- Home

- »

- Medical Devices

- »

-

Hydrogen Peroxide Sterilizers Market Size Report, 2033GVR Report cover

![Hydrogen Peroxide Sterilizers Market Size, Share & Trends Report]()

Hydrogen Peroxide Sterilizers Market (2026 - 2033) Size, Share & Trends Analysis Report By Modality (Floor-standing, Benchtop/Tabletop), By Type (Plasma Hydrogen Peroxide Sterilizers), By Compatibility, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-844-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrogen Peroxide Sterilizers Market Summary

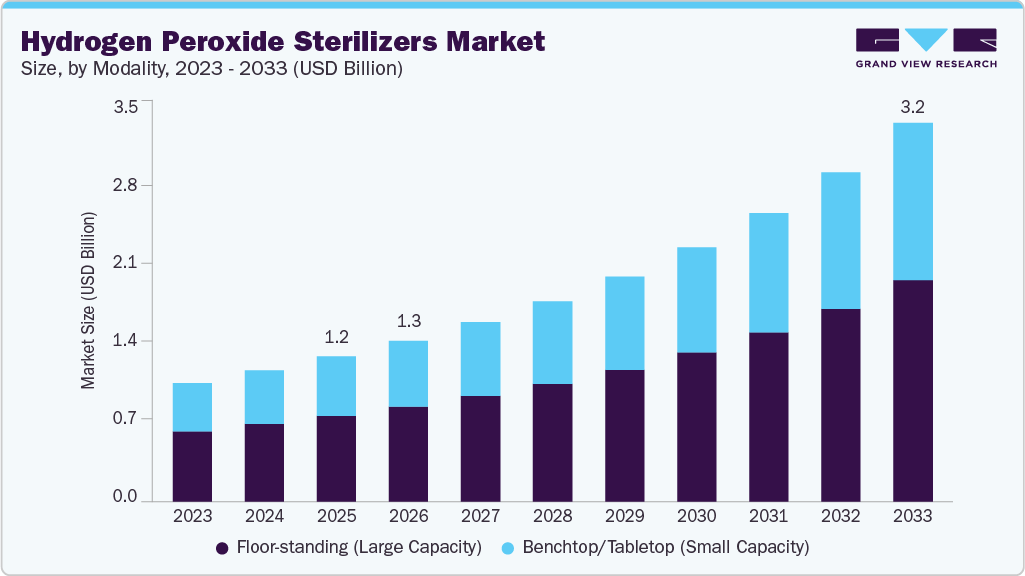

The global hydrogen peroxide sterilizers market size was estimated at USD 1.20 billion in 2025 and is projected to reach USD 3.15 billion by 2033, growing at a CAGR of 13.03% from 2026 to 2033. The growth is primarily driven by increasing demand for advanced sterilization solutions in the healthcare and pharmaceutical sectors, rising awareness about hospital-acquired infections, and the adoption of next-generation sterilization technologies, such as vaporized and plasma-based systems.

Key Market Trends & Insights

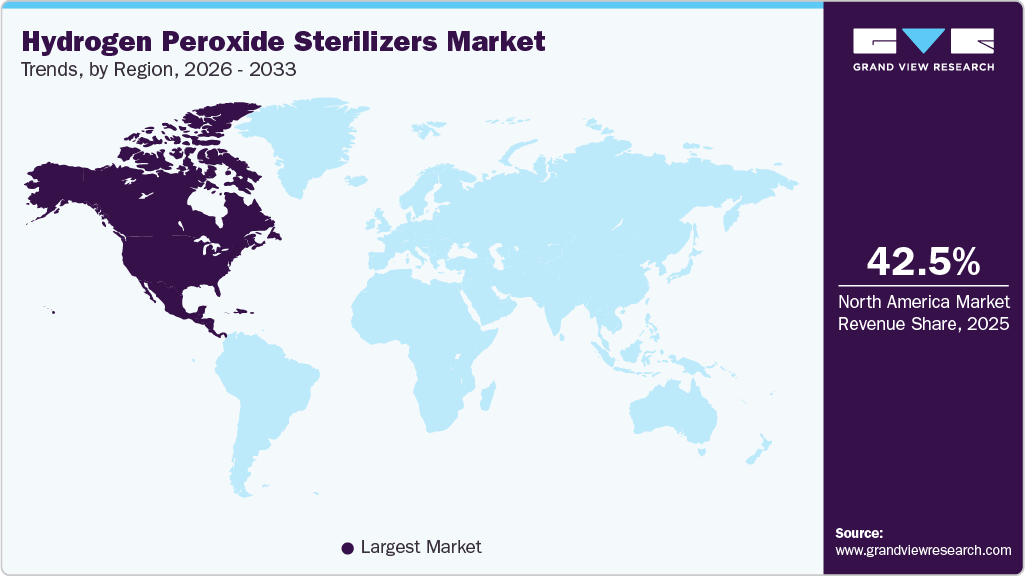

- North America dominated the global hydrogen peroxide sterilizers market with the largest revenue share of 42.51% in 2025.

