- Home

- »

- Medical Devices

- »

-

Hyperspectral Imaging Systems Market Size Report, 2033GVR Report cover

![Hyperspectral Imaging Systems Market Size, Share & Trends Report]()

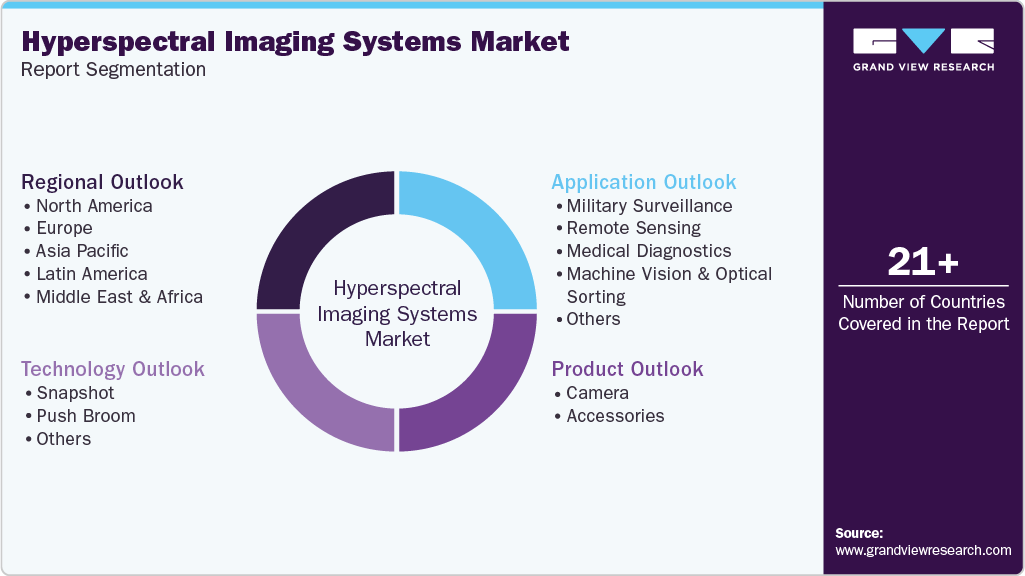

Hyperspectral Imaging Systems Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Military, Remote Sensing, Medical Diagnostics, Machine Vision & Optical Sorting), By Product (Camera, Accessories), By Technology (Push Broom), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-788-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hyperspectral Imaging Systems Market Summary

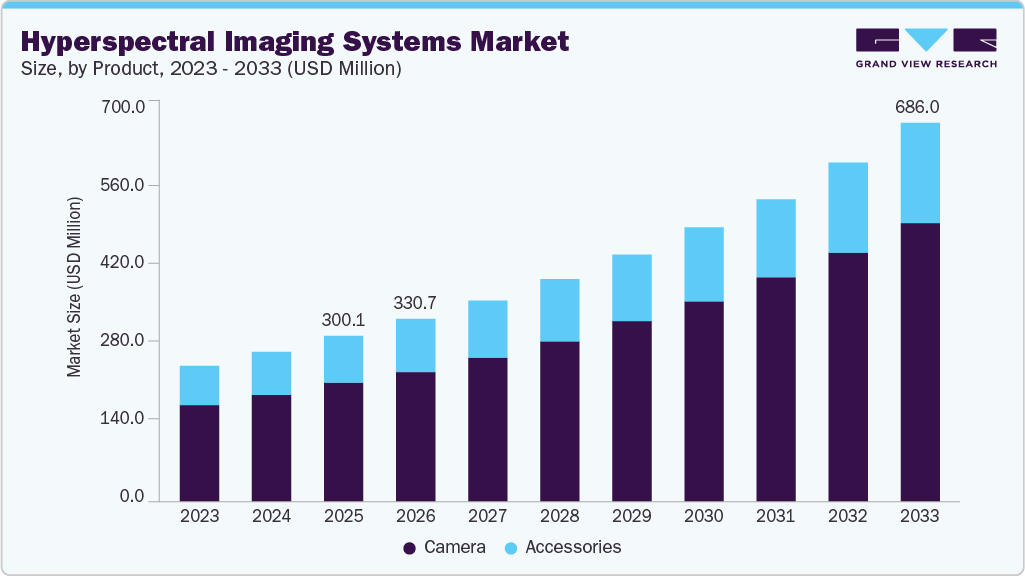

The global hyperspectral imaging systems market size was estimated at USD 300.13 million in 2025 and is projected to reach USD 686.01 million by 2033, growing at a CAGR of 11.00% from 2026 to 2033. The rising adoption of hyperspectral imagery systems in various sectors, such as R&D, healthcare, defense, food industry, night vision, and remote sensing, is anticipated to create high demand in the market.

