- Home

- »

- Distribution & Utilities

- »

-

HV Bushing Market Size, Share And Trends Report, 2030GVR Report cover

![HV Bushing Market Size, Share & Trends Report]()

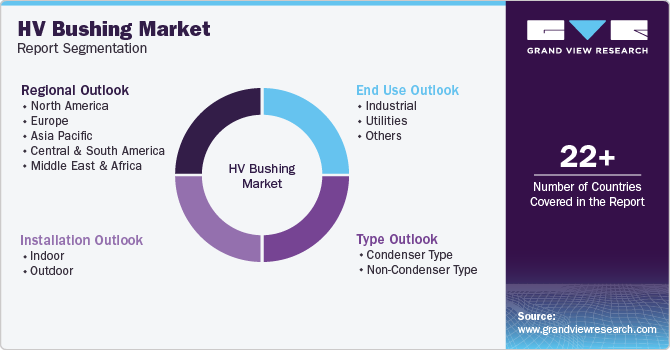

HV Bushing Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Condenser Type, Non Condenser Type), By Installation (Indoor, Outdoor), By End Use (Industrial, Utilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-430-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HV Bushing Market Size & Trends

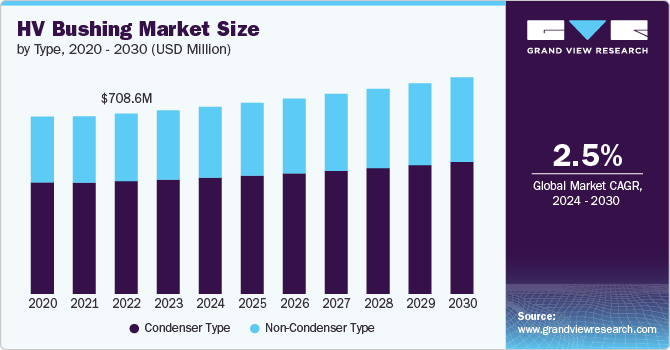

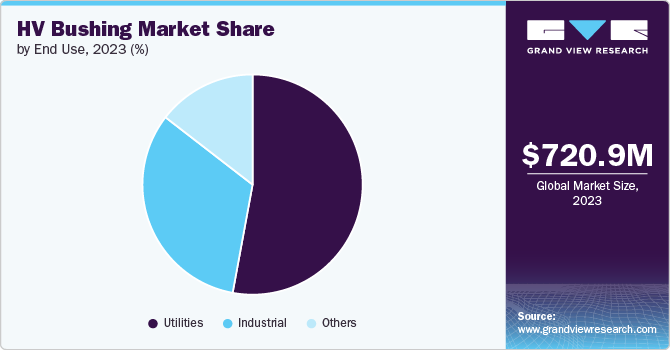

The global HV bushing market size was estimated at USD 720.89 million in 2023 and is expected to grow at a CAGR of 2.5% from 2024 to 2030. The primary drivers of the market are the growing demand for electricity, modernization of existing electrical infrastructure, and rapid urbanization in developing countries. The increasing population and rising power consumption per capita fuel the need for a stable and reliable power distribution supply.

Electrical bushings are essential components that ensure the safe and continuous transmission of electricity through various electrical apparatuses, such as transformers, circuit breakers, and power capacitors. Additionally, the expansion and upgradation of grid structures, along with the increasing focus on renewable energy sources, are expected to create significant opportunities for the HV bushing market.

Drivers, Opportunities & Restraints

The high voltage (HV) bushing market is primarily driven by the growing demand for electricity, modernization of existing electrical infrastructure, and rapid urbanization in developing countries. The increasing population and rising power consumption per capita are fueling the need for a stable and reliable supply of power distribution. Electrical bushings are essential components that ensure the safe and continuous transmission of electricity through various electrical apparatuses, such as transformers, circuit breakers, and power capacitors.

The market presents significant opportunities driven by the urgent need to upgrade aging electrical infrastructure and the increasing demand for renewable energy sources. As countries modernize their power grids to enhance reliability and efficiency, investments in substations and transformers are expected to rise, boosting the demand for electrical bushings.

The key restraints for the market include untimely bushing failures, which can lead to costly asset losses and safety issues, and the presence of a large number of local and regional players that create a competitive pricing environment. Additionally, fluctuating raw material prices and transportation costs pose affordability challenges for the market.

Type Insights

Condenser type held the market with the largest revenue share of 62.26% in 2023. The segment’s growth is poised for significant growth, driven by its established reputation for excellent electrical insulation and mechanical strength. Ceramic insulators are primarily utilized in overhead transmission and distribution lines, preventing current leakage and ensuring safe electricity transmission. Their durability and ability to withstand high voltages make them essential in modern electrical infrastructure, particularly as energy demand continues to rise globally, supporting the expansion of transmission networks and the integration of renewable energy sources.

