- Home

- »

- Medical Devices

- »

-

Hysteroscope Market Size Report, 2030GVR Report cover

![Hysteroscope Market Share & Trends Report]()

Hysteroscope Market (2024 - 2030) Share & Trends Analysis Report By Product (Rigid, Flexible, Disposable), By Application (Myomectomy, Polypectomy, Endometrial Ablation), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-760-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hysteroscope Market Size & Trends

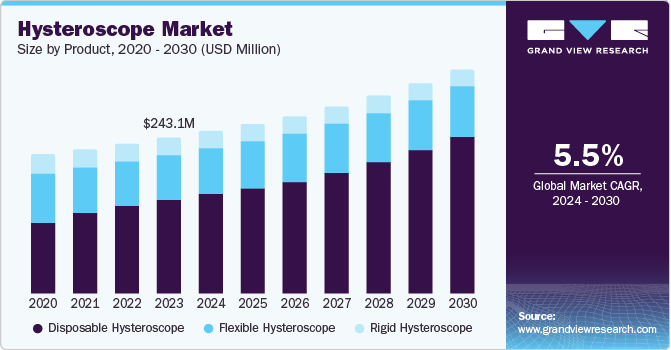

The global hysteroscope market size was valued at USD 243.1 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The market growth is due to the rising prevalence of gynecological disorders and increased adoption of minimally invasive treatments. Growth in the cases regarding infertility and an increase in the female senior population are also responsible for the market growth.

There is an increase in hysteroscopy procedures due to a rise in the number of patients suffering from gynecological disorders such as uterine fibroids, menstrual issues, ovarian cysts, and ovarian cancer. The procedure is conducted with the help of a hysteroscope, which is a slender, illuminated tube placed into the vaginal canal to inspect the cervix and interior of the uterus. Hysteroscopy procedures may be performed before or following other gynecological procedures such as endometrial ablation or myomectomy.

The increase in the elderly population is projected to boost market expansion as older women are more prone to conditions requiring hysteroscope use, such as abnormal uterine bleeding and fertility evaluations. The anticipated rise in the use of assisted reproductive technology procedures by couples is also predicted to drive market growth. Furthermore, the rising popularity of minimally invasive surgery is also contributing to the higher demand for hysteroscopy procedures. Minimally invasive surgery has become the typical method for treating gynecological diseases. Minimally invasive surgery in gynecological diseases offers decreased pain, shorter hospital stays, less blood loss, and reduced risk of scarring. Therefore, these factors have resulted in the market growth of the hysteroscope market.

Product Insights

The disposable hysteroscope segment dominated the market in 2023, with a share of 60.3% owing to the increased demand for hysteroscopy procedures and the rising prevalence of gynecological disorders in the female population. A disposable hysteroscope provides better patient safety by eliminating the cleaning and sterilization process, which helps prevent infections and bacteria. Furthermore, major companies are innovating to launch technologically advanced disposable hysteroscopes by improving their efficiency and performance. Hence, these factors are responsible for the market growth of this segment.

The flexible hysteroscope segment is expected to grow at a CAGR of 1.7% during the forecast period. This market growth is attributed to the flexible hysteroscopes' minimally invasive and better image quality properties. They are minimally invasive as they can be used without any surgical incisions. Technological advancements in flexible hysteroscopes have resulted in better image clarity, which aids in accurate treatment. Furthermore, financial growth in the healthcare sector has resulted in hospitals adopting better hysteroscopy equipment. Therefore, these factors have resulted in the market growth of this segment.

Application Insights

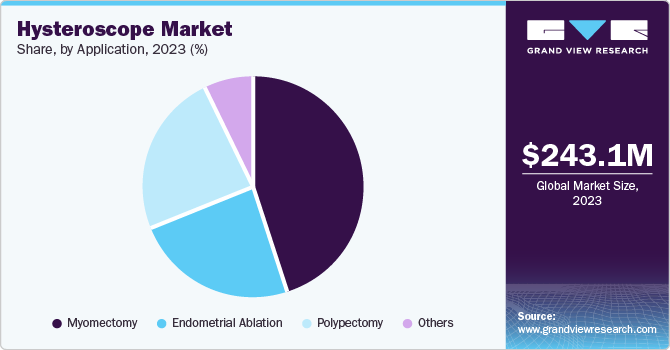

The endometrial ablation segment dominated the market in 2023 with a share of 24.3% attributed to the rising prevalence of gynecological disorders and the increase in the female geriatric population. The endometrial ablation segment is growing as it aids in treating abnormal uterine conditions such as irregular bleeding, menorrhagia, and more. This minimally invasive treatment has a better success rate, resulting in increased preference among female patients. Hence, these factors have resulted in the market growth of this segment.

The polypectomy segment is projected to grow at a CAGR of 5.9% during the forecast period. This market growth is attributed to the increased prevalence of diseases such as uterine polyps and gynecological disorders. Polypectomy aids in the treatment of issues such as pelvic pain, infertility, and bleeding. Furthermore, increased awareness regarding polypectomy and its minimally invasive procedure has resulted in the market growth of this segment.