Key Market Trends & Insights

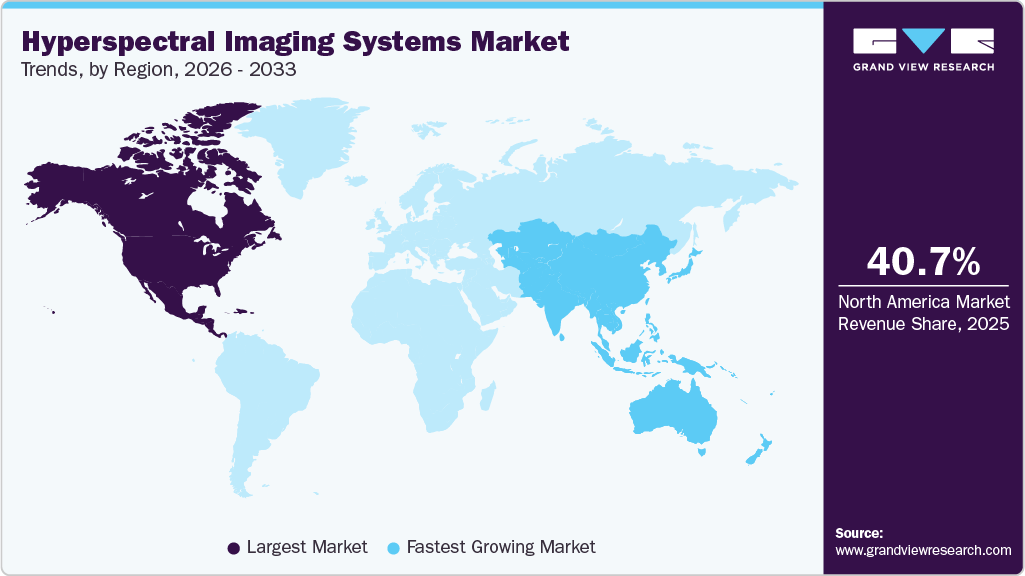

- North America held the largest market share of over 40.73% in 2025.

- The U.S. market is expected to grow over the forecast period due to rising defense spending and a wide application scope of hyperspectral imaging systems.

- Based on product, the camera segment held the largest market share of over 72.2% in 2025 and is expected to grow at the fastest CAGR from 2026 to 2033.

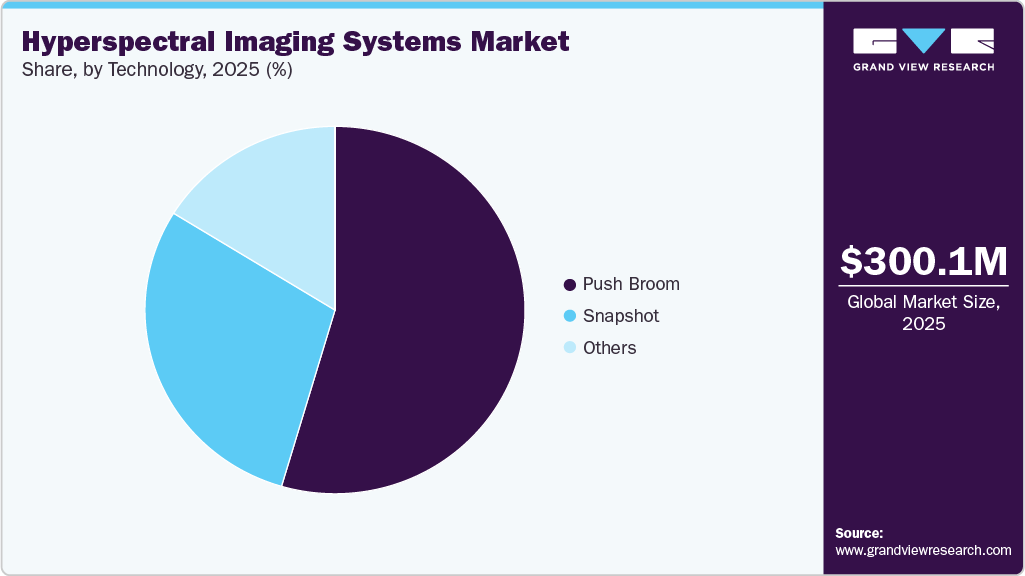

- Based on technology, the push broom sensors segment held a largest market share in 2025.

