Ibuprofen API Market Size & Trends

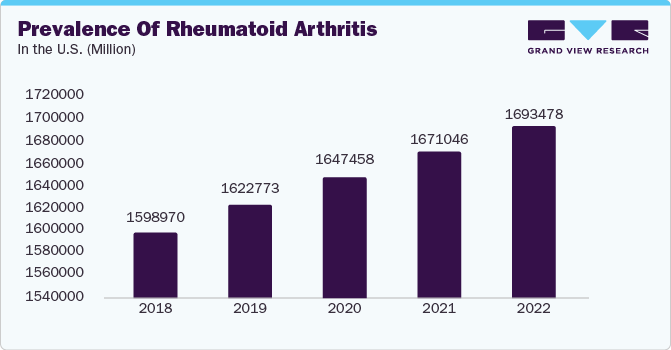

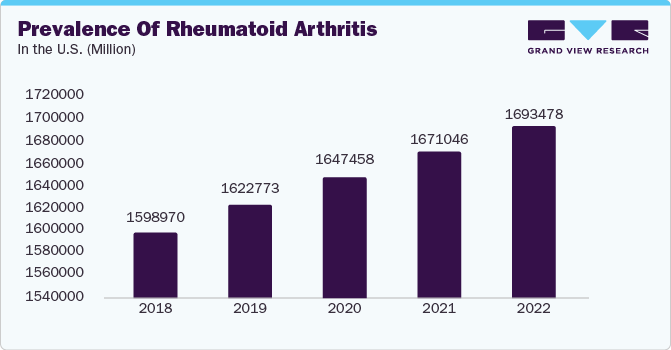

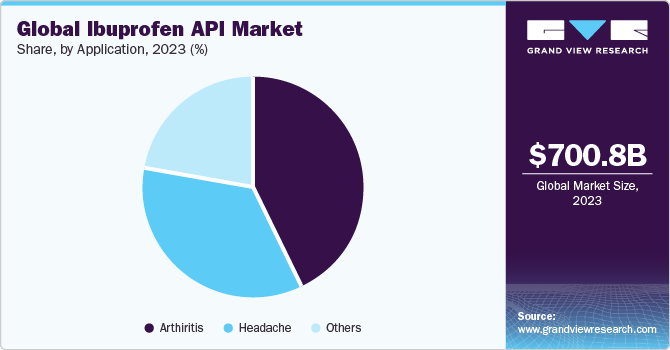

The global ibuprofen API market size was valued at USD 700.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 1.17% from 2024 to 2030. The evolving API scenario in emerging economies, the increase in pharmaceutical and biopharmaceutical production, and the growing geriatric population are the key factors driving the market growth. Moreover, rising incidence of chronic diseases such as rheumatoid arthritis and migraine are projected to propel the market during the study period. For instance, rheumatoid arthritis affects approximately 1 percent of the population in India, leading to an estimated impact on around 1 million people.

The ibuprofen API market experienced a significant impact during the COVID-19 pandemic due to its heightened demand owing to its analgesic properties. Its widespread use globally led to shortages in pharmacies. According to a research article published in the Infectious Diseases and Therapy Journal in March 2021, ibuprofen disappeared from pharmacy shelves during the pandemic. The study also revealed that the use of ibuprofen, whether acute or chronic, was not linked to worse outcomes in COVID-19 cases. Consequently, it was widely utilized for self-medication purposes worldwide. However, as COVID-19 cases declined, the market observed a slight decline in growth.

The growing prevalence of musculoskeletal disorders across various age groups on a global scale is fueling the need for drug development and driving market expansion. Statistics Canada's August 2022 update revealed that in 2021, 657,900 individuals aged 35 to 49 years, 2,042,100 individuals aged 50 to 64 years, and 3,138,500 individuals aged 65 and above were afflicted with arthritis. The increasing burden of arthritis, coupled with its rising occurrence as people age, is closely linked to the high demand for ibuprofen as a pain relief solution.

