- Home

- »

- Medical Devices

- »

-

Hybrid Imaging Market Size, Share & Trends Report, 2030GVR Report cover

![Hybrid Imaging Market Size, Share & Trends Report]()

Hybrid Imaging Market Size, Share & Trends Analysis Report By Type (PET/CT, SPET/CT), By Application (Oncology, Cardiology), By End Use (Hospitals, Diagnostic Imaging Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-145-0

- Number of Report Pages: 210

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hybrid Imaging Market Size & Trends

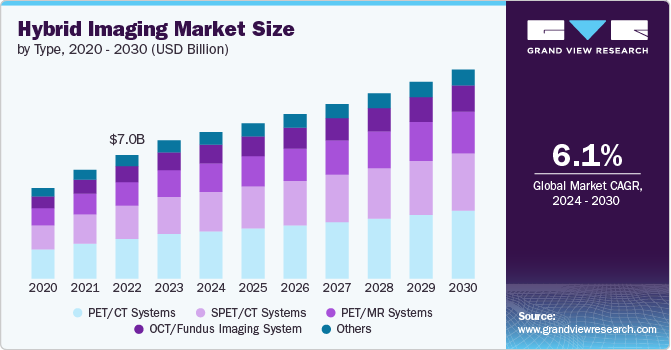

The global hybrid imaging market size was valued at USD 7.91 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. This market is primarily driven by the increasing significance of integration of molecular and anatomical data & standalone imaging techniques, and the rising cases of chronic disorders worldwide. According to the PCR online, CVD continues to be the primary cause of death for both men and women worldwide. As of 2023, the global population is 8 billion, with approximately 620 million individuals living with heart and circulatory diseases. Each year, approximately 60 million people worldwide develop heart or circulatory diseases.

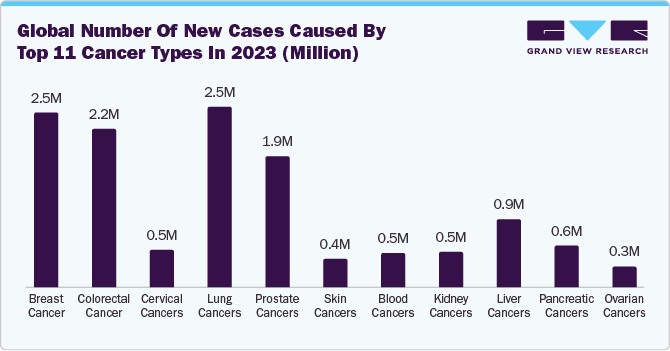

Moreover, the growing prevalence of cancer globally drives the demand for hybrid imaging or multimodal imaging market. For instance, according to the WHO, in 2022, approximately 20 million new cases of cancer were reported, resulting in 9.7 million deaths. An estimated 53.5 million individuals survived for at least 5 years after being diagnosed with cancer. Roughly one-fifth of the global population is affected by cancer during their lifetime, with around 1 in 9 men and 1 in 12 women succumbing to the illness. In addition, this number is projected to reach 24.5 million by 2030. In 2020, cancer accounted for an estimated 10 million deaths.

The growing number of outpatient settings with imaging services is further propelling the market growth. These centers use advanced techniques and high-tech equipment to produce accurate & clear images of bones, arteries, organs, blood vessels, nervous system, and soft tissues. High-definition images provide exact information that allows doctors or healthcare professionals to precisely diagnose a variety of conditions. This helps doctors recommend effective and appropriate treatments. According to Definitive Healthcare, as of February 2023, there were around 18,861 imaging centers across the U.S. Shared below is a regional breakdown of the leading imaging centers in the country.

Furthermore, the rising geriatric population is also a major factor driving multimodal imaging market growth. Elderly individuals often have complex healthcare needs that require a multidisciplinary approach for effective management. Multimodal imaging modalities provide comprehensive information by combining anatomical and functional data in a single scan, enabling healthcare providers to make more informed decisions regarding patient care. According to Australian Institute of Health and Welfare (AIHW) article published in June 2024, around 15.4 million individuals, constituting 61% of the population, were living with at least one chronic health conditionin 2022. The prevalence of these conditions varied from 28% among individuals aged 0-14 to 94% among those aged 85 and above.