- By application, the military segment dominated the market with a share of over 33.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 300.13 Million

- 2033 Projected Market Size: USD 686.01 Million

- CAGR (2026-2033): 11.00%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, technological advancements, such as sensor design, high spectral resolution, high spatial resolution, and compact & lightweight devices, are anticipated to further boost product adoption. For instance, Pixxel launched its third hyperspectral imaging satellite, which was mounted on the Polar Satellite Launch Vehicle (PSLV) in November 2022.Hyperspectral imaging systems characterization involves assessing various aspects of their performance, capabilities, and specifications. This process typically includes spectral range, spectral resolution, temporal resolution, and many other factors. In comparison to traditional imaging and detection methods, hyperspectral imaging enhances sensitivity and differencing capability by integrating digital imaging with spectroscopy. The growing adoption of this technology is primarily attributed to its clarity and precision. Moreover, hyperspectral imaging devices offer several key benefits, including the ability to analyze spectral data at each point without prior knowledge. Furthermore, it provides comprehensive information for image analysis and processing. Owing to these advantages, this technology is attracting investments from many companies. However, high hyperspectral imaging system prices and lack of standardization and interoperability of this system may hinder market growth.

The growing application scope of hyperspectral imaging, such as the detection of rock minerals, the diagnosis of plant diseases in crops, diagnostic imaging, and the detection of foreign toxins in food processing are expected to boost its adoption. In addition, the applications of hyperspectral imaging are particularly increasing in the field of disease diagnosis and image-guided surgeries. The market is anticipated to grow at a significant rate, as hyperspectral imaging offers strong potential for disease screening, detection, and diagnosis due to its ability to recognize biochemical modifications brought on by the development of diseases, such as changes in cancer cell metabolism.

In January 2023, Imec demonstrated a system that combines a Visible and Near Infrared (VIS-NIR) spectral camera with high-resolution RGB imaging for data acquisition at video rate. The camera offers three sensors, which are integrated into a single housing. The camera is also equipped with a standard F-mount lens. This is expected to help users opt for a suitable sensor and compare the pros and cons of different spectral resolutions and ranges without needing to own numerous gadgets. The camera can provide support in uncontrollably dynamic scenarios including medical situations such as image-assisted surgeries.

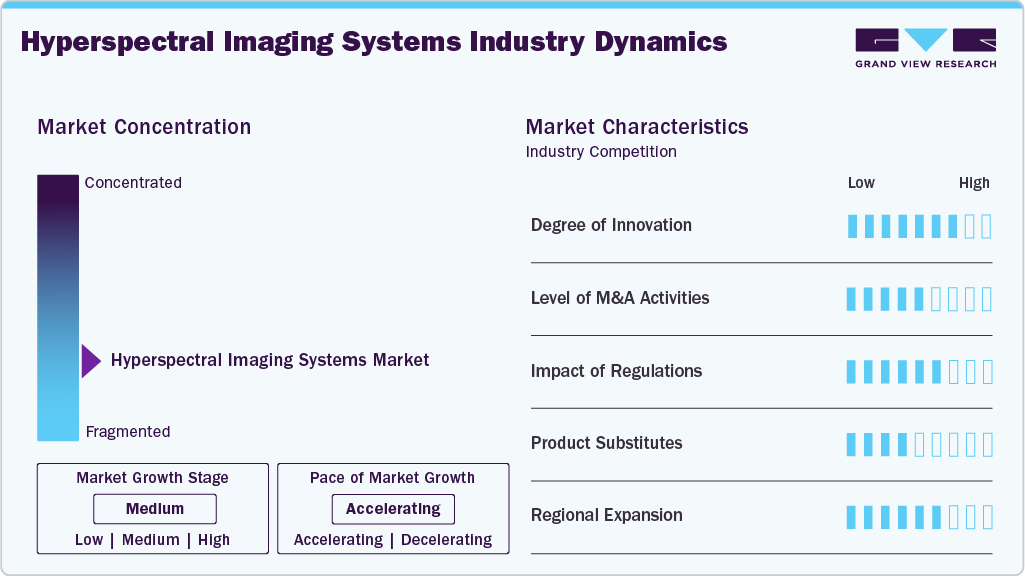

Market Concentration & Characteristics

The market is growing due to the broad application scope of products across diverse fields, such as healthcare, agriculture, defense, aerospace, mining, and others. These systems can conduct detailed spectral analysis across a broad spectrum of wavelengths, allowing them to deliver valuable insights and solutions across various applications. In healthcare, hyperspectral imaging enables precise diagnosis, tissue characterization, and surgical guidance, thereby enhancing patient care and outcomes.

