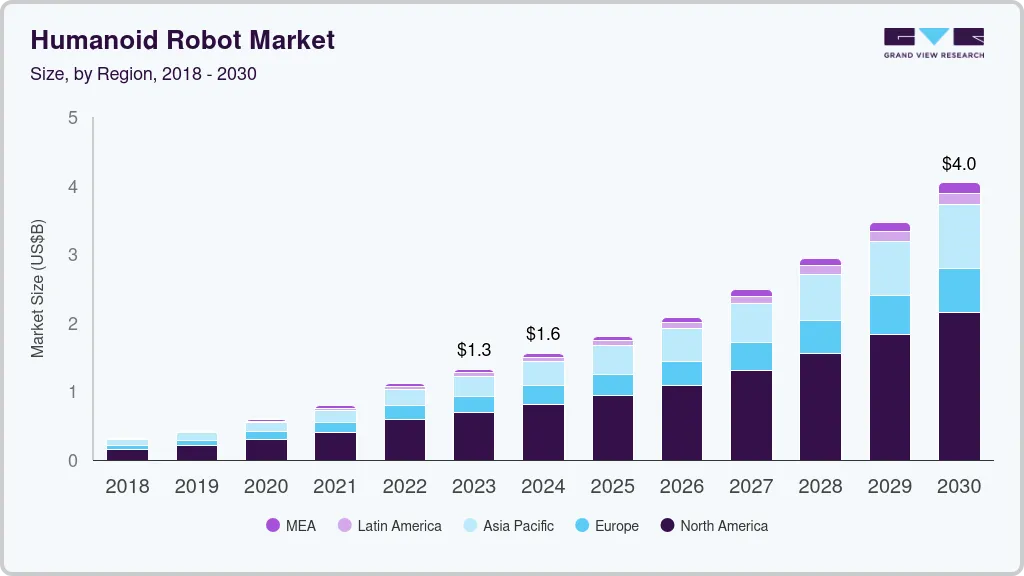

The global humanoid robot market size was estimated at USD 1.55 billion in 2024 and is projected to reach USD 4.04 billion by 2030, growing at a CAGR of 17.5% from 2025 to 2030. The market growth is propelled by several factors, including the growing utilization of humanoid robots for surveillance and security, such as detecting unauthorized intrusion and terrorist activities.

Key Market Trends & Insights

- North American humanoid robot market dominated the industry with a revenue share of 52.2% in 2024 and is expected to grow at fastest CAGR over the forecast period.

- The humanoid robot industry in the U.S. held the largest market share in 2024.

- By component, hardware segment held the largest market share of 69.7% in 2024.

- By application, the personal assistance and caregiving segment dominated the market with revenue share of 31.6% in 2024.

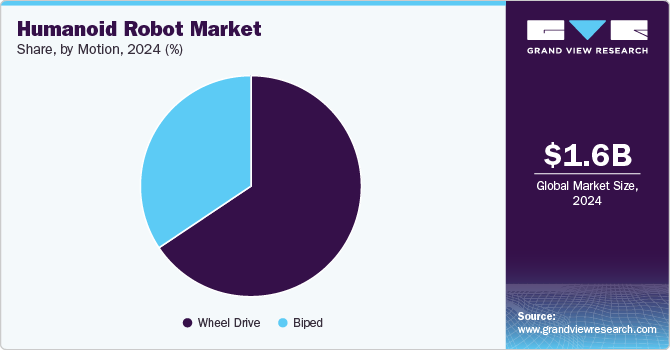

- By motion, the wheel drive segment held the highest market share of 65.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.55 Billion