- The hydrogen peroxide sterilizers industry in the U.S. accounted for the largest market revenue share in North America in 2025.

- By type, the vaporized hydrogen peroxide (VHP) sterilizers segment accounted for the largest market revenue share in North America in 2025.

- By modality, the floor-standing (large capacity) segment accounted for the largest market revenue share in 2025.

- By device compatibility, the endoscopes segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.20 Billion

- 2033 Projected Market Size: USD 3.15 Billion

- CAGR (2026-2033): 13.03%

- North America: Largest Market in 2025

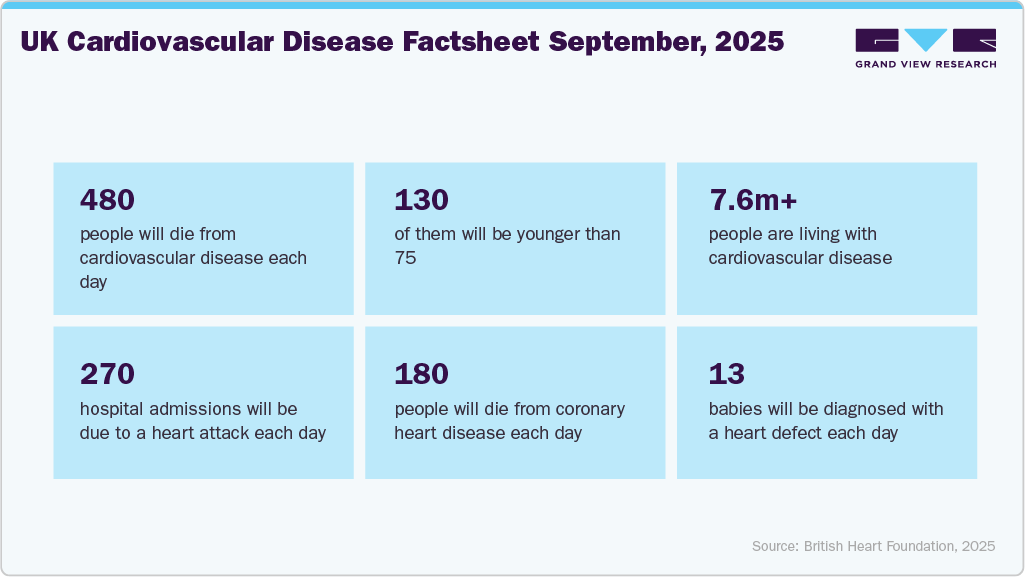

Cardiovascular diseases, including coronary artery disease, peripheral artery disease, and structural heart disorders, significantly drive the hydrogen peroxide sterilizers industry due to the rising volume of diagnostic and interventional cardiac procedures worldwide. The growing use of minimally invasive techniques, such as angioplasty, stent placement, catheter-based valve repair, and electrophysiology procedures, has increased reliance on sophisticated, heat- and moisture-sensitive instruments, including catheters, endoscopes, and robotic-assisted surgical tools.

Hydrogen peroxide-based sterilization systems, particularly vaporized and plasma technologies, are preferred in cardiovascular care settings as they provide rapid cycle times, high material compatibility, and effective microbial elimination without damaging delicate device components. In addition, strict infection control standards in cardiac catheterization labs, operating rooms, and hybrid surgical suites further support the adoption of hydrogen peroxide sterilizers, as they help healthcare facilities meet regulatory compliance while reducing the risk of post-procedural infections and improving patient outcomes.