Market players are adopting different initiatives, such as product launches to expand their market reach. For instance, in January 2024, Specim, Spectral Imaging Ltd., announced the release of the Specim FX120, an advanced long-wave infrared hyperspectral camera featuring a full LWIR spectral range of 7.7 to 12.3 µm. This fast push-broom thermal hyperspectral camera is poised to redefine chemical imaging capabilities in challenging environments, operating seamlessly day and night.

Hyperspectral imaging systems have undergone significant innovation, driven by remarkable technological advancements that have positioned them as leading technology across various fields, including healthcare, agriculture, defense, aerospace, mining, and others. Technological advancements, such as high spectral resolution, sensor design, high spatial resolution, and lightweight & compact devices, are expected to boost the adoption of hyperspectral imaging systems.

Manufacturers are increasingly engaging in integration through merger and acquisition activities. This strategic approach aims to augment technological capabilities, broaden market reach, and ensure competitiveness in the rapidly evolving healthcare landscape. For instance, in January 2024, Headwall Photonics acquired inno-spec GmbH, based in Nuremberg, Germany. Inno-spec GmbH is a renowned manufacturer of industrial hyperspectral imaging systems utilized in high-volume recycling, industrial sorting, and quality testing applications.

Regulations play a crucial role in shaping the development, manufacturing, and commercialization of hyperspectral imaging systems, particularly in fields, such as agriculture, healthcare, and environmental monitoring. In agriculture, regulations may govern the use of hyperspectral imaging for crop monitoring, pesticide application, and soil analysis to ensure compliance with safety and environmental standards.

The presence of product substitutes for hyperspectral imaging cameras, such as the multispectral imaging systems and Fourier transform infrared (FTIR) spectroscopy, offers end-users alternatives to consider when making their imaging investments. While hyperspectral imaging cameras help capture detailed spectral information across a broad range of wavelengths, the availability of substitutes provides flexibility and choice to meet specific application needs and budget constraints.

The geographical reach of hyperspectral imaging systems has been expanding at a moderate to high level, primarily driven by increased adoption in developed economies, such as the U.S. and Japan. However, in underdeveloped or developing economies, their adoption is relatively low due to factors, such as limited access and inadequate regulations.

Product Insights

The camera segment held the largest market share of over 72.2% in 2025 and is expected to grow at the fastest CAGR from 2026 to 2033. Technological advancements, such as high-speed and low-cost circuits, advanced manufacturing technologies, and novel signal-processing methods in sensor development, have contributed to the segment growth. Factors, such as the quality, economic efficiency, and reliability of technical products, are anticipated to contribute to hyperspectral camera marketgrowth.

A hyperspectral camera acquires light intensity for a wide range of spectral bands. With this feature, every pixel in the image has a continuous spectrum, which can be used for the identification of objects with precision and detail. In addition, the availability of low-cost cameras and widening computing power are projected to boost the adoption of these products.

Technology Insights

The push broom sensors segment held a largest market share in 2025. Push broom sensors are mounted on moving platforms, such as aircraft or satellites, and scan the scene line by line, creating a continuous image of the spectral information. For instance, BaySpec’s OCI-F Hyperspectral Imager is a compact ‘true push-broom technology. The HSI push broom market is expected to grow significantly over the forecast period, due to the increasing demand for remote sensing, environmental monitoring, mineral exploration, and other fields that require detailed and accurate data.

The snapshot segment is expected to grow at a significant rate over the forecast period owing to increasing demand for high-resolution and real-time spectral data. Snapshot spectral sensors utilize optical designs that vary significantly from standard forms, and this technology does not require scanning in the spatial or spectral dimensions, such as push broom.