Government initiatives for the development of multimodal imaging devices are expected to drive the market. For instance, in June 2023, the IMAGIO consortium was awarded a significant grant of USD 15.3 million from the Innovative Health Initiative. This funding aims to support the consortium’s efforts in enhancing cancer treatments through innovative approaches and technologies. The grant is likely to enable the consortium to conduct research, develop new therapies, and implement strategies to improve patient outcomes in the field of oncology.

There is a growing awareness among both healthcare providers and patients about the importance of early diagnosis of diseases and disorders. Early detection can significantly improve patient outcomes by enabling timely interventions and treatments. Multimodal imaging systems allow for early detection by combining multiple imaging modalities to detect abnormalities at an early stage when they may be more treatable. For instance, in March 2022, the Advanced Research Projects Agency for Health (ARPA-H) was established by the U.S. President with bipartisan funding of USD 2.5 billion. The primary goal of ARPA-H is to drive scientific breakthroughs in the fields of prevention, detection, and treatment for various diseases, with a particular focus on cancer.

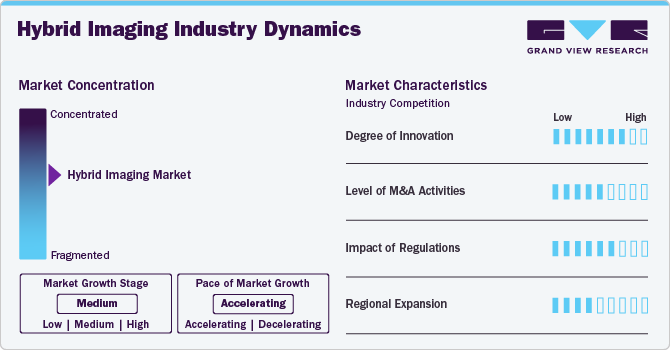

Industry Concentration & Characteristics

The hybrid imaging industry exhibits a moderate level of market concentration. Market characteristics include rapid technological advancements, such as the integration of artificial intelligence (AI), and hybrid monitoring. The industry showcases continuous innovation and expansion fueled by rising healthcare expenditure and the growing prevalence of chronic disorders and the growing adoption of healthcare technologies and solutions.

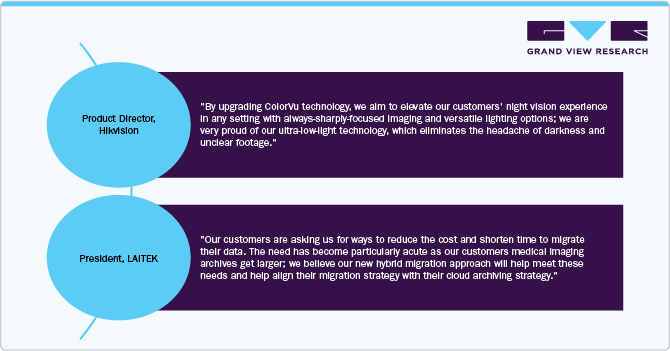

The industry is characterized by a high degree of innovation. The integration of multiple imaging modalities, such as PET/CT, MRI/CT, and ultrasound with other techniques provides clinicians with a comprehensive view of both anatomical structures and functional information within the body, enabling more accurate diagnoses and treatment planning. Furthermore, manufacturers in the market are focusing on enhancing product quality, performance, and technological capabilities to meet the evolving needs of healthcare professionals and patients. For instance, in April 2023, Hikvision launched its next-generation ColorVu technology. This new technology boasts enhanced low-light imaging capabilities through the incorporation of Super Confocal and Smart Hybrid Light innovations.