The non-condenser type segment is anticipated to experience robust growth from 2024 to 2030, driven by the increasing demand for efficient and reliable power transmission systems. These insulators, made from advanced types like fiber non-condenser type and silicone rubber, offer superior performance compared to traditional options. Their lightweight and durable nature enhances installation ease and reduces maintenance costs, making them ideal for modern electrical infrastructure. As global electricity demand rises, particularly with the expansion of renewable energy sources and smart grid projects, the adoption of composite insulators is expected to accelerate, ensuring safe and effective electricity distribution across increasingly complex power networks.

Installation Insights

The outdoor segment held the market with the largest revenue share of 73.17% in 2023. This is driven by several key factors, primarily the increasing demand for reliable electricity transmission and distribution systems. As global electricity consumption rises, particularly in emerging economies, there is a significant push to upgrade and expand electrical infrastructure, including outdoor HV bushings. This growth is further fueled by the transition to renewable energy sources, which require robust and efficient electrical components to manage variable loads.

Indoor installation is anticipated to grow at notable CAGR from 2024 to 2030. The increasing adoption of renewable energy sources, such as solar and wind power, is fueling the need for indoor HV bushings in substations and switchgear applications. These bushings are designed to provide superior insulation and withstand high electrical stresses while occupying a minimal footprint. The trend towards compact and modular electrical equipment is further propelling the growth of the indoor HV bushing market, as these bushings enable the integration of advanced features and functionalities into space-constrained installations.

End Use Insights

The utilities segment held the market with the largest revenue share of 52.90% in 2023. This is driven by the increasing demand for reliable power transmission and distribution systems, necessitated by rising electricity consumption and urbanization. Upgrading aging infrastructure and integrating renewable energy sources further boosts market growth, as utilities require efficient and durable components to ensure seamless electricity flow.

Additionally, advancements in smart grid technologies and the need for enhanced grid stability contribute to the growing adoption of HV bushings in the utilities sector, supporting their critical role in maintaining safe and efficient operations across electrical networks.

Regional Insights

The HV bushing market in North America is characterized by a well-established electricity infrastructure, marked by a robust transmission and distribution network. The demand for HV bushings is driven by the need to upgrade aging infrastructure, improve grid reliability, and facilitate the integration of renewable energy sources. Significant investments in smart grid technologies and the replacement of older bushings with advanced designs further contribute to market growth.

U.S. HV Bushing Market Trends

The U.S. HV bushing market is driven by the need for reliable and efficient power transmission as the country modernizes its aging electrical infrastructure. With increasing electricity demand and a push for renewable energy integration, utilities are investing in advanced HV bushings to enhance grid stability and performance. The market is characterized by significant investments in smart grid technologies and the replacement of outdated equipment.

Asia Pacific HV Bushing Market Trends

Asia Pacific HV bushing market dominated and accounted for largest revenue share of over 43.39% in 2023. The region’s market is driven by rapid urbanization, industrialization, and a significant increase in electricity demand across countries like China, Japan, and India. Governments are heavily investing in expanding electricity infrastructure and modernizing transmission and distribution networks to enhance grid reliability.

Additionally, the integration of renewable energy sources necessitates robust HV bushing solutions, further propelling market growth. Initiatives to improve electricity access in rural areas and rising investments in power generation projects also contribute to the expanding demand for HV bushings in the region. The region's significant investments in expanding and modernizing electrical infrastructure are crucial to meet rising energy needs. Governments are actively promoting the integration of renewable energy sources, which necessitates the deployment of reliable HV bushing solutions to ensure efficient power transmission and distribution.

The HV bushing market in China is the largest market in the Asia Pacific region, driven by rapid urbanization, industrialization, and a significant increase in electricity demand. The country's focus on expanding electricity infrastructure and integrating renewable energy sources fuels the growing adoption of HV bushings to ensure reliable power transmission.

Japan HV bushing market is driven by the country's commitment to enhancing its electrical infrastructure and integrating renewable energy sources. As Japan seeks to improve grid reliability and efficiency following past energy challenges, the demand for high-performance HV bushings is increasing. Investments in smart grid technologies and the modernization of aging power systems further support market growth. Additionally, Japan's focus on safety and environmental standards necessitates the use of advanced insulation solutions, positioning HV bushings as critical components in both utility and industrial applications. The market is expected to grow steadily, reflecting Japan's broader energy transition goals and infrastructure development initiatives.

Europe HV Bushing Market Trends

The HV bushing market in Europe is characterized by a strong focus on renewable energy integration and advanced grid modernization, making it the second-largest market globally. The region benefits from highly developed electricity transmission and distribution systems, with increasing investments in offshore wind farms and smart grid initiatives driving demand. Stringent environmental regulations and energy efficiency standards further support market growth. Germany holds the largest market share, while the UK is experiencing rapid growth in HV bushing adoption. As Europe continues to prioritize sustainable energy solutions, the demand for reliable and efficient HV bushings is expected to rise, bolstering the market's expansion.