Application Insights

The military segment dominated the market with a share of over 33.6% in 2025 owing to the advancements in data management, along with component fabrication techniques. Hyperspectral imaging has a wide range of military applications in the domains of tracking and identification of personnel or other objects. Better accuracy and consistency compared to other conventional imaging techniques are contributing to segment growth. Medical diagnostics is expected to become the fastest-growing segment with a CAGR of 12.0% from 2026 to 2033. Hyperspectral imaging offers a diagnosis of issues related to tissue morphology, structure, and physiology.

During the progression of a disease, the fluorescence, scattering, and absorption of the tissue change. Hence, tissue imaging techniques create a major scope of application in the diagnosis of tissue pathology. Furthermore, ophthalmology, injury analysis, procedures involving the digestive system, fluorescence microscopy, biology of cells, and cardiovascular systems all make extensive use of hyperspectral imaging techniques. The high precision and clarity of the hyperspectral imaging technology and ongoing innovation and technological advancements are expected to lead to growth opportunities for the medical diagnostics segment.

Regional Insights

North America held the largest market share of over 40.73% in 2025 owing to technologically advanced healthcare infrastructure, increased defense expenditure, adoption of novel technologies, and the presence of key players in the region. In addition, improved funding for R&D has boosted research activities in the region. As North America continues to drive innovation in hyperspectral imaging, the technology's versatility and rising application scope are poised to play a pivotal role in shaping the future of imaging technologies across the region.

U.S. Hyperspectral Imaging Systems Market Trends

The U.S. market is expected to grow over the forecast period due to rising defense spending and a wide application scope of hyperspectral imaging systems. According to the Office of Management and Budget, the U.S. expended USD 766 billion on national defense in FY 2022, which amounted to 12% of federal spending. Lawmakers' allocation of significant funds toward defense highlights their prioritization of national security in their budget. The U.S. allocates a greater portion of its budget to defense to its economic size than any other member of the G7.

Europe Hyperspectral Imaging Systems Market Trends

The increasing adoption of hyperspectral imaging across various fields, such as chemical, pharmaceutical, medical diagnostics, food, agricultural, aerospace, and defense industries, is projected to drive growth in Europe. Technological advancements, including innovations in sensor design, high spectral and spatial resolutions, compactness, seamless integration with software, and the development of lightweight devices, are anticipated to propel market expansion. For instance, in November 2020, Imec and XIMEA launched a hyperspectral camera solution that meets the high requirements for machine vision applications.

The UK market is expected to grow at the fastest rate from 2026 to 2033 owing to technological advancements, particularly in sensor technologies and data processing techniques. Furthermore, the rising defense and healthcare spending in the UK is expected to fuel market growth. For instance, in 2021-2022, the UK spent nearly USD 57.97 billion on defense.

The France market is expected to grow significantly over the forecast period due to the need for efficient and advanced technologies in environmental monitoring to address several issues, such as deforestation, biodiversity loss, and climate change. According to an article published by SpaceWatch.Global GmbH, Australia, and France collaborated in hyperspectral imaging for environmental monitoring.

The presence of several key players and their strategic initiatives in the region are expected to fuel the regional market growth. For instance, in January 2024, Headwall Photonics acquired inno-spec GmbH, which is a leading manufacturer of industrial hyperspectral imaging systems used for quality testing.

Asia Pacific Hyperspectral Imaging Systems Market Trends

The market in Asia Pacific is estimated to witness the fastest CAGR from 2026 to 2033 due to the rising demand for hyperspectral imaging in research activities, remote sensing, farming, and mining explorations. Precision farming practices, facilitated by hyperspectral technology, enable farmers to monitor crop health, identify diseases, and optimize resource utilization. Asia Pacific stands out as the largest and most varied agricultural market globally, boasting a diverse range of climates, farmland types, and agricultural production methods.

In 2023, China dominated the Asia Pacific regional market by capturing the largest share. This was primarily attributed to a range of initiatives undertaken within the country. For instance, in January 2024, the China National Space Administration (CNSA) declared the official initiation of activities for its newest Earth observation resource, the Gaofen 5 01A hyperspectral remote-sensing satellite, which was launched in December 2022, marking a significant stride in China's hyperspectral imaging systems sector.

Japan is projected to experience the fastest CAGR from 2026 to 2033. This growth can be attributed to the country's strong focus on technological innovation and R&D, providing an ideal environment for the advancement of hyperspectral imaging systems technology. For instance, in January 2023, Panasonic, a Japan-based company, introduced a hyperspectral imaging systems technology employing compressed sensing technology in medical care and space exploration.

