- Home

- »

- Medical Devices

- »

-

Hyaluronic Acid Market Size, Share & Trends Report, 2030GVR Report cover

![Hyaluronic Acid Market Size, Share & Trends Report]()

Hyaluronic Acid Market Size, Share & Trends Analysis Report By Application (Dermal Fillers, Osteoarthritis, Ophthalmic, Vesicoureteral Reflux), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-333-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hyaluronic Acid Market Size & Trends

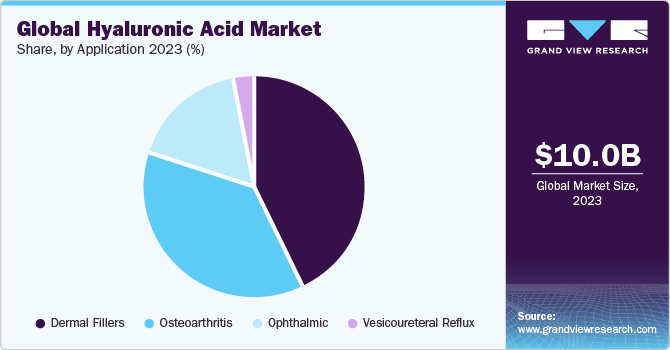

The global hyaluronic acid market size was valued at USD 10.04 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. Increasing geriatric population is a major factor contributing to the market growth. According to the WHO estimates, the proportion of people aged 60 years and above is estimated to increase from 1 billion in 2020 to 1.4 billion by 2030. People aged 60 years and over worldwide are estimated to be 2.1 billion by 2050. Growing awareness for antiaging products and high prevalence of target diseases are factors expected to drive market growth in the forecast period.

The COVID-19 pandemic, which is now endemic, negatively impacted the hyaluronic acid products market in 2020. This was due to the stringent lockdowns and restrictions applied by countries worldwide. Hyaluronic acid is widely used in ophthalmology applications such as intravitreal injection, dry eye treatment, and contact lenses. According to NCBI article published in August 2021, in 2020, there was a decrease in referral of eye care by 54.2% as well as visits to the ocular emergency department at an early pandemic lockdown, which declined by 73%.

Growing awareness about antiaging products is boosting the demand for antiaging cosmetic and esthetic treatments. Due to their distinctive viscoelastic and moisturizing properties and lower toxicity levels, there is a rising demand for hyaluronic acid products for minimally invasive antiaging solutions. Currently, a large number of people, especially women, are concerned about esthetics and looking younger, boosting their overall awareness about the antiaging products. The demand for hyaluronic acid products such as dermal fillers and the treatment of vesicoureteral reflux is anticipated to increase, because of the high awareness & minimally invasive nature. In North America, awareness & demand for such products is the highest. According to the Premium Beauty News published in May 2023, In the U.S., antiaging products remain highly popular among women. About 70% of women surveyed said they buy or use antiaging products, and 55% had a minimum of 3 products labelled as antiaging. They are mostly seeking anti-aging benefits: reducing wrinkles and fine lines, improving skin elasticity, sun protection, and deep hydration. These aspects are boosting the demand for the hyaluronic acid market.

COVID-19 Hyaluronic Acid Market Impact: 4.4% growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The demand for hyaluronic acid declined, as it has major applications in elective procedures, due to COVID-19 restrictions, especially during the early stages of the pandemic. Moreover, patients opted out or postponed procedures even in later stages of the pandemic to avoid the risk of infection, which negatively impacted the industry, resulting in a decline in the overall revenue

Easing of pandemic restrictions across the world, a higher preference for injection-based elective procedures has been observed over surgeries, which is expected to boost hyaluronic acid market post-pandemic

The use of hyaluronic acid-based supplements was reduced drastically during the pandemic. Anika Therapeutics, one of the top companies offering hyaluronic acid supplements for osteoarthritis, witnessed a 24% decline in the use of these supplements

Top players in different segments are launching new products to maintain their position in these tough times. ClearVisc Ophthalmic Viscosurgical Device (OVD) by Bausch Health is the latest approved hyaluronic acid-based viscosupplement for ophthalmic use

There has been a continuous increase in the prevalence of orthopedic & ophthalmic disorders, as a result of aging population & changing lifestyles. According to Osteoarthritis Alliance U.S, It is estimated that in the U.S., every 1 in 4 adults has some type of arthritis, wherein osteoarthritis is the most commonly observed one, affecting nearly 32.5 million U.S adults. According to NVISION Eye Centers report published in December 2022, In the U.S. alone, about 12 million people age 40 and above suffer from vision impairment, with about 1 million suffering from blindness. As per World Health Organization reports, more than 2 billion people worldwide have an eye or vision problem, and statistics around the globe are similar.

