- Home

- »

- Next Generation Technologies

- »

-

Machine Vision Market Size & Share, Industry Report, 2030GVR Report cover

![Machine Vision Market Size, Share & Trends Report]()

Machine Vision Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Product (PC Based, Smart Camera Based), By Application (Quality Assurance & Inspection, Positioning & Guidance), By End-use, And Segment Forecasts

- Report ID: GVR-1-68038-842-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Machine Vision Market Summary

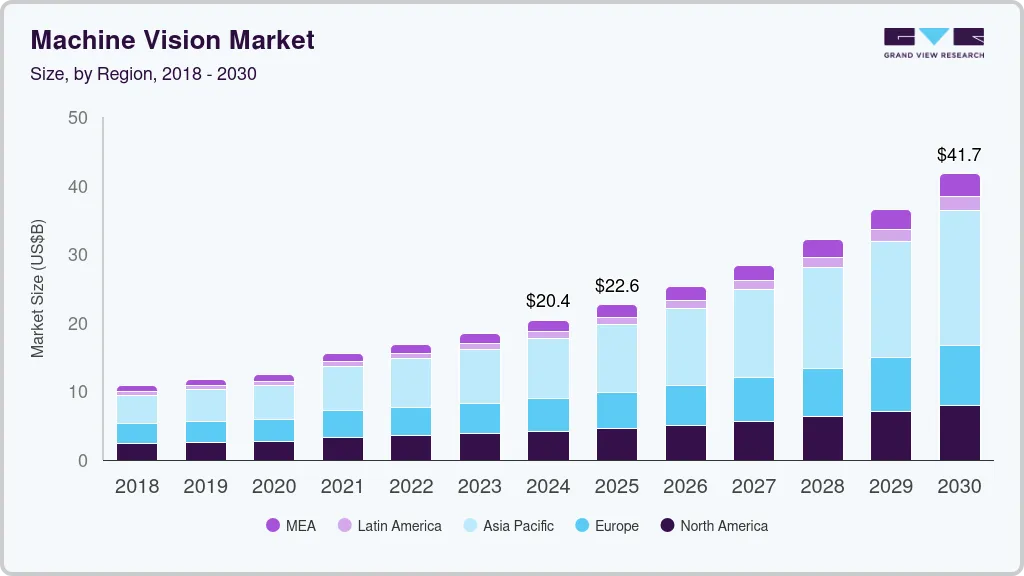

The global machine vision market size was estimated at USD 20,378.6 million in 2024 and is projected to reach USD 41,744.0 million by 2030, growing at a CAGR of 13.0% from 2025 to 2030. The increasing need for quality inspection and productivity is driving the development of machine vision technology.

Key Market Trends & Insights

- Machine vision market in Asia-Pacific dominated the global market with a share of over 43% in 2024.

- The U.S. machine vision market is expected to grow at the fastest CAGR of over 12% from 2025 to 2030.

- Based on offering, the hardware segment accounted for the largest market share of over 61% in 2024.

- Based on product, PC-based segment accounted for the largest market share in 2024.

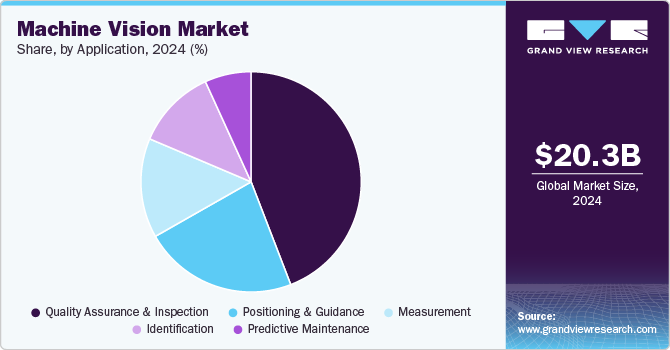

- Based on application, quality assurance and inspection segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20,378.6 Million

- 2030 Projected Market Size: USD 41,744.0 Million

- CAGR (2025-2030): 13.0%

- Asia Pacific: Largest market in 2024

Additionally, the surge in the implementation of advanced technologies by manufacturers is contributing to the development of machine vision industry growth. The increasing need for machine vision systems to be integrated with vision-guided robot controllers has witnessed a significant surge in use for automation across sectors such as automotive and aerospace, which is expected to drive market growth in the coming years. The increasing demand for automation across various industries is further enhancing the machine vision industry expansion. Industries are striving for greater efficiency, accuracy, and productivity, making automation increasingly indispensable. Machine vision systems play a crucial role by providing real-time visual inspection, quality control, and process optimization. These systems enable rapid and precise identification of defects, measurement of components, and monitoring of production processes by leveraging advanced imaging technology, reducing manual intervention and minimizing errors, thereby driving the machine vision industry expansion.