Latin America Hyperspectral Imaging Systems Market Trends

Latin America is anticipated to undergo moderate growth throughout the forecast period driven by several factors, including increasing demand for hyperspectral imaging technology within the healthcare sector, rising incidence of cancer, growing emphasis on R&D, adoption of advanced healthcare technologies, and supportive government initiatives.

MEA Hyperspectral Imaging Systems Market Trends

Middle East & Africa is anticipated to experience moderate growth during the forecast period owing to the increased focus of countries like Saudi Arabia and South Africa toward enhancing their military and healthcare sectors.

Key Hyperspectral Imaging Systems Company Insights

The key players operating in the hyperspectral imaging systems market are working to improve their product offerings by upgrading their products, leveraging important cooperative drives, as well as considering acquisitions and government approvals to increase their client base and get a larger part of the market share. For instance, In November 2023, Specim, Spectral Imaging Ltd. announced the launch of the upgraded Specim FX50 Middle-wave Infrared (MWIR) hyperspectral camera. The Specim FX50 is the first and only push-broom hyperspectral camera covering the full MWIR spectral range of 2.7 - 5.3 μm. This enhanced version marks a significant milestone for Specim and its customers. The initial release of the camera occurred in 2019.

Key Hyperspectral Imaging Systems Companies:

The following are the leading companies in the hyperspectral imaging systems market. These companies collectively hold the largest market share and dictate industry trends.

- Corning Inc.

- Specim

- Spectral Imaging Ltd.

- Resonon Inc.

- Headwall Photonics

- Telops

- Norsk Elektro Optikk

- Surface Optics Corporation

- BaySpec, Inc.

- HAIP Solutions GmbH

- XIMEA GmbH

- imec

Recent Developments

-

In January 2024, Specim, Spectral Imaging Ltd. entered into a partnership with GEONA hyperspectral. Specim proudly endorses GEONA as its preferred standalone processing solution for the complete range of SPECIM airborne hyperspectral sensors

-

In April 2023, Headwall Photonics and K8 announced Aermatica3D srl as an authorized, official reseller of their remote sensing products in Italy. Leveraging Aermatica3D's engineering expertise, the company is capable of developing custom solutions tailored for companies, professional firms, and research institutes

-

In June 2022, Resonon Inc. announced the launch of its Pika IR-L and IR-L+ hyperspectral cameras (925 - 1700 nm). These instruments boast impressive spectral and spatial resolution, which, when combined with their compact size and lightweight, render them ideal for UAV-based remote sensing applications

Hyperspectral Imaging Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 330.74 million

Revenue forecast in 2033

USD 686.01 million

Growth rate

CAGR of 11.0% from 2026 to 2033

Actual period

2021 - 2024

Forecast period

2026 - 2033

Report updated

December 2025

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Corning Inc.; Specim; Spectral Imaging Ltd.; Resonon Inc.; Headwall Photonics; Telops; Norsk Elektro Optikk; Surface Optics Corp.; BaySpec, Inc.; HAIP Solutions GmbH; XIMEA GmbH; imec

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hyperspectral Imaging Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hyperspectral imaging systems market report on the basis of product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Camera

-

Accessories

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Snapshot

-

Push Broom

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Military Surveillance

-

Remote Sensing

-

Medical Diagnostics

-

Machine Vision & Optical Sorting

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hyperspectral imaging systems market size was estimated at USD 300.13 million in 2025 and is expected to reach USD 330.74 million in 2026.

b. The global hyperspectral imaging systems market is expected to grow at a compound annual growth rate of 11.00% from 2026 to 2033 to reach USD 686.01 million by 2033.

b. North America held the largest market share of over 40.73% in 2025. This is attributable to to technologically advanced healthcare infrastructure, increased defense expenditure, adoption of novel technologies, and the existence of several market players in the region.

b. Some key players operating in the hyperspectral imaging systems market include Corning Inc.; Specim; Spectral Imaging Ltd.; Resonon Inc.; Headwall Photonics; Telops; Norsk Elektro Optikk; Surface Optics Corp.; BaySpec, Inc.; HAIP Solutions GmbH; XIMEA GmbH; imec

b. Key factors that are driving the market growth include increasing application of hyperspectral imaging in various sectors, such as research and development, healthcare, defense, food industry, night vision, and remote sensing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.