Market Characteristics & Concentration

The global hyaluronic acid market research study has showcased that the industry is characterized by a moderate degree of innovation. While there have been significant advancements in understanding hyaluronic acid and its underlying causes, treatment options remain primarily focused on symptom management rather than addressing the condition's root cause.

Several market players, such as Allergan, Sanofi, Genzyme Corporation, and Anika Therapeutics, Inc., are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories, driving the hyaluronic acid market revenue.

Companies are actively investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This results in increasing the cost of developing novel hyaluronic acid products.

The hyaluronic acid market is witnessing product expansion through the development of serum and mask skincare solutions. These advancements attract youth, and product consumers have increased in recent years. The presence of a strong product pipeline is expected to provide opportunities for market expansion over the forecast period. Key players are strengthening their strong portfolio of hyaluronic acid-based dermatological products by adding highly innovative products to the pipeline.

Application Insights

Dermal fillers segment led the market and accounted for the largest revenue share of 39.9% in 2023, Dermal fillers, also known as soft tissue fillers, are made up of synthetically derived or natural materials like hyaluronic acid that injected through the skin to obtain smoother and wrinkle-free skin. Dermal filling is a minimally invasive procedure widely used as an anti-aging therapy. Hyaluronic acid-based dermal fillers are most used in aesthetic surgical procedures to reduce eye wrinkles, nasolabial folds, scar remediation, dark circles, and rejuvenation. The U.S. FDA has approved dermal fillers for various applications, including correction and restoration of lipoatrophy in HIV-infected people. Other applications of dermal fillers include reducing acne scars and correcting the cheek. The hyaluronic acid fillers market shows promising growth prospects and offers opportunity to grow for players operating in the market.

Osteoarthritis is anticipated to witness the significant market growth over the forecast period.Osteoarthritis (OA) is the most prevalent form of arthritis, which is degenerative, painful, and tends to worsen with time. Hyaluronic acid injections are found to be effective in treating knee pain caused by OA in patients who were previously, unsuccessfully, treated with painkillers (e.g., ibuprofen) and other therapies. Hyaluronic acid acts as a shock absorber or a cushion and lubricates the joints, thus helping in proper functioning. These injections are also referred to as “viscosupplements,” as they provide thick fluid for the lubrication of joints. Euflexxa, Hyalgan, Orthovisc, Monovisc, Supartz, Synvisc, and Synvisc-One are some of the brands of hyaluronic acid that have been approved for treating knee OA. Hyaluronic acid injection market is expected to growth owing to the rising demand forosteoarthritis treatment.

Regional Insights

North America dominated the market and accounted for 43.4% share in 2023. Rising incidence of osteoarthritis and ophthalmic diseases, such as dry eye and cataracts, are among the factors responsible for the region's largest share in the market.According to CDC, 1 in 4 of the U.S. adults suffers from some form of arthritis. Furthermore, favorable government reimbursement policies and growing demand for facial esthetics are among the factors propelling hyaluronic acid market growth in North America.

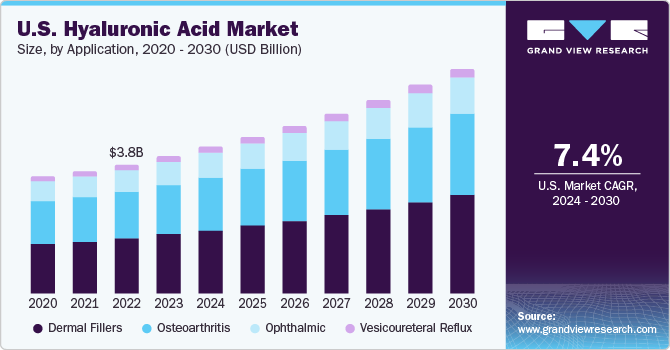

The U.S. is accounted for the largest share in terms of revenue in North America in 2023. Increasing popularity of dermal fillers, especially among women with a desire to look attractive, is a key factor expected to boost market growth in the U.S. According to the American Society of Plastic Surgeons (ASPS), over 3.41 million soft tissue filler procedures were performed in 2020; out of which, hyaluronic acid-based dermal fillers were used in 2.61 million procedures.

Asia Pacific is anticipated to witness significant growth in the hyaluronic acid market owing to the increasing population and growing incidences of osteoarthritis and ophthalmic diseases especially in China and India. The National Programme for Control of Blindness and Visual Impairment (NPCBVI), a 100% central government-sponsored scheme, was launched by the government to decrease the frequency of blindness to 0.3% by 2020. Under this scheme a total of 83,44,824 surgical procedures were conducted beating for the FY 2022-23.

Japan held the largest market share in Asia-Pacific in 2023. Rising awareness among Japanese population regarding the benefits of hyaluronic acid on skin and treatment of various diseases is boosting market growth in Japan. The influence of social media and selfies is increasing in the young generation. They desire picture-perfect celebrity looks. This is leading to increased adoption of cosmetic procedures in the country.