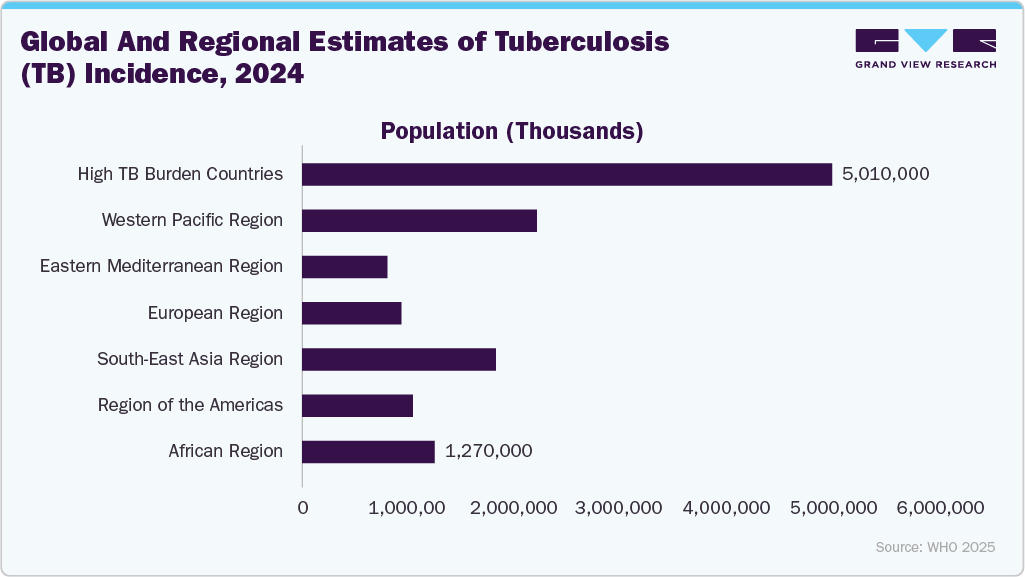

Tuberculosis (TB) significantly drives the hydrogen peroxide sterilizers industry due to the need for strict infection prevention and control in healthcare and laboratory settings. As an airborne infectious disease, TB increases the risk of cross-contamination during diagnostic and treatment procedures, including bronchoscopy, sputum sample handling, and laboratory culture testing. These procedures rely on reusable, heat- and moisture-sensitive medical instruments that require reliable low-temperature sterilization. Hydrogen peroxide-based sterilizers, particularly vaporized and plasma systems, are widely adopted as they provide rapid, high-efficacy microbial inactivation without damaging delicate devices. The high TB burden in regions such as South-East Asia and Africa, coupled with expanding government-supported TB control programs and diagnostic infrastructure, is accelerating demand for compliant, efficient sterilization technologies, thereby supporting market growth.

The increasing popularity of vaporized hydrogen peroxide sterilization is anticipated to boost market growth in the forecast years. Supportive government rules and regulations for this sterilization technique are expected to boost the demand for low-temperature sterilizers that use vaporized hydrogen peroxide sterilization methods. For instance, in January 2024, Vaporized Hydrogen Peroxide (VHP), a low-temperature sterilization technique, was approved by the FDA to sterilize medical devices. With this authorization, the agency facilitated broader adoption of VHP as a sterilization technique for the medical device industry. Such approvals from the regulatory authorities for vaporized hydrogen peroxide are anticipated to boost market growth in the forecast years.

“Vaporized hydrogen peroxide’s addition as an established sterilization method helps us build a more resilient supply chain for sterilized devices that can help prevent medical device shortages. As innovations in sterilization advance, the FDA will continue to seek additional modalities that deliver safe and effective sterilization methods that best protect public health.” Suzanne Schwartz, M.D., M.B.A., director of the Office of Strategic Partnerships and Technology Innovation in the FDA’s Center for Devices and Radiological Health

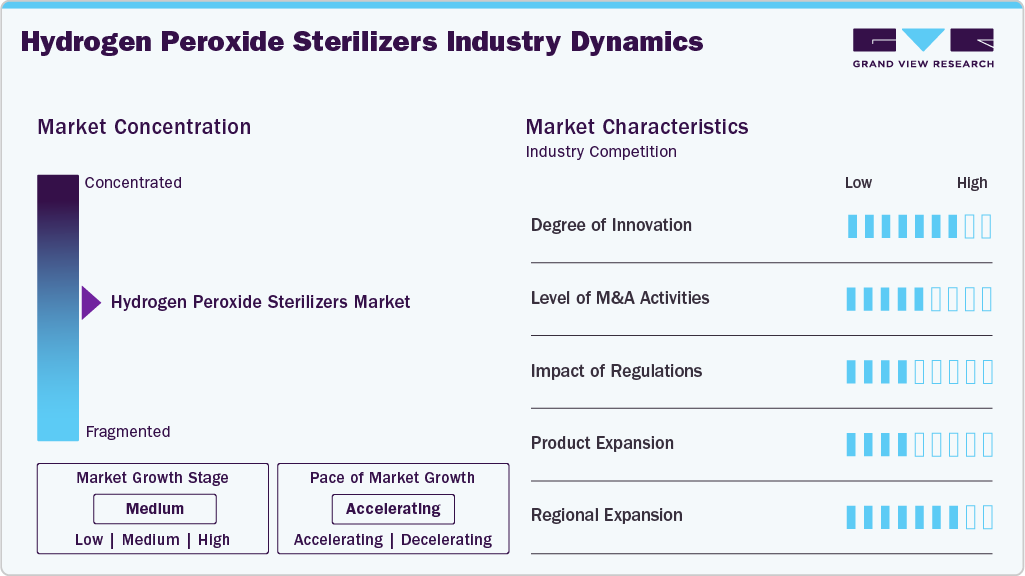

Market Concentration & Characteristics

The hydrogen peroxide sterilizers industry is characterized by a strong focus on technological innovation, increasing adoption of low-temperature sterilization systems, and growing demand from hospitals, diagnostic laboratories, and pharmaceutical manufacturing facilities.

