- Home

- »

- Advanced Interior Materials

- »

-

HVAC Rental Services Market Size And Share Report, 2030GVR Report cover

![HVAC Rental Services Market Size, Share & Trends Report]()

HVAC Rental Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Heating, Ventilation, Cooling, Cooling), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-457-6

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HVAC Rental Services Market Summary

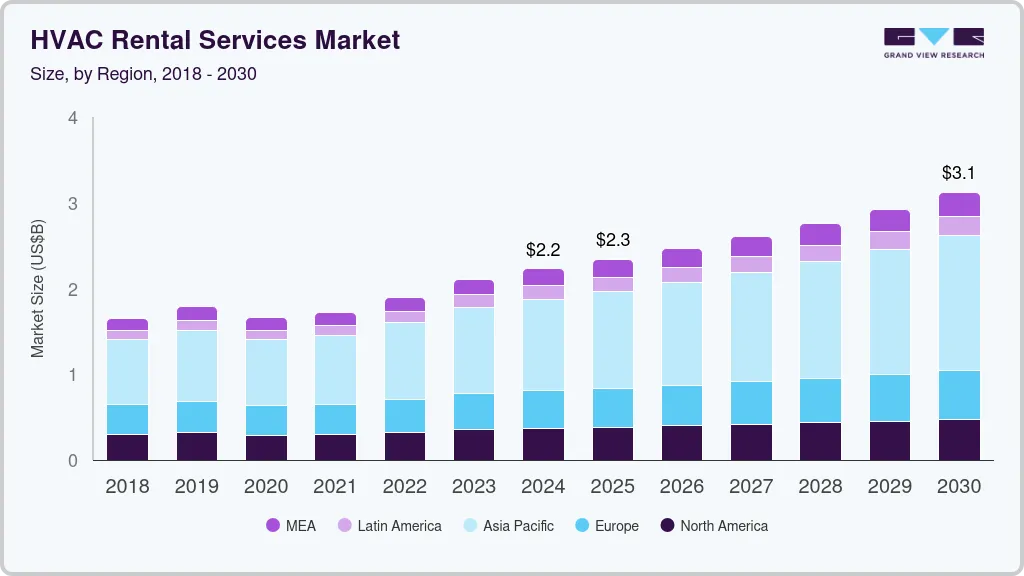

The global HVAC rental services market size was estimated at USD 2,228.5 million in 2024 and is projected to reach USD 3,124.5 million by 2030, growing at a CAGR of 5.9% from 2025 to 2030. Cost-effectiveness plays a crucial role in driving market growth.

Key Market Trends & Insights

- Asia Pacific dominated the HVAC rental services market with the largest revenue share of 47.58% in 2023.

- India is estimated to grow at the fastest CAGR of 7.4% over the forecast period.

- Based on product, the heating segment led the market with the largest revenue share of 32.9% in 2023.

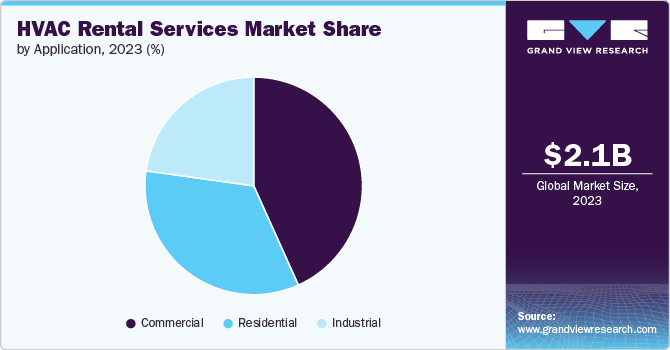

- Based on application, the commercial segment led the market with the largest revenue share of 43.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2,228.5 Million

- 2030 Projected Market Size: USD 3,124.5 Million

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2023

Renting Heating, Ventilation, and Air Conditioning (HVAC) equipment allows businesses to avoid the high upfront costs of purchasing new systems and instead pay for rental services only when needed. This approach can be more financially manageable, particularly for short-term requirements.

Technological advancements further enhance the attractiveness of HVAC rentals. Modern rental units often incorporate the latest energy-efficient technology, providing superior performance and cost savings. Businesses are increasingly drawn to these advanced systems, which offer both temporary solutions and high efficiency.

Drivers, Opportunities & Restraints

The growth of the construction and event management sectors also drives demand for HVAC rentals. As construction projects become more frequent and events more elaborate, the need for temporary climate control solutions rises. Similarly, emergency response and disaster recovery efforts benefit from rapid deployment of rental HVAC systems, which help maintain operations and support recovery.