Key Companies & Market Share Insights

Allergan, Galderma Laboratories L.P., Sanofi, Genzyme Corporation, and Anika Therapeutics, Inc. are some of the dominant players operating in hyaluronic acid market. These key players adopt various strategies to compete in the market and maintain their dominance. Strategies adopted by these players include new product launches and mergers and acquisitions. These strategies allow these leading players to grow at a competitive advantage.

Salix Pharmaceuticals, Zimmer Biomet, Smith & Nephew Plc, Bloomage Biotechnology Corporation Limited,Maruha Nichiro, Inc. and LG Life Sciences Ltd (LG Chem.) are some emerging market players functioning in hyaluronic acid market. These companies majorly focus in distribution enhancement, new delivery system, and collaboration and partnership to grow in this market. These companies gain a competitive edge by offering effective pricing and managing at a low operative cost.

Key Hyaluronic Acid Companies:

- Allergan

- Sanofi

- Genzyme Corporation

- Anika Therapeutics, Inc.

- Salix Pharmaceuticals

- Seikagaku Corporation

- F. Hoffmann-La Roche Ag

- Galderma Laboratories L.P.

- Zimmer Biomet

- Smith & Nephew Plc

- Ferring B.V.

- Lifecore Biomedical, Llc

- HTL Biotechnology

- Shiseido Company, Limited

- Bloomage Biotechnology Corporation Limited

- LG Life Sciences Ltd (LG Chem.)

- Maruha Nichiro, Inc.

Recent Developments

-

In June 2023, Galderma received approval for Restylane EyeLight and was granted by FDA approval for the treatment of undereye dullens, also known as black shadows, in adults 21 years and older.

-

In May 2023, Allergan Aesthetics received an US FDA approval for its product ‘Skinvive’, a hyaluronic acid intradermal microdroplet injection.

-

In January 2022, Seikagaku Corporation established a new company, Seikagaku North America Corporation, in Canada as a wholly owned subsidiary of Seikagaku's subsidiary, Dalton Chemical Laboratories.

-

In August 2022, Allergan Aesthetics, an AbbVie subsidiary, received the U.S. FDA clearance for JUVÉDERM VOLUX XC to improve jaw contour in adults aged 21 and above with moderate to severe jaw contour loss.

Hyaluronic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.73 billion

Revenue forecast in 2030

USD 16.75 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Allergan, Sanofi, Genzyme Corporation, Anika Therapeutics, Inc., Salix Pharmaceuticals, Seikagaku Corporation, F. Hoffmann-La Roche Ag, Galderma Laboratories L.P., Zimmer Biomet, Smith & Nephew Plc, Ferring B.V., Lifecore Biomedical, Llc, HTL Biotechnology, Shiseido Company, Limited, Bloomage Biotechnology Corporation Limited, LG Life Sciences Ltd (LG Chem.), Maruha Nichiro, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Hyaluronic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hyaluronic acid market report on the basis of application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermal fillers

-

Osteoarthritis

-

Single-injection

-

Three-injection

-

Five-injection

-

-

Ophthalmic

-

Vesicoureteral reflux

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hyaluronic acid market size was estimated at USD 10.04 billion in 2023 and is expected to reach USD 10.73 billion in 2024.

b. The global hyaluronic acid market is expected to grow at a compound annual growth rate of 7.7% from 2024 to 2030 to reach USD 16.75 billion by 2030.

b. Dermal fillers application dominated the global industry and accounted for 39.9% of the overall revenue in the year 2023. This is attributable to the increasing demand for minimally invasive facial procedures with no side effects.

b. Some key players operating in the hyaluronic acid market include Allergan, Inc.; Galderma; Salix Pharmaceuticals; Lifecore Biomedical; Anika Therapeutics; Sanofi, Shiseido; Smith and Nephew Plc; LG Life Sciences; Maruha Nichiro, Inc.; Ferring Pharmaceutical; and Contipro.

b. Key factors that are driving the hyaluronic acid market growth include increasing aesthetic consciousness, the aging population, the introduction of cost-effective treatments and products, and technological advancements.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Application

1.2.2. Regional scope

1.2.3. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Application

2.2.2. Regional outlook

2.3. Competitive Insights

Chapter 3. Hyaluronic Acid Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing Geriatric Population

3.2.1.2. Growing Awareness For Antiaging Products

3.2.1.3. High Prevalence Of Target Diseases

3.2.2. Market restraint analysis

3.2.2.1. Associated adverse effects of hyaluronic acid

3.2.2.2. High cost of products and related services

3.3. Hyaluronic Acid Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.3.3. Pricing Analysis

Chapter 4. Hyaluronic Acid Market: Application Estimates & Trend Analysis

4.1. Application Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Hyaluronic Acid Market by Application Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Dermal fillers