The hydrogen peroxide sterilizers industry demonstrates a high degree of innovation, driven by the need for faster cycle times, improved material compatibility, and enhanced sterilization efficacy. Manufacturers are introducing advanced vaporized hydrogen peroxide (VHP) and plasma-based systems that enable low-temperature sterilization of complex, heat-sensitive medical devices. For instance, in June 2025, Solventum launched next-generation hydrogen peroxide sterilization systems that incorporate both vaporized and plasma technologies, enabling healthcare facilities to expand their sterilization capabilities beyond traditional methods while ensuring high efficacy and compliance with regulatory standards. Such innovations support the broader adoption of cleanroom environments across hospitals, ambulatory surgical centers, and pharmaceutical facilities.

Regulatory developments are significantly accelerating the adoption of hydrogen peroxide-based sterilization technologies, particularly vaporized hydrogen peroxide (VH₂O₂) systems. The publication of ISO 22441:2022 and its subsequent recognition by the U.S. FDA, along with the FDA’s 2024 reclassification of VH₂O₂ sterilization as an Established Category A process, have strengthened regulatory confidence in this modality. This regulatory clarity reduces validation uncertainty for medical device manufacturers and healthcare facilities, encouraging broader use of hydrogen peroxide sterilizers for both commercial device manufacturing and in-hospital reprocessing.

The hydrogen peroxide sterilizers industry has witnessed moderate to high levels of mergers and acquisitions as companies seek to expand their technology portfolios, geographic reach, and service offerings. Leading players are acquiring specialized sterilization technology firms and service providers to strengthen their competitive positioning and offer integrated sterilization solutions. For instance, in August 2023, STERIS plc announced the completion of its previously disclosed acquisition of the surgical instrumentation, laparoscopic instrumentation, and sterilization container assets from BD.

Product expansion in the hydrogen peroxide sterilizers industry is focused on developing systems with varying chamber sizes, automation levels, and digital connectivity to address diverse end-user needs. Manufacturers are expanding their portfolios to include compact units for ambulatory surgical centers and clinics, as well as high-capacity systems for large hospitals and pharmaceutical facilities. The integration of digital monitoring, remote diagnostics, and data logging features supports compliance reporting and operational efficiency. This continuous expansion of product offerings enables vendors to cater to a wider customer base while addressing evolving sterilization requirements across healthcare and life sciences sectors.

The hydrogen peroxide sterilizers industry is witnessing active regional expansion as manufacturers strengthen their presence in high-growth healthcare markets across Asia-Pacific, Latin America, and the Middle East & Africa. Companies are expanding their production capacities, establishing local partnerships, and introducing region-specific product portfolios to address the rising demand for advanced sterilization solutions, driven by increasing surgical volumes and stricter infection control standards. For instance, in November 2024, Solvay licensed its hydrogen peroxide process technology to North Huajin Refining and Petrochemical Company in China, supporting large-scale hydrogen peroxide production and reinforcing its strategic footprint in the Asia-Pacific region. Such regional expansion initiatives enable companies to improve supply chain resilience, reduce lead times, and better serve rapidly growing healthcare and life sciences markets.

Modality Insights

The floor-standing (large-capacity) segment accounted for the largest market revenue share in 2025. These units are designed to handle high volumes of instruments and equipment, making them especially suitable for large hospitals, central sterile processing departments, and primary healthcare facilities with heavy sterilization needs. Their larger chamber size and greater throughput enable the bulk sterilization of surgical instruments, endoscopes, and other reusable medical tools in a single cycle, improving operational efficiency and cost-effectiveness compared to smaller tabletop or portable units. As a result, healthcare providers with high procedural volumes prefer floor-standing systems to support strict infection control protocols and steady workflow demands, which contributes to this segment’s leading market share.

The benchtop/tabletop (small capacity) segment is expected to grow at the fastest CAGR during the forecast period. These compact units are well-suited for smaller healthcare settings, such as clinics, dental offices, ambulatory surgical centers, and outpatient facilities, that require reliable sterilization but have limited space and lower instrument volumes. Their smaller footprint, ease of installation, lower upfront costs, and user-friendly operation make them attractive to facilities with constrained budgets or lower daily throughput, while still providing effective low-temperature sterilization for heat-sensitive instruments. As healthcare delivery expands beyond large hospitals into decentralized and outpatient settings, demand for benchtop and tabletop sterilizers is increasing, enabling this segment to maintain a significant market share.

