- Home

- »

- Advanced Interior Materials

- »

-

Ignition Coil Market Size And Share, Industry Report, 2030GVR Report cover

![Ignition Coil Market Size, Share & Trends Report]()

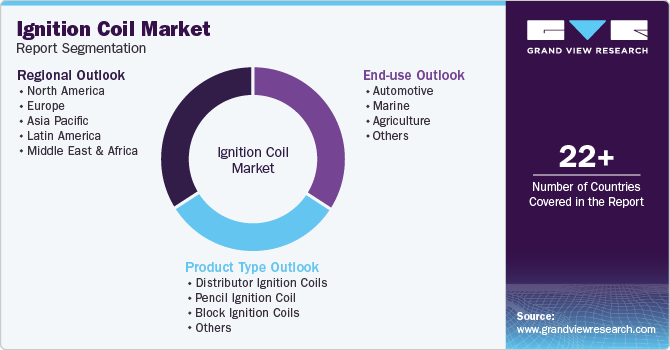

Ignition Coil Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Distributor Ignition Coils, Pencil Ignition Coil, Block Ignition Coils, Others), By End Use (Automotive, Marine, Agriculture, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-567-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ignition Coil Market Summary

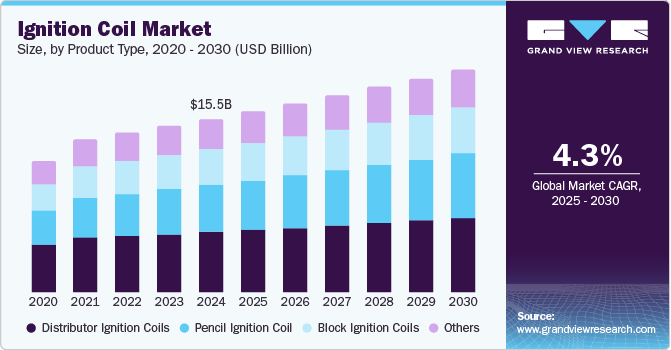

The global ignition coil market size was estimated at USD 15.45 billion in 2024 and is projected to reach USD 19.88 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030, driven by the surge in automotive production and sales across both developed and emerging economies. As internal combustion engine (ICE) vehicles continue to dominate the automotive landscape, the need for efficient ignition systems remains paramount.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 46.4% in 2024.

- China, the largest automotive market globally, is a major contributor to ignition coil demand.

- By product type, the distributor ignition coils segment led the market and accounted for the largest revenue share of 34.7% in 2024.

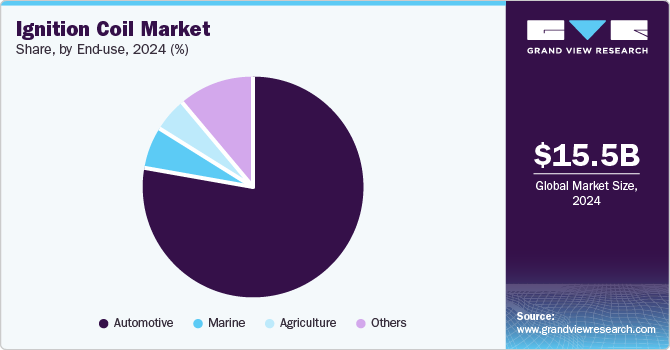

- By end use, the automotive segment dominated the market and accounted for the largest revenue share of 77.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.45 Billion

- 2030 Projected Market Size: USD 19.88 Billion

- CAGR (2025-2030): 4.3%

- Asia Pacific: Largest market in 2024

Ignition coils, essential for converting low voltage from a vehicle’s battery into the high voltage necessary for engine operation, are integral to this process. The growth trajectory is further supported by the rising adoption of advanced ignition technologies, such as coil-on-plug systems, which offer improved performance and fuel efficiency.

Several factors contribute to the rising demand for ignition coils. The global increase in automobile production and sales, especially in emerging economies, necessitates advanced ignition systems. Stringent emission regulations worldwide compel manufacturers to enhance vehicle efficiency and reduce emissions, increasing the demand for ignition systems that support these advancements. Additionally, the focus on improving engine efficiency and reducing carbon footprints encourages the integration of advanced ignition coils that contribute to better fuel economy and lower emissions.