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Osteoarthritis

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2. Single-injection

4.4.2.2.1 Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.3. Three-injection

4.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.3. Five-injection

4.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.3. Ophthalmic

4.4.3.3. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.4. Vesicoureteral reflux

4.4.2.3. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Hyaluronic Acid Market: Regional Estimates & Trend Analysis

5.1. Regional Market Share Analysis, 2023 & 2030

5.2. Regional Market Dashboard

5.3. Global Regional Market Snapshot

5.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

5.5. North America

5.5.1. U.S.

5.5.1.1. Key country dynamics

5.5.1.2. Regulatory framework/ reimbursement structure

5.5.1.3. Competitive scenario

5.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

5.5.2. Canada

5.5.2.1. Key country dynamics

5.5.2.2. Regulatory framework/ reimbursement structure

5.5.2.3. Competitive scenario

5.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

5.6. Europe

5.6.1. UK

5.6.1.1. Key country dynamics

5.6.1.2. Regulatory framework/ reimbursement structure

5.6.1.3. Competitive scenario

5.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

5.6.2. Germany

5.6.2.1. Key country dynamics

5.6.2.2. Regulatory framework/ reimbursement structure

5.6.2.3. Competitive scenario

5.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

5.6.3. France

5.6.3.1. Key country dynamics

5.6.3.2. Regulatory framework/ reimbursement structure

5.6.3.3. Competitive scenario

5.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

5.6.4. Italy

5.6.4.1. Key country dynamics

5.6.4.2. Regulatory framework/ reimbursement structure

5.6.4.3. Competitive scenario

5.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

5.6.5. Spain

5.6.5.1. Key country dynamics

5.6.5.2. Regulatory framework/ reimbursement structure

5.6.5.3. Competitive scenario

5.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

5.6.6. Norway

5.6.6.1. Key country dynamics

5.6.6.2. Regulatory framework/ reimbursement structure

5.6.6.3. Competitive scenario

5.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

5.6.7. Sweden

5.6.7.1. Key country dynamics

5.6.7.2. Regulatory framework/ reimbursement structure

5.6.7.3. Competitive scenario

5.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

5.6.8. Denmark

5.6.8.1. Key country dynamics

5.6.8.2. Regulatory framework/ reimbursement structure

5.6.8.3. Competitive scenario

5.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

5.7. Asia Pacific

5.7.1. Japan

5.7.1.1. Key country dynamics

5.7.1.2. Regulatory framework/ reimbursement structure

5.7.1.3. Competitive scenario

5.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

5.7.2. China

5.7.2.1. Key country dynamics

5.7.2.2. Regulatory framework/ reimbursement structure

5.7.2.3. Competitive scenario

5.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

5.7.3. India

5.7.3.1. Key country dynamics

5.7.3.2. Regulatory framework/ reimbursement structure

5.7.3.3. Competitive scenario

5.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

5.7.4. Australia

5.7.4.1. Key country dynamics

5.7.4.2. Regulatory framework/ reimbursement structure

5.7.4.3. Competitive scenario

5.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

5.7.5. South Korea

5.7.5.1. Key country dynamics

5.7.5.2. Regulatory framework/ reimbursement structure

5.7.5.3. Competitive scenario

5.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

5.7.6. Thailand

5.7.6.1. Key country dynamics

5.7.6.2. Regulatory framework/ reimbursement structure

5.7.6.3. Competitive scenario

5.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

5.8. Latin America

5.8.1. Brazil

5.8.1.1. Key country dynamics

5.8.1.2. Regulatory framework/ reimbursement structure

5.8.1.3. Competitive scenario

5.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

5.8.2. Mexico

5.8.2.1. Key country dynamics

5.8.2.2. Regulatory framework/ reimbursement structure

5.8.2.3. Competitive scenario

5.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

5.8.3. Argentina

5.8.3.1. Key country dynamics

5.8.3.2. Regulatory framework/ reimbursement structure

5.8.3.3. Competitive scenario

5.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

5.9. MEA

5.9.1. South Africa

5.9.1.1. Key country dynamics

5.9.1.2. Regulatory framework/ reimbursement structure

5.9.1.3. Competitive scenario

5.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

5.9.2. Saudi Arabia

5.9.2.1. Key country dynamics

5.9.2.2. Regulatory framework/ reimbursement structure

5.9.2.3. Competitive scenario

5.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

5.9.3. UAE

5.9.3.1. Key country dynamics

5.9.3.2. Regulatory framework/ reimbursement structure

5.9.3.3. Competitive scenario

5.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

5.9.4. Kuwait

5.9.4.1. Key country dynamics

5.9.4.2. Regulatory framework/ reimbursement structure

5.9.4.3. Competitive scenario

5.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Company/Competition Categorization