Type Insights

The vaporized hydrogen peroxide (VHP) sterilizers segment accounted for the largest market revenue share in 2025, driven by its widespread adoption in hospitals, pharmaceutical facilities, and laboratories. VHP sterilizers are highly effective at sterilizing complex and heat-sensitive instruments, offering broad penetration and consistent sterilization results. Their reliability, regulatory acceptance, and suitability for high-volume operations make them the preferred choice for large healthcare and cleanroom environments, ensuring strong and sustained market leadership.

The plasma hydrogen peroxide sterilizers segment is expected to register at the fastest CAGR during the forecast period, due to its advanced, low-temperature sterilization process, rapid cycle times, and ability to sterilize delicate instruments safely. Increasing adoption in modern hospitals, smaller clinics, and ambulatory surgical centers, coupled with technological advancements and rising awareness of infection control, is driving strong demand. As healthcare facilities seek more efficient and versatile sterilization solutions, plasma sterilizers are projected to grow more over the period.

Device Compatibility Insights

The endoscopes segment accounted for the largest market revenue share in 2025. Endoscopic procedures are widely used in a range of diagnostic and minimally invasive surgical applications, particularly in gastroenterology and respiratory care, resulting in consistently high demand for effective sterilization solutions. As endoscopes are complex, heat-sensitive instruments with intricate channels that must be reliably sterilized to prevent cross-contamination and healthcare-associated infections, healthcare facilities are adopting advanced sterilization technologies, such as hydrogen peroxide systems, to ensure patient safety and regulatory compliance. The consistently high procedural volume positions the endoscopes segment as the leader in the market.

The ophthalmic & microsurgical instruments segment is expected to register at the fastest CAGR during the forecast period. Precision eye and microsurgical procedures are rapidly advancing, driving the greater use of delicate, high-value instruments that require specialized low-temperature sterilization to maintain their integrity and performance. As the prevalence of eye disorders increases with aging populations and demand rises for advanced ophthalmic surgeries, sterilization requirements for these sensitive tools grow accordingly. This increasing demand, combined with technological advancements in sterilization equipment designed for smaller, intricate surgical instruments, supports future growth in this segment.

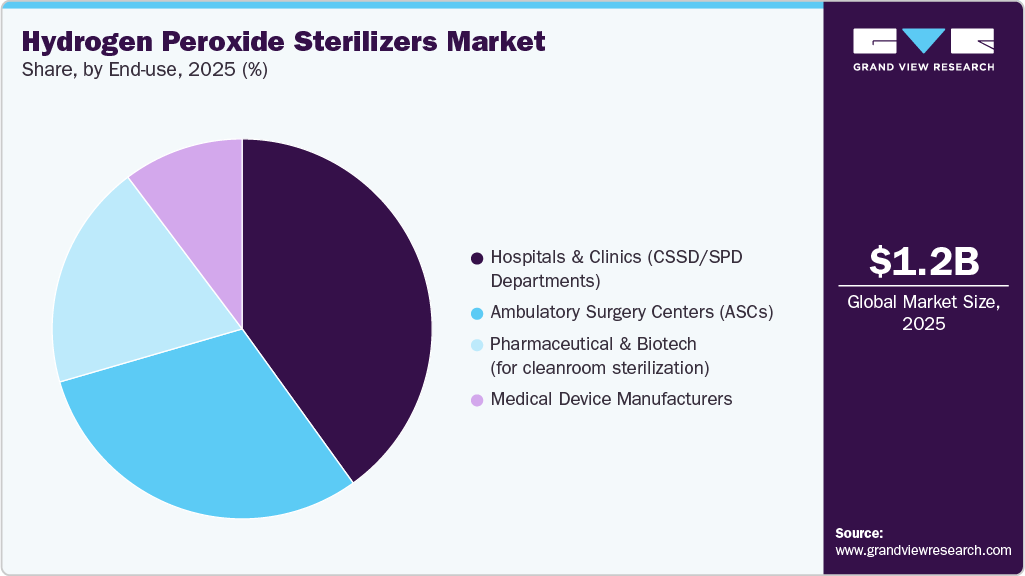

End Use Insights

The hospitals & clinics segment led the market with the largest revenue share of 40.06% in 2025. High procedural volumes and a critical need for reliable sterilization. These facilities handle large quantities of surgical instruments and reusable medical devices daily, requiring efficient, high-capacity sterilization solutions to maintain patient safety and comply with stringent infection control standards. The scale of operations and continuous demand for advanced sterilization technologies support this segment’s leading market position.

The ambulatory surgery centers segment is expected to register at the fastest CAGR during the forecast period, as outpatient procedures and minimally invasive surgeries gain popularity. ASCs adopt hydrogen peroxide sterilizers due to their compact design, rapid cycle times, and low-temperature sterilization capabilities, which are ideal for smaller facilities with limited space. The rising demand for efficient sterilization in decentralized healthcare settings, driven by the growth of outpatient surgical care, is expected to fuel strong future growth for this segment.