End Use Insights

The outpatient facilities segment dominated the market in 2023, with a share of 53.3% in 2023 owing to the increased preference for outpatient facilities as they provide better patient comfort and diagnosis. An outpatient hysteroscopy offers efficient and cost-effective treatment. Increased accuracy and service provided by outpatient facilities have resulted in market growth. Moreover, an increase in disposable income has resulted in a patient seeking private outpatient facilities for their hysteroscopy procedures.

The hospitals segment is expected to grow at a CAGR of 4.7% during the forecast period. This market growth is attributed to the growth in the healthcare sector and the increasing number of female patients suffering from gynecological disorders. Financial growth in the healthcare sector has further resulted in an increased number of hospitals equipped with new and technologically advanced hysteroscopy equipment and gynecology treatment facilities. Furthermore, rising disposable income in the population has resulted in increased adoption of expensive hysteroscopy treatments. Therefore, these factors contribute to the market growth of this segment.

Regional Insights

North America hysteroscope market dominated the global market with a 39.3% market share in 2023 pertaining to the presence of a developed healthcare sector and major manufacturing companies in the region. Heavy investments by the companies in launching technologically advanced hysteroscopes to improve gynecological treatment have aided in the market growth. Furthermore, increased awareness regarding women's health and favorable reimbursement policies have developed the hysteroscope market in this region.

U.S. Hysteroscope Market Trends

The U.S. hysteroscope market held a substantial market share of 85.3% in North America due to the presence of major medical institutes and the rising female population suffering from gynecological and uterine disorders. Furthermore, the increase in disposable income has resulted in an increased number of patients opting for expensive hysteroscopy treatments. Government initiatives regarding spreading awareness of women's health and favorable regulations have further improved the market growth of this segment.

Europe Hysteroscope Market Trends

Europe hysteroscope market was identified as a lucrative region in this industry owing to the increasing prevalence of gynecological disorders such as vaginal bleeding, infertility, miscarriages, and more. Increased awareness regarding hysteroscopy treatments and their minimally invasive properties has resulted in increased adoption in the female population. Furthermore, the rise in the female geriatric population has increased the demand for hysteroscopy treatments in this region.

The UK hysteroscope market is expected to proliferate due to the presence of significant medical institutes and rising awareness regarding women's health. Increased demand for minimally invasive procedures and increased prevalence of uterine diseases in the female population have further resulted in market growth. Moreover, technological advancements in hysteroscope technology and an increased number of couples adopting assisted reproductive technologies have aided the development of the hysteroscope market in this country.

Asia Pacific Hysteroscope Market Trends

Asia Pacific hysteroscope market held a significant share of the global market in 2023 owing to the developing healthcare sector and the increase in the population in countries such as China, India, and Japan. Major companies invest heavily in marketing their hysteroscopy equipment in this region to increase market penetration. Furthermore, growing awareness regarding gynecological treatments has resulted in women adopting hysteroscopy treatments.

China hysteroscope market is expected to witness a significant growth in the coming years due to the growing number of female populations suffering from gynecological and uterine disorders. Increasing disposable income has resulted in patients adopting technologically advanced treatments. Furthermore, major market players' heavy investments to expand their market presence in the growing healthcare sector have further improved the growth of the hysteroscope market in this country.

Key Hysteroscope Company Insights

Some of the major companies in the hysteroscope market are Olympus (Olympus Corporation), Stryker, Karl Storz SE & Co. KG, Boston Scientific Corporation and more. Companies are focusing on improving services with the help of collaboration, launching new products, and market expansion in developing regions.

-

Hologic, Inc. is a medical technology company that specializes on products related to women’s health. The company manufactures and sells medical devices that are used for diagnostics, medical imaging, and surgery.

-

Medtronic is a medical technology company that specializes in designing, developing and manufacturing of medical devices and solutions. The company operates in divisions such as spinal and biologics, cardiovascular, neuromodulation, diabetes, and more.

Key Hysteroscope Companies:

The following are the leading companies in the hysteroscope market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus (Olympus Corporation)

- Stryker

- Karl Storz SE & Co. KG

- Boston Scientific Corporation

- Richard Wolf GmbH

- Medtronic

- B. Braun SE

- Hologic, Inc.

- CooperSurgical Inc.

- Cook Medical

Recent Developments

-

In October 2023, Hologic, Inc. announced a collaboration with AAGL and Inovus Medical to optimize OB-GYN training for the training of minimally invasive surgeries. Hologic became the chief provider of hysteroscopes for AAGL's essentials in minimally invasive gynecologic surgery (EMIGS) hands-on hysteroscopy skills training for OB-GYN residents.

Hysteroscope Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 253.4 million

Revenue forecast in 2030

USD 349.6 million

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Olympus (Olympus Corporation), Stryker, Karl Storz SE & Co. KG, Boston Scientific Corporation, Richard Wolf GmbH, Medtronic, B. Braun SE, Hologic, Inc., CooperSurgical Inc., Cook Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hysteroscope Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Hysteroscope Market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid Hysteroscope

-

Flexible Hysteroscope

-

Disposable Hysteroscope

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Myomectomy

-

Polypectomy

-

Endometrial Ablation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.