Regulations significantly impact the industry by ensuring patient safety, product quality, and efficacy.Companies invest substantial resources in R&D activities and regulatory submissions to obtain regulatory approval for pipeline products. For instance, in May 2023, FDA approved an imaging agent that utilizes Radiohybrid technology to aid in the identification of the location and extent of prostate cancer. This approval marks a significant advancement in the field of prostate cancer diagnosis and treatment.Radiohybrid technology combines the benefits of both radioisotopes and optical imaging agents. It allows for precise localization and visualization of tumors, offering improved accuracy in identifying cancerous tissues.

Mergers and acquisitions in the industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in March 2024, Titan Medical and Conavi announced a merger agreement to switch from developing robotic-assisted surgery technologies to exploring other avenues for its intellectual property. This decision led to the acquisition by Conavi, an imaging company focusing on commercializing its Novasight Hybrid System for guiding minimally invasive coronary procedures.

The multimodal imaging industry is experiencing robust global expansion. Companies are implementing various strategies, such as distribution agreements, geographic expansion, and new product development, to improve their market penetration. For instance, in November 2023, Fujifilm introduced a new medical imaging innovation at the Radiological Society of North America (RSNA) Conference. This event serves as a platform for companies including Fujifilm to showcase their latest advancements in medical imaging technology, which can have significant implications for healthcare providers and patients advancing the field of medical imaging and improving patient care through innovative solutions.

Type Insights

The PET/CT systems segment accounted for the largest market share of 32.3% in 2023. Technical advancements in PET imaging for advanced diagnostics applications and oncology and rising demand for PET analysis in radiopharmaceuticals are expected to drive market growth. Additionally, the increasing shift toward image-guided interventions and X-ray Tomography (CT) integration with PET is expected to further propel the growth of the PET scanners market globally.Positron Emission Tomography (PET) is an indispensable medical imaging method. The ongoing innovations are pushing the limits of PET detector technology to enhance sensitivity and are helping to improve molecular imaging in the future. For instance, in June 2023, United Imaging unveiled its next-generation PET/CT systems and an integrated molecular technology platform at the Society of Nuclear Medicine and Molecular Imaging (SNMMI) Annual Meeting. This significant announcement marks a milestone in the field of diagnostic imaging and molecular medicine.This new technology is a powerful imaging modality that combines functional information from PET with anatomical details from CT scans. This integration allows for more precise localization of abnormalities, improved diagnostic accuracy, and better treatment planning in oncology, cardiology, neurology, and other medical specialties.

Furthermore, government support to key companies operating in the market is expected to further increase the technological advancements of PET imaging techniques.For instance, in May 2023, The FDA approved the first radiohybrid Prostate-Specific Membrane Antigen (PSMA)-targeted PET imaging agent for prostate cancer. This new imaging agent offers several advantages over traditional imaging modalities, such as improved detection of small lesions, better delineation of tumor margins, and more accurate assessment of disease extent and response to treatment.

The PET/MR systems segment is anticipated to witness the fastest growth rate over the forecast period. Multimodality imaging, with commercialized PET/MRI systems, is becoming increasingly important. This trend is anticipated to contribute significantly to market growth. For instance, a study released by the Radiological Society of North America in May 2024 emphasized how the integration of PET/MRI technology can provide a more comprehensive insight into brain abnormalities associated with cognitive decline, thereby assisting in the diagnosis of Alzheimer’s disease. This research highlights the potential of hybrid imaging systems to improve diagnostic capabilities and stimulate growth in the market.

Application Insights

The oncology segment accounted for the largest market share of 39.2% in 2023 and is expected to grow at the fastest CAGR over the projected period. The growth in this market segment is driven by the rising prevalence of cancer and advancements in the field, along with the introduction of new MRI products. Cancer is a widespread chronic illness globally, making MRI scans, surgeries, and radiation therapies essential for both detecting cancer and planning its treatment. Moreover, the increasing emphasis on research in cancer radiation therapy is also fueling the expansion of this market segment. For instance, in January 2022, researchers at the Sylvester Comprehensive Cancer Center at the University of Miami developed a technique for MRI-guided radiation therapy using machine learning. This technique allows for real-time monitoring of glioblastoma treatment response by combining daily MRI with radiation. It provides physicians with high-resolution images to track the tumor's progress and understand how the cancer is reacting to treatment. Positive outcomes from such studies may lead to the adoption of new cancer treatments, driving growth in this market segment.