Regional Insights

North America dominated the global hydrogen peroxide sterilizers market with the largest revenue share of 42.51% in 2025, driven by advanced healthcare infrastructure, high adoption of innovative sterilization systems, and stringent infection control standards established by agencies such as the FDA and CDC. Hospitals, clinics, and pharmaceutical manufacturers across the U.S. and Canada are investing in hydrogen peroxide sterilization to meet stringent regulatory requirements and improve patient safety by reducing healthcare‑associated infections. This has been supported by ongoing technological improvements, a strong awareness of infection prevention practices, and robust distribution networks for sterilization equipment, all of which contribute to sustained demand and growth in the region.

U.S. Hydrogen Peroxide Sterilizers Market Trends

The hydrogen peroxide sterilizers market in U.S. accounted for the largest market revenue share in North America in 2025, as healthcare facilities, medical device manufacturers, and laboratories adopt advanced sterilization technologies to improve infection control and patient safety. Rising awareness of healthcare-associated infections, affecting a significant number of hospital patients annually, has driven hospitals and clinics to invest in effective low-temperature hydrogen peroxide sterilization systems that reduce infection risk and comply with stringent CDC and FDA protocols. This focus on HAI prevention, along with technological advancements, shorter sterilization cycles, and the ability to sterilize heat‑sensitive instruments, is fueling continued demand in the U.S. market and contributing to projected growth over the forecast period.

According to CDC 2024, on any given day, about one in 31 hospital patients has at least one healthcare-associated infection.

National Level (Acute Care Hospitals, 2022-2023):

-

Methicillin-resistant Staphylococcus aureus (MRSA) infections decreased by 16%

-

Central line-associated bloodstream infections (CLABSI) decreased by 13%

-

Clostridioides difficile infection (CDI) decreased by 13%

-

Catheter-associated urinary tract infections (CAUTI) decreased by 11%

-

Ventilator-associated events decreased by 5%

-

Surgical site infections (SSIs) after abdominal hysterectomy increased by 8%

Europe Hydrogen Peroxide Sterilizers Market Trends

The hydrogen peroxide sterilizers market in Europe is driven by the rising prevalence of healthcare-associated infections, including E. coli bacteraemia, C. difficile infections, and surgical site infections, which has increased the demand for advanced sterilization solutions in hospitals and surgical centers. The growing adoption of minimally invasive and robotic surgeries requires the sterilization of heat-sensitive instruments, further boosting demand for low-temperature hydrogen peroxide sterilizers. Stringent regulatory frameworks and infection control guidelines across European countries, coupled with initiatives aimed at reducing hospital-acquired infections and enhancing patient safety, are also supporting market growth.

The UKhydrogen peroxide sterilizers market is experiencing growth. The rising incidence of Escherichia coli (E. coli) bacteraemia and Clostridioides difficile (C. difficile) infections in the UK is a key factor driving the hydrogen peroxide sterilizers industry. Both are major healthcare-associated infections, linked to contaminated medical devices and hospital environments. E. coli bacteraemia can lead to severe bloodstream infections, while (C. difficile) causes persistent diarrhea and colitis, particularly in hospitalized or immunocompromised patients. Hospitals and surgical centers are investing in advanced sterilization technologies to prevent cross-contamination and reduce the incidence of infections. Hydrogen peroxide sterilizers, especially low-temperature systems, are highly effective against resilient pathogens, including C. difficile spores and E. coli on heat-sensitive instruments used in endoscopy, surgery, and intensive care.

Cases Escherichia Coli (E. Coli) Bacteraemia & Clostridioides Difficile (C. Difficile) Infection UK Per 100,000 Populations, UK

Organization name

Escherichia coli (E. coli) bacteremia

Clostridioides difficile (C. difficile) infection

2020/21

2021/22

2022/23

2023/24

2020/21

2021/22

2022/23

2023/24

Bolton NHS Trust

116.85

105.39

88.78

96.36

62.60

68.78

91.56

87.64

Stockport NHS Trust

114.03

108.80

119.88

110.38

43.76

62.10

57.29

61.02

West Suffolk NHS Trust

112.74

92.79

144.99

141.03

71.34

67.63

49.95

79.16

Airedale NHS Foundation Trust

168.23

131.88

124.33

132.34

49.21

58.18

63.84

97.21

Alder Hey Children's NHS Foundation Trust

29.76

27.03

46.13

27.92

6.38

7.95

1.49

10.47

Ashford And St Peter's Hospitals NHS Foundation Trust

157.94

125.81

137.33

160.02

27.71

28.49

33.25

45.08

Source: UKHSA, NHS

The hydrogen peroxide sterilizersmarket in Germanyis rising. Healthcare-associated infections continue to play a significant role in driving the German medical devices and infection-control market. As per Deutscher Ärzteverlag GmbH, with around one in twenty hospitalized patients affected by an HAI, hospitals face sustained pressure to strengthen infection prevention and control practices. This has led to increased investment in advanced sterilization and disinfection technologies, reprocessing equipment, and low-temperature sterilizers suitable for heat-sensitive medical devices.

