- Home

- »

- Sensors & Controls

- »

-

Image Sensor Market Size And Share, Industry Report, 2030GVR Report cover

![Image Sensor Market Size, Share & Trends Report]()

Image Sensor Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Image Processing Technology, By Resolution (Up to 5 MP, 5 MP to 12 MP, 12 MP to 16 MP, Above 16 MP), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-072-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Image Sensor Market Summary

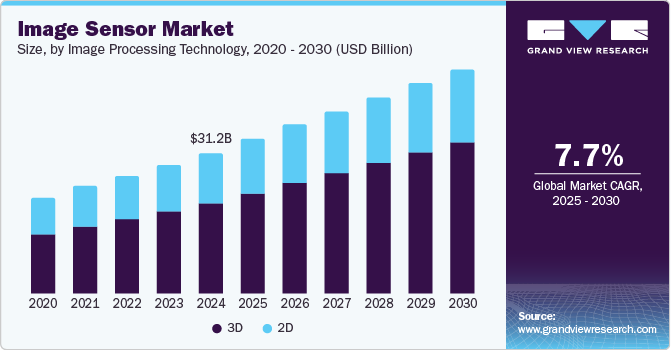

The global image sensor market size was estimated at USD 31.17 billion in 2024 and is projected to reach USD 49.82 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The rising demand for high-quality imaging in consumer electronics, especially smartphones, is a key factor driving growth.

Key Market Trends & Insights

- North America image sensor market is expected to grow at a significant CAGR from 2025 to 2030.

- The U.S. image sensor market dominated the regional market in 2024.

- By type, the CMOS image sensors segment dominated the market with a share of 98.4% in 2024.

- By image processing technology, the 3D segment dominated the market with the largest revenue share in 2024.

- By resolution, the above 16 MP segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 31.17 Billion

- 2030 Projected Market Size: USD 49.82 Billion

- CAGR (2025-2030): 7.7%

- Asia Pacific: Largest market in 2024

As consumers prioritize superior camera performance for photography and videography, manufacturers are compelled to enhance their image sensor technologies. This trend is further supported by the rapid advancements in Complementary Metal-Oxide-Semiconductor (CMOS) sensors, which offer better efficiency and lower production costs, making high-quality imaging more accessible.

The rising adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles necessitates sophisticated imaging solutions for safety and navigation. For instance, Samsung's ISOCELL auto image sensors combine an 8.3MP resolution with advanced high dynamic range and flicker mitigation technologies, enhancing safety and comfort during driving experiences. Moreover, image sensors play a crucial role in enabling features such as lane departure warnings, adaptive cruise control, and parking assistance. As automotive manufacturers increasingly integrate these technologies into their vehicles, the demand for advanced image sensors is expected to rise significantly.

The growing emphasis on Artificial Intelligence (AI) and Machine Learning (ML) in imaging applications is set to enhance the capabilities of image sensors. These technologies enable real-time processing and analysis of visual data, leading to improved functionalities such as object recognition and enhanced low-light performance. Integrating AI and machine learning is expected to broaden the range of applications for image sensors across multiple sectors, including healthcare, security, and robotics.

Type Insights

The CMOS image sensors segment dominated the market with a share of 98.4% in 2024. This can be attributed to the widespread adoption of CMOS technology in consumer electronics, such as smartphones and cameras, where high-quality imaging is essential. For instance, Canon's current Cinema EOS, PowerShot, and EOS camera lines utilize CMOS sensors, including the mirrorless EOS R System. This integration enables Canon to provide high-quality imaging capabilities across its diverse product offerings, appealing to amateur and professional photographers. Moreover, CMOS sensors offer several advantages, including lower power consumption, faster processing speeds, and compact designs that fit well into slim devices.

The CCD image sensors segment CAGR is projected to decline during the forecast period due to the increasing preference for CMOS sensors, which have become more cost-effective and versatile over time. While CCD sensors are known for their superior image quality and low noise levels, they face challenges in adapting to the evolving demands of modern imaging applications that require rapid processing and integration into compact devices. As manufacturers focus on developing advanced CMOS solutions that meet consumer needs for high-quality imaging at lower costs, the CCD segment may struggle to maintain its relevance in the competitive landscape of the image sensor industry.