6.3. Vendor Landscape

6.3.1. List of key distributors and channel partners

6.3.2. Key customers

6.3.3. Key company market share analysis, 2023

6.3.4. Allergan

6.3.4.1. Company overview

6.3.4.2. Financial performance

6.3.4.3. Product benchmarking

6.3.4.4. Strategic initiatives

6.3.5. Sanofi

6.3.5.1. Company overview

6.3.5.2. Financial performance

6.3.5.3. Product benchmarking

6.3.5.4. Strategic initiatives

6.3.6. Genzyme Corporation

6.3.6.1. Company overview

6.3.6.2. Financial performance

6.3.6.3. Product benchmarking

6.3.6.4. Strategic initiatives

6.3.7. Anika Therapeutics, Inc.

6.3.7.1. Company overview

6.3.7.2. Financial performance

6.3.7.3. Product benchmarking

6.3.7.4. Strategic initiatives

6.3.8. Salix Pharmaceuticals

6.3.8.1. Company overview

6.3.8.2. Financial performance

6.3.8.3. Product benchmarking

6.3.8.4. Strategic initiatives

6.3.9. Seikagaku Corporation

6.3.9.1. Company overview

6.3.9.2. Financial performance

6.3.9.3. Product benchmarking

6.3.9.4. Strategic initiatives

6.3.10. F. Hoffmann-La Roche Ag

6.3.10.1. Company overview

6.3.10.2. Financial performance

6.3.10.3. Product benchmarking

6.3.10.4. Strategic initiatives

6.3.11. Galderma Laboratories L.P.

6.3.11.1. Company overview

6.3.11.2. Financial performance

6.3.11.3. Product benchmarking

6.3.11.4. Strategic initiatives

6.3.12. Zimmer Biomet

6.3.12.1. Company overview

6.3.12.2. Financial performance

6.3.12.3. Product benchmarking

6.3.12.4. Strategic initiatives

6.3.13. Smith & Nephew Plc

6.3.13.1. Company overview

6.3.13.2. Financial performance

6.3.13.3. Product benchmarking

6.3.13.4. Strategic initiatives

6.3.14. Ferring B.V.

6.3.14.1. Company overview

6.3.14.2. Financial performance

6.3.14.3. Product benchmarking

6.3.14.4. Strategic initiatives

6.3.15. Lifecore Biomedical, Llc

6.3.15.1. Company overview

6.3.15.2. Financial performance

6.3.15.3. Product benchmarking

6.3.15.4. Strategic initiatives

6.3.16. HTL Biotechnology

6.3.16.1. Company overview

6.3.16.2. Financial performance

6.3.16.3. Product benchmarking

6.3.16.4. Strategic initiatives

6.3.17. Shiseido Company, Limited

6.3.17.1. Company overview

6.3.17.2. Financial performance

6.3.17.3. Product benchmarking

6.3.17.4. Strategic initiatives

6.3.18. Bloomage Biotechnology Corporation Limited

6.3.18.1. Company overview

6.3.18.2. Financial performance

6.3.18.3. Product benchmarking

6.3.18.4. Strategic initiatives

6.3.19. LG Life Sciences Ltd (LG Chem.)

6.3.19.1. Company overview

6.3.19.2. Financial performance

6.3.19.3. Product benchmarking

6.3.19.4. Strategic initiatives

6.3.20. Maruha Nichiro, Inc.

6.3.20.1. Company overview

6.3.20.2. Financial performance

6.3.20.3. Product benchmarking

6.3.20.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America Hyaluronic Acid market, by region, 2018 - 2030 (USD Million)

Table 3 North America Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 4 U.S. Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 5 Canada Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 6 Europe Hyaluronic Acid market, by region, 2018 - 2030 (USD Million)

Table 7 Europe Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 8 Germany Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 9 UK Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 10 France Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 11 Italy Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 12 Spain Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 13 Denmark Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 14 Sweden Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 15 Norway Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 16 Asia Pacific Hyaluronic Acid market, by region, 2018 - 2030 (USD Million)

Table 17 Asia Pacific Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 18 China Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 19 Japan Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 20 India Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 21 South Korea Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 22 Australia Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 23 Thailand Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 24 Latin America Hyaluronic Acid market, by region, 2018 - 2030 (USD Million)

Table 25 Latin America Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 26 Brazil Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 27 Mexico Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 28 Argentina Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 29 MEA Hyaluronic Acid market, by region, 2018 - 2030 (USD Million)

Table 30 MEA Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 31 South Africa Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 32 Saudi Arabia Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 33 UAE Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

Table 34 Kuwait Hyaluronic Acid market, by application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Hyaluronic Acid market: market outlook

Fig. 14 Hyaluronic Acid competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Hyaluronic Acid market driver impact