Additionally, advancements in artificial intelligence (AI) and automation are enhancing precision and efficiency in manufacturing, healthcare, automotive, and other sectors, propelling the machine vision market. Software components have become more sophisticated, offering advanced image processing, pattern recognition, and deep learning capabilities. This progress has enabled machine vision systems to handle complex tasks in industries such as manufacturing, healthcare, and autonomous vehicles, driving market expansion. These trends collectively enhance user experience and drive the machine vision industry's growth.

Furthermore, the growing demand for vision-guided robotics systems is leading to significant changes in the machine vision market. The rapid growth in the use of industrial robots for automation, especially in the automotive and consumer electronics sectors, is increasing the need to integrate machine vision systems with vision-guided robot controllers. Machine vision systems enhance the efficiency of robots by enabling them to perceive and respond to their environments. These factors are driving the machine vision industry's growth.

Moreover, machine vision companies focus on developing smart camera vision systems, providing comprehensive training and support, forming strategic alliances, improving imaging capabilities and integrating AI, expanding product lines, deeply understanding target market needs, and leveraging licensing and partnerships to broaden product offerings. By implementing these strategies, companies aim to enhance productivity, improve quality control standards, and better serve application-specific customer requirements in diverse industries, further driving the machine vision industry expansion. Such strategies by key companies are expected to drive the machine vision industry growth in the coming years.

Offering Insights

The hardware segment accounted for the largest market share of over 61% in 2024. This dominance is driven by the continued launch of advanced, cutting-edge hardware. The notable advancements and innovations observed in the hardware segment are fueled by the need for durable solutions that can function effectively in various environments and offer protection against factors such as dirt, dust, vibration, and extreme temperatures, while also catering to specific power requirements. Advanced products also deliver sufficient processing power to run complex algorithms and provide essential input/output features vital for industrial vision sensors. This focus on durability, versatility, and processing capacity underscores the crucial role of hardware in facilitating efficient and dependable machine vision systems across different industries.

The software segment is expected to witness the fastest CAGR of over 13% from 2025 to 2030. The need for precise and consistent quality inspection, defect detection, and process automation in various industries is propelling the adoption of machine vision technology. Machine vision systems maintain a high level of error recognition for extended periods, enabling high-speed production lines, clean room environments, microscopic inspection, closed-loop process control, and precise non-contact measurement. These factors are driving segmental growth.

Product Insights

The PC-based segment accounted for the largest market share in 2024, driven by its high processing power, speed, and adaptability in handling complex machine vision tasks. PC-based systems offer advanced image processing and AI-driven algorithms, enabling precise defect detection and quality control. Their customizability and scalability make them ideal for industries requiring sophisticated vision solutions, such as manufacturing and automation. As demand for high-performance, flexible vision systems grows, PC-based machine vision continues to lead the market, ensuring accuracy in detecting product variances and enhancing operational efficiency.

The smart camera-based segment is expected to witness the fastest CAGR from 2025 to 2030. driven by its compact design, built-in processing capabilities, and automation efficiency. These standalone systems enhance industrial decision-making by reading labels, directing products, and reducing human errors. Their ability to streamline inspections and improve accuracy is fueling adoption across various industries, making smart camera-based machine vision a key trend in automation and quality control.

Application Insights

The quality assurance and inspection segment accounted for the largest market share in 2024, driven by the growing adoption of machine vision for stringent quality control. Industries are increasingly leveraging advanced vision systems to detect defects, contamination, and production flaws, ensuring product safety and compliance. From pharmaceuticals to manufacturing, machine vision plays a critical role in maintaining high-quality standards and enhancing customer satisfaction. As businesses prioritize automation and precision in quality control, the demand for machine vision in inspection processes continues to rise.

The identification segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the increasing adoption of machine vision for barcode scanning, pattern recognition, and object identification. Businesses are leveraging this technology to enhance product tracking, streamline inventory management, and optimize logistics. As automation becomes essential for efficiency, machine vision-powered identification is transforming supply chains and operational workflows across industries, fueling rapid adoption in the coming years.

End-use Insights

The automotive segment accounted for the largest market share in 2024. The automotive industry utilizes machine vision for enhancing vehicle perception, driver assistance systems, and overall safety. AI-powered machine vision systems are being adopted by OEMs and suppliers for heightened inspection confidence, parts traceability, and operational transparency. These systems play a role in automating inspection tasks requiring high precision. The integration of computer vision algorithms for object detection, lane tracking, and gesture recognition contributes to the development of advanced driver assistance systems (ADAS) and autonomous vehicles.