The persistent burden of surgical site, respiratory, and urinary tract infections also supports demand for stricter hygiene protocols, automated sterilization systems, and compliance-driven upgrades aligned with national regulations and ECDC guidelines. In the 2022, point prevalence survey, 3,467 healthcare-associated infections (HAIs) were reported among 3,292 patients. The most common HAIs were surgical site infections (816 cases), lower respiratory tract infections (749 cases), and urinary tract infections (659 cases), each accounting for roughly 20% of the total infections.

Asia Pacific Hydrogen Peroxide Sterilizers Market Trends

The hydrogen peroxide sterilizers market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, due to the expansion of healthcare infrastructure, the rising number of surgical and diagnostic procedures, and the increasing demand for advanced sterilization technologies for heat-sensitive medical devices. The rapid development of hospitals and ambulatory surgical centers in countries such as China, India, Japan, and South Korea, combined with growing awareness of infection control and the prevention of healthcare-associated infections, is driving the adoption of low-temperature sterilization systems. In addition, government initiatives to upgrade sterilization standards and investments in biopharmaceutical manufacturing and cleanroom facilities are further supporting market growth across the region.

For instance, the July 2025 decision by India’s Central Drugs Standard Control Organization (CDSCO) to ease regulations for outsourced medical device sterilization directly supports the growth of the hydrogen peroxide sterilizers market. By removing the requirement for a separate loan license when licensed third-party facilities perform sterilization, the policy reduces regulatory complexity and compliance costs for manufacturers. This encourages the broader use of outsourced sterilization services, prompting contract sterilization providers to expand their capacity and invest in modern, low-temperature technologies, such as hydrogen peroxide plasma and vaporized hydrogen peroxide systems.

The Japan hydrogen peroxide sterilizers market is growing, driven by rising demand for advanced low-temperature sterilization solutions in hospitals and clinics, increasing use of minimally invasive and endoscopic procedures, and heightened focus on infection control and patient safety. Stringent regulatory requirements for medical device sterilization, and the shift away from traditional methods like ethylene oxide due to safety and environmental concerns are further encouraging adoption. In September 2024, Japan’s National University Corporation (Shizuoka) issued a government tender to procure a hydrogen peroxide low-temperature gas sterilization system for Hamamatsu University School of Medicine Hospital, with delivery planned by March 2025. This reflects continued public-sector investment in low-temperature hydrogen peroxide sterilizers to support infection control and safe reprocessing of heat-sensitive medical devices in hospitals.

The hydrogen peroxide sterilizers market in China is driven by the expansion of healthcare infrastructure, rising surgical volumes, and increasing demand for advanced sterilization solutions for heat-sensitive medical devices. Strong government initiatives to upgrade infection control practices and align with international patient safety standards are encouraging hospitals and ambulatory care centers to adopt low-temperature sterilization technologies. In November 2025, China’s National Medical Products Administration (NMPA) released a revised Good Manufacturing Practice (GMP) for Medical Devices, effective from November 2026, significantly strengthening regulatory requirements across the medical device lifecycle. The updated GMP places strong emphasis on quality assurance, verification and validation, risk-based lifecycle management, and contract manufacturing oversight, all of which are highly relevant to hydrogen peroxide sterilizers and their manufacturers.

Latin America Hydrogen Peroxide Sterilizers Market Trends

The hydrogen peroxide sterilizers market in Latin America is growing steadily as healthcare facilities modernize and prioritize infection control. Growth is supported by increasing investments in healthcare infrastructure, expansion of surgical services, and rising demand for advanced sterilization technologies that can safely process heat-sensitive medical devices. Government initiatives and public health programs in countries such as Brazil and Argentina are strengthening sterile processing capabilities in both public and private hospitals. In addition, awareness of healthcare-associated infections and efforts to align with international sterilization standards are encouraging the adoption of low-temperature hydrogen peroxide systems.

Middle East & Africa Hydrogen Peroxide Sterilizers Trends

The hydrogen peroxide sterilizers market in Middle East & Africa is experiencing growth, driven by increasing investments in healthcare infrastructure, rising demand for advanced sterilization solutions in hospitals and clinics, and growing awareness of infection control practices. The expansion of surgical procedures, modernization of central sterile supply departments, and the rising adoption of low-temperature sterilization technologies for heat-sensitive medical devices are further fueling market growth. In addition, supportive government initiatives to enhance healthcare quality and stringent regulatory focus on patient safety are encouraging the development of hydrogen peroxide sterilization systems across the region.