Fig. 20 Hyaluronic Acid market restraint impact

Fig. 21 Hyaluronic Acid market strategic initiatives analysis

Fig. 22 Hyaluronic Acid market: Application movement analysis

Fig. 23 Hyaluronic Acid market: Application outlook and key takeaways

Fig. 24 Dermal fillers market estimates and forecast, 2018 - 2030

Fig. 25 Osteoarthritis market estimates and forecast, 2018 - 2030

Fig. 26 Single-injection market estimates and forecast, 2018 - 2030

Fig. 27 Three-injection market estimates and forecast, 2018 - 2030

Fig. 28 Five-injection market estimates and forecast, 2018 - 2030

Fig. 29 Ophthalmic market estimates and forecast, 2018 - 2030

Fig. 30 Vesicoureteral reflux market estimates and forecast, 2018 - 2030

Fig. 31 Global Hyaluronic Acid market: Regional movement analysis

Fig. 32 Global Hyaluronic Acid market: Regional outlook and key takeaways

Fig. 33 Global Hyaluronic Acid market share and leading players

Fig. 34 North America market share and leading players

Fig. 35 Europe market share and leading players

Fig. 36 Asia Pacific market share and leading players

Fig. 37 Latin America market share and leading players

Fig. 38 Middle East & Africa market share and leading players

Fig. 39 North America: SWOT

Fig. 40 Europe SWOT

Fig. 41 Asia Pacific SWOT

Fig. 42 Latin America SWOT

Fig. 43 MEA SWOT

Fig. 44 North America, by country

Fig. 45 North America

Fig. 46 North America market estimates and forecasts, 2018 - 2030

Fig. 47 U.S.

Fig. 48 U.S. market estimates and forecasts, 2018 - 2030

Fig. 49 Canada

Fig. 50 Canada market estimates and forecasts, 2018 - 2030

Fig. 51 Europe

Fig. 52 Europe market estimates and forecasts, 2018 - 2030

Fig. 53 UK

Fig. 54 UK market estimates and forecasts, 2018 - 2030

Fig. 55 Germany

Fig. 56 Germany market estimates and forecasts, 2018 - 2030

Fig. 57 France

Fig. 58 France market estimates and forecasts, 2018 - 2030

Fig. 59 Italy

Fig. 60 Italy market estimates and forecasts, 2018 - 2030

Fig. 61 Spain

Fig. 62 Spain market estimates and forecasts, 2018 - 2030

Fig. 63 Denmark

Fig. 64 Denmark market estimates and forecasts, 2018 - 2030

Fig. 65 Sweden

Fig. 66 Sweden market estimates and forecasts, 2018 - 2030

Fig. 67 Norway

Fig. 68 Norway market estimates and forecasts, 2018 - 2030

Fig. 69 Asia Pacific

Fig. 70 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 71 China

Fig. 72 China market estimates and forecasts, 2018 - 2030

Fig. 73 Japan

Fig. 74 Japan market estimates and forecasts, 2018 - 2030

Fig. 75 India

Fig. 76 India market estimates and forecasts, 2018 - 2030

Fig. 77 Thailand

Fig. 78 Thailand market estimates and forecasts, 2018 - 2030

Fig. 79 South Korea

Fig. 80 South Korea market estimates and forecasts, 2018 - 2030

Fig. 81 Australia

Fig. 82 Australia market estimates and forecasts, 2018 - 2030

Fig. 83 Latin America

Fig. 84 Latin America market estimates and forecasts, 2018 - 2030

Fig. 85 Brazil

Fig. 86 Brazil market estimates and forecasts, 2018 - 2030

Fig. 87 Mexico

Fig. 88 Mexico market estimates and forecasts, 2018 - 2030

Fig. 89 Argentina

Fig. 90 Argentina market estimates and forecasts, 2018 - 2030

Fig. 91 Middle East and Africa

Fig. 92 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 93 South Africa

Fig. 94 South Africa market estimates and forecasts, 2018 - 2030

Fig. 95 Saudi Arabia

Fig. 96 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 97 UAE

Fig. 98 UAE market estimates and forecasts, 2018 - 2030

Fig. 99 Kuwait

Fig. 100 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 101 Market share of key market players- Hyaluronic Acid marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Hyaluronic Acid Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- U.S.