The cardiology segment is anticipated to grow at a lucrative CAGR over the forecast period due to increasing prevalence of coronary atherosclerosis. For instance, according to Heart Research Institute, atherosclerosis is a common occurrence in individuals over 40 years old who are generally in good health. The likelihood of developing serious atherosclerosis increases with age, with most people over 60 having some degree of the condition. It serves as the root cause of cardiovascular diseases, which are leading causes of death globally and significantly contribute to heart attacks and strokes.

Moreover, increasing adoption of multimodal imaging for diagnosis is also contributing to the growth of the segment. These devices, mainly computed tomography coronary angiography (CTCA) with SPECT or PET, are largely used in the field of cardiology. This is because these multimodal devices help in diagnosing coronary artery disease by accurately visualizing coronary atherosclerotic lesions and their hemodynamic consequences. CTCA along with MRI and PET/MRI are upcoming hybrid imaging devices for the diagnosis of cardiac diseases and are expected to drive the segment during the forecast period.

End Use Insights

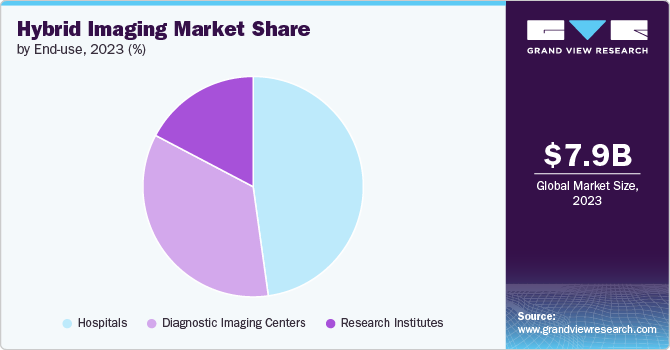

Hospitals dominated the market with 53.5% of the revenue share in 2023. The market growth is anticipated to receive a significant boost from the increased adoption of new and advanced MRI systems by end-users. For instance, in June 2023, Moffitt McKinley Hospital implemented intraoperative Magnetic Resonance Imaging (MRI), a state-of-the-art technology that aids surgeons during complex surgeries. This advanced tool offers superior resolution compared to traditional imaging methods such as ultrasounds and CT scanners, enabling precise tumor localization and detailed understanding of their physical characteristics. The integration of this technology into the hospital’s operations is fueling market growth.

Diagnostic imaging centers are anticipated to grow at the fastest rate during the forecast period due to high adoption of these centers in developed countries. Moreover, the market players are utilizing their expertise to develop cutting-edge solutions with the aim of addressing unmet clinical needs and improving diagnostic accuracy. For instance, in January 2024, GE HealthCare has announced its acquisition of MIM Software, a prominent global provider of medical imaging analysis and artificial intelligence solutions in various healthcare fields. This strategic move is intended to integrate MIM Software’s advanced imaging analytics and digital workflow capabilities into GE HealthCare’s offerings, aiming to drive innovation and improve patient care on a global scale. The focus on innovation is expected to boost the adoption of hybrid imaging technologies and open up new avenues for market growth.

Regional Insights

North America hybrid imaging market dominated the global market and accounted for 42.0% revenue share in 2023. Factors such as growing investment in advancing hybrid imaging & imaging healthcare organizations and growing adoption of advanced medical technologies are contributing to the increasing growth of the market in the region. For instance, in July 2024, the British Columbia (B.C.) government announced a USD 8.91 million investment in a new hybrid imaging system at the University of British Columbia (UBC) Hospital. The project involving the Ministry of Health and the Nanaimo Regional Hospital District, with Western Medical Canada Inc. leading the construction and installation of a new imaging room with a scanner, plays a significant role in driving the hybrid imaging market in North America.