- 2030 Projected Market Size: USD 4.04 Billion

- CAGR (2025-2030): 17.5%

- North America: Largest market in 2024

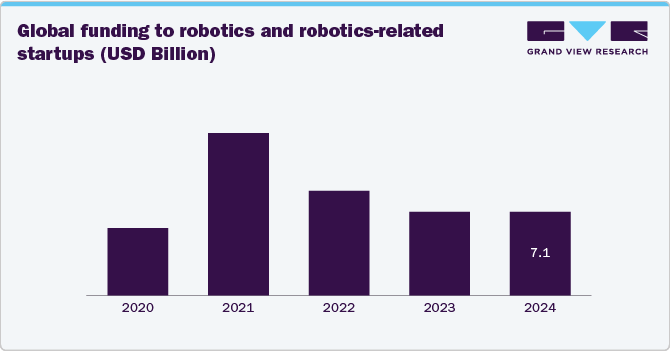

Furthermore, humanoid robots are utilized for research and space exploration, enabling connectivity from remote locations. For instance, in April 2022, Jane Li, an Assistant Professor of Robotics Engineering at Worcester Polytechnic Institute in Massachusetts, along with her research team, initiated the development of advanced remote-controlled humanoid robots designed to assist healthcare professionals in managing patients in quarantine or isolation.Public and corporate subsidy funds become more demanding for the goals and perceived guiding research in humanoids despite significant advancements in many fundamental and technological areas of humanoid robotics. For instance, in February 2024, Figure AI, a startup developing humanoid robots, received funding of USD 675 million from investors including Nvidia, Jeff Bezos, OpenAI, and Microsoft to accelerate the development of its humanoid robots. Apart from pure robots, humanoid robots help study participation, cognition, and a broader range of neuroscience and behavioral sciences. In addition, they are represented by working in the media sector as staff members and participating in other social activities, such as assisting older individuals.

The novel product launch by industry players boosts the market. For instance, in January 2023, Aeolus Robotics launched Aeo, a dual-arm humanoid robot for the novel uses for a range of service duties, including security, delivery, operating kiosks, eldercare, and ultraviolet germicidal cleaning. Operated by Aeo, the company takes a hands-on approach to service, integrating unique mobility with advanced functionality to accomplish tasks such as collecting items, opening doors, and navigating elevators. The robot is designed at a convenient height and with accessible container placement, allowing even patients with mobility challenges to approach it efficiently. In addition, medical professionals ensure that each patient receives the correct medication through a built-in video call feature.

The robotics sector is experiencing a substantial transformation and growth, marked by increased commercial investments, reduced hardware costs, the presence of new international market players, and a rising interest in existing robotic technologies. Despite notable advancements in humanoid robotics research, funding from both the public and private sectors has become more stringent, demanding clearer justifications and insights into the purpose of such research. For instance, in March 2023, OpenAI invested in 1X's (a robotics and engineering company) Bipedal Humanoid Robot NEO around USD 23.5 million in a Series A2 funding round.

Apart from robotics applications, humanoid robotics holds potential in areas related to embodiment, consciousness, neurosciences, and cognitive sciences. In addition, these robots are expected to have roles in the entertainment industry as receptionists and in social interactions, particularly assisting the elderly. Leading companies such as SoftBank Robotics in Japan and PAL Robotics in Spain have invested substantially in humanoid robots and integrated them into their business strategies, particularly targeting the service industry, including healthcare, hospitality, and retail.

The humanoid robot industry is experiencing ongoing innovation as enterprises launch sophisticated AI-driven models and broaden their uses across various industries. Two significant recent advancements include Tesla's Optimus robot and the introduction of Figure AI's humanoid robot.

-

Figure AI, a startup focused on developing versatile humanoid robots, has recently introduced its prototype. The company aims to create robots that handle tasks similar to those performed by humans in various sectors, including warehouses and elder care. Supported by significant funding and partnerships with prominent AI companies, Figure AI's humanoid robot highlights the increasing progress in this field.

-

Tesla made substantial strides in humanoid robotics with its Optimus robot, which is intended to handle repetitive and dangerous tasks in manufacturing and logistics. Featuring AI-powered decision-making abilities, Optimus was created to aid humans in a range of industrial and household tasks. This advancement marks a significant step in incorporating humanoid robots into daily work settings.