- U.S. Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- U.S. Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Canada

- Canada Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Canada Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- North America Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Europe

- Europe Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- UK

- UK Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- UK Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Germany

- Germany Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Germany Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- France

- France Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- France Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Italy

- Italy Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Italy Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Spain

- Spain Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Spain Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Denmark

- Denmark Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Denmark Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Sweden

- Sweden Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Sweden Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Norway

- Norway Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Norway Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Europe Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Asia Pacific

- Asia Pacific Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- China

- China Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- China Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Japan

- Japan Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Japan Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- India

- India Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- India Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Australia

- Australia Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Australia Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Thailand

- Thailand Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Thailand Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- South Korea

- South Korea Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- South Korea Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Asia Pacific Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Latin America

- Latin America Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Brazil

- Brazil Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Brazil Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Mexico

- Mexico Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Mexico Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Argentina

- Argentina Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Argentina Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Latin America Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Middle East & Africa

- Middle East & Africa Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- South Africa

- South Africa Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- South Africa Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Saudi Arabia

- Saudi Arabia Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Saudi Arabia Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- UAE

- UAE Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- UAE Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Kuwait

- Kuwait Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Dermal fillers

- Osteoarthritis

- Single-injection

- Three-injection

- Five-injection

- Ophthalmic

- Vesicoureteral reflux

- Kuwait Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- Middle East & Africa Hyaluronic Acid Application Outlook (Revenue, USD Million, 2018 - 2030)

- North America

Hyaluronic Acid Market Dynamics

Driver: Increasing Geriatric Population

The global geriatric population is rapidly rising. As per the World Health Organization (WHO) estimates, the global populace among the age group of 65 years and above is predicted to rise from 7% in 2000 to 16% in 2050. As per the Department of Economic & Social Affairs of the UN, the population over 80 years of age is anticipated to grow three times by 2050, reaching 425 million. As per the U.S. Census Bureau, at present, 54 million adults in the U.S. are 65 or above, making it 16% of the total population. Furthermore, Asia Pacific also holds the highest aging population record. According to the recent-most statistics on the aging population, Japan has the highest aging population across the world with 29% of the nation’s population aged 65 & above. A related issue of this will be an upsurge in the prevalence of obesity, skin aging, and osteoarthritis which is predicted to substantially boost the demand for hyaluronic acid (HA) products over the forecast period.

Surging Consciousness Regarding Antiaging Products

Growing consciousness about antiaging products is predicted to upsurge the demand for antiaging cosmetic and aesthetic treatments. Due to their distinctive viscoelastic and moisturizing properties, paired with decreased toxicity levels, hyaluronic acid products are straightly impacted by surging demand for negligibly invasive antiaging solutions. At present, a huge number of people, specifically women, are worried about aesthetics and looking younger, increasing their general mindfulness about the antiaging section. The demand for hyaluronic acid-infused products as dermal fillers and the treatment of vesicoureteral reflux is predicted to rise, owing to the high cognizance and marginally invasive nature. In North America, demand for such products is on a higher side. According to a report by Allergan, 50% of men & women in Canada are aware of dermal fillers & prefer them as a better aesthetic choice in comparison with surgical methods. In emerging countries, people are well-informed due to improving access to information and accessibility to products.

Restraint : Adversarial Impacts Related with Hyaluronic Acid

There are few negative results concerned to the usage of hyaluronic acid cycles. In most of the HA injections, the complications are mild and transient. This involves bruising, bleeding, redness, and overcorrection of itching, wrinkles, and inflammation. Nevertheless, in few cases, severe negative problems, such as cerebrovascular accidents, necrosis, and vision loss are likely to arise. Other adversarial event that can arise owing to the usage of HA-based dermal fillers is the formation of nodules and lumps. For instance, high pressure is placed on the syringe while injecting, it can lead to the formation of large boluses of fillers. Furthermore, as per an article issued in the American Academy of Ophthalmology, HA dermal injections to the tear trough may result in malar edema in nearly 11% of cases. The repetitive pain-bearing linked with numerous injection cycles is also a deterrent. Due to this, numerous people are indecisive regarding dermal filler injections.

What Does This Report Include?

This section will provide insights into the contents included in this hyaluronic acid market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Hyaluronic acid market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Hyaluronic acid market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the hyaluronic acid market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for hyaluronic acid market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of hyaluronic acid market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Hyaluronic Acid Market Categorization:

The hyaluronic acid market was categorized into two segments, namely application (Dermal fillers, Osteoarthritis, Ophthalmic, Vesicoureteral reflux), region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa).

Segment Market Methodology:

The hyaluronic acid market was segmented into applications and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The hyaluronic acid market was analyzed at a regional level. The globe was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; the UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Hyaluronic acid market companies & financials:

The hyaluronic acid market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

AbbVie - AbbVie is a biopharmaceutical company that specializes in manufacturing and distribution of immunology, hematic oncology dermatology, ophthalmology, neuroscience, women’s health, urology, and esthetic products, including best-selling pharmaceuticals & medical devices. The company has a market presence around the globe. In May 2020, AbbVie completed the acquisition of Allergan.

-

Sanofi - Sanofi is a French multinational conglomerate involved in manufacturing & marketing of healthcare products as well as R&D. As of 2017, the company operates through its offices and research & production centers and logistics services in around 100 countries across the globe. Sanofi’s product portfolio includes consumer healthcare products, insulin, generic drugs, enzymes, syrups, tablets, and therapeutic solutions intended for use in curing diseases such as diabetes, cancer, and multiple sclerosis, as well as diseases related to animal health. The company has 300 subsidiaries around the globe, including Aventis, Inc.; Aventis Pharma SA; Genzyme Corporation; Hoechst GmbH, and others.