Image Processing Technology Insights

The 3D segment dominated the market with the largest revenue share in 2024. The growing demand for 3D sensing technologies in applications such as Augmented Reality (AR), Virtual Reality (VR), and facial recognition has propelled this segment forward. Industries such as gaming, retail, and healthcare are increasingly incorporating 3D imaging to enhance user experiences and improve interaction with digital environments. For instance, Microsoft's Kinect system uses 3D imaging technology to create a "depth map" of the area before it, allowing it to sense the third dimension of the environment and its people. In addition, advancements in depth-sensing technologies have made 3D sensors more accurate and reliable.

The 2D segment is projected to grow at a significant CAGR during the forecast period due to its widespread use in various applications, including security cameras, industrial automation systems, and consumer electronics. As businesses continue to invest in surveillance and monitoring systems to enhance security measures and operational efficiency, the growth of 2D image sensors is set to impact the overall expansion of the image sensor industry positively. Moreover, sensor resolution and sensitivity improvements are making 2D sensors more appealing for high-performance applications.

Resolution Insights

The above 16 MP segment dominated the market with the largest revenue share in 2024. Higher-resolution sensors are increasingly sought for professional photography and high-end consumer devices where image clarity and detail are paramount. For instance, the Sony Alpha 7R IV full-frame camera enables users to take advantage of its 61.0-megapixel full-frame shooting capabilities, which benefits professional photography where cropping and editing are often necessary to enlarge the captured images. The rise of social media platforms emphasizing visual content has further fueled consumer demand for high-resolution imaging capabilities. Manufacturers are responding by developing advanced imaging technologies that enhance resolution and improve dynamic range and color accuracy.

The 5 MP to 12 MP segment is expected to grow at the highest CAGR over the forecast period. This growth is fueled by consumer preferences for mid-range smartphones that balance performance and affordability without compromising camera quality. As manufacturers aim to meet this demand by integrating high-quality sensors into budget-friendly devices, this segment is likely to see substantial growth within the image sensor industry. In addition, sensor technology improvements enable these mid-range devices to offer features previously associated with higher-end models, further driving consumer interest.

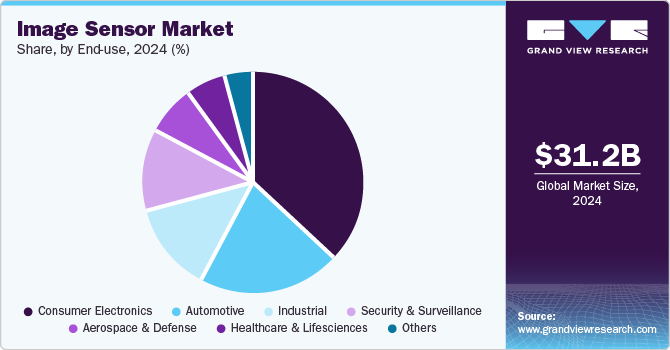

End Use Insights

The consumer electronics segment dominated the market with the largest revenue share in 2024. The proliferation of smartphones, tablets, and other electronic devices is significantly increasing demand for advanced imaging technologies that enhance user experience. As consumers prioritize camera quality when selecting devices, manufacturers are required to invest heavily in image sensor technology to differentiate their products in a crowded marketplace. This trend is further amplified by innovations such as multi-camera setups and computational photography techniques that rely on sophisticated image-sensing capabilities.

The healthcare & life sciences segment is expected to grow at the fastest CAGR over the forecast period. As healthcare providers increasingly adopt sophisticated medical imaging solutions such as MRI machines, CT scanners, and ultrasound devices for accurate diagnostics and treatment options, image sensors play a crucial role in enabling high-resolution imaging that facilitates early detection of medical conditions such as tumors or cardiovascular diseases. The integration of advanced imaging technologies, such as molecular imaging, enhances healthcare capabilities further by improving patient outcomes through precise diagnostics tailored to individual needs.

Regional Insights

North America image sensor market is expected to grow at a significant CAGR from 2025 to 2030. The region's strong technological infrastructure supports advancements in imaging technologies across various sectors, such as automotive, healthcare, and consumer electronics. In addition, increasing investments in research and development by leading companies foster innovation within this space. North America's emphasis on smart city initiatives is likely to further stimulate demand for advanced imaging solutions in various fields, encompassing surveillance systems and traffic management technologies.

U.S. Image Sensor Market Trends

The U.S. image sensor market dominated the regional market in 2024 due to its robust consumer electronics sector and significant investments in automotive technologies to enhance safety features through advanced imaging solutions. Major players based in the U.S., such as Sony and OmniVision Technologies, continue to innovate and expand their product offerings while collaborating with tech startups focused on emerging applications such as AI-driven imaging solutions.