Furthermore, the innovation of new products by research institutions is also fueling the market growth in the region. For instance, in January 2024, Ohio State University conducted a research study highlighting real-time magnetic resonance imaging (MRI) during gene therapy in the nervous system. This technology plays a crucial role in enhancing the effectiveness, safety, and efficiency of delivering gene therapy to the nervous system. The utilization of real-time MRI for gene therapy delivery is anticipated to see increased adoption over the next 3 to 5 years as more facilities acquire the necessary infrastructure and expertise.

U.S. Hybrid Imaging Market Trends

The hybrid imaging market in the U.S. held a significant share of the North American market in 2023. The growth is attributed to the growing establishment of pediatric hybrid intraoperative MRI neurosurgery suite the country. For instance, in March 2023, pediatric hybrid intraoperative MRI neurosurgery suite was introduced to offer numerous benefits for both patients and healthcare providers. This innovative technology allows for real-time imaging during surgery, enabling surgeons to visualize critical structures with exceptional detail and accuracy. By incorporating advanced imaging capabilities directly into the operating room, this suite enhances surgical precision, reduces the risk of complications, and ultimately improves patient outcomes.

Europe Hybrid Imaging Market Trends

The hybrid imaging market in Europe is witnessing growth fueled by the growing focus on developing multimodal imaging in the region. The European Society for Hybrid, Molecular and Translational Imaging (ESHIᴹᵀ) is a non-profit organization developed in Europe for promoting and coordinating professional activities of people working in the field of hybrid imaging. This organization arranges various educational and training programs for physicians, scientists, physicists, technologists, radiographers, and others in the field.

UK hybrid imaging market is one of the major markets in the European region. The growth is attributed to the increasing government initiatives of lifesaving cancer checks for patients in the UK which has significant implications for the healthcare industry, particularly in driving the hybrid imaging market. For instance, in June 2023, the National Health Service (NHS) carried out urgent cancer checks for an unprecedented number of over 261 thousand individuals in the UK. This figure represents a significant portion of the UK population, demonstrating the healthcare system’s proactive response to the rising global cancer diagnoses. Furthermore, a record-breaking 335 thousand individuals started cancer treatments between July 2022 and June 2023, exceeding previous years’ figures. This surge in cancer checks and treatments highlights the growing demand for advanced medical technologies such as Magnetic Resonance Imaging (MRI) systems.

Thehybrid imaging marketin Germany is projected to expand in the forecast period owing to a rapidly aging population, growing prevalence of chronic diseases, presence of a sophisticated healthcare system, a highly qualified workforce, and high healthcare spending. Moreover, the hybrid imaging market in Germany is significantly influenced by international events and advancements in technology. For instance, in April 2023, Hyperion Hybrid Imaging Systems participated at the DGN NuklerMedizin event in Germany. Thus, participating in DGN NuklerMedizin 2023, Hyperion hybrid imaging or multimodal imaging systems gains exposure and visibility among industry professionals, healthcare providers, researchers, and potential customers in Germany. This exposure helps raise awareness about the company’s innovative hybrid imaging solutions and technologies, increasing its brand recognition and market presence.

Asia Pacific Hybrid Imaging Market Trends

The hybrid imaging market in Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2030. The growing usage of hybrid devices such as PET/CT in various radiology departments across the region is expected to contribute to market growth. Moreover, global market players are continuously developing advanced software for multimodal imaging devices in the region. For instance, syngo.via by Siemens Healthineers incorporates various technologies such as Pre-fetching, ALPHA Technology, SMART Layout, and Findings Navigator, which helps in translating data captured by various multimodality imaging devices such as PET/CT and SPECT/CT into concise reports.