-

Genzyme Corporation 7 - Genzyme Corporation became a fully owned subsidiary of Sanofi after its acquisition in 2011. With global presence in over 100 countries, it has 17 manufacturing units and 9 medical testing laboratories. The company focuses on five areas—rare diseases, rare blood disorders, multiple sclerosis, oncology, and immunology. Through various mergers and acquisitions over the years, it has become the fourth largest biopharmaceutical company in the U.S. In 2005, it was awarded the highest level of honor—The National Medal of Technology— by the U.S. president The company is focused on discovering advanced new therapies by developing highly specialized treatments.

-

Anika Therapeutics, Inc. - Anika Therapeutics, Inc. is a global medical technology company. The company, together with its subsidiaries, manufactures, develops, and commercializes hyaluronic acid-based products. It also manufactures and commercializes products related to orthopedics, ophthalmology, surgical antiadhesives, veterinary osteoarthritis therapies, and dermatology. More than 60% of the company’s annual revenue is derived from orthopedic products. The company has long term collaborations for licensing and supply agreements for its products with global companies that include DePuy Mitek, Inc.; Medtronic, Inc.; Boehringer Ingelheim Vetmedica, Inc.; Sports Medicine, Inc.; Medline Industries, Inc.; Nordic Pharma B.V.; and Green Cross Corporation.

-

Seikagaku Corporation - The company is majorly involved in the manufacture and sales of pharmaceuticals and medical devices, particularly related to glycoconjugates. It primarily has two businesses: pharmaceuticals and Limulus Amebocyte Lysate (LAL). They do not operate through a sales network and distribute their products through their partners. The company currently has HA-NSAID conjugates in its pipeline. The R&D expenditures accounted for about 20% of net sales.

-

F. Hoffmann-La Roche AG - F. Hoffmann-La Roche AG is actively involved in development and manufacture of diagnostic & pharmaceutical products. The company has over 26 manufacturing sites worldwide. It operates across two verticals: pharmaceuticals and diagnostics. Under pharmaceuticals, it manufactures drugs for infectious, cardiovascular, respiratory, metabolic, central nervous system, and autoimmune diseases, as well as for cancer. Roche diagnostics is involved in market segments ranging from patient self-monitoring to clinical laboratory systems. Roche professional diagnostics is the company’s largest business area, providing solutions, tests, and instrument systems for reliable & cost-effective delivery of results. Ventana Medical, a member of Roche group, is involved in development of assays and kits for in situ hybridization.

-

Galderma Laboratories L.P. - Galderma Laboratories L.P. operates as a medical solution business of Nestlé Skin Health. It develops, manufactures, and sells medically proven hair, skin, & nails solutions in 100 countries. Since the past 35 years, it has been investing in R&D to develop quality products to address and treat compromised & aging skin. The company also conducts training programs for healthcare professionals to keep them updated with evolving trends and therapies in dermatology. It provides therapies and products for dermatology conditions such as rosacea, acne, psoriasis & steroid-responsive dermatoses, nail mycosis, skin cancer, and skin senescence. In October 2019, the company became an independent dermatology company after divestment from Nestlé Skin Health.

-

Zimmer Biomet - Zimmer Biomet is a public medical device company involved in designing & marketing of orthopedic products, dental implants, and tissue grafting materials. The company design, produce and market orthopedic reconstructive products, biologics, sports medicine, extremities and trauma products (S.E.T), spine, office-based technologies, dental implants, craniomaxillofacial and thoracic products (CMF), and surgical products. The company is present in over 100 countries across the globe, with direct operations across 25 countries.

-

Smith & Nephew Plc - Smith & Nephew Plc is a globally established company with diverse operations in healthcare. The company is included in top 100 companies based on market capitalization and has been listed on London Stock Exchange since 1937. It is a public limited organization involved in orthopedic reconstruction, sports medicine, trauma, and advanced wound management. It has established global compliance policies and operates on the same.

-

Ferring B.V. - Ferring B.V. is a biopharmaceutical company focusing on research of innovative and personalized healthcare solutions. The company is developing and marketing pharmaceutical products in line with the treatment of life-threatening conditions. The company offers products for reproductive medicine and maternal health, gastroenterology, urology and uro-oncology, endocrinology, and orthopedics. Ferring is a leading provider in assisted reproductive technology for fertility treatment and offers peptide-based medicines to prevent preterm labor. The company has a presence in more than 110 countries across the globe and has operating subsidiaries in nearly 60 countries. The company’s key therapeutic areas include reproductive health, urology, gastroenterology, and endocrinology.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Hyaluronic Acid Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2022, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Hyaluronic Acid Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationShare this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."