Substantial funding from governments and private companies accelerates the innovation and commercialization of humanoid robots. Moreover, the growing demand for automation in healthcare, manufacturing, and hoXspitality industries is driving investment. For instance, in February 2024, Figure AI, a developer of humanoid robots (a startup company), raised funding of USD 675 million from investors such as Microsoft, Jeff Bezos, and Nvidia.

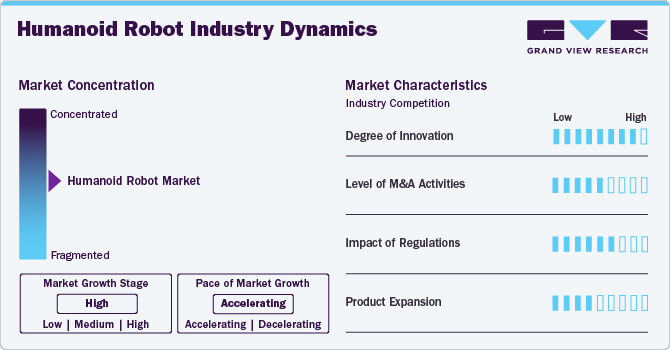

Market Concentration & Characteristics

Due to technological advancement, the humanoid robot industry has witnessed a high degree of innovation over the years. Furthermore, novel and innovative robots in the healthcare sector help doctors perform procedures without worrying about injuring themselves or their patients during surgical operations. For instance, in March 2024, NVIDIA announced Project GR00T, a versatile foundational model aimed at humanoid robots, to advance its initiatives in enhancing robotics and making significant progress in embodied AI.

The humanoid robot industry is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. This strategy enables companies to access complementary technologies, expertise, and distribution networks, which helps them accelerate their product development, enhance operational efficiency, and secure a larger share. For instance, in March 2024, Highest Performances Holdings Inc. (HPH) acquired 77.5% equity with White Group through a supplementary agreement in Singapore White Lingjun Pt. The acquisition aims to enhance the Company's AI Humanoid product offerings for physical disability assistance, medical education, and elderly care.

As artificial intelligence (AI) and machine learning (ML) technologies become increasingly integrated into medical devices, the FDA has proactively developed regulatory frameworks to address these advancements. In the U.S., humanoid robots in healthcare are primarily overseen by the U.S. Food and Drug Administration (FDA). Furthermore, the Ministry of Industry and Information Technology in China has released specific guidelines to advance humanoid robotics.

Several market players are adopting this strategy to expand their business by introducing new products and entering new geographical regions to strengthen their market position. For instance, in January 2024, Kody Technolab Limited, an Indian company, introduced Skändä, its first advanced AI-powered humanoid robot, at the Vibrant Gujarat 2024 Summit.

Component Insights

By component, hardware segment held the largest market share of 69.7% in 2024. The hardware consists of bodily parts and electronic, electrical, and mechanical components that cooperate to carry out a given duty, and sensors, actuators, generators, control systems, and others. The hardware elements give humanoid robots a human-like look, which significantly increases their worth. Humanoid robots perform duties in a variety of industries, including medical care, research, and education as the hardware components that enable the smooth integration of new technology. For instance, in March 2023, Sanctuary Cognitive Systems Corporation (Sanctuary AI), a developer of industrial-grade humanoid robots, in collaboration with Canadian Tire Corporation (CTC), a provider of retail goods and services in Canada, completed the first deployment of an innovative system designed to equip general-purpose robots with human-like intelligence at a customer’s commercial facility.

The software segment is anticipated to witness the fastest CAGR over the forecast period. Humanoid robots have a software feature that allows them to carry out challenging jobs and interact with their environment. For instance, in January 2023, as a part of the Ansys Startup Program, Halodi Robotics revealed that it employs Ansys simulation software to create humanoid robots that interact with people in regular settings. These robots help with the developing shortage of workers by allowing key individuals to focus solely on jobs that call for their advanced abilities. These robots are expected to carry out activities, including nighttime building patrols, grocery store shelf replenishment, and hospital logistics. Ansys helped Halodi Robotics cut the length of the development process by months with the help of Elite Channel Partner EDRMedeso.