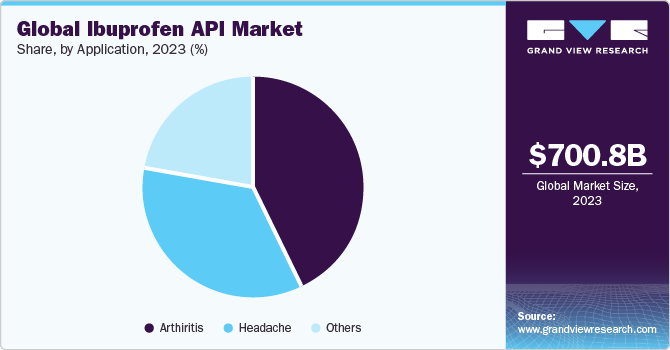

Application Insights

Based on application, the market is segmented into headache, arthritis, and other applications. The arthritis segment held the largest market share in 2023 owing to the increasing occurrence of various forms of arthritis, the introduction of new products, and the expanding elderly population. According to the 2022 report from the Juvenile Arthritis Foundation Australia, juvenile arthritis is estimated to impact 6,000 to 10,000 Australian children between the ages of 1 and 16, making it as prevalent as childhood diabetes and epilepsy. The significant number of pediatric patients with arthritis needing pain relief medications is anticipated to drive the growth of the ibuprofen API market and boost the segment's expansion.

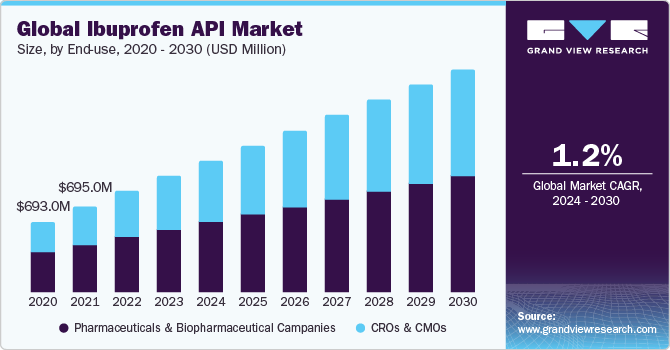

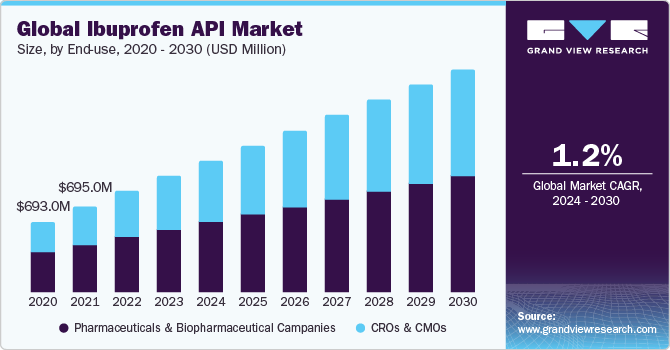

End-use Insights

On the basis of end use, the market is segmented into CROs & CMOs and pharmaceutical and biopharmaceutical companies. The pharmaceutical and biopharmaceutical companies segment accounted for the largest revenue share in 2023. The growth is being propelled by several factors, such as escalating shortages of API drugs, the formation of task forces to address these shortages, the emergence of cost-effective drug manufacturers in numerous countries, and the supply of API drugs to developed nations.

Regional Insights

Asia Pacific's ibuprofen market is expected to grow significantly during the forecast period, primarily due to the escalating healthcare expenditure in the region. Moreover, low manufacturing costs in countries like China and India have led to the establishment of increased production facilities, attracting pharmaceutical and biotechnological giants from around the world to invest in the Asia-Pacific region.

Key Ibuprofen API Company Insights

Key players operating in the market are BASF SE, Dr. Reddy's Laboratories Ltd, IOL Chemicals and Pharmaceuticals Limited, SI Group, Inc., Sino-US Zibo Xinhua-Perrigo Pharmaceutical Co., Ltd, Solara Active Pharma Sciences Limited, Strides Pharma Science Limited, SX Pharma, Granules India Limited, Rochem International Inc., Octavius Pharma Pvt. Ltd, Athenex, Inc., Teva Pharmaceutical Industries Ltd. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In July 2023, Granules India Limited announced the U.S. FDA approval for Acetaminophen and Ibuprofen tablets for treating headaches, minor arthritis pain, and toothaches, among others.

- In February 2023, Univar Solutions Brasil Ltd. entered into distribution agreement with SI Group to boost the company’s Ibuprofen offerings in Brazil.