Key drivers of the ignition coil industry include technological advancements in ignition coil design and manufacturing. Manufacturers are investing in research and development to improve performance and reliability, leading to the development of advanced product types and designs. The increasing adoption of electric and hybrid vehicles, which require sophisticated ignition systems, also propels market growth. Furthermore, the growing focus on fuel efficiency and emission reduction in vehicles drives the demand for efficient ignition systems

The market faces challenges such as the high cost of advanced ignition coil systems and the growing popularity of electric vehicles, which do not require traditional ignition coils. However, opportunities exist in the aftermarket segment, where the replacement and maintenance of ignition coils are witnessing substantial growth due to the increasing vehicle parc and the need for periodic replacements. The shift towards electrification and hybridization also opens up opportunities for ignition coil manufacturers to develop specialized ignition systems for hybrid vehicles and auxiliary power units.

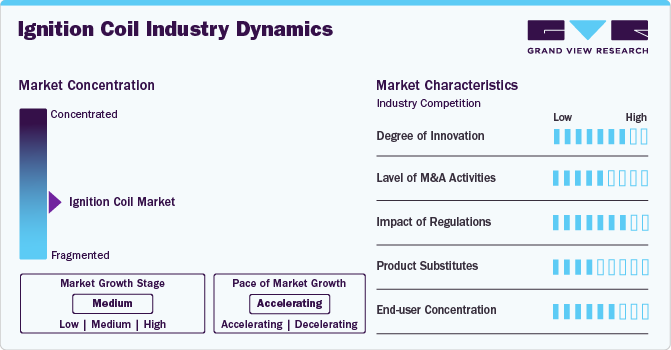

Market Concentration & Characteristics

The ignition coil industry is witnessing a high degree of innovation, driven by the need for greater engine efficiency, lower emissions, and enhanced durability. Innovations range from product type improvements, such as using advanced polymers and high-temperature resistant components, to structural advancements like coil-on-plug (COP) and pencil coil designs that improve energy transfer and spark precision. Manufacturers are also exploring miniaturization and integrating ignition coils with control electronics, enabling smarter ignition timing through electronic control units (ECUs). These types of innovation boost engine performance and align with evolving automotive trends like turbocharging, downsizing, and hybridization.

The market is marked by intense competition, driven by numerous manufacturers catering to OEM and aftermarket segments. Companies constantly strive to improve product performance, durability, and cost-effectiveness to gain an edge over rivals. Innovation plays a key role in developing ignition systems that meet evolving emission standards and enhance fuel efficiency. The market also sees competitive pricing strategies, product differentiation, and emerging-market expansion as common tactics. As demand grows, especially in regions with expanding vehicle production, the competitive landscape continues to evolve, encouraging constant technological advancement and value-added services.

Product Type Insights

The distributor ignition coils segment led the market and accounted for the largest revenue share of 34.7% in 2024. They are widely used in older vehicle models and various internal combustion engine (ICE) applications. These coils are essential in traditional ignition systems, where they work in conjunction with the distributor to direct the spark to the appropriate cylinder. Despite the rise of newer ignition technologies like coil-on-plug (COP) systems, distributor ignition coils are still prevalent in many vehicles, especially in markets with a large number of older vehicles. The affordability and ease of replacement of distributor ignition coils also contribute to their high demand in regions where cost-effectiveness is a priority.

Pencil ignition coils are expected to grow at the fastest rate due to their compact design, improved performance, and increasing adoption in modern vehicles. These coils are characterized by their smaller, cylindrical shape, which allows for easier integration directly into the spark plug, known as a coil-on-plug (COP) system. This design eliminates the need for spark plug wires, reducing the complexity of the ignition system and improving overall engine performance by providing more precise and direct spark delivery. As automakers focus on reducing engine size, improving fuel efficiency, and enhancing power output, pencil coils are becoming the preferred choice, especially in smaller, more compact engines in passenger vehicles and motorcycles.