Germany HV bushing market holds a significant position in the European region, driven by the country's focus on renewable energy integration and grid modernization. As a leader in wind and solar power generation, Germany requires robust and efficient HV bushings to ensure the reliable transmission of electricity from renewable sources to the grid. The market is characterized by ongoing investments in offshore wind farms and smart grid initiatives, which are key drivers of HV bushing demand.

The HV bushing market in the UK is expected to grow at significant CAGR from 2024 to 2030. As the UK transitions towards renewable energy sources, particularly wind and solar power, the need for efficient and durable HV bushings becomes critical to ensure safe and effective power distribution. The market is characterized by investments in grid expansion and smart grid technologies, which enhance the overall reliability and efficiency of electrical networks. Additionally, the UK government’s commitment to reducing carbon emissions and improving energy efficiency further propels the adoption of high-performance HV bushings in various applications, including utilities and industrial sectors.

Central & South America HV Bushing Market Trends

The Central and South America HV bushing market is poised for growth, driven by increasing investments in electrical infrastructure and the expansion of power generation capabilities. As countries in the region seek to enhance their energy access and reliability, there is a growing demand for efficient HV bushings to support the modernization of transmission and distribution networks. The integration of renewable energy sources, particularly solar and wind, is also a significant factor, necessitating robust HV bushing solutions to manage variable power outputs.

Middle East & Africa HV Bushing Market Trends

The HV bushing market in the Middle East and Africa is poised for significant growth, driven by increasing investments in electrical infrastructure and the expansion of power generation capabilities. As countries in the region focus on enhancing energy access and reliability, there is a rising demand for efficient HV bushings to support the modernization of transmission and distribution networks. The integration of renewable energy sources, particularly solar and wind, is a key factor, necessitating robust HV bushing solutions to manage variable power outputs.

Key HV Bushing Company Insights

The market is characterized by a competitive landscape featuring key players such as General Electric, Siemens, ABB, and Crompton Greaves, among others. These companies are focusing on research and development to enhance product offerings and meet the growing demand for efficient power transmission solutions. Regional dynamics show significant market shares in North America and Europe, with Asia-Pacific expected to exhibit the fastest growth due to rapid urbanization and renewable energy integration. Companies are also pursuing strategic partnerships and innovations to strengthen their market positions and address customer needs effectively.

Key HV Bushing Companies:

The following are the leading companies in the HV bushing market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric

- LAPP Insulators GmbH

- Siemens Energy

- Sediver

- Olectra Greentech Limited

- GIPRO GmbH

- PFISTERER Holding SE

- Hitachi Energy Ltd.

- Hubbell

- Newell Porcelain

Recent Developments

-

In May 2024, Hitachi Energy launched GOB+ OIP Transformer Bushings range at Berlin 2024. The company claims that these bushings offer wider voltage and current range which simplifies customization and installation.

-

In April 2023, Siemens AG launched the SIBushing, a smart and intelligent cable connection bushing, alongside the SICAM FCM plus, which serves as a short circuit and earth fault indicator. This innovative system enhances fault detection and provides greater transparency in medium voltage distribution networks, operating effectively in grounded, isolated, and compensated configurations.

HV Bushing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 735.16 million

Revenue forecast in 2030

USD 850.91 million

Growth rate

CAGR of 2.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, installation, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

General Electric; LAPP Insulators GmbH; Siemens Energy; Sediver, Olectra Greentech Limited; GIPRO GmbH; PFISTERER Holding SE; Hitachi Energy Ltd.; Hubbell; Newell Porcelain

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HV Bushing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HV bushing market report based on the type, installation, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Condenser Type

-

Non-Condenser Type

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global HV bushing market size was estimated at USD 720.89 million in 2023 and is expected to reach USD 735.16 million in 2024.

b. The global HV bushing market is expected to grow at a compounded annual growth rate of 2.5% from 2024 to 2030 to reach USD 850.91 million by 2030.

b. Asia Pacific dominated the HV Bushing market with the highest share of about 43.39% in 2023. The Asia Pacific HV bushing market is driven by rapid urbanization, industrialization, and a significant increase in electricity demand across countries like China and India.

b. Some key players operating in the High Voltage Insulator market include General Electric, Siemens, ANTAS GmbH, Crompton Greaves, Webster-Wilkinson Ltd among others.

b. The primary drivers for the high voltage (HV) bushing market are the growing demand for electricity, modernization of existing electrical infrastructure, and rapid urbanization in developing countries. The increasing population and rising power consumption per capita are fueling the need for a stable and reliable supply of power distribution.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.