Asia Pacific Image Sensor Market Trends

Asia Pacific image sensor market dominated the global market with a revenue share of 49.6% in 2024 due to rapid technological advancements and a large consumer base demanding high-quality imaging solutions across various applications, including smartphones and security systems. The region's manufacturing capabilities enable companies to produce sensors at scale while keeping costs competitive globally. Furthermore, government initiatives promoting technological innovation have fostered an environment conducive to growth within this sector.

China dominated the Asia Pacific region in 2024 due to its large manufacturing base, efficiently producing high volumes of advanced sensors while meeting domestic and international demand for quality imaging solutions across multiple sectors, including consumer electronics and automotive industries. The country's focus on innovation through substantial investments in research and development positions it as a robust player within the global image sensor industry.

Europe Image Sensor Market Trends

Europe image sensor market is expected to grow at a significant CAGR from 2025 to 2030, driven by increasing investments in advancing technology across sectors such as automotive safety features requiring enhanced imaging capabilities and healthcare innovations demanding high-resolution medical imaging solutions for diagnostic purposes. European manufacturers focus on developing cutting-edge products that comply with stringent regulatory standards while meeting evolving consumer demands.

Key Image Sensor Company Insights

The image sensor market features several key players that shape its landscape. ams OSRAM AG focuses on advanced sensor solutions, enhancing digital imaging capabilities for automotive and consumer electronics, while Canon Inc. is recognized for its high-performance image sensors, integral to its cameras and optical products. Continental AG incorporates advanced imaging technology into automotive systems to improve safety and automation through driver assistance features, while Denso Corp. develops sophisticated image sensors that support vehicle safety and automation, contributing to advancements in intelligent transportation systems. These companies play a significant role in shaping the image sensor industry.

-

Canon Inc. is recognized for its innovative imaging technologies. The company develops a wide range of high-performance image sensors integral to its cameras and optical products, catering to consumer and professional markets. Canon's focus on research and development enables it to deliver advanced imaging solutions that enhance picture quality and performance across various applications, including photography, videography, and industrial uses.

-

Denso Corp. develops advanced imaging technologies for the automotive image sensor market, focusing on enhancing vehicle safety and automation. The company integrates sophisticated image sensors into its automotive systems, enabling features such as ADAS and automated driving functionalities. Denso's innovations in imaging technology contribute to the progression of intelligent transportation systems, improving road safety and operational efficiency.

Key Image Sensor Companies:

The following are the leading companies in the image sensor market. These companies collectively hold the largest market share and dictate industry trends.

- ams OSRAM AG

- Canon Inc.

- Continental AG

- Denso Corp.

- GalaxyCore Shanghai Limited Corporation

- Gentex Corporation

- Hamamatsu Photonics K.K.

- Himax Technologies, Inc.

- Infineon Technologies AG

- NXP Semiconductors

Recent Development

-

In December 2024, at the IEEE International Electron Devices Meeting, imec and its collaborators in the Belgian Project Q-COMIRSE presented a prototype SWIR image sensor utilizing indium arsenide quantum dot photodiodes. The sensor successfully demonstrated imaging capabilities at 1390 nm, providing an eco-friendly alternative to earlier quantum dots that contained lead, which had restricted their broader manufacturing applications.

-

In October 2024, OMNIVISION announced that its complete camera solution, featuring the OG02B10 color GS image sensor and the OAX4000 ASIC ISP, has received verification for compatibility with the NVIDIA Jetson platform and NVIDIA Holoscan sensor processing platform. This integration enhances the capabilities of edge AI and robotics applications, highlighting OMNIVISION's dedication to advancing digital imaging technologies across various industries.

Image Sensor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.34 billion

Revenue forecast in 2030

USD 49.82 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, image processing technology, resolution, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, Saudi Arabia, South Africa

Key companies profiled

ams OSRAM AG; Canon Inc.; Continental AG; Denso Corp.; GalaxyCore Shanghai Limited Corporation; Gentex Corporation; Hamamatsu Photonics K.K.; Himax Technologies, Inc.; Infineon Technologies AG; NXP Semiconductors

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Image Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global image sensor market report based on type, image processing technology, resolution, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

CCD Image Sensors

-

CMOS Image Sensors

-

-

Image Processing Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

-

Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 5 MP

-

5 MP to 12 MP

-

12 MP to 16 MP

-

Above 16 MP

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Consumer Electronics

-

Healthcare & Lifesciences

-

Industrial

-

Security & Surveillance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.