End Use Insights

The automotive segment dominated the market and accounted for the largest revenue share of 77.7% in 2024. This is due to the critical role these components play in engine performance and efficiency. As the automotive industry continues to grow globally, the need for reliable ignition systems has become more pronounced, especially with advancements in engine technology. Ignition coils are essential in ensuring proper combustion within internal combustion engines, directly affecting fuel efficiency, engine power, and emission levels. With stricter emission regulations and rising consumer expectations for fuel-efficient and environmentally friendly vehicles, the demand for high-performance ignition coils is set to remain strong in the automotive sector.

The agriculture segment is the fastest growing in the market due to the increasing use of advanced machinery and equipment in modern farming practices. Agricultural vehicles such as tractors, harvesters, and irrigation systems require reliable and efficient ignition systems to operate optimally, especially as farms become more mechanized. As the agricultural industry moves towards automation and precision farming, the demand for robust ignition coils that can handle the high-performance requirements of these machines is rising.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 46.4% in 2024. This is due to rapid industrialization, urbanization, and a booming automotive sector, especially in countries like India, Japan, and South Korea. Rising disposable incomes, expanding middle-class populations, and strong domestic vehicle manufacturing contribute to the growing demand. Government initiatives to promote cleaner emissions and fuel-efficient technologies are also pushing manufacturers to adopt advanced ignition systems. The region's focus on hybrid and compact car segments also boosts the adoption of newer ignition technologies.

China Ignition Coil Market Trends

China, the largest automotive market globally, is a major contributor to ignition coil demand. The growth is driven by high vehicle production, a robust aftermarket for replacement parts, and government policies encouraging the use of energy-efficient vehicles. The increasing adoption of turbocharged engines and hybrid technologies is also fueling the need for modern, high-performance ignition coils in both domestic and exported vehicles. Furthermore, strong R&D investment and rapid electrification accelerate the shift toward smart ignition components.

Europe Ignition Coil Market Trends

In Europe, stringent emission regulations and strong environmental awareness are key factors boosting the demand for advanced ignition systems. The region's automakers focus on engine downsizing and turbocharging, which require high-efficiency ignition coils to ensure performance and compliance. The presence of a large fleet of high-end vehicles and a mature aftermarket also supports consistent demand for ignition coil replacements. In addition, incentives for eco-friendly vehicles indirectly drive ignition technology upgrades.

The Germany ignition coil market is propelling because the country is a leading hub for premium automobile manufacturing. It shows a growing demand for ignition coils due to their emphasis on performance, efficiency, and innovation in automotive engineering. The shift toward hybrid powertrains and stricter CO₂ targets has increased the integration of advanced ignition technologies. Germany's strong export activity further drives ignition coil demand, as high-performance vehicles are sold globally. The presence of top-tier engineering talent and cutting-edge R&D further contributes to technological progress in ignition systems.

North America Ignition Coil Market Trends

In North America, rising consumer demand for pickup trucks, SUVs, and high-performance vehicles supports growth in the ignition coil market. The presence of a large vehicle parc and a strong culture of vehicle maintenance and repair sustains demand in the aftermarket. Furthermore, increasing environmental regulations in the U.S. and Canada encourage automakers to upgrade ignition systems for better fuel economy and reduced emissions. The adoption of advanced diagnostic tools also boosts timely ignition component replacement.

The U.S. market for ignition coils is experiencing increased ignition coil demand due to aging vehicle fleets, widespread ownership, and a high preference for large-engine vehicles requiring more robust ignition systems. Growth in the electric and hybrid vehicle segment also contributes, as some hybrid systems still require specialized ignition coils for internal combustion components. Additionally, the strong presence of DIY vehicle maintenance culture fuels the replacement parts market, further supporting growth.

Latin America Ignition Coil Market Trends

Latin America's ignition coil market is expanding as vehicle ownership rises across the region, particularly in Brazil and Mexico. Economic growth, infrastructure improvement, and investment in local automotive production fuel this trend. Additionally, the growing importance of vehicle maintenance and the gradual shift toward stricter emission norms encourage the use of advanced ignition technologies. Trade agreements and foreign investments in the auto sector are expected to further stimulate market expansion.