Application Insights

By application, the personal assistance and caregiving segment dominated the market with revenue share of 31.6% in 2024. Humanoid robots are utilized in various instances, including homes, hospitals, and assisted living facilities; these robots are intended to support and help people. By helping with daily chores and offering companionship, the program aims to improve users' quality of life. Humanoids provide daily assistance to patients and the elderly, helping them with tasks like timely medication delivery. The normal chores that carers often carry out include monitoring vital signs, giving prescriptions, assisting with meals, and alerting medical personnel in case of an emergency. These humanoids are likewise designed to carry out these tasks.

However, the education and entertainment segment is expected to grow at the fastest CAGR over the forecast period. Humanoid robots are employed in the educational sector to improve students' learning opportunities. They can serve as interactive tutors, giving pupils individualized training and involving them in enjoyable and creative ways. In addition, robots can assist in the STEM (science, technology, engineering, mathematics) and foreign language classrooms.

Humanoid robots are employed in the entertainment sector to amuse audiences at theme parks, exhibits, events, and even as characters in films and television programs. These robots have cutting-edge AI and sensors that allow them to interact with people, dance, sing, and do other entertaining things. A variety of new technology, including a variety of robots that can manage things from medicine to rock music, was displayed at the Summit. 51 novel robots were displayed at the summit, nine of which were humanoid and geared to assist people by performing tasks in accordance with the SDGs. According to ITU, Engineered Arts' Ameca is an ideal platform for examining how machines coexist with people in sustainable communities of the future, work with them, and enhance human life. According to the UN organization, assistive robots are altering human lives in many ways. These robots help mobility, interaction, wellness, and other crucial everyday tasks using artificial intelligence and AI, restoring confidence and autonomy for the people.

Motion Insights

By motion, the wheel drive segment held the highest market share of 65.6% in 2024. Wheel drive technology has made a substantial contribution to robots by providing effective mobility and adaptable maneuverability. A humanoid robot with a wheeled base and cutting-edge AI capabilities for human interaction is Pepper by SoftBank Robotics (Japan), for example. Small humanoid robot Alpha Mini by UBTECH (China) has wheels for easy movement and interactive features. Designed for amusement and education, MIP is a little wheel drive robot by WOWWee U.S. These many wheel-drive robots have greatly increased the potential in robotics, allowing applications in customer service, research in education, and entertainment.

In addition, wheel drive segment is considered as the fastest growing segment over the forecast period. Wheel-type robots are predicted to become more popular in military and defense applications to their advantage. Wheel-drive humanoid robots are utilized for entertainment in theme parks, science fairs, and other public venues. It is anticipated that these factors will fuel market growth.

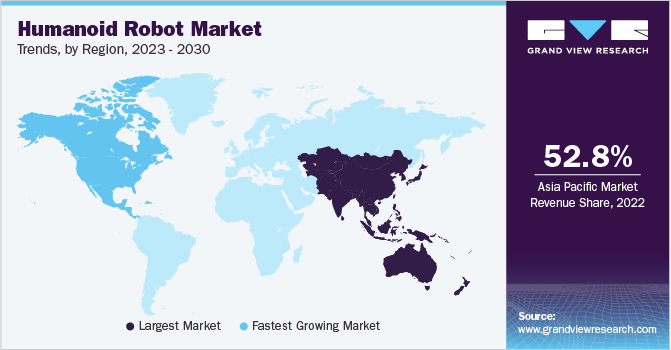

Regional Insights

North American humanoid robot market dominated the industry with a revenue share of 52.2% in 2024 and is expected to grow at fastest CAGR over the forecast period. Numerous top robotics businesses and research centers that have been at the forefront of developing humanoid robot technology are located in North America. Humanoid robots have been used in a variety of fields, including research and development, education, entertainment, and healthcare in the U.S. and Canada. Humanoid robots are being investigated by businesses and organizations in North America to enhance learning environments, assist with medical procedures, and improve customer experience. The North American market is expected to flourish owing to the result of the region's unique robotics research facilities, encouraging governmental initiatives, and robust academic-industry partnerships.