Moreover, the rising prevalence of Alzheimer’s disease, dementia and multiple sclerosis in the region is further propelling the market growth. For instance, according to the Australian Institutes of Health and Welfare study published in March 2024, it was approximated that there were 411,100 individuals in Australia who were living with dementia in 2023. Moreover, the estimated number of Australians with dementia in 2022 falls between 386,200 and 487,500. This turns to a prevalence of 15 cases of dementia per 1,000 Australians, which escalates to 83 cases per 1,000 Australians aged 65 and older. In Australia, approximately two-thirds of dementia patients are women. Consequently, the anticipated rise in dementia cases will drive an increased demand for MRI scans in Australia, thereby contributing to market expansion.

China hybrid imaging marketis expected to grow at the fastest CAGR owing to the growing trend toward the adoption of hybrid imaging systems in China. For instance, in May 2023, the approval was obtained by Conavi Medical for their Novasight Hybrid System, which is a breakthrough imaging platform that enables simultaneous intravascular ultrasound (IVUS) and optical coherence tomography (OCT) imaging of coronary arteries with a single catheter. This system combines the advantages of both IVUS and OCT, allowing for better visualization and assessment during minimally invasive heart procedures like percutaneous coronary interventions (PCIs). The Novasight Hybrid System has received regulatory approvals from various authorities including the U.S. FDA, Health Canada, China’s NMPA, and Japan’s Ministry of Health.

The hybrid imaging marketin India holds a significant share of the Asia Pacific regional market revenue. The expansion is attributed to the increasing utilization and development of MRI technology in emerging markets, which is bolstered by the establishment of new facilities in various countries. For instance, in August 2023, India introduced one of the initial lightweights, high field (1.5 Tesla), cost-effective, ultrafast MRI scanners developed domestically in New Delhi. This endeavor, part of the National Biopharma Mission, aims to cater to the healthcare needs of the country. The creation of an MRI system customized for the demands of emerging markets is expected to drive the adoption of this technology and bolster overall market expansion.

Latin America Hybrid Imaging Market Trends

The hybrid imaging market in Latin America is driven by rising chronic disease rates, particularly cancer and cardiovascular conditions, which increase demand for advanced diagnostic tools. The IAEA held its first regional training course on Dual Energy Computed Tomography (DECT) in Latin America and the Caribbean in December 2023, involving medical professionals from 13 countries. DECT, utilizing dual X-ray energy levels, enhances imaging precision by revealing tissue energy absorption characteristics. This training aimed to strengthen regional proficiency in DECT, improving diagnostic accuracy and patient care standards. DECT enables detailed differentiation of tissue chemistry and disease processes, empowering physicians to make precise diagnoses and enhance regional healthcare outcomes.

Brazil hybrid imaging market integrates PET-CT and SPECT-CT technologies, enhancing diagnostic capabilities in oncology, cardiology, and neurology. This sector is expanding due to rising chronic disease rates and the need for accurate diagnostic solutions. As of 2022, Brazil has 6,219 CT scanners, with 6,030 operational, based on UMass Chan Medical School data. According to the National Registry of Health Establishments, there are 153,758 diagnostic imaging units in Brazil, with 94% currently operational.

ME&A Hybrid Imaging Market Trends

The hybrid imaging market in the MEA region is expected to witness significant growth over the forecast period due to the growing partnerships in the region during. These partnerships signify the company’s commitment to expanding its presence and enhancing healthcare services in MEA. For instance, in February 2023, United Imaging announced a strategic partnership with various healthcare providers during the Arab Health 2023 conference in the Middle East and Africa to supply them with state-of-the-art imaging and radiotherapy solutions. These collaborations aim to improve diagnostic capabilities, treatment outcomes, and patient care in the region.

Saudi Arabia hybrid imaging market is anticipated to expand by merging molecular and anatomical data, the GHE23 solution offers enhanced diagnostic capabilities, enabling healthcare providers in Saudi Arabia. For instance, in October 2023, Siemens Healthineers Saudi Arabia successfully concluded its participation at Global Health 2023, showcasing its full range of healthcare solutions including Diagnostic Imaging, Advanced Therapies, Ultrasound, Laboratory Diagnostics, Point-of-Care, and Cancer Care Solutions from Varian. The event marked the achievement of key strategic milestones and engagements that will further solidify Siemens Healthineers’ dedication to the Saudi healthcare market.