Middle East & Africa Ignition Coil Market Trends

In the Middle East & Africa, demand for ignition coils is rising due to increasing vehicle imports, especially in urban centers with growing middle-class populations. Economic diversification and infrastructure development are also spurring vehicle sales. The harsh climatic conditions in many parts of the region necessitate robust and heat-resistant ignition systems, which further supports market growth. Moreover, the growth of the aftermarket and parallel import channels makes replacement ignition coils more accessible to consumers.

Key Ignition Coil Company Insights

Some of the key players operating in market include Robert Bosch GmbH and Hitachi Astemo, Ltd.

-

Founded in 1886, Robert Bosch GmbH is a global leader in automotive technology, producing a wide range of components including high-performance ignition coils. Bosch ignition coils are known for their precision, reliability, and ability to support cleaner combustion and fuel efficiency, catering to both OEMs and the aftermarket.

-

Established in 2021 through the merger of Hitachi Automotive Systems and several other affiliates, Hitachi Astemo is a key supplier of advanced mobility technologies. The company manufactures ignition coils that ensure optimal spark delivery and durability, aligning with evolving emission standards and engine performance needs.

Niterra Co., Ltd. and Mitsubishi Electric Corporation are some of the emerging market participants in the ignition coil market.

-

Niterra Co., Ltd., formerly NGK Spark Plug Co., Ltd., was founded in 1936 and is a renowned name in ignition systems globally. The company offers a wide range of ignition coils, including pencil and coil-on-plug types designed for fuel-efficient and low-emission engine performance in OEM and aftermarket sectors.

-

Founded in 1921, Mitsubishi Electric Corporation is a prominent manufacturer of automotive electrical systems, including ignition coils. Their products are engineered for compactness, long life, and reliable spark control, contributing to efficient engine operation and compliance with environmental regulations.

Key Ignition Coil Companies:

The following are the leading companies in the ignition coil market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- DENSO Corporation

- Hitachi Astemo, Ltd.

- Mitsubishi Electric Corporation

- Niterra Co., Ltd.

- Valeo S.A.

- Standard Motor Products, Inc.

- HELLA GmbH & Co. KGaA

- BorgWarner Inc.

- Diamond Electric Mfg. Co., Ltd.

Recent Developments

-

In July 2024, Niterra India PVT. LTD., unveiled new ignition coils for Hyundai i20 and Venue models, identified by part number U5310. These pencil-type ignition coils are designed to meet the specific needs of these popular models, ensuring optimal performance and reliability.

Ignition Coil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.11 billion

Revenue forecast in 2030

USD 19.88 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific;Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Robert Bosch GmbH; DENSO Corporation; Hitachi Astemo, Ltd.; Mitsubishi Electric Corporation; Niterra Co., Ltd.; Valeo S.A.; Standard Motor Products, Inc.; HELLA GmbH & Co. KGaA; BorgWarner.Inc; Diamond Electric Mfg. Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ignition Coil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ignition coil market report based on product type, end use and region.

-

Product Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Distributor Ignition Coils

-

Pencil Ignition Coil

-

Block Ignition Coils

-

Others

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Automotive

-

Marine

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

RoEU

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

RoAPAC

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global ignition coil market size was estimated at USD 15.45 billion in 2024 and is expected to reach USD 16.11 billion in 2025.

b. The global ignition coil market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030 to reach USD 19.88 billion by 2030.

b. The distributor ignition coil segment led the market and accounted for the largest revenue share of 34.7% in 2024, due to their widespread use in older vehicles and cost-effective aftermarket replacement demand.

b. Some of the key players operating in the ignition coil market include Robert Bosch GmbH, DENSO Corporation, Hitachi Astemo, Ltd., Mitsubishi Electric Corporation, Niterra Co., Ltd., Valeo S.A., Standard Motor Products, Inc., HELLA GmbH & Co. KGaA, HAYASHI TELEMPU CORPORATION, Diamond Electric Mfg. Co., Ltd.

b. Key factors for increasing demand include rising global vehicle production, stricter emission norms, and advancements in engine efficiency technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.