U.S. Humanoid Robot Industry Trends

The humanoid robot industry in the U.S. held the largest market share in 2024 owing to strong investment in research and development, coupled with supportive regulatory environments. Moreover, the country's well-developed healthcare infrastructure, advancements in robotics, and presence of key market players are anticipated to drive the market over the forecast period. For instance, in December 2022, Apptronik, a robotics company in the U.S., collaborated with NASA to develop "Apollo," a general-purpose humanoid robot to aid with tasks in space, the commercial sector, and at home.

Canada humanoid robot market is anticipated to register the fastest growth rate during the forecast period. Various factors contributing to market growth in the country include the presence of key market players and the rise in the launch of humanoid robots. For instance, in April 2024, Sanctuary AI, a Vancouver-based robotic company, introduced the seventh generation of its Phoenix humanoid robots.

Europe Humanoid Robot Industry Trends

Europe humanoid robot market is anticipated to register a considerable growth rate during the forecast period. Growing demand for humanoid robots from the healthcare sector and the rising development of humanoid robots with technologically advanced features propel market growth during the forecast period. Moreover, the significant rise in the baby boomer population in developed countries offers substantial growth opportunities for the humanoid robot sector.

UK humanoid robot industry is anticipated to register a considerable growth rate during the forecast period. Rising adoption of humanoid robots in the country due to rising awareness regarding the benefits of technological advancements in robotics, the introduction of new robots, and increasing funding for robotic research are among the factors contributing to market growth. For instance, in April 2024, The National Robotarium at Heriot-Watt University partnered with The University of Edinburgh to acquire Ameca from Engineered Arts. This acquisition marks the Robotarium as the first UK facility to host this advanced humanoid robot.

Germany dominated the humanoid robot market in terms of revenue share in 2024. An increasing number of initiatives undertaken by various public and private organizations and a rise in funding boosts market growth. For instance, RobCo, a German robotics startup, received Series A funding from US powerhouse Sequoia Capital in 2022, and in 2024, received a fresh USD 43 million Series B from fellow American VC Lightspeed Venture Partners.

Asia Pacific Humanoid Robot Industry Trends

The Asia Pacific region held the major share of the humanoid robot industry in 2024. A big portion of its contribution is being contributed to by nations such as Japan, South Korea, and China. The region is a leader in the adoption since it has companies manufacturing humanoids. It is also one of the few places in the world where significant firms such as Robotis of Korea, Softbank of Japan, Invento Robotics of India, and other businesses have made progress with humanoids.

Japan humanoid robot market is anticipated to register the fastest growth rate during the forecast period. Advanced healthcare systems, with a strong focus on innovation and technological advancements, are boosting market growth. For example, Rosemary's Robot Baby CB2 is a humanoid robot developed by the Graduate School of Engineering at Osaka University. This robot, which simulates the movements of a young child and is abbreviated as "Child-Robot with Biometric Body," has captivated global audiences with its unique capability to react to auditory stimuli by moving and altering its facial expressions.

China humanoid robot industry is anticipated to register considerable growth during the forecast period. Key factors contributing to market growth include a structured regulatory framework and the launch of new robots in the Chinese market. For instance, in May 2024, the Beijing Humanoid Robot Innovation Center introduced Tiangong, a humanoid robot running on electric power. Furthermore, Beijing’s Ministry of Industry and Information Technology (MIIT), which regulates the country’s industrial sector, published a guideline in November 2023 to develop humanoid robots.

Latin America Humanoid Robot Industry Trends

Latin America is witnessing steady growth in the humanoid robot market due to growing awareness of their availability and benefits. The healthcare industry in this area has seen a growing need for humanoid robots, as they can support medical staff and improve patient care. Such factors boost market growth in this region.

Argentina humanoid robot market is expected to register considerable growth during the forecast period. Argentina has made substantial progress in the use of technology in recent years. Increasing preference and growing availability of humanoid robots in various sectors such as healthcare, hospitality, and research activities in robotics boost market growth.