The pharmaceuticals & chemicals segment is expected to register the fastest CAGR from 2025 to 2030, driven by strict regulatory compliance, quality control demands, and the push for automation. AI-powered machine vision is revolutionizing defect detection, label verification, and packaging integrity, ensuring precision and efficiency. With increased focus on traceability and cost reduction, industries are adopting machine vision to enhance manufacturing, streamline quality assurance, and meet evolving compliance standards.

Regional Insights

North America machine vision market is expected to grow at a CAGR of over 11% from 2025 to 2030, primarily driven by the continuous development of 3D technology-based machine vision systems. Furthermore, factors such as the continued evolution of CMOS image sensors and the surge in demand for automation in industrial applications support the growth of the regional market.

U.S. Machine Vision Market Trends

The U.S. machine vision market is expected to grow at the fastest CAGR of over 12% from 2025 to 2030, driven by the concentration of key vendors who are continuously working toward developing 3D technology-based machine vision systems. Furthermore, factors such as the continued evolution of CMOS image sensors and the surge in demand for automation in industrial applications support the growth of the regional market.

Europe Machine Vision Market Trends

Europe machine vision market is expected to grow at a CAGR of over 10% from 2025 to 2030. The wide range of industrial automation applications, coupled with increasing government initiatives focused on developing advanced robotics for industries, is boosting the growth of the Europe machine vision market. In Germany, approximately half the sales of machine vision systems producers are for parts inspection. Metrological applications for both 2D and 3D rose in Germany in 2020. Other critical applications include the recognition of parts and characters, vision-guided robotic systems, and code reading. The industrial sector in European countries is moving toward digital transformation.

The UK machine vision market is expected to grow at a significant rate in the coming years, attributed to the increased automation across various industries, particularly in manufacturing and logistics, driven by the need for efficiency and quality control. Furthermore, the country has a strong reputation for technological innovation and research excellence. The U.K. government and industry associations support research and innovation in machine vision through funding programs, grants, and collaborative initiatives.

Machine vision market in Germany is experiencing the fastest growth driven by technological advancements. Key trends in the country include the increasing sales of 3D cameras, the adoption of Short-Wave Infrared (SWIR) cameras, multispectral and hyperspectral vision systems, and embedded vision technology. These advancements and emphasis on the integration of digital technologies, automation, and data analytics in manufacturing processes are fueling the growth of the market.

Asia-Pacific Machine Vision Market Trends

Machine vision market in Asia-Pacific dominated the global market with a share of over 43% in 2024. The growth is attributed to the lucrative opportunities in automotive, pharmaceutical, packaging, and other industrial applications in the region. The Asia Pacific region is witnessing rapid industrialization and manufacturing expansion, particularly in countries such as China, Japan, South Korea, Taiwan, and India. The increasing adoption of automation and robotics in manufacturing processes is driving the demand for machine vision systems for surface inspection, defect detection, color verification, product quality & consistency; accurate dimension measurement such as length, angles, shapes, & distances; product identification, verification, and traceability; sorting and classifying objects; and assembly verification; among others.

Japan machine vision market is gaining traction in high-precision manufacturing, particularly in industries such as automotive, electronics, semiconductor, and robotics. The adoption of machine vision technology is driven by the need to maintain high product standards, improve production efficiency, and reduce costs. In addition, Japan's aging population and labor shortage create challenges for traditional manufacturing processes. Machine vision technology helps alleviate these challenges by automating repetitive tasks and reducing the reliance on manual labor. The Japanese government supports research and development in advanced technologies, including machine vision, through funding programs, grants, and incentives.

Machine vision market China is rapidly expanding, as the country is one of the world's largest manufacturing hubs, with a diverse range of industries, including electronics, automotive, semiconductor, pharmaceuticals, and consumer goods that are widely increasing the adoption of machine vision systems. The increasing emphasis on product quality, safety, and compliance with regulatory standards is driving the demand for machine vision systems in China. The country is one of the largest markets for industrial robots, with the manufacturing and logistics sectors being the key adopters. Machine vision technology enables vision-guided robotics for applications such as pick-and-place, sorting, and quality inspection, driving the demand for machine vision systems in conjunction with robotics.

Key Machine Vision Company Insights

Some of the key players operating in the market are Cognex Corporation and OMRON Corporation, among others.

-

Cognex Corporation is a manufacturer of machine vision products, sensors, and software. The company operates through two business divisions, namely the Modular Vision Systems Division (MVSD) and Surface Inspection Systems Division (SISD). In addition, it operates through a single segment called machine vision technology, which offers a range of vision and ID products to meet consumer needs at different prices and performance points.