Key Hydrogen Peroxide Sterilizers Company Insights

The hydrogen peroxide sterilizers industry is highly competitive, with key players holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Hydrogen Peroxide Sterilizers Companies:

The following are the leading companies in the hydrogen peroxide sterilizers market. These companies collectively hold the largest market share and dictate industry trends.

- ASP Global (Fortive Corporation)

- Bionics Scientific

- DE LAMA S.P.A.

- Genist Technocracy

- Getinge

- Labotronics Scientific

- MATACHANA

- Qingdao Antech Scientific Co., Ltd.

- Renosem

- Scitek Global

- Shinva Medical

- Sterile Safequip

- STERIS

- Stryker

- Tuttnauer

- Human Meditek

- MMM Group

- Steelco S.p.A.

- Canon Singapore

- CASP

Recent Developments

-

In September 2025, the Society for Sterility Assurance Professionals (SfSAP) launched a new Working Group dedicated to Vaporized Hydrogen Peroxide (VHP) sterilization. SfSAP, a non-profit professional association established collaboratively by the International Irradiation Association, AAMI, and PDA, aims to support the sterility assurance community by developing standardized competency and training frameworks for professionals and organizations involved in sterilizing medical and pharmaceutical products.

-

In June 2025, Solventum announced the launch of its Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack, a preassembled, see-through test pack for low-temperature medical instrument sterilization. This innovative solution integrates both a biological indicator (BI) and a chemical indicator (CI) into a single, ready-to-use design, enabling monitoring of every load across multiple sterilizer brands, models, and cycle types.

-

In June 2024, Getinge introduced Poladus 150, its latest Vaporized Hydrogen Peroxide (VH₂O₂) low-temperature sterilizer, designed to meet the growing demand for safe reprocessing of heat-sensitive surgical instruments. The new system supports Getinge’s position in one of the fastest-growing segments of sterile reprocessing.

Hydrogen Peroxide Sterilizers Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.33 billion

Revenue forecast in 2033

USD 3.15 billion

Growth rate

CAGR of 13.03% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, type, device compatibility, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

ASP Global (Fortive Corporation); Bionics Scientific; DE LAMA S.P.A.; Genist Technocracy; Getinge; Labotronics Scientific; MATACHANA; Qingdao Antech Scientific Co., Ltd.; Renosem; Scitek Global; Shinva Medical; Sterile Safequip; STERIS; Stryker; Tuttnauer; Human Meditek; MMM Group; Steelco S.p.A.; Canon Singapore; CASP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrogen Peroxide Sterilizers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hydrogen peroxide sterilizers market report based on the modality, type, device compatibility, end use, region:

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Floor-standing (Large Capacity)

-

Benchtop/Tabletop (Small Capacity)

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Plasma Hydrogen Peroxide Sterilizers

-

Vaporized Hydrogen Peroxide (VHP) Sterilizers

-

-

Device Compatibility (Revenue, USD Million, 2021 - 2033)

-

Endoscopes

-

Flexible Endoscopes

-

Single-channel Flexible Endoscopes

-

Dual-channel Flexible Endoscopes

-

Triple-channel Flexible Endoscopes

-

-

Rigid Endoscopes

-

Single-channel Rigid Endoscopes

-

Dual-channel Rigid Endoscopes

-

-

-

Ophthalmic & Microsurgical Instruments

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics (CSSD/SPD departments)

-

Ambulatory Surgery Centers (ASCs)

-

Pharmaceutical & Biotech (for cleanroom sterilization)

-

Medical Device Manufacturers

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hydrogen peroxide sterilizers market is expected to grow at a compound annual growth rate of 13.03% from 2026 to 2033 to reach USD 3.15 billion by 2033.

b. The global hydrogen peroxide sterilizers market size was estimated at USD 1.20 billion in 2025.

b. North America dominated the hydrogen peroxide sterilizers market in 2025.

b. Some of the key players operating in the hydrogen peroxide sterilizers market include ASP Global (Fortive Corporation), Bionics Scientific, DE LAMA S.P.A., Genist Technocracy, Getinge, Labotronics Scientific, MATACHANA, Qingdao Antech Scientific Co., Ltd., Renosem, Scitek Global, Shinva Medical, Sterile Safequip, STERIS, Stryker, Tuttnauer, Human Meditek, MMM Group, Steelco S.p.A., Canon Singapore, and CASP.

b. The hydrogen peroxide sterilizers market is driven by rising demand for effective infection control in healthcare, especially for sterilizing heat- and moisture-sensitive medical devices. Technological advancements in low-temperature sterilization systems, along with stricter regulatory standards and growing focus on environmentally safe sterilization methods, are further supporting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.