Middle East Humanoid Robot Industry Trends

The Middle East and Africa regions are experiencing lucrative growth in the humanoid robot market. The anticipated benefits and current research efforts focused on the development of new technologies are expected to enhance the utilization of humanoid robots, leading to their increased implementation in the healthcare industry, which further fuels market growth.

The UAE humanoid robot market is expected to register considerable growth during the forecast period. Improving healthcare infrastructure, rapid technological advancements, and growing awareness are among the factors boosting market growth in the country. For instance, in September 2023, RDI Robots, a manufacturer of autonomous service robots, introduced Ardi, a humanoid robot, to arrange a RoboShow. This project spanned eight months in development.

Key Humanoid Robot Company Insights

Key participants in the global humanoid robot industry are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Humanoid Robot Companies:

The following are the leading companies in the humanoid robot market. These companies collectively hold the largest market share and dictate industry trends.

- HYULIM Robot Co., Ltd

- HANSON ROBOTICS LTD

- Engineered Arts Limited

- Honda

- KAWADA Robotics Corporation

- SoftBank Robotics

- Sanbot Co

- ROBOTIS

- Willow Garage

- Toshiba Corporation

Recent Developments

-

In April 2024, Boston Dynamics, a U.S.-based engineering and robotics company, introduced its all-new electric Atlas humanoid robot, which succeeds its hydraulic predecessor, to revolutionize the robotics industry.

-

In February 2024, Kepler Exploration Robot Co., Ltd., a manufacturer of humanoid robots, introduced the Kepler Forerunner series of general-purpose humanoid robots (Kepler Humanoid Robot). These robots stand at a height of 178cm (5'10") and weigh 85kg (187 lbs.). They feature highly intelligent hands capable of intricate movements with 12 degrees of freedom.

Humanoid Robot Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.81 billion

Revenue forecast in 2030

USD 4.04 billion

Growth Rate

CAGR of 17.5% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Component, application, motion

Regional Scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; Australia; South Korea; India; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

HYULIM Robot Co., Ltd; HANSON ROBOTICS LTD; Engineered Arts Limited; Honda; KAWADA Robotics Corporation; SoftBank Robotics; Sanbot Co; ROBOTIS; Willow Garage; Toshiba Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Humanoid Robot Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global humanoid robot market report on the basis of component, application, motion and region:

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Research and Space Exploration

-

Education and Entertainment

-

Personal Assistance and Caregiving

-

Hospitality

-

Search and Rescue

-

Others

-

-

Motion Outlook (Revenue, USD Million; 2018 - 2030)

-

Biped

-

Wheel drive

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global humanoid robot market size was estimated at USD 1.55 billion in 2024 and is expected to reach USD 1.81 billion in 2025.

b. The global humanoid robot market is expected to grow at a compound annual growth rate of 17.5% from 2025 to 2030 to reach USD 4.04 billion by 2030.

b. North America dominated the humanoid robot market with a share of 52.2% in 2024. The market's growth is propelled by several factors, including the expanding utilization of humanoid robots for surveillance and security, such as detecting unauthorized intrusion and terrorist activities. Furthermore, humanoid robots are utilized for research and space exploration, enabling connectivity from remote locations.

b. Some of the key players in the humanoid robot market are HYULIM Robot Co., Ltd, HANSON ROBOTICS LTD, Engineered Arts Limited, Honda, KAWADA Robotics Corporation, SoftBank Robotics, Sanbot Co, ROBOTIS, Willow Garage, and Toshiba Corporation.

b. The global market for humanoid robots is poised for substantial growth due to rapid technological advancements leading to more efficient and affordable robot models. Furthermore, the increasing adoption of humanoid robots in military and defense applications, providing battlefield intelligence and knowledge of enemy movements, is expected to drive market expansion. Additionally, the growing trend of industry automation is anticipated to further fuel the demand for humanoid robots in various sectors in the near future.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.