Key Hybrid Imaging Company Insights

The global market is highly competitive. Key companies deploy strategic initiatives, such as product development, launches, and sales & marketing strategies to increase product awareness and regional expansions and partnerships to strengthen their market share. Market players are also involved in conducting clinical testing of their products, patent applications, and increasing product penetration.

Key Hybrid Imaging Companies:

The following are the leading companies in the hybrid imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Siemens Healthcare

- Koninklijke Philips N.V.

- CANON MEDICAL SYSTEMS CORPORATION

- Shanghai United Imaging Healthcare Co., LTD

- TTG IMAGING SOLUTIONS (Digirad)

- Carl Zeiss Meditec AG

- Topcon Corporation

- Heidelberg Engineering

- NIDEK

Recent Developments

-

In July 2024, LAITEK launched an Advanced Hybrid Migration Service for medical imaging data. This service aims to lower the cost of migrating and storing medical imaging data while enabling health systems to improve control over and access to critical diagnostic data. The LAITEK Hybrid Migration Service is designed to reduce upfront migration costs, ongoing storage costs, and operational costs associated with managing older clinical information.

-

In September 2023, the U.S. FDA granted approval to ZimVie Inc. for its Mobi-C Cervical Disc Hybrid Investigational Device Exemption (IDE) application. This authorization allows ZimVie to commence enrolling patients in the study, focusing on individuals undergoing simultaneous cervical disc arthroplasty (CDA) and anterior cervical discectomy and fusion (ACDF) at adjacent levels spanning from C3 to C7.

-

In July 2023, the Medical Imaging & Technology Alliance expressed its support for the FDA’s approval of Leqembi (lecanemab) through the traditional pathway for treating individuals with mild cognitive impairment or mild dementia. MITA is calling on CMS to release the proposed decision memorandum regarding reconsideration of the one scan limit for beta-amyloid PET and the elimination of coverage with evidence development (CED) for beta-amyloid PET.

-

In May 2023, the FDA recently approved the first radiohybrid PSMA-targeted PET imaging agent for prostate cancer. This approval marks a significant advancement in the field of prostate cancer diagnostics and treatment monitoring.The availability of this novel imaging agent is likely to have significant clinical implications for patients with prostate cancer.

-

In May 2023, the FDA approved Flotufolastat Fluorine-18 injection, which is the first radiohybrid PSMA-targeted PET imaging agent used for detecting prostate cancer. This approval marks a significant milestone in the field of prostate cancer imaging and diagnosis.

Hybrid Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.37 billion

Revenue forecast in 2030

USD 11.95 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico; UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

GE HealthCare; Siemens Healthcare; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; Shanghai United Imaging Healthcare Co., LTD; TTG IMAGING SOLUTIONS (Digirad); Carl Zeiss Meditec AG; Topcon Corporation; Heidelberg Engineering; NIDEK

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hybrid Imaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hybrid imaging market report on the basis of type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

PET/CT systems

-

SPET/CT systems

-

PET/MR systems

-

OCT/Fundus Imaging System

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Ophthalmology

-

Cardiology

-

Brain & Neurology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hybrid imaging market size was estimated at USD 7.91 billion in 2023 and is expected to reach USD 8.37 billion in 2024.

b. The global hybrid imaging market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 11.94 billion by 2030.

b. PET/CT systems dominated the hybrid imaging market with a share of 32.28% in 2023. This is attributable to its growing usage in the field of oncology

b. Some key players operating in the xx market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; CANON MEDICAL SYSTEMS CORPORATION; Bruker; Mediso Ltd.; MILabs B.V.; MR Solutions; TriFoil Imaging; PerkinElmer Inc.; FUJIFILM VisualSonics Inc.; and Cubresa Inc.

b. Key factors that are driving the market growth include government initiatives for the development of multimodal or hybrid diagnostic imaging devices and increasing usage of hybrid imaging in diagnosis of diseases across various disciplines of medicine, including oncology, cardiology, and neurology.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."