-

OMRON Corporation manufactures automation equipment, systems, and components. The company also specializes in power supplies, robotics, motion/drivers, environment measurement equipment/energy conservation support, automation systems, relays, control components, switches, safety components, sensors, and automation systems, among others. The company is also known for its medical equipment, including nebulizers, blood pressure monitors, and digital thermometers. The company also provides environmental solutions and power distribution and controls for drilling rigs.

Allied Vision Technologies GmbH and Sick AG are some of the emerging market participants in the machine vision market.

-

Allied Vision Technologies GmbH offers digital cameras, embedded vision solutions, related software and accessories, and customization services. The company’s cameras are used for image processing in life sciences and industrial applications. The company also offers Vimba, a software development kit for the integration and customization of machine vision cameras for OEM customers, and related accessories.

-

Sick AG is engaged in the production of sensors and sensor solutions for industrial applications. The company operates through three segments, namely process automation, logistics automation, and factory automation. It offers various products, such as encoders, photoelectric sensors, proximity sensors, optoelectronic protective devices, magnetic cylinder sensors, and safety switches.

Key Machine Vision Companies:

The following are the leading companies in the machine vision market. These companies collectively hold the largest market share and dictate industry trends.

- Basler AG

- Cognex Corporation

- Keyence Corporation

- Keyence Corporation

- LMI Technologies, Inc. (A subsidiary of TKH Group NV)

- Stemmer Imaging

- National Instruments Corporation

- OMRON Corporation

- Sick AG

- Tordivel AS

Recent Developments

-

In July 2024, OMRON Corporation released a software update for its FH Vision System and FHV7 Smart Camera, integrating Digimarc decoding technology. This enhancement enables advanced digital product identification using digital watermarks, ensuring accurate packaging verification at high speeds of over 2,000 parts per minute. The integration offers enhanced detection accuracy, rapid processing, flexible camera integration, robust redundancy, and comprehensive inspection types, reinforcing OMRON's commitment to innovation and providing consumer goods manufacturers with valuable tools for quality assurance and efficiency.

-

In June 2024, SICK AG launched the Inspector83x 2D vision sensor, a standalone solution for automated inspection tasks like defect detection, sorting, and OCR/OCV, processing up to 15 inspections per second. The system combines AI-enabled and rules-based algorithms, allowing AI training with just a few images directly on the device. Featuring up to 5 MPixel resolution, built-in lighting, a quad-core CPU, dual-port Ethernet, C-mount lens threading, and a port for external illumination, it comes with SICK Nova, the company’s configurable machine vision software.

-

In April 2024, Cognex Corporation launched the In-Sight L38 3D Vision System, the world's first AI-powered 3D vision system designed for fast deployment and reliable inspections in manufacturing automation. The system combines AI, 2D, and 3D vision technologies, creating unique projection images that simplify training and reveal features not visible with traditional 2D imaging.

Machine Vision Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22,620.2 million

Revenue forecast in 2030

USD 41,744.0 million

Growth rate

CAGR of 13.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, product, application, end-use

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Australia; Japan; India; South Korea; Singapore; Brazil; Israel; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Allied Vision Technologies; Basler AG; Cognex Corporation; Keyence Corporation; LMI Technologies; Stemmer Imaging; National Instruments Corporation; OMRON Corporation; Sick AG

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Machine Vision Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the machine vision market report based on offering, product, application, and end-use:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Camera

-

2D

-

3D

-

-

Frame Grabber

-

Optics/Lenses

-

LED Lighting

-

Processor

-

-

Software

-

Barcode Reading

-

Standard Algorithm

-

Deep Learning Software

-

-

Services

-

Integration

-

Solution Management

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

PC Based

-

Smart Camera Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Quality Assurance and Inspection

-

Positioning and Guidance

-

Measurement

-

Identification

-

Predictive Maintenance

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Pharmaceuticals & Chemicals

-

Electronics & Semiconductor

-

Pulp & Paper

-

Printing & Labeling

-

Food & Beverage (Packaging and Bottling)

-

Glass & Metal

-

Postal & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Israel

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global machine vision market size was valued at USD 20,378.6 million in 2024 and is expected to reach USD 22,620.2 million in 2025.

b. The global machine vision market is expected to advance at a compound annual growth rate of 13.0% from 2025 to 2030 to reach USD 41,744.0 million by 2030.

b. The hardware segment accounted for the largest share of more than 61% in 2024 in the machine vision market driven by the continued launch of advanced, cutting-edge hardware

b. The PC-based segment dominated the market in 2024, driven by its high processing power, speed, and adaptability in handling complex machine vision tasks.

b. The quality assurance and inspection segment accounted for the largest market share in 2024, driven by the growing adoption of machine vision for stringent quality control.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.