Rental services may be limited to remote or less accessible locations, where logistical challenges and higher transportation costs can affect the availability and timeliness of rental units. This can restrict market growth in such areas.

The expansion of urban areas and infrastructure development in emerging markets presents new opportunities for HVAC rental services. As these regions grow, they require temporary climate control solutions, creating a potential growth avenue for rental providers.

Product Insights

“The cooling segment is expected to grow at a notable CAGR of 6.1% from 2024 to 2030 in terms of revenue”

The heating segment led the market with the largest revenue share of 32.9% in 2023. During construction and renovation projects, heating systems are essential to maintain appropriate working conditions and ensure the proper curing of materials, which boosts demand for rental services. The appeal of modern, energy-efficient heating technologies also plays a role, as they offer better performance and lower operating costs. In addition, heating rentals are crucial in emergencies, such as system failures or power outages, where rapid and reliable solutions are needed.

The growing demand for cooling systems within the global market is significantly influenced by rising global temperatures and more frequent heatwaves, which increase the demand for effective cooling solutions. As urbanization expands and high-density buildings create heat retention in cities, the need for efficient cooling becomes more pronounced. In addition, advancements in cooling technologies, including energy-efficient and environmentally friendly systems, make rental options more attractive.

Application Insights

"The demand for the industrial segment is expected to grow at a considerable CAGR of 6.1% from 2024 to 2030 in terms of revenue”

Based on application, the commercial segment led the market with the largest revenue share of 43.3% in 2023. Increasing commercial real estate development contributes significantly to this growth. As businesses expand and new commercial spaces are constructed or renovated, there is a heightened need for temporary HVAC solutions to ensure comfort and meet building codes during these phases. This trend is particularly prominent in sectors such as retail, office spaces, and hospitality.

The industrial segment experiences growth driven by the expansion of industrial activities and the establishment of new facilities, which creates a demand for systems that maintain optimal working conditions and equipment efficiency. Compliance with strict regulations regarding workplace conditions and environmental controls necessitates the use of advanced HVAC systems, and rental services offer a flexible solution for meeting these requirements.

Regional Insights

“India to witness fastest market growth at 7.4% CAGR”

The HVAC rental services market in North America benefits from a combination of technological advancements and regulatory requirements. The region's emphasis on energy efficiency and environmental sustainability drives the demand for modern, energy-efficient rental HVAC systems that help businesses meet stringent regulations and reduce their carbon footprints. Seasonal extremes in temperature—such as hot summers and cold winters—also create a steady need for temporary heating and cooling solutions.

U.S. HVAC Rental Services Market Trends

The HVAC rental service market in the U.S. is experiencing robust growth driven by increased demand for temporary climate control solutions across various sectors. This growth is fueled by factors such as rising construction activities, emergency repair needs, and seasonal temperature fluctuations that necessitate flexible HVAC solutions. Additionally, the trend towards shorter project timelines and the need for cost-effective, scalable solutions further bolster the market. Companies are expanding their rental fleets and enhancing service offerings to meet the evolving needs of industries ranging from construction to events, contributing to the sector's dynamic expansion.

Asia Pacific HVAC Rental Services Market Trends

Asia Pacific dominated the HVAC rental services market with the largest revenue share of 47.58% in 2023. The market growth is primarily driven by rapid urbanization and industrial expansion. As cities across Asia Pacific experience significant population growth and infrastructure development, the demand for temporary HVAC solutions for construction projects, commercial spaces, and events increases. The region's diverse climate conditions, ranging from extreme heat in some areas to cold temperatures in others, further fuels the need for adaptable and efficient HVAC systems. In addition, the economic growth in emerging markets within Asia Pacific contributes to rising construction activities and increased investment in temporary HVAC solutions for both short-term and seasonal needs.

The HVAC rental services market in India is estimated to grow at the fastest CAGR of 7.4% over the forecast period. Rapid urbanization and infrastructure development across cities increase the demand for temporary climate control solutions for construction projects, commercial spaces, and events. Seasonal temperature extremes necessitate adaptable HVAC systems to manage heating and cooling needs. The growing industrial sector further fuels demand for temporary HVAC solutions during peak periods and for specialized applications. In addition, the rise in disposable incomes and the expansion of the event and hospitality industries contribute to the need for flexible and cost-effective HVAC rental options.

Europe HVAC Rental Services Market Trends

The HVAC rental services market in Europe is influenced by a strong focus on regulatory compliance and sustainability. European countries have rigorous standards for indoor air quality and energy efficiency, which prompts businesses to seek rental solutions that align with these regulations. The region's emphasis on reducing greenhouse gas emissions and promoting eco-friendly technologies drives interest in advanced, energy-efficient rental systems. In addition, Europe’s fluctuating climate conditions, with cold winters and hot summers in various parts, contribute to the need for temporary HVAC solutions to address seasonal demands and ensure optimal conditions for commercial and industrial activities.

Key HVAC Rental Services Company Insights

Some of the key players operating in the market include Caterpillar, and Carrier among others.

-

Caterpillar is a global manufacturing company that specializes in construction and mining equipment, diesel-electric locomotives, natural gas engines, industrial gas turbines, and diesel engines for marine applications. The company's products are sold in more than 190 countries. Caterpillar's HVAC rental service business offers a wide range of heating, ventilation, and air conditioning equipment for rent, including chillers, air conditioners and different types of heaters. This service is particularly valuable for temporary heating and cooling needs, such as construction sites, events, and emergency situations

-

Carrier is a global provider of heating, ventilation, air conditioning, and refrigeration systems. The company offers a wide range of products and services, including commercial and residential HVAC systems, refrigeration equipment, building automation systems, and aftermarket parts and services. Carrier is known for its innovative products and solutions and has a long history of technological advancements in the HVAC industry

Key HVAC Rental Services Companies:

The following are the leading companies in the HVAC rental services market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier.

- Aggreko

- Air on Location Inc. (Dex Media.)

- HVAC Rentals

- Air Solutions LLC.

- Andrews Sykes Group Plc

- Johnson Controls International Plc.

- Big Ten Rentals

- Brookfield Business Partners LP

- Caterpillar Inc.

- City Air Toronto Air Conditioning and Heating

- Trane Technologies Plc

- United Rentals Inc.

- Herc Holdings Inc.

Recent Developments

-

In January 2024, ClimateCare, Canada’s prominent cooperative of residential HVAC contractors announced an update to its Consolidated Purchasing Program. With this upgrade, ClimateCare member companies will now have access to the full range of residential equipment distributed by Carrier (Canada branch). This partnership aids Carrier in deeper market penetration in Canada

-

In November 2023, Andrews Sykes Group Plc, a provider of temporary climate control and energy solutions, announced its expansion into Germany. The company has established a new branch in Hamburg, marking its entry into the German market. This strategic move is aimed at enhancing their service capabilities and expanding their customer base in the region

HVAC Rental Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,342.1 million

Revenue forecast in 2030

USD 3,124.5 million

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil;

Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Carrier.; Aggreko; Air on Location Inc. (Dex Media.); HVAC Rentals; Air Solutions LLC.; Andrews Sykes Group Plc; Johnson Controls International Plc.; Big Ten Rentals; Brookfield Business Partners LP; Caterpillar Inc.; City Air Toronto Air Conditioning and Heating; Trane Technologies Plc; United Rentals Inc.; and Herc Holdings Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HVAC Rental Services Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HVAC rental services market report based on the product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Heating

-

Ventilation

-

Cooling

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global HVAC rental services market size was estimated at USD 2,110.5 million in 2023 and is expected to reach USD 3,124.5 million in 2024.

b. The global HVAC rental services market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 3,124.5 million by 2030.

b. The commercial segment dominated the market in 2023 accounting for 43.3% of the market share in 2023. Flexibility and cost-efficiency are critical drivers for the commercial segment. Renting HVAC systems allows businesses to avoid the substantial capital expenditures associated with purchasing new equipment. Instead, they can manage expenses more effectively by paying for rental services only when needed, which is especially beneficial for short-term or seasonal requirements. This flexibility also helps businesses scale their HVAC solutions up or down based on fluctuating demands or temporary needs.

b. Some of the key players operating in the HVAC rental services market are Carrier., Aggreko, Air on Location Inc. (Dex Media.), HVAC Rentals, Air Solutions LLC., Andrews Sykes Group Plc, Johnson Controls International Plc., Big Ten Rentals, Brookfield Business Partners LP, Caterpillar Inc., City Air Toronto Air Conditioning and Heating, Trane Technologies Plc, United Rentals Inc., and Herc Holdings Inc.

b. The HVAC rental service market is growing due to rising demand for temporary climate control in construction and events. Key drivers include the cost-effectiveness of renting over buying, flexibility to scale solutions, and advancements in energy-efficient technologies. Regulatory compliance also plays a role, as businesses seek rental options to